AI in Insurance Claims: A Guide to Automation and Customer Care

AI in Insurance Claims: A Guide to Automation and Customer Care

Explore how AI is revolutionizing insurance claims. This guide covers automation, AI customer care, and implementation for modern AI insurance companies.

No customer wants to face a mountain of paperwork right after a loss. For years, the insurance claims process has been notoriously slow and manual, but that's finally changing. A smarter, AI-driven model isn't just an upgrade—it's becoming a necessity for AI insurance companies, driven by customers who expect instant service and a sharp increase in claims from major disruptive events. Automating insurance claims with AI is no longer a futuristic concept; it's a present-day reality.

The End of the Traditional Insurance Claims Process

The very DNA of insurance is being rewritten. For decades, the claims lifecycle was a predictable, often frustrating, sequence of phone calls, paperwork, and waiting. A customer would report an incident, an adjuster would eventually show up, and a settlement check might arrive weeks or even months later. In a world of on-demand everything, that model just doesn't work anymore.

It's like moving from a horse-drawn carriage to a self-driving car. The destination—a settled claim—is the same, but the speed, efficiency, and overall experience are worlds apart. AI insurance companies aren't just swapping out old tools for new ones; they're redesigning the entire journey to be faster, more accurate, and built around superior AI customer care.

Forces Driving Industry Change

Several powerful trends are pushing this transition forward. The industry is under immense pressure from all sides, making automation less of a "nice-to-have" and more of a core survival strategy, especially for financial services.

Rising Customer Expectations: Modern consumers are used to the instant gratification of digital services. They simply won't tolerate long hold times and confusing processes. They expect the same level of AI customer care from their insurer that they get from their bank or favorite online retailer.

Increasing Claim Volume: Climate change is fueling more frequent and severe natural catastrophes. Over the last decade, the global insurance protection gap for these events hit a staggering 60%. Economic losses of $2.3 trillion dwarfed the $944 billion that was actually covered by insurance.

Operational Inefficiency: Let's be honest: manual processing is expensive and riddled with potential for human error. To really grasp how much AI changes the game, it helps to understand the sheer complexity of the traditional home insurance claims process.

The future of claims isn't just about cutting costs. It's about fundamentally redefining the customer relationship at its most critical moment. AI gives insurers the ability to deliver on their promise with empathy and speed, right when policyholders need them the most.

This kind of fundamental shift takes more than just new software; it requires a whole new way of thinking about operations. By exploring modern claims AI reviews and solutions, carriers can find the right partners to help them navigate this transition. The goal is to build a resilient, responsive system that serves customers brilliantly while managing risk. If you're looking to strengthen your operational backbone, you might find our deep dive on modern claims management systems helpful.

How AI Is Rebuilding the Claims Lifecycle

The days of endless paperwork and long waits are numbered. Automating insurance claims with AI is fundamentally reshaping the process, creating an experience that's faster, more accurate, and far more customer-friendly. This isn't just a concept on a whiteboard; it's a real-world operational shift happening right now.

And it couldn't come at a better time. Claim volumes are surging. In the first half of 2025 alone, insured losses from natural disasters hit a staggering $100 billion globally. The United States was on the hook for over 90% of that total, which represented a 40% jump from the previous year. Those numbers put immense pressure on carriers to handle claims with speed and precision.

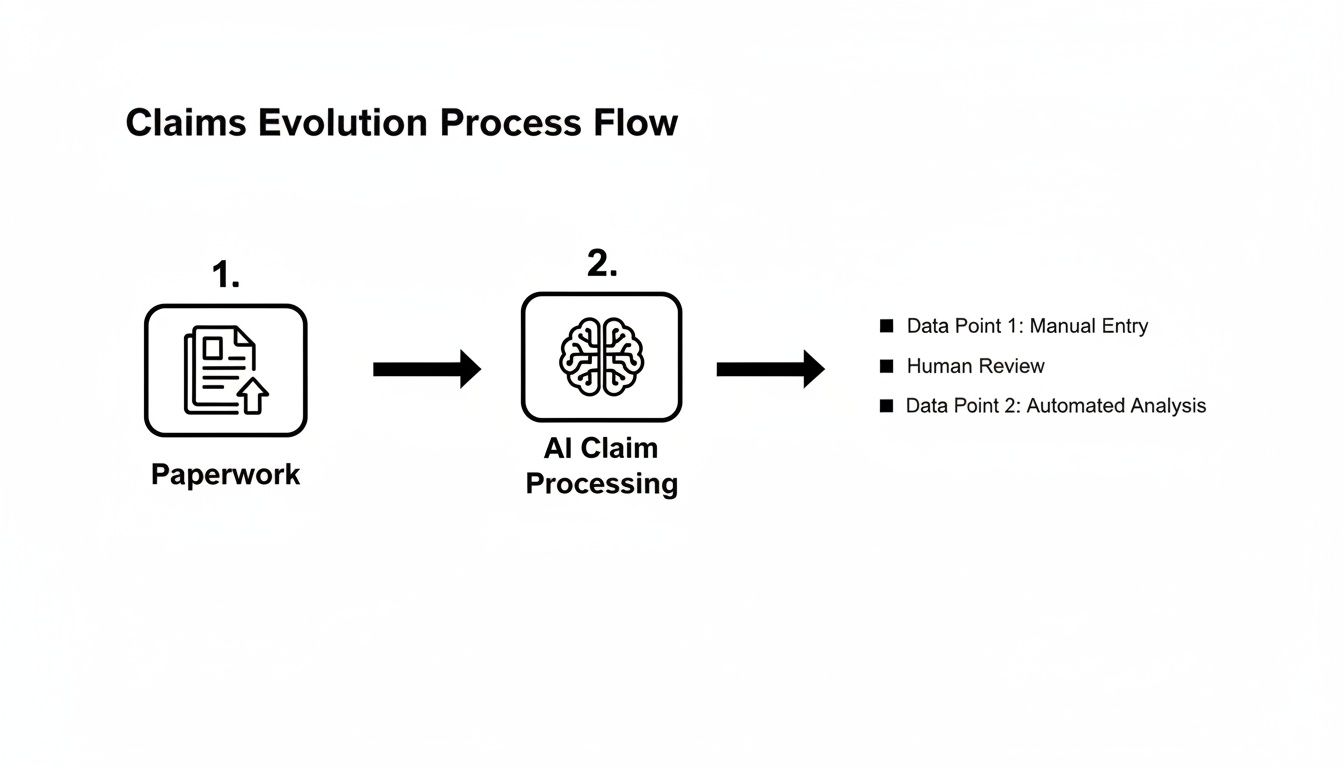

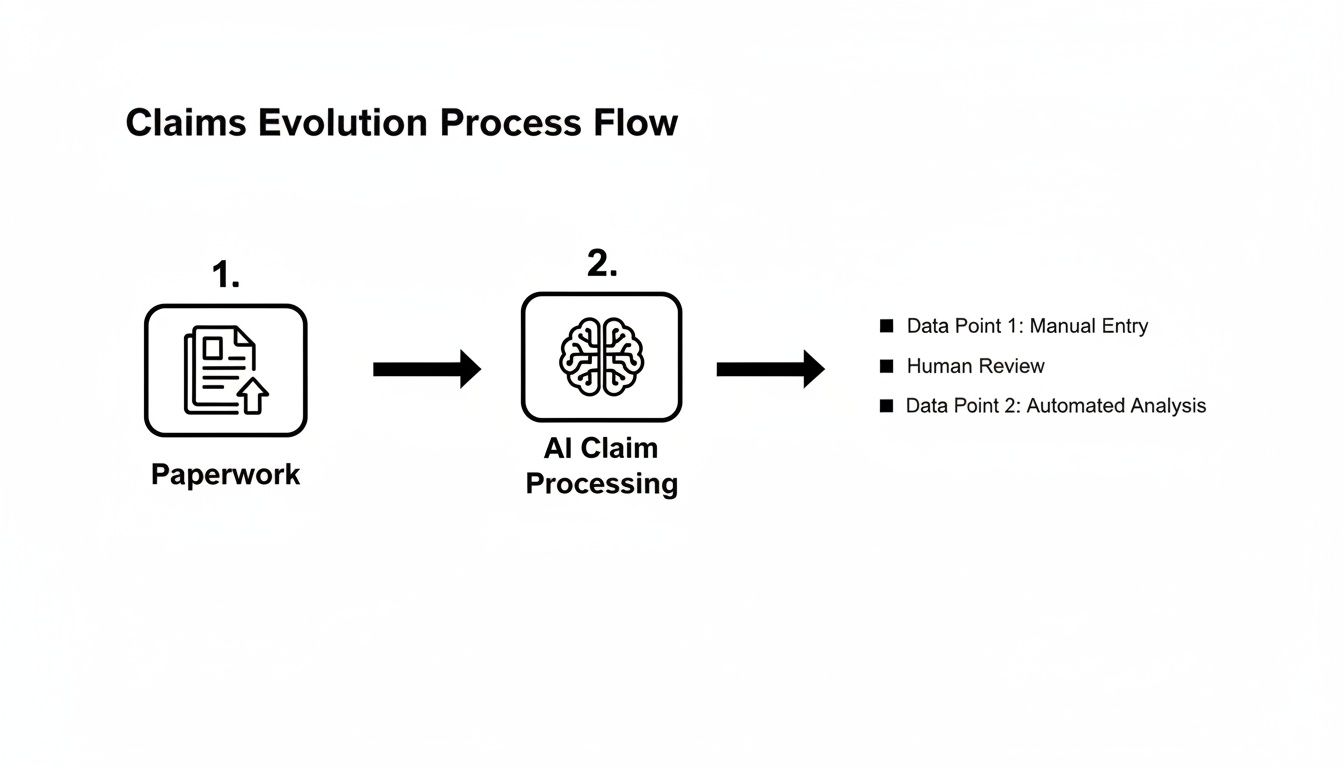

This graphic really shows the evolution—moving from stacks of paper and manual data entry to a modern, AI-driven workflow.

What you're seeing is more than just a tech upgrade. It's about AI agents taking on the heavy lifting of data intake and initial analysis, which frees up human experts to focus on the complex decisions that require their judgment.

Instant First Notice of Loss

Everything starts with the First Notice of Loss (FNOL), which is often the most stressful moment for a policyholder. In the past, this meant long hold times and answering the same questions over and over. Now, leading carriers are using conversational AI chatbots that act like a 24/7 digital concierge, a cornerstone of modern AI customer care.

These AI agents can capture all the critical details of an incident through a simple chat on a website or app. They guide the customer through the report with clear, reassuring language, making sure all the necessary information is collected correctly the first time. This simple change gets rid of frustrating delays and gives the customer immediate peace of mind that their claim is underway.

AI-Powered Damage Assessment

Damage assessment has always been a major bottleneck. Waiting for a field adjuster to schedule a visit could add days, if not weeks, to the timeline. AI completely re-engineers this step.

Using computer vision, customers can now just upload photos or videos of the damage right from their smartphones. An AI model gets to work instantly, analyzing the images to identify the extent of the damage, estimate repair costs, and even look up the parts needed for a replacement.

Think about an auto insurance claim. The AI can:

Identify exactly which parts are damaged—a bumper, headlight, or fender.

Assess the severity, from a minor scratch to major structural damage.

Estimate labor and parts costs based on the vehicle model and local rates.

A process that used to take a week is now done in minutes. This sets the stage for a much faster resolution for the policyholder.

Intelligent Fraud Detection

Fraud is a persistent, expensive problem for the financial services industry. AI offers a powerful new line of defense, acting as a digital detective that can spot suspicious patterns a human could never see.

Machine learning algorithms sift through massive datasets, flagging inconsistencies across millions of insurance claims. They can spot a digitally altered photo, a claim that shares strange similarities with known fraud cases, or even a network of people filing suspiciously similar claims. This lets human fraud investigators focus their time on high-risk cases, saving money and stopping improper payouts.

By automating the hunt for anomalies, AI protects the integrity of the claims pool. Ultimately, that helps keep premiums more stable for every policyholder.

Automated Settlements and Payouts

For simple, low-risk claims, AI can now drive a fully automated settlement process. Once the FNOL is logged, the damage is assessed, and the claim is cleared of any fraud flags, the system can approve it and trigger an instant digital payment. You can dive deeper into how this works in our guide to insurance claims processing automation.

This "touchless" approach is a game-changer for customer satisfaction. Instead of waiting for a check to arrive in the mail, a policyholder can get the funds in their bank account within hours of filing. This entire workflow shows how automating insurance claims with AI isn't just another tool—it's the foundational technology building a new, more efficient claims lifecycle.

Delivering Superior AI Customer Care

An insurance claim is the ultimate test of an insurer's promise. It's that critical moment of truth where a transactional relationship has to become a genuinely supportive one. For far too long, this experience has been defined by anxiety and frustrating delays. But today, leading AI insurance companies are completely rewriting that script by delivering a higher standard of AI customer care for financial services.

The real goal here is to transform a moment of crisis into a moment of loyalty. By strategically automating the right parts of the claims journey, carriers can create an experience that feels personal, empathetic, and remarkably efficient, building deep-seated trust when it matters most.

Empathetic Support, Around the Clock

When a policyholder suffers a loss, the first thing they need is reassurance. They need to know their insurer is there for them, no matter the hour. This is where conversational AI becomes an incredible ally, acting as a personal guide through the often-baffling insurance claims process.

Instead of navigating frustrating phone menus or waiting for business hours, a customer can get help instantly from an AI agent. These aren't the simple, robotic chatbots of yesterday; modern AI understands context, can be trained to show empathy, and provides clear, helpful answers.

A claimant might ask:

"What's the status of my auto claim?"

"What documents do I need to send in next?"

"How long until I receive a payment?"

The AI can provide immediate, accurate answers, which goes a long way in reducing the claimant's anxiety and giving them a sense of control. This level of responsive AI customer care also frees up your human agents to focus on the more emotionally charged or complex conversations where they're needed most.

Hyper-Personalization at Scale

Every customer is unique, and a one-size-fits-all approach to claims communication simply doesn't cut it. AI opens the door to hyper-personalization, tailoring every interaction to the individual's history, their preferences, and the specific context of their claim.

By analyzing customer data, an AI system can figure out the best way to communicate. A tech-savvy customer might prefer proactive SMS updates, for example, while another might respond better to a detailed email summary. This personalized approach makes the customer feel seen and understood.

AI can even help tailor settlement options. By analyzing past claims and customer profiles, the system can present offers that are not only fair but also structured in a way that resonates with the policyholder’s financial situation, leading to faster and more agreeable resolutions.

This kind of detailed, bespoke experience was previously impossible to deliver at scale. Now, insurers can provide it for every single claimant.

The Human-in-the-Loop Advantage

Automating insurance claims with AI doesn’t mean removing the human touch—it means optimizing it. The most effective model is a "human-in-the-loop" system, where technology and people work together, each playing to their strengths.

AI is brilliant at handling high-volume, repetitive tasks with incredible speed and accuracy. It can manage the initial data intake, answer routine status questions, and flag claims that need a closer look. This creates a highly efficient foundation for the entire process.

But when a situation demands deep empathy, complex negotiation, or critical judgment, the AI seamlessly hands the case over to a human expert. This ensures the most sensitive moments of a claim are always managed by a person who can provide the necessary compassion and nuanced problem-solving.

This balanced approach allows AI insurance companies to operate with remarkable efficiency without sacrificing the quality of the customer experience. A quick look at claims AI reviews and case studies makes it clear: this collaborative model delivers the best results for both the insurer and the policyholder, turning a stressful event into a positive brand interaction.

The Business Case For Claims Automation

The technology is impressive, no doubt. But for any leader in financial services, the real question is about return on investment. When you peel back the layers of automation and AI, what's the actual, measurable impact on the business? The good news is, for carriers ready to move past legacy systems, the numbers tell a compelling story.

You can see the market practically screaming for more efficiency. While global commercial insurance rates dipped a modest 4% in Q3 2025, casualty insurance rates kept climbing. This trend was largely fueled by a spike in both the frequency and severity of claims in the US, putting immense pressure on specific lines of business. It’s no wonder AI insurance companies are doubling down on smarter, faster ways to manage risk.

Slashing Costs And Boosting Efficiency

The first and most obvious win from AI is in pure operational efficiency. Automating insurance claims with AI addresses a process that is painfully slow and expensive, bogged down by endless hours of data entry, manual reviews, and back-and-forth communication. Automation can take that process from weeks down to minutes for simple, straightforward claims.

This speed directly translates to lower claim handling costs. By letting AI manage the routine tasks, insurers can push through a much higher volume of claims without adding headcount. That efficiency gain is a massive profitability driver, especially for high-volume lines like auto glass or minor property damage claims.

AI isn't just about speeding up the old process. It’s about building an entirely new, more cost-effective way of operating. The savings build on each other over time, freeing up capital to invest in better products and customer experiences.

The knock-on effects are just as important. Faster cycle times mean less administrative overhead and the ability to close out reserves more quickly, which strengthens the entire organization's financial footing. Seeing the full picture of https://nolana.com/articles/business-process-automation-benefits is essential for making a strong investment case.

Enhancing Accuracy And Compliance

In a manual claims world, human error is an expensive fact of life. One misplaced decimal point or a misread policy clause can lead to a major overpayment. Or, just as damaging, an underpayment that creates compliance headaches and destroys customer trust. AI all but eliminates these risks by enforcing consistency.

AI agents are built to follow your standard operating procedures to the letter, every single time. They check policies, validate data, and apply business rules without getting tired or distracted, dramatically cutting the error rates that cause financial leakage. That level of precision is also critical for staying on the right side of regulators and avoiding hefty fines. When putting together the business case, it's helpful to understand how specific AI tools contribute. For example, exploring the benefits of AI chatbots for your business can show how even customer-facing automation strengthens the overall strategy.

To really grasp the difference AI makes, let's look at how it moves the needle on the metrics that matter most.

Impact of AI on Key Insurance Claims Metrics

Metric | Traditional Processing | AI-Augmented Processing | Improvement |

|---|---|---|---|

Claim Cycle Time | 10-15 Days | 1-3 Days | 70-90% Reduction |

Claim Handling Cost | $150-$300 per claim | $30-$60 per claim | 75-80% Reduction |

Error Rate | 3-5% | <0.5% | Over 85% Reduction |

Customer Satisfaction | 70-80% CSAT | 90%+ CSAT | 15-20% Increase |

Fraud Detection | 10-15% | 30-40% | 2-3x Improvement |

As the table shows, this isn't about small, incremental gains. AI fundamentally changes the performance ceiling for claims operations, driving significant improvements across the board.

Empowering Your Human Talent

This might be the most underrated benefit of all: the positive impact automation has on your people. Your claims adjusters are skilled experts, but they're often stuck doing tedious, repetitive work. That kind of administrative drag is a direct path to burnout and high turnover.

AI takes that low-value work off their plates. By handling the data collection, initial triage, and routine communications, automation frees up your adjusters to be strategic problem-solvers. They can focus their talent on the complex, high-value cases that truly require negotiation, empathy, and human judgment. This shift doesn't just improve morale; it helps you hold on to your best people.

Your AI Implementation Playbook

Bringing AI into your claims process isn’t about flipping a switch. It's a strategic journey that requires a clear plan. For AI insurance companies, the real goal is to weave automation into the very fabric of their operations, creating a system that’s both hyper-efficient and genuinely focused on the customer. This playbook is a practical guide for leaders working through the complexities of an AI rollout, from the first hurdles to long-term success.

The first big challenge is usually technical. Most established carriers are running on complex legacy systems that were never built to play nicely with modern AI platforms. This can cause a lot of friction. You need a solid plan to get new technologies talking to older core systems without bringing daily operations to a halt. Bridging this gap is the essential first step for automating insurance claims.

And it’s not just about the tech. Data privacy and algorithmic fairness are non-negotiable. Handling sensitive customer data demands ironclad security, and the AI models themselves need to be watched constantly to make sure they aren’t introducing unintended bias into claims decisions.

Navigating Common Implementation Hurdles

Getting an AI deployment right means facing a few key challenges head-on. A little proactive planning can turn these potential roadblocks into stepping stones.

Integrating with Legacy Systems: The trick is to work with AI partners who specialize in connecting to established insurance platforms like Guidewire or Duck Creek. Using APIs and middleware creates a bridge between your old and new systems, allowing you to integrate in phases instead of attempting a risky, all-at-once overhaul.

Ensuring Data Privacy and Security: Make it a priority to work with vendors who are SOC 2 Type II and GDPR compliant. All data must be encrypted, both in transit and at rest. You also need strict access controls to protect sensitive policyholder information at every touchpoint.

Mitigating Algorithmic Bias: It’s critical to train your AI models on diverse, representative datasets. From there, you have to conduct regular audits to find and fix any biases that creep in. This is the only way to ensure every claim is assessed fairly and equitably.

Proven Strategies For a Successful Rollout

Once you have a handle on the challenges, you can focus on a proven roadmap for implementation. This kind of structured approach helps manage risk, build momentum, and ensure the technology starts delivering real value right away.

It all starts with a focused proof of concept. A pilot program is the single most important first step. Don't try to boil the ocean with a massive, company-wide deployment. Instead, pick a high-volume, low-complexity claims area—think auto glass repair or minor water damage—to test the AI. This lets you measure the ROI, iron out the kinks in a controlled environment, and build internal confidence with a quick, tangible win.

After a successful pilot, data preparation moves to the top of the list. An AI is only as good as the data it’s trained on. This means you have to clean and structure your historical claims data so it's accurate, consistent, and ready for machine learning. This upfront work pays off enormously in the accuracy and effectiveness of your automated workflows down the line.

Choosing the right technology partner is make-or-break. Look beyond the sales pitch and dive into detailed claims AI reviews and case studies from other carriers. The ideal partner understands the nuances of insurance just as deeply as they understand artificial intelligence.

Finally, you can't forget the human side of this change. Automation can feel like a threat, so you have to communicate a clear vision. Frame AI as a tool that empowers your people, freeing them from repetitive tasks so they can focus on the high-value work that requires their expertise and empathy. Investing in training and upskilling programs helps build a culture that embraces automation instead of fearing it.

To see how one carrier successfully navigated this journey, you can explore a case study on transforming insurance claims with agentic AI. This approach ensures a much smoother transition and sets you up for continuous improvement.

Common Questions About AI in Insurance Claims

Bringing AI into your claims process is a big step, and it's natural to have questions. For leaders in banking and insurance, the biggest concerns often revolve around how this technology will impact people, security, and the way you do business. Let's tackle some of the most common questions head-on.

The number one concern we hear? The human element. People want to know if AI is going to make their experienced adjusters obsolete.

Will AI Replace Human Claims Adjusters?

The short answer is no. Think of AI as a powerful partner for your team, not a replacement.

AI is brilliant at handling the high-volume, repetitive, data-heavy work that bogs down your best people. This frees up your human adjusters to concentrate on what they're truly great at: managing complex, sensitive cases that demand empathy, sharp negotiation skills, and seasoned judgment. Their role evolves from a claims processor into a high-value case manager and customer advocate.

This shift means your most skilled professionals can apply their expertise where it matters most, improving outcomes and even boosting job satisfaction. Instead of getting buried in paperwork, they're focused on relationships and resolutions.

How Does AI Actually Get Smarter at Detecting Fraud?

AI systems use machine learning to scan millions of data points in real time, catching subtle patterns and anomalies that even the sharpest human eye might miss. Unlike older, rigid rule-based systems, these AI models learn and adapt continuously from new data.

AI can flag anything from inconsistent details in a claimant's story and doctored images to hidden links within sophisticated fraud rings. This intelligence directs your specialized investigators to the highest-risk cases, letting them focus their efforts where they're most needed to protect your bottom line.

What's the Best First Step to Implementing AI?

Don't try to boil the ocean. The smartest way to start is with a focused pilot program.

Pick a high-volume, low-complexity claim type—think auto glass repair or minor property damage—and launch a pilot. This controlled approach is the key to a successful rollout. It lets you test the technology, measure the ROI, and build internal confidence with a clear, tangible win before you even think about scaling to more complex lines of business. It’s all about building momentum, not attempting a massive, high-risk overhaul from day one.

How Do We Choose the Right AI Partner?

Look past the flashy demos and marketing hype. When you're evaluating vendors, zero in on a few critical things.

Proven Track Record: Do they have successful case studies in your specific line of business?

Seamless Integration: Can their platform connect smoothly with your existing core systems, like your claims management software?

Real-World Proof: Dig into claims AI reviews from other carriers and insist on a proof-of-concept (POC) that uses your actual data.

The right partner understands the nuances of insurance just as deeply as they understand artificial intelligence. That dual expertise is non-negotiable, as it ensures the solution will stand up to your unique operational and regulatory demands.

Nolana provides a compliant, agentic AI platform designed to automate high-stakes claims and customer service operations from end to end. By integrating with your existing systems and learning from your team's actions, our AI agents execute tasks, assist decisions, and deliver real-time automation with the accuracy and control required in regulated environments. Discover how to accelerate cycle times and enhance customer experiences at https://nolana.com.

No customer wants to face a mountain of paperwork right after a loss. For years, the insurance claims process has been notoriously slow and manual, but that's finally changing. A smarter, AI-driven model isn't just an upgrade—it's becoming a necessity for AI insurance companies, driven by customers who expect instant service and a sharp increase in claims from major disruptive events. Automating insurance claims with AI is no longer a futuristic concept; it's a present-day reality.

The End of the Traditional Insurance Claims Process

The very DNA of insurance is being rewritten. For decades, the claims lifecycle was a predictable, often frustrating, sequence of phone calls, paperwork, and waiting. A customer would report an incident, an adjuster would eventually show up, and a settlement check might arrive weeks or even months later. In a world of on-demand everything, that model just doesn't work anymore.

It's like moving from a horse-drawn carriage to a self-driving car. The destination—a settled claim—is the same, but the speed, efficiency, and overall experience are worlds apart. AI insurance companies aren't just swapping out old tools for new ones; they're redesigning the entire journey to be faster, more accurate, and built around superior AI customer care.

Forces Driving Industry Change

Several powerful trends are pushing this transition forward. The industry is under immense pressure from all sides, making automation less of a "nice-to-have" and more of a core survival strategy, especially for financial services.

Rising Customer Expectations: Modern consumers are used to the instant gratification of digital services. They simply won't tolerate long hold times and confusing processes. They expect the same level of AI customer care from their insurer that they get from their bank or favorite online retailer.

Increasing Claim Volume: Climate change is fueling more frequent and severe natural catastrophes. Over the last decade, the global insurance protection gap for these events hit a staggering 60%. Economic losses of $2.3 trillion dwarfed the $944 billion that was actually covered by insurance.

Operational Inefficiency: Let's be honest: manual processing is expensive and riddled with potential for human error. To really grasp how much AI changes the game, it helps to understand the sheer complexity of the traditional home insurance claims process.

The future of claims isn't just about cutting costs. It's about fundamentally redefining the customer relationship at its most critical moment. AI gives insurers the ability to deliver on their promise with empathy and speed, right when policyholders need them the most.

This kind of fundamental shift takes more than just new software; it requires a whole new way of thinking about operations. By exploring modern claims AI reviews and solutions, carriers can find the right partners to help them navigate this transition. The goal is to build a resilient, responsive system that serves customers brilliantly while managing risk. If you're looking to strengthen your operational backbone, you might find our deep dive on modern claims management systems helpful.

How AI Is Rebuilding the Claims Lifecycle

The days of endless paperwork and long waits are numbered. Automating insurance claims with AI is fundamentally reshaping the process, creating an experience that's faster, more accurate, and far more customer-friendly. This isn't just a concept on a whiteboard; it's a real-world operational shift happening right now.

And it couldn't come at a better time. Claim volumes are surging. In the first half of 2025 alone, insured losses from natural disasters hit a staggering $100 billion globally. The United States was on the hook for over 90% of that total, which represented a 40% jump from the previous year. Those numbers put immense pressure on carriers to handle claims with speed and precision.

This graphic really shows the evolution—moving from stacks of paper and manual data entry to a modern, AI-driven workflow.

What you're seeing is more than just a tech upgrade. It's about AI agents taking on the heavy lifting of data intake and initial analysis, which frees up human experts to focus on the complex decisions that require their judgment.

Instant First Notice of Loss

Everything starts with the First Notice of Loss (FNOL), which is often the most stressful moment for a policyholder. In the past, this meant long hold times and answering the same questions over and over. Now, leading carriers are using conversational AI chatbots that act like a 24/7 digital concierge, a cornerstone of modern AI customer care.

These AI agents can capture all the critical details of an incident through a simple chat on a website or app. They guide the customer through the report with clear, reassuring language, making sure all the necessary information is collected correctly the first time. This simple change gets rid of frustrating delays and gives the customer immediate peace of mind that their claim is underway.

AI-Powered Damage Assessment

Damage assessment has always been a major bottleneck. Waiting for a field adjuster to schedule a visit could add days, if not weeks, to the timeline. AI completely re-engineers this step.

Using computer vision, customers can now just upload photos or videos of the damage right from their smartphones. An AI model gets to work instantly, analyzing the images to identify the extent of the damage, estimate repair costs, and even look up the parts needed for a replacement.

Think about an auto insurance claim. The AI can:

Identify exactly which parts are damaged—a bumper, headlight, or fender.

Assess the severity, from a minor scratch to major structural damage.

Estimate labor and parts costs based on the vehicle model and local rates.

A process that used to take a week is now done in minutes. This sets the stage for a much faster resolution for the policyholder.

Intelligent Fraud Detection

Fraud is a persistent, expensive problem for the financial services industry. AI offers a powerful new line of defense, acting as a digital detective that can spot suspicious patterns a human could never see.

Machine learning algorithms sift through massive datasets, flagging inconsistencies across millions of insurance claims. They can spot a digitally altered photo, a claim that shares strange similarities with known fraud cases, or even a network of people filing suspiciously similar claims. This lets human fraud investigators focus their time on high-risk cases, saving money and stopping improper payouts.

By automating the hunt for anomalies, AI protects the integrity of the claims pool. Ultimately, that helps keep premiums more stable for every policyholder.

Automated Settlements and Payouts

For simple, low-risk claims, AI can now drive a fully automated settlement process. Once the FNOL is logged, the damage is assessed, and the claim is cleared of any fraud flags, the system can approve it and trigger an instant digital payment. You can dive deeper into how this works in our guide to insurance claims processing automation.

This "touchless" approach is a game-changer for customer satisfaction. Instead of waiting for a check to arrive in the mail, a policyholder can get the funds in their bank account within hours of filing. This entire workflow shows how automating insurance claims with AI isn't just another tool—it's the foundational technology building a new, more efficient claims lifecycle.

Delivering Superior AI Customer Care

An insurance claim is the ultimate test of an insurer's promise. It's that critical moment of truth where a transactional relationship has to become a genuinely supportive one. For far too long, this experience has been defined by anxiety and frustrating delays. But today, leading AI insurance companies are completely rewriting that script by delivering a higher standard of AI customer care for financial services.

The real goal here is to transform a moment of crisis into a moment of loyalty. By strategically automating the right parts of the claims journey, carriers can create an experience that feels personal, empathetic, and remarkably efficient, building deep-seated trust when it matters most.

Empathetic Support, Around the Clock

When a policyholder suffers a loss, the first thing they need is reassurance. They need to know their insurer is there for them, no matter the hour. This is where conversational AI becomes an incredible ally, acting as a personal guide through the often-baffling insurance claims process.

Instead of navigating frustrating phone menus or waiting for business hours, a customer can get help instantly from an AI agent. These aren't the simple, robotic chatbots of yesterday; modern AI understands context, can be trained to show empathy, and provides clear, helpful answers.

A claimant might ask:

"What's the status of my auto claim?"

"What documents do I need to send in next?"

"How long until I receive a payment?"

The AI can provide immediate, accurate answers, which goes a long way in reducing the claimant's anxiety and giving them a sense of control. This level of responsive AI customer care also frees up your human agents to focus on the more emotionally charged or complex conversations where they're needed most.

Hyper-Personalization at Scale

Every customer is unique, and a one-size-fits-all approach to claims communication simply doesn't cut it. AI opens the door to hyper-personalization, tailoring every interaction to the individual's history, their preferences, and the specific context of their claim.

By analyzing customer data, an AI system can figure out the best way to communicate. A tech-savvy customer might prefer proactive SMS updates, for example, while another might respond better to a detailed email summary. This personalized approach makes the customer feel seen and understood.

AI can even help tailor settlement options. By analyzing past claims and customer profiles, the system can present offers that are not only fair but also structured in a way that resonates with the policyholder’s financial situation, leading to faster and more agreeable resolutions.

This kind of detailed, bespoke experience was previously impossible to deliver at scale. Now, insurers can provide it for every single claimant.

The Human-in-the-Loop Advantage

Automating insurance claims with AI doesn’t mean removing the human touch—it means optimizing it. The most effective model is a "human-in-the-loop" system, where technology and people work together, each playing to their strengths.

AI is brilliant at handling high-volume, repetitive tasks with incredible speed and accuracy. It can manage the initial data intake, answer routine status questions, and flag claims that need a closer look. This creates a highly efficient foundation for the entire process.

But when a situation demands deep empathy, complex negotiation, or critical judgment, the AI seamlessly hands the case over to a human expert. This ensures the most sensitive moments of a claim are always managed by a person who can provide the necessary compassion and nuanced problem-solving.

This balanced approach allows AI insurance companies to operate with remarkable efficiency without sacrificing the quality of the customer experience. A quick look at claims AI reviews and case studies makes it clear: this collaborative model delivers the best results for both the insurer and the policyholder, turning a stressful event into a positive brand interaction.

The Business Case For Claims Automation

The technology is impressive, no doubt. But for any leader in financial services, the real question is about return on investment. When you peel back the layers of automation and AI, what's the actual, measurable impact on the business? The good news is, for carriers ready to move past legacy systems, the numbers tell a compelling story.

You can see the market practically screaming for more efficiency. While global commercial insurance rates dipped a modest 4% in Q3 2025, casualty insurance rates kept climbing. This trend was largely fueled by a spike in both the frequency and severity of claims in the US, putting immense pressure on specific lines of business. It’s no wonder AI insurance companies are doubling down on smarter, faster ways to manage risk.

Slashing Costs And Boosting Efficiency

The first and most obvious win from AI is in pure operational efficiency. Automating insurance claims with AI addresses a process that is painfully slow and expensive, bogged down by endless hours of data entry, manual reviews, and back-and-forth communication. Automation can take that process from weeks down to minutes for simple, straightforward claims.

This speed directly translates to lower claim handling costs. By letting AI manage the routine tasks, insurers can push through a much higher volume of claims without adding headcount. That efficiency gain is a massive profitability driver, especially for high-volume lines like auto glass or minor property damage claims.

AI isn't just about speeding up the old process. It’s about building an entirely new, more cost-effective way of operating. The savings build on each other over time, freeing up capital to invest in better products and customer experiences.

The knock-on effects are just as important. Faster cycle times mean less administrative overhead and the ability to close out reserves more quickly, which strengthens the entire organization's financial footing. Seeing the full picture of https://nolana.com/articles/business-process-automation-benefits is essential for making a strong investment case.

Enhancing Accuracy And Compliance

In a manual claims world, human error is an expensive fact of life. One misplaced decimal point or a misread policy clause can lead to a major overpayment. Or, just as damaging, an underpayment that creates compliance headaches and destroys customer trust. AI all but eliminates these risks by enforcing consistency.

AI agents are built to follow your standard operating procedures to the letter, every single time. They check policies, validate data, and apply business rules without getting tired or distracted, dramatically cutting the error rates that cause financial leakage. That level of precision is also critical for staying on the right side of regulators and avoiding hefty fines. When putting together the business case, it's helpful to understand how specific AI tools contribute. For example, exploring the benefits of AI chatbots for your business can show how even customer-facing automation strengthens the overall strategy.

To really grasp the difference AI makes, let's look at how it moves the needle on the metrics that matter most.

Impact of AI on Key Insurance Claims Metrics

Metric | Traditional Processing | AI-Augmented Processing | Improvement |

|---|---|---|---|

Claim Cycle Time | 10-15 Days | 1-3 Days | 70-90% Reduction |

Claim Handling Cost | $150-$300 per claim | $30-$60 per claim | 75-80% Reduction |

Error Rate | 3-5% | <0.5% | Over 85% Reduction |

Customer Satisfaction | 70-80% CSAT | 90%+ CSAT | 15-20% Increase |

Fraud Detection | 10-15% | 30-40% | 2-3x Improvement |

As the table shows, this isn't about small, incremental gains. AI fundamentally changes the performance ceiling for claims operations, driving significant improvements across the board.

Empowering Your Human Talent

This might be the most underrated benefit of all: the positive impact automation has on your people. Your claims adjusters are skilled experts, but they're often stuck doing tedious, repetitive work. That kind of administrative drag is a direct path to burnout and high turnover.

AI takes that low-value work off their plates. By handling the data collection, initial triage, and routine communications, automation frees up your adjusters to be strategic problem-solvers. They can focus their talent on the complex, high-value cases that truly require negotiation, empathy, and human judgment. This shift doesn't just improve morale; it helps you hold on to your best people.

Your AI Implementation Playbook

Bringing AI into your claims process isn’t about flipping a switch. It's a strategic journey that requires a clear plan. For AI insurance companies, the real goal is to weave automation into the very fabric of their operations, creating a system that’s both hyper-efficient and genuinely focused on the customer. This playbook is a practical guide for leaders working through the complexities of an AI rollout, from the first hurdles to long-term success.

The first big challenge is usually technical. Most established carriers are running on complex legacy systems that were never built to play nicely with modern AI platforms. This can cause a lot of friction. You need a solid plan to get new technologies talking to older core systems without bringing daily operations to a halt. Bridging this gap is the essential first step for automating insurance claims.

And it’s not just about the tech. Data privacy and algorithmic fairness are non-negotiable. Handling sensitive customer data demands ironclad security, and the AI models themselves need to be watched constantly to make sure they aren’t introducing unintended bias into claims decisions.

Navigating Common Implementation Hurdles

Getting an AI deployment right means facing a few key challenges head-on. A little proactive planning can turn these potential roadblocks into stepping stones.

Integrating with Legacy Systems: The trick is to work with AI partners who specialize in connecting to established insurance platforms like Guidewire or Duck Creek. Using APIs and middleware creates a bridge between your old and new systems, allowing you to integrate in phases instead of attempting a risky, all-at-once overhaul.

Ensuring Data Privacy and Security: Make it a priority to work with vendors who are SOC 2 Type II and GDPR compliant. All data must be encrypted, both in transit and at rest. You also need strict access controls to protect sensitive policyholder information at every touchpoint.

Mitigating Algorithmic Bias: It’s critical to train your AI models on diverse, representative datasets. From there, you have to conduct regular audits to find and fix any biases that creep in. This is the only way to ensure every claim is assessed fairly and equitably.

Proven Strategies For a Successful Rollout

Once you have a handle on the challenges, you can focus on a proven roadmap for implementation. This kind of structured approach helps manage risk, build momentum, and ensure the technology starts delivering real value right away.

It all starts with a focused proof of concept. A pilot program is the single most important first step. Don't try to boil the ocean with a massive, company-wide deployment. Instead, pick a high-volume, low-complexity claims area—think auto glass repair or minor water damage—to test the AI. This lets you measure the ROI, iron out the kinks in a controlled environment, and build internal confidence with a quick, tangible win.

After a successful pilot, data preparation moves to the top of the list. An AI is only as good as the data it’s trained on. This means you have to clean and structure your historical claims data so it's accurate, consistent, and ready for machine learning. This upfront work pays off enormously in the accuracy and effectiveness of your automated workflows down the line.

Choosing the right technology partner is make-or-break. Look beyond the sales pitch and dive into detailed claims AI reviews and case studies from other carriers. The ideal partner understands the nuances of insurance just as deeply as they understand artificial intelligence.

Finally, you can't forget the human side of this change. Automation can feel like a threat, so you have to communicate a clear vision. Frame AI as a tool that empowers your people, freeing them from repetitive tasks so they can focus on the high-value work that requires their expertise and empathy. Investing in training and upskilling programs helps build a culture that embraces automation instead of fearing it.

To see how one carrier successfully navigated this journey, you can explore a case study on transforming insurance claims with agentic AI. This approach ensures a much smoother transition and sets you up for continuous improvement.

Common Questions About AI in Insurance Claims

Bringing AI into your claims process is a big step, and it's natural to have questions. For leaders in banking and insurance, the biggest concerns often revolve around how this technology will impact people, security, and the way you do business. Let's tackle some of the most common questions head-on.

The number one concern we hear? The human element. People want to know if AI is going to make their experienced adjusters obsolete.

Will AI Replace Human Claims Adjusters?

The short answer is no. Think of AI as a powerful partner for your team, not a replacement.

AI is brilliant at handling the high-volume, repetitive, data-heavy work that bogs down your best people. This frees up your human adjusters to concentrate on what they're truly great at: managing complex, sensitive cases that demand empathy, sharp negotiation skills, and seasoned judgment. Their role evolves from a claims processor into a high-value case manager and customer advocate.

This shift means your most skilled professionals can apply their expertise where it matters most, improving outcomes and even boosting job satisfaction. Instead of getting buried in paperwork, they're focused on relationships and resolutions.

How Does AI Actually Get Smarter at Detecting Fraud?

AI systems use machine learning to scan millions of data points in real time, catching subtle patterns and anomalies that even the sharpest human eye might miss. Unlike older, rigid rule-based systems, these AI models learn and adapt continuously from new data.

AI can flag anything from inconsistent details in a claimant's story and doctored images to hidden links within sophisticated fraud rings. This intelligence directs your specialized investigators to the highest-risk cases, letting them focus their efforts where they're most needed to protect your bottom line.

What's the Best First Step to Implementing AI?

Don't try to boil the ocean. The smartest way to start is with a focused pilot program.

Pick a high-volume, low-complexity claim type—think auto glass repair or minor property damage—and launch a pilot. This controlled approach is the key to a successful rollout. It lets you test the technology, measure the ROI, and build internal confidence with a clear, tangible win before you even think about scaling to more complex lines of business. It’s all about building momentum, not attempting a massive, high-risk overhaul from day one.

How Do We Choose the Right AI Partner?

Look past the flashy demos and marketing hype. When you're evaluating vendors, zero in on a few critical things.

Proven Track Record: Do they have successful case studies in your specific line of business?

Seamless Integration: Can their platform connect smoothly with your existing core systems, like your claims management software?

Real-World Proof: Dig into claims AI reviews from other carriers and insist on a proof-of-concept (POC) that uses your actual data.

The right partner understands the nuances of insurance just as deeply as they understand artificial intelligence. That dual expertise is non-negotiable, as it ensures the solution will stand up to your unique operational and regulatory demands.

Nolana provides a compliant, agentic AI platform designed to automate high-stakes claims and customer service operations from end to end. By integrating with your existing systems and learning from your team's actions, our AI agents execute tasks, assist decisions, and deliver real-time automation with the accuracy and control required in regulated environments. Discover how to accelerate cycle times and enhance customer experiences at https://nolana.com.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP