Call Center Staffing Calculator: Forecasting Made Simple

Call Center Staffing Calculator: Forecasting Made Simple

Explore the call center staffing calculator to forecast staffing needs accurately. Learn key formulas, avoid pitfalls, and see AI-driven forecasting insights.

At its core, a call center staffing calculator is the tool that tells you exactly how many agents you need on the floor at any given time. Think of it as a strategic formula that balances the flow of incoming customer calls against your team's capacity, all while aiming for specific service goals. It prevents the two classic contact center nightmares: overstaffing, which burns money, and understaffing, which burns out agents and frustrates customers.

For any business in financial services, getting this number right isn't just about efficiency—it's about maintaining trust and operational integrity, especially when automating processes like insurance claims with AI.

Why a Staffing Calculator Is Essential for Financial Services

Trying to manage agent schedules in a high-stakes industry like banking or insurance often feels like walking a tightrope. On one side, you have the unpredictable rhythm of customer demand, which can spike due to market volatility, a new product launch, or an unforeseen event. On the other, you're constrained by tight budgets and strict compliance requirements.

Leaning too far in either direction has real consequences. If you're understaffed, you're staring down long queue times, unhappy customers, and agents who are completely overwhelmed. Go the other way with overstaffing, and you're watching operational costs balloon and profit margins shrink. A solid staffing calculator replaces educated guesses with a data-driven, actionable plan.

From Manual Spreadsheets to AI Automation

For a long time, the go-to tools were clunky spreadsheets and simple historical averages. They were better than flying blind, but they just couldn't keep up with the real-time swings and complexities of today's customer interactions. That's where AI-driven platforms are completely changing the game.

The real power of modern staffing tools lies not just in calculation, but in intelligent forecasting. AI can analyze complex patterns and predict demand with far greater accuracy than traditional models, which is essential for regulated industries where service continuity is paramount.

For AI insurance companies, this means having the right number of people ready to handle claims after a major storm. For banks, it means delivering exceptional AI customer care when the market is shaky. These tools don't just spit out a number; they give you the foresight to build a more resilient and efficient operation.

Precision: Match your agent coverage to customer demand, often down to 15-minute intervals.

Efficiency: Stop paying for idle time by cutting back on overstaffing during lulls.

Compliance: Consistently hit your service level agreements (SLAs), which is fundamental to keeping customers and avoiding regulatory heat.

By handing off these complex calculations to automation, your team is freed up to focus on strategy. You can find out more about bringing this level of precision to your own team by exploring workforce management automation. The objective shifts from just answering calls to optimizing every single interaction—especially as tasks like initial claims AI reviews become automated, changing the very nature of an agent's work.

The Math Behind a Smart Staffing Plan

How many agents do you really need? It's the million-dollar question for any contact center manager. The answer isn't a gut feeling or a lucky guess—it's a science. A solid call center staffing calculator relies on proven mathematical models that turn your call data into a clear, actionable staffing schedule. These formulas are the engine that helps you anticipate demand, manage your queues, and make sure you have the right people ready to go at the right time.

The cornerstone of this science is a model that's over a century old: the Erlang C formula. It was originally created to figure out how many telephone lines a city needed, but its logic is perfectly suited for the modern contact center. Think of it as the original queueing theory. It expertly models the relationship between incoming calls, available agents, and the chances a customer will have to wait. It’s the foundational math that prevents chaos when things get busy.

Understanding the Erlang C Model

Let's use a simple analogy. Imagine a coffee shop with a few baristas and a line of caffeine-deprived customers. The Erlang C formula helps the manager answer a few critical questions:

If 10 customers walk in every 5 minutes, how many baristas do we need to keep the wait under 2 minutes?

What happens to the average wait time if we add one more barista during the morning rush?

What are the odds that the next person to walk in gets served immediately?

This is the exact same logic that applies to your call center. You plug in your call volume and how long each call typically takes, and Erlang C helps you figure out the minimum number of agents needed to hit your service goals. It brings a welcome dose of predictability to the seemingly random flow of customer calls.

The Key Inputs That Make It Work

While Erlang C is the engine, it needs high-quality fuel to give you an accurate result. A few core metrics are essential for any staffing calculation. Getting these numbers right is absolutely critical—a small mistake in one input can throw off your entire forecast and leave you scrambling.

The table below breaks down the essential metrics you'll need to gather. Think of these as the ingredients for your staffing recipe.

Metric | Description | Impact on Staffing |

|---|---|---|

Average Handle Time (AHT) | The total time an agent spends on an interaction, including talk time, hold time, and after-call work. | Higher AHT means you need more agents to handle the same call volume. |

Service Level | Your goal for answering calls, like "80% of calls answered in 20 seconds." | A more aggressive service level (e.g., 90/10) requires a significantly larger team. |

Shrinkage | All the time agents are paid but aren't available to take calls (breaks, training, meetings, etc.). | This is a huge factor. Ignoring it is the fastest way to find yourself understaffed. |

Occupancy | The percentage of time an agent is busy with call-related work while logged in. | Pushing occupancy too high (above 85%) leads to burnout. The calculator helps find a healthy balance. |

Getting a handle on shrinkage is especially important. It’s one of the most common pitfalls in workforce planning.

For example, let's say your calculator tells you that you need 70 agents on the floor to meet demand. If your shrinkage is 30%, you don't just add 21 people (30% of 70). You have to calculate the total number of scheduled agents required to yield 70 available agents. The correct formula is 70 / (1 - 0.30), which means you actually need to schedule 100 agents. That’s a massive difference.

How This Applies to AI-Powered Financial Services

These calculations are becoming even more vital as AI insurance companies and banks integrate more automation. When a bot or an AI system handles the simple, routine questions, the calls that get through to your human agents are almost always more complex. This naturally pushes Average Handle Time up. Your staffing calculator has to account for this shift.

For instance, as AI takes over the initial fact-finding for claims AI reviews, your agents become escalation specialists, dealing with nuanced problems and emotional customers. This new reality must be baked into your staffing models. Great AI customer care depends on a flawless handoff from automation to a human, and that only works if a well-rested, capable agent is there to pick up the call without a long, frustrating wait. At the end of the day, these classic formulas provide the data-driven foundation for building a modern, efficient, and customer-first operation.

How to Calculate Staffing Needs Step by Step

Alright, let's move from theory to practice. Seeing how these numbers and concepts connect is the best way to understand how a staffing calculator really works. We'll walk through a full calculation for a fictional insurance claims call center, turning raw data into a solid staffing plan.

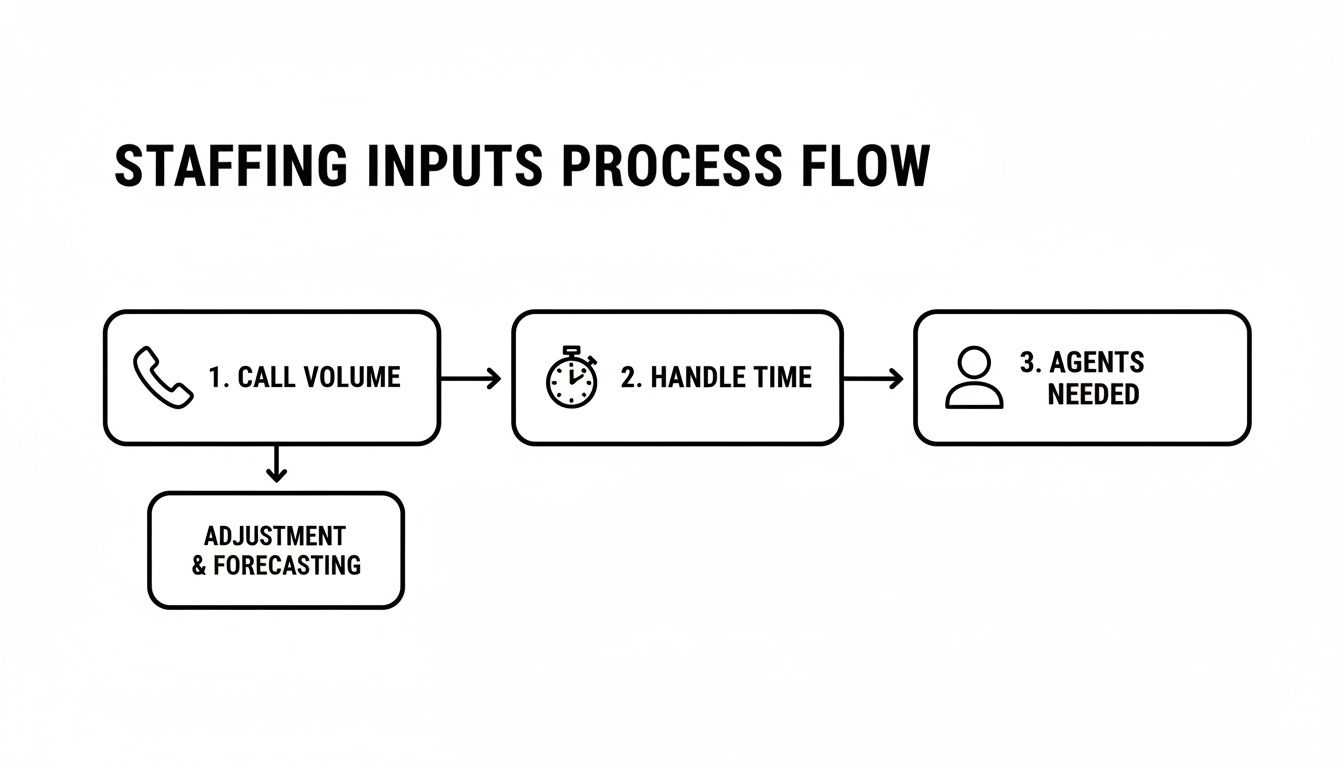

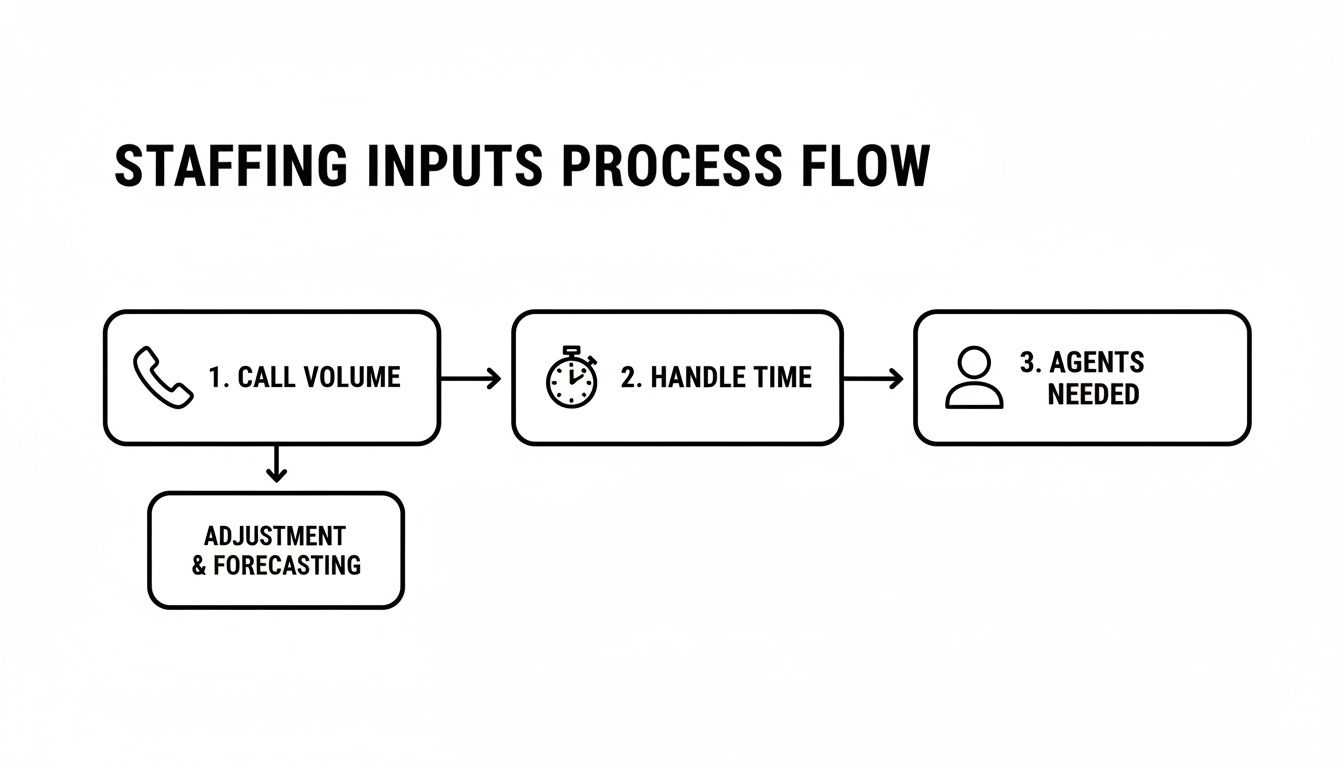

This whole process is about taking two core ingredients—how many calls you get and how long they take—and figuring out the final headcount you need.

As you can see, staffing is a direct result of customer demand clashing with your team's efficiency. Nailing this relationship is the foundation of any good forecast.

Step 1: Gather Your Core Data

First things first, we need the raw materials. Let’s assume our insurance claims center has the following metrics during its busiest hour of the day:

Call Volume: 200 calls per hour

Average Handle Time (AHT): 300 seconds (a clean 5 minutes)

Service Level Goal: Answer 80% of calls within 20 seconds (the classic 80/20)

Shrinkage: 30%

This data gives us a clear snapshot of our operational reality. We have a consistent flow of calls, each one takes a decent chunk of time, and we're committed to answering them quickly. That 30% shrinkage figure is absolutely critical—it represents all the paid time when agents aren't available to take calls, like breaks, coaching sessions, or team meetings.

Step 2: Calculate Base Staffing with Erlang C

With our data in hand, it's time to use the Erlang C formula. This will give us the absolute minimum number of agents needed to be logged in and ready for calls. This is what we call the "butts-in-seats" number.

Plugging in 200 calls per hour, a 300-second AHT, and an 80/20 service level target, the calculator tells us we need 38 agents actively handling calls. This number ensures we hit our service goal, but it assumes a perfect world where no one ever takes a break.

The Erlang C calculation gives you the theoretical minimum number of agents required under perfect conditions. Think of it as your starting point, not your final answer, because it hasn't yet accounted for the messy reality of a human workplace.

This initial number is the bedrock of our plan. For a deeper look at how different operational factors can influence these numbers, understanding strategic resource allocation planning is a great next step. For now, we need to adjust our base number for the real world.

Step 3: Account for Real-World Shrinkage

The 38 agents from the Erlang C formula only cover the people who are actively available. But we already know from our data that 30% of our team will be tied up with other necessary activities. Forgetting to factor this in is probably the single most common mistake in workforce planning, and it's a recipe for disaster.

To figure out how many people we actually need to have on the schedule, we use a simple formula:

Required Agents / (1 - Shrinkage Percentage)

For our insurance center, the math looks like this: 38 / (1 - 0.30) = 54.28

Of course, you can't schedule 0.28 of a person, so we round up. We need to schedule 55 agents to make sure we always have at least 38 available to handle the call volume and hit our service targets.

This final number is far more grounded in reality. It’s what prevents the chronic understaffing that burns out agents and sends customer satisfaction scores plummeting. It's also vital to track and predict absenteeism; tools like a Bradford Factor Score Calculator can help quantify unplanned leave patterns. By following this data-driven process, you move from mere guesswork to true strategic workforce management.

Common Pitfalls and Limitations of Traditional Calculators

A traditional call center staffing calculator is a great starting point, giving you a solid mathematical baseline for your team. But it's important to understand its blind spots. These older models, which lean heavily on formulas like Erlang C, are grounded in historical averages. They can tell you a lot about the past, but they often struggle with the sheer unpredictability of modern financial services.

Think of it this way: a basic calculator can accurately predict a typical Tuesday based on the last six months of data. What it can't do is anticipate a sudden market downturn that sends a flood of calls to your banking support line. It has no way of knowing a regional storm is about to cause a spike in claims for AI insurance companies. This leaves you and your team in a constant state of reaction, always playing catch-up with customer demand.

The Dangers of Inaccurate Forecasting

When your forecast is off, the problems start piling up fast. Get caught understaffed during an unexpected surge, and you'll immediately see the damage to both customer trust and your bottom line.

Long Wait Times: A customer calling about an urgent insurance claim or a sensitive financial matter isn't going to be happy sitting on hold. Frustration builds, and satisfaction scores plummet.

Agent Burnout: Your team gets hammered. Overburdened agents are forced to rush through complex calls, which is a recipe for errors in critical processes like claims AI reviews.

Compliance Risks: In the financial sector, failing to meet your service level agreements (SLAs) isn't just bad service—it can have serious regulatory consequences where timely communication is a legal requirement.

This constant firefighting isn't a sustainable way to operate. Traditional calculators also fall short when it comes to managing agents with multiple skills, often resulting in one queue being overstaffed while another is desperately short-handed. It’s an efficiency leak that quietly drains resources day after day.

The Occupancy Trap and Employee Turnover

There's another common trap I see leaders fall into: trying to maximize agent occupancy, which is the percentage of time agents are busy with call-related work. On a spreadsheet, pushing occupancy to 90% or higher looks like a massive win. In the real world, it's a fast track to burning out your team.

When agents have zero breathing room between complex, often emotionally charged conversations, stress levels go through the roof. This relentless pace is a direct cause of high employee turnover, one of the biggest hidden costs in any contact center.

The global call center market is a massive $352.4 billion industry, yet it’s plagued by high turnover rates, often between 30% and 45% each year. Replacing a single agent can cost anywhere from $10,000 to $15,000. Chasing that last bit of occupancy might look good for a quarter, but it ends up costing you far more in the long run through a painful cycle of hiring and retraining.

The AI Solution to Legacy Limitations

This is exactly where modern AI platforms change the game. Instead of just looking backward, AI analyzes real-time data streams and uses predictive analytics to anticipate what's coming next. It can foresee demand spikes, intelligently schedule your multi-skilled agents, and help you deliver exceptional AI customer care without overwhelming your people.

For financial services, where managing risk and maintaining an auditable forecast are non-negotiable, this is more than just an upgrade—it's essential. To see how modern tools can elevate your planning, take a look at our guide on how to capture leads with interactive calculators.

How AI Changes the Staffing and Forecasting Game

Traditional staffing calculators are fantastic for giving you a snapshot based on what’s already happened. They’re like looking in the rearview mirror. But they can’t tell you what’s around the next corner, whether that’s a sudden market dip or an unexpected surge in insurance claims. This is where AI steps in, moving beyond simple math and into the realm of intelligent forecasting. It completely rewrites the rules for how financial services manage their workforce.

AI-native platforms, such as Nolana, don't just crunch historical numbers. They actively analyze real-time data streams and predictive models to get ahead of demand. For AI insurance companies and banks, this means you can adjust agent schedules before a rush hits, keeping your service levels stable and compliant no matter how volatile things get.

This is a fundamental shift from being reactive to truly predictive. In heavily regulated industries where operational resilience is paramount, that’s not just an advantage—it's a necessity.

Putting Automation to Work in Financial Services

One of the first and most tangible ways AI impacts staffing is by taking over high-volume, repetitive tasks. In the financial world, this has a direct, measurable effect on how many agents you actually need on the floor. AI agents can handle routine interactions on their own, filtering out the simple stuff before it ever has to touch a human.

Here are a couple of real-world examples:

AI Insurance Companies: Imagine an AI agent handling the first notice of loss (FNOL). It can gather all the initial data for claims AI reviews without needing a person on the other end. This frees up your licensed adjusters to do what they do best: assess complex cases and negotiate with customers.

Banking Customer Service: For a bank, AI can instantly resolve common queries like balance checks, transaction history requests, and password resets. Customers get 24/7 support, and your overall call volume plummets.

By automating these front-line tasks, AI directly lowers the call volume your human team is responsible for. This, in turn, reduces the raw number of agents your call center staffing calculator says you need. It’s less about cutting costs and more about optimizing your human talent for what really matters.

Building a Smarter, More Strategic Workforce

When AI handles the mundane work, your human agents are freed up to focus on more complex, high-value interactions. Their roles shift from repetitive to strategic, zeroing in on situations that demand empathy, critical thinking, and creative problem-solving. It’s a recipe for a more engaged and effective team.

The real goal of bringing in AI isn't to replace agents, but to amplify them. It's about building a hybrid team where AI handles the predictable, allowing your skilled professionals to manage the exceptions and forge deeper customer relationships.

This hybrid approach has another powerful side effect: it generates cleaner, more reliable data for your forecasting. As AI systems process thousands of interactions, they spot patterns and trends with a precision that manual analysis could never hope to match. This refined data then feeds back into your staffing models, making them smarter and more accurate over time. To fully grasp the strategic side of this, it's worth exploring the broader role of AI in human resources management.

The Bottom-Line Impact of AI

The rise of AI in contact centers is reshaping both budgets and strategies. The conversational AI market is set to skyrocket from $17.05 billion in 2025 to a massive $49.8 billion by 2031, fueled by its knack for precise agent allocation.

By 2030, contact center AI is expected to slash labor costs by an estimated $80 billion. It achieves this by automating routine tasks, freeing up human experts to handle tricky banking questions and complex insurance claims. This isn't some far-off future; it's happening right now. While about 50% of contact centers use tools like chatbots today, that number is projected to hit 80% by the end of 2025, driving faster resolutions and more efficient teams.

Frequently Asked Questions

Let's tackle some of the common questions that come up when you start using a call center staffing calculator, especially as you bring AI into your financial services operations.

How Does AI Change Staffing Needs for Insurance Companies?

For AI insurance companies, automation completely changes the game for staffing. Think about all those high-volume, repetitive tasks—like filing a first notice of loss or just gathering the basic info for a claims AI review. AI agents can handle that work tirelessly.

This means fewer of those simple, transactional calls ever hit your human agents. Your team gets to focus on the complex, high-empathy escalations where they're needed most. As a result, when you run the numbers in your call center staffing calculator, you'll see you need a smaller core team, but one that's highly skilled.

Can a Calculator Help with AI Customer Care in Banking?

Absolutely. In fact, a staffing calculator is essential for navigating the shift to AI customer care. When you have AI handling routine banking questions like balance inquiries or transaction lookups, the calls that do get through to a person are usually the tough ones. They're more complex and take longer to resolve.

This is where you need to be careful. Your calculator must be updated to reflect a higher Average Handle Time (AHT) for these more involved conversations. If you don't adjust for this, you'll be understaffed.

When calibrated correctly, the calculator helps you build a smaller, more specialized team that’s perfectly equipped for the new types of customer issues they'll be facing.

Is Erlang C Still Relevant with AI and Automation?

Yes, Erlang C still has its place. The core formula is still the gold standard for figuring out how many agents you need to handle live phone calls at a specific service level. But AI and automation mean it's no longer the only piece of the puzzle.

Think of it this way: Erlang C is great for the live-call portion, but modern forecasting models layer it with other powerful tools. They use predictive analytics to get ahead of demand and AI insights to model how many tasks will be deflected away from humans entirely. The formula is a critical input, but it doesn't operate in a vacuum anymore. You also need to manage agent availability effectively, using tools like a timesheet submission form template to keep schedules tight.

Ready to move beyond traditional calculators and embrace intelligent automation? Nolana deploys compliant AI agents to automate your high-stakes banking and insurance operations from end to end. Discover how to optimize your workforce and accelerate your workflows today.

At its core, a call center staffing calculator is the tool that tells you exactly how many agents you need on the floor at any given time. Think of it as a strategic formula that balances the flow of incoming customer calls against your team's capacity, all while aiming for specific service goals. It prevents the two classic contact center nightmares: overstaffing, which burns money, and understaffing, which burns out agents and frustrates customers.

For any business in financial services, getting this number right isn't just about efficiency—it's about maintaining trust and operational integrity, especially when automating processes like insurance claims with AI.

Why a Staffing Calculator Is Essential for Financial Services

Trying to manage agent schedules in a high-stakes industry like banking or insurance often feels like walking a tightrope. On one side, you have the unpredictable rhythm of customer demand, which can spike due to market volatility, a new product launch, or an unforeseen event. On the other, you're constrained by tight budgets and strict compliance requirements.

Leaning too far in either direction has real consequences. If you're understaffed, you're staring down long queue times, unhappy customers, and agents who are completely overwhelmed. Go the other way with overstaffing, and you're watching operational costs balloon and profit margins shrink. A solid staffing calculator replaces educated guesses with a data-driven, actionable plan.

From Manual Spreadsheets to AI Automation

For a long time, the go-to tools were clunky spreadsheets and simple historical averages. They were better than flying blind, but they just couldn't keep up with the real-time swings and complexities of today's customer interactions. That's where AI-driven platforms are completely changing the game.

The real power of modern staffing tools lies not just in calculation, but in intelligent forecasting. AI can analyze complex patterns and predict demand with far greater accuracy than traditional models, which is essential for regulated industries where service continuity is paramount.

For AI insurance companies, this means having the right number of people ready to handle claims after a major storm. For banks, it means delivering exceptional AI customer care when the market is shaky. These tools don't just spit out a number; they give you the foresight to build a more resilient and efficient operation.

Precision: Match your agent coverage to customer demand, often down to 15-minute intervals.

Efficiency: Stop paying for idle time by cutting back on overstaffing during lulls.

Compliance: Consistently hit your service level agreements (SLAs), which is fundamental to keeping customers and avoiding regulatory heat.

By handing off these complex calculations to automation, your team is freed up to focus on strategy. You can find out more about bringing this level of precision to your own team by exploring workforce management automation. The objective shifts from just answering calls to optimizing every single interaction—especially as tasks like initial claims AI reviews become automated, changing the very nature of an agent's work.

The Math Behind a Smart Staffing Plan

How many agents do you really need? It's the million-dollar question for any contact center manager. The answer isn't a gut feeling or a lucky guess—it's a science. A solid call center staffing calculator relies on proven mathematical models that turn your call data into a clear, actionable staffing schedule. These formulas are the engine that helps you anticipate demand, manage your queues, and make sure you have the right people ready to go at the right time.

The cornerstone of this science is a model that's over a century old: the Erlang C formula. It was originally created to figure out how many telephone lines a city needed, but its logic is perfectly suited for the modern contact center. Think of it as the original queueing theory. It expertly models the relationship between incoming calls, available agents, and the chances a customer will have to wait. It’s the foundational math that prevents chaos when things get busy.

Understanding the Erlang C Model

Let's use a simple analogy. Imagine a coffee shop with a few baristas and a line of caffeine-deprived customers. The Erlang C formula helps the manager answer a few critical questions:

If 10 customers walk in every 5 minutes, how many baristas do we need to keep the wait under 2 minutes?

What happens to the average wait time if we add one more barista during the morning rush?

What are the odds that the next person to walk in gets served immediately?

This is the exact same logic that applies to your call center. You plug in your call volume and how long each call typically takes, and Erlang C helps you figure out the minimum number of agents needed to hit your service goals. It brings a welcome dose of predictability to the seemingly random flow of customer calls.

The Key Inputs That Make It Work

While Erlang C is the engine, it needs high-quality fuel to give you an accurate result. A few core metrics are essential for any staffing calculation. Getting these numbers right is absolutely critical—a small mistake in one input can throw off your entire forecast and leave you scrambling.

The table below breaks down the essential metrics you'll need to gather. Think of these as the ingredients for your staffing recipe.

Metric | Description | Impact on Staffing |

|---|---|---|

Average Handle Time (AHT) | The total time an agent spends on an interaction, including talk time, hold time, and after-call work. | Higher AHT means you need more agents to handle the same call volume. |

Service Level | Your goal for answering calls, like "80% of calls answered in 20 seconds." | A more aggressive service level (e.g., 90/10) requires a significantly larger team. |

Shrinkage | All the time agents are paid but aren't available to take calls (breaks, training, meetings, etc.). | This is a huge factor. Ignoring it is the fastest way to find yourself understaffed. |

Occupancy | The percentage of time an agent is busy with call-related work while logged in. | Pushing occupancy too high (above 85%) leads to burnout. The calculator helps find a healthy balance. |

Getting a handle on shrinkage is especially important. It’s one of the most common pitfalls in workforce planning.

For example, let's say your calculator tells you that you need 70 agents on the floor to meet demand. If your shrinkage is 30%, you don't just add 21 people (30% of 70). You have to calculate the total number of scheduled agents required to yield 70 available agents. The correct formula is 70 / (1 - 0.30), which means you actually need to schedule 100 agents. That’s a massive difference.

How This Applies to AI-Powered Financial Services

These calculations are becoming even more vital as AI insurance companies and banks integrate more automation. When a bot or an AI system handles the simple, routine questions, the calls that get through to your human agents are almost always more complex. This naturally pushes Average Handle Time up. Your staffing calculator has to account for this shift.

For instance, as AI takes over the initial fact-finding for claims AI reviews, your agents become escalation specialists, dealing with nuanced problems and emotional customers. This new reality must be baked into your staffing models. Great AI customer care depends on a flawless handoff from automation to a human, and that only works if a well-rested, capable agent is there to pick up the call without a long, frustrating wait. At the end of the day, these classic formulas provide the data-driven foundation for building a modern, efficient, and customer-first operation.

How to Calculate Staffing Needs Step by Step

Alright, let's move from theory to practice. Seeing how these numbers and concepts connect is the best way to understand how a staffing calculator really works. We'll walk through a full calculation for a fictional insurance claims call center, turning raw data into a solid staffing plan.

This whole process is about taking two core ingredients—how many calls you get and how long they take—and figuring out the final headcount you need.

As you can see, staffing is a direct result of customer demand clashing with your team's efficiency. Nailing this relationship is the foundation of any good forecast.

Step 1: Gather Your Core Data

First things first, we need the raw materials. Let’s assume our insurance claims center has the following metrics during its busiest hour of the day:

Call Volume: 200 calls per hour

Average Handle Time (AHT): 300 seconds (a clean 5 minutes)

Service Level Goal: Answer 80% of calls within 20 seconds (the classic 80/20)

Shrinkage: 30%

This data gives us a clear snapshot of our operational reality. We have a consistent flow of calls, each one takes a decent chunk of time, and we're committed to answering them quickly. That 30% shrinkage figure is absolutely critical—it represents all the paid time when agents aren't available to take calls, like breaks, coaching sessions, or team meetings.

Step 2: Calculate Base Staffing with Erlang C

With our data in hand, it's time to use the Erlang C formula. This will give us the absolute minimum number of agents needed to be logged in and ready for calls. This is what we call the "butts-in-seats" number.

Plugging in 200 calls per hour, a 300-second AHT, and an 80/20 service level target, the calculator tells us we need 38 agents actively handling calls. This number ensures we hit our service goal, but it assumes a perfect world where no one ever takes a break.

The Erlang C calculation gives you the theoretical minimum number of agents required under perfect conditions. Think of it as your starting point, not your final answer, because it hasn't yet accounted for the messy reality of a human workplace.

This initial number is the bedrock of our plan. For a deeper look at how different operational factors can influence these numbers, understanding strategic resource allocation planning is a great next step. For now, we need to adjust our base number for the real world.

Step 3: Account for Real-World Shrinkage

The 38 agents from the Erlang C formula only cover the people who are actively available. But we already know from our data that 30% of our team will be tied up with other necessary activities. Forgetting to factor this in is probably the single most common mistake in workforce planning, and it's a recipe for disaster.

To figure out how many people we actually need to have on the schedule, we use a simple formula:

Required Agents / (1 - Shrinkage Percentage)

For our insurance center, the math looks like this: 38 / (1 - 0.30) = 54.28

Of course, you can't schedule 0.28 of a person, so we round up. We need to schedule 55 agents to make sure we always have at least 38 available to handle the call volume and hit our service targets.

This final number is far more grounded in reality. It’s what prevents the chronic understaffing that burns out agents and sends customer satisfaction scores plummeting. It's also vital to track and predict absenteeism; tools like a Bradford Factor Score Calculator can help quantify unplanned leave patterns. By following this data-driven process, you move from mere guesswork to true strategic workforce management.

Common Pitfalls and Limitations of Traditional Calculators

A traditional call center staffing calculator is a great starting point, giving you a solid mathematical baseline for your team. But it's important to understand its blind spots. These older models, which lean heavily on formulas like Erlang C, are grounded in historical averages. They can tell you a lot about the past, but they often struggle with the sheer unpredictability of modern financial services.

Think of it this way: a basic calculator can accurately predict a typical Tuesday based on the last six months of data. What it can't do is anticipate a sudden market downturn that sends a flood of calls to your banking support line. It has no way of knowing a regional storm is about to cause a spike in claims for AI insurance companies. This leaves you and your team in a constant state of reaction, always playing catch-up with customer demand.

The Dangers of Inaccurate Forecasting

When your forecast is off, the problems start piling up fast. Get caught understaffed during an unexpected surge, and you'll immediately see the damage to both customer trust and your bottom line.

Long Wait Times: A customer calling about an urgent insurance claim or a sensitive financial matter isn't going to be happy sitting on hold. Frustration builds, and satisfaction scores plummet.

Agent Burnout: Your team gets hammered. Overburdened agents are forced to rush through complex calls, which is a recipe for errors in critical processes like claims AI reviews.

Compliance Risks: In the financial sector, failing to meet your service level agreements (SLAs) isn't just bad service—it can have serious regulatory consequences where timely communication is a legal requirement.

This constant firefighting isn't a sustainable way to operate. Traditional calculators also fall short when it comes to managing agents with multiple skills, often resulting in one queue being overstaffed while another is desperately short-handed. It’s an efficiency leak that quietly drains resources day after day.

The Occupancy Trap and Employee Turnover

There's another common trap I see leaders fall into: trying to maximize agent occupancy, which is the percentage of time agents are busy with call-related work. On a spreadsheet, pushing occupancy to 90% or higher looks like a massive win. In the real world, it's a fast track to burning out your team.

When agents have zero breathing room between complex, often emotionally charged conversations, stress levels go through the roof. This relentless pace is a direct cause of high employee turnover, one of the biggest hidden costs in any contact center.

The global call center market is a massive $352.4 billion industry, yet it’s plagued by high turnover rates, often between 30% and 45% each year. Replacing a single agent can cost anywhere from $10,000 to $15,000. Chasing that last bit of occupancy might look good for a quarter, but it ends up costing you far more in the long run through a painful cycle of hiring and retraining.

The AI Solution to Legacy Limitations

This is exactly where modern AI platforms change the game. Instead of just looking backward, AI analyzes real-time data streams and uses predictive analytics to anticipate what's coming next. It can foresee demand spikes, intelligently schedule your multi-skilled agents, and help you deliver exceptional AI customer care without overwhelming your people.

For financial services, where managing risk and maintaining an auditable forecast are non-negotiable, this is more than just an upgrade—it's essential. To see how modern tools can elevate your planning, take a look at our guide on how to capture leads with interactive calculators.

How AI Changes the Staffing and Forecasting Game

Traditional staffing calculators are fantastic for giving you a snapshot based on what’s already happened. They’re like looking in the rearview mirror. But they can’t tell you what’s around the next corner, whether that’s a sudden market dip or an unexpected surge in insurance claims. This is where AI steps in, moving beyond simple math and into the realm of intelligent forecasting. It completely rewrites the rules for how financial services manage their workforce.

AI-native platforms, such as Nolana, don't just crunch historical numbers. They actively analyze real-time data streams and predictive models to get ahead of demand. For AI insurance companies and banks, this means you can adjust agent schedules before a rush hits, keeping your service levels stable and compliant no matter how volatile things get.

This is a fundamental shift from being reactive to truly predictive. In heavily regulated industries where operational resilience is paramount, that’s not just an advantage—it's a necessity.

Putting Automation to Work in Financial Services

One of the first and most tangible ways AI impacts staffing is by taking over high-volume, repetitive tasks. In the financial world, this has a direct, measurable effect on how many agents you actually need on the floor. AI agents can handle routine interactions on their own, filtering out the simple stuff before it ever has to touch a human.

Here are a couple of real-world examples:

AI Insurance Companies: Imagine an AI agent handling the first notice of loss (FNOL). It can gather all the initial data for claims AI reviews without needing a person on the other end. This frees up your licensed adjusters to do what they do best: assess complex cases and negotiate with customers.

Banking Customer Service: For a bank, AI can instantly resolve common queries like balance checks, transaction history requests, and password resets. Customers get 24/7 support, and your overall call volume plummets.

By automating these front-line tasks, AI directly lowers the call volume your human team is responsible for. This, in turn, reduces the raw number of agents your call center staffing calculator says you need. It’s less about cutting costs and more about optimizing your human talent for what really matters.

Building a Smarter, More Strategic Workforce

When AI handles the mundane work, your human agents are freed up to focus on more complex, high-value interactions. Their roles shift from repetitive to strategic, zeroing in on situations that demand empathy, critical thinking, and creative problem-solving. It’s a recipe for a more engaged and effective team.

The real goal of bringing in AI isn't to replace agents, but to amplify them. It's about building a hybrid team where AI handles the predictable, allowing your skilled professionals to manage the exceptions and forge deeper customer relationships.

This hybrid approach has another powerful side effect: it generates cleaner, more reliable data for your forecasting. As AI systems process thousands of interactions, they spot patterns and trends with a precision that manual analysis could never hope to match. This refined data then feeds back into your staffing models, making them smarter and more accurate over time. To fully grasp the strategic side of this, it's worth exploring the broader role of AI in human resources management.

The Bottom-Line Impact of AI

The rise of AI in contact centers is reshaping both budgets and strategies. The conversational AI market is set to skyrocket from $17.05 billion in 2025 to a massive $49.8 billion by 2031, fueled by its knack for precise agent allocation.

By 2030, contact center AI is expected to slash labor costs by an estimated $80 billion. It achieves this by automating routine tasks, freeing up human experts to handle tricky banking questions and complex insurance claims. This isn't some far-off future; it's happening right now. While about 50% of contact centers use tools like chatbots today, that number is projected to hit 80% by the end of 2025, driving faster resolutions and more efficient teams.

Frequently Asked Questions

Let's tackle some of the common questions that come up when you start using a call center staffing calculator, especially as you bring AI into your financial services operations.

How Does AI Change Staffing Needs for Insurance Companies?

For AI insurance companies, automation completely changes the game for staffing. Think about all those high-volume, repetitive tasks—like filing a first notice of loss or just gathering the basic info for a claims AI review. AI agents can handle that work tirelessly.

This means fewer of those simple, transactional calls ever hit your human agents. Your team gets to focus on the complex, high-empathy escalations where they're needed most. As a result, when you run the numbers in your call center staffing calculator, you'll see you need a smaller core team, but one that's highly skilled.

Can a Calculator Help with AI Customer Care in Banking?

Absolutely. In fact, a staffing calculator is essential for navigating the shift to AI customer care. When you have AI handling routine banking questions like balance inquiries or transaction lookups, the calls that do get through to a person are usually the tough ones. They're more complex and take longer to resolve.

This is where you need to be careful. Your calculator must be updated to reflect a higher Average Handle Time (AHT) for these more involved conversations. If you don't adjust for this, you'll be understaffed.

When calibrated correctly, the calculator helps you build a smaller, more specialized team that’s perfectly equipped for the new types of customer issues they'll be facing.

Is Erlang C Still Relevant with AI and Automation?

Yes, Erlang C still has its place. The core formula is still the gold standard for figuring out how many agents you need to handle live phone calls at a specific service level. But AI and automation mean it's no longer the only piece of the puzzle.

Think of it this way: Erlang C is great for the live-call portion, but modern forecasting models layer it with other powerful tools. They use predictive analytics to get ahead of demand and AI insights to model how many tasks will be deflected away from humans entirely. The formula is a critical input, but it doesn't operate in a vacuum anymore. You also need to manage agent availability effectively, using tools like a timesheet submission form template to keep schedules tight.

Ready to move beyond traditional calculators and embrace intelligent automation? Nolana deploys compliant AI agents to automate your high-stakes banking and insurance operations from end to end. Discover how to optimize your workforce and accelerate your workflows today.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP