Claims Management Systems: AI-Driven Insurance Efficiency

Claims Management Systems: AI-Driven Insurance Efficiency

Explore how claims management systems use AI to automate claims, improve customer service, and boost operational excellence.

A claims management system is the digital backbone of any modern insurance operation. It’s the central hub that orchestrates every single step of a claim’s journey, from the moment a customer first reports an incident all the way through to the final settlement and payment.

Essentially, this system takes the old, chaotic world of paper files and disjointed spreadsheets and replaces it with a streamlined, intelligent, and automated process. It's the critical infrastructure for managing the flood of data, documents, tasks, and communications that every claim generates.

What Is a Claims Management System

Picture an old-school insurance adjuster's desk: stacks of manila folders, overflowing in-trays, and critical details scattered across sticky notes and disconnected spreadsheets. It’s a slow, error-prone process that inevitably leads to delays and frustrated customers.

Now, contrast that with the control room of an air traffic control tower. Everything is organized, tracked in real-time, and managed according to precise rules to ensure safety and efficiency. This is exactly what a modern claims management system does for an insurer. It brings order to the chaos.

These platforms act as the central nervous system for the entire claims department. They create a single, unified digital environment where every piece of information—policy details, customer emails, damage photos, repair estimates, and settlement approvals—lives in one accessible place. This breaks down information silos and establishes a definitive "single source of truth" for every claim.

The Shift from Manual to Automated Operations

At its core, a claims management system is designed to automate the repetitive, rules-based tasks that used to eat up so much of an adjuster's day. Instead of someone having to manually pull up a policy to verify coverage, the system checks it instantly against predefined rules.

This fundamental shift allows skilled claims professionals to stop being data entry clerks and start focusing on the parts of the job that require real human expertise, empathy, and critical thinking. The impact is felt almost immediately.

Increased Efficiency: Automation can slash the total time it takes to process a claim by up to 40%, getting customers back on their feet faster.

Enhanced Accuracy: By enforcing business rules and automating workflows, these systems dramatically reduce the risk of human error, leading to more consistent and compliant outcomes.

Improved Customer Experience: Quick, transparent, and accurate claims handling is one of the biggest drivers of policyholder satisfaction and loyalty.

Evolving with AI Customer Care

Today's claims platforms are moving well beyond simple task automation. The integration of artificial intelligence is creating a new, smarter generation of systems, particularly in financial services. For example, AI customer care features like intelligent chatbots can provide 24/7 support, answering basic questions and guiding customers through the initial reporting process.

You can dive deeper into how this works in our guide to automating insurance claims processing.

According to multiple claims AI reviews, this intelligent layer allows the system to do more than just manage workflows—it can actively assist adjusters. It might analyze incoming photos to assess damage, flag a claim for potential fraud based on subtle data patterns, or even recommend the next best action for the adjuster to take. This transforms the claims management system from a simple database into an intelligent partner, helping insurers handle claims with more speed and precision than ever before.

What Are the Core Components of a Claims System?

To really get what a modern claims management system does, you have to look under the hood. Think of it like a high-performance engine—it’s not one single part but a collection of specialized components working together in perfect sync. A claims platform is much the same, built from a suite of integrated modules that each own a critical piece of the claims journey.

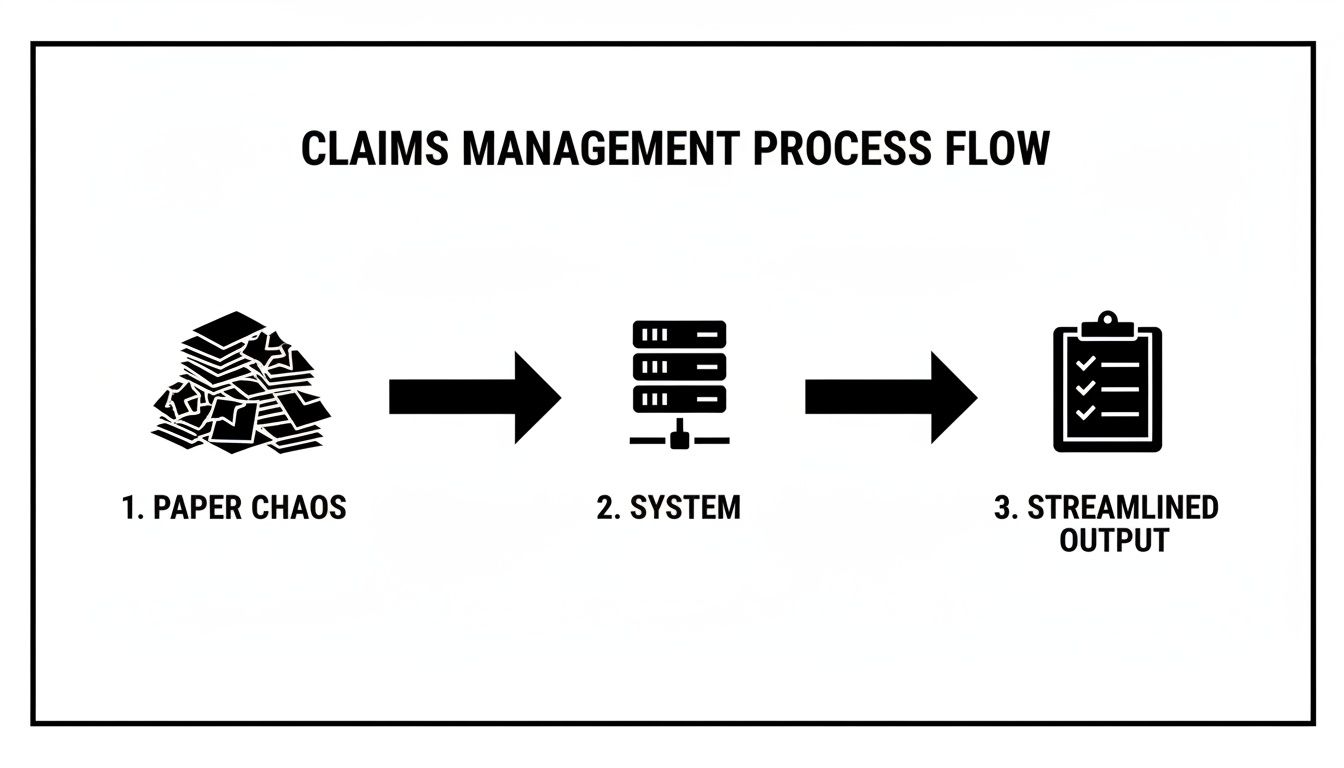

These modules talk to each other constantly, passing data and tasks along what is essentially an automated production line. This is what turns the old, chaotic, paper-heavy process into a clean digital workflow, dramatically cutting down the time from incident to resolution. The image below really captures this shift from disorganized inputs to structured, efficient outputs.

As you can see, the system is the central processor. It takes the raw, often messy, data from a new claim and turns it into a clear, actionable file that's ready for a quick resolution. Let's break down the core components that make this happen.

First Notice of Loss (FNOL) and Intake

It all starts at the First Notice of Loss (FNOL), which is simply the first report of an incident. Modern systems give customers plenty of ways to file, from a traditional phone call to self-service web portals and mobile apps. This flexibility is the first step toward providing a great customer experience right from the start.

For instance, when a policyholder uses an app to report a car accident, the system can instantly grab photos, GPS data, and a preliminary statement. This kind of structured data intake is miles ahead of manual entry and sets the stage for everything that follows. If you're building out an intake process, a well-designed form is a must; you can find some great starting points in this insurance claim form template.

Policy Verification and Initial Triage

Once the FNOL comes in, the system’s next job is to perform an immediate policy verification. It automatically pings the core policy administration system (think Guidewire or Duck Creek) to confirm a few key things:

Is the policy active and paid up?

Does the incident reported actually fall under the policy's coverage?

Are there any other red flags to consider?

This check used to eat up a human adjuster's time, but now it happens in milliseconds. Based on the claim's details and policy rules, the system then does an initial triage, assigning the claim to the right adjuster or, for simple cases, sending it down a "fast track" for straight-through processing.

Automated Adjudication and Fraud Detection

This is where the real power of automating insurance claims with AI becomes clear. The adjudication module uses a set of predefined business rules to evaluate the claim. For a simple cracked windshield claim, the system can often approve it automatically without anyone touching it, triggering the next step in the process.

At the same time, an intelligent fraud detection engine is running in the background. It crunches the claim data, comparing it against historical patterns and known fraud indicators. These algorithms can flag suspicious connections, inconsistent statements, or weird claim frequencies that a person might easily miss, protecting the carrier from major losses.

Payment Processing and Final Settlement

The final piece of the puzzle is the payment and settlement module. As soon as a claim is approved—whether automatically or by an adjuster—this module gets to work on the financial side. It calculates the payout based on policy limits and repair estimates, processes the payment through different methods (like direct deposit or a check), and generates all the closing documents.

A claims management system doesn't just hold information; it actively pushes the process forward. Each integrated module does its job and then cleanly hands the claim off to the next, creating a continuous, automated workflow that gets rid of delays and manual work.

Of course, for these systems to stay effective in the long run, they need to be maintained properly. This involves things like managing technical debt in risk control to ensure these core components remain solid. Ultimately, this integrated design is what delivers the speed, accuracy, and efficiency that both insurers and their customers demand.

How AI Is Reshaping Claims Automation

The real game-changer in modern claims management systems isn't just about digitizing old workflows; it's about making them intelligent. Artificial Intelligence (AI) is fundamentally overhauling the claims process, turning it from a reactive, manual chore into a predictive, automated, and customer-focused operation. This shift lets leading AI insurance companies process claims faster, more accurately, and with an efficiency that was once unthinkable.

Instead of adjusters manually sifting through piles of documents and photos, AI algorithms now analyze complex information in seconds. This provides instant insights that fast-track decisions. We're not talking about some far-off future—this is happening right now, delivering real results that improve both operational metrics and customer satisfaction.

This technological leap is a massive force behind the industry’s growth. The global claims management market, valued at USD 4.60 billion in 2023, is expected to jump to USD 13.95 billion by 2032. That’s a powerful annual growth rate of 13.3%. Large enterprises are at the forefront, using AI for automating insurance claims at scale, managing high volumes with incredible precision and cutting processing times by up to 30% in many instances.

From Visual Assessment to Document Intelligence

One of the most immediate ways AI makes a difference is in the initial assessment. Think about a typical auto insurance claim. In the past, assessing vehicle damage meant scheduling an adjuster, waiting for an inspection, and then manually creating an estimate. The whole thing could take days, if not weeks.

Today, AI-powered visual assessment changes the entire equation. A policyholder just needs to upload a few photos of the damage through a mobile app. An AI model, trained on millions of similar images, analyzes them instantly to identify damaged parts, gauge the severity, and generate a preliminary repair estimate. It's that simple.

But it’s not just about images. AI also brings powerful document intelligence to the table using Natural Language Processing (NLP).

Policy Analysis: NLP algorithms can read and interpret dense policy documents to instantly confirm coverage details.

Medical Reports: For health or workers' comp claims, AI can pull key information from lengthy medical records, invoices, and doctor’s notes.

Legal Documents: The technology can even parse police reports and legal filings, flagging the most relevant information for the adjuster.

This knack for understanding unstructured data—the words in a document, the pixels in a photo—automates tedious, error-prone work and frees up adjusters to focus on what they do best: complex decision-making.

The Rise of AI Customer Care

A huge focus for any financial service is the customer experience, and this is where AI customer care really shines. When a customer files a claim, they're often stressed and just want clear, immediate answers. AI-driven tools deliver on that need, providing support well beyond a 9-to-5 schedule.

AI-powered chatbots and virtual assistants can be integrated directly into an insurer's website or app. They’re able to answer common questions, walk users through the claims filing process, and provide real-time status updates 24/7. This instant support dramatically reduces call volumes to contact centers and ensures customers never feel like they’re left in the dark.

AI customer care doesn't replace the human touch; it enhances it. By handling routine inquiries, AI frees up human agents to manage sensitive or complex cases that require empathy and nuanced judgment, leading to better outcomes for everyone.

This approach is quickly becoming a standard feature among top carriers, as positive feedback from claims AI reviews consistently points to the value of immediate, always-on support.

Uncovering Fraud and Enabling Agentic AI

Beyond making things more efficient, AI adds a critical layer of defense against fraud. Predictive analytics models can analyze thousands of data points within a single claim—and across an insurer's entire book of business—to spot subtle patterns that would be invisible to a human reviewer. These systems can flag suspicious connections, unusual claim frequencies, or inconsistencies in evidence, sending high-risk cases for a closer look.

Looking ahead, the next frontier is agentic AI, where autonomous AI agents manage entire chunks of the claims process on their own. For example, an agentic system like Nolana can be trained on an insurer's standard operating procedures to handle low-complexity, high-volume claims from start to finish. You can learn more by exploring our detailed guide on https://nolana.com/articles/insurance-claims-processing-automation.

These AI agents can perform a whole sequence of tasks:

Receiving the First Notice of Loss (FNOL).

Verifying policy coverage automatically.

Cross-referencing details with third-party data sources.

Approving the claim based on predefined rules.

Initiating the payment process.

This kind of end-to-end automation allows human adjusters to function as true experts, overseeing the system and stepping in only when their critical thinking is truly needed. To go deeper into how this works, you can find great discussions about AI in insurance claims processing. This shift truly elevates the role of claims professionals and allows AI insurance companies to operate at a scale and speed that was simply impossible before.

Building a Connected Claims Ecosystem

A powerful claims management system operating in a vacuum is like a world-class musician playing alone. The performance might be technically perfect, but the real magic—the symphony—only happens when it connects with the entire orchestra. The same is true for your claims platform; its true value is only realized when it’s fully integrated into your company's technology stack.

This isn't just about plugging in another piece of software. It's a strategic move to create a fluid, two-way conversation between all your critical business systems, typically through Application Programming Interfaces (APIs). This approach finally breaks down the data silos that have plagued financial services for decades, establishing a single, reliable source of truth for every claim and customer interaction.

When all your systems are talking, you get a 360-degree view of the customer. That’s the foundation for faster, smarter, and more empathetic service.

Weaving Together Core Systems

At the center of this ecosystem are the connections to your core operational platforms. For AI insurance companies, this means linking the claims system to policy administration software like Guidewire or Duck Creek. When a new claim comes in, the system shouldn't have to wait for manual checks. Instead, it instantly queries the policy system to verify coverage, check limits, and pull up relevant customer history.

The same principle applies to your CRM. Integrating with a platform like Salesforce is a game-changer for delivering top-tier AI customer care. When an agent speaks with a policyholder, they see the full claims context right alongside the customer's entire relationship history. This simple connection eliminates the frustration of customers having to repeat themselves and gives your agents the information they need to provide truly personal support.

A connected ecosystem ensures that data entered once is available everywhere it's needed, in real-time. This eliminates redundant data entry, reduces the chance of errors, and creates a seamless workflow across departments.

Tapping into External Data Sources

A truly modern ecosystem doesn't stop at your internal tools. It extends outward to a vast array of external data sources, which is where the claims process gets genuinely proactive and intelligent. By connecting to third-party services, a claims system can automatically pull in crucial context to enrich a claim file.

Think about what this looks like in the real world:

Weather Data: A homeowner files a claim for roof damage after a storm. The claims system automatically pulls meteorological data for their address, instantly confirming that a severe hailstorm did, in fact, occur on that date.

Police Reports: For an auto accident, the system can connect to a database to retrieve the official police report, saving the adjuster the manual effort of tracking it down.

Vehicle History: Before settling an auto claim, the system can access vehicle history reports to check for pre-existing damage, helping to assess the claim more accurately.

This kind of automated data validation and enrichment helps adjusters make faster, more confident decisions. Healthcare is a prime example of this integrated approach taking off. The global market for healthcare claims management hit USD 16.8 billion in 2024 and is projected to nearly double to USD 33.4 billion by 2033. A huge driver is the integration with Electronic Health Records (EHR), which can slash processing errors by up to 40% by simply getting systems to talk to each other.

You can learn more from these healthcare claims management market insights or see real-world examples of how Nolana is transforming insurance claims with agentic AI. Ultimately, this interconnectedness is the bedrock of any resilient and efficient claims operation.

How to Choose the Right Claims Management System

Picking a new claims management system is a huge decision. It’s not just a software purchase; it’s a commitment that will shape how your teams work and how customers see you for years to come. You're not just buying features off a list—you're looking for a partner whose technology aligns with where your business is headed, especially when it comes to automating insurance claims and delivering top-notch AI customer care.

To get this right, you have to look past the sales pitches and ask the tough questions. The real goal is to find a platform that solves today's headaches while being flexible enough for tomorrow's challenges. That means digging into its scalability, security, compliance, and, most importantly, its plan for intelligent automation.

The market for these platforms is already big and getting bigger. It was valued at USD 4,697.85 million in 2021 and is on track to hit USD 6,460.3 million by 2025. Top vendors are pushing hard on innovation, and we're seeing a rise in outsourced models that help carriers manage massive claim spikes while cutting operational costs by 20-25%. You can dig deeper into these trends in this claims management solution market report.

Creating Your Evaluation Checklist

Before you ever sit through a demo, get your team together and build a checklist of your absolute must-haves. This isn't just about features; it's a strategic framework to ensure you're judging every option by the same standard—the one that matters to your business.

Think bigger than just basic functions. Your checklist needs to cover the core pillars of a great system:

Scalability and Performance: What happens when a hurricane hits and claims triple overnight? Can the system keep up without crashing or slowing to a crawl?

Security and Compliance: Does it meet the tough regulatory demands of standards like GDPR and HIPAA? You need to see proof of data encryption, strict access controls, and clear audit trails.

Integration Capabilities: How well does it play with others? You need seamless API connections to your core systems, whether it's Guidewire, Salesforce, or other third-party data sources.

Vendor Support and Partnership: What happens after you sign the contract? Look into the quality of their training, implementation support, and ongoing customer service.

Key Questions to Ask Potential Vendors

With your internal checklist in hand, you're ready to talk to vendors. This is your chance to cut through the marketing fluff and get to the truth about what their system can really do. Your questions should be pointed and tied directly to your goals, like boosting efficiency with AI and making customer interactions smoother.

Here are a few questions you should be asking:

AI Roadmap: Show me your roadmap for AI. How, specifically, will your upcoming developments help us deliver better AI customer care?

Integration Demo: Don't just tell me it integrates. Show me. Can you do a live demo of how your system connects with our CRM and policy admin software?

Data Handling: Our claims data is messy—photos, PDFs, emails. How does your system take in all that unstructured data and use it for automating insurance claims?

Customization and Configuration: How much can my team configure on our own? Can we adjust workflows and business rules without calling in your developers every time?

Performance Metrics: What KPIs do your best customers use to measure ROI? And how does your platform make it easy to track and report on those numbers?

Choosing a claims management system is a long-term commitment. Focus on finding a vendor that acts as a true partner, one who is invested in your success and has a clear, forward-thinking vision for the future of claims automation.

Comparing Deployment Models

One of the last big calls you'll have to make is whether to go with an on-premises system or a cloud-based Software-as-a-Service (SaaS) solution. This choice has major implications for your budget, IT workload, and ability to scale. It's no surprise that many forward-thinking AI insurance companies are moving to the cloud for its flexibility and lower upfront costs.

Deciding between on-prem and cloud really comes down to your organization's resources, security posture, and long-term strategy. The table below breaks down the key factors to help you weigh the pros and cons of each approach.

On-Premises vs. Cloud-Based Claims Management Systems

Factor | On-Premises System | Cloud-Based System (SaaS) |

|---|---|---|

Initial Cost | High upfront investment in hardware, licenses, and infrastructure. | Lower upfront cost with a predictable monthly or annual subscription fee. |

Maintenance | Your internal IT team is responsible for all updates, security, and maintenance. | The vendor manages all updates, security patches, and server maintenance. |

Scalability | Scaling requires purchasing and configuring additional hardware. | Easily scalable up or down based on your claim volume and business needs. |

Accessibility | Access is typically limited to your internal network, requiring a VPN for remote work. | Accessible from anywhere with an internet connection, supporting remote teams. |

Implementation | Longer implementation timelines due to hardware setup and configuration. | Faster deployment as the infrastructure is already in place. |

Ultimately, while on-premises gives you total control, cloud-based systems offer agility and can free up your IT team to focus on more strategic work instead of just keeping the lights on.

Implementing Your System for Maximum ROI

Getting a powerful claims management system is just the start. The real magic happens during implementation—that critical phase where you prepare your team, secure your data, and define exactly what success looks like. Without a smart rollout strategy, even the best tech can fall flat.

A successful launch is about more than just installing software; it’s about fundamentally changing how your team operates. This means getting everyone on board through solid change management, ensuring a seamless data migration, and delivering training that truly empowers your people. Get this right, and you're building a foundation for a serious return on your investment.

Defining and Tracking Key Performance Indicators

You can't prove the value of your investment if you don't measure what matters. Vague goals won't cut it. You need to zero in on specific Key Performance Indicators (KPIs) that act as a health check for your claims department.

These metrics give you a clear "before and after" snapshot, highlighting precisely where the new system is making a difference.

Claim Cycle Time: How long does it take from the First Notice of Loss (FNOL) to the final check being cut? A major goal is to shrink this timeline dramatically.

Cost Per Claim: Pinpoint the all-in administrative cost to process a single claim. Automation should push this number down, period.

Customer Satisfaction (CSAT): Survey your policyholders after their claim is closed. Happier customers mean faster, more transparent service, and higher CSAT scores are the proof.

Fraud Detection Accuracy: Keep an eye on the percentage of fraudulent claims you successfully catch and prevent. This KPI has a direct, positive impact on your bottom line.

Building a Culture of Continuous Optimization

Implementation isn't a "set it and forget it" project. It's the beginning of a long-term commitment to getting better every single day. The most successful AI insurance companies foster a culture of constant refinement, always looking for ways to tweak workflows and squeeze more performance out of their tools. This mindset is essential for anyone serious about how to improve operational efficiency.

This approach ensures your system grows with your business, not against it. Make it a habit to review your KPIs, listen to feedback from your adjusters on the front lines, and collaborate with your vendor to explore new features and automation possibilities.

A successful implementation creates a feedback loop where data from your KPIs informs process improvements, which in turn boosts your ROI. It’s a cycle of constant refinement that keeps your operations sharp and competitive.

When you pair a strong initial rollout with a dedication to ongoing improvement, your claims management system transforms from a simple tool into a lasting strategic asset that delivers more and more value over time.

Common Questions Answered

When diving into modern claims management systems, a few key questions always come up. Most leaders want to know what the practical, on-the-ground impact of AI will be for their teams and their customers. Let's tackle those head-on.

How Does AI Change the Role of a Claims Adjuster?

The short answer is, AI doesn't replace adjusters—it makes them better. Think of it as taking the tedious, repetitive work off their plates so they can focus on what humans do best.

AI excels at the heavy lifting, like sifting through documents or running initial damage assessments. This frees your adjusters to handle the complex parts of the job: intricate investigations, strategic decision-making, and providing genuine, empathetic AI customer care when policyholders need it most. Their role evolves from a processor to an expert manager, using technology to get faster, better results and stepping in when a situation demands human judgment.

What Is the Impact of AI on Customer Care?

The difference is night and day. For AI insurance companies, bringing AI into the customer experience means you can offer instant support, 24/7. Intelligent chatbots and virtual assistants can answer common questions and provide claim status updates in real-time, eliminating frustrating wait times.

This isn't just about speed; it's about giving customers a sense of control. As countless claims AI reviews show, policyholders who feel informed and supported through the process are significantly more satisfied, and that immediate, accessible communication is a huge part of it.

The real power of AI in claims management is how it empowers your human experts. It lets them apply their skills where they truly count, turning them into strategic problem-solvers and exceptional advocates for your customers.

How Secure Is Customer Data in a Cloud-Based System?

It's a valid concern, and top-tier providers treat it as their highest priority. The leading cloud-based claims management systems are built on a foundation of robust security. They use advanced encryption for all data, whether it's moving or sitting still, and enforce strict access controls to ensure only authorized personnel can view sensitive information.

These platforms also undergo constant, rigorous third-party security audits. Reputable vendors will always be compliant with major standards like SOC 2 Type II and GDPR, often delivering a level of security that’s far more advanced than what most companies could realistically build and maintain in-house.

Ready to see how agentic AI can automate your claims operations from end-to-end? Discover Nolana and learn how our compliant, AI-native platform can cut costs, accelerate cycle times, and improve customer experiences. Learn more about Nolana.

A claims management system is the digital backbone of any modern insurance operation. It’s the central hub that orchestrates every single step of a claim’s journey, from the moment a customer first reports an incident all the way through to the final settlement and payment.

Essentially, this system takes the old, chaotic world of paper files and disjointed spreadsheets and replaces it with a streamlined, intelligent, and automated process. It's the critical infrastructure for managing the flood of data, documents, tasks, and communications that every claim generates.

What Is a Claims Management System

Picture an old-school insurance adjuster's desk: stacks of manila folders, overflowing in-trays, and critical details scattered across sticky notes and disconnected spreadsheets. It’s a slow, error-prone process that inevitably leads to delays and frustrated customers.

Now, contrast that with the control room of an air traffic control tower. Everything is organized, tracked in real-time, and managed according to precise rules to ensure safety and efficiency. This is exactly what a modern claims management system does for an insurer. It brings order to the chaos.

These platforms act as the central nervous system for the entire claims department. They create a single, unified digital environment where every piece of information—policy details, customer emails, damage photos, repair estimates, and settlement approvals—lives in one accessible place. This breaks down information silos and establishes a definitive "single source of truth" for every claim.

The Shift from Manual to Automated Operations

At its core, a claims management system is designed to automate the repetitive, rules-based tasks that used to eat up so much of an adjuster's day. Instead of someone having to manually pull up a policy to verify coverage, the system checks it instantly against predefined rules.

This fundamental shift allows skilled claims professionals to stop being data entry clerks and start focusing on the parts of the job that require real human expertise, empathy, and critical thinking. The impact is felt almost immediately.

Increased Efficiency: Automation can slash the total time it takes to process a claim by up to 40%, getting customers back on their feet faster.

Enhanced Accuracy: By enforcing business rules and automating workflows, these systems dramatically reduce the risk of human error, leading to more consistent and compliant outcomes.

Improved Customer Experience: Quick, transparent, and accurate claims handling is one of the biggest drivers of policyholder satisfaction and loyalty.

Evolving with AI Customer Care

Today's claims platforms are moving well beyond simple task automation. The integration of artificial intelligence is creating a new, smarter generation of systems, particularly in financial services. For example, AI customer care features like intelligent chatbots can provide 24/7 support, answering basic questions and guiding customers through the initial reporting process.

You can dive deeper into how this works in our guide to automating insurance claims processing.

According to multiple claims AI reviews, this intelligent layer allows the system to do more than just manage workflows—it can actively assist adjusters. It might analyze incoming photos to assess damage, flag a claim for potential fraud based on subtle data patterns, or even recommend the next best action for the adjuster to take. This transforms the claims management system from a simple database into an intelligent partner, helping insurers handle claims with more speed and precision than ever before.

What Are the Core Components of a Claims System?

To really get what a modern claims management system does, you have to look under the hood. Think of it like a high-performance engine—it’s not one single part but a collection of specialized components working together in perfect sync. A claims platform is much the same, built from a suite of integrated modules that each own a critical piece of the claims journey.

These modules talk to each other constantly, passing data and tasks along what is essentially an automated production line. This is what turns the old, chaotic, paper-heavy process into a clean digital workflow, dramatically cutting down the time from incident to resolution. The image below really captures this shift from disorganized inputs to structured, efficient outputs.

As you can see, the system is the central processor. It takes the raw, often messy, data from a new claim and turns it into a clear, actionable file that's ready for a quick resolution. Let's break down the core components that make this happen.

First Notice of Loss (FNOL) and Intake

It all starts at the First Notice of Loss (FNOL), which is simply the first report of an incident. Modern systems give customers plenty of ways to file, from a traditional phone call to self-service web portals and mobile apps. This flexibility is the first step toward providing a great customer experience right from the start.

For instance, when a policyholder uses an app to report a car accident, the system can instantly grab photos, GPS data, and a preliminary statement. This kind of structured data intake is miles ahead of manual entry and sets the stage for everything that follows. If you're building out an intake process, a well-designed form is a must; you can find some great starting points in this insurance claim form template.

Policy Verification and Initial Triage

Once the FNOL comes in, the system’s next job is to perform an immediate policy verification. It automatically pings the core policy administration system (think Guidewire or Duck Creek) to confirm a few key things:

Is the policy active and paid up?

Does the incident reported actually fall under the policy's coverage?

Are there any other red flags to consider?

This check used to eat up a human adjuster's time, but now it happens in milliseconds. Based on the claim's details and policy rules, the system then does an initial triage, assigning the claim to the right adjuster or, for simple cases, sending it down a "fast track" for straight-through processing.

Automated Adjudication and Fraud Detection

This is where the real power of automating insurance claims with AI becomes clear. The adjudication module uses a set of predefined business rules to evaluate the claim. For a simple cracked windshield claim, the system can often approve it automatically without anyone touching it, triggering the next step in the process.

At the same time, an intelligent fraud detection engine is running in the background. It crunches the claim data, comparing it against historical patterns and known fraud indicators. These algorithms can flag suspicious connections, inconsistent statements, or weird claim frequencies that a person might easily miss, protecting the carrier from major losses.

Payment Processing and Final Settlement

The final piece of the puzzle is the payment and settlement module. As soon as a claim is approved—whether automatically or by an adjuster—this module gets to work on the financial side. It calculates the payout based on policy limits and repair estimates, processes the payment through different methods (like direct deposit or a check), and generates all the closing documents.

A claims management system doesn't just hold information; it actively pushes the process forward. Each integrated module does its job and then cleanly hands the claim off to the next, creating a continuous, automated workflow that gets rid of delays and manual work.

Of course, for these systems to stay effective in the long run, they need to be maintained properly. This involves things like managing technical debt in risk control to ensure these core components remain solid. Ultimately, this integrated design is what delivers the speed, accuracy, and efficiency that both insurers and their customers demand.

How AI Is Reshaping Claims Automation

The real game-changer in modern claims management systems isn't just about digitizing old workflows; it's about making them intelligent. Artificial Intelligence (AI) is fundamentally overhauling the claims process, turning it from a reactive, manual chore into a predictive, automated, and customer-focused operation. This shift lets leading AI insurance companies process claims faster, more accurately, and with an efficiency that was once unthinkable.

Instead of adjusters manually sifting through piles of documents and photos, AI algorithms now analyze complex information in seconds. This provides instant insights that fast-track decisions. We're not talking about some far-off future—this is happening right now, delivering real results that improve both operational metrics and customer satisfaction.

This technological leap is a massive force behind the industry’s growth. The global claims management market, valued at USD 4.60 billion in 2023, is expected to jump to USD 13.95 billion by 2032. That’s a powerful annual growth rate of 13.3%. Large enterprises are at the forefront, using AI for automating insurance claims at scale, managing high volumes with incredible precision and cutting processing times by up to 30% in many instances.

From Visual Assessment to Document Intelligence

One of the most immediate ways AI makes a difference is in the initial assessment. Think about a typical auto insurance claim. In the past, assessing vehicle damage meant scheduling an adjuster, waiting for an inspection, and then manually creating an estimate. The whole thing could take days, if not weeks.

Today, AI-powered visual assessment changes the entire equation. A policyholder just needs to upload a few photos of the damage through a mobile app. An AI model, trained on millions of similar images, analyzes them instantly to identify damaged parts, gauge the severity, and generate a preliminary repair estimate. It's that simple.

But it’s not just about images. AI also brings powerful document intelligence to the table using Natural Language Processing (NLP).

Policy Analysis: NLP algorithms can read and interpret dense policy documents to instantly confirm coverage details.

Medical Reports: For health or workers' comp claims, AI can pull key information from lengthy medical records, invoices, and doctor’s notes.

Legal Documents: The technology can even parse police reports and legal filings, flagging the most relevant information for the adjuster.

This knack for understanding unstructured data—the words in a document, the pixels in a photo—automates tedious, error-prone work and frees up adjusters to focus on what they do best: complex decision-making.

The Rise of AI Customer Care

A huge focus for any financial service is the customer experience, and this is where AI customer care really shines. When a customer files a claim, they're often stressed and just want clear, immediate answers. AI-driven tools deliver on that need, providing support well beyond a 9-to-5 schedule.

AI-powered chatbots and virtual assistants can be integrated directly into an insurer's website or app. They’re able to answer common questions, walk users through the claims filing process, and provide real-time status updates 24/7. This instant support dramatically reduces call volumes to contact centers and ensures customers never feel like they’re left in the dark.

AI customer care doesn't replace the human touch; it enhances it. By handling routine inquiries, AI frees up human agents to manage sensitive or complex cases that require empathy and nuanced judgment, leading to better outcomes for everyone.

This approach is quickly becoming a standard feature among top carriers, as positive feedback from claims AI reviews consistently points to the value of immediate, always-on support.

Uncovering Fraud and Enabling Agentic AI

Beyond making things more efficient, AI adds a critical layer of defense against fraud. Predictive analytics models can analyze thousands of data points within a single claim—and across an insurer's entire book of business—to spot subtle patterns that would be invisible to a human reviewer. These systems can flag suspicious connections, unusual claim frequencies, or inconsistencies in evidence, sending high-risk cases for a closer look.

Looking ahead, the next frontier is agentic AI, where autonomous AI agents manage entire chunks of the claims process on their own. For example, an agentic system like Nolana can be trained on an insurer's standard operating procedures to handle low-complexity, high-volume claims from start to finish. You can learn more by exploring our detailed guide on https://nolana.com/articles/insurance-claims-processing-automation.

These AI agents can perform a whole sequence of tasks:

Receiving the First Notice of Loss (FNOL).

Verifying policy coverage automatically.

Cross-referencing details with third-party data sources.

Approving the claim based on predefined rules.

Initiating the payment process.

This kind of end-to-end automation allows human adjusters to function as true experts, overseeing the system and stepping in only when their critical thinking is truly needed. To go deeper into how this works, you can find great discussions about AI in insurance claims processing. This shift truly elevates the role of claims professionals and allows AI insurance companies to operate at a scale and speed that was simply impossible before.

Building a Connected Claims Ecosystem

A powerful claims management system operating in a vacuum is like a world-class musician playing alone. The performance might be technically perfect, but the real magic—the symphony—only happens when it connects with the entire orchestra. The same is true for your claims platform; its true value is only realized when it’s fully integrated into your company's technology stack.

This isn't just about plugging in another piece of software. It's a strategic move to create a fluid, two-way conversation between all your critical business systems, typically through Application Programming Interfaces (APIs). This approach finally breaks down the data silos that have plagued financial services for decades, establishing a single, reliable source of truth for every claim and customer interaction.

When all your systems are talking, you get a 360-degree view of the customer. That’s the foundation for faster, smarter, and more empathetic service.

Weaving Together Core Systems

At the center of this ecosystem are the connections to your core operational platforms. For AI insurance companies, this means linking the claims system to policy administration software like Guidewire or Duck Creek. When a new claim comes in, the system shouldn't have to wait for manual checks. Instead, it instantly queries the policy system to verify coverage, check limits, and pull up relevant customer history.

The same principle applies to your CRM. Integrating with a platform like Salesforce is a game-changer for delivering top-tier AI customer care. When an agent speaks with a policyholder, they see the full claims context right alongside the customer's entire relationship history. This simple connection eliminates the frustration of customers having to repeat themselves and gives your agents the information they need to provide truly personal support.

A connected ecosystem ensures that data entered once is available everywhere it's needed, in real-time. This eliminates redundant data entry, reduces the chance of errors, and creates a seamless workflow across departments.

Tapping into External Data Sources

A truly modern ecosystem doesn't stop at your internal tools. It extends outward to a vast array of external data sources, which is where the claims process gets genuinely proactive and intelligent. By connecting to third-party services, a claims system can automatically pull in crucial context to enrich a claim file.

Think about what this looks like in the real world:

Weather Data: A homeowner files a claim for roof damage after a storm. The claims system automatically pulls meteorological data for their address, instantly confirming that a severe hailstorm did, in fact, occur on that date.

Police Reports: For an auto accident, the system can connect to a database to retrieve the official police report, saving the adjuster the manual effort of tracking it down.

Vehicle History: Before settling an auto claim, the system can access vehicle history reports to check for pre-existing damage, helping to assess the claim more accurately.

This kind of automated data validation and enrichment helps adjusters make faster, more confident decisions. Healthcare is a prime example of this integrated approach taking off. The global market for healthcare claims management hit USD 16.8 billion in 2024 and is projected to nearly double to USD 33.4 billion by 2033. A huge driver is the integration with Electronic Health Records (EHR), which can slash processing errors by up to 40% by simply getting systems to talk to each other.

You can learn more from these healthcare claims management market insights or see real-world examples of how Nolana is transforming insurance claims with agentic AI. Ultimately, this interconnectedness is the bedrock of any resilient and efficient claims operation.

How to Choose the Right Claims Management System

Picking a new claims management system is a huge decision. It’s not just a software purchase; it’s a commitment that will shape how your teams work and how customers see you for years to come. You're not just buying features off a list—you're looking for a partner whose technology aligns with where your business is headed, especially when it comes to automating insurance claims and delivering top-notch AI customer care.

To get this right, you have to look past the sales pitches and ask the tough questions. The real goal is to find a platform that solves today's headaches while being flexible enough for tomorrow's challenges. That means digging into its scalability, security, compliance, and, most importantly, its plan for intelligent automation.

The market for these platforms is already big and getting bigger. It was valued at USD 4,697.85 million in 2021 and is on track to hit USD 6,460.3 million by 2025. Top vendors are pushing hard on innovation, and we're seeing a rise in outsourced models that help carriers manage massive claim spikes while cutting operational costs by 20-25%. You can dig deeper into these trends in this claims management solution market report.

Creating Your Evaluation Checklist

Before you ever sit through a demo, get your team together and build a checklist of your absolute must-haves. This isn't just about features; it's a strategic framework to ensure you're judging every option by the same standard—the one that matters to your business.

Think bigger than just basic functions. Your checklist needs to cover the core pillars of a great system:

Scalability and Performance: What happens when a hurricane hits and claims triple overnight? Can the system keep up without crashing or slowing to a crawl?

Security and Compliance: Does it meet the tough regulatory demands of standards like GDPR and HIPAA? You need to see proof of data encryption, strict access controls, and clear audit trails.

Integration Capabilities: How well does it play with others? You need seamless API connections to your core systems, whether it's Guidewire, Salesforce, or other third-party data sources.

Vendor Support and Partnership: What happens after you sign the contract? Look into the quality of their training, implementation support, and ongoing customer service.

Key Questions to Ask Potential Vendors

With your internal checklist in hand, you're ready to talk to vendors. This is your chance to cut through the marketing fluff and get to the truth about what their system can really do. Your questions should be pointed and tied directly to your goals, like boosting efficiency with AI and making customer interactions smoother.

Here are a few questions you should be asking:

AI Roadmap: Show me your roadmap for AI. How, specifically, will your upcoming developments help us deliver better AI customer care?

Integration Demo: Don't just tell me it integrates. Show me. Can you do a live demo of how your system connects with our CRM and policy admin software?

Data Handling: Our claims data is messy—photos, PDFs, emails. How does your system take in all that unstructured data and use it for automating insurance claims?

Customization and Configuration: How much can my team configure on our own? Can we adjust workflows and business rules without calling in your developers every time?

Performance Metrics: What KPIs do your best customers use to measure ROI? And how does your platform make it easy to track and report on those numbers?

Choosing a claims management system is a long-term commitment. Focus on finding a vendor that acts as a true partner, one who is invested in your success and has a clear, forward-thinking vision for the future of claims automation.

Comparing Deployment Models

One of the last big calls you'll have to make is whether to go with an on-premises system or a cloud-based Software-as-a-Service (SaaS) solution. This choice has major implications for your budget, IT workload, and ability to scale. It's no surprise that many forward-thinking AI insurance companies are moving to the cloud for its flexibility and lower upfront costs.

Deciding between on-prem and cloud really comes down to your organization's resources, security posture, and long-term strategy. The table below breaks down the key factors to help you weigh the pros and cons of each approach.

On-Premises vs. Cloud-Based Claims Management Systems

Factor | On-Premises System | Cloud-Based System (SaaS) |

|---|---|---|

Initial Cost | High upfront investment in hardware, licenses, and infrastructure. | Lower upfront cost with a predictable monthly or annual subscription fee. |

Maintenance | Your internal IT team is responsible for all updates, security, and maintenance. | The vendor manages all updates, security patches, and server maintenance. |

Scalability | Scaling requires purchasing and configuring additional hardware. | Easily scalable up or down based on your claim volume and business needs. |

Accessibility | Access is typically limited to your internal network, requiring a VPN for remote work. | Accessible from anywhere with an internet connection, supporting remote teams. |

Implementation | Longer implementation timelines due to hardware setup and configuration. | Faster deployment as the infrastructure is already in place. |

Ultimately, while on-premises gives you total control, cloud-based systems offer agility and can free up your IT team to focus on more strategic work instead of just keeping the lights on.

Implementing Your System for Maximum ROI

Getting a powerful claims management system is just the start. The real magic happens during implementation—that critical phase where you prepare your team, secure your data, and define exactly what success looks like. Without a smart rollout strategy, even the best tech can fall flat.

A successful launch is about more than just installing software; it’s about fundamentally changing how your team operates. This means getting everyone on board through solid change management, ensuring a seamless data migration, and delivering training that truly empowers your people. Get this right, and you're building a foundation for a serious return on your investment.

Defining and Tracking Key Performance Indicators

You can't prove the value of your investment if you don't measure what matters. Vague goals won't cut it. You need to zero in on specific Key Performance Indicators (KPIs) that act as a health check for your claims department.

These metrics give you a clear "before and after" snapshot, highlighting precisely where the new system is making a difference.

Claim Cycle Time: How long does it take from the First Notice of Loss (FNOL) to the final check being cut? A major goal is to shrink this timeline dramatically.

Cost Per Claim: Pinpoint the all-in administrative cost to process a single claim. Automation should push this number down, period.

Customer Satisfaction (CSAT): Survey your policyholders after their claim is closed. Happier customers mean faster, more transparent service, and higher CSAT scores are the proof.

Fraud Detection Accuracy: Keep an eye on the percentage of fraudulent claims you successfully catch and prevent. This KPI has a direct, positive impact on your bottom line.

Building a Culture of Continuous Optimization

Implementation isn't a "set it and forget it" project. It's the beginning of a long-term commitment to getting better every single day. The most successful AI insurance companies foster a culture of constant refinement, always looking for ways to tweak workflows and squeeze more performance out of their tools. This mindset is essential for anyone serious about how to improve operational efficiency.

This approach ensures your system grows with your business, not against it. Make it a habit to review your KPIs, listen to feedback from your adjusters on the front lines, and collaborate with your vendor to explore new features and automation possibilities.

A successful implementation creates a feedback loop where data from your KPIs informs process improvements, which in turn boosts your ROI. It’s a cycle of constant refinement that keeps your operations sharp and competitive.

When you pair a strong initial rollout with a dedication to ongoing improvement, your claims management system transforms from a simple tool into a lasting strategic asset that delivers more and more value over time.

Common Questions Answered

When diving into modern claims management systems, a few key questions always come up. Most leaders want to know what the practical, on-the-ground impact of AI will be for their teams and their customers. Let's tackle those head-on.

How Does AI Change the Role of a Claims Adjuster?

The short answer is, AI doesn't replace adjusters—it makes them better. Think of it as taking the tedious, repetitive work off their plates so they can focus on what humans do best.

AI excels at the heavy lifting, like sifting through documents or running initial damage assessments. This frees your adjusters to handle the complex parts of the job: intricate investigations, strategic decision-making, and providing genuine, empathetic AI customer care when policyholders need it most. Their role evolves from a processor to an expert manager, using technology to get faster, better results and stepping in when a situation demands human judgment.

What Is the Impact of AI on Customer Care?

The difference is night and day. For AI insurance companies, bringing AI into the customer experience means you can offer instant support, 24/7. Intelligent chatbots and virtual assistants can answer common questions and provide claim status updates in real-time, eliminating frustrating wait times.

This isn't just about speed; it's about giving customers a sense of control. As countless claims AI reviews show, policyholders who feel informed and supported through the process are significantly more satisfied, and that immediate, accessible communication is a huge part of it.

The real power of AI in claims management is how it empowers your human experts. It lets them apply their skills where they truly count, turning them into strategic problem-solvers and exceptional advocates for your customers.

How Secure Is Customer Data in a Cloud-Based System?

It's a valid concern, and top-tier providers treat it as their highest priority. The leading cloud-based claims management systems are built on a foundation of robust security. They use advanced encryption for all data, whether it's moving or sitting still, and enforce strict access controls to ensure only authorized personnel can view sensitive information.

These platforms also undergo constant, rigorous third-party security audits. Reputable vendors will always be compliant with major standards like SOC 2 Type II and GDPR, often delivering a level of security that’s far more advanced than what most companies could realistically build and maintain in-house.

Ready to see how agentic AI can automate your claims operations from end-to-end? Discover Nolana and learn how our compliant, AI-native platform can cut costs, accelerate cycle times, and improve customer experiences. Learn more about Nolana.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP