AI in Insurance Claims: The Ultimate Guide to Automation

AI in Insurance Claims: The Ultimate Guide to Automation

Discover how AI in insurance claims is revolutionizing the industry. Learn to automate processes, improve fraud detection, and enhance AI customer care.

Picture this: a claims process that once took weeks to resolve now gets done in minutes. That’s not science fiction; it’s the tangible impact of AI in insurance claims. This isn't just a buzzword anymore—it's technology that is fundamentally changing how insurers manage everything from the first notice of loss to the final payout, delivering very real results. By automating insurance claims with AI, companies are not just speeding things up; they are revolutionizing customer care.

The New Reality of Insurance Claims Processing

For decades, the claims journey has been notoriously slow and manual. Think of it like an old-school library, where adjusters had to sift through stacks of paper to find one crucial piece of information. The process was bogged down by endless paperwork, manual data entry, and a constant back-and-forth that frustrated customers and drove up operational costs for insurers. This hands-on approach was also a breeding ground for human error, which only added to settlement delays and eroded customer trust.

The AI-powered approach, on the other hand, is like having a powerful digital search engine that finds exactly what you need in an instant. By automating key parts of the claims workflow, carriers are building a far more seamless, efficient, and transparent experience. This isn't just an internal upgrade; it's a complete overhaul of the customer experience, weaving sophisticated AI customer care into every step of the process for financial services.

From Manual Effort to Automated Precision

The real difference comes down to speed and accuracy. An adjuster might spend hours poring over accident reports and cross-checking policy details. An AI can do the same job in seconds.

Instant Triage: AI algorithms can analyze a new claim the moment it arrives, instantly classifying its severity and routing it to the right team or adjuster without anyone lifting a finger.

Enhanced Accuracy: Automation slashes the risk of simple data entry mistakes and ensures every claim is measured against the same consistent standards, removing guesswork and bias.

24/7 Availability: AI systems don't sleep. Customers can file claims and get updates anytime, day or night, which dramatically improves service and accessibility.

The goal here isn't to replace seasoned claims professionals. It's to empower them. By taking over the repetitive, high-volume tasks, AI frees up your team to focus on the complex, high-empathy cases where their human judgment is irreplaceable.

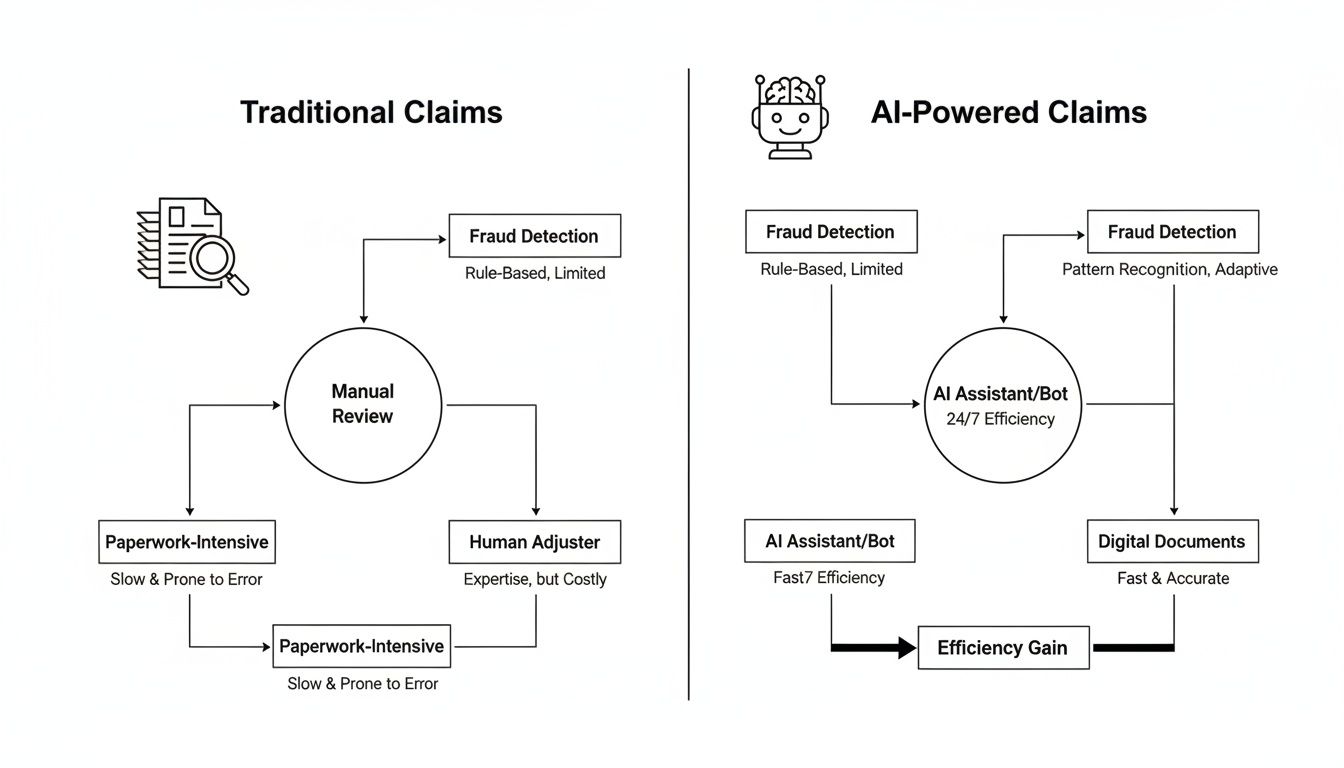

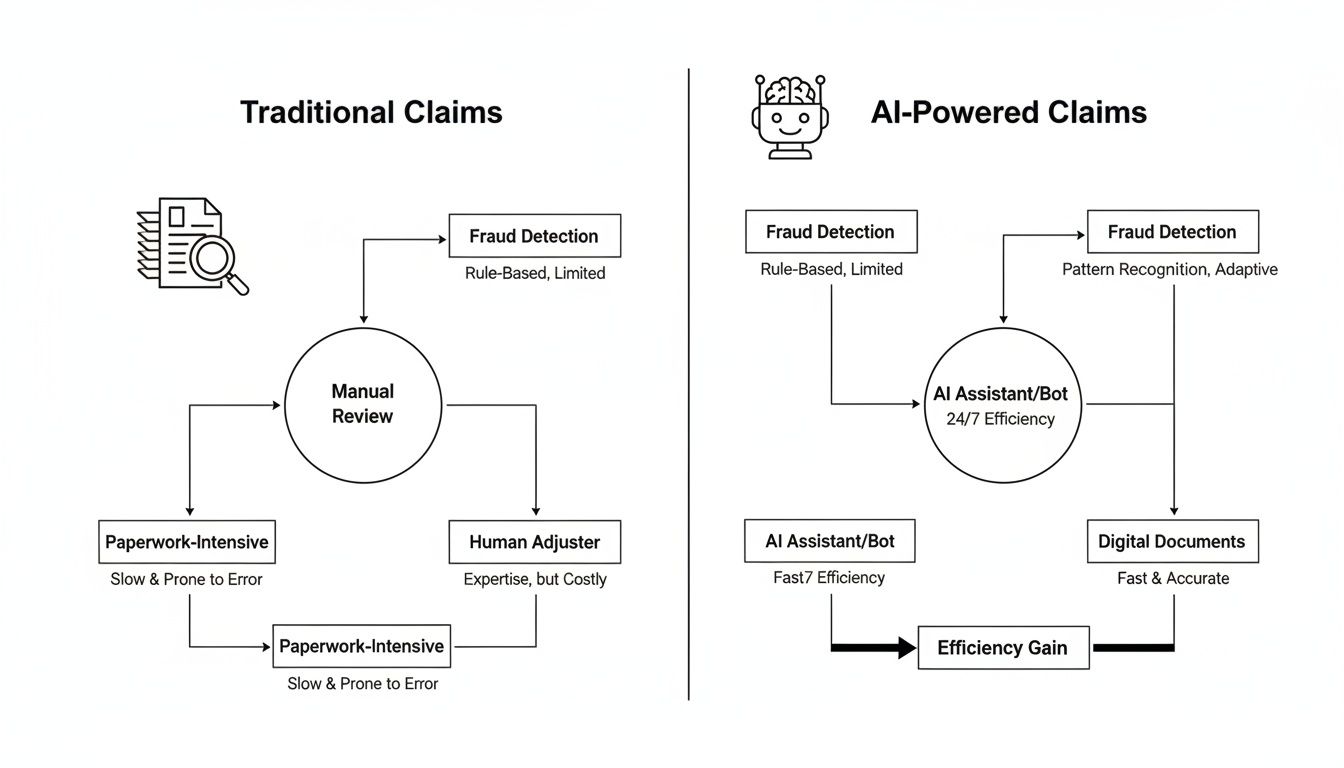

To give you a clearer picture, let’s compare the two approaches side-by-side.

Traditional vs AI-Powered Claims Processing At a Glance

This table breaks down the claims lifecycle, showing how AI injects speed and intelligence at every stage.

Claims Stage | Traditional Method (Manual) | AI-Powered Method (Automated) |

|---|---|---|

First Notice of Loss (FNOL) | Phone calls, manual data entry from forms. High potential for errors. | Smart forms, chatbots, and mobile apps capture data instantly and accurately. |

Triage & Assignment | Supervisor manually reviews and assigns claims based on workload. | AI analyzes claim data to automatically categorize severity and assign to the best-suited adjuster. |

Damage Assessment | Relies on adjusters visiting sites and manually reviewing photos/documents. Can take days or weeks. | AI analyzes uploaded photos/videos to produce an initial damage estimate in minutes. |

Fraud Detection | Depends on adjuster intuition and manual checks against limited data. | AI cross-references thousands of data points to flag suspicious patterns in real-time. |

Settlement & Payout | Manual calculation and approval processes, leading to delays in payment. | Automated settlement for simple claims; calculations are instant, and payouts are initiated automatically. |

As you can see, the shift from manual to automated isn't just an incremental improvement—it’s a complete operational redesign that benefits everyone involved.

Revolutionizing Customer Care

This shift in technology has a direct and powerful effect on policyholders. Faster processing means they get their claims resolved and paid out far quicker, which significantly reduces the stress that comes with a loss.

Imagine a customer who can get instant status updates from an intelligent chatbot or submit photos of a damaged car through an app and receive an estimate almost immediately. That kind of speed and convenience completely changes their perception of their insurance provider. For a deeper look at these modern workflows, you can explore our detailed guide on next-generation insurance claims processing. Ultimately, automating insurance claims with AI allows for a much more responsive and empathetic customer service model, setting a new standard for the entire industry.

How AI Is Reshaping Claims Management Right Now

It's one thing to talk about the theory of AI in insurance claims, but it's another to see it in action. The good news is that we've moved well past the theoretical stage. Top-tier AI insurance companies are already deploying intelligent systems that are fundamentally changing how claims are handled, from the first phone call to the final payment.

This isn't a glimpse into the distant future; these are practical tools delivering real, measurable results today. The impact starts right at the beginning—the first notice of loss.

A Smarter First Notice of Loss

The First Notice of Loss (FNOL) is the starting pistol for every claim. For decades, it's been a manual, often clunky process involving a phone call and an agent typing information into a system. AI flips that script by meeting customers on their preferred channel: their smartphone.

Using natural language processing (NLP), an AI-powered assistant can understand what a customer is saying or typing about an incident. At the same time, computer vision can look at a photo of a dented bumper or a water-stained ceiling and instantly pull out the critical details.

This allows the system to perform an immediate triage. It can gauge the claim's complexity on the spot, routing it to the right team or, in simple cases, flagging it for straight-through processing without a human ever touching it.

By automating FNOL, insurers are cutting down intake times from days to mere minutes. That first interaction, powered by sharp AI customer care, sets a positive tone and a new standard for policyholder experience right from the start.

Seeing Through the Fog of Fraud

Insurance fraud is a multi-billion dollar headache for the industry. Traditionally, catching it relied on an adjuster's gut feeling or random manual reviews—hardly a foolproof system. AI offers a much stronger line of defense by sifting through massive amounts of data to spot suspicious patterns a person could never see.

Here’s how AI-driven fraud detection works:

Connecting the Dots: The system can analyze millions of data points, linking seemingly unrelated claims, providers, and individuals to expose organized fraud rings.

Spotting What's Off: AI models learn what a "normal" claim looks like for a specific scenario. When a new claim deviates from that baseline—like an unusually high repair estimate or conflicting damage reports—it gets flagged instantly.

Predicting Risk: By crunching historical data, the AI assigns a risk score to every new claim in real-time. This lets adjusters focus their investigative energy where it’s needed most.

The flowchart below shows just how different the old, paper-heavy process is from the fast, data-driven AI approach.

You can see how AI brings speed and intelligence to every step, turning a slow, linear process into a dynamic and automated workflow.

Near-Instant and Accurate Damage Assessment

Assessing damage has always been a major bottleneck. It usually means scheduling an appraiser, waiting for their report, and then manually putting together a repair estimate. AI tears up that playbook.

Take a typical auto insurance claim. The policyholder just needs to upload a few photos of their car's damage through an app. An AI model, which has learned from millions of images of vehicle damage, gets to work.

Within seconds, the AI identifies the damaged parts, grades the severity (is it a scratch, a dent, or does it need replacing?), and cross-references everything with a parts and labor database. The result? A precise repair estimate, generated on the spot. This doesn't just speed things up; it makes the process more consistent and fair, since the AI applies the same objective logic every single time. Many claims AI reviews point to this capability as a game-changer for both efficiency and customer happiness.

Finding Hidden Subrogation Opportunities

After an insurer pays a claim, they often have the right to get that money back from a third party who was actually at fault. This process is called subrogation. In the chaos of a busy claims department, these opportunities are easy to miss, leaving money on the table.

AI systems act like a second set of eyes. They can scan adjuster notes, police reports, and witness statements to automatically sniff out potential subrogation cases. By flagging claims where someone else might be liable, AI ensures recovery teams can go after every dollar they're owed. Suddenly, the claims department isn't just a cost center—it's actively recovering revenue for the business.

To see these ideas put into practice, you can explore Nolana's work on transforming insurance claims with agentic AI. Each of these applications is a critical piece in building a smarter, faster, and more customer-focused claims operation.

The Real Business Impact of Claims Automation

The technology powering AI in insurance claims is certainly impressive, but for executives and operations leaders, the conversation always comes back to one thing: results. The real story isn't about the algorithms; it's about how those tools translate into hard numbers that strengthen the bottom line and create happier customers.

Automating insurance claims delivers immediate and often dramatic cost reductions. By taking over the repetitive, manual work—think data entry, document verification, and initial assessments—AI frees up resources and slashes the operational overhead tied to each claim. This isn't just a minor tweak; it's a fundamental shift in how work gets done.

The proof is in the numbers. The global AI in insurance market, driven heavily by claims and fraud detection, grew from $4.59 billion in 2022 and is on track to hit an incredible $79.86 billion by 2032. This explosive growth shows just how profoundly AI is changing the game, turning manual reviews that once took weeks into processes that take hours or days. Insurers putting AI to work in their claims departments are already seeing up to 40% reductions in processing expenses. For more on this explosive market growth, check out the analysis on binariks.com.

Slashing Cycle Times and Boosting Satisfaction

In customer service, speed is everything—especially when a policyholder is dealing with a stressful loss. Traditional claims cycles are often measured in weeks, which only adds to the anxiety. AI-driven automation collapses these timelines, shrinking them from weeks or days down to just hours, or in some cases, minutes.

This incredible acceleration has a direct and powerful impact on customer satisfaction scores (CSAT). Imagine a policyholder who can file a claim on their phone, get an instant acknowledgment, and receive a settlement offer in a fraction of the time they expected. That experience completely changes their perception of the insurer. This is where top-tier AI customer care becomes a massive driver of loyalty and retention.

A fast, transparent claims process is no longer a "nice-to-have"; it's a competitive differentiator. Policyholders who have a positive claims experience are significantly more likely to renew their policies and recommend their insurer to others.

From Cost Center to Strategic Advantage

The leading AI insurance companies are proving that an automated claims department can be much more than an operational unit—it can be a true strategic asset. By pairing lightning-fast processing with advanced fraud detection, these insurers aren't just cutting costs; they're protecting their bottom line from significant financial losses.

To get a better sense of how AI achieves this, looking at broader business process automation examples can be helpful. You quickly see how the core principles of intelligent automation deliver value across different industries.

Let’s look at a real-world scenario:

The Challenge: A large P&C insurer was wrestling with high claims processing costs and a fraud rate that was stubbornly above the industry average. Their manual review process was slow, frustrating customers and letting fraudulent claims slip through the cracks.

The AI Solution: They brought in an AI platform to automate their entire workflow for low-complexity claims, from FNOL to settlement. The system used computer vision to assess photos of damage and machine learning to flag any suspicious claims for a human expert to review.

The Results: In the first year alone, the insurer saw a 35% reduction in operational costs for that segment of claims. Even better, the AI’s precision in spotting fraud led to a $15 million reduction in fraudulent payouts.

This example highlights how automation creates a powerful flywheel effect. Faster processing makes for happier customers, while smarter fraud detection boosts profitability. You can dive deeper into the strategic benefits of business process automation to see how these advantages apply to core operations. By transforming claims into a swift, intelligent, and secure process, insurers are building a more resilient and profitable business for the future.

Weaving AI into Your Claims Workflow

Bringing AI into your day-to-day claims operation isn't about flipping a switch and hoping for the best. It’s a thoughtful, step-by-step process, and it all starts with the one thing that fuels every algorithm: your data.

Think of high-quality, well-structured data as the lifeblood of your AI system. Without it, even the most powerful models will stumble, delivering unreliable results. This is why the real first step is getting your data house in order. That means establishing solid data governance and building on an API-first architecture, ensuring your new tools can talk seamlessly to your existing core systems, like a Guidewire or a Duck Creek.

Evolving Your Team for the Future

Adopting this kind of technology is as much a people challenge as it is a technical one. Success hinges on great change management. The real goal is to shift your talented claims professionals from manual data processors to strategic problem-solvers.

You're not looking to replace your team; you're looking to empower them. By handing off the repetitive, time-consuming tasks to AI, you free up your adjusters to apply their deep expertise to the complex, high-value cases. These are the situations that demand uniquely human skills like critical judgment, empathy, and nuanced negotiation—things AI just can't replicate.

In this new model, your team becomes more valuable than ever. They are the critical "human-in-the-loop," managing the exceptions, keeping an eye on the AI's performance, and stepping in to provide a genuine human touch when a customer needs it most.

This is exactly where the leading insurers are finding their edge. Just look at Aviva. They rolled out over 80 AI models and saw incredible results, cutting complex liability assessment times by 23 days and watching customer complaints drop by a massive 65%. For a deeper dive, McKinsey.com has some great findings on how AI is reshaping the industry.

The Big Question: Build or Buy?

Once your data is clean and your team is ready, you’ll face a major strategic decision: do you build your own AI solution from the ground up, or do you partner with a specialist? There's no single right answer, and the best path depends entirely on your company's goals.

Your choice really comes down to your available resources, in-house technical talent, and long-term vision.

Factor | Building In-House (Proprietary) | Partnering with a Vendor (e.g., Nolana) |

|---|---|---|

Control | You own everything—the features, the roadmap, and the IP. | You gain a proven, specialized platform but have less direct control. |

Cost | A significant upfront investment in talent, infrastructure, and R&D. | A more predictable, often subscription-based (SaaS) cost model. |

Speed to Market | Slower. It can take years to develop and deploy a solid solution. | Much faster. You're using existing technology and expertise. |

Expertise | Requires recruiting and retaining a dedicated team of AI engineers. | Instantly access a team that lives and breathes AI for insurance. |

Maintenance | All updates, security patches, and model retraining are on you. | The vendor handles all maintenance, updates, and platform improvements. |

For a lot of carriers, working with a specialized partner like Nolana is simply the most direct and efficient way to get there. It allows you to tap into a platform built specifically for high-stakes financial services without the immense cost and risk of starting from scratch. If you're looking to solidify your understanding of the core concepts, our guide on what workflow automation is and how it works is a great place to start.

Ultimately, you want to pick the path that aligns with your business strategy and sets you up for a smooth, successful rollout of automated claims AI reviews and processes.

Navigating Compliance and Ethical AI in Claims

When AI insurance companies start weaving automation into their core operations, the conversation has to shift from pure capability to accountability. Using AI in insurance claims unlocks incredible efficiency, but that power comes with a serious need for governance, solid risk management, and strict compliance. After all, the most sophisticated algorithm is worthless if it breaks customer trust or gets you into hot water with regulators.

This new reality calls for a proactive stance on ethical AI. It’s no longer enough for a model to be accurate; it must also be fair, transparent, and secure. For any insurer looking to succeed in the long run, building these guardrails isn't optional.

Confronting Algorithmic Bias

One of the biggest ethical minefields is algorithmic bias. An AI model is only as good as the data it’s trained on. If your historical claims data has hidden biases—tied to geography, demographics, or even income levels—the AI will learn and, worse, amplify those same unfair patterns.

This can lead to some really problematic outcomes, like incorrectly denying valid claims or flagging certain customer groups for fraud far more often than others. To get ahead of this, insurers have to be intentional.

Audit Your Training Data: Before you even start training a model, you need to actively comb through your historical data for skewed patterns and take steps to clean or rebalance those datasets.

Implement Continuous Monitoring: Don't just set it and forget it. You have to regularly test your AI models against fairness metrics to make sure they aren’t slowly drifting toward biased decisions over time.

Establish a Human-in-the-Loop: For critical decisions like a claim denial, make sure a human expert is there to review the AI’s recommendation. They provide the final, common-sense judgment.

The Mandate for Explainable AI

Regulators and customers are asking the same simple question when an AI makes a decision: "Why?" If your system denies a claim or flags it as suspicious, you absolutely have to be able to explain the reasoning behind it. This is the core idea behind Explainable AI (XAI).

A "black box" model that spits out answers without any justification is a massive compliance headache waiting to happen. Insurers need systems that can clearly show the key factors that led to a specific outcome.

For example, an explainable system might show that a claim was flagged because the repair quote was 30% higher than the average for similar damage, and the incident report had conflicting details. That kind of transparency is crucial for internal audits, regulatory reviews, and clear communication with your policyholders.

As AI becomes central to claims, particularly in fraud detection, it's vital to stay ahead of regulatory pressure. Getting a firm grip on the connection between AI-driven fraud analysis and regulatory compliance is essential for building a strategy that lasts.

Protecting Data and Upholding Privacy

Insurance claims are built on a bedrock of sensitive personal information. Protecting that data isn't just a good idea; it's a legal obligation under regulations like GDPR and a patchwork of state-level privacy laws.

When you bring AI into the mix, data security becomes even more paramount. The huge datasets needed to train effective models are a goldmine for cyber threats. Because of this, AI insurance companies must operate with a security-first mindset.

This goes way beyond basic firewalls. It’s about putting robust data handling protocols, encryption standards, and strict access controls in place to protect customer information at every single step. For any organization handling this kind of sensitive data, earning rigorous security certifications is a fundamental part of building trust. You can dig deeper into these standards by understanding what is SOC 2 compliance and the role it plays in keeping data safe.

By embedding these ethical and compliance-focused principles directly into your AI strategy, you can innovate with confidence, knowing you have the trust of both your customers and the regulators watching over them.

Common Questions About AI in Insurance Claims

As insurance leaders start seriously looking at AI for their claims operations, a lot of practical questions naturally come up. Moving away from legacy systems to a more automated workflow is a big leap, so it’s understandable to have concerns about the cost, the impact on your team, and what it all means for your customers.

Let's cut through the noise and get straight to the answers you're looking for.

Will AI Replace Human Claims Adjusters?

This is usually the first question on everyone's mind, and the answer is a firm no. AI isn't here to replace your adjusters; it's here to empower them. Think of it as the ultimate assistant—one that’s brilliant at handling the repetitive, high-volume tasks that eat up so much of an adjuster’s day.

By automating insurance claims with AI, you free up your experienced professionals to focus on the work that truly requires their skills. This means they can spend more time on complex, high-value cases that demand nuanced judgment, real empathy, and sharp negotiation—all things a machine can't replicate. The adjuster's role shifts from a data processor to a strategic problem-solver, making their job more impactful and far more rewarding.

What Is the Biggest Hurdle to Implementing Claims AI?

Surprisingly, the biggest challenge for most insurers isn’t the AI technology itself. It’s the data. The performance of any AI model is completely dependent on the quality and accessibility of the data it learns from. Many carriers find their information is trapped in different legacy systems, often in messy, inconsistent formats, which can stop a project in its tracks.

A successful AI initiative always starts with a solid data strategy. This means you have to:

Clean the data: Find and fix the errors and inconsistencies hiding in your historical claims files.

Structure the information: Turn unstructured data, like adjuster notes or customer emails, into a format the AI can actually process.

Integrate your systems: Make sure your AI platform can talk to your core systems, pulling and pushing data seamlessly in real-time.

Getting this data foundation right is the most critical part of the whole process. Without clean, organized data, even the most sophisticated AI will fail to deliver the results you're after.

How Does AI Improve Customer Care in the Claims Process?

AI completely changes the game for the customer by delivering what they want most during a stressful time: speed, transparency, and round-the-clock access. Great AI customer care isn't about removing the human element; it's about making every interaction better.

For instance, an AI-powered chatbot can give a policyholder an instant status update on their claim at 3 a.m. For a simple auto or property claim, automation can turn a settlement cycle that used to take weeks into one that takes just a few hours. That speed doesn't just reduce a customer's anxiety—it builds incredible loyalty.

But here’s the most important part: by taking over the administrative grind, AI gives your human agents more time. It allows them to provide focused, empathetic support to customers who are dealing with difficult or emotionally charged situations, creating a much more personal and supportive experience.

Can Smaller Insurers Afford to Implement AI for Claims?

Absolutely. Not too long ago, this kind of technology was only accessible to the largest carriers with deep pockets for in-house development. That's all changed with the rise of AI-as-a-Service (AIaaS) and specialized platforms built for the insurance industry.

These solutions have leveled the playing field, giving smaller and mid-sized insurers access to powerful automation. You no longer need to build everything from the ground up. Instead, you can subscribe to scalable platforms that solve specific problems, like catching fraudulent claims or automating initial damage assessments. This approach lets you compete on efficiency and customer service without the massive upfront investment or the need for a dedicated data science team. Many claims AI reviews point to these platforms as the most cost-effective way to modernize.

Ready to see how intelligent automation can transform your claims operations? Nolana provides a compliant, AI-native operating system designed for high-stakes financial services. Our platform deploys AI agents that integrate with your existing core systems to automate workflows, accelerate cycle times, and deliver exceptional customer care with full auditability and control. Discover a smarter way to manage claims by visiting https://nolana.com.

Picture this: a claims process that once took weeks to resolve now gets done in minutes. That’s not science fiction; it’s the tangible impact of AI in insurance claims. This isn't just a buzzword anymore—it's technology that is fundamentally changing how insurers manage everything from the first notice of loss to the final payout, delivering very real results. By automating insurance claims with AI, companies are not just speeding things up; they are revolutionizing customer care.

The New Reality of Insurance Claims Processing

For decades, the claims journey has been notoriously slow and manual. Think of it like an old-school library, where adjusters had to sift through stacks of paper to find one crucial piece of information. The process was bogged down by endless paperwork, manual data entry, and a constant back-and-forth that frustrated customers and drove up operational costs for insurers. This hands-on approach was also a breeding ground for human error, which only added to settlement delays and eroded customer trust.

The AI-powered approach, on the other hand, is like having a powerful digital search engine that finds exactly what you need in an instant. By automating key parts of the claims workflow, carriers are building a far more seamless, efficient, and transparent experience. This isn't just an internal upgrade; it's a complete overhaul of the customer experience, weaving sophisticated AI customer care into every step of the process for financial services.

From Manual Effort to Automated Precision

The real difference comes down to speed and accuracy. An adjuster might spend hours poring over accident reports and cross-checking policy details. An AI can do the same job in seconds.

Instant Triage: AI algorithms can analyze a new claim the moment it arrives, instantly classifying its severity and routing it to the right team or adjuster without anyone lifting a finger.

Enhanced Accuracy: Automation slashes the risk of simple data entry mistakes and ensures every claim is measured against the same consistent standards, removing guesswork and bias.

24/7 Availability: AI systems don't sleep. Customers can file claims and get updates anytime, day or night, which dramatically improves service and accessibility.

The goal here isn't to replace seasoned claims professionals. It's to empower them. By taking over the repetitive, high-volume tasks, AI frees up your team to focus on the complex, high-empathy cases where their human judgment is irreplaceable.

To give you a clearer picture, let’s compare the two approaches side-by-side.

Traditional vs AI-Powered Claims Processing At a Glance

This table breaks down the claims lifecycle, showing how AI injects speed and intelligence at every stage.

Claims Stage | Traditional Method (Manual) | AI-Powered Method (Automated) |

|---|---|---|

First Notice of Loss (FNOL) | Phone calls, manual data entry from forms. High potential for errors. | Smart forms, chatbots, and mobile apps capture data instantly and accurately. |

Triage & Assignment | Supervisor manually reviews and assigns claims based on workload. | AI analyzes claim data to automatically categorize severity and assign to the best-suited adjuster. |

Damage Assessment | Relies on adjusters visiting sites and manually reviewing photos/documents. Can take days or weeks. | AI analyzes uploaded photos/videos to produce an initial damage estimate in minutes. |

Fraud Detection | Depends on adjuster intuition and manual checks against limited data. | AI cross-references thousands of data points to flag suspicious patterns in real-time. |

Settlement & Payout | Manual calculation and approval processes, leading to delays in payment. | Automated settlement for simple claims; calculations are instant, and payouts are initiated automatically. |

As you can see, the shift from manual to automated isn't just an incremental improvement—it’s a complete operational redesign that benefits everyone involved.

Revolutionizing Customer Care

This shift in technology has a direct and powerful effect on policyholders. Faster processing means they get their claims resolved and paid out far quicker, which significantly reduces the stress that comes with a loss.

Imagine a customer who can get instant status updates from an intelligent chatbot or submit photos of a damaged car through an app and receive an estimate almost immediately. That kind of speed and convenience completely changes their perception of their insurance provider. For a deeper look at these modern workflows, you can explore our detailed guide on next-generation insurance claims processing. Ultimately, automating insurance claims with AI allows for a much more responsive and empathetic customer service model, setting a new standard for the entire industry.

How AI Is Reshaping Claims Management Right Now

It's one thing to talk about the theory of AI in insurance claims, but it's another to see it in action. The good news is that we've moved well past the theoretical stage. Top-tier AI insurance companies are already deploying intelligent systems that are fundamentally changing how claims are handled, from the first phone call to the final payment.

This isn't a glimpse into the distant future; these are practical tools delivering real, measurable results today. The impact starts right at the beginning—the first notice of loss.

A Smarter First Notice of Loss

The First Notice of Loss (FNOL) is the starting pistol for every claim. For decades, it's been a manual, often clunky process involving a phone call and an agent typing information into a system. AI flips that script by meeting customers on their preferred channel: their smartphone.

Using natural language processing (NLP), an AI-powered assistant can understand what a customer is saying or typing about an incident. At the same time, computer vision can look at a photo of a dented bumper or a water-stained ceiling and instantly pull out the critical details.

This allows the system to perform an immediate triage. It can gauge the claim's complexity on the spot, routing it to the right team or, in simple cases, flagging it for straight-through processing without a human ever touching it.

By automating FNOL, insurers are cutting down intake times from days to mere minutes. That first interaction, powered by sharp AI customer care, sets a positive tone and a new standard for policyholder experience right from the start.

Seeing Through the Fog of Fraud

Insurance fraud is a multi-billion dollar headache for the industry. Traditionally, catching it relied on an adjuster's gut feeling or random manual reviews—hardly a foolproof system. AI offers a much stronger line of defense by sifting through massive amounts of data to spot suspicious patterns a person could never see.

Here’s how AI-driven fraud detection works:

Connecting the Dots: The system can analyze millions of data points, linking seemingly unrelated claims, providers, and individuals to expose organized fraud rings.

Spotting What's Off: AI models learn what a "normal" claim looks like for a specific scenario. When a new claim deviates from that baseline—like an unusually high repair estimate or conflicting damage reports—it gets flagged instantly.

Predicting Risk: By crunching historical data, the AI assigns a risk score to every new claim in real-time. This lets adjusters focus their investigative energy where it’s needed most.

The flowchart below shows just how different the old, paper-heavy process is from the fast, data-driven AI approach.

You can see how AI brings speed and intelligence to every step, turning a slow, linear process into a dynamic and automated workflow.

Near-Instant and Accurate Damage Assessment

Assessing damage has always been a major bottleneck. It usually means scheduling an appraiser, waiting for their report, and then manually putting together a repair estimate. AI tears up that playbook.

Take a typical auto insurance claim. The policyholder just needs to upload a few photos of their car's damage through an app. An AI model, which has learned from millions of images of vehicle damage, gets to work.

Within seconds, the AI identifies the damaged parts, grades the severity (is it a scratch, a dent, or does it need replacing?), and cross-references everything with a parts and labor database. The result? A precise repair estimate, generated on the spot. This doesn't just speed things up; it makes the process more consistent and fair, since the AI applies the same objective logic every single time. Many claims AI reviews point to this capability as a game-changer for both efficiency and customer happiness.

Finding Hidden Subrogation Opportunities

After an insurer pays a claim, they often have the right to get that money back from a third party who was actually at fault. This process is called subrogation. In the chaos of a busy claims department, these opportunities are easy to miss, leaving money on the table.

AI systems act like a second set of eyes. They can scan adjuster notes, police reports, and witness statements to automatically sniff out potential subrogation cases. By flagging claims where someone else might be liable, AI ensures recovery teams can go after every dollar they're owed. Suddenly, the claims department isn't just a cost center—it's actively recovering revenue for the business.

To see these ideas put into practice, you can explore Nolana's work on transforming insurance claims with agentic AI. Each of these applications is a critical piece in building a smarter, faster, and more customer-focused claims operation.

The Real Business Impact of Claims Automation

The technology powering AI in insurance claims is certainly impressive, but for executives and operations leaders, the conversation always comes back to one thing: results. The real story isn't about the algorithms; it's about how those tools translate into hard numbers that strengthen the bottom line and create happier customers.

Automating insurance claims delivers immediate and often dramatic cost reductions. By taking over the repetitive, manual work—think data entry, document verification, and initial assessments—AI frees up resources and slashes the operational overhead tied to each claim. This isn't just a minor tweak; it's a fundamental shift in how work gets done.

The proof is in the numbers. The global AI in insurance market, driven heavily by claims and fraud detection, grew from $4.59 billion in 2022 and is on track to hit an incredible $79.86 billion by 2032. This explosive growth shows just how profoundly AI is changing the game, turning manual reviews that once took weeks into processes that take hours or days. Insurers putting AI to work in their claims departments are already seeing up to 40% reductions in processing expenses. For more on this explosive market growth, check out the analysis on binariks.com.

Slashing Cycle Times and Boosting Satisfaction

In customer service, speed is everything—especially when a policyholder is dealing with a stressful loss. Traditional claims cycles are often measured in weeks, which only adds to the anxiety. AI-driven automation collapses these timelines, shrinking them from weeks or days down to just hours, or in some cases, minutes.

This incredible acceleration has a direct and powerful impact on customer satisfaction scores (CSAT). Imagine a policyholder who can file a claim on their phone, get an instant acknowledgment, and receive a settlement offer in a fraction of the time they expected. That experience completely changes their perception of the insurer. This is where top-tier AI customer care becomes a massive driver of loyalty and retention.

A fast, transparent claims process is no longer a "nice-to-have"; it's a competitive differentiator. Policyholders who have a positive claims experience are significantly more likely to renew their policies and recommend their insurer to others.

From Cost Center to Strategic Advantage

The leading AI insurance companies are proving that an automated claims department can be much more than an operational unit—it can be a true strategic asset. By pairing lightning-fast processing with advanced fraud detection, these insurers aren't just cutting costs; they're protecting their bottom line from significant financial losses.

To get a better sense of how AI achieves this, looking at broader business process automation examples can be helpful. You quickly see how the core principles of intelligent automation deliver value across different industries.

Let’s look at a real-world scenario:

The Challenge: A large P&C insurer was wrestling with high claims processing costs and a fraud rate that was stubbornly above the industry average. Their manual review process was slow, frustrating customers and letting fraudulent claims slip through the cracks.

The AI Solution: They brought in an AI platform to automate their entire workflow for low-complexity claims, from FNOL to settlement. The system used computer vision to assess photos of damage and machine learning to flag any suspicious claims for a human expert to review.

The Results: In the first year alone, the insurer saw a 35% reduction in operational costs for that segment of claims. Even better, the AI’s precision in spotting fraud led to a $15 million reduction in fraudulent payouts.

This example highlights how automation creates a powerful flywheel effect. Faster processing makes for happier customers, while smarter fraud detection boosts profitability. You can dive deeper into the strategic benefits of business process automation to see how these advantages apply to core operations. By transforming claims into a swift, intelligent, and secure process, insurers are building a more resilient and profitable business for the future.

Weaving AI into Your Claims Workflow

Bringing AI into your day-to-day claims operation isn't about flipping a switch and hoping for the best. It’s a thoughtful, step-by-step process, and it all starts with the one thing that fuels every algorithm: your data.

Think of high-quality, well-structured data as the lifeblood of your AI system. Without it, even the most powerful models will stumble, delivering unreliable results. This is why the real first step is getting your data house in order. That means establishing solid data governance and building on an API-first architecture, ensuring your new tools can talk seamlessly to your existing core systems, like a Guidewire or a Duck Creek.

Evolving Your Team for the Future

Adopting this kind of technology is as much a people challenge as it is a technical one. Success hinges on great change management. The real goal is to shift your talented claims professionals from manual data processors to strategic problem-solvers.

You're not looking to replace your team; you're looking to empower them. By handing off the repetitive, time-consuming tasks to AI, you free up your adjusters to apply their deep expertise to the complex, high-value cases. These are the situations that demand uniquely human skills like critical judgment, empathy, and nuanced negotiation—things AI just can't replicate.

In this new model, your team becomes more valuable than ever. They are the critical "human-in-the-loop," managing the exceptions, keeping an eye on the AI's performance, and stepping in to provide a genuine human touch when a customer needs it most.

This is exactly where the leading insurers are finding their edge. Just look at Aviva. They rolled out over 80 AI models and saw incredible results, cutting complex liability assessment times by 23 days and watching customer complaints drop by a massive 65%. For a deeper dive, McKinsey.com has some great findings on how AI is reshaping the industry.

The Big Question: Build or Buy?

Once your data is clean and your team is ready, you’ll face a major strategic decision: do you build your own AI solution from the ground up, or do you partner with a specialist? There's no single right answer, and the best path depends entirely on your company's goals.

Your choice really comes down to your available resources, in-house technical talent, and long-term vision.

Factor | Building In-House (Proprietary) | Partnering with a Vendor (e.g., Nolana) |

|---|---|---|

Control | You own everything—the features, the roadmap, and the IP. | You gain a proven, specialized platform but have less direct control. |

Cost | A significant upfront investment in talent, infrastructure, and R&D. | A more predictable, often subscription-based (SaaS) cost model. |

Speed to Market | Slower. It can take years to develop and deploy a solid solution. | Much faster. You're using existing technology and expertise. |

Expertise | Requires recruiting and retaining a dedicated team of AI engineers. | Instantly access a team that lives and breathes AI for insurance. |

Maintenance | All updates, security patches, and model retraining are on you. | The vendor handles all maintenance, updates, and platform improvements. |

For a lot of carriers, working with a specialized partner like Nolana is simply the most direct and efficient way to get there. It allows you to tap into a platform built specifically for high-stakes financial services without the immense cost and risk of starting from scratch. If you're looking to solidify your understanding of the core concepts, our guide on what workflow automation is and how it works is a great place to start.

Ultimately, you want to pick the path that aligns with your business strategy and sets you up for a smooth, successful rollout of automated claims AI reviews and processes.

Navigating Compliance and Ethical AI in Claims

When AI insurance companies start weaving automation into their core operations, the conversation has to shift from pure capability to accountability. Using AI in insurance claims unlocks incredible efficiency, but that power comes with a serious need for governance, solid risk management, and strict compliance. After all, the most sophisticated algorithm is worthless if it breaks customer trust or gets you into hot water with regulators.

This new reality calls for a proactive stance on ethical AI. It’s no longer enough for a model to be accurate; it must also be fair, transparent, and secure. For any insurer looking to succeed in the long run, building these guardrails isn't optional.

Confronting Algorithmic Bias

One of the biggest ethical minefields is algorithmic bias. An AI model is only as good as the data it’s trained on. If your historical claims data has hidden biases—tied to geography, demographics, or even income levels—the AI will learn and, worse, amplify those same unfair patterns.

This can lead to some really problematic outcomes, like incorrectly denying valid claims or flagging certain customer groups for fraud far more often than others. To get ahead of this, insurers have to be intentional.

Audit Your Training Data: Before you even start training a model, you need to actively comb through your historical data for skewed patterns and take steps to clean or rebalance those datasets.

Implement Continuous Monitoring: Don't just set it and forget it. You have to regularly test your AI models against fairness metrics to make sure they aren’t slowly drifting toward biased decisions over time.

Establish a Human-in-the-Loop: For critical decisions like a claim denial, make sure a human expert is there to review the AI’s recommendation. They provide the final, common-sense judgment.

The Mandate for Explainable AI

Regulators and customers are asking the same simple question when an AI makes a decision: "Why?" If your system denies a claim or flags it as suspicious, you absolutely have to be able to explain the reasoning behind it. This is the core idea behind Explainable AI (XAI).

A "black box" model that spits out answers without any justification is a massive compliance headache waiting to happen. Insurers need systems that can clearly show the key factors that led to a specific outcome.

For example, an explainable system might show that a claim was flagged because the repair quote was 30% higher than the average for similar damage, and the incident report had conflicting details. That kind of transparency is crucial for internal audits, regulatory reviews, and clear communication with your policyholders.

As AI becomes central to claims, particularly in fraud detection, it's vital to stay ahead of regulatory pressure. Getting a firm grip on the connection between AI-driven fraud analysis and regulatory compliance is essential for building a strategy that lasts.

Protecting Data and Upholding Privacy

Insurance claims are built on a bedrock of sensitive personal information. Protecting that data isn't just a good idea; it's a legal obligation under regulations like GDPR and a patchwork of state-level privacy laws.

When you bring AI into the mix, data security becomes even more paramount. The huge datasets needed to train effective models are a goldmine for cyber threats. Because of this, AI insurance companies must operate with a security-first mindset.

This goes way beyond basic firewalls. It’s about putting robust data handling protocols, encryption standards, and strict access controls in place to protect customer information at every single step. For any organization handling this kind of sensitive data, earning rigorous security certifications is a fundamental part of building trust. You can dig deeper into these standards by understanding what is SOC 2 compliance and the role it plays in keeping data safe.

By embedding these ethical and compliance-focused principles directly into your AI strategy, you can innovate with confidence, knowing you have the trust of both your customers and the regulators watching over them.

Common Questions About AI in Insurance Claims

As insurance leaders start seriously looking at AI for their claims operations, a lot of practical questions naturally come up. Moving away from legacy systems to a more automated workflow is a big leap, so it’s understandable to have concerns about the cost, the impact on your team, and what it all means for your customers.

Let's cut through the noise and get straight to the answers you're looking for.

Will AI Replace Human Claims Adjusters?

This is usually the first question on everyone's mind, and the answer is a firm no. AI isn't here to replace your adjusters; it's here to empower them. Think of it as the ultimate assistant—one that’s brilliant at handling the repetitive, high-volume tasks that eat up so much of an adjuster’s day.

By automating insurance claims with AI, you free up your experienced professionals to focus on the work that truly requires their skills. This means they can spend more time on complex, high-value cases that demand nuanced judgment, real empathy, and sharp negotiation—all things a machine can't replicate. The adjuster's role shifts from a data processor to a strategic problem-solver, making their job more impactful and far more rewarding.

What Is the Biggest Hurdle to Implementing Claims AI?

Surprisingly, the biggest challenge for most insurers isn’t the AI technology itself. It’s the data. The performance of any AI model is completely dependent on the quality and accessibility of the data it learns from. Many carriers find their information is trapped in different legacy systems, often in messy, inconsistent formats, which can stop a project in its tracks.

A successful AI initiative always starts with a solid data strategy. This means you have to:

Clean the data: Find and fix the errors and inconsistencies hiding in your historical claims files.

Structure the information: Turn unstructured data, like adjuster notes or customer emails, into a format the AI can actually process.

Integrate your systems: Make sure your AI platform can talk to your core systems, pulling and pushing data seamlessly in real-time.

Getting this data foundation right is the most critical part of the whole process. Without clean, organized data, even the most sophisticated AI will fail to deliver the results you're after.

How Does AI Improve Customer Care in the Claims Process?

AI completely changes the game for the customer by delivering what they want most during a stressful time: speed, transparency, and round-the-clock access. Great AI customer care isn't about removing the human element; it's about making every interaction better.

For instance, an AI-powered chatbot can give a policyholder an instant status update on their claim at 3 a.m. For a simple auto or property claim, automation can turn a settlement cycle that used to take weeks into one that takes just a few hours. That speed doesn't just reduce a customer's anxiety—it builds incredible loyalty.

But here’s the most important part: by taking over the administrative grind, AI gives your human agents more time. It allows them to provide focused, empathetic support to customers who are dealing with difficult or emotionally charged situations, creating a much more personal and supportive experience.

Can Smaller Insurers Afford to Implement AI for Claims?

Absolutely. Not too long ago, this kind of technology was only accessible to the largest carriers with deep pockets for in-house development. That's all changed with the rise of AI-as-a-Service (AIaaS) and specialized platforms built for the insurance industry.

These solutions have leveled the playing field, giving smaller and mid-sized insurers access to powerful automation. You no longer need to build everything from the ground up. Instead, you can subscribe to scalable platforms that solve specific problems, like catching fraudulent claims or automating initial damage assessments. This approach lets you compete on efficiency and customer service without the massive upfront investment or the need for a dedicated data science team. Many claims AI reviews point to these platforms as the most cost-effective way to modernize.

Ready to see how intelligent automation can transform your claims operations? Nolana provides a compliant, AI-native operating system designed for high-stakes financial services. Our platform deploys AI agents that integrate with your existing core systems to automate workflows, accelerate cycle times, and deliver exceptional customer care with full auditability and control. Discover a smarter way to manage claims by visiting https://nolana.com.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP