Financial Services Digital Transformation With AI for Claims and Customer Care

Financial Services Digital Transformation With AI for Claims and Customer Care

Explore how financial services digital transformation leverages AI to automate insurance claims and elevate customer care with intelligent solutions.

Overview Of Insurance Claims And AI Customer Care

Switching from paper forms and back-and-forth emails to intelligent AI customer care workflows doesn’t just speed things up—it changes the game. By embedding AI into customer care and claims processing, ai insurance companies transform lengthy approval cycles into near-instant decisions.

Here’s what organizations are seeing:

Speed Gains: Claim cycles fall from weeks to just hours with AI analysis.

Accuracy Boost: AI-driven claims ai reviews check documents with up to 95% precision.

Cost Reduction: Automated workflows drive down expenses by 30%.

AI Customer Care: 24/7 intelligent support lifts satisfaction scores through real-time assistance.

To illustrate the shift, here’s a side-by-side look at legacy versus AI-powered processes.

Overview Of Transformation Benefits

Aspect | Traditional Process | AI-Enabled Outcome |

|---|---|---|

Speed | Weeks-long approval cycles | Hours-long AI-powered claims ai reviews |

Accuracy | Manual review prone to errors | 95% document validation via AI claims review |

Cost | High staffing and printing expenses | 30% lower operational costs |

User Experience | Delayed updates and opaque status calls | Real-time notifications and self-service via AI customer care |

By comparing each side, it’s clear how AI reshapes efficiency, accuracy, and customer engagement.

Legacy Limitations Versus AI Possibilities

Old systems juggle siloed data and require manual handoffs at every stage. That often means missed details and frustrated policyholders. Top ai insurance companies have moved beyond these constraints.

In contrast, AI agents act like orchestration hubs. They pull information together, trigger necessary tasks instantly, and flag exceptions without human intervention.

80% cycle time reduction ensures faster settlements and happier customers.

This dynamic monitoring transforms a static, paper-heavy process into a live, transparent workflow.

Immediate Benefits For Leaders

Grants executives a clear line of sight through real-time dashboards and data-driven alerts, including AI customer care insights.

Cuts out routine approvals so teams can tackle complex cases faster.

Delivers measurable ROI via shorter cycle times, superior claims ai reviews, and lower operational costs.

With these gains, decision-makers understand why integrating AI into claims reviews and customer care isn’t optional. It’s a strategic move that drives tangible business impact.

Understanding The Key Concepts

Digital transformation in financial services means aligning advanced technologies with core business goals in banking and insurance. It brings together AI-native platforms, agentic automation, and cloud-native infrastructure to make processes faster and more reliable. Many ai insurance companies are already leveraging these capabilities.

Imagine an AI agent working like a veteran claims adjuster who never needs a break. Think of automation as a precision assembly line that repeats tasks without error. By breaking down these pieces, you’ll see how new tech—like claims ai reviews—translates into quicker decisions, stronger controls, and more satisfying experiences for policyholders.

This mindset also guides vendor selection, shapes governance models, and informs change-management practices.

Core Platform Components

AI-native platforms house compliant agents trained on standard operating procedures. They gather data, offer recommendations, and carry out routine workflows. Agentic automation strings together multi-step processes, cutting down on manual touchpoints. Meanwhile, cloud-native infrastructure scales on demand and keeps systems available day and night. Integration layers tie together policy engines, billing systems, and CRM tools for a seamless flow of information.

AI Agents reduce manual review and accelerate claims ai reviews by up to 80%.

Integration Layers bridge legacy core systems to modern, API-driven services.

Compliance Modules log every action to satisfy regulatory audits.

Together, these elements form a cohesive architecture that drives end-to-end automation.

Drivers Of Transformation

Strict regulations, fierce competition, and rising customer expectations are pushing banks and insurers to adopt AI customer care and automated claims processing. Leading ai insurance companies are racing to stay ahead.

Here’s how the numbers stack up:

Metric | Value |

|---|---|

Global DX Spending by 2027 | $4 trillion |

CAGR (2023–2027) | 16.2% |

Increase Since 2023 | 55% |

Financial Services Digital Score | 4.5 |

Source: Data Transformation Challenge Statistics

4.5 digitalization score illustrates why ai insurance companies are doubling down on digital roadmaps.

These figures translate into clear expectations for IT and operations teams.

Strategic Outcome Linkages

Connecting AI-native components to customer channels delivers measurable impact:

Faster claim settlements boost policyholder satisfaction through advanced claims ai reviews.

Automated triage cuts operational costs by around 30%.

Real-time dashboards empower leaders with actionable insights, including AI customer care metrics.

Personalized, proactive outreach improves retention.

These metrics form the strategic framework your executive team can use to build KPI dashboards, shape change-management plans, and pick the right implementation partners. Governance and compliance stay front and center throughout the journey.

Preparing For Action

With these concepts in place, leaders can see why digital transformation is essential for financial services. Next up: automating insurance claims with AI and rolling out AI customer care platforms. We’ll explore high-impact use cases like computer vision damage assessment and NLP-driven intake, plus data governance best practices and pilot frameworks. Detailed performance metrics await in the following section. Stay tuned!

Automating Insurance Claims With AI

Insurers can now take a claim from the first notice of loss to settlement in hours instead of weeks using advanced claims ai reviews. AI drives faster, more accurate damage assessments, zips through paperwork, and flags suspicious patterns.

That means fewer manual handoffs, happier customers, and leaner operating budgets. One mid-sized carrier, for instance, saw its cycle time collapse from weeks to mere hours—letting staff focus on the toughest, exception-based cases.

Claims processing times can shrink by 80%, shifting employees from routine tasks to high-judgment roles. Learn more about AI’s impact on processing times in financial services in the report findings.

Damage Assessment With Computer Vision

With computer vision, a single photo or video becomes a detailed damage report in seconds. The system cross-references each image against a library of past claims, flags unusual patterns, and projects repair costs. As a result, onsite visits from human adjusters drop dramatically and payouts happen sooner. Leading ai insurance companies leverage this to reduce operational overhead.

High-resolution image processing detects dents, cracks, and water damage automatically.

Predictive models assign severity scores with 95% confidence, speeding up go/no-go decisions.

Policyholders can snap photos in a mobile app and get a repair estimate on the spot.

“Computer vision acts like an expert adjuster that never needs a break,” says a claims operations lead.

NLP For Intake And Document Review

When claims arrive by email, fax, or even a recorded phone call, NLP springs into action. It pulls out dates, policy numbers, claim amounts, and other key details, then hands off a clean summary to your team. The result is fewer typos, less manual copy-and-paste, and a smoother handoff down the line—improving the quality of claims ai reviews.

Automated classification of claim types improves routing accuracy.

Entity extraction populates policy numbers, incident dates, and claimant details.

Anomaly detection flags odd or suspicious entries based on historical patterns.

Phase | AI Technique | Outcome |

|---|---|---|

Intake | NLP-driven form parsing | 90% Reduction in Data Errors |

Document Review | Semantic analysis | 70% Faster Document Validation |

Fraud Detection | Predictive analytics | 30% Fewer False Positives |

Taken together, these methods bring consistency and visibility to every step of the review.

Pilot Framework To Evaluate Claims AI Solutions

Before rolling out AI at scale, run a focused pilot to keep risk in check and prove ROI. Start with high-volume, low-complexity claims so you can capture clean performance benchmarks. That test bed gives you a safe space to integrate with policy databases and billing systems without disrupting daily operations.

Define objectives and success metrics—cycle time, accuracy in claims ai reviews, cost per claim.

Select representative claim samples and record current cycle times for a baseline.

Deploy AI models in a sandbox, connecting to core systems via APIs.

Track results in real time and tweak rules or workflows based on feedback.

Integration is key: your AI agents should talk directly to policy engines, CRM platforms, and billing modules.

Connect with RESTful APIs for instant data updates.

Automate handoffs via event-driven flows.

Use middleware layers to capture audit trails and ensure compliance.

Data Governance And Integration Best Practices

Good governance is the backbone of any automated claims system. It starts with secure pipelines and strict access controls to keep data clean and private. Then schedule model retraining on fresh claim batches to maintain accuracy and guard against bias in claims ai reviews.

Use end-to-end data lineage tracking so you can trace every decision.

Encrypt data in motion and at rest to satisfy GDPR and SOC 2 Type II.

Run regular bias audits to catch and correct any model drift.

With secure data flows and clear governance, insurers can roll out AI at scale. This groundwork extends beyond claims, paving the way for AI-enabled customer care. Platforms like Nolana help coordinate compliant AI agents across claims and service workflows, ensuring smooth escalations and audit trails.

AI insurance companies adopt innovations.

Deploying AI Customer Care

Every customer interaction is a chance to build loyalty. Gone are the days of one-size-fits-all scripts. Instead, AI-driven platforms power conversations that adapt on the fly—helping banks and insurers resolve issues faster and more accurately. This is the future of AI customer care in financial services.

These systems can deliver up to 90% first-contact resolution.

24/7 virtual assistants that handle balance checks, transaction queries, and routine requests

Real-time sentiment analysis to flag urgent or high-value interactions

Proactive outreach suggesting relevant products based on behavior signals

65% of inquiries wrap up without human intervention, according to recent claims ai reviews.

Consider a major insurer that rolled out a smart chatbot integrated with its CRM. Within six months, call volume dropped by 60%, thanks to early detection of issues and seamless handoffs. Results like this explain why insurers are automating end-to-end customer care. Leading ai insurance companies are using AI customer care to reduce churn and boost NPS.

Key design elements include:

Context retention so bots remember past exchanges

Fallback mechanisms that smoothly hand off to humans

Feedback loops for continuous language refinement

These features keep conversations fluid and customer-centric, while live data drives ongoing improvement.

Designing Natural Conversation Flows

Start by mapping the most frequent inquiries—account status, payment dates, claim updates. Then:

Define clear intents and craft responses that convey genuine empathy

Use context windows to recall prior messages for more personal replies

Incorporate real user feedback (for example, from claims ai reviews) to fine-tune language models

Next, link your chatbot securely to CRM systems via APIs. Finally, establish escalation rules that trigger human intervention for complex cases.

Before launch, bake in privacy and compliance:

Role-based access controls on conversation logs

Encryption of messages both in transit and at rest

Regular audits of AI decisions and data handling

Align these measures with GDPR, SOC 2, and local financial regulations. Transparent consent banners and embedded audit trails boost customer trust.

Platforms like Nolana unify chat flows with core banking and policy systems for a truly seamless experience.

Predictive Outreach And Insights

Studying past interactions reveals behavior patterns you can’t see in real time. It’s like having a window into customer needs before they pick up the phone. AI customer care platforms use these insights to proactively engage.

Automate payment reminders when a due date approaches

Suggest tailored products as you detect interest signals

Schedule follow-ups after policy renewals or major transactions

One regional bank used sentiment triggers to cut escalations by 45%, while boosting its Net Promoter Score by 15 points. Proactive care doesn’t just solve problems—it drives growth.

Continuous Improvement And Feedback

Ongoing excellence relies on tracking the right KPIs and acting on what you learn. Tying feedback from claims ai reviews into customer care models creates a virtuous cycle.

KPI | Bank Outcome | Insurer Outcome |

|---|---|---|

First Contact Resolution | 90% | 85% |

Call Volume Reduction | 60% | 55% |

Customer Satisfaction Lift | 20% | 18% |

Monitor metrics like handle time, escalation rate, and post-chat satisfaction scores. Feed insights back into regular model retraining.

Empower your teams with targeted training:

Hands-on workshops using anonymized chat transcripts

Reviews of key metrics—resolution time, customer satisfaction, escalation volume

Updated SOPs that reflect AI-assisted workflows

A culture of continuous learning and clear governance turns AI into a trusted teammate for frontline staff.

Discover how Nolana’s AI-native framework integrates with ServiceNow, Salesforce, and Genesys.

Contact the team to start the journey.

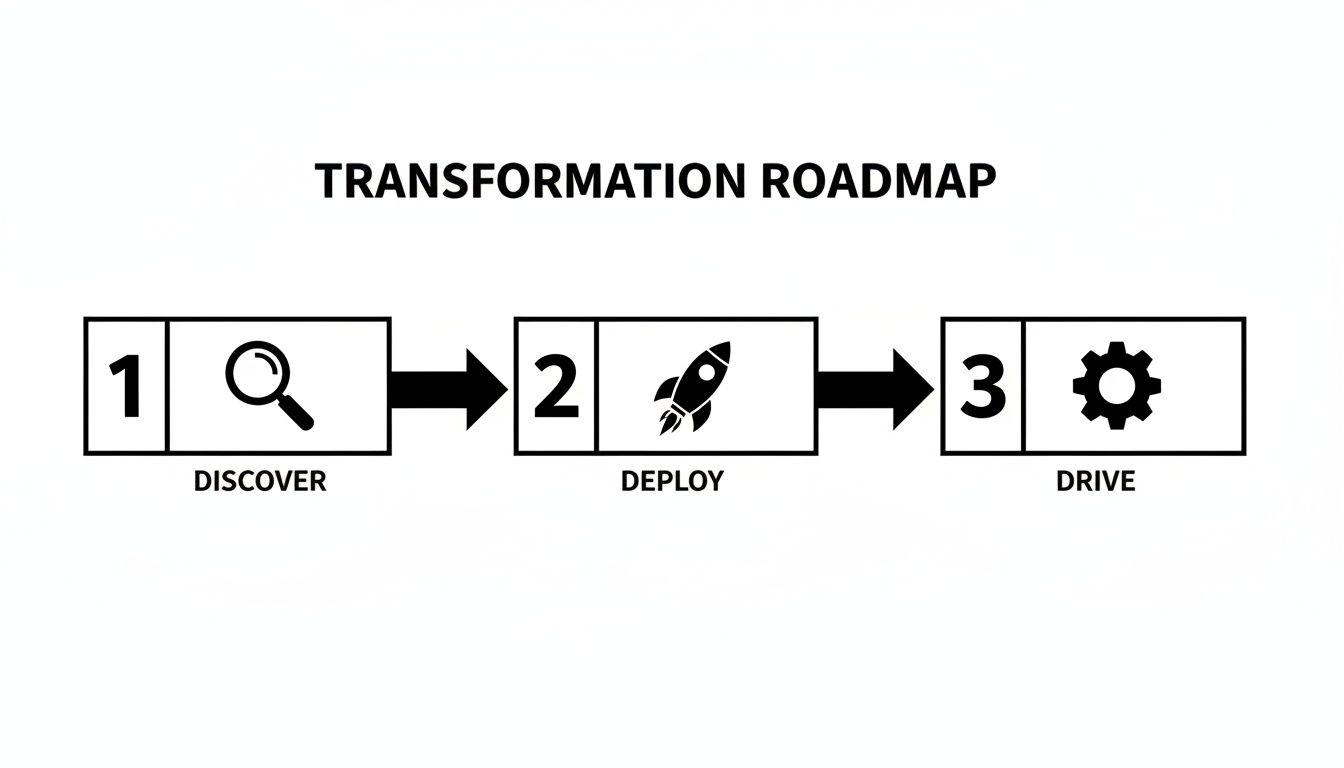

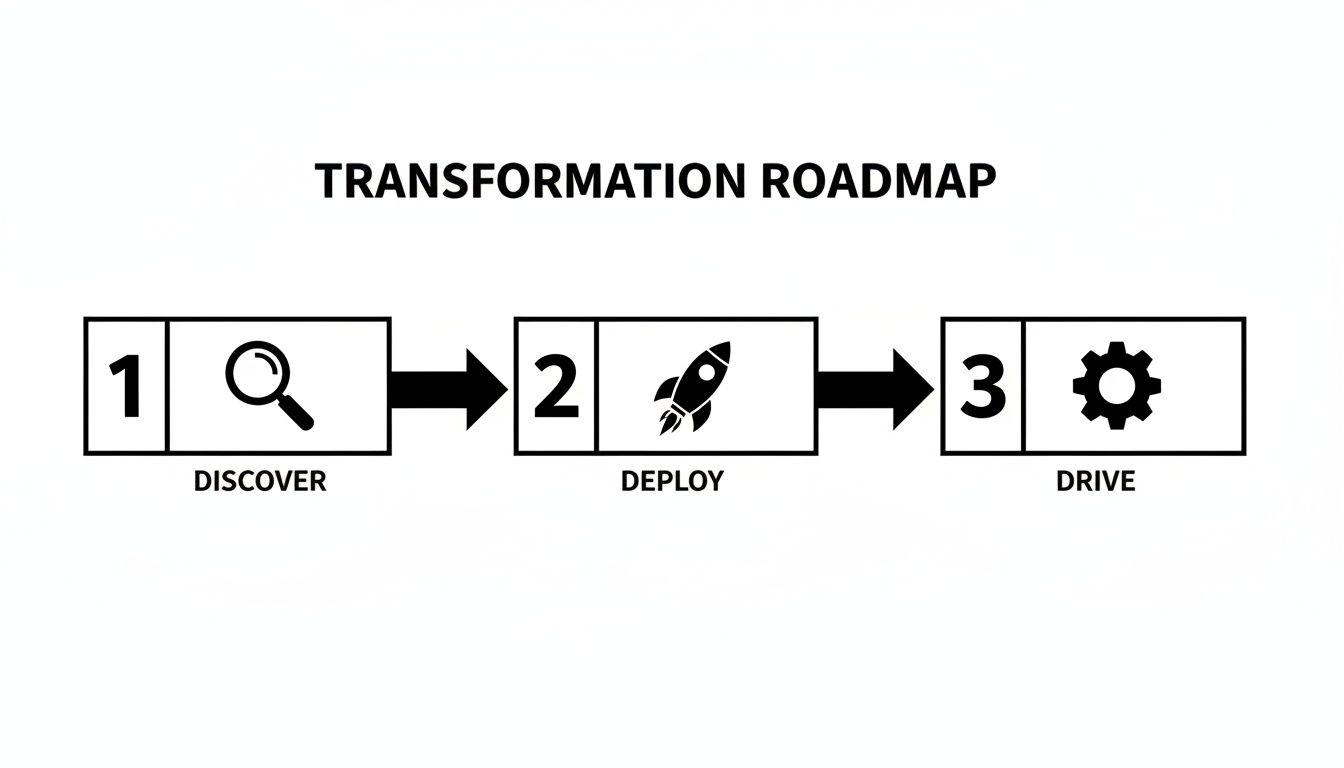

Rolling Out A Transformation Roadmap

Turning a high-level digital vision into concrete results takes more than enthusiasm—it needs a clear, phased plan. Picture it as three acts: Discover, Deploy, and Drive Continuous Improvement. Each phase balances fast wins—like claims automation with robust claims ai reviews—with governance to keep models honest over time.

The roadmap prioritizes the most impactful AI initiatives, from claims automation to AI customer care. It’s designed to capture quick ROI while laying down policies and processes for the long haul.

Discover Phase

In this opening movement, teams map existing workflows and hunt down pain points. Stakeholders come together to draft project charters and standard operating procedures (SOPs). Along the way, they gauge data readiness, integration touchpoints, and the organization’s appetite for change—just like top ai insurance companies do.

Define scope and objectives with executive sponsors for clear accountability.

Gather process maps and system inventories to spot inefficiencies.

Score use cases by effort, cost savings, and compliance risk.

This step highlights where AI insurance companies stand to gain the most value.

The infographic shows how Discover feeds rapid pilots, Deploy scales proven workflows, and Drive Continuous Improvement embeds ongoing optimization.

Deploy Phase

Once Discovery wraps, it’s time to pilot and validate. Teams use ready-made templates for charters, SOPs, and KPI dashboards, then plug AI models into core systems through APIs.

Launch pilots on low-risk, high-volume processes like simple claims ai reviews.

Monitor performance against KPIs such as cycle time and accuracy.

Secure budgets for model upkeep and assign owners to manage updates.

Integration with CRM and policy platforms powers AI customer care at scale. Real-time dashboards flag issues before they ripple out to customers.

Drive Continuous Improvement

The final phase turns pilots into institutional muscle. Feedback loops, governance checks, and change-management rituals keep the momentum going. Successful pilots expand across regions and product lines, while teams record lessons in a shared knowledge base.

Conduct quarterly model audits to catch drift and bias in claims ai reviews.

Update SOPs based on user feedback and performance data.

Record lessons learned in a centralized knowledge base.

“Continuous iteration drove a 30% boost in SLA adherence within six months,” says a transformation lead.

This phase cements a cycle of measurement, learning, and scaling for lasting impact.

Governance And Budgeting

Strong executive backing ensures steady funding and visibility. Define budgets for ongoing model tuning, staff training, and license renewals. Governance forums then meet regularly to review performance dashboards and greenlight expansions.

Establish steering committees with IT, risk, and operations leads to oversee AI initiatives.

With clear roles and budgets, pilots evolve into enterprise-wide standards backed by accountability.

Change Management Plans

Moving fast is great, but adoption is non-negotiable. A solid change management plan includes tailored communications, hands-on training, and dedicated support channels.

Roll out training workshops using real claims ai reviews to demonstrate improvements.

Publish change playbooks and video guides in internal portals for easy access.

Schedule monthly cross-team reviews to share successes and adjust timelines.

This roadmap equips leaders to achieve measurable impact in financial services digital transformation. Next, we’ll dive into measuring impact and governance routines in detail.

Measuring Business Impact And Ensuring Governance

Think of your digital transformation effort as a ship at sea: without a clear compass, you risk drifting off course. Tracking real-time metrics keeps everyone aligned, from boardroom strategy down to daily operations.

In this section, we zero in on the most telling numbers for banks and insurers—claims ai reviews and AI customer care—and how executive dashboards tie it all together.

Key Performance Indicators

When you focus on the right KPIs, you can steer projects confidently. Here are the metrics that matter most:

Claims Processing Time Reduction

Measures the percentage drop in average claim cycle times after AI tools go live.Cost Savings Per Claim

Tracks the dollar value saved by automating document reviews and payouts.Customer Satisfaction Score

Captures policyholder feedback on speed and accuracy once AI customer care handles service queries.Model Accuracy Rate

Shows the share of correct predictions in fraud detection and document classification, including claims ai reviews accuracy.

These figures serve as your dashboard’s heartbeat, letting you know if you’re pacing toward strategic goals.

Key Metrics For Transformation Success

Below is a quick reference table to benchmark progress and set realistic ambitions. Use it as a starting point, then refine targets based on your own history and industry norms.

KPI | Definition | Target Metric |

|---|---|---|

Claims Processing Time Reduction | Percentage decrease in average claim cycle time | 50% |

Cost Savings Per Claim | Average cost saved per automated claim | $15 |

Customer Satisfaction Score | Average net promoter score post-AI service | 75 |

Model Accuracy Rate | Rate of correct AI predictions on sample tests | 90% |

This table lays out clear milestones. Keep these in view as you build out your monitoring tools.

73% of transformation leaders say real-time dashboards are essential for control and transparency.

Next up: how to bring these metrics into a single, actionable view.

Building Executive Dashboards

Imagine stepping into an aircraft cockpit: all your instruments are in one place, ready to guide your next move. An executive dashboard works the same way for digital transformation.

First, bring in your claims ai review logs and AI customer care feeds. Then:

Map exceptions and outliers so nothing slips by.

Layer visual alerts on spikes in processing times or service tickets.

Filter data by region, product line, or risk category for deeper insights.

The screenshot below shows how quickly you can spot erratic claims volumes or dips in customer service performance.

With this cockpit in place, teams respond faster and keep projects on track.

Governance And Audit Routines

Strong controls are your north star for compliance and risk management. Build audit routines that:

Record every AI decision in immutable event logs.

Run quarterly bias checks to catch model drift in fraud detection and document review.

Encrypt data at rest and in transit to satisfy GDPR and SOC 2 Type II requirements.

Automate compliance report generation for regulators and internal stakeholders.

These steps lock in accountability and help you pass any surprise audit with confidence.

Setting Target Thresholds

Benchmarks must balance ambition with reality. For instance, many insurers aim for a 40% cut in claim cycle time within six months. Meanwhile, a customer satisfaction score north of 80 usually signals healthy engagement, and 95% model accuracy keeps error rates low.

To define your own thresholds:

Review legal and regulatory guardrails so you stay compliant.

Compare results against peer institutions to spot improvement areas.

Run simulations to see how targets play out under different scenarios.

Revisit goals quarterly, adjusting for new data and audit findings.

Clear thresholds drive accountability and focus your improvement efforts.

Continuous Governance Loops

A single review isn’t enough. Close the loop by feeding performance data back into your processes. Each cycle ends with:

A documented action plan.

An assigned owner.

A timeline for re-evaluation.

For real-time alerts and workflow adjustments, consider using Nolana dashboards. Automated notifications keep teams on exception handling, not busywork.

Executive Reporting Cadence

Regular updates ensure stakeholders stay aligned and invested:

Weekly: Quick summaries of key KPI trends and any red flags.

Monthly: Cross-functional meetings to dig into insights and next steps.

Quarterly: Strategic reviews to realign budgets and priorities.

A predictable rhythm keeps everyone in sync—and transformation on course.

FAQ

1. What Is Financial Services Digital Transformation And Why Is It Crucial?

Financial services digital transformation is the process of weaving AI, cloud computing and automation into everyday operations. It slashes manual handoffs in claims processing and customer support, freeing teams to tackle more complex issues. At the same time, built-in audit trails satisfy regulators with clear, timestamped records.

2. How Can AI Customer Care Boost Client Satisfaction?

Picture a concierge who never sleeps. Virtual agents equipped with sentiment analysis pick up on frustration, adapt responses and deliver personalized service around the clock. By anticipating needs, these tools defuse problems before they escalate and deepen client loyalty.

24/7 Support: Virtual agents handle routine questions instantly.

Predictive Outreach: Sends relevant offers before the customer asks.

Sentiment Alerts: Flags at-risk clients for a personal follow-up.

Best Practices

Define a robust intent library to train your virtual assistant and reduce misrouted requests.

Incorporate claims ai reviews early to measure handover quality and refine performance.

Integrate directly with your CRM to keep data consistent across channels.

3. What Are The First Steps To Automate Insurance Claims?

Start with a pilot focused on straightforward, high-volume claims to learn quickly without risking complex cases. Apply AI for document parsing and fraud detection, then set KPIs around processing speed and accuracy. Use regular claims ai reviews to fine-tune your models and workflows.

4. How Do You Measure ROI On Transformation Efforts?

Zoom in on metrics like cycle-time reduction, cost savings per claim and customer satisfaction scores. Real-time dashboards let you adjust investments on the fly based on what’s working. Finally, balance these financial gains against compliance checks and client feedback for a full picture.

80% faster claim cycle times and 30% cost cuts illustrate real gains in financial services digital transformation.

Ready to power your automation journey? Learn how Nolana can accelerate claims AI reviews and AI customer care in regulated environments.

Get started today with a free demo.

Overview Of Insurance Claims And AI Customer Care

Switching from paper forms and back-and-forth emails to intelligent AI customer care workflows doesn’t just speed things up—it changes the game. By embedding AI into customer care and claims processing, ai insurance companies transform lengthy approval cycles into near-instant decisions.

Here’s what organizations are seeing:

Speed Gains: Claim cycles fall from weeks to just hours with AI analysis.

Accuracy Boost: AI-driven claims ai reviews check documents with up to 95% precision.

Cost Reduction: Automated workflows drive down expenses by 30%.

AI Customer Care: 24/7 intelligent support lifts satisfaction scores through real-time assistance.

To illustrate the shift, here’s a side-by-side look at legacy versus AI-powered processes.

Overview Of Transformation Benefits

Aspect | Traditional Process | AI-Enabled Outcome |

|---|---|---|

Speed | Weeks-long approval cycles | Hours-long AI-powered claims ai reviews |

Accuracy | Manual review prone to errors | 95% document validation via AI claims review |

Cost | High staffing and printing expenses | 30% lower operational costs |

User Experience | Delayed updates and opaque status calls | Real-time notifications and self-service via AI customer care |

By comparing each side, it’s clear how AI reshapes efficiency, accuracy, and customer engagement.

Legacy Limitations Versus AI Possibilities

Old systems juggle siloed data and require manual handoffs at every stage. That often means missed details and frustrated policyholders. Top ai insurance companies have moved beyond these constraints.

In contrast, AI agents act like orchestration hubs. They pull information together, trigger necessary tasks instantly, and flag exceptions without human intervention.

80% cycle time reduction ensures faster settlements and happier customers.

This dynamic monitoring transforms a static, paper-heavy process into a live, transparent workflow.

Immediate Benefits For Leaders

Grants executives a clear line of sight through real-time dashboards and data-driven alerts, including AI customer care insights.

Cuts out routine approvals so teams can tackle complex cases faster.

Delivers measurable ROI via shorter cycle times, superior claims ai reviews, and lower operational costs.

With these gains, decision-makers understand why integrating AI into claims reviews and customer care isn’t optional. It’s a strategic move that drives tangible business impact.

Understanding The Key Concepts

Digital transformation in financial services means aligning advanced technologies with core business goals in banking and insurance. It brings together AI-native platforms, agentic automation, and cloud-native infrastructure to make processes faster and more reliable. Many ai insurance companies are already leveraging these capabilities.

Imagine an AI agent working like a veteran claims adjuster who never needs a break. Think of automation as a precision assembly line that repeats tasks without error. By breaking down these pieces, you’ll see how new tech—like claims ai reviews—translates into quicker decisions, stronger controls, and more satisfying experiences for policyholders.

This mindset also guides vendor selection, shapes governance models, and informs change-management practices.

Core Platform Components

AI-native platforms house compliant agents trained on standard operating procedures. They gather data, offer recommendations, and carry out routine workflows. Agentic automation strings together multi-step processes, cutting down on manual touchpoints. Meanwhile, cloud-native infrastructure scales on demand and keeps systems available day and night. Integration layers tie together policy engines, billing systems, and CRM tools for a seamless flow of information.

AI Agents reduce manual review and accelerate claims ai reviews by up to 80%.

Integration Layers bridge legacy core systems to modern, API-driven services.

Compliance Modules log every action to satisfy regulatory audits.

Together, these elements form a cohesive architecture that drives end-to-end automation.

Drivers Of Transformation

Strict regulations, fierce competition, and rising customer expectations are pushing banks and insurers to adopt AI customer care and automated claims processing. Leading ai insurance companies are racing to stay ahead.

Here’s how the numbers stack up:

Metric | Value |

|---|---|

Global DX Spending by 2027 | $4 trillion |

CAGR (2023–2027) | 16.2% |

Increase Since 2023 | 55% |

Financial Services Digital Score | 4.5 |

Source: Data Transformation Challenge Statistics

4.5 digitalization score illustrates why ai insurance companies are doubling down on digital roadmaps.

These figures translate into clear expectations for IT and operations teams.

Strategic Outcome Linkages

Connecting AI-native components to customer channels delivers measurable impact:

Faster claim settlements boost policyholder satisfaction through advanced claims ai reviews.

Automated triage cuts operational costs by around 30%.

Real-time dashboards empower leaders with actionable insights, including AI customer care metrics.

Personalized, proactive outreach improves retention.

These metrics form the strategic framework your executive team can use to build KPI dashboards, shape change-management plans, and pick the right implementation partners. Governance and compliance stay front and center throughout the journey.

Preparing For Action

With these concepts in place, leaders can see why digital transformation is essential for financial services. Next up: automating insurance claims with AI and rolling out AI customer care platforms. We’ll explore high-impact use cases like computer vision damage assessment and NLP-driven intake, plus data governance best practices and pilot frameworks. Detailed performance metrics await in the following section. Stay tuned!

Automating Insurance Claims With AI

Insurers can now take a claim from the first notice of loss to settlement in hours instead of weeks using advanced claims ai reviews. AI drives faster, more accurate damage assessments, zips through paperwork, and flags suspicious patterns.

That means fewer manual handoffs, happier customers, and leaner operating budgets. One mid-sized carrier, for instance, saw its cycle time collapse from weeks to mere hours—letting staff focus on the toughest, exception-based cases.

Claims processing times can shrink by 80%, shifting employees from routine tasks to high-judgment roles. Learn more about AI’s impact on processing times in financial services in the report findings.

Damage Assessment With Computer Vision

With computer vision, a single photo or video becomes a detailed damage report in seconds. The system cross-references each image against a library of past claims, flags unusual patterns, and projects repair costs. As a result, onsite visits from human adjusters drop dramatically and payouts happen sooner. Leading ai insurance companies leverage this to reduce operational overhead.

High-resolution image processing detects dents, cracks, and water damage automatically.

Predictive models assign severity scores with 95% confidence, speeding up go/no-go decisions.

Policyholders can snap photos in a mobile app and get a repair estimate on the spot.

“Computer vision acts like an expert adjuster that never needs a break,” says a claims operations lead.

NLP For Intake And Document Review

When claims arrive by email, fax, or even a recorded phone call, NLP springs into action. It pulls out dates, policy numbers, claim amounts, and other key details, then hands off a clean summary to your team. The result is fewer typos, less manual copy-and-paste, and a smoother handoff down the line—improving the quality of claims ai reviews.

Automated classification of claim types improves routing accuracy.

Entity extraction populates policy numbers, incident dates, and claimant details.

Anomaly detection flags odd or suspicious entries based on historical patterns.

Phase | AI Technique | Outcome |

|---|---|---|

Intake | NLP-driven form parsing | 90% Reduction in Data Errors |

Document Review | Semantic analysis | 70% Faster Document Validation |

Fraud Detection | Predictive analytics | 30% Fewer False Positives |

Taken together, these methods bring consistency and visibility to every step of the review.

Pilot Framework To Evaluate Claims AI Solutions

Before rolling out AI at scale, run a focused pilot to keep risk in check and prove ROI. Start with high-volume, low-complexity claims so you can capture clean performance benchmarks. That test bed gives you a safe space to integrate with policy databases and billing systems without disrupting daily operations.

Define objectives and success metrics—cycle time, accuracy in claims ai reviews, cost per claim.

Select representative claim samples and record current cycle times for a baseline.

Deploy AI models in a sandbox, connecting to core systems via APIs.

Track results in real time and tweak rules or workflows based on feedback.

Integration is key: your AI agents should talk directly to policy engines, CRM platforms, and billing modules.

Connect with RESTful APIs for instant data updates.

Automate handoffs via event-driven flows.

Use middleware layers to capture audit trails and ensure compliance.

Data Governance And Integration Best Practices

Good governance is the backbone of any automated claims system. It starts with secure pipelines and strict access controls to keep data clean and private. Then schedule model retraining on fresh claim batches to maintain accuracy and guard against bias in claims ai reviews.

Use end-to-end data lineage tracking so you can trace every decision.

Encrypt data in motion and at rest to satisfy GDPR and SOC 2 Type II.

Run regular bias audits to catch and correct any model drift.

With secure data flows and clear governance, insurers can roll out AI at scale. This groundwork extends beyond claims, paving the way for AI-enabled customer care. Platforms like Nolana help coordinate compliant AI agents across claims and service workflows, ensuring smooth escalations and audit trails.

AI insurance companies adopt innovations.

Deploying AI Customer Care

Every customer interaction is a chance to build loyalty. Gone are the days of one-size-fits-all scripts. Instead, AI-driven platforms power conversations that adapt on the fly—helping banks and insurers resolve issues faster and more accurately. This is the future of AI customer care in financial services.

These systems can deliver up to 90% first-contact resolution.

24/7 virtual assistants that handle balance checks, transaction queries, and routine requests

Real-time sentiment analysis to flag urgent or high-value interactions

Proactive outreach suggesting relevant products based on behavior signals

65% of inquiries wrap up without human intervention, according to recent claims ai reviews.

Consider a major insurer that rolled out a smart chatbot integrated with its CRM. Within six months, call volume dropped by 60%, thanks to early detection of issues and seamless handoffs. Results like this explain why insurers are automating end-to-end customer care. Leading ai insurance companies are using AI customer care to reduce churn and boost NPS.

Key design elements include:

Context retention so bots remember past exchanges

Fallback mechanisms that smoothly hand off to humans

Feedback loops for continuous language refinement

These features keep conversations fluid and customer-centric, while live data drives ongoing improvement.

Designing Natural Conversation Flows

Start by mapping the most frequent inquiries—account status, payment dates, claim updates. Then:

Define clear intents and craft responses that convey genuine empathy

Use context windows to recall prior messages for more personal replies

Incorporate real user feedback (for example, from claims ai reviews) to fine-tune language models

Next, link your chatbot securely to CRM systems via APIs. Finally, establish escalation rules that trigger human intervention for complex cases.

Before launch, bake in privacy and compliance:

Role-based access controls on conversation logs

Encryption of messages both in transit and at rest

Regular audits of AI decisions and data handling

Align these measures with GDPR, SOC 2, and local financial regulations. Transparent consent banners and embedded audit trails boost customer trust.

Platforms like Nolana unify chat flows with core banking and policy systems for a truly seamless experience.

Predictive Outreach And Insights

Studying past interactions reveals behavior patterns you can’t see in real time. It’s like having a window into customer needs before they pick up the phone. AI customer care platforms use these insights to proactively engage.

Automate payment reminders when a due date approaches

Suggest tailored products as you detect interest signals

Schedule follow-ups after policy renewals or major transactions

One regional bank used sentiment triggers to cut escalations by 45%, while boosting its Net Promoter Score by 15 points. Proactive care doesn’t just solve problems—it drives growth.

Continuous Improvement And Feedback

Ongoing excellence relies on tracking the right KPIs and acting on what you learn. Tying feedback from claims ai reviews into customer care models creates a virtuous cycle.

KPI | Bank Outcome | Insurer Outcome |

|---|---|---|

First Contact Resolution | 90% | 85% |

Call Volume Reduction | 60% | 55% |

Customer Satisfaction Lift | 20% | 18% |

Monitor metrics like handle time, escalation rate, and post-chat satisfaction scores. Feed insights back into regular model retraining.

Empower your teams with targeted training:

Hands-on workshops using anonymized chat transcripts

Reviews of key metrics—resolution time, customer satisfaction, escalation volume

Updated SOPs that reflect AI-assisted workflows

A culture of continuous learning and clear governance turns AI into a trusted teammate for frontline staff.

Discover how Nolana’s AI-native framework integrates with ServiceNow, Salesforce, and Genesys.

Contact the team to start the journey.

Rolling Out A Transformation Roadmap

Turning a high-level digital vision into concrete results takes more than enthusiasm—it needs a clear, phased plan. Picture it as three acts: Discover, Deploy, and Drive Continuous Improvement. Each phase balances fast wins—like claims automation with robust claims ai reviews—with governance to keep models honest over time.

The roadmap prioritizes the most impactful AI initiatives, from claims automation to AI customer care. It’s designed to capture quick ROI while laying down policies and processes for the long haul.

Discover Phase

In this opening movement, teams map existing workflows and hunt down pain points. Stakeholders come together to draft project charters and standard operating procedures (SOPs). Along the way, they gauge data readiness, integration touchpoints, and the organization’s appetite for change—just like top ai insurance companies do.

Define scope and objectives with executive sponsors for clear accountability.

Gather process maps and system inventories to spot inefficiencies.

Score use cases by effort, cost savings, and compliance risk.

This step highlights where AI insurance companies stand to gain the most value.

The infographic shows how Discover feeds rapid pilots, Deploy scales proven workflows, and Drive Continuous Improvement embeds ongoing optimization.

Deploy Phase

Once Discovery wraps, it’s time to pilot and validate. Teams use ready-made templates for charters, SOPs, and KPI dashboards, then plug AI models into core systems through APIs.

Launch pilots on low-risk, high-volume processes like simple claims ai reviews.

Monitor performance against KPIs such as cycle time and accuracy.

Secure budgets for model upkeep and assign owners to manage updates.

Integration with CRM and policy platforms powers AI customer care at scale. Real-time dashboards flag issues before they ripple out to customers.

Drive Continuous Improvement

The final phase turns pilots into institutional muscle. Feedback loops, governance checks, and change-management rituals keep the momentum going. Successful pilots expand across regions and product lines, while teams record lessons in a shared knowledge base.

Conduct quarterly model audits to catch drift and bias in claims ai reviews.

Update SOPs based on user feedback and performance data.

Record lessons learned in a centralized knowledge base.

“Continuous iteration drove a 30% boost in SLA adherence within six months,” says a transformation lead.

This phase cements a cycle of measurement, learning, and scaling for lasting impact.

Governance And Budgeting

Strong executive backing ensures steady funding and visibility. Define budgets for ongoing model tuning, staff training, and license renewals. Governance forums then meet regularly to review performance dashboards and greenlight expansions.

Establish steering committees with IT, risk, and operations leads to oversee AI initiatives.

With clear roles and budgets, pilots evolve into enterprise-wide standards backed by accountability.

Change Management Plans

Moving fast is great, but adoption is non-negotiable. A solid change management plan includes tailored communications, hands-on training, and dedicated support channels.

Roll out training workshops using real claims ai reviews to demonstrate improvements.

Publish change playbooks and video guides in internal portals for easy access.

Schedule monthly cross-team reviews to share successes and adjust timelines.

This roadmap equips leaders to achieve measurable impact in financial services digital transformation. Next, we’ll dive into measuring impact and governance routines in detail.

Measuring Business Impact And Ensuring Governance

Think of your digital transformation effort as a ship at sea: without a clear compass, you risk drifting off course. Tracking real-time metrics keeps everyone aligned, from boardroom strategy down to daily operations.

In this section, we zero in on the most telling numbers for banks and insurers—claims ai reviews and AI customer care—and how executive dashboards tie it all together.

Key Performance Indicators

When you focus on the right KPIs, you can steer projects confidently. Here are the metrics that matter most:

Claims Processing Time Reduction

Measures the percentage drop in average claim cycle times after AI tools go live.Cost Savings Per Claim

Tracks the dollar value saved by automating document reviews and payouts.Customer Satisfaction Score

Captures policyholder feedback on speed and accuracy once AI customer care handles service queries.Model Accuracy Rate

Shows the share of correct predictions in fraud detection and document classification, including claims ai reviews accuracy.

These figures serve as your dashboard’s heartbeat, letting you know if you’re pacing toward strategic goals.

Key Metrics For Transformation Success

Below is a quick reference table to benchmark progress and set realistic ambitions. Use it as a starting point, then refine targets based on your own history and industry norms.

KPI | Definition | Target Metric |

|---|---|---|

Claims Processing Time Reduction | Percentage decrease in average claim cycle time | 50% |

Cost Savings Per Claim | Average cost saved per automated claim | $15 |

Customer Satisfaction Score | Average net promoter score post-AI service | 75 |

Model Accuracy Rate | Rate of correct AI predictions on sample tests | 90% |

This table lays out clear milestones. Keep these in view as you build out your monitoring tools.

73% of transformation leaders say real-time dashboards are essential for control and transparency.

Next up: how to bring these metrics into a single, actionable view.

Building Executive Dashboards

Imagine stepping into an aircraft cockpit: all your instruments are in one place, ready to guide your next move. An executive dashboard works the same way for digital transformation.

First, bring in your claims ai review logs and AI customer care feeds. Then:

Map exceptions and outliers so nothing slips by.

Layer visual alerts on spikes in processing times or service tickets.

Filter data by region, product line, or risk category for deeper insights.

The screenshot below shows how quickly you can spot erratic claims volumes or dips in customer service performance.

With this cockpit in place, teams respond faster and keep projects on track.

Governance And Audit Routines

Strong controls are your north star for compliance and risk management. Build audit routines that:

Record every AI decision in immutable event logs.

Run quarterly bias checks to catch model drift in fraud detection and document review.

Encrypt data at rest and in transit to satisfy GDPR and SOC 2 Type II requirements.

Automate compliance report generation for regulators and internal stakeholders.

These steps lock in accountability and help you pass any surprise audit with confidence.

Setting Target Thresholds

Benchmarks must balance ambition with reality. For instance, many insurers aim for a 40% cut in claim cycle time within six months. Meanwhile, a customer satisfaction score north of 80 usually signals healthy engagement, and 95% model accuracy keeps error rates low.

To define your own thresholds:

Review legal and regulatory guardrails so you stay compliant.

Compare results against peer institutions to spot improvement areas.

Run simulations to see how targets play out under different scenarios.

Revisit goals quarterly, adjusting for new data and audit findings.

Clear thresholds drive accountability and focus your improvement efforts.

Continuous Governance Loops

A single review isn’t enough. Close the loop by feeding performance data back into your processes. Each cycle ends with:

A documented action plan.

An assigned owner.

A timeline for re-evaluation.

For real-time alerts and workflow adjustments, consider using Nolana dashboards. Automated notifications keep teams on exception handling, not busywork.

Executive Reporting Cadence

Regular updates ensure stakeholders stay aligned and invested:

Weekly: Quick summaries of key KPI trends and any red flags.

Monthly: Cross-functional meetings to dig into insights and next steps.

Quarterly: Strategic reviews to realign budgets and priorities.

A predictable rhythm keeps everyone in sync—and transformation on course.

FAQ

1. What Is Financial Services Digital Transformation And Why Is It Crucial?

Financial services digital transformation is the process of weaving AI, cloud computing and automation into everyday operations. It slashes manual handoffs in claims processing and customer support, freeing teams to tackle more complex issues. At the same time, built-in audit trails satisfy regulators with clear, timestamped records.

2. How Can AI Customer Care Boost Client Satisfaction?

Picture a concierge who never sleeps. Virtual agents equipped with sentiment analysis pick up on frustration, adapt responses and deliver personalized service around the clock. By anticipating needs, these tools defuse problems before they escalate and deepen client loyalty.

24/7 Support: Virtual agents handle routine questions instantly.

Predictive Outreach: Sends relevant offers before the customer asks.

Sentiment Alerts: Flags at-risk clients for a personal follow-up.

Best Practices

Define a robust intent library to train your virtual assistant and reduce misrouted requests.

Incorporate claims ai reviews early to measure handover quality and refine performance.

Integrate directly with your CRM to keep data consistent across channels.

3. What Are The First Steps To Automate Insurance Claims?

Start with a pilot focused on straightforward, high-volume claims to learn quickly without risking complex cases. Apply AI for document parsing and fraud detection, then set KPIs around processing speed and accuracy. Use regular claims ai reviews to fine-tune your models and workflows.

4. How Do You Measure ROI On Transformation Efforts?

Zoom in on metrics like cycle-time reduction, cost savings per claim and customer satisfaction scores. Real-time dashboards let you adjust investments on the fly based on what’s working. Finally, balance these financial gains against compliance checks and client feedback for a full picture.

80% faster claim cycle times and 30% cost cuts illustrate real gains in financial services digital transformation.

Ready to power your automation journey? Learn how Nolana can accelerate claims AI reviews and AI customer care in regulated environments.

Get started today with a free demo.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP