AI in regulatory compliance in financial services: Streamlining Oversight

AI in regulatory compliance in financial services: Streamlining Oversight

Discover how regulatory compliance in financial services can be streamlined with AI, boosting risk management, reporting, and oversight.

Regulatory compliance isn't just a department—it’s the very foundation of trust in financial services. It encompasses all the laws, rules, and guidelines that banks, insurers, and other financial firms must live by to operate legally and ethically.

At its core, compliance is about building robust systems to prevent misconduct, catch violations when they happen, and maintain operational integrity. The real challenge, however, isn't just knowing the rules; it's keeping up with them. The volume of regulations is staggering, and they're constantly changing.

Navigating the Shifting Tides of Financial Compliance

Think of it like trying to navigate a ship through a storm with an outdated map. Your crew might be incredibly diligent, but the tools they're using were never designed for today's turbulent conditions. That's the reality for many compliance teams right now.

This intense pressure is coming from all sides, especially from escalating enforcement actions and increasingly complex global standards.

Take the U.S. Securities and Exchange Commission (SEC), for example. In fiscal year 2025, it dramatically ramped up its enforcement. The agency launched a staggering 200 actions in the first quarter alone, including a record 75 actions in October 2024. That’s the fastest pace we’ve seen in over two decades. This relentless crackdown and the harsh penalties that come with it have put the entire industry on high alert.

To better understand this complex environment, let's break down the key pressures that are reshaping how financial institutions approach compliance.

Key Regulatory Pressures Shaping Financial Services

The table below outlines the primary regulatory challenges and shows how they directly affect day-to-day operations in both banking and insurance.

Regulatory Driver | Description | Impact on Insurance & Banking |

|---|---|---|

Increased Enforcement | Regulators like the SEC and FINRA are launching more investigations and imposing stricter penalties for non-compliance. | Firms face higher risks of substantial fines, reputational damage, and operational disruption. Every process must be defensible. |

Data Privacy Mandates | Regulations like GDPR and CCPA govern how customer data is collected, stored, and used, requiring strict consent and security protocols. | Requires a complete overhaul of data governance. Both insurers and banks must prove they handle sensitive customer information securely. |

Anti-Money Laundering (AML) | Evolving AML and Know Your Customer (KYC) rules demand continuous monitoring of transactions to detect and report suspicious activity. | Puts immense pressure on transaction monitoring systems and customer onboarding processes to prevent illicit financial flows. |

Consumer Protection Laws | Rules focusing on fair lending, transparent product disclosures, and ethical marketing practices are becoming more stringent. | Demands careful oversight of all customer interactions, from loan origination in banking to claims handling in insurance. |

These drivers illustrate a clear trend: the margin for error is shrinking. Regulators expect more, and the consequences of falling short have never been greater.

The Limits of Manual Compliance

Faced with this reality, the traditional, manual methods of compliance are simply breaking down. Picture a team of analysts buried in spreadsheets, manually cross-referencing thousands of transactions against hundreds of different rules. It’s not just slow and incredibly prone to human error—it creates massive operational bottlenecks.

The real problem is trying to manage enormous volumes of data while somehow maintaining a perfect, irrefutable audit trail for every single decision.

When a regulator knocks on the door asking for proof of compliance, piecing that story together from disparate emails, documents, and spreadsheets can take weeks. Even then, the final report might have gaps. This reactive, manual posture just isn't sustainable anymore.

AI as the Modern Navigation System

This is where AI-driven automation changes the game. It acts as a modern navigation system, transforming regulatory compliance in financial services from a reactive burden into a proactive, strategic advantage. Instead of just trying to stay afloat, institutions can actively manage risk and find new efficiencies.

The impact is most profound in high-volume, data-heavy areas like customer service and claims processing.

Automating Insurance Claims: An insurer using AI can instantly verify policy details, automatically flag potential fraud indicators, and create a flawless audit log for every step of the process. This is crucial for maintaining a clean record and ensuring a positive claims experience.

Enhancing Customer Care: An AI-powered customer care system can run real-time identity checks during onboarding or resolve service issues, all while ensuring every interaction is fully compliant with consumer protection laws.

By automating these routine, rule-based processes, financial institutions can guarantee consistency, accuracy, and full traceability. This shift is a critical piece of a successful digital transformation in financial services. It empowers organizations to not only meet regulatory demands but also to deliver faster, more reliable services to their customers—turning a compliance headache into a genuine competitive edge.

How AI Gets to Work: Claims and Customer Care

Let's move past the theoretical and look at where the rubber meets the road. The true test for AI in financial services isn't just about efficiency; it's about performing flawlessly in high-stakes, tightly regulated areas. Insurance claims and customer care are two perfect examples. These are complex, data-heavy processes where intelligent automation can deliver both a better customer experience and ironclad compliance.

Think about the traditional auto insurance claim. It’s a slow, cumbersome journey of manual data entry, endless handoffs between departments, and long waits for a decision. Now, let’s inject some intelligence into that process.

Transforming Insurance Claims with Compliant Automation

When AI insurance companies bring in intelligent agents, they don't just speed up the claims lifecycle; they strengthen regulatory compliance in financial services at every turn. From the moment a First Notice of Loss (FNOL) arrives—be it via phone, email, or a mobile app—an AI agent is on the case. Instantly.

This is much more than just robotic data entry. It’s about smart processing. The AI agent can:

Ingest and Digitize Information: It pulls key details from unstructured sources like photos, police reports, and witness statements, neatly organizing everything into a structured case file.

Perform Instant Policy Verification: The agent checks the claim against the customer's policy in real time, confirming coverage limits, deductibles, and any specific exclusions. No human intervention needed.

Identify Subtle Fraud Indicators: By analyzing patterns from thousands of past claims, the AI can flag anomalies that a human might miss—things like conflicting statements or unusually high repair estimates.

This automated first pass doesn't make human adjusters obsolete. It makes them better. For a straightforward, low-value claim, the AI might handle the entire process from start to finish. But if it flags inconsistencies, the agent packages a complete summary and routes it to a senior human adjuster. This ensures expert human judgment is focused where it adds the most value.

The real game-changer here is the creation of a perfect audit trail. Every action the AI takes is logged, timestamped, and linked to a specific business rule. This level of transparency is gold for claims AI reviews, giving regulators a clear, defensible record of how every decision was made.

Elevating Customer Care with Built-In Guardrails

The same core principles apply to AI customer care in banking and insurance. Customer interactions are governed by a maze of regulations, from identity verification protocols to rules on handling complaints. AI agents can manage these conversations with a consistency that’s incredibly difficult for human teams to maintain alone.

Take a new customer opening a bank account. This is a critical compliance checkpoint where Know Your Customer (KYC) and Anti-Money Laundering (AML) checks are non-negotiable. An AI agent can walk a new customer through this with ease.

The AI orchestrates a sophisticated workflow by:

Capturing Information: It collects all necessary documents and data through a simple, conversational interface.

Integrating with Core Systems: The agent connects to external KYC/AML databases and internal platforms like Salesforce or Genesys to verify the customer's identity on the spot.

Executing SOPs: It follows the bank's standard operating procedures for identity checks to the letter, ensuring no step is ever skipped.

Escalating Exceptions: If it finds a mismatch—say, a provided address doesn't line up with official records—the AI immediately sends the case to a compliance officer with a full report.

This integration is what makes it work. The AI isn't just a simple chatbot; it's an intelligent operator that pulls together data from multiple sources to solve complex problems. Whether it's a confusing billing inquiry or a request to update policy details, the AI agent can find the right information and get the job done while respecting all consumer protection laws. You can see a deeper breakdown of how this tech is changing the game in our guide on AI in insurance claims.

By automating these front-line tasks, financial institutions can give customers faster answers and a smoother experience, all while ensuring every single interaction is documented and fully compliant. It’s a practical application that proves technology can be a powerful partner in mastering modern financial regulation.

Building a Compliant and Auditable AI Framework

When you bring AI into high-stakes operations like insurance claims or customer service, you have to answer one crucial question for regulators: how do you prove it’s trustworthy? It’s not enough for the AI to be fast; you need an ironclad case for every single automated decision. This boils down to building a framework around two core ideas: auditability and explainability.

Think of it as installing a flight data recorder for every AI interaction. A truly compliant system has to log every step, every calculation, and every piece of data it touches. This creates a clear, unbroken trail showing that each decision maps directly back to a specific company standard operating procedure (SOP).

For example, if an AI agent denies part of an insurance claim, a compliance officer needs to be able to pull up the exact policy clause, customer data point, and internal rule the AI used to make that call. This level of detail is fundamental to proving that you’re applying company policies consistently and without bias—a cornerstone of regulatory compliance in financial services.

The Power of Explainable AI in Audits

Auditability tells you what happened. But regulators will always follow up with a simple, direct question: Why? This is where Explainable AI (XAI) moves from a nice-to-have to an essential compliance tool. XAI is designed to translate an AI’s complex internal logic into plain language that people can actually understand.

Instead of a "black box" that spits out answers, an explainable system lets you look under the hood and ask about its reasoning. For a compliance officer facing an audit, this is huge. It means they can confidently explain why a customer was flagged for extra identity verification, rather than just shrugging their shoulders.

An XAI system can give a straightforward answer, like: "The customer's address didn't match our third-party verification service, which triggered SOP 7.2 for a manual review." This kind of transparency turns claims AI reviews from a stressful, defensive scramble into a clear demonstration of robust internal controls.

This capability is especially critical as models get more complex. When you're working with something like a Large Language Model (LLM), getting that transparency can be tough, which is where services from LLM visibility tracking agencies can make a real difference in monitoring performance.

Establishing Clear Guardrails and Escalation Paths

Ultimately, a human has to be in control. A compliant AI framework isn’t about letting algorithms run wild; it’s about smart automation that operates within strict, well-defined boundaries. We establish these boundaries by setting up clear operational guardrails.

These guardrails act as the digital equivalent of an employee's authorization level. They define exactly what an AI agent can and can't do on its own, ensuring it only handles tasks it’s been properly trained and approved for.

A solid control structure needs a few key components:

Predefined Escalation Paths: When an AI hits a problem it can't solve—like a bizarre claim scenario or a highly distressed customer—it needs a clear, immediate path to a human expert. No guesswork involved.

Human-in-the-Loop (HITL) Oversight: For the most sensitive decisions, like fair lending assessments or approving massive claims, a human must have the final say. The AI can do the legwork and make a recommendation, but a qualified person signs off.

Continuous Monitoring: An AI's performance is never "set it and forget it." Teams have to constantly watch for accuracy, drift, and bias, using that feedback to make the system smarter and safer over time.

This structured approach lets you get the efficiency benefits of automation without sacrificing the human oversight that regulators demand. As you build out your compliance infrastructure, understanding frameworks like SOC 2 becomes critical. To get up to speed, take a look at our guide on https://nolana.com/articles/what-is-soc-2-compliance, which explains how it reinforces data security and operational integrity.

By weaving together detailed audit logs, explainable logic, and firm human oversight, financial institutions can deploy AI customer care and claims automation that will stand up to even the toughest regulatory inspection.

Integrating AI with Your Existing Tech Stack

When IT leaders hear "AI deployment," they often brace for a painful, multi-year overhaul. The thought of untangling fragmented data silos and dealing with deeply embedded legacy systems like Guidewire or Duck Creek makes any major change feel like an impossible task. But bringing in AI doesn't have to mean starting from scratch.

The secret is focusing on integration, not replacement. Modern AI platforms are built to act as a smart orchestration layer that works with your current infrastructure. They plug into your core systems through APIs, giving them the ability to read, write, and kick off tasks across the very tools your teams rely on every day.

This approach lets you bring powerful automation into the fold without blowing up your operational foundation.

Connecting AI to Legacy Systems

It helps to think of your core systems as well-established libraries full of critical information. An AI agent is like a hyper-efficient research assistant who doesn't need to rewrite all the books. It just needs a library card—an API key—to get the information required to do its job.

For AI insurance companies, this plays out in very practical ways. An AI agent can:

Pull policy details from Guidewire to validate a new claim.

Update a customer’s record in Salesforce right after a service call.

Tap into KYC/AML databases to run identity verification checks in real-time.

This API-first strategy keeps your existing investments valuable while adding a new layer of intelligence on top. It’s a practical path to modernization that sidesteps the massive risks of a "rip and replace" project. You can dig deeper into building this kind of flexible infrastructure by reading about microservices architecture patterns in our related article.

Mastering Data Governance and Security

Of course, letting AI access your core data immediately brings up critical questions about governance, privacy, and security. In a highly regulated industry, these aren't just details to figure out later; they are the bedrock of regulatory compliance in financial services. Your entire AI framework has to be built on trust and control.

It all starts with solid data governance. AI agents must be programmed to handle information according to strict rules, ensuring they comply with regulations like GDPR. They need to know precisely what data they can touch, how they can use it, and when it must be anonymized or deleted.

Security is just as non-negotiable. Any enterprise-grade AI platform must come with verifiable security credentials, most notably a SOC 2 Type II certification. This attestation is independent proof that the provider has implemented serious controls to protect the confidentiality, integrity, and availability of your data.

By choosing a platform with these guardrails already built-in, you can be confident that your automated workflows will hold up under the toughest regulatory scrutiny.

Automating Data Capture for Complex Rules

One of the biggest compliance headaches has always been capturing data accurately. A recent Indicator survey from Wolters Kluwer put a spotlight on this pain point, with 69% of lenders and insurers pointing to the Small Business Data Collection Rule (Section 1071) as a major priority. The survey also found a 12-point jump in data capture concerns and a 9-point rise in worries about system upgrades, showing just how much operational strain new rules can create.

This is exactly where AI automation can make a huge difference. Manually collecting and validating data against a long list of complex rules is slow, tedious, and filled with opportunities for human error. An AI agent, on the other hand, can run these checks with perfect consistency every single time.

For instance, while processing a loan application or a complicated insurance claim, the AI can:

Automatically request all the required documentation from the customer.

Cross-reference the information provided against internal and external data sources.

Flag any missing fields or inconsistent data points for immediate human review.

This level of automated precision drastically cuts down on human error, ensuring the data you collect for regulatory reporting is both complete and accurate. It turns a high-risk manual process into a reliable, auditable workflow, strengthening your compliance from the ground up.

Your Roadmap to Deploying Compliant AI Automation

Putting theory into practice demands a clear, strategic playbook. For leaders in operations and transformation, deploying AI isn't a "big bang" event. It's a phased journey that carefully balances immediate operational gains with long-term risk management, making sure regulatory compliance in financial services is baked in from day one.

Your first move? Pinpoint the right starting line. Look for workflows with high impact and lower risk—processes where the rules are well-defined and the potential for a quick win is obvious. This strategy helps you demonstrate value early and build crucial institutional confidence in the automation.

Identifying Your First Automation Wins

Start by thinking about your most repetitive, high-volume tasks. These are almost always the processes that bog down your best people and create frustrating compliance bottlenecks.

For AI insurance companies, this could mean automating the initial validation for a flood of low-value claims. For a bank, it might be as simple as handling standard customer queries about account balances or recent transactions.

A few excellent candidates for an initial AI deployment include:

Initial Claims Validation: An AI agent can instantly verify policy coverage, check for complete documentation, and flag simple claims for straight-through processing. This frees up your experienced human adjusters to concentrate on the truly complex cases.

Standard Customer Queries: Deploying AI customer care agents to resolve common issues cuts down wait times and guarantees every customer gets a consistent, compliant answer based on pre-approved scripts.

Data Entry and Verification: Automating how customer information is captured and verified during onboarding drastically reduces human error and strengthens your KYC and AML processes.

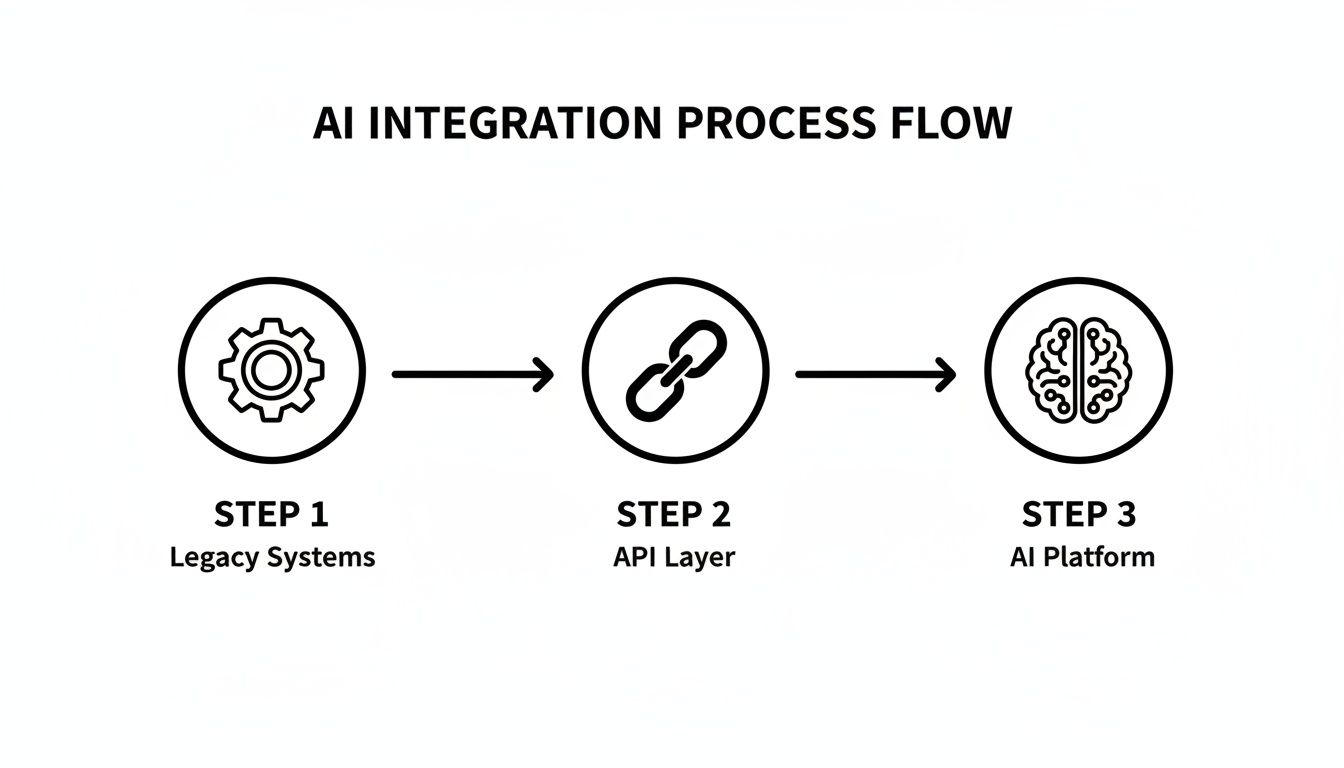

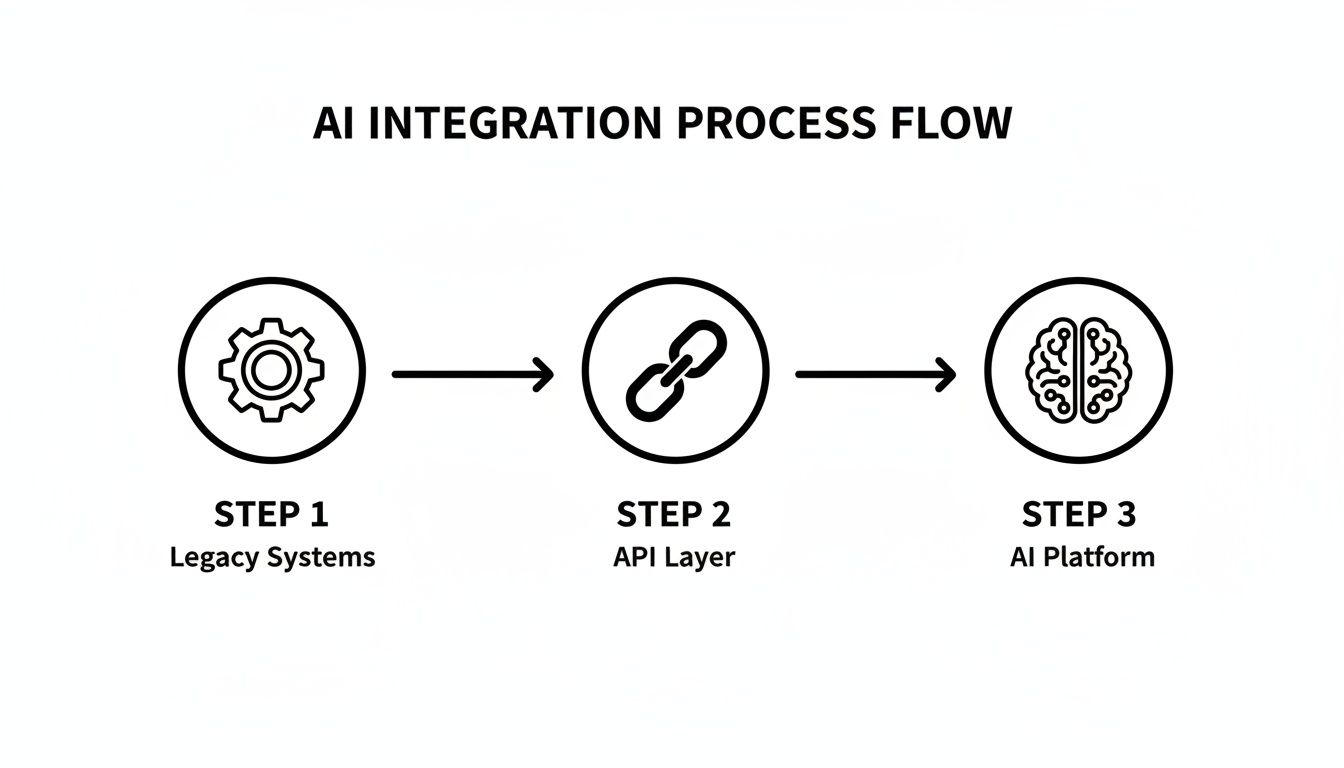

This diagram shows a common integration pattern. AI platforms don't have to rip and replace your core systems; they use an API layer to connect with them, acting as an intelligent layer on top of your existing tech stack.

As you can see, modern AI works with your legacy infrastructure, not against it, orchestrating tasks without requiring a disruptive overhaul.

Defining Clear and Measurable KPIs

To prove your automation efforts are paying off, you need to define key performance indicators (KPIs) right from the start. These metrics must connect directly to both operational efficiency and compliance strength. Don't settle for vague goals; focus on concrete, quantifiable outcomes that make sense to business leaders and auditors.

The goal is to create a scorecard that proves AI is not just faster, but also safer and more reliable. This data becomes invaluable for internal business cases and external claims AI reviews with regulators.

Here’s a practical, phased roadmap that financial institutions can follow to roll out AI-driven automation in a controlled and compliant manner.

AI Implementation Roadmap for Compliance Automation

Phase | Key Actions | Primary Goal | Success Metrics (KPIs) |

|---|---|---|---|

Phase 1: Pilot & Prove (1-3 Months) | Identify a high-volume, low-risk workflow. Train a single AI agent on specific SOPs. Run in a firewalled or "human-in-the-loop" environment. | Validate the technology and demonstrate a quick win. Build internal confidence. | >95% accuracy on task execution. 30% reduction in manual handling time for the pilot process. |

Phase 2: Scale & Integrate (4-9 Months) | Expand AI to 3-5 related processes. Integrate with key systems (e.g., CRM, claims management). Establish the full audit trail and reporting dashboard. | Achieve measurable operational impact across a department. Embed compliance controls. | 50% reduction in cost-per-interaction. 100% audit trail completeness. Increase in First Contact Resolution (FCR) by 15%. |

Phase 3: Optimize & Empower (10+ Months) | Deploy AI across the entire business unit. Empower teams to identify new automation opportunities. Use AI analytics to find process inefficiencies. | Drive enterprise-level efficiency and create a culture of continuous improvement. | Positive ROI within 12-18 months. Consistent reduction in error rates quarter-over-quarter. Employee satisfaction scores improve. |

This roadmap provides a structured path from a small, contained pilot to a full-scale, optimized deployment, ensuring compliance and value are built in at every step.

Training AI Agents on Your Specific SOPs

An AI agent is only as good as the knowledge you give it. Unlike generic chatbots, compliant AI for financial services must be deeply trained on your company’s specific Standard Operating Procedures (SOPs). This is the only way to ensure it executes tasks exactly the way your best human employee would, every single time.

This training involves feeding the AI your internal documentation, process maps, and even historical data showing how your teams handled similar cases in the past. The Nolana platform, for example, actually learns from your team's real-world actions to build its automation playbooks. This ensures the AI doesn’t just know the rules—it understands the context behind them.

This step is absolutely critical for building a system you can trust with high-stakes decisions. It guarantees the AI’s actions are always aligned with your internal policies and regulatory obligations.

Fostering a Collaborative Human-AI Culture

Ultimately, a successful AI deployment is as much about people as it is about technology. The most effective implementations create a culture where human teams and AI agents work together as a single, unified force.

The AI takes on the repetitive, data-heavy lifting. This, in turn, empowers your human experts to focus on judgment-based work, complex problem-solving, and building genuine customer relationships.

It's vital to communicate that AI is a tool to augment human capabilities, not replace them. When employees see automation freeing them from tedious work to focus on more meaningful tasks, they become champions of the new system. This seamless partnership is the key to achieving operational excellence while upholding the highest standards of compliance.

Shifting from Reactive Compliance to Proactive Risk Management

Let’s be honest: for decades, regulatory compliance in financial services has been a game of defense. A new rule comes out, and we scramble to react. But the real leap forward is flipping that script entirely—moving from a defensive, reactive crouch to a proactive, forward-looking stance.

Instead of just ticking boxes, leading institutions are now using AI to get ahead of the curve, spotting and neutralizing risks before they ever become front-page problems. This changes everything. Compliance stops being a necessary but costly burden and starts becoming a real strategic advantage.

Think about it. By sifting through massive pools of data—transactions, emails, customer chats—smart AI can pick up on the faint, almost invisible signals that often precede financial crime or a compliance breach. That kind of foresight is exactly what you need when you're drowning in regulatory filings.

From Quantity to Quality in Risk Detection

One of the biggest operational headaches for any financial institution is managing Suspicious Activity Reports (SARs). The firehose of alerts is constant, and compliance teams are often so buried in noise that they struggle to find the real threats among all the false positives. This is where AI’s ability to find the needle in the haystack really pays off.

The pressure is only mounting. FinCEN data shows an 18.5% surge in SAR filings between mid-2023 and the end of 2024. And it's not just a feeling; a recent BSA/AML Roundtable found that a staggering 75% of its members are dealing with spikes in alert volume. As PwC’s latest survey confirms, the focus for 2025 is squarely on improving compliance and transaction monitoring. For a deeper dive, EY's comprehensive regulatory outlook lays this out in stark detail.

An AI-native operating system gives you the controls to manage this chaos. By automating that first pass on alerts, AI filters out the static and hands your human experts a curated list of high-priority cases, complete with the context they need to make a quick, accurate call. This not only improves the quality of your SAR filings but also strengthens your entire risk framework. You can read more about this in our guide on operational risk management in banking.

This proactive approach allows organizations to not only meet today’s regulatory standards but also build a resilient framework capable of adapting to future requirements. It’s about building a system that learns, predicts, and protects.

Ultimately, when you weave AI into core operations—from insurance claims processing to customer service—you create a powerful feedback loop. Insights from claims AI reviews and AI customer care interactions are fed back into the risk models, sharpening them over time. That’s how AI insurance companies and forward-thinking banks build a lasting competitive edge founded on trust, efficiency, and genuine foresight.

Common Questions Answered

How Does AI Actually Handle Complex Insurance Claims?

Think of AI not as a replacement for your seasoned adjusters, but as a powerful assistant that handles the tedious, high-volume work. For AI insurance companies, this means agents can instantly verify policies and gather initial claim data, creating a clean, complete file for human review. It's about getting the groundwork perfect, every time.

This lets your human team focus their expertise on the complex, nuanced cases that require empathy and deep investigation. The AI works like a co-pilot, flagging potential fraud or inconsistencies and routing the claim, with all its context, to the right specialist. This model boosts both speed and accuracy.

Can We Trust AI with Sensitive Customer Issues?

Yes, and in many ways, AI customer care can actually improve how you handle sensitive interactions from a compliance standpoint. An AI agent is meticulously trained on your standard operating procedures, ensuring every initial response is consistent and strictly adheres to consumer protection regulations.

When a conversation becomes emotionally charged or moves beyond the AI's defined scope, it doesn't guess. It follows a clear, pre-set escalation path, seamlessly handing off the customer—and the full interaction history—to a human agent prepared to manage the situation.

This structured process guarantees customers get consistent, compliant service. It also ensures that the most sensitive cases receive the human touch they need, upholding the high standards required for regulatory compliance in financial services.

Does This Mean We Have to Replace Our Core Systems?

Not at all. Modern AI platforms are built to work with what you already have, not tear it down. They use an API-first design, functioning as a smart orchestration layer that plugs right into your existing systems, whether it's Guidewire or Salesforce.

This allows the AI to pull and push data in real-time, automating processes that span your entire technology stack. You get the benefits of intelligent automation without the headache and cost of a massive "rip-and-replace" project.

Nolana provides an AI-native operating system designed to automate high-stakes financial services operations with precision and control. Discover how our compliant AI agents can transform your workflows by visiting https://nolana.com.

Regulatory compliance isn't just a department—it’s the very foundation of trust in financial services. It encompasses all the laws, rules, and guidelines that banks, insurers, and other financial firms must live by to operate legally and ethically.

At its core, compliance is about building robust systems to prevent misconduct, catch violations when they happen, and maintain operational integrity. The real challenge, however, isn't just knowing the rules; it's keeping up with them. The volume of regulations is staggering, and they're constantly changing.

Navigating the Shifting Tides of Financial Compliance

Think of it like trying to navigate a ship through a storm with an outdated map. Your crew might be incredibly diligent, but the tools they're using were never designed for today's turbulent conditions. That's the reality for many compliance teams right now.

This intense pressure is coming from all sides, especially from escalating enforcement actions and increasingly complex global standards.

Take the U.S. Securities and Exchange Commission (SEC), for example. In fiscal year 2025, it dramatically ramped up its enforcement. The agency launched a staggering 200 actions in the first quarter alone, including a record 75 actions in October 2024. That’s the fastest pace we’ve seen in over two decades. This relentless crackdown and the harsh penalties that come with it have put the entire industry on high alert.

To better understand this complex environment, let's break down the key pressures that are reshaping how financial institutions approach compliance.

Key Regulatory Pressures Shaping Financial Services

The table below outlines the primary regulatory challenges and shows how they directly affect day-to-day operations in both banking and insurance.

Regulatory Driver | Description | Impact on Insurance & Banking |

|---|---|---|

Increased Enforcement | Regulators like the SEC and FINRA are launching more investigations and imposing stricter penalties for non-compliance. | Firms face higher risks of substantial fines, reputational damage, and operational disruption. Every process must be defensible. |

Data Privacy Mandates | Regulations like GDPR and CCPA govern how customer data is collected, stored, and used, requiring strict consent and security protocols. | Requires a complete overhaul of data governance. Both insurers and banks must prove they handle sensitive customer information securely. |

Anti-Money Laundering (AML) | Evolving AML and Know Your Customer (KYC) rules demand continuous monitoring of transactions to detect and report suspicious activity. | Puts immense pressure on transaction monitoring systems and customer onboarding processes to prevent illicit financial flows. |

Consumer Protection Laws | Rules focusing on fair lending, transparent product disclosures, and ethical marketing practices are becoming more stringent. | Demands careful oversight of all customer interactions, from loan origination in banking to claims handling in insurance. |

These drivers illustrate a clear trend: the margin for error is shrinking. Regulators expect more, and the consequences of falling short have never been greater.

The Limits of Manual Compliance

Faced with this reality, the traditional, manual methods of compliance are simply breaking down. Picture a team of analysts buried in spreadsheets, manually cross-referencing thousands of transactions against hundreds of different rules. It’s not just slow and incredibly prone to human error—it creates massive operational bottlenecks.

The real problem is trying to manage enormous volumes of data while somehow maintaining a perfect, irrefutable audit trail for every single decision.

When a regulator knocks on the door asking for proof of compliance, piecing that story together from disparate emails, documents, and spreadsheets can take weeks. Even then, the final report might have gaps. This reactive, manual posture just isn't sustainable anymore.

AI as the Modern Navigation System

This is where AI-driven automation changes the game. It acts as a modern navigation system, transforming regulatory compliance in financial services from a reactive burden into a proactive, strategic advantage. Instead of just trying to stay afloat, institutions can actively manage risk and find new efficiencies.

The impact is most profound in high-volume, data-heavy areas like customer service and claims processing.

Automating Insurance Claims: An insurer using AI can instantly verify policy details, automatically flag potential fraud indicators, and create a flawless audit log for every step of the process. This is crucial for maintaining a clean record and ensuring a positive claims experience.

Enhancing Customer Care: An AI-powered customer care system can run real-time identity checks during onboarding or resolve service issues, all while ensuring every interaction is fully compliant with consumer protection laws.

By automating these routine, rule-based processes, financial institutions can guarantee consistency, accuracy, and full traceability. This shift is a critical piece of a successful digital transformation in financial services. It empowers organizations to not only meet regulatory demands but also to deliver faster, more reliable services to their customers—turning a compliance headache into a genuine competitive edge.

How AI Gets to Work: Claims and Customer Care

Let's move past the theoretical and look at where the rubber meets the road. The true test for AI in financial services isn't just about efficiency; it's about performing flawlessly in high-stakes, tightly regulated areas. Insurance claims and customer care are two perfect examples. These are complex, data-heavy processes where intelligent automation can deliver both a better customer experience and ironclad compliance.

Think about the traditional auto insurance claim. It’s a slow, cumbersome journey of manual data entry, endless handoffs between departments, and long waits for a decision. Now, let’s inject some intelligence into that process.

Transforming Insurance Claims with Compliant Automation

When AI insurance companies bring in intelligent agents, they don't just speed up the claims lifecycle; they strengthen regulatory compliance in financial services at every turn. From the moment a First Notice of Loss (FNOL) arrives—be it via phone, email, or a mobile app—an AI agent is on the case. Instantly.

This is much more than just robotic data entry. It’s about smart processing. The AI agent can:

Ingest and Digitize Information: It pulls key details from unstructured sources like photos, police reports, and witness statements, neatly organizing everything into a structured case file.

Perform Instant Policy Verification: The agent checks the claim against the customer's policy in real time, confirming coverage limits, deductibles, and any specific exclusions. No human intervention needed.

Identify Subtle Fraud Indicators: By analyzing patterns from thousands of past claims, the AI can flag anomalies that a human might miss—things like conflicting statements or unusually high repair estimates.

This automated first pass doesn't make human adjusters obsolete. It makes them better. For a straightforward, low-value claim, the AI might handle the entire process from start to finish. But if it flags inconsistencies, the agent packages a complete summary and routes it to a senior human adjuster. This ensures expert human judgment is focused where it adds the most value.

The real game-changer here is the creation of a perfect audit trail. Every action the AI takes is logged, timestamped, and linked to a specific business rule. This level of transparency is gold for claims AI reviews, giving regulators a clear, defensible record of how every decision was made.

Elevating Customer Care with Built-In Guardrails

The same core principles apply to AI customer care in banking and insurance. Customer interactions are governed by a maze of regulations, from identity verification protocols to rules on handling complaints. AI agents can manage these conversations with a consistency that’s incredibly difficult for human teams to maintain alone.

Take a new customer opening a bank account. This is a critical compliance checkpoint where Know Your Customer (KYC) and Anti-Money Laundering (AML) checks are non-negotiable. An AI agent can walk a new customer through this with ease.

The AI orchestrates a sophisticated workflow by:

Capturing Information: It collects all necessary documents and data through a simple, conversational interface.

Integrating with Core Systems: The agent connects to external KYC/AML databases and internal platforms like Salesforce or Genesys to verify the customer's identity on the spot.

Executing SOPs: It follows the bank's standard operating procedures for identity checks to the letter, ensuring no step is ever skipped.

Escalating Exceptions: If it finds a mismatch—say, a provided address doesn't line up with official records—the AI immediately sends the case to a compliance officer with a full report.

This integration is what makes it work. The AI isn't just a simple chatbot; it's an intelligent operator that pulls together data from multiple sources to solve complex problems. Whether it's a confusing billing inquiry or a request to update policy details, the AI agent can find the right information and get the job done while respecting all consumer protection laws. You can see a deeper breakdown of how this tech is changing the game in our guide on AI in insurance claims.

By automating these front-line tasks, financial institutions can give customers faster answers and a smoother experience, all while ensuring every single interaction is documented and fully compliant. It’s a practical application that proves technology can be a powerful partner in mastering modern financial regulation.

Building a Compliant and Auditable AI Framework

When you bring AI into high-stakes operations like insurance claims or customer service, you have to answer one crucial question for regulators: how do you prove it’s trustworthy? It’s not enough for the AI to be fast; you need an ironclad case for every single automated decision. This boils down to building a framework around two core ideas: auditability and explainability.

Think of it as installing a flight data recorder for every AI interaction. A truly compliant system has to log every step, every calculation, and every piece of data it touches. This creates a clear, unbroken trail showing that each decision maps directly back to a specific company standard operating procedure (SOP).

For example, if an AI agent denies part of an insurance claim, a compliance officer needs to be able to pull up the exact policy clause, customer data point, and internal rule the AI used to make that call. This level of detail is fundamental to proving that you’re applying company policies consistently and without bias—a cornerstone of regulatory compliance in financial services.

The Power of Explainable AI in Audits

Auditability tells you what happened. But regulators will always follow up with a simple, direct question: Why? This is where Explainable AI (XAI) moves from a nice-to-have to an essential compliance tool. XAI is designed to translate an AI’s complex internal logic into plain language that people can actually understand.

Instead of a "black box" that spits out answers, an explainable system lets you look under the hood and ask about its reasoning. For a compliance officer facing an audit, this is huge. It means they can confidently explain why a customer was flagged for extra identity verification, rather than just shrugging their shoulders.

An XAI system can give a straightforward answer, like: "The customer's address didn't match our third-party verification service, which triggered SOP 7.2 for a manual review." This kind of transparency turns claims AI reviews from a stressful, defensive scramble into a clear demonstration of robust internal controls.

This capability is especially critical as models get more complex. When you're working with something like a Large Language Model (LLM), getting that transparency can be tough, which is where services from LLM visibility tracking agencies can make a real difference in monitoring performance.

Establishing Clear Guardrails and Escalation Paths

Ultimately, a human has to be in control. A compliant AI framework isn’t about letting algorithms run wild; it’s about smart automation that operates within strict, well-defined boundaries. We establish these boundaries by setting up clear operational guardrails.

These guardrails act as the digital equivalent of an employee's authorization level. They define exactly what an AI agent can and can't do on its own, ensuring it only handles tasks it’s been properly trained and approved for.

A solid control structure needs a few key components:

Predefined Escalation Paths: When an AI hits a problem it can't solve—like a bizarre claim scenario or a highly distressed customer—it needs a clear, immediate path to a human expert. No guesswork involved.

Human-in-the-Loop (HITL) Oversight: For the most sensitive decisions, like fair lending assessments or approving massive claims, a human must have the final say. The AI can do the legwork and make a recommendation, but a qualified person signs off.

Continuous Monitoring: An AI's performance is never "set it and forget it." Teams have to constantly watch for accuracy, drift, and bias, using that feedback to make the system smarter and safer over time.

This structured approach lets you get the efficiency benefits of automation without sacrificing the human oversight that regulators demand. As you build out your compliance infrastructure, understanding frameworks like SOC 2 becomes critical. To get up to speed, take a look at our guide on https://nolana.com/articles/what-is-soc-2-compliance, which explains how it reinforces data security and operational integrity.

By weaving together detailed audit logs, explainable logic, and firm human oversight, financial institutions can deploy AI customer care and claims automation that will stand up to even the toughest regulatory inspection.

Integrating AI with Your Existing Tech Stack

When IT leaders hear "AI deployment," they often brace for a painful, multi-year overhaul. The thought of untangling fragmented data silos and dealing with deeply embedded legacy systems like Guidewire or Duck Creek makes any major change feel like an impossible task. But bringing in AI doesn't have to mean starting from scratch.

The secret is focusing on integration, not replacement. Modern AI platforms are built to act as a smart orchestration layer that works with your current infrastructure. They plug into your core systems through APIs, giving them the ability to read, write, and kick off tasks across the very tools your teams rely on every day.

This approach lets you bring powerful automation into the fold without blowing up your operational foundation.

Connecting AI to Legacy Systems

It helps to think of your core systems as well-established libraries full of critical information. An AI agent is like a hyper-efficient research assistant who doesn't need to rewrite all the books. It just needs a library card—an API key—to get the information required to do its job.

For AI insurance companies, this plays out in very practical ways. An AI agent can:

Pull policy details from Guidewire to validate a new claim.

Update a customer’s record in Salesforce right after a service call.

Tap into KYC/AML databases to run identity verification checks in real-time.

This API-first strategy keeps your existing investments valuable while adding a new layer of intelligence on top. It’s a practical path to modernization that sidesteps the massive risks of a "rip and replace" project. You can dig deeper into building this kind of flexible infrastructure by reading about microservices architecture patterns in our related article.

Mastering Data Governance and Security

Of course, letting AI access your core data immediately brings up critical questions about governance, privacy, and security. In a highly regulated industry, these aren't just details to figure out later; they are the bedrock of regulatory compliance in financial services. Your entire AI framework has to be built on trust and control.

It all starts with solid data governance. AI agents must be programmed to handle information according to strict rules, ensuring they comply with regulations like GDPR. They need to know precisely what data they can touch, how they can use it, and when it must be anonymized or deleted.

Security is just as non-negotiable. Any enterprise-grade AI platform must come with verifiable security credentials, most notably a SOC 2 Type II certification. This attestation is independent proof that the provider has implemented serious controls to protect the confidentiality, integrity, and availability of your data.

By choosing a platform with these guardrails already built-in, you can be confident that your automated workflows will hold up under the toughest regulatory scrutiny.

Automating Data Capture for Complex Rules

One of the biggest compliance headaches has always been capturing data accurately. A recent Indicator survey from Wolters Kluwer put a spotlight on this pain point, with 69% of lenders and insurers pointing to the Small Business Data Collection Rule (Section 1071) as a major priority. The survey also found a 12-point jump in data capture concerns and a 9-point rise in worries about system upgrades, showing just how much operational strain new rules can create.

This is exactly where AI automation can make a huge difference. Manually collecting and validating data against a long list of complex rules is slow, tedious, and filled with opportunities for human error. An AI agent, on the other hand, can run these checks with perfect consistency every single time.

For instance, while processing a loan application or a complicated insurance claim, the AI can:

Automatically request all the required documentation from the customer.

Cross-reference the information provided against internal and external data sources.

Flag any missing fields or inconsistent data points for immediate human review.

This level of automated precision drastically cuts down on human error, ensuring the data you collect for regulatory reporting is both complete and accurate. It turns a high-risk manual process into a reliable, auditable workflow, strengthening your compliance from the ground up.

Your Roadmap to Deploying Compliant AI Automation

Putting theory into practice demands a clear, strategic playbook. For leaders in operations and transformation, deploying AI isn't a "big bang" event. It's a phased journey that carefully balances immediate operational gains with long-term risk management, making sure regulatory compliance in financial services is baked in from day one.

Your first move? Pinpoint the right starting line. Look for workflows with high impact and lower risk—processes where the rules are well-defined and the potential for a quick win is obvious. This strategy helps you demonstrate value early and build crucial institutional confidence in the automation.

Identifying Your First Automation Wins

Start by thinking about your most repetitive, high-volume tasks. These are almost always the processes that bog down your best people and create frustrating compliance bottlenecks.

For AI insurance companies, this could mean automating the initial validation for a flood of low-value claims. For a bank, it might be as simple as handling standard customer queries about account balances or recent transactions.

A few excellent candidates for an initial AI deployment include:

Initial Claims Validation: An AI agent can instantly verify policy coverage, check for complete documentation, and flag simple claims for straight-through processing. This frees up your experienced human adjusters to concentrate on the truly complex cases.

Standard Customer Queries: Deploying AI customer care agents to resolve common issues cuts down wait times and guarantees every customer gets a consistent, compliant answer based on pre-approved scripts.

Data Entry and Verification: Automating how customer information is captured and verified during onboarding drastically reduces human error and strengthens your KYC and AML processes.

This diagram shows a common integration pattern. AI platforms don't have to rip and replace your core systems; they use an API layer to connect with them, acting as an intelligent layer on top of your existing tech stack.

As you can see, modern AI works with your legacy infrastructure, not against it, orchestrating tasks without requiring a disruptive overhaul.

Defining Clear and Measurable KPIs

To prove your automation efforts are paying off, you need to define key performance indicators (KPIs) right from the start. These metrics must connect directly to both operational efficiency and compliance strength. Don't settle for vague goals; focus on concrete, quantifiable outcomes that make sense to business leaders and auditors.

The goal is to create a scorecard that proves AI is not just faster, but also safer and more reliable. This data becomes invaluable for internal business cases and external claims AI reviews with regulators.

Here’s a practical, phased roadmap that financial institutions can follow to roll out AI-driven automation in a controlled and compliant manner.

AI Implementation Roadmap for Compliance Automation

Phase | Key Actions | Primary Goal | Success Metrics (KPIs) |

|---|---|---|---|

Phase 1: Pilot & Prove (1-3 Months) | Identify a high-volume, low-risk workflow. Train a single AI agent on specific SOPs. Run in a firewalled or "human-in-the-loop" environment. | Validate the technology and demonstrate a quick win. Build internal confidence. | >95% accuracy on task execution. 30% reduction in manual handling time for the pilot process. |

Phase 2: Scale & Integrate (4-9 Months) | Expand AI to 3-5 related processes. Integrate with key systems (e.g., CRM, claims management). Establish the full audit trail and reporting dashboard. | Achieve measurable operational impact across a department. Embed compliance controls. | 50% reduction in cost-per-interaction. 100% audit trail completeness. Increase in First Contact Resolution (FCR) by 15%. |

Phase 3: Optimize & Empower (10+ Months) | Deploy AI across the entire business unit. Empower teams to identify new automation opportunities. Use AI analytics to find process inefficiencies. | Drive enterprise-level efficiency and create a culture of continuous improvement. | Positive ROI within 12-18 months. Consistent reduction in error rates quarter-over-quarter. Employee satisfaction scores improve. |

This roadmap provides a structured path from a small, contained pilot to a full-scale, optimized deployment, ensuring compliance and value are built in at every step.

Training AI Agents on Your Specific SOPs

An AI agent is only as good as the knowledge you give it. Unlike generic chatbots, compliant AI for financial services must be deeply trained on your company’s specific Standard Operating Procedures (SOPs). This is the only way to ensure it executes tasks exactly the way your best human employee would, every single time.

This training involves feeding the AI your internal documentation, process maps, and even historical data showing how your teams handled similar cases in the past. The Nolana platform, for example, actually learns from your team's real-world actions to build its automation playbooks. This ensures the AI doesn’t just know the rules—it understands the context behind them.

This step is absolutely critical for building a system you can trust with high-stakes decisions. It guarantees the AI’s actions are always aligned with your internal policies and regulatory obligations.

Fostering a Collaborative Human-AI Culture

Ultimately, a successful AI deployment is as much about people as it is about technology. The most effective implementations create a culture where human teams and AI agents work together as a single, unified force.

The AI takes on the repetitive, data-heavy lifting. This, in turn, empowers your human experts to focus on judgment-based work, complex problem-solving, and building genuine customer relationships.

It's vital to communicate that AI is a tool to augment human capabilities, not replace them. When employees see automation freeing them from tedious work to focus on more meaningful tasks, they become champions of the new system. This seamless partnership is the key to achieving operational excellence while upholding the highest standards of compliance.

Shifting from Reactive Compliance to Proactive Risk Management

Let’s be honest: for decades, regulatory compliance in financial services has been a game of defense. A new rule comes out, and we scramble to react. But the real leap forward is flipping that script entirely—moving from a defensive, reactive crouch to a proactive, forward-looking stance.

Instead of just ticking boxes, leading institutions are now using AI to get ahead of the curve, spotting and neutralizing risks before they ever become front-page problems. This changes everything. Compliance stops being a necessary but costly burden and starts becoming a real strategic advantage.

Think about it. By sifting through massive pools of data—transactions, emails, customer chats—smart AI can pick up on the faint, almost invisible signals that often precede financial crime or a compliance breach. That kind of foresight is exactly what you need when you're drowning in regulatory filings.

From Quantity to Quality in Risk Detection

One of the biggest operational headaches for any financial institution is managing Suspicious Activity Reports (SARs). The firehose of alerts is constant, and compliance teams are often so buried in noise that they struggle to find the real threats among all the false positives. This is where AI’s ability to find the needle in the haystack really pays off.

The pressure is only mounting. FinCEN data shows an 18.5% surge in SAR filings between mid-2023 and the end of 2024. And it's not just a feeling; a recent BSA/AML Roundtable found that a staggering 75% of its members are dealing with spikes in alert volume. As PwC’s latest survey confirms, the focus for 2025 is squarely on improving compliance and transaction monitoring. For a deeper dive, EY's comprehensive regulatory outlook lays this out in stark detail.

An AI-native operating system gives you the controls to manage this chaos. By automating that first pass on alerts, AI filters out the static and hands your human experts a curated list of high-priority cases, complete with the context they need to make a quick, accurate call. This not only improves the quality of your SAR filings but also strengthens your entire risk framework. You can read more about this in our guide on operational risk management in banking.

This proactive approach allows organizations to not only meet today’s regulatory standards but also build a resilient framework capable of adapting to future requirements. It’s about building a system that learns, predicts, and protects.

Ultimately, when you weave AI into core operations—from insurance claims processing to customer service—you create a powerful feedback loop. Insights from claims AI reviews and AI customer care interactions are fed back into the risk models, sharpening them over time. That’s how AI insurance companies and forward-thinking banks build a lasting competitive edge founded on trust, efficiency, and genuine foresight.

Common Questions Answered

How Does AI Actually Handle Complex Insurance Claims?

Think of AI not as a replacement for your seasoned adjusters, but as a powerful assistant that handles the tedious, high-volume work. For AI insurance companies, this means agents can instantly verify policies and gather initial claim data, creating a clean, complete file for human review. It's about getting the groundwork perfect, every time.

This lets your human team focus their expertise on the complex, nuanced cases that require empathy and deep investigation. The AI works like a co-pilot, flagging potential fraud or inconsistencies and routing the claim, with all its context, to the right specialist. This model boosts both speed and accuracy.

Can We Trust AI with Sensitive Customer Issues?

Yes, and in many ways, AI customer care can actually improve how you handle sensitive interactions from a compliance standpoint. An AI agent is meticulously trained on your standard operating procedures, ensuring every initial response is consistent and strictly adheres to consumer protection regulations.

When a conversation becomes emotionally charged or moves beyond the AI's defined scope, it doesn't guess. It follows a clear, pre-set escalation path, seamlessly handing off the customer—and the full interaction history—to a human agent prepared to manage the situation.

This structured process guarantees customers get consistent, compliant service. It also ensures that the most sensitive cases receive the human touch they need, upholding the high standards required for regulatory compliance in financial services.

Does This Mean We Have to Replace Our Core Systems?

Not at all. Modern AI platforms are built to work with what you already have, not tear it down. They use an API-first design, functioning as a smart orchestration layer that plugs right into your existing systems, whether it's Guidewire or Salesforce.

This allows the AI to pull and push data in real-time, automating processes that span your entire technology stack. You get the benefits of intelligent automation without the headache and cost of a massive "rip-and-replace" project.

Nolana provides an AI-native operating system designed to automate high-stakes financial services operations with precision and control. Discover how our compliant AI agents can transform your workflows by visiting https://nolana.com.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP