A Guide to Automated Underwriting Systems in Finance

A Guide to Automated Underwriting Systems in Finance

Discover how automated underwriting systems use AI to transform insurance and finance. Streamline claims, enhance customer care, and reduce operational costs.

Think about your best underwriter—the one with years of experience, razor-sharp instincts, and an uncanny ability to spot risk. Now, imagine that expert could analyze thousands of data points in seconds, never gets tired, and works around the clock. That, in essence, is what an automated underwriting system (AUS) brings to the table.

These platforms are the intelligent decision-making engines for modern finance and insurance, turning slow, manual processes into fast, accurate, and remarkably consistent operations. For AI insurance companies, this technology is foundational for automating everything from initial risk assessment to the final claims payout.

The Modern Engine of Financial Decisions

Traditional underwriting has always been a bit like detective work. An underwriter manually sifts through piles of documents, piecing together clues to form a complete picture of risk. It's a painstaking process, often slow and susceptible to human error or unconscious bias.

An automated underwriting system, on the other hand, operates more like a high-tech command center. It ingests a massive amount of applicant data in an instant, applies a complex set of pre-defined rules and models, and produces a clear, data-backed decision in moments. This isn't just about doing the same job faster; it's a fundamental shift toward precision and reliability in high-stakes financial decisions, from loan approvals to insurance claims processing.

More Than Just a Checklist

It’s easy to mistake these systems for simple rules-followers, but modern AUS platforms are far more sophisticated. They are built to handle nuance and complexity, creating a robust framework for making decisions. This idea is central to the broader field of intelligent process automation, where technology doesn’t just execute tasks but also learns and adapts.

Here’s what these systems really do:

Instant Data Aggregation: They pull information simultaneously from credit bureaus, internal customer records, and dozens of third-party data sources.

Consistent Rule Application: Every single application is evaluated against the exact same criteria, which removes human subjectivity and improves fairness.

Sophisticated Risk Assessment: Advanced algorithms can identify subtle patterns and risk indicators that even a seasoned underwriter might overlook.

Streamlined Workflows: Simple, clear-cut applications get approved automatically, while the truly complex or borderline cases are flagged for an expert human review.

Fueling Growth in a Competitive Market

The move toward automated underwriting isn't just a minor trend—it's a force reshaping the entire industry. The AUS segment now dominates the global underwriting software market, accounting for more than 60% of total revenue in 2023.

This market is exploding, with projections showing growth from $5.7 billion in 2023 to $15.9 billion by 2032. The driving forces are clear: an insatiable need for real-time risk assessment and the challenge of managing ever-increasing submission volumes in both lending and insurance.

By putting a system in place that delivers precise, data-backed decisions, an organization isn't just buying a new tool. It's building a core strategic asset that drives accuracy, consistency, and compliance into every transaction.

This foundational change empowers banks and insurers to improve everything from their internal risk controls to the customer experience, setting a new bar for operational excellence with powerful AI customer care and claims automation.

The Core Components of a Modern AUS Platform

To really get what makes an automated underwriting system tick, you have to look under the hood. It’s not just one piece of software; a modern AUS is a sophisticated platform where three distinct, powerful components work together. Think of it as an intelligent framework built to automate the complex, high-stakes decisions common in banking and insurance.

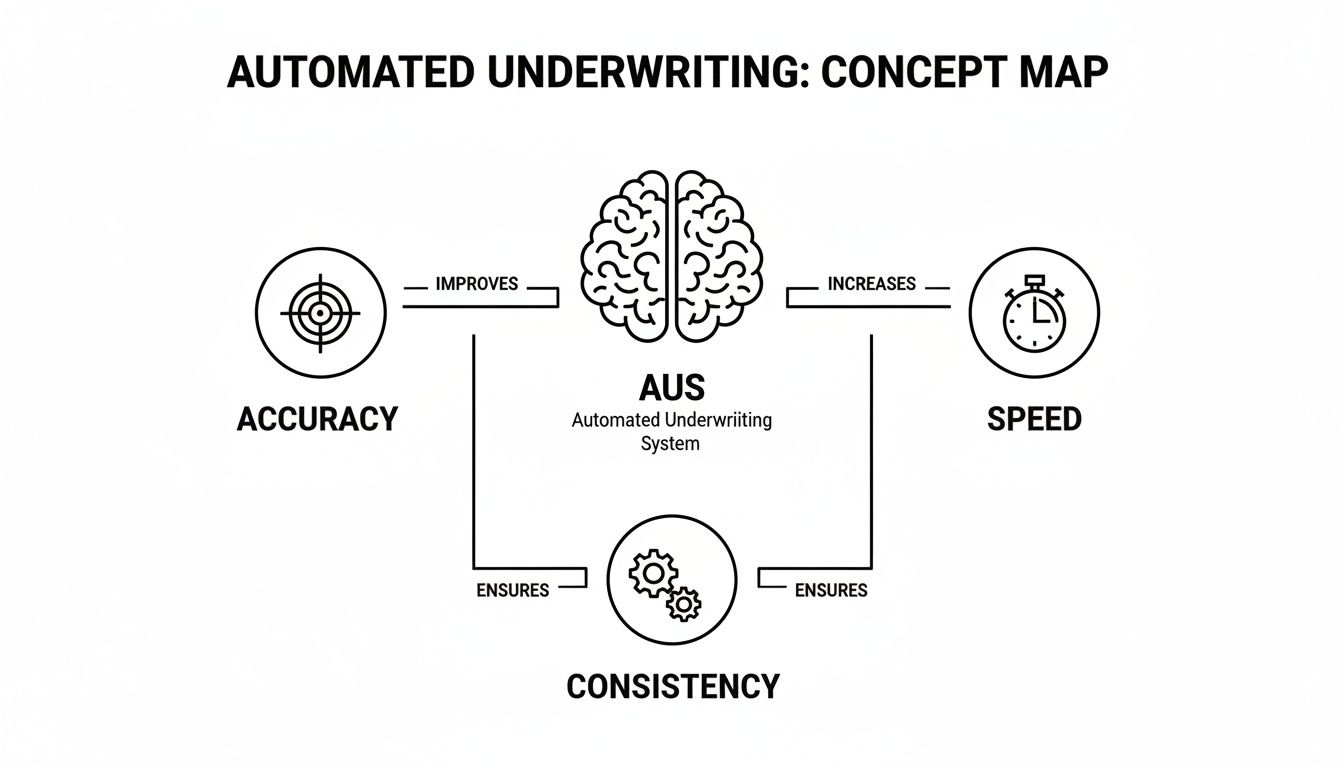

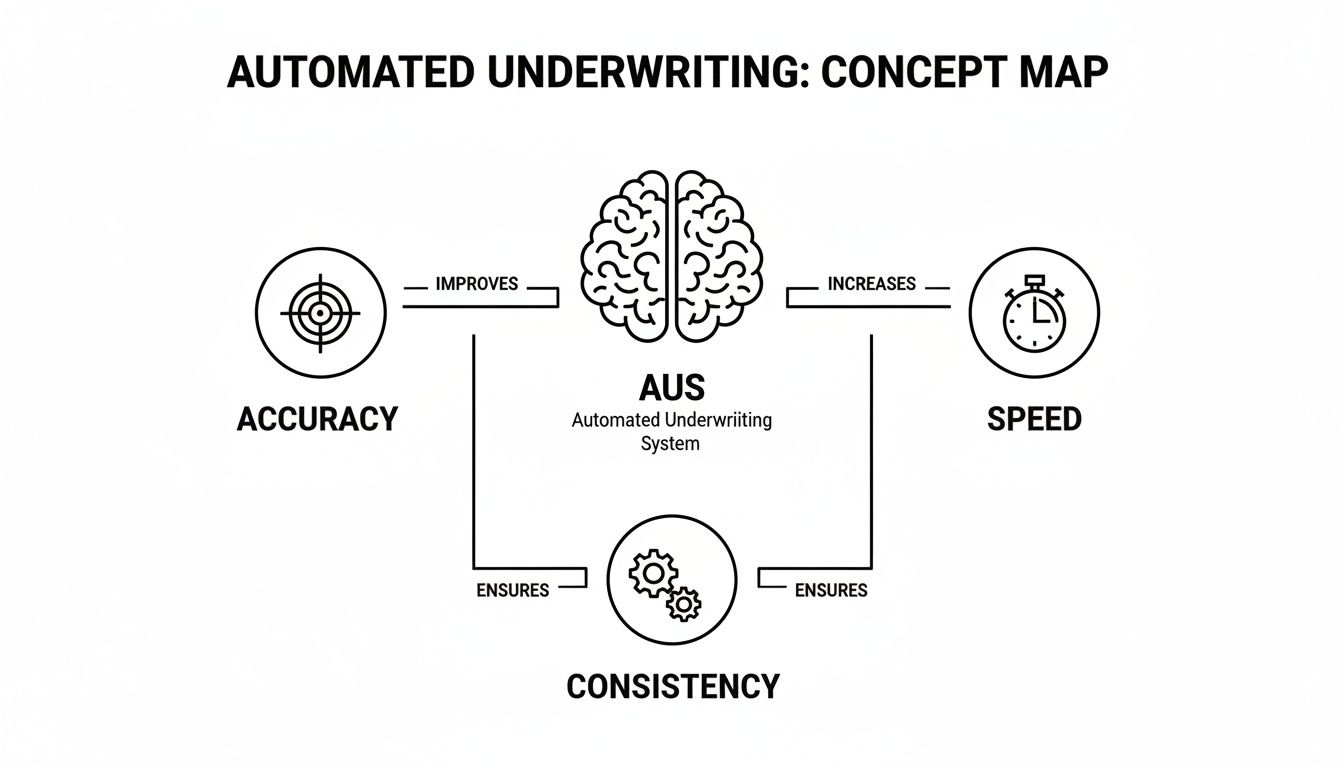

At its heart, a good AUS is an orchestrator. It makes sure every task—from simple data checks to complex AI-driven analysis—is executed perfectly. The whole point is to drive accuracy, speed, and consistency, which are the cornerstones of a successful underwriting operation.

As you can see, the system is designed to make processes more precise, much faster, and completely uniform. For everything from insurance claims to loan applications, those outcomes are non-negotiable.

The Foundational Rules Engine

The rules engine is the system's foundational playbook. It’s the part that takes your company's established guidelines and policies and enforces them with unwavering consistency. It operates on a series of simple "if-then" statements that turn institutional knowledge into code.

For instance, a rule could be: "If an insurance claim amount is below $1,000 and the policyholder has no prior claims in the last 24 months, then automatically approve for payment." This rigid, logic-based approach is perfect for churning through high volumes of straightforward applications and claims, ensuring compliance and eliminating human error.

Machine Learning Models: The Adaptive Strategists

If the rules engine provides the foundation, machine learning (ML) models add a crucial layer of adaptive intelligence. These are the strategists. They learn from new data to refine decisions over time, much like a seasoned underwriter develops intuition from years of experience.

Unlike a fixed rule, an ML model can spot subtle patterns and correlations in massive datasets that a person could easily miss. This is a game-changer for fraud detection. A model might flag a new insurance claim as high-risk by identifying a unique combination of factors that, on their own, wouldn't trigger a standard rule, a common topic in claims AI reviews.

This ability to learn and adapt is what makes ML models indispensable for navigating ambiguity and evolving risks. As they process more data, the models get progressively smarter, continuously improving their accuracy over time.

The Decisioning Pipeline: The Workflow Conductor

The decisioning pipeline is the final piece of the puzzle. It’s the conductor that orchestrates the entire workflow, seamlessly routing tasks between the rules engine, ML models, and, when needed, human experts.

This pipeline ensures every application or claim flows through the right process without a hitch. It’s responsible for:

Data Intake and Validation: Gathering and verifying all the necessary information from different sources.

Intelligent Routing: Sending simple cases to the rules engine for instant processing while directing more complex ones to an ML model for deeper analysis.

Human Escalation: Flagging ambiguous or high-risk cases that absolutely require the nuanced judgment of a human underwriter.

By managing this entire journey, the decisioning pipeline brings order and efficiency to the whole operation. It creates a structured, repeatable process that is fundamental to building a scalable and compliant system.

To dive deeper into how these intelligent systems are built, you can explore our detailed guide on AI-powered decision-making.

Putting AI to Work: Transforming Insurance Claims and Customer Care

The true power of an automated underwriting system really comes alive when you see how it changes the day-to-day grind. This isn't just about assessing risk anymore. These smart platforms are completely overhauling how AI insurance companies manage claims and talk to their customers, replacing slow, manual processes with something fast, accurate, and responsive.

This is where the rubber meets the road—where automation delivers real business results you can see and feel. Instead of making policyholders wait days for an update, AI-driven workflows can give them answers and resolutions almost instantly.

From Manual Delays to Automated Decisions

Think about the old way of handling an insurance claim. A customer calls, waits on hold, and finally talks to an agent who types their information into a system for the First Notice of Loss (FNOL). That data then gets passed from one department to another, with every handoff adding more time, more cost, and another chance for a mistake.

Now, imagine the AI-powered alternative. A customer can report that same claim anytime, day or night, through a simple app. An AI agent instantly verifies their policy, asks for the necessary details in a quick, guided chat, and can even approve a straightforward, low-risk claim right then and there. This isn't a futuristic concept; it's quickly becoming the new benchmark for operational excellence.

The leap from a multi-day, error-prone manual process to a minutes-long, accurate automated one is the core benefit that many claims AI reviews highlight. It’s a direct line to better customer loyalty and a sharp drop in operational overhead.

The same principles that make automated underwriting so effective are what make AI customer care a game-changer across the board, especially in financial services.

Real-World AI Applications in Claims and Service

AI agents, guided by these automated systems, can take over a huge range of essential tasks. This frees up your human experts to dig into the complex cases that actually require their experience and judgment. It’s the perfect blend of machine efficiency and human insight.

Here are just a few of the functions that can be automated:

First Notice of Loss (FNOL): AI agents can handle the entire initial claim intake, gathering structured data 24/7 without anyone needing to lift a finger.

Policy Verification: The system checks coverage details, limits, and deductibles in a split second, cutting out frustrating delays right at the start.

Intelligent Routing: Based on the claim's type, severity, and complexity, the system sends the case directly to the right specialist or department, no guesswork required.

Automated Adjudication: For simple claims, like minor bumper damage, AI can analyze photos, estimate repair costs, and trigger the payment—all in one seamless, automated flow.

This kind of automation builds a claims ecosystem that's both efficient and transparent, a key advantage for leading AI insurance companies.

Enhancing Customer Care with AI

The very same technology that makes claims faster also creates a better customer experience. When policyholders have a question or need to update their policy, they don't want to wait. AI customer care meets that expectation with instant, personalized help.

AI-powered chatbots and virtual assistants can:

Answer common policy questions on the spot.

Handle service requests like adding a driver or updating a mailing address.

Give real-time status updates on a pending claim or application.

This table shows the dramatic shift in performance metrics when moving from traditional methods to AI-powered automation in insurance and financial services.

AI Automation Impact on Insurance and Banking Operations

Operational Metric | Traditional Manual Process | AI-Automated Process |

|---|---|---|

Claim Processing Time (FNOL) | 2-3 Days | 5-10 Minutes |

Initial Customer Response | 24-48 Hours | Instant (24/7) |

Data Entry Error Rate | 3-5% | < 0.5% |

Cost Per Claim/Inquiry | High (Labor-Intensive) | Low (Reduced Staff Time) |

Agent Time on Routine Tasks | 60-70% | 10-15% |

The numbers speak for themselves. The gains in speed, accuracy, and cost-efficiency allow teams to refocus their energy on high-value work.

This immediate responsiveness doesn't just make customers happier; it also lightens the load on your human support teams. By automating routine interactions, AI insurance companies let their people focus on building relationships and solving the tricky problems—creating a smarter, more strategic customer care operation.

Managing Compliance and Risk in Automated Decisions

Let's be honest: for heavily regulated industries like banking and insurance, the idea of handing over high-stakes decisions to an automated system can be nerve-wracking. We're talking about sectors built on trust and transparency. For any compliance officer or risk manager, the question isn't just if we can automate, but how we do it without losing control, visibility, or the trust we've worked so hard to build.

Fortunately, modern automated underwriting systems aren't the "black boxes" of the past. They're designed from the ground up with auditability baked into their DNA. This creates an unshakable record of every single action, which is absolutely vital for AI insurance companies trying to demonstrate fairness and consistency to regulators, auditors, and customers.

Building Trust Through Radical Transparency

A core feature of any compliance-ready automated system is its ability to create a complete and detailed audit trail. Think of it as a flight recorder for every decision. This log meticulously captures every data point that was considered, every rule that was triggered, and the specific rationale behind each approval, denial, or escalation.

This level of detail is a godsend during audits and regulatory reviews. Instead of spending weeks manually piecing together a decision from scattered notes, emails, and system logs, compliance teams can pull a comprehensive report in seconds. It shows exactly why a certain outcome occurred.

This kind of built-in transparency does more than just satisfy auditors—it builds confidence both inside and outside the company. It’s hard proof that decisions are based on consistent, objective criteria, which is always a major focus in claims AI reviews.

Guardrails and Human Escalation Paths

Smart automation doesn't replace people; it elevates them. It frees up your best talent to focus on the complex cases where their experience and judgment truly matter. A well-designed system achieves this balance with a mix of automated guardrails and seamless escalation paths.

Here’s a typical workflow:

Confidence Scoring: The system gives each automated decision a confidence score. Simple, low-risk cases with high scores get processed instantly.

Threshold-Based Escalation: If a decision's confidence score dips below a predefined level, it's automatically flagged and routed to a human underwriter or claims adjuster for a second look.

Exception Handling: The system is also trained to spot anomalies—edge cases or weird data patterns that don't fit the rules—and immediately send them up the chain for expert review.

This hybrid model gives you the best of both worlds: the raw speed of automation for the straightforward stuff and the nuanced judgment of your seasoned professionals for everything else. As you implement a modern AUS, building out robust compliance frameworks is essential. For more on this, check out this guide to modern compliance risk assessment software.

Demystifying Key Compliance Certifications

When you're handling sensitive financial and personal data, security and compliance certifications aren't just a nice-to-have; they're table stakes. These certifications provide independent, third-party proof that a platform meets rigorous standards for data security and operational integrity. This is especially true for AI customer care systems that process personal information during every interaction.

Two of the most important certifications to look for are:

SOC 2 Type II: This report verifies that a company has effective controls for security, availability, processing integrity, confidentiality, and privacy—and that those controls were operating effectively over a period of time. You can learn more in our detailed article explaining what is SOC 2 compliance.

GDPR: The General Data Protection Regulation is the EU's landmark data privacy law. It imposes strict rules on how organizations collect, process, and protect the personal data of anyone in the European Union.

For risk managers, the big takeaway is this: properly implemented automation actually reduces risk. It drastically cuts down on human error, enforces your policies with 100% consistency, and generates a perfect, easily-auditable trail of every single decision made.

Integrating an AUS with Your Core Systems

For any CIO, the idea of a massive system overhaul is enough to cause a headache. But here’s the good news: modern automated underwriting systems are built to enhance, not replace, the technology you’ve already invested in. They’re designed to be an intelligent layer that sits on top of your existing core systems, orchestrating the entire process.

Think of it like adding a smart home hub to your house. You don't throw out your lights, thermostat, and security system. Instead, the hub connects them all, making them work together in a more powerful, automated way. This approach lets banks and insurers protect their current investments while adding some serious automation firepower—a path to modernization without the massive disruption.

Unifying a Fragmented Technology Stack

Let's be honest, the current reality for most underwriting teams is a tangled mess. Professionals are bouncing between an average of 6 different systems every day—some as many as 10—just to handle triage, pricing, and documentation. It's no wonder that a staggering 73% of underwriters say they struggle to get a clear view of portfolio performance.

Worse yet, over 56% admit they're still working off outdated, static guidelines. This kind of fragmentation screams inefficiency and risk. These insights, backed by industry research which you can explore further at Federato.ai, show just how badly an integrated solution is needed. An AUS solves this by using robust APIs to connect these disparate systems, pulling data from one place, analyzing it, and pushing a decision into the next.

Seamless Connection with Industry-Standard Software

A modern AUS has to play well with others. Its real strength lies in its ability to plug directly into the software that already runs your business, from your CRM to your claims platform. This is critical for creating a unified operational view across the entire organization.

Common integrations usually fall into a few key categories:

CRM Platforms: Connecting to a system like Salesforce gives you that coveted 360-degree customer view, feeding crucial client history directly into the underwriting process.

Insurance Core Suites: Tight integration with platforms like Guidewire, Duck Creek, or Sapiens is non-negotiable. It ensures policy and claims data flows right where it needs to, fueling automated decisions.

Contact Center Software: By linking with tools like Genesys, an AUS can arm AI customer care agents with real-time underwriting insights and even automate service requests that come in through the contact center.

By acting as an intelligent hub, an automated underwriting system ensures data consistency and process continuity across your entire technology ecosystem. It doesn't rip and replace; it connects and elevates.

An Orchestration Layer for Smarter Operations

At the end of the day, integration is about more than just moving data around. A modern AUS acts as the central brain, orchestrating complex workflows from start to finish. It doesn’t just make a decision; it triggers the right actions in your other core systems based on that decision's outcome.

For instance, once a claim is automatically approved, the system can kick off a chain reaction:

It logs the decision in your claims platform (like Guidewire).

It updates the customer's record in your CRM (like Salesforce).

It triggers a notification to the customer through your communications platform (like Genesys).

This level of orchestration completely eliminates the manual handoffs that slow things down and introduce errors. It shrinks cycle times dramatically and helps your teams get a much faster return on the technology you already own.

Measuring the Success of Your AUS Implementation

Investing in an automated underwriting system is a major strategic decision. To justify that investment and prove its worth, you need more than just good feelings and anecdotal feedback. You need hard data. Building a solid business case depends on a clear framework for measuring success, which all starts with a smart implementation plan and a laser focus on the right Key Performance Indicators (KPIs).

A successful rollout isn't about flipping a switch and hoping for the best. It starts by defining exactly what you want to achieve. From there, a phased implementation lets you deploy in a controlled way, monitor what's happening, and make adjustments as you go. This approach ensures the system delivers on its promise without throwing your core operations into chaos.

Key Performance Indicators to Track

To get a true picture of your AUS's impact, you need to track metrics in three key areas: operational efficiency, customer experience, and risk management. These KPIs will give you the concrete evidence needed to justify the spend and guide future improvements, especially for AI-driven claims and customer care.

Table: Key Performance Indicators (KPIs) for Automated Underwriting Success

Tracking the right metrics is the only way to truly understand the before-and-after story of your AUS implementation. The table below outlines some of the most critical KPIs to monitor, connecting each metric to its direct business impact.

KPI Category | Example Metric | Business Impact |

|---|---|---|

Operational Efficiency | Straight-Through Processing (STP) Rate | Measures the percentage of applications or claims processed without any human touch. A higher rate means lower costs and faster turnaround. |

Operational Efficiency | Cost Per Transaction | Calculates the total cost to process one application or claim. Automation should significantly drive this number down. |

Operational Efficiency | Claim/Application Cycle Time | Tracks the average time from submission to final decision. This is a powerful, tangible measure of speed improvements. |

Customer Experience | Application Abandonment Rate | For new business, this shows how many people drop off during the process. A smoother, faster workflow should lower this rate. |

Customer Experience | Customer Satisfaction (CSAT) / Net Promoter Score (NPS) | Gathers direct feedback on the experience. Faster, more transparent decisions almost always lead to happier customers. |

Risk & Compliance | Decision Consistency Rate | Audits automated decisions against your underwriting rules. The goal is to get this as close to 100% as possible. |

Risk & Compliance | Reduction in Data Entry Errors | Compares error rates before and after. Eliminating manual entry directly improves data quality and reduces downstream problems. |

By closely monitoring these metrics, you can create a clear, data-backed narrative that demonstrates precisely how the AUS is driving value across the organization, from the back office to the front lines.

A Deeper Dive Into the Metrics

Operational KPIs get right to the heart of your internal workflows and costs. These are often the easiest numbers to pull and usually show the quickest return on your investment.

Claim or Application Cycle Time: Start tracking the average time from the moment a submission hits your system to a final decision. Watching that number shrink from days to hours—or even minutes—is one of the most compelling signs of success.

Cost Per Transaction: You need to calculate the all-in operational cost to process a single claim or application, including labor and system overhead. Automation is designed to crush this number.

Straight-Through Processing (STP) Rate: This is a huge one. It measures the percentage of applications or claims that fly through the system from start to finish without a human ever touching them. A higher STP rate is a direct indicator of massive efficiency gains.

Customer-Focused KPIs show you how automation is actually affecting your policyholders. In an industry where customer experience is a make-or-break differentiator for leading AI insurance companies, these metrics are non-negotiable.

Customer Satisfaction (CSAT) Scores: After someone interacts with the automated system, survey them. Faster decisions and 24/7 availability through platforms like AI customer care should send satisfaction scores climbing.

Net Promoter Score (NPS): This metric tells you about overall customer loyalty. A fast, simple, and transparent process is often what turns a neutral customer into someone who actively recommends your brand.

Application Abandonment Rate: When you're writing new business, how many people start an application but never finish? A clunky process is a common culprit. A clean, quick automated workflow should make this number drop.

By tracking these customer-centric metrics, you can directly connect your investment in automated systems to improved retention and growth—a narrative that resonates strongly with executive leadership.

Risk and Compliance KPIs are all about proving your AUS isn't just faster, but also smarter and more consistent. This is absolutely critical for keeping regulators happy and is a frequent focus of internal and external claims AI reviews.

Decision Consistency: You have to audit a sample of automated decisions to make sure they perfectly follow your established underwriting rules. Your goal here should be to approach 100% consistency, eliminating human variability.

Audit Trail Completeness: Check the system's ability to generate a crystal-clear audit log for every single decision. It needs to show precisely what data was used and which rules were fired.

Reduction in Data Entry Errors: Simply compare error rates from before and after you went live. When you get rid of manual data entry, you dramatically improve data accuracy and prevent a whole host of downstream problems.

Frequently Asked Questions About Automated Underwriting

As you explore bringing automated underwriting into your operations, some key questions are bound to come up. Let's walk through the most common ones with practical answers focused on what this shift really means for your claims and customer service teams.

How Does This Affect Our Claims Process?

The change is dramatic. Automated systems take the claims process from a slow, paper-heavy bottleneck to a nimble, data-driven workflow. Think about the First Notice of Loss (FNOL)—instead of manual entry and a series of handoffs, an AI insurance company can automate that entire intake. The system instantly cross-references policy details, pulls the necessary data, and can often green-light simple, clear-cut claims in a matter of minutes.

This isn't just about speed; it's about reallocating your most valuable resources. When you automate the routine, you free up your seasoned adjusters to dig into the complex, high-stakes cases that truly need their expertise. Many claims AI reviews point to this as the single biggest win—it directly cuts down on operational drag and shrinks claim cycle times.

Can We Really Trust AI with Customer Care?

Yes, but it's important to understand the goal. AI customer care isn't about replacing your people; it's about making them more effective. AI-powered agents are fantastic at handling the high volume of predictable questions that clog up your phone lines and inboxes—things like policy questions or claim status updates. They can do it instantly, accurately, and around the clock.

This frees up your human support teams to focus on the conversations that build loyalty and solve real problems—the situations that demand empathy, creativity, and critical thinking. You end up with a faster, more responsive customer service operation that actually feels more human, not less.

How Do These Systems Handle Complex Cases?

Smart automation knows its own limits. These platforms are brilliant at processing standard, data-rich applications, but they are designed with built-in triggers for anything that looks unusual. If a case falls outside the established rules or gets a low confidence score from the model, it’s immediately kicked over to a human underwriter.

It works like a super-efficient triage system:

Simple Cases: Processed automatically in minutes.

Complex Cases: Flagged and routed to the right specialist.

Edge Cases: Immediately sent for human review.

This lets you capture the speed of automation without ever sacrificing the expert judgment needed for the tough calls. A great first step is structuring how you collect information in the first place. For example, using a well-designed insurance claim form template ensures the data is clean and organized from the start, making the entire process smoother. This hybrid approach ensures every single case gets the right level of attention.

Ready to see how AI agents can automate your most critical operations? Nolana provides an AI-native operating system that deploys compliant, skilled agents to manage claims, customer service, and case management workflows end-to-end. https://nolana.com

Think about your best underwriter—the one with years of experience, razor-sharp instincts, and an uncanny ability to spot risk. Now, imagine that expert could analyze thousands of data points in seconds, never gets tired, and works around the clock. That, in essence, is what an automated underwriting system (AUS) brings to the table.

These platforms are the intelligent decision-making engines for modern finance and insurance, turning slow, manual processes into fast, accurate, and remarkably consistent operations. For AI insurance companies, this technology is foundational for automating everything from initial risk assessment to the final claims payout.

The Modern Engine of Financial Decisions

Traditional underwriting has always been a bit like detective work. An underwriter manually sifts through piles of documents, piecing together clues to form a complete picture of risk. It's a painstaking process, often slow and susceptible to human error or unconscious bias.

An automated underwriting system, on the other hand, operates more like a high-tech command center. It ingests a massive amount of applicant data in an instant, applies a complex set of pre-defined rules and models, and produces a clear, data-backed decision in moments. This isn't just about doing the same job faster; it's a fundamental shift toward precision and reliability in high-stakes financial decisions, from loan approvals to insurance claims processing.

More Than Just a Checklist

It’s easy to mistake these systems for simple rules-followers, but modern AUS platforms are far more sophisticated. They are built to handle nuance and complexity, creating a robust framework for making decisions. This idea is central to the broader field of intelligent process automation, where technology doesn’t just execute tasks but also learns and adapts.

Here’s what these systems really do:

Instant Data Aggregation: They pull information simultaneously from credit bureaus, internal customer records, and dozens of third-party data sources.

Consistent Rule Application: Every single application is evaluated against the exact same criteria, which removes human subjectivity and improves fairness.

Sophisticated Risk Assessment: Advanced algorithms can identify subtle patterns and risk indicators that even a seasoned underwriter might overlook.

Streamlined Workflows: Simple, clear-cut applications get approved automatically, while the truly complex or borderline cases are flagged for an expert human review.

Fueling Growth in a Competitive Market

The move toward automated underwriting isn't just a minor trend—it's a force reshaping the entire industry. The AUS segment now dominates the global underwriting software market, accounting for more than 60% of total revenue in 2023.

This market is exploding, with projections showing growth from $5.7 billion in 2023 to $15.9 billion by 2032. The driving forces are clear: an insatiable need for real-time risk assessment and the challenge of managing ever-increasing submission volumes in both lending and insurance.

By putting a system in place that delivers precise, data-backed decisions, an organization isn't just buying a new tool. It's building a core strategic asset that drives accuracy, consistency, and compliance into every transaction.

This foundational change empowers banks and insurers to improve everything from their internal risk controls to the customer experience, setting a new bar for operational excellence with powerful AI customer care and claims automation.

The Core Components of a Modern AUS Platform

To really get what makes an automated underwriting system tick, you have to look under the hood. It’s not just one piece of software; a modern AUS is a sophisticated platform where three distinct, powerful components work together. Think of it as an intelligent framework built to automate the complex, high-stakes decisions common in banking and insurance.

At its heart, a good AUS is an orchestrator. It makes sure every task—from simple data checks to complex AI-driven analysis—is executed perfectly. The whole point is to drive accuracy, speed, and consistency, which are the cornerstones of a successful underwriting operation.

As you can see, the system is designed to make processes more precise, much faster, and completely uniform. For everything from insurance claims to loan applications, those outcomes are non-negotiable.

The Foundational Rules Engine

The rules engine is the system's foundational playbook. It’s the part that takes your company's established guidelines and policies and enforces them with unwavering consistency. It operates on a series of simple "if-then" statements that turn institutional knowledge into code.

For instance, a rule could be: "If an insurance claim amount is below $1,000 and the policyholder has no prior claims in the last 24 months, then automatically approve for payment." This rigid, logic-based approach is perfect for churning through high volumes of straightforward applications and claims, ensuring compliance and eliminating human error.

Machine Learning Models: The Adaptive Strategists

If the rules engine provides the foundation, machine learning (ML) models add a crucial layer of adaptive intelligence. These are the strategists. They learn from new data to refine decisions over time, much like a seasoned underwriter develops intuition from years of experience.

Unlike a fixed rule, an ML model can spot subtle patterns and correlations in massive datasets that a person could easily miss. This is a game-changer for fraud detection. A model might flag a new insurance claim as high-risk by identifying a unique combination of factors that, on their own, wouldn't trigger a standard rule, a common topic in claims AI reviews.

This ability to learn and adapt is what makes ML models indispensable for navigating ambiguity and evolving risks. As they process more data, the models get progressively smarter, continuously improving their accuracy over time.

The Decisioning Pipeline: The Workflow Conductor

The decisioning pipeline is the final piece of the puzzle. It’s the conductor that orchestrates the entire workflow, seamlessly routing tasks between the rules engine, ML models, and, when needed, human experts.

This pipeline ensures every application or claim flows through the right process without a hitch. It’s responsible for:

Data Intake and Validation: Gathering and verifying all the necessary information from different sources.

Intelligent Routing: Sending simple cases to the rules engine for instant processing while directing more complex ones to an ML model for deeper analysis.

Human Escalation: Flagging ambiguous or high-risk cases that absolutely require the nuanced judgment of a human underwriter.

By managing this entire journey, the decisioning pipeline brings order and efficiency to the whole operation. It creates a structured, repeatable process that is fundamental to building a scalable and compliant system.

To dive deeper into how these intelligent systems are built, you can explore our detailed guide on AI-powered decision-making.

Putting AI to Work: Transforming Insurance Claims and Customer Care

The true power of an automated underwriting system really comes alive when you see how it changes the day-to-day grind. This isn't just about assessing risk anymore. These smart platforms are completely overhauling how AI insurance companies manage claims and talk to their customers, replacing slow, manual processes with something fast, accurate, and responsive.

This is where the rubber meets the road—where automation delivers real business results you can see and feel. Instead of making policyholders wait days for an update, AI-driven workflows can give them answers and resolutions almost instantly.

From Manual Delays to Automated Decisions

Think about the old way of handling an insurance claim. A customer calls, waits on hold, and finally talks to an agent who types their information into a system for the First Notice of Loss (FNOL). That data then gets passed from one department to another, with every handoff adding more time, more cost, and another chance for a mistake.

Now, imagine the AI-powered alternative. A customer can report that same claim anytime, day or night, through a simple app. An AI agent instantly verifies their policy, asks for the necessary details in a quick, guided chat, and can even approve a straightforward, low-risk claim right then and there. This isn't a futuristic concept; it's quickly becoming the new benchmark for operational excellence.

The leap from a multi-day, error-prone manual process to a minutes-long, accurate automated one is the core benefit that many claims AI reviews highlight. It’s a direct line to better customer loyalty and a sharp drop in operational overhead.

The same principles that make automated underwriting so effective are what make AI customer care a game-changer across the board, especially in financial services.

Real-World AI Applications in Claims and Service

AI agents, guided by these automated systems, can take over a huge range of essential tasks. This frees up your human experts to dig into the complex cases that actually require their experience and judgment. It’s the perfect blend of machine efficiency and human insight.

Here are just a few of the functions that can be automated:

First Notice of Loss (FNOL): AI agents can handle the entire initial claim intake, gathering structured data 24/7 without anyone needing to lift a finger.

Policy Verification: The system checks coverage details, limits, and deductibles in a split second, cutting out frustrating delays right at the start.

Intelligent Routing: Based on the claim's type, severity, and complexity, the system sends the case directly to the right specialist or department, no guesswork required.

Automated Adjudication: For simple claims, like minor bumper damage, AI can analyze photos, estimate repair costs, and trigger the payment—all in one seamless, automated flow.

This kind of automation builds a claims ecosystem that's both efficient and transparent, a key advantage for leading AI insurance companies.

Enhancing Customer Care with AI

The very same technology that makes claims faster also creates a better customer experience. When policyholders have a question or need to update their policy, they don't want to wait. AI customer care meets that expectation with instant, personalized help.

AI-powered chatbots and virtual assistants can:

Answer common policy questions on the spot.

Handle service requests like adding a driver or updating a mailing address.

Give real-time status updates on a pending claim or application.

This table shows the dramatic shift in performance metrics when moving from traditional methods to AI-powered automation in insurance and financial services.

AI Automation Impact on Insurance and Banking Operations

Operational Metric | Traditional Manual Process | AI-Automated Process |

|---|---|---|

Claim Processing Time (FNOL) | 2-3 Days | 5-10 Minutes |

Initial Customer Response | 24-48 Hours | Instant (24/7) |

Data Entry Error Rate | 3-5% | < 0.5% |

Cost Per Claim/Inquiry | High (Labor-Intensive) | Low (Reduced Staff Time) |

Agent Time on Routine Tasks | 60-70% | 10-15% |

The numbers speak for themselves. The gains in speed, accuracy, and cost-efficiency allow teams to refocus their energy on high-value work.

This immediate responsiveness doesn't just make customers happier; it also lightens the load on your human support teams. By automating routine interactions, AI insurance companies let their people focus on building relationships and solving the tricky problems—creating a smarter, more strategic customer care operation.

Managing Compliance and Risk in Automated Decisions

Let's be honest: for heavily regulated industries like banking and insurance, the idea of handing over high-stakes decisions to an automated system can be nerve-wracking. We're talking about sectors built on trust and transparency. For any compliance officer or risk manager, the question isn't just if we can automate, but how we do it without losing control, visibility, or the trust we've worked so hard to build.

Fortunately, modern automated underwriting systems aren't the "black boxes" of the past. They're designed from the ground up with auditability baked into their DNA. This creates an unshakable record of every single action, which is absolutely vital for AI insurance companies trying to demonstrate fairness and consistency to regulators, auditors, and customers.

Building Trust Through Radical Transparency

A core feature of any compliance-ready automated system is its ability to create a complete and detailed audit trail. Think of it as a flight recorder for every decision. This log meticulously captures every data point that was considered, every rule that was triggered, and the specific rationale behind each approval, denial, or escalation.

This level of detail is a godsend during audits and regulatory reviews. Instead of spending weeks manually piecing together a decision from scattered notes, emails, and system logs, compliance teams can pull a comprehensive report in seconds. It shows exactly why a certain outcome occurred.

This kind of built-in transparency does more than just satisfy auditors—it builds confidence both inside and outside the company. It’s hard proof that decisions are based on consistent, objective criteria, which is always a major focus in claims AI reviews.

Guardrails and Human Escalation Paths

Smart automation doesn't replace people; it elevates them. It frees up your best talent to focus on the complex cases where their experience and judgment truly matter. A well-designed system achieves this balance with a mix of automated guardrails and seamless escalation paths.

Here’s a typical workflow:

Confidence Scoring: The system gives each automated decision a confidence score. Simple, low-risk cases with high scores get processed instantly.

Threshold-Based Escalation: If a decision's confidence score dips below a predefined level, it's automatically flagged and routed to a human underwriter or claims adjuster for a second look.

Exception Handling: The system is also trained to spot anomalies—edge cases or weird data patterns that don't fit the rules—and immediately send them up the chain for expert review.

This hybrid model gives you the best of both worlds: the raw speed of automation for the straightforward stuff and the nuanced judgment of your seasoned professionals for everything else. As you implement a modern AUS, building out robust compliance frameworks is essential. For more on this, check out this guide to modern compliance risk assessment software.

Demystifying Key Compliance Certifications

When you're handling sensitive financial and personal data, security and compliance certifications aren't just a nice-to-have; they're table stakes. These certifications provide independent, third-party proof that a platform meets rigorous standards for data security and operational integrity. This is especially true for AI customer care systems that process personal information during every interaction.

Two of the most important certifications to look for are:

SOC 2 Type II: This report verifies that a company has effective controls for security, availability, processing integrity, confidentiality, and privacy—and that those controls were operating effectively over a period of time. You can learn more in our detailed article explaining what is SOC 2 compliance.

GDPR: The General Data Protection Regulation is the EU's landmark data privacy law. It imposes strict rules on how organizations collect, process, and protect the personal data of anyone in the European Union.

For risk managers, the big takeaway is this: properly implemented automation actually reduces risk. It drastically cuts down on human error, enforces your policies with 100% consistency, and generates a perfect, easily-auditable trail of every single decision made.

Integrating an AUS with Your Core Systems

For any CIO, the idea of a massive system overhaul is enough to cause a headache. But here’s the good news: modern automated underwriting systems are built to enhance, not replace, the technology you’ve already invested in. They’re designed to be an intelligent layer that sits on top of your existing core systems, orchestrating the entire process.

Think of it like adding a smart home hub to your house. You don't throw out your lights, thermostat, and security system. Instead, the hub connects them all, making them work together in a more powerful, automated way. This approach lets banks and insurers protect their current investments while adding some serious automation firepower—a path to modernization without the massive disruption.

Unifying a Fragmented Technology Stack

Let's be honest, the current reality for most underwriting teams is a tangled mess. Professionals are bouncing between an average of 6 different systems every day—some as many as 10—just to handle triage, pricing, and documentation. It's no wonder that a staggering 73% of underwriters say they struggle to get a clear view of portfolio performance.

Worse yet, over 56% admit they're still working off outdated, static guidelines. This kind of fragmentation screams inefficiency and risk. These insights, backed by industry research which you can explore further at Federato.ai, show just how badly an integrated solution is needed. An AUS solves this by using robust APIs to connect these disparate systems, pulling data from one place, analyzing it, and pushing a decision into the next.

Seamless Connection with Industry-Standard Software

A modern AUS has to play well with others. Its real strength lies in its ability to plug directly into the software that already runs your business, from your CRM to your claims platform. This is critical for creating a unified operational view across the entire organization.

Common integrations usually fall into a few key categories:

CRM Platforms: Connecting to a system like Salesforce gives you that coveted 360-degree customer view, feeding crucial client history directly into the underwriting process.

Insurance Core Suites: Tight integration with platforms like Guidewire, Duck Creek, or Sapiens is non-negotiable. It ensures policy and claims data flows right where it needs to, fueling automated decisions.

Contact Center Software: By linking with tools like Genesys, an AUS can arm AI customer care agents with real-time underwriting insights and even automate service requests that come in through the contact center.

By acting as an intelligent hub, an automated underwriting system ensures data consistency and process continuity across your entire technology ecosystem. It doesn't rip and replace; it connects and elevates.

An Orchestration Layer for Smarter Operations

At the end of the day, integration is about more than just moving data around. A modern AUS acts as the central brain, orchestrating complex workflows from start to finish. It doesn’t just make a decision; it triggers the right actions in your other core systems based on that decision's outcome.

For instance, once a claim is automatically approved, the system can kick off a chain reaction:

It logs the decision in your claims platform (like Guidewire).

It updates the customer's record in your CRM (like Salesforce).

It triggers a notification to the customer through your communications platform (like Genesys).

This level of orchestration completely eliminates the manual handoffs that slow things down and introduce errors. It shrinks cycle times dramatically and helps your teams get a much faster return on the technology you already own.

Measuring the Success of Your AUS Implementation

Investing in an automated underwriting system is a major strategic decision. To justify that investment and prove its worth, you need more than just good feelings and anecdotal feedback. You need hard data. Building a solid business case depends on a clear framework for measuring success, which all starts with a smart implementation plan and a laser focus on the right Key Performance Indicators (KPIs).

A successful rollout isn't about flipping a switch and hoping for the best. It starts by defining exactly what you want to achieve. From there, a phased implementation lets you deploy in a controlled way, monitor what's happening, and make adjustments as you go. This approach ensures the system delivers on its promise without throwing your core operations into chaos.

Key Performance Indicators to Track

To get a true picture of your AUS's impact, you need to track metrics in three key areas: operational efficiency, customer experience, and risk management. These KPIs will give you the concrete evidence needed to justify the spend and guide future improvements, especially for AI-driven claims and customer care.

Table: Key Performance Indicators (KPIs) for Automated Underwriting Success

Tracking the right metrics is the only way to truly understand the before-and-after story of your AUS implementation. The table below outlines some of the most critical KPIs to monitor, connecting each metric to its direct business impact.

KPI Category | Example Metric | Business Impact |

|---|---|---|

Operational Efficiency | Straight-Through Processing (STP) Rate | Measures the percentage of applications or claims processed without any human touch. A higher rate means lower costs and faster turnaround. |

Operational Efficiency | Cost Per Transaction | Calculates the total cost to process one application or claim. Automation should significantly drive this number down. |

Operational Efficiency | Claim/Application Cycle Time | Tracks the average time from submission to final decision. This is a powerful, tangible measure of speed improvements. |

Customer Experience | Application Abandonment Rate | For new business, this shows how many people drop off during the process. A smoother, faster workflow should lower this rate. |

Customer Experience | Customer Satisfaction (CSAT) / Net Promoter Score (NPS) | Gathers direct feedback on the experience. Faster, more transparent decisions almost always lead to happier customers. |

Risk & Compliance | Decision Consistency Rate | Audits automated decisions against your underwriting rules. The goal is to get this as close to 100% as possible. |

Risk & Compliance | Reduction in Data Entry Errors | Compares error rates before and after. Eliminating manual entry directly improves data quality and reduces downstream problems. |

By closely monitoring these metrics, you can create a clear, data-backed narrative that demonstrates precisely how the AUS is driving value across the organization, from the back office to the front lines.

A Deeper Dive Into the Metrics

Operational KPIs get right to the heart of your internal workflows and costs. These are often the easiest numbers to pull and usually show the quickest return on your investment.

Claim or Application Cycle Time: Start tracking the average time from the moment a submission hits your system to a final decision. Watching that number shrink from days to hours—or even minutes—is one of the most compelling signs of success.

Cost Per Transaction: You need to calculate the all-in operational cost to process a single claim or application, including labor and system overhead. Automation is designed to crush this number.

Straight-Through Processing (STP) Rate: This is a huge one. It measures the percentage of applications or claims that fly through the system from start to finish without a human ever touching them. A higher STP rate is a direct indicator of massive efficiency gains.

Customer-Focused KPIs show you how automation is actually affecting your policyholders. In an industry where customer experience is a make-or-break differentiator for leading AI insurance companies, these metrics are non-negotiable.

Customer Satisfaction (CSAT) Scores: After someone interacts with the automated system, survey them. Faster decisions and 24/7 availability through platforms like AI customer care should send satisfaction scores climbing.

Net Promoter Score (NPS): This metric tells you about overall customer loyalty. A fast, simple, and transparent process is often what turns a neutral customer into someone who actively recommends your brand.

Application Abandonment Rate: When you're writing new business, how many people start an application but never finish? A clunky process is a common culprit. A clean, quick automated workflow should make this number drop.

By tracking these customer-centric metrics, you can directly connect your investment in automated systems to improved retention and growth—a narrative that resonates strongly with executive leadership.

Risk and Compliance KPIs are all about proving your AUS isn't just faster, but also smarter and more consistent. This is absolutely critical for keeping regulators happy and is a frequent focus of internal and external claims AI reviews.

Decision Consistency: You have to audit a sample of automated decisions to make sure they perfectly follow your established underwriting rules. Your goal here should be to approach 100% consistency, eliminating human variability.

Audit Trail Completeness: Check the system's ability to generate a crystal-clear audit log for every single decision. It needs to show precisely what data was used and which rules were fired.

Reduction in Data Entry Errors: Simply compare error rates from before and after you went live. When you get rid of manual data entry, you dramatically improve data accuracy and prevent a whole host of downstream problems.

Frequently Asked Questions About Automated Underwriting

As you explore bringing automated underwriting into your operations, some key questions are bound to come up. Let's walk through the most common ones with practical answers focused on what this shift really means for your claims and customer service teams.

How Does This Affect Our Claims Process?

The change is dramatic. Automated systems take the claims process from a slow, paper-heavy bottleneck to a nimble, data-driven workflow. Think about the First Notice of Loss (FNOL)—instead of manual entry and a series of handoffs, an AI insurance company can automate that entire intake. The system instantly cross-references policy details, pulls the necessary data, and can often green-light simple, clear-cut claims in a matter of minutes.

This isn't just about speed; it's about reallocating your most valuable resources. When you automate the routine, you free up your seasoned adjusters to dig into the complex, high-stakes cases that truly need their expertise. Many claims AI reviews point to this as the single biggest win—it directly cuts down on operational drag and shrinks claim cycle times.

Can We Really Trust AI with Customer Care?

Yes, but it's important to understand the goal. AI customer care isn't about replacing your people; it's about making them more effective. AI-powered agents are fantastic at handling the high volume of predictable questions that clog up your phone lines and inboxes—things like policy questions or claim status updates. They can do it instantly, accurately, and around the clock.

This frees up your human support teams to focus on the conversations that build loyalty and solve real problems—the situations that demand empathy, creativity, and critical thinking. You end up with a faster, more responsive customer service operation that actually feels more human, not less.

How Do These Systems Handle Complex Cases?

Smart automation knows its own limits. These platforms are brilliant at processing standard, data-rich applications, but they are designed with built-in triggers for anything that looks unusual. If a case falls outside the established rules or gets a low confidence score from the model, it’s immediately kicked over to a human underwriter.

It works like a super-efficient triage system:

Simple Cases: Processed automatically in minutes.

Complex Cases: Flagged and routed to the right specialist.

Edge Cases: Immediately sent for human review.

This lets you capture the speed of automation without ever sacrificing the expert judgment needed for the tough calls. A great first step is structuring how you collect information in the first place. For example, using a well-designed insurance claim form template ensures the data is clean and organized from the start, making the entire process smoother. This hybrid approach ensures every single case gets the right level of attention.

Ready to see how AI agents can automate your most critical operations? Nolana provides an AI-native operating system that deploys compliant, skilled agents to manage claims, customer service, and case management workflows end-to-end. https://nolana.com

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP