AI Claims Automation: A Modern Guide for Financial Services

AI Claims Automation: A Modern Guide for Financial Services

Discover how AI claims automation transforms financial services by boosting speed, customer care, and compliance. Learn to implement and scale your AI strategy.

When we talk about AI claims automation, we're really talking about a fundamental shift in how insurance claims are handled. It's about swapping out the old, paper-shuffling, manual processes for intelligent systems that can manage the entire claims journey, from the moment a customer reports an incident to the final payout. The goal is simple: make the process faster and more efficient for insurers and a whole lot smoother for policyholders. For ai insurance companies, this is the new standard for automating insurance claims with AI and elevating AI customer care.

The New Reality of AI Claims Automation

For a long time, "AI" was just a buzzword in financial services. That's no longer the case. We’ve moved past the hype and into a new operational reality where AI-driven claims processing isn't just a "nice-to-have"—it's a requirement for staying competitive. This is more than a simple tech upgrade; it's a complete reimagining of the claims workflow by automating insurance claims with AI.

Think of the old way as a postal service. It gets the job done, but it’s slow, deliberate, and has built-in delays at every handoff. An AI-powered system, on the other hand, is like a digital command center. It ingests information, verifies it, and executes tasks almost instantly, with a level of precision that’s hard to match manually.

The Dual Benefits of Intelligent Automation

The real power of bringing AI into the claims process lies in its twofold impact: it benefits both the carrier and the customer. For insurers, the advantages are concrete and easy to measure. Automating the routine, high-volume tasks—like data entry, checking documents, and initial damage triage—slashes operational costs and frees up your experienced adjusters to focus on the complex, high-stakes claims where their expertise truly matters.

This newfound efficiency has a direct, positive effect on the customer's experience. Policyholders get:

Faster Turnarounds: AI can analyze and validate a straightforward claim in minutes, not days. That means quicker settlements and happier customers.

24/7 Service: An AI system doesn't sleep. Customers can file a claim or check its status at 2 AM on a Sunday if they need to.

Greater Accuracy: Automation removes the risk of human error in data entry or document review, which often leads to frustrating delays.

By letting AI handle the predictable, repetitive work, your claims professionals can dedicate their time to what humans do best: providing empathy, navigating nuance, and making critical judgment calls. This is the synergy that truly modernizes the claims operation.

A Strategic Imperative for Growth

At the end of the day, adopting AI claims automation is a strategic move. It's about building a claims department that is more resilient, agile, and completely focused on the customer. When you start looking at different solutions, initial claims AI reviews will often point to the immediate ROI from lower processing costs.

But the real, long-term value comes from creating a scalable system that enhances AI customer care and solidifies your competitive position. To better understand the specific applications and benefits, you can learn more about how AI is reshaping the insurance claims landscape in our detailed guide. This forward-thinking approach is no longer optional for any financial institution that wants to succeed.

How AI Is Reshaping Claims and Customer Experience

AI is moving claims processing beyond manual, step-by-step workflows and introducing a level of speed and accuracy that just wasn't possible before. At its core, AI gives us a new kind of digital workforce. Think of AI agents trained on your company’s specific playbooks—its standard operating procedures (SOPs)—ready to handle the repetitive, high-volume tasks that tie up your best people.

Take the very first step in any claim: the first notice of loss. Traditionally, this kicks off a cascade of manual work—opening files, reading through documents, and punching data into different systems. When you start automating insurance claims with AI, that entire front-end bottleneck disappears. The AI can instantly read everything from a police report to a repair quote, pull out the critical information, and build the claims file on its own.

But this is much more than glorified data entry. These systems are smart enough to run initial validation and fraud checks on the fly, flagging anything that looks out of place for a human expert to review. By getting these fundamentals right from the start, AI builds a foundation of accurate, verified information, paving the way for a much smoother path to settlement.

A New Standard for Customer Interactions

AI’s influence doesn't stop with back-office tasks; it’s completely changing how insurers interact with their customers. In any financial service, fast and accurate support is everything. This is where AI customer care really shines. Policyholders are no longer stuck waiting for business hours to get an answer to a simple question or check on their claim.

AI-driven systems provide support 24/7. They can guide a customer through submitting a claim, answer frequently asked questions in an instant, and provide real-time status updates without ever needing a person to intervene. This kind of self-service capability takes a huge load off call centers, freeing up human agents to focus on the complex, high-empathy conversations where they’re needed most. You can get a much deeper look at how this technology works in our guide on AI customer care for modern businesses.

The difference for ai insurance companies is night and day:

Before AI: Long hold times, rigid 9-to-5 support hours, and customers left in the dark.

After AI: Instant answers, around-the-clock help, and policyholders who feel in control.

The result is a direct and positive impact on customer satisfaction scores and a massive reduction in operational headaches.

The Clear Business Case for AI in Claims

The argument for bringing AI into claims workflows isn't theoretical—it's backed by solid numbers. The efficiency gains lead directly to lower operational costs and faster settlement times, creating a powerful and undeniable return on investment. This tangible financial impact is what most claims AI reviews rightly focus on.

The real value of AI is unlocked when it stops being a buzzword and becomes a core part of your operations—something that makes your workflows faster, smarter, and more focused on the customer.

Across the board, carriers that have put AI to work are reporting dramatic drops in claims handling times. Recent deployments have shown claims-processing time cuts in the 55–75% range, with document-heavy claims seeing reductions as high as 75–85%. It's not just small players, either. A major carrier like Aviva cut its liability assessment time by 23 days for complex cases and improved its routing accuracy by 30% after rolling out over 80 AI models. The savings are substantial.

Beyond speed, AI's ability to spot patterns in huge datasets is a game-changer for fraud detection. To see this in action, it's worth exploring how leading companies leverage machine learning for fraud detection. This proactive defense doesn't just save money; it protects the integrity of the entire claims system. By automating key processes and elevating the customer experience, AI delivers a clear and compelling ROI that forward-thinking organizations can’t afford to overlook.

Building Your Compliant AI Claims Architecture

For technology and compliance leaders, bringing an AI claims system into the fold isn't just about cool tech—it's about architecture, integration, and rock-solid regulatory oversight. Getting from a whiteboard concept to a working reality means choosing a platform that's not only smart but also transparent, auditable, and built for the regulated world we live in. Compliance can't be a bolt-on; it has to be part of the foundation.

Think of an enterprise-grade AI platform less as a standalone tool and more as an "agentic operating system." It doesn't work in isolation. Instead, it’s an intelligent layer that plugs right into the core systems you already depend on, whether that's Guidewire or Duck Creek for claims management or Salesforce and ServiceNow for customer engagement. This connection happens through APIs, giving the AI the ability to read information, make decisions, and take action inside your existing infrastructure.

The goal here is a unified workflow where AI handles the predictable, high-volume work, freeing up your expert teams to manage the exceptions and complex judgment calls. This kind of architecture guarantees that every automated action is a perfect mirror of your internal policies.

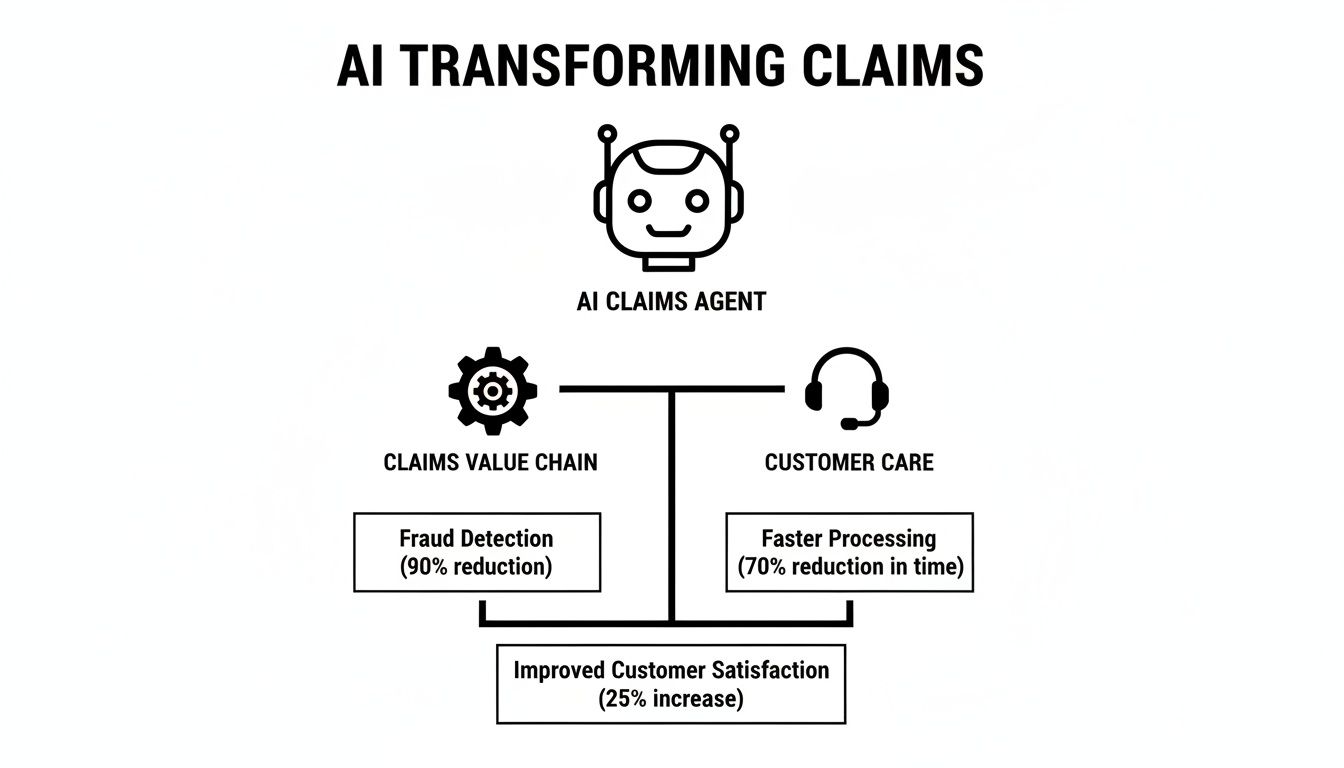

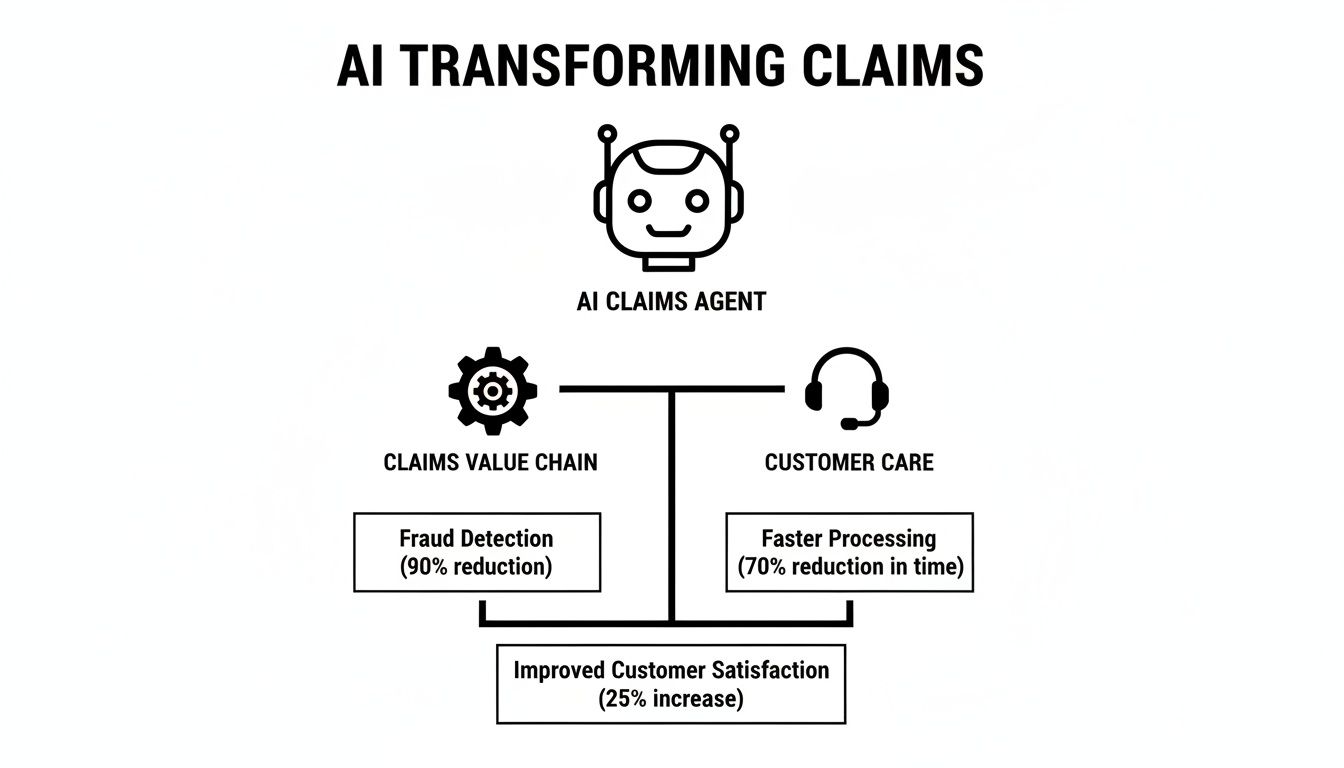

This infographic shows how a central AI agent can orchestrate improvements across the entire claims value chain and customer care.

By bridging these two critical functions—automating insurance claims with AI and enhancing AI customer care—the AI creates a far more efficient, responsive, and cohesive operation.

Non-Negotiable Features for Regulated Industries

In financial services, a "black box" AI is a complete non-starter. You absolutely must have clarity and control over how and why it makes every single decision. To satisfy both internal risk teams and external regulators, the architecture has to be built around a few non-negotiable principles. These features are what give you the confidence that your AI is a reliable, controllable part of your operations.

Here’s what that looks like in practice:

Full Auditability: Every single action an AI agent takes—from reading a document to updating a claim status—must be logged immutably. This creates a transparent, time-stamped audit trail that you can pull up and review at any moment.

Clear Human-in-the-Loop Escalation: The system must know its own limits. When the AI hits a scenario it wasn’t trained for or has low confidence in its decision, it has to automatically route the case to a human expert. No exceptions.

Transparent Decision Logs: The logic behind every automated decision needs to be crystal clear and traceable. If an AI agent flags a claim for review, the system must show you exactly which data points and rules triggered that action.

Compliant by Design: SOP-Based Training

The most effective and safest AI platforms are trained directly on your company’s specific Standard Operating Procedures (SOPs). This "compliant by design" approach ensures the AI doesn’t just learn generic industry best practices; it learns your way of doing things. It internalizes your unique business rules, your specific compliance needs, and your established operational workflows.

When an AI is trained on your SOPs, it becomes a digital extension of your own compliance framework. Every automated task is performed exactly as your best-trained employee would, ensuring consistency and adherence to regulations on a massive scale.

This method is quickly becoming a must-have for large-scale adoption, especially as regulatory scrutiny gets more intense. Recent industry analysis shows that while generative AI is moving from experimental to mainstream—with about 55% of insurers reporting early or full adoption—regulators are simultaneously turning up the heat on governance. This trend explains why enterprise programs now demand auditability, SOP-based training, and robust controls as table stakes for scaling AI claims automation. You can review the complete analysis on AI adoption and regulatory trends in the insurance sector.

Ultimately, a well-designed architecture gives you verifiable proof that your AI is operating within established guardrails. Security and trust are paramount, which is why controls aligned with standards like GDPR are crucial. For a deeper dive into these security frameworks, check out our guide on what is SOC 2 compliance. This focus on building a controlled, auditable, and reliable system is what separates a successful enterprise AI implementation from a risky science project.

Your Roadmap for a Successful AI Implementation

Getting an AI claims solution off the ground isn't just a technology project; it’s a strategic initiative that needs a clear playbook. For operations leaders, the best way to start isn't a big-bang, company-wide rollout. It's much smarter to begin with a focused pilot project and build momentum from there.

The trick is to pick a workflow that’s high-volume but not overly complex. Think initial claims intake for a specific policy type or verifying a standard set of documents. This approach lets you score a quick, measurable win—and those early victories are crucial for getting the internal buy-in you'll need to expand later.

That first success story becomes your best asset. It’s tangible proof for stakeholders across the business that AI customer care and automation work, turning cautious skepticism into genuine support. It's the first real step toward showing everyone how modern AI insurance companies can, and should, operate.

Managing the Human Element of Change

One of the biggest hurdles in any automation project is the natural fear that AI is coming for people's jobs. Strong change management tackles this concern directly by changing the conversation. It's essential to frame the AI as a powerful assistant for your claims handlers, not a replacement.

Think of it this way: when your best people are freed from the drudgery of manual data entry and cross-referencing documents, they can focus their expertise where it truly matters. They suddenly have more time for nuanced negotiations, sensitive customer conversations, and the kind of critical thinking that no algorithm can replicate. You end up with a claims team that’s more engaged, more effective, and adding far more value.

Defining and Tracking Your Success Metrics

To prove the value of your AI claims implementation, you have to know what success looks like from day one. That means defining and tracking the right Key Performance Indicators (KPIs). These metrics give you the hard data needed to show a clear return on investment and build the case for scaling up. Always establish a baseline before you go live so you can measure the true impact.

Key Performance Indicators for AI Claims Automation

Tracking the right metrics is the only way to tell if your AI investment is paying off. This table breaks down the essential KPIs to monitor, both before and after you deploy an AI solution, to get a clear picture of its operational and financial impact.

Metric Category | KPI | Description | Impact of AI |

|---|---|---|---|

Operational Efficiency | Claims Processing Cycle Time | The average time from First Notice of Loss (FNOL) to final settlement. | AI dramatically reduces this by automating data intake, verification, and simple decision-making. |

Cost-per-Claim | The total operational cost associated with processing a single claim. | Lowers costs by reducing manual labor and rework, allowing staff to handle higher volumes. | |

Customer Experience | Customer Effort Score (CES) | A measure of how easy it is for a policyholder to get their claim resolved. | AI-powered self-service and faster processing lead to a lower-effort, more satisfying experience. |

Net Promoter Score (NPS) | A measure of customer loyalty and willingness to recommend your company. | A smoother, faster claims process often boosts customer satisfaction and, in turn, NPS. | |

Quality and Accuracy | First-Pass Resolution Rate | The percentage of claims processed correctly the first time without manual intervention or rework. | AI improves data accuracy and consistency, significantly increasing this rate. |

Error Rate | The frequency of errors in data entry, policy checking, or payment calculation. | Automation minimizes human error, leading to more accurate and compliant outcomes. |

A well-designed KPI strategy provides the proof you need to justify the investment and tells a powerful story about how your operations are evolving.

A well-defined KPI strategy does more than just measure success; it tells a compelling story about how AI is transforming your operations, improving the customer journey, and strengthening your bottom line.

By carefully planning your rollout, managing the cultural shift, and rigorously tracking your results, you build a repeatable model for success. This methodical approach takes the guesswork out of the process and helps your organization sidestep the common pitfalls on the path to intelligent automation. For a deep dive into how these principles work in the real world, you can explore detailed case studies about transforming insurance claims with agentic AI. It’s a great blueprint for turning a strategic vision into a concrete operational reality.

Choosing the Right AI Partner for Financial Services

Picking the right technology partner is a make-or-break decision that will define your entire AI journey. Once you move past the initial research and generic claims AI reviews, your focus has to sharpen. You're looking for a partner who truly gets the immense pressures of the financial services world. This isn't just about buying a piece of software; it's about forming a strategic alliance.

Your evaluation should start with a partner’s specific expertise. You need vendors with a proven track record in insurance or banking—not just tech in general. They have to show they understand your day-to-day operational realities, from integrating with your core systems to navigating the maze of regulatory compliance.

Beyond Basic Automation: The Power of Agentic AI Platforms

There’s a massive difference between basic automation tools and true agentic AI platforms, and it's a distinction you can't afford to miss. Simple Robotic Process Automation (RPA) is great for repetitive, rule-based tasks but completely breaks down when it hits an exception or a complex, multi-step process. It’s just following a rigid script.

Agentic AI, on the other hand, is built for dynamic, context-aware thinking. These platforms can read unstructured data, navigate complicated workflows, and adapt on the fly, much like a seasoned human adjuster would. That adaptability is absolutely essential for handling the unpredictable nature of AI claims and providing a genuinely helpful AI customer care experience.

A true AI partner delivers a platform that learns directly from your Standard Operating Procedures (SOPs) and your team’s actions. This ensures every automated task perfectly mirrors your established business rules and compliance standards.

As you weigh your options, it's also smart to understand the different kinds of external support available. For instance, knowing what an AI automation agency offers versus a dedicated platform provider will give you the context to pick the model that aligns with your long-term goals.

Essential Evaluation Criteria for AI Insurance Companies

When you start vetting potential partners, you need a checklist of non-negotiables. These are the elements that ensure the platform you choose is not just powerful but also secure, compliant, and ready to plug into your existing tech stack.

Proven Integration Capabilities: The platform absolutely must connect with your core systems, whether it's Guidewire, Duck Creek, or your CRM. Demand to see case studies that prove they’ve done it before.

A Rock-Solid Commitment to Security and Compliance: Look for vendors who can show you verifiable certifications like SOC 2 Type II and who deeply understand regulations like GDPR. Their security protocols shouldn't be a secret; they should be robust and transparent.

Built-in Support for Audit and Compliance Teams: Every action the AI takes must be fully auditable. The system should produce clear, unchangeable logs that your internal teams can easily pull to satisfy any regulatory inquiry.

Asking the Tough Questions

To make the right call, you have to get past the sales pitch. Asking pointed, challenging questions will reveal a vendor’s real capabilities and how serious they are about a true partnership. For AI insurance companies, this due diligence is the single most important step. To see how other top carriers are approaching this, check out our guide on the rise of AI insurance companies.

Here are a few questions you should absolutely be asking:

How is the AI trained? Can we train it on our specific SOPs so it follows our unique compliance rules to the letter?

What are your data privacy and security protocols? Show me how you protect sensitive customer and claims data, both in transit and at rest.

How does your platform handle exceptions? What does the human-in-the-loop escalation path actually look like in practice?

What kind of ongoing support do you provide? How will you help us adapt the AI as our business processes and regulations inevitably change?

By prioritizing deep industry expertise, agentic AI capabilities, and an unwavering focus on compliance, you can select a partner who will help you achieve your automation goals safely and effectively.

What the Future of AI in Claims Means for You

The early wins from automating insurance claims with AI are clear enough—we're seeing real cost savings, incredible speed, and better customer service right out of the gate. But if you stop there, you're missing the point. We're not just bolting on a new tool; we're witnessing a foundational shift where AI becomes the strategic heart of a smarter, more resilient financial services operation.

The real game-changer is the deep operational intelligence AI unlocks over time. As these systems churn through thousands of claims, they're not just processing transactions—they're learning. They're building a rich repository of data that spots risk patterns and operational logjams that were completely invisible before. This is what allows insurers to finally get ahead of problems instead of constantly reacting to them.

The Shift to Agentic Workflows

The future isn't about automating single tasks in a vacuum; it’s about handing off entire workflows. The next wave is agentic AI, which can manage complex, multi-step claims from start to finish with very little human hand-holding.

Picture an AI agent taking a claim from the first notice of loss all the way to settlement. It coordinates with repair shops, keeps the policyholder updated, and only loops in a human expert for the truly tricky exceptions. This isn't science fiction; it's the next logical step in operational design.

This kind of end-to-end orchestration completely changes the math on operational capacity. It means you can scale your business without automatically scaling your headcount, which builds a far more sustainable and profitable model. Your human teams are then freed up to focus on what they do best: high-level strategy, creative problem-solving, and building customer relationships.

An Accelerating Market Is Your Wake-Up Call

This isn't just a theoretical opportunity; the market is putting its money where its mouth is. The addressable market for AI in insurance is growing fast, with most of the investment aimed squarely at claims and fraud detection.

One recent analysis valued the broader ‘AI in insurance’ market at $4.59 billion, with projections showing it could skyrocket to nearly $79.9 billion by 2032. This explosive growth is fueled by the undeniable ROI companies are getting from automation and analytics. More targeted forecasts for AI in claims processing alone predict compound annual growth rates of around 28%. You can explore more data on the expanding AI in insurance market on binariks.com.

This isn't some far-off trend. It's happening now, and the pace is picking up. For industry leaders, the message is clear: the time for waiting and seeing is over.

Ultimately, making AI a strategic priority is the defining challenge for this generation of insurance leaders. It’s about making bold moves today to build the operational backbone for tomorrow's growth. The question is no longer if AI will reshape claims and AI customer care, but who will lead the way.

Frequently Asked Questions About AI in Claims

When financial services leaders start exploring intelligent automation, a lot of good questions come up. Let's tackle some of the most common ones we hear about putting compliant, enterprise-grade AI to work in claims operations.

How Does AI Handle Complex or Exception-Based Insurance Claims?

This is a critical point. The best enterprise-grade AI systems aren't designed to be a black box; they operate on a "human-in-the-loop" principle.

For the straightforward, high-volume tasks, the AI works independently, following your SOPs to the letter. But the moment it hits a snag—a complex scenario or data that falls outside its confidence score—it doesn't guess. Instead, it instantly flags the case and routes it to a human claims expert for review.

This hybrid approach gives you the best of both worlds: your team's nuanced judgment is reserved for the claims that actually need it, while the AI handles the predictable, repetitive work with incredible speed and accuracy.

Will Implementing AI Replace Our Existing Claims Adjusters?

The goal isn't replacement; it's augmentation. Think of AI as a tool that finally frees your experienced adjusters from the mountain of administrative busywork that bogs them down—things like mind-numbing data entry and document verification.

This allows them to focus on the high-value work that only humans can do well: handling sensitive negotiations, delivering empathetic AI customer care, and making tough judgment calls on complex claims.

It effectively elevates their role from a processor to a strategic problem-solver. For forward-thinking ai insurance companies, this shift not only boosts team capacity but is also key to improving job satisfaction and retaining top talent.

Ultimately, it transforms the claims department into a more strategic, high-impact team.

How Do We Ensure an AI Claims System Stays Compliant?

Compliance isn't an afterthought; it has to be built into the DNA of the AI platform from day one. This is a common theme in positive claims ai reviews for a reason.

Modern systems are trained directly on your company's specific Standard Operating Procedures (SOPs). This ensures the AI agents act as a perfect digital extension of your existing compliance framework.

Better yet, every single action the AI takes is recorded in a permanent, unchangeable audit trail. This gives you complete transparency for internal reviews and regulators. When rules change, you don't have to overhaul the system—you just update the governing SOPs, and the AI agents are retrained on the new guidelines, guaranteeing consistent and auditable compliance.

Ready to see how compliant AI automation can transform your operations? Nolana deploys intelligent agents trained on your specific procedures to automate claims and customer service workflows from end to end. Schedule a demo today.

When we talk about AI claims automation, we're really talking about a fundamental shift in how insurance claims are handled. It's about swapping out the old, paper-shuffling, manual processes for intelligent systems that can manage the entire claims journey, from the moment a customer reports an incident to the final payout. The goal is simple: make the process faster and more efficient for insurers and a whole lot smoother for policyholders. For ai insurance companies, this is the new standard for automating insurance claims with AI and elevating AI customer care.

The New Reality of AI Claims Automation

For a long time, "AI" was just a buzzword in financial services. That's no longer the case. We’ve moved past the hype and into a new operational reality where AI-driven claims processing isn't just a "nice-to-have"—it's a requirement for staying competitive. This is more than a simple tech upgrade; it's a complete reimagining of the claims workflow by automating insurance claims with AI.

Think of the old way as a postal service. It gets the job done, but it’s slow, deliberate, and has built-in delays at every handoff. An AI-powered system, on the other hand, is like a digital command center. It ingests information, verifies it, and executes tasks almost instantly, with a level of precision that’s hard to match manually.

The Dual Benefits of Intelligent Automation

The real power of bringing AI into the claims process lies in its twofold impact: it benefits both the carrier and the customer. For insurers, the advantages are concrete and easy to measure. Automating the routine, high-volume tasks—like data entry, checking documents, and initial damage triage—slashes operational costs and frees up your experienced adjusters to focus on the complex, high-stakes claims where their expertise truly matters.

This newfound efficiency has a direct, positive effect on the customer's experience. Policyholders get:

Faster Turnarounds: AI can analyze and validate a straightforward claim in minutes, not days. That means quicker settlements and happier customers.

24/7 Service: An AI system doesn't sleep. Customers can file a claim or check its status at 2 AM on a Sunday if they need to.

Greater Accuracy: Automation removes the risk of human error in data entry or document review, which often leads to frustrating delays.

By letting AI handle the predictable, repetitive work, your claims professionals can dedicate their time to what humans do best: providing empathy, navigating nuance, and making critical judgment calls. This is the synergy that truly modernizes the claims operation.

A Strategic Imperative for Growth

At the end of the day, adopting AI claims automation is a strategic move. It's about building a claims department that is more resilient, agile, and completely focused on the customer. When you start looking at different solutions, initial claims AI reviews will often point to the immediate ROI from lower processing costs.

But the real, long-term value comes from creating a scalable system that enhances AI customer care and solidifies your competitive position. To better understand the specific applications and benefits, you can learn more about how AI is reshaping the insurance claims landscape in our detailed guide. This forward-thinking approach is no longer optional for any financial institution that wants to succeed.

How AI Is Reshaping Claims and Customer Experience

AI is moving claims processing beyond manual, step-by-step workflows and introducing a level of speed and accuracy that just wasn't possible before. At its core, AI gives us a new kind of digital workforce. Think of AI agents trained on your company’s specific playbooks—its standard operating procedures (SOPs)—ready to handle the repetitive, high-volume tasks that tie up your best people.

Take the very first step in any claim: the first notice of loss. Traditionally, this kicks off a cascade of manual work—opening files, reading through documents, and punching data into different systems. When you start automating insurance claims with AI, that entire front-end bottleneck disappears. The AI can instantly read everything from a police report to a repair quote, pull out the critical information, and build the claims file on its own.

But this is much more than glorified data entry. These systems are smart enough to run initial validation and fraud checks on the fly, flagging anything that looks out of place for a human expert to review. By getting these fundamentals right from the start, AI builds a foundation of accurate, verified information, paving the way for a much smoother path to settlement.

A New Standard for Customer Interactions

AI’s influence doesn't stop with back-office tasks; it’s completely changing how insurers interact with their customers. In any financial service, fast and accurate support is everything. This is where AI customer care really shines. Policyholders are no longer stuck waiting for business hours to get an answer to a simple question or check on their claim.

AI-driven systems provide support 24/7. They can guide a customer through submitting a claim, answer frequently asked questions in an instant, and provide real-time status updates without ever needing a person to intervene. This kind of self-service capability takes a huge load off call centers, freeing up human agents to focus on the complex, high-empathy conversations where they’re needed most. You can get a much deeper look at how this technology works in our guide on AI customer care for modern businesses.

The difference for ai insurance companies is night and day:

Before AI: Long hold times, rigid 9-to-5 support hours, and customers left in the dark.

After AI: Instant answers, around-the-clock help, and policyholders who feel in control.

The result is a direct and positive impact on customer satisfaction scores and a massive reduction in operational headaches.

The Clear Business Case for AI in Claims

The argument for bringing AI into claims workflows isn't theoretical—it's backed by solid numbers. The efficiency gains lead directly to lower operational costs and faster settlement times, creating a powerful and undeniable return on investment. This tangible financial impact is what most claims AI reviews rightly focus on.

The real value of AI is unlocked when it stops being a buzzword and becomes a core part of your operations—something that makes your workflows faster, smarter, and more focused on the customer.

Across the board, carriers that have put AI to work are reporting dramatic drops in claims handling times. Recent deployments have shown claims-processing time cuts in the 55–75% range, with document-heavy claims seeing reductions as high as 75–85%. It's not just small players, either. A major carrier like Aviva cut its liability assessment time by 23 days for complex cases and improved its routing accuracy by 30% after rolling out over 80 AI models. The savings are substantial.

Beyond speed, AI's ability to spot patterns in huge datasets is a game-changer for fraud detection. To see this in action, it's worth exploring how leading companies leverage machine learning for fraud detection. This proactive defense doesn't just save money; it protects the integrity of the entire claims system. By automating key processes and elevating the customer experience, AI delivers a clear and compelling ROI that forward-thinking organizations can’t afford to overlook.

Building Your Compliant AI Claims Architecture

For technology and compliance leaders, bringing an AI claims system into the fold isn't just about cool tech—it's about architecture, integration, and rock-solid regulatory oversight. Getting from a whiteboard concept to a working reality means choosing a platform that's not only smart but also transparent, auditable, and built for the regulated world we live in. Compliance can't be a bolt-on; it has to be part of the foundation.

Think of an enterprise-grade AI platform less as a standalone tool and more as an "agentic operating system." It doesn't work in isolation. Instead, it’s an intelligent layer that plugs right into the core systems you already depend on, whether that's Guidewire or Duck Creek for claims management or Salesforce and ServiceNow for customer engagement. This connection happens through APIs, giving the AI the ability to read information, make decisions, and take action inside your existing infrastructure.

The goal here is a unified workflow where AI handles the predictable, high-volume work, freeing up your expert teams to manage the exceptions and complex judgment calls. This kind of architecture guarantees that every automated action is a perfect mirror of your internal policies.

This infographic shows how a central AI agent can orchestrate improvements across the entire claims value chain and customer care.

By bridging these two critical functions—automating insurance claims with AI and enhancing AI customer care—the AI creates a far more efficient, responsive, and cohesive operation.

Non-Negotiable Features for Regulated Industries

In financial services, a "black box" AI is a complete non-starter. You absolutely must have clarity and control over how and why it makes every single decision. To satisfy both internal risk teams and external regulators, the architecture has to be built around a few non-negotiable principles. These features are what give you the confidence that your AI is a reliable, controllable part of your operations.

Here’s what that looks like in practice:

Full Auditability: Every single action an AI agent takes—from reading a document to updating a claim status—must be logged immutably. This creates a transparent, time-stamped audit trail that you can pull up and review at any moment.

Clear Human-in-the-Loop Escalation: The system must know its own limits. When the AI hits a scenario it wasn’t trained for or has low confidence in its decision, it has to automatically route the case to a human expert. No exceptions.

Transparent Decision Logs: The logic behind every automated decision needs to be crystal clear and traceable. If an AI agent flags a claim for review, the system must show you exactly which data points and rules triggered that action.

Compliant by Design: SOP-Based Training

The most effective and safest AI platforms are trained directly on your company’s specific Standard Operating Procedures (SOPs). This "compliant by design" approach ensures the AI doesn’t just learn generic industry best practices; it learns your way of doing things. It internalizes your unique business rules, your specific compliance needs, and your established operational workflows.

When an AI is trained on your SOPs, it becomes a digital extension of your own compliance framework. Every automated task is performed exactly as your best-trained employee would, ensuring consistency and adherence to regulations on a massive scale.

This method is quickly becoming a must-have for large-scale adoption, especially as regulatory scrutiny gets more intense. Recent industry analysis shows that while generative AI is moving from experimental to mainstream—with about 55% of insurers reporting early or full adoption—regulators are simultaneously turning up the heat on governance. This trend explains why enterprise programs now demand auditability, SOP-based training, and robust controls as table stakes for scaling AI claims automation. You can review the complete analysis on AI adoption and regulatory trends in the insurance sector.

Ultimately, a well-designed architecture gives you verifiable proof that your AI is operating within established guardrails. Security and trust are paramount, which is why controls aligned with standards like GDPR are crucial. For a deeper dive into these security frameworks, check out our guide on what is SOC 2 compliance. This focus on building a controlled, auditable, and reliable system is what separates a successful enterprise AI implementation from a risky science project.

Your Roadmap for a Successful AI Implementation

Getting an AI claims solution off the ground isn't just a technology project; it’s a strategic initiative that needs a clear playbook. For operations leaders, the best way to start isn't a big-bang, company-wide rollout. It's much smarter to begin with a focused pilot project and build momentum from there.

The trick is to pick a workflow that’s high-volume but not overly complex. Think initial claims intake for a specific policy type or verifying a standard set of documents. This approach lets you score a quick, measurable win—and those early victories are crucial for getting the internal buy-in you'll need to expand later.

That first success story becomes your best asset. It’s tangible proof for stakeholders across the business that AI customer care and automation work, turning cautious skepticism into genuine support. It's the first real step toward showing everyone how modern AI insurance companies can, and should, operate.

Managing the Human Element of Change

One of the biggest hurdles in any automation project is the natural fear that AI is coming for people's jobs. Strong change management tackles this concern directly by changing the conversation. It's essential to frame the AI as a powerful assistant for your claims handlers, not a replacement.

Think of it this way: when your best people are freed from the drudgery of manual data entry and cross-referencing documents, they can focus their expertise where it truly matters. They suddenly have more time for nuanced negotiations, sensitive customer conversations, and the kind of critical thinking that no algorithm can replicate. You end up with a claims team that’s more engaged, more effective, and adding far more value.

Defining and Tracking Your Success Metrics

To prove the value of your AI claims implementation, you have to know what success looks like from day one. That means defining and tracking the right Key Performance Indicators (KPIs). These metrics give you the hard data needed to show a clear return on investment and build the case for scaling up. Always establish a baseline before you go live so you can measure the true impact.

Key Performance Indicators for AI Claims Automation

Tracking the right metrics is the only way to tell if your AI investment is paying off. This table breaks down the essential KPIs to monitor, both before and after you deploy an AI solution, to get a clear picture of its operational and financial impact.

Metric Category | KPI | Description | Impact of AI |

|---|---|---|---|

Operational Efficiency | Claims Processing Cycle Time | The average time from First Notice of Loss (FNOL) to final settlement. | AI dramatically reduces this by automating data intake, verification, and simple decision-making. |

Cost-per-Claim | The total operational cost associated with processing a single claim. | Lowers costs by reducing manual labor and rework, allowing staff to handle higher volumes. | |

Customer Experience | Customer Effort Score (CES) | A measure of how easy it is for a policyholder to get their claim resolved. | AI-powered self-service and faster processing lead to a lower-effort, more satisfying experience. |

Net Promoter Score (NPS) | A measure of customer loyalty and willingness to recommend your company. | A smoother, faster claims process often boosts customer satisfaction and, in turn, NPS. | |

Quality and Accuracy | First-Pass Resolution Rate | The percentage of claims processed correctly the first time without manual intervention or rework. | AI improves data accuracy and consistency, significantly increasing this rate. |

Error Rate | The frequency of errors in data entry, policy checking, or payment calculation. | Automation minimizes human error, leading to more accurate and compliant outcomes. |

A well-designed KPI strategy provides the proof you need to justify the investment and tells a powerful story about how your operations are evolving.

A well-defined KPI strategy does more than just measure success; it tells a compelling story about how AI is transforming your operations, improving the customer journey, and strengthening your bottom line.

By carefully planning your rollout, managing the cultural shift, and rigorously tracking your results, you build a repeatable model for success. This methodical approach takes the guesswork out of the process and helps your organization sidestep the common pitfalls on the path to intelligent automation. For a deep dive into how these principles work in the real world, you can explore detailed case studies about transforming insurance claims with agentic AI. It’s a great blueprint for turning a strategic vision into a concrete operational reality.

Choosing the Right AI Partner for Financial Services

Picking the right technology partner is a make-or-break decision that will define your entire AI journey. Once you move past the initial research and generic claims AI reviews, your focus has to sharpen. You're looking for a partner who truly gets the immense pressures of the financial services world. This isn't just about buying a piece of software; it's about forming a strategic alliance.

Your evaluation should start with a partner’s specific expertise. You need vendors with a proven track record in insurance or banking—not just tech in general. They have to show they understand your day-to-day operational realities, from integrating with your core systems to navigating the maze of regulatory compliance.

Beyond Basic Automation: The Power of Agentic AI Platforms

There’s a massive difference between basic automation tools and true agentic AI platforms, and it's a distinction you can't afford to miss. Simple Robotic Process Automation (RPA) is great for repetitive, rule-based tasks but completely breaks down when it hits an exception or a complex, multi-step process. It’s just following a rigid script.

Agentic AI, on the other hand, is built for dynamic, context-aware thinking. These platforms can read unstructured data, navigate complicated workflows, and adapt on the fly, much like a seasoned human adjuster would. That adaptability is absolutely essential for handling the unpredictable nature of AI claims and providing a genuinely helpful AI customer care experience.

A true AI partner delivers a platform that learns directly from your Standard Operating Procedures (SOPs) and your team’s actions. This ensures every automated task perfectly mirrors your established business rules and compliance standards.

As you weigh your options, it's also smart to understand the different kinds of external support available. For instance, knowing what an AI automation agency offers versus a dedicated platform provider will give you the context to pick the model that aligns with your long-term goals.

Essential Evaluation Criteria for AI Insurance Companies

When you start vetting potential partners, you need a checklist of non-negotiables. These are the elements that ensure the platform you choose is not just powerful but also secure, compliant, and ready to plug into your existing tech stack.

Proven Integration Capabilities: The platform absolutely must connect with your core systems, whether it's Guidewire, Duck Creek, or your CRM. Demand to see case studies that prove they’ve done it before.

A Rock-Solid Commitment to Security and Compliance: Look for vendors who can show you verifiable certifications like SOC 2 Type II and who deeply understand regulations like GDPR. Their security protocols shouldn't be a secret; they should be robust and transparent.

Built-in Support for Audit and Compliance Teams: Every action the AI takes must be fully auditable. The system should produce clear, unchangeable logs that your internal teams can easily pull to satisfy any regulatory inquiry.

Asking the Tough Questions

To make the right call, you have to get past the sales pitch. Asking pointed, challenging questions will reveal a vendor’s real capabilities and how serious they are about a true partnership. For AI insurance companies, this due diligence is the single most important step. To see how other top carriers are approaching this, check out our guide on the rise of AI insurance companies.

Here are a few questions you should absolutely be asking:

How is the AI trained? Can we train it on our specific SOPs so it follows our unique compliance rules to the letter?

What are your data privacy and security protocols? Show me how you protect sensitive customer and claims data, both in transit and at rest.

How does your platform handle exceptions? What does the human-in-the-loop escalation path actually look like in practice?

What kind of ongoing support do you provide? How will you help us adapt the AI as our business processes and regulations inevitably change?

By prioritizing deep industry expertise, agentic AI capabilities, and an unwavering focus on compliance, you can select a partner who will help you achieve your automation goals safely and effectively.

What the Future of AI in Claims Means for You

The early wins from automating insurance claims with AI are clear enough—we're seeing real cost savings, incredible speed, and better customer service right out of the gate. But if you stop there, you're missing the point. We're not just bolting on a new tool; we're witnessing a foundational shift where AI becomes the strategic heart of a smarter, more resilient financial services operation.

The real game-changer is the deep operational intelligence AI unlocks over time. As these systems churn through thousands of claims, they're not just processing transactions—they're learning. They're building a rich repository of data that spots risk patterns and operational logjams that were completely invisible before. This is what allows insurers to finally get ahead of problems instead of constantly reacting to them.

The Shift to Agentic Workflows

The future isn't about automating single tasks in a vacuum; it’s about handing off entire workflows. The next wave is agentic AI, which can manage complex, multi-step claims from start to finish with very little human hand-holding.

Picture an AI agent taking a claim from the first notice of loss all the way to settlement. It coordinates with repair shops, keeps the policyholder updated, and only loops in a human expert for the truly tricky exceptions. This isn't science fiction; it's the next logical step in operational design.

This kind of end-to-end orchestration completely changes the math on operational capacity. It means you can scale your business without automatically scaling your headcount, which builds a far more sustainable and profitable model. Your human teams are then freed up to focus on what they do best: high-level strategy, creative problem-solving, and building customer relationships.

An Accelerating Market Is Your Wake-Up Call

This isn't just a theoretical opportunity; the market is putting its money where its mouth is. The addressable market for AI in insurance is growing fast, with most of the investment aimed squarely at claims and fraud detection.

One recent analysis valued the broader ‘AI in insurance’ market at $4.59 billion, with projections showing it could skyrocket to nearly $79.9 billion by 2032. This explosive growth is fueled by the undeniable ROI companies are getting from automation and analytics. More targeted forecasts for AI in claims processing alone predict compound annual growth rates of around 28%. You can explore more data on the expanding AI in insurance market on binariks.com.

This isn't some far-off trend. It's happening now, and the pace is picking up. For industry leaders, the message is clear: the time for waiting and seeing is over.

Ultimately, making AI a strategic priority is the defining challenge for this generation of insurance leaders. It’s about making bold moves today to build the operational backbone for tomorrow's growth. The question is no longer if AI will reshape claims and AI customer care, but who will lead the way.

Frequently Asked Questions About AI in Claims

When financial services leaders start exploring intelligent automation, a lot of good questions come up. Let's tackle some of the most common ones we hear about putting compliant, enterprise-grade AI to work in claims operations.

How Does AI Handle Complex or Exception-Based Insurance Claims?

This is a critical point. The best enterprise-grade AI systems aren't designed to be a black box; they operate on a "human-in-the-loop" principle.

For the straightforward, high-volume tasks, the AI works independently, following your SOPs to the letter. But the moment it hits a snag—a complex scenario or data that falls outside its confidence score—it doesn't guess. Instead, it instantly flags the case and routes it to a human claims expert for review.

This hybrid approach gives you the best of both worlds: your team's nuanced judgment is reserved for the claims that actually need it, while the AI handles the predictable, repetitive work with incredible speed and accuracy.

Will Implementing AI Replace Our Existing Claims Adjusters?

The goal isn't replacement; it's augmentation. Think of AI as a tool that finally frees your experienced adjusters from the mountain of administrative busywork that bogs them down—things like mind-numbing data entry and document verification.

This allows them to focus on the high-value work that only humans can do well: handling sensitive negotiations, delivering empathetic AI customer care, and making tough judgment calls on complex claims.

It effectively elevates their role from a processor to a strategic problem-solver. For forward-thinking ai insurance companies, this shift not only boosts team capacity but is also key to improving job satisfaction and retaining top talent.

Ultimately, it transforms the claims department into a more strategic, high-impact team.

How Do We Ensure an AI Claims System Stays Compliant?

Compliance isn't an afterthought; it has to be built into the DNA of the AI platform from day one. This is a common theme in positive claims ai reviews for a reason.

Modern systems are trained directly on your company's specific Standard Operating Procedures (SOPs). This ensures the AI agents act as a perfect digital extension of your existing compliance framework.

Better yet, every single action the AI takes is recorded in a permanent, unchangeable audit trail. This gives you complete transparency for internal reviews and regulators. When rules change, you don't have to overhaul the system—you just update the governing SOPs, and the AI agents are retrained on the new guidelines, guaranteeing consistent and auditable compliance.

Ready to see how compliant AI automation can transform your operations? Nolana deploys intelligent agents trained on your specific procedures to automate claims and customer service workflows from end to end. Schedule a demo today.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP