Data: data analytics in insurance for smarter risk and better customer care

Data: data analytics in insurance for smarter risk and better customer care

Discover how data analytics in insurance is transforming risk management, claims automation, and customer care - unlock smarter insights and competitive advantage.

Imagine an insurance world where a claim is settled in minutes, not weeks. Where your provider anticipates a need before you even think to ask. This isn't science fiction; it's the reality being built right now by data analytics in insurance. The industry is making a fundamental shift, moving away from simply looking in the rearview mirror to using predictive AI to reshape operations from the ground up.

The New Reality of Insurance Analytics

For decades, insurance has been a reactive business. But that's changing fast. The most forward-thinking ai insurance companies are no longer just analyzing what happened last year; they're using data to predict what’s coming next. This proactive approach gives them a serious competitive edge, letting them craft highly personalized products and run their businesses with a new level of precision.

You can see this shift most clearly in two places that matter most to customers: claims and service. The days of endless paperwork, manual reviews, and long waits on hold are fading. AI is here to automate the heavy lifting, delivering faster, more accurate results that benefit both the insurer and the policyholder.

Reinventing Claims and Customer Care

This is more than just an efficiency play. By automating core processes, insurers are not just trimming expenses—they're building stronger, more responsive businesses. Let's break down how this is actually working in the real world.

We're going to dive into a few key areas:

Automating Insurance Claims with AI: We'll look at how AI can manage the entire claims lifecycle—from the first notice of loss and damage assessment all the way to authorizing payment. We’ll also see how systems can handle claims ai reviews to maintain total transparency.

Elevating AI Customer Care for Financial Services: Discover how smart virtual assistants and predictive models are creating smooth, proactive customer service, 24/7.

Smarter Underwriting: Understand how real-time data feeds enable far more accurate risk assessments and dynamic pricing models.

This entire operational model depends on one thing: turning an ocean of data into sharp, actionable intelligence. For a deeper look at how data is reshaping risk, claims, and customer engagement, this guide on data analytics for insurance is an excellent starting point. As we continue, you'll see a clear picture of how these technologies fit together to create the insurer of the future.

4. Automating Insurance Claims with AI

For decades, the claims process has been the ultimate "moment of truth" in an insurer-policyholder relationship. Unfortunately, it's also been the most common source of friction. The old way was manual, slow, and often felt like a black box to the customer. This is exactly where data analytics in insurance makes one of its most immediate and powerful impacts, turning what was once a multi-week headache into a quick, transparent interaction.

Imagine an AI-powered claims system as a digital first responder. It's on call 24/7, ready to help a customer right after a stressful event, like a car accident. Instead of having to wait until Monday morning, a policyholder can open an app, chat with an AI assistant to file their First Notice of Loss (FNOL), and be guided through every single step.

That instant response is just the start. The system can immediately put computer vision to work, analyzing photos of vehicle damage to assess the impact and generate a reliable repair estimate on the spot. This one capability alone can replace days of waiting for an adjuster's visit and manual review.

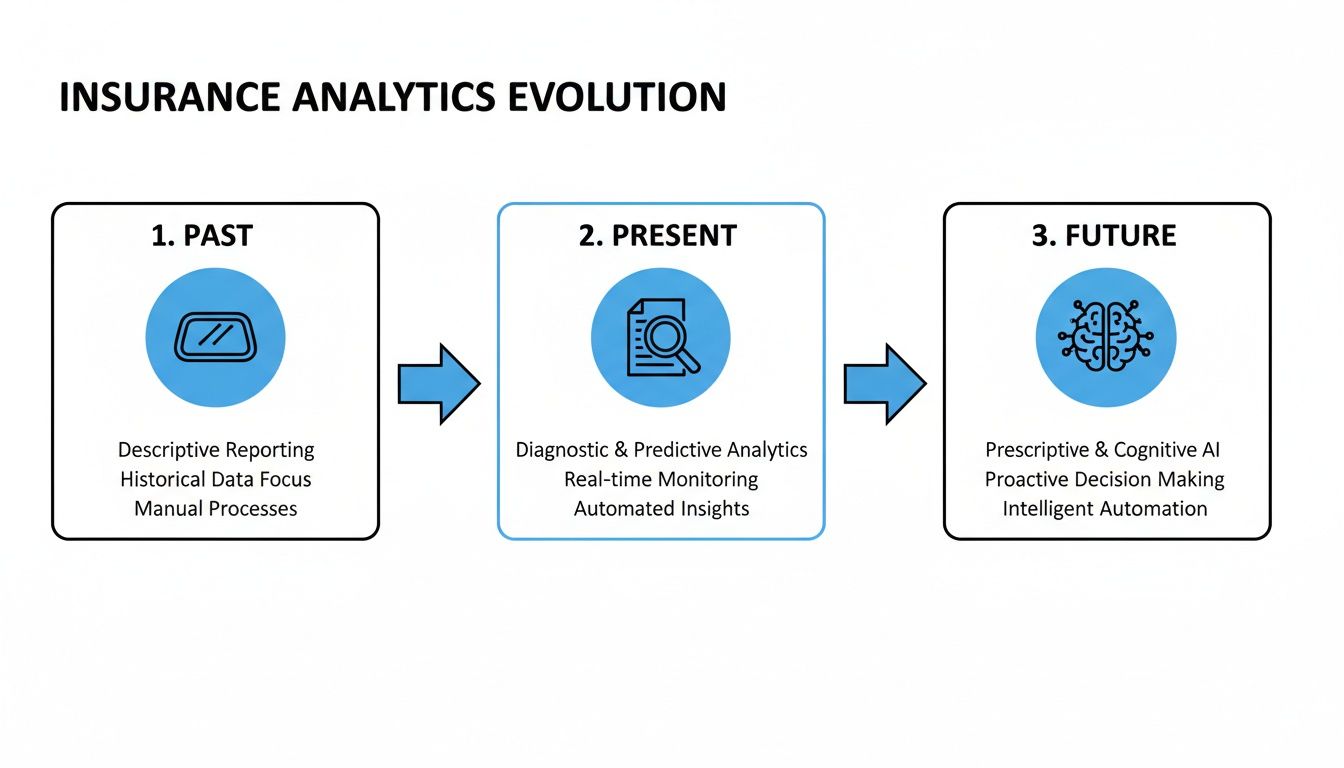

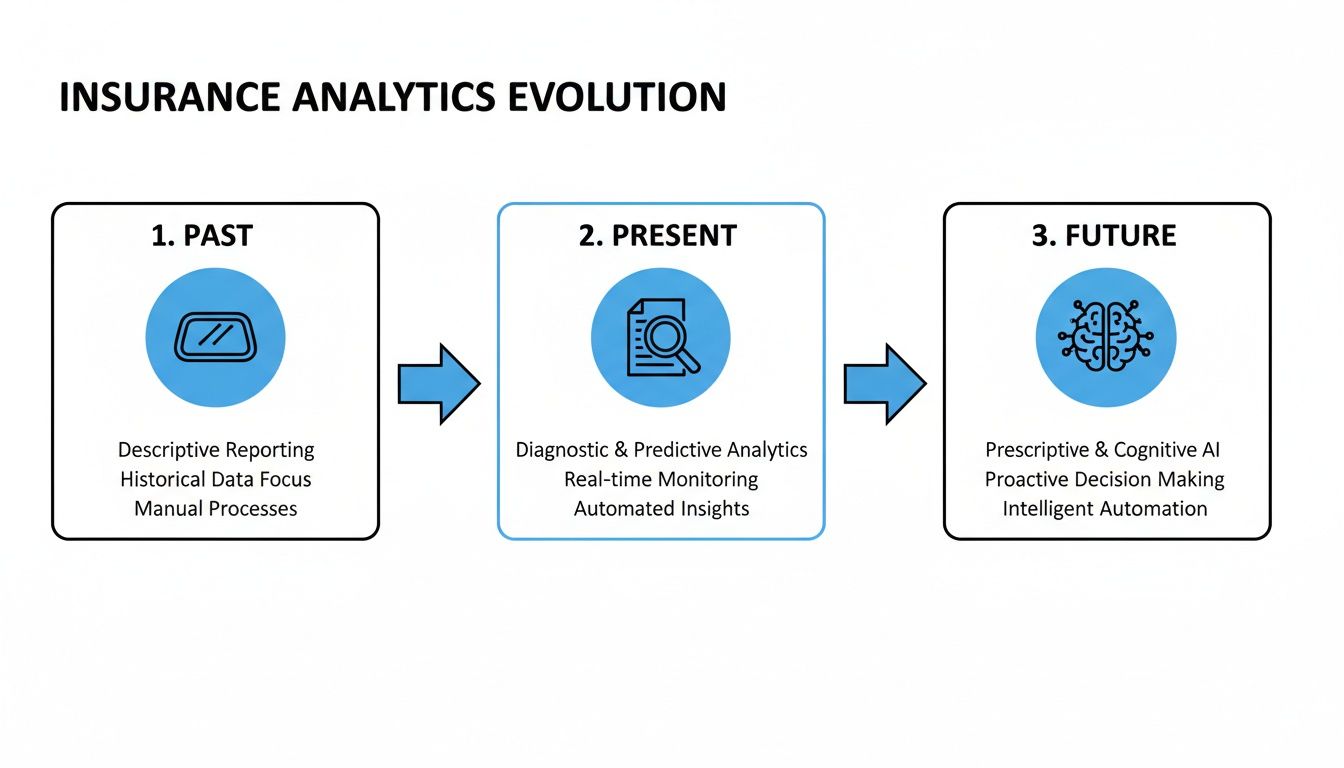

The graphic below shows just how far we've come—from basic retrospective reporting to the kind of intelligent, predictive automation that's reshaping the industry today.

This evolution is key. It's about moving from simply understanding what already happened to actively predicting and influencing what happens next, which is the entire point of modern claims automation.

The Brains Behind the Operation

Once that initial claim data comes in, machine learning models get to work as a team of vigilant gatekeepers, performing several critical checks at once.

Coverage Verification: The AI instantly confirms the policy is active and actually covers the type of damage being reported, doing away with manual lookups.

Fraud Detection: Trained on millions of historical claims, sophisticated algorithms can pick up on subtle patterns that might signal fraud. They flag these suspicious cases for a human expert to review while letting the legitimate ones sail through.

Automated Adjudication: For simple, clear-cut claims that tick all the right boxes, the system can approve the claim and kick off the payment process automatically.

This kind of smart workflow allows AI insurance companies to achieve straight-through processing for a huge chunk of their claims. The real win? It frees up experienced adjusters to apply their skills to the complex, high-stakes cases that truly need human judgment and empathy.

By automating the routine, insurers can slash claim processing times by an average of 30%. This doesn't just make customers happier; it drives down operational costs in a big way.

The market is certainly taking notice. Valued at USD 13.84 billion in 2024, the global insurance analytics sector is on track to hit USD 31.33 billion by 2030. This growth isn't just hype; it’s a direct result of the clear, bottom-line impact of data-driven decisions in core functions like claims. You can see a more detailed breakdown of this trend in a recent market analysis from Grand View Research.

Ensuring Transparency with AI Claims Reviews

A big worry with any kind of automation is the "black box" problem—decisions being made without anyone understanding why. Modern platforms are built to solve this. The idea of claims ai reviews is fundamental to keeping both trust and control.

Every single action the AI takes is logged, creating a clear and auditable trail. This transparent record shows exactly which data points led to a specific decision. If a claim gets flagged or denied, a human adjuster can instantly pull up the entire automated workflow, see the evidence the AI used, and make an informed final call. It’s the best of both worlds: the speed of automation with the crucial oversight of human experts.

This level of detail is essential for internal governance and for satisfying regulators, proving that every decision is fair, well-documented, and explainable. To get a closer look at how these workflows are built, our guide on insurance claims processing automation dives into the mechanics.

Ultimately, automating insurance claims with AI isn't about replacing people. It's about empowering them to deliver faster, fairer, and more accurate help to customers when they need it most.

5. Transforming Customer Care With AI

Beyond just making claims processing more efficient, perhaps the most significant impact of data analytics in insurance is how it's completely reshaping the customer relationship. For a long time, the only time a policyholder heard from their insurer was during renewal season or a stressful claim. That's changing. Now, AI customer care is setting a new standard where service is proactive, personalized, and always on.

This turns customer support from a necessary cost into a powerful tool for keeping customers happy and loyal.

Forget about endless hold music and being told the office is closed. The new front line of customer care with AI for financial services is often an intelligent virtual assistant that can generate instant quotes, answer surprisingly complex policy questions, and walk customers through processes anytime, day or night. This kind of immediate, accessible support is what people expect now, making every interaction feel smooth and easy.

This evolution from reactive to proactive service is where forward-thinking insurers are really starting to pull away from the competition. It’s no longer about just answering the phone; it’s about anticipating what customers need before they even realize it themselves.

Moving From Reactive to Proactive Service

What if your insurer knew you needed help before you even had to ask? That’s the real power of predictive analytics at work. By analyzing data from telematics devices in a car, smart home sensors, or even local weather patterns, an insurer can get ahead of a customer's needs with incredible accuracy.

For instance, if a car's telematics data flags a potential engine problem, the system could automatically send the policyholder a notification with a list of approved mechanics nearby. It might even offer to arrange a rental car. This small act transforms the relationship from a simple financial transaction into a genuine partnership, building trust and showing value that goes way beyond the policy document.

The global insurance analytics market is a testament to this shift, projected to climb from USD 16.70 billion in 2025 to an incredible USD 43.95 billion by 2032. This explosive growth is coming from firms that are using their data to create smarter pricing, better service, and experiences that build lasting loyalty.

Here's a quick look at how AI is being applied across the customer journey.

AI Applications in Insurance Customer Care

Customer Lifecycle Stage | AI Application | Key Benefit |

|---|---|---|

Onboarding | Automated document verification & identity checks. | Speeds up policy issuance and reduces manual errors. |

Policy Servicing | 24/7 AI chatbots for instant query resolution. | Improves customer satisfaction and frees up human agents. |

Engagement | Predictive analytics for personalized recommendations. | Increases cross-sell/up-sell opportunities and adds value. |

Renewal | Churn prediction models to identify at-risk customers. | Enables proactive retention efforts and reduces attrition. |

Claims | AI-powered first notice of loss (FNOL) intake. | Simplifies and accelerates the initial claims process. |

As the table shows, AI isn't just a single tool; it's a suite of technologies that can enhance every single touchpoint a customer has with their insurer.

An Early Warning System For Customer Churn

One of the most valuable uses of AI in customer care is its ability to act as an early warning system. Sophisticated natural language processing (NLP) models can analyze the sentiment behind customer calls, emails, and chat logs in real-time. This gives you an objective pulse on customer satisfaction and instantly flags interactions that show frustration or disappointment.

When the system detects a high-risk conversation, it can trigger an immediate alert for a human agent or manager. This lets the team jump in quickly, fix the problem, and potentially save a customer who was about to walk away. Suddenly, your customer service department becomes a strategic retention engine.

By identifying at-risk customers early, insurers can improve retention rates by up to 23%. This proactive approach not only preserves revenue but also provides invaluable feedback for improving products and services.

This level of insight also helps human agents be their best. Technologies like real-time agent assist can feed agents live guidance during a call, pulling up the right policy information or suggesting the next-best action to take. This ensures every interaction is consistent, effective, and helpful. You can learn more about the wider applications in our guide to AI in customer care.

Ultimately, data analytics gives insurers the ability to understand their customers on a much deeper level. It transforms every touchpoint into a chance to build a stronger, more resilient relationship.

Smarter Underwriting and Risk Management with Data

While efficient claims and customer care are essential, the real bedrock of any insurance business is its ability to accurately assess and price risk. This is where data analytics in insurance offers one of its most powerful advantages, fundamentally shifting the industry from static, historical models to a dynamic, real-time approach.

Think of it as the difference between navigating with an old paper map versus using a live GPS that reroutes you around hazards before you even see them.

For centuries, underwriting relied on actuarial tables—broad, dusty categorizations of risk based on a handful of data points. Today, leading insurers are building risk models that are alive with fresh data, giving them a much clearer and more detailed picture of the risks they're taking on.

This precision allows for pricing that is not only more accurate but also fairer to the individual policyholder. A driver with a perfect safety record shouldn't be penalized with the same rate as someone with multiple accidents, just because they share a zip code. Data analytics finally makes that level of fairness possible.

From Static Tables to Dynamic Models

The real magic behind modern underwriting is the ability to pull in and analyze a massive variety of data sources in near real time. Machine learning algorithms can then sift through this ocean of information to find subtle risk patterns that would be completely invisible to even the most experienced human underwriter.

Here are just a few examples of the data streams fueling these new models:

Telematics Data: Information from devices in cars paints a clear picture of actual driving behavior—speed, braking habits, and mileage. This is the foundation of usage-based insurance that directly reflects how an individual drives.

Smart Home Sensors: Data from IoT devices like smart smoke detectors, water leak sensors, and security systems can help insurers offer meaningful discounts to homeowners who proactively manage their property risks.

External Environmental Data: Real-time weather patterns, local crime statistics, and even hyper-local flood risk data can be woven together to create an incredibly precise risk profile for a home or business.

By combining these diverse datasets, insurers can move beyond simple correlations to a deep, causal understanding of risk. This enables them to price policies with an accuracy that was previously unimaginable. In fact, insurers using predictive modeling in underwriting have seen a 67% improvement in risk assessment accuracy—a game-changing advantage.

Managing Portfolio-Wide Risk Exposure

Beyond just pricing individual policies, data analytics provides a powerful lens for managing risk across an entire portfolio. This is where the technology evolves from a tactical tool to a strategic necessity, ensuring the long-term stability and solvency of the company.

Risk management is a clear powerhouse application. The global market—valued at USD 14.50 billion in 2024—is expected to hit USD 43.95 billion by 2032 with a compound annual growth rate of 14.8%. A huge part of that growth is driven by analytics in risk and customer management. As you can read in these insurance analytics market trends, insurance firms hold the largest market share by using these tools for precise underwriting, pricing, and fraud prevention.

By simulating the financial impact of large-scale events, insurers can ensure they have adequate reserves and robust reinsurance strategies in place. This proactive approach is vital for maintaining financial stability in the face of increasing climate and cyber-related threats.

Using advanced modeling, insurance companies can run complex simulations to understand their exposure to catastrophic events. For instance, they can model the potential financial hit from a major hurricane striking a specific coastal region or a widespread cyberattack targeting a particular industry.

These simulations allow them to:

Identify Risk Concentrations: Pinpoint areas where they might be over-exposed to a single type of risk.

Optimize Reinsurance: Make smarter, data-backed decisions about how much reinsurance to purchase and from whom.

Stress-Test Capital Reserves: Ensure they can withstand a worst-case scenario without financial instability.

This macro-level view is every bit as important as pricing an individual policy correctly. It’s what allows an insurer to confidently promise to be there for its customers, no matter what happens. To see how these principles are applied in practice, you can explore examples like this AI-generated risk assessment form template that structures data for analysis. By mastering both the micro and macro sides of risk, data analytics truly fortifies an insurer's entire business from the ground up.

Building Your Insurance Data Analytics Framework

Having powerful AI models is one thing, but having the right infrastructure to support them is another entirely. Think of it like a high-performance engine—it's useless without a well-built car. In the same way, successful data analytics in insurance depends on a robust, well-designed framework. This is your practical blueprint for building the data foundation that turns raw information into a true strategic asset for modern ai insurance companies.

This framework isn't just about technology. It's a blend of the right tools, smart processes, and a culture that's ready to embrace data. The real goal here is to create a system that can reliably pull in, clean up, and analyze data to power everything from automated underwriting to proactive AI customer care.

The journey starts by gathering data from every corner of your business. This means setting up pipelines to pull information not just from modern IoT devices or telematics sensors, but also from those deep-rooted legacy systems that often hold decades of invaluable historical data.

Core Components of a Modern Data Infrastructure

To build an analytics framework that actually works, you need to assemble a few key components that play well together. This isn't a one-size-fits-all solution, but a strategic assembly of technology designed to meet your specific operational needs. A well-structured system ensures data is not only accessible but also trustworthy and secure.

The main pillars of this infrastructure include:

Data Ingestion and Integration: This is your starting line, where you collect data from all sources. Think policy administration systems, claims databases, customer interaction logs, and even external sources like weather data or vehicle history reports.

Data Warehousing and Lakes: Once you have the data, it needs a home. A data warehouse is perfect for storing structured, processed data that’s ready for immediate analysis. A data lake, on the other hand, holds vast amounts of raw data in its native format, giving your data science teams the flexibility they need for future projects.

Data Governance and Quality: This is a crucial layer that often gets overlooked. It involves the processes that ensure your data is accurate, consistent, and secure. This means defining data ownership, setting quality rules, and managing who gets access to sensitive information.

A strong data governance program is the bedrock of trustworthy AI. Insurers that invest in comprehensive data quality and governance are 3.4 times more likely to report successful outcomes from their analytics initiatives.

Navigating Regulatory and Human Challenges

Putting a sophisticated data analytics framework in place is much more than just installing new software. It means navigating a complex web of regulatory requirements and, just as importantly, fostering a cultural shift within your organization. This is where many initiatives stumble if not managed carefully from the get-go.

One of the biggest hurdles is ensuring compliance with data privacy laws like GDPR and CCPA. These regulations lay down strict rules on how personal data is collected, stored, and used. Your framework must be built with privacy by design, with features for data anonymization, consent management, and the ability to respond to customer data requests efficiently.

Another critical challenge is model explainability. Regulators and customers are rightfully wary of "black box" AI models that make decisions without clear reasoning. It’s essential to build systems that can provide transparent claims ai reviews and underwriting decisions, showing exactly which data points influenced an outcome. This level of auditability is non-negotiable in a regulated field. For a closer look at how modern platforms achieve this, explore our insights on transforming insurance claims processing.

Finally, success hinges on fostering a data-first culture. You have to train and empower your teams to use data in their everyday decision-making, turning analytics from a niche, specialized function into a company-wide capability.

What’s Next for AI in Insurance?

Looking ahead, it's clear that data analytics isn't just another department in an insurance company anymore. It's quickly becoming the central nervous system of the entire operation. The future isn't about using AI to do the old things a little faster; it’s about inventing entirely new ways to manage risk and connect with customers.

Forward-thinking AI insurance companies are already pushing the boundaries. Take parametric insurance, for instance. Imagine a farmer’s crop insurance policy that pays out automatically the moment a weather station reports a drought of a certain severity. There's no lengthy claims process—payment is triggered instantly by verifiable data, like a specific rainfall deficit or a sustained heatwave. This turns a slow, reactive system into a proactive, data-driven backstop for customers.

Blending Human Judgment with Intelligent Automation

Another major frontier is hyper-personalization. Policies are shifting from rigid annual contracts to dynamic agreements that adapt to real-time behavior. A commercial fleet's premium could adjust daily based on telematics data, rewarding safer driving habits on the spot. A homeowner's policy could offer discounts the second they arm their new smart security system.

The real winners will be the insurers who master the delicate balance between human expertise and intelligent automation. AI is brilliant at sifting through mountains of data and handling repetitive tasks, which frees up your experts to do what they do best: solve complex problems, make strategic calls, and build genuine relationships with clients.

This synergy is everything. While claims ai reviews can process thousands of straightforward cases in an hour, nothing can replace the empathy and nuanced judgment of a human adjuster when a customer is facing a truly difficult situation.

Likewise, AI customer care bots can answer common questions around the clock, but a skilled human agent is essential for navigating sensitive conversations and building the kind of trust that keeps customers loyal. The aim isn’t to replace your people but to supercharge their abilities.

The end goal is an insurance ecosystem where data flows seamlessly, informing every decision from underwriting a new policy to resolving a complex claim. By embracing these changes now, insurers aren't just staying current—they're building the future of the industry.

To see how this is already happening, check out these real-world examples of transforming insurance claims with agentic AI.

Frequently Asked Questions

As you start to see the potential of data analytics in insurance, some practical questions naturally come to mind. Let's tackle a few of the most common ones that come up when insurers begin this journey.

Think of this as your quick-reference guide to clarify how these concepts translate from theory into practice.

What Does Data Analytics in Insurance Mean?

At its core, data analytics in insurance is about using technology to find meaningful patterns in vast amounts of data. It’s the shift from simply reporting on what happened to predicting what will likely happen next.

Instead of just looking at historical loss reports, you're using predictive models and AI to inform everything from underwriting and pricing to claims handling. It’s about making smarter, evidence-based decisions that cut down on risk, boost efficiency, and ultimately create a much better experience for your policyholders.

How Does AI Improve the Insurance Claims Process?

AI completely changes the speed and accuracy of claims handling. Imagine a system that can read a first notice of loss, analyze photos of vehicle damage with computer vision, and instantly verify policy details. That's what AI brings to the table.

This allows for "touchless" processing on straightforward claims, shrinking the timeline from weeks down to just a few minutes. For your adjusters, AI becomes a co-pilot, automatically flagging suspicious claims for a closer look and organizing all the relevant data. This frees them up to apply their expertise to the truly complex cases that need a human touch, all while creating a transparent log for any claims ai reviews.

Some insurers have already seen incredible results, cutting their claims processing times by an average of 30%. That’s a massive win for both operational efficiency and customer happiness.

What Are the Main Challenges of Using AI in Insurance?

The biggest hurdles are usually data, regulations, and people. Many insurers are sitting on decades of data locked away in legacy systems, and pulling that information together—while ensuring it's clean and reliable—is a major project.

On top of that, you have to navigate a complex web of data privacy and usage regulations. There’s also a real shortage of people who are experts in both data science and the nuances of insurance. Finally, building trust is key; you have to ensure your AI models are fair and their decisions can be explained. Avoiding a "black box" is crucial for earning the confidence of both regulators and customers, especially when it comes to areas like AI customer care.

Ready to bring intelligent automation to your insurance operations? Nolana deploys compliant, auditable AI agents to handle complex case management, claims processing, and customer service workflows from end to end. Learn how Nolana can transform your business.

Imagine an insurance world where a claim is settled in minutes, not weeks. Where your provider anticipates a need before you even think to ask. This isn't science fiction; it's the reality being built right now by data analytics in insurance. The industry is making a fundamental shift, moving away from simply looking in the rearview mirror to using predictive AI to reshape operations from the ground up.

The New Reality of Insurance Analytics

For decades, insurance has been a reactive business. But that's changing fast. The most forward-thinking ai insurance companies are no longer just analyzing what happened last year; they're using data to predict what’s coming next. This proactive approach gives them a serious competitive edge, letting them craft highly personalized products and run their businesses with a new level of precision.

You can see this shift most clearly in two places that matter most to customers: claims and service. The days of endless paperwork, manual reviews, and long waits on hold are fading. AI is here to automate the heavy lifting, delivering faster, more accurate results that benefit both the insurer and the policyholder.

Reinventing Claims and Customer Care

This is more than just an efficiency play. By automating core processes, insurers are not just trimming expenses—they're building stronger, more responsive businesses. Let's break down how this is actually working in the real world.

We're going to dive into a few key areas:

Automating Insurance Claims with AI: We'll look at how AI can manage the entire claims lifecycle—from the first notice of loss and damage assessment all the way to authorizing payment. We’ll also see how systems can handle claims ai reviews to maintain total transparency.

Elevating AI Customer Care for Financial Services: Discover how smart virtual assistants and predictive models are creating smooth, proactive customer service, 24/7.

Smarter Underwriting: Understand how real-time data feeds enable far more accurate risk assessments and dynamic pricing models.

This entire operational model depends on one thing: turning an ocean of data into sharp, actionable intelligence. For a deeper look at how data is reshaping risk, claims, and customer engagement, this guide on data analytics for insurance is an excellent starting point. As we continue, you'll see a clear picture of how these technologies fit together to create the insurer of the future.

4. Automating Insurance Claims with AI

For decades, the claims process has been the ultimate "moment of truth" in an insurer-policyholder relationship. Unfortunately, it's also been the most common source of friction. The old way was manual, slow, and often felt like a black box to the customer. This is exactly where data analytics in insurance makes one of its most immediate and powerful impacts, turning what was once a multi-week headache into a quick, transparent interaction.

Imagine an AI-powered claims system as a digital first responder. It's on call 24/7, ready to help a customer right after a stressful event, like a car accident. Instead of having to wait until Monday morning, a policyholder can open an app, chat with an AI assistant to file their First Notice of Loss (FNOL), and be guided through every single step.

That instant response is just the start. The system can immediately put computer vision to work, analyzing photos of vehicle damage to assess the impact and generate a reliable repair estimate on the spot. This one capability alone can replace days of waiting for an adjuster's visit and manual review.

The graphic below shows just how far we've come—from basic retrospective reporting to the kind of intelligent, predictive automation that's reshaping the industry today.

This evolution is key. It's about moving from simply understanding what already happened to actively predicting and influencing what happens next, which is the entire point of modern claims automation.

The Brains Behind the Operation

Once that initial claim data comes in, machine learning models get to work as a team of vigilant gatekeepers, performing several critical checks at once.

Coverage Verification: The AI instantly confirms the policy is active and actually covers the type of damage being reported, doing away with manual lookups.

Fraud Detection: Trained on millions of historical claims, sophisticated algorithms can pick up on subtle patterns that might signal fraud. They flag these suspicious cases for a human expert to review while letting the legitimate ones sail through.

Automated Adjudication: For simple, clear-cut claims that tick all the right boxes, the system can approve the claim and kick off the payment process automatically.

This kind of smart workflow allows AI insurance companies to achieve straight-through processing for a huge chunk of their claims. The real win? It frees up experienced adjusters to apply their skills to the complex, high-stakes cases that truly need human judgment and empathy.

By automating the routine, insurers can slash claim processing times by an average of 30%. This doesn't just make customers happier; it drives down operational costs in a big way.

The market is certainly taking notice. Valued at USD 13.84 billion in 2024, the global insurance analytics sector is on track to hit USD 31.33 billion by 2030. This growth isn't just hype; it’s a direct result of the clear, bottom-line impact of data-driven decisions in core functions like claims. You can see a more detailed breakdown of this trend in a recent market analysis from Grand View Research.

Ensuring Transparency with AI Claims Reviews

A big worry with any kind of automation is the "black box" problem—decisions being made without anyone understanding why. Modern platforms are built to solve this. The idea of claims ai reviews is fundamental to keeping both trust and control.

Every single action the AI takes is logged, creating a clear and auditable trail. This transparent record shows exactly which data points led to a specific decision. If a claim gets flagged or denied, a human adjuster can instantly pull up the entire automated workflow, see the evidence the AI used, and make an informed final call. It’s the best of both worlds: the speed of automation with the crucial oversight of human experts.

This level of detail is essential for internal governance and for satisfying regulators, proving that every decision is fair, well-documented, and explainable. To get a closer look at how these workflows are built, our guide on insurance claims processing automation dives into the mechanics.

Ultimately, automating insurance claims with AI isn't about replacing people. It's about empowering them to deliver faster, fairer, and more accurate help to customers when they need it most.

5. Transforming Customer Care With AI

Beyond just making claims processing more efficient, perhaps the most significant impact of data analytics in insurance is how it's completely reshaping the customer relationship. For a long time, the only time a policyholder heard from their insurer was during renewal season or a stressful claim. That's changing. Now, AI customer care is setting a new standard where service is proactive, personalized, and always on.

This turns customer support from a necessary cost into a powerful tool for keeping customers happy and loyal.

Forget about endless hold music and being told the office is closed. The new front line of customer care with AI for financial services is often an intelligent virtual assistant that can generate instant quotes, answer surprisingly complex policy questions, and walk customers through processes anytime, day or night. This kind of immediate, accessible support is what people expect now, making every interaction feel smooth and easy.

This evolution from reactive to proactive service is where forward-thinking insurers are really starting to pull away from the competition. It’s no longer about just answering the phone; it’s about anticipating what customers need before they even realize it themselves.

Moving From Reactive to Proactive Service

What if your insurer knew you needed help before you even had to ask? That’s the real power of predictive analytics at work. By analyzing data from telematics devices in a car, smart home sensors, or even local weather patterns, an insurer can get ahead of a customer's needs with incredible accuracy.

For instance, if a car's telematics data flags a potential engine problem, the system could automatically send the policyholder a notification with a list of approved mechanics nearby. It might even offer to arrange a rental car. This small act transforms the relationship from a simple financial transaction into a genuine partnership, building trust and showing value that goes way beyond the policy document.

The global insurance analytics market is a testament to this shift, projected to climb from USD 16.70 billion in 2025 to an incredible USD 43.95 billion by 2032. This explosive growth is coming from firms that are using their data to create smarter pricing, better service, and experiences that build lasting loyalty.

Here's a quick look at how AI is being applied across the customer journey.

AI Applications in Insurance Customer Care

Customer Lifecycle Stage | AI Application | Key Benefit |

|---|---|---|

Onboarding | Automated document verification & identity checks. | Speeds up policy issuance and reduces manual errors. |

Policy Servicing | 24/7 AI chatbots for instant query resolution. | Improves customer satisfaction and frees up human agents. |

Engagement | Predictive analytics for personalized recommendations. | Increases cross-sell/up-sell opportunities and adds value. |

Renewal | Churn prediction models to identify at-risk customers. | Enables proactive retention efforts and reduces attrition. |

Claims | AI-powered first notice of loss (FNOL) intake. | Simplifies and accelerates the initial claims process. |

As the table shows, AI isn't just a single tool; it's a suite of technologies that can enhance every single touchpoint a customer has with their insurer.

An Early Warning System For Customer Churn

One of the most valuable uses of AI in customer care is its ability to act as an early warning system. Sophisticated natural language processing (NLP) models can analyze the sentiment behind customer calls, emails, and chat logs in real-time. This gives you an objective pulse on customer satisfaction and instantly flags interactions that show frustration or disappointment.

When the system detects a high-risk conversation, it can trigger an immediate alert for a human agent or manager. This lets the team jump in quickly, fix the problem, and potentially save a customer who was about to walk away. Suddenly, your customer service department becomes a strategic retention engine.

By identifying at-risk customers early, insurers can improve retention rates by up to 23%. This proactive approach not only preserves revenue but also provides invaluable feedback for improving products and services.

This level of insight also helps human agents be their best. Technologies like real-time agent assist can feed agents live guidance during a call, pulling up the right policy information or suggesting the next-best action to take. This ensures every interaction is consistent, effective, and helpful. You can learn more about the wider applications in our guide to AI in customer care.

Ultimately, data analytics gives insurers the ability to understand their customers on a much deeper level. It transforms every touchpoint into a chance to build a stronger, more resilient relationship.

Smarter Underwriting and Risk Management with Data

While efficient claims and customer care are essential, the real bedrock of any insurance business is its ability to accurately assess and price risk. This is where data analytics in insurance offers one of its most powerful advantages, fundamentally shifting the industry from static, historical models to a dynamic, real-time approach.

Think of it as the difference between navigating with an old paper map versus using a live GPS that reroutes you around hazards before you even see them.

For centuries, underwriting relied on actuarial tables—broad, dusty categorizations of risk based on a handful of data points. Today, leading insurers are building risk models that are alive with fresh data, giving them a much clearer and more detailed picture of the risks they're taking on.

This precision allows for pricing that is not only more accurate but also fairer to the individual policyholder. A driver with a perfect safety record shouldn't be penalized with the same rate as someone with multiple accidents, just because they share a zip code. Data analytics finally makes that level of fairness possible.

From Static Tables to Dynamic Models

The real magic behind modern underwriting is the ability to pull in and analyze a massive variety of data sources in near real time. Machine learning algorithms can then sift through this ocean of information to find subtle risk patterns that would be completely invisible to even the most experienced human underwriter.

Here are just a few examples of the data streams fueling these new models:

Telematics Data: Information from devices in cars paints a clear picture of actual driving behavior—speed, braking habits, and mileage. This is the foundation of usage-based insurance that directly reflects how an individual drives.

Smart Home Sensors: Data from IoT devices like smart smoke detectors, water leak sensors, and security systems can help insurers offer meaningful discounts to homeowners who proactively manage their property risks.

External Environmental Data: Real-time weather patterns, local crime statistics, and even hyper-local flood risk data can be woven together to create an incredibly precise risk profile for a home or business.

By combining these diverse datasets, insurers can move beyond simple correlations to a deep, causal understanding of risk. This enables them to price policies with an accuracy that was previously unimaginable. In fact, insurers using predictive modeling in underwriting have seen a 67% improvement in risk assessment accuracy—a game-changing advantage.

Managing Portfolio-Wide Risk Exposure

Beyond just pricing individual policies, data analytics provides a powerful lens for managing risk across an entire portfolio. This is where the technology evolves from a tactical tool to a strategic necessity, ensuring the long-term stability and solvency of the company.

Risk management is a clear powerhouse application. The global market—valued at USD 14.50 billion in 2024—is expected to hit USD 43.95 billion by 2032 with a compound annual growth rate of 14.8%. A huge part of that growth is driven by analytics in risk and customer management. As you can read in these insurance analytics market trends, insurance firms hold the largest market share by using these tools for precise underwriting, pricing, and fraud prevention.

By simulating the financial impact of large-scale events, insurers can ensure they have adequate reserves and robust reinsurance strategies in place. This proactive approach is vital for maintaining financial stability in the face of increasing climate and cyber-related threats.

Using advanced modeling, insurance companies can run complex simulations to understand their exposure to catastrophic events. For instance, they can model the potential financial hit from a major hurricane striking a specific coastal region or a widespread cyberattack targeting a particular industry.

These simulations allow them to:

Identify Risk Concentrations: Pinpoint areas where they might be over-exposed to a single type of risk.

Optimize Reinsurance: Make smarter, data-backed decisions about how much reinsurance to purchase and from whom.

Stress-Test Capital Reserves: Ensure they can withstand a worst-case scenario without financial instability.

This macro-level view is every bit as important as pricing an individual policy correctly. It’s what allows an insurer to confidently promise to be there for its customers, no matter what happens. To see how these principles are applied in practice, you can explore examples like this AI-generated risk assessment form template that structures data for analysis. By mastering both the micro and macro sides of risk, data analytics truly fortifies an insurer's entire business from the ground up.

Building Your Insurance Data Analytics Framework

Having powerful AI models is one thing, but having the right infrastructure to support them is another entirely. Think of it like a high-performance engine—it's useless without a well-built car. In the same way, successful data analytics in insurance depends on a robust, well-designed framework. This is your practical blueprint for building the data foundation that turns raw information into a true strategic asset for modern ai insurance companies.

This framework isn't just about technology. It's a blend of the right tools, smart processes, and a culture that's ready to embrace data. The real goal here is to create a system that can reliably pull in, clean up, and analyze data to power everything from automated underwriting to proactive AI customer care.

The journey starts by gathering data from every corner of your business. This means setting up pipelines to pull information not just from modern IoT devices or telematics sensors, but also from those deep-rooted legacy systems that often hold decades of invaluable historical data.

Core Components of a Modern Data Infrastructure

To build an analytics framework that actually works, you need to assemble a few key components that play well together. This isn't a one-size-fits-all solution, but a strategic assembly of technology designed to meet your specific operational needs. A well-structured system ensures data is not only accessible but also trustworthy and secure.

The main pillars of this infrastructure include:

Data Ingestion and Integration: This is your starting line, where you collect data from all sources. Think policy administration systems, claims databases, customer interaction logs, and even external sources like weather data or vehicle history reports.

Data Warehousing and Lakes: Once you have the data, it needs a home. A data warehouse is perfect for storing structured, processed data that’s ready for immediate analysis. A data lake, on the other hand, holds vast amounts of raw data in its native format, giving your data science teams the flexibility they need for future projects.

Data Governance and Quality: This is a crucial layer that often gets overlooked. It involves the processes that ensure your data is accurate, consistent, and secure. This means defining data ownership, setting quality rules, and managing who gets access to sensitive information.

A strong data governance program is the bedrock of trustworthy AI. Insurers that invest in comprehensive data quality and governance are 3.4 times more likely to report successful outcomes from their analytics initiatives.

Navigating Regulatory and Human Challenges

Putting a sophisticated data analytics framework in place is much more than just installing new software. It means navigating a complex web of regulatory requirements and, just as importantly, fostering a cultural shift within your organization. This is where many initiatives stumble if not managed carefully from the get-go.

One of the biggest hurdles is ensuring compliance with data privacy laws like GDPR and CCPA. These regulations lay down strict rules on how personal data is collected, stored, and used. Your framework must be built with privacy by design, with features for data anonymization, consent management, and the ability to respond to customer data requests efficiently.

Another critical challenge is model explainability. Regulators and customers are rightfully wary of "black box" AI models that make decisions without clear reasoning. It’s essential to build systems that can provide transparent claims ai reviews and underwriting decisions, showing exactly which data points influenced an outcome. This level of auditability is non-negotiable in a regulated field. For a closer look at how modern platforms achieve this, explore our insights on transforming insurance claims processing.

Finally, success hinges on fostering a data-first culture. You have to train and empower your teams to use data in their everyday decision-making, turning analytics from a niche, specialized function into a company-wide capability.

What’s Next for AI in Insurance?

Looking ahead, it's clear that data analytics isn't just another department in an insurance company anymore. It's quickly becoming the central nervous system of the entire operation. The future isn't about using AI to do the old things a little faster; it’s about inventing entirely new ways to manage risk and connect with customers.

Forward-thinking AI insurance companies are already pushing the boundaries. Take parametric insurance, for instance. Imagine a farmer’s crop insurance policy that pays out automatically the moment a weather station reports a drought of a certain severity. There's no lengthy claims process—payment is triggered instantly by verifiable data, like a specific rainfall deficit or a sustained heatwave. This turns a slow, reactive system into a proactive, data-driven backstop for customers.

Blending Human Judgment with Intelligent Automation

Another major frontier is hyper-personalization. Policies are shifting from rigid annual contracts to dynamic agreements that adapt to real-time behavior. A commercial fleet's premium could adjust daily based on telematics data, rewarding safer driving habits on the spot. A homeowner's policy could offer discounts the second they arm their new smart security system.

The real winners will be the insurers who master the delicate balance between human expertise and intelligent automation. AI is brilliant at sifting through mountains of data and handling repetitive tasks, which frees up your experts to do what they do best: solve complex problems, make strategic calls, and build genuine relationships with clients.

This synergy is everything. While claims ai reviews can process thousands of straightforward cases in an hour, nothing can replace the empathy and nuanced judgment of a human adjuster when a customer is facing a truly difficult situation.

Likewise, AI customer care bots can answer common questions around the clock, but a skilled human agent is essential for navigating sensitive conversations and building the kind of trust that keeps customers loyal. The aim isn’t to replace your people but to supercharge their abilities.

The end goal is an insurance ecosystem where data flows seamlessly, informing every decision from underwriting a new policy to resolving a complex claim. By embracing these changes now, insurers aren't just staying current—they're building the future of the industry.

To see how this is already happening, check out these real-world examples of transforming insurance claims with agentic AI.

Frequently Asked Questions

As you start to see the potential of data analytics in insurance, some practical questions naturally come to mind. Let's tackle a few of the most common ones that come up when insurers begin this journey.

Think of this as your quick-reference guide to clarify how these concepts translate from theory into practice.

What Does Data Analytics in Insurance Mean?

At its core, data analytics in insurance is about using technology to find meaningful patterns in vast amounts of data. It’s the shift from simply reporting on what happened to predicting what will likely happen next.

Instead of just looking at historical loss reports, you're using predictive models and AI to inform everything from underwriting and pricing to claims handling. It’s about making smarter, evidence-based decisions that cut down on risk, boost efficiency, and ultimately create a much better experience for your policyholders.

How Does AI Improve the Insurance Claims Process?

AI completely changes the speed and accuracy of claims handling. Imagine a system that can read a first notice of loss, analyze photos of vehicle damage with computer vision, and instantly verify policy details. That's what AI brings to the table.

This allows for "touchless" processing on straightforward claims, shrinking the timeline from weeks down to just a few minutes. For your adjusters, AI becomes a co-pilot, automatically flagging suspicious claims for a closer look and organizing all the relevant data. This frees them up to apply their expertise to the truly complex cases that need a human touch, all while creating a transparent log for any claims ai reviews.

Some insurers have already seen incredible results, cutting their claims processing times by an average of 30%. That’s a massive win for both operational efficiency and customer happiness.

What Are the Main Challenges of Using AI in Insurance?

The biggest hurdles are usually data, regulations, and people. Many insurers are sitting on decades of data locked away in legacy systems, and pulling that information together—while ensuring it's clean and reliable—is a major project.

On top of that, you have to navigate a complex web of data privacy and usage regulations. There’s also a real shortage of people who are experts in both data science and the nuances of insurance. Finally, building trust is key; you have to ensure your AI models are fair and their decisions can be explained. Avoiding a "black box" is crucial for earning the confidence of both regulators and customers, especially when it comes to areas like AI customer care.

Ready to bring intelligent automation to your insurance operations? Nolana deploys compliant, auditable AI agents to handle complex case management, claims processing, and customer service workflows from end to end. Learn how Nolana can transform your business.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP