Snapsheet Chicago The Future of AI-Powered Insurance Claims

Snapsheet Chicago The Future of AI-Powered Insurance Claims

Explore how Snapsheet Chicago is transforming the insurance industry. This guide explains their AI-powered claims process, AI customer care, and market impact.

Headquartered right in Chicago, Illinois, Snapsheet has carved out a serious name for itself in the insurance technology world. The company built its reputation on a cloud-native platform designed from the ground up to automate insurance claims with AI, simplifying the entire journey for carriers, TPAs, and MGAs.

The Rise of Snapsheet in the Chicago Insurtech Scene

Snapsheet wasn't just another tech startup jumping on the bandwagon; it was born from a genuine need to fix a broken, age-old industry problem. Anyone who's dealt with a traditional insurance claim knows the drill: slow, paper-intensive, and frustrating for everyone involved.

Snapsheet’s whole idea was to scrap that outdated model. They envisioned a digital-first approach that acts like a real-time GPS for claims management, replacing the cumbersome paper map that carriers and customers had been forced to use for decades.

This strategy started with a laser focus on automating insurance claims with AI. By simply letting customers snap and submit photos of damage through a mobile app, Snapsheet introduced a level of speed and convenience that was unheard of at the time. That initial win was the foundation for the much broader platform they offer today, one that can manage the entire claims lifecycle from start to finish.

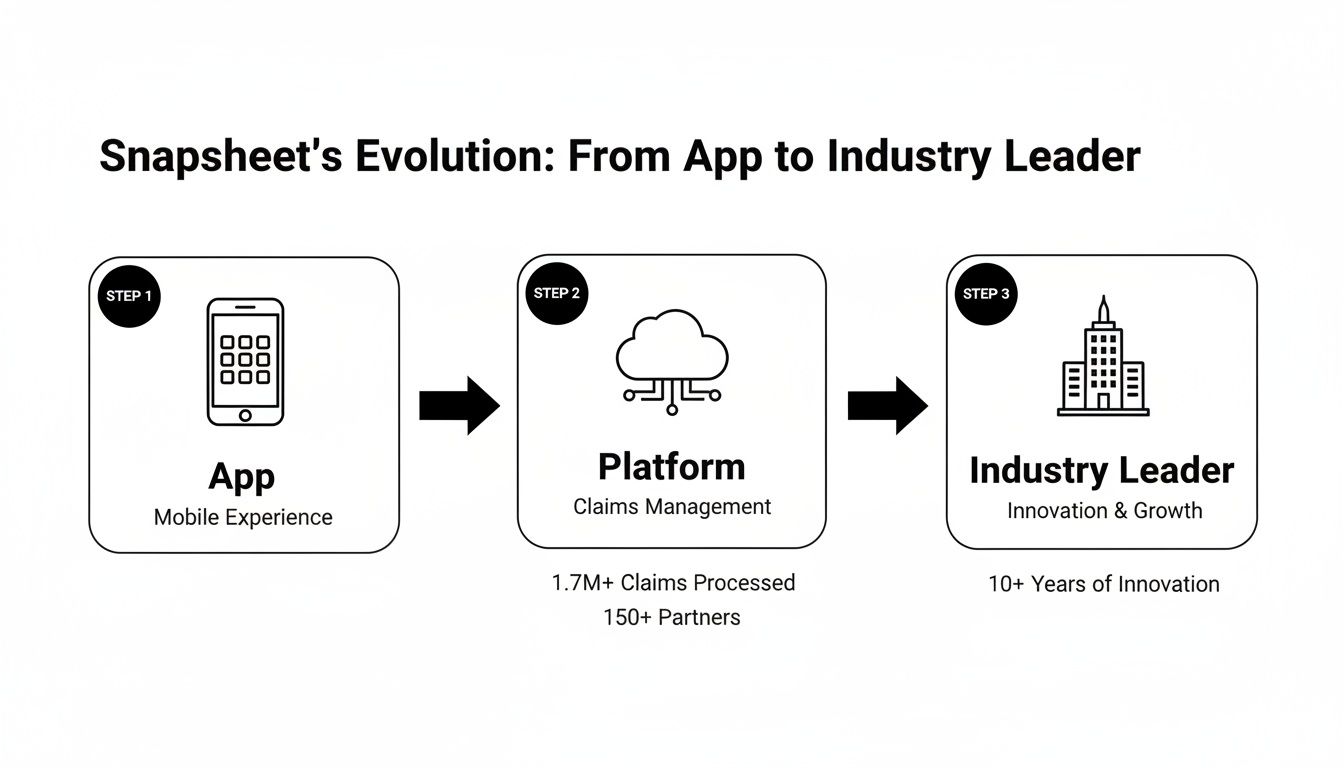

From App to Industry Powerhouse

Snapsheet's growth from a scrappy startup to an industry staple tells the whole story. Founded back in 2011, the company has come a long way from its simple mobile app roots. It's now a complete cloud-native platform, backed by $125.6 million in funding that has fueled its impressive expansion.

Now based at 1 North Dearborn Street, Snapsheet pulls in $124.6 million in revenue, cementing its role as a key player in the US insurtech market. You can find more of Snapsheet's key business insights on zoominfo.com.

Being in Chicago gave the company a huge advantage, putting it right in the middle of a hub for both tech talent and deep insurance industry knowledge. Today, its platform is a go-to tool for automating complex workflows and elevating the customer experience.

By transforming a series of manual, sequential tasks into a fluid, automated workflow, Snapsheet helps AI insurance companies reduce operational friction and accelerate resolution times, directly impacting policyholder satisfaction.

This relentless focus on efficiency and better customer outcomes has made Snapsheet a trusted partner for financial services organizations trying to modernize their operations. To get the full picture, you can explore the capabilities of the Snapsheet platform in our detailed guide.

Ultimately, Snapsheet’s journey from a local Chicago startup to an industry leader is a masterclass in how to apply technology to solve thorny, real-world business challenges.

How AI Is Automating the Entire Claims Lifecycle

At its core, Snapsheet's AI engine is designed to take the traditionally slow, manual claims process and turn it into a fast, automated workflow. Think of it as a hyper-efficient digital adjuster working around the clock. This system can instantly analyze photos, calculate damages, and route tasks, all without needing a human to step in.

This level of automation delivers more than just speed—it produces real business results. For AI insurance companies, this translates to dramatically shorter cycle times and much lower operational costs. It effectively turns the claims department from a necessary cost center into a real competitive advantage.

One of the platform's biggest strengths is its no-code configurability. This is a huge deal for carriers. It gives them the power to design, test, and roll out their own custom workflows without getting stuck in a long IT development queue. When market conditions shift or new business rules are needed, they can adapt on the fly.

From First Notice to Final Payment

The automation kicks in right from the very first step: the First Notice of Loss (FNOL). Instead of a policyholder spending time on a long phone call, they can now submit a claim through a mobile app in just a few minutes, photos and all. From there, the AI takes the wheel.

Triage and Assignment: The system immediately assesses the claim's complexity. It then decides whether to push it through a fully automated workflow or flag it for a human adjuster to review.

Damage Analysis: AI models get to work, scanning photos to identify the extent of the damage. They can generate a preliminary appraisal and estimate repair costs in a fraction of the time it would take a person.

Workflow Orchestration: The platform then manages every step that follows, from scheduling inspections and coordinating with shops to issuing payments. Critically, it keeps everyone in the loop along the way.

This diagram shows just how far Snapsheet has come, evolving from a simple app into a comprehensive platform for the entire industry.

The image really captures the company's journey, growing from a niche tool into a foundational piece of technology for modern claims management.

Real-World Impact and Scalability

This isn't just theory; the impact is proven and measurable. Snapsheet, a Chicago-based leader in this space, had its strongest year ever in 2021, posting a massive 159% year-over-year growth as the industry accelerated its digital adoption. Headquartered at 1 N Dearborn St Ste 600 in Chicago, the company has processed over 2.5 million claims and handled more than $10 billion in indemnity, demonstrating it can scale to meet the demands of even the largest carriers.

The table below breaks down the difference between the old way of doing things and the new, AI-powered approach.

Traditional Claims vs Snapsheet AI-Powered Claims

Process Step | Traditional Method | Snapsheet AI Method |

|---|---|---|

FNOL Intake | Manual data entry via phone call | Customer-led mobile submission |

Damage Assessment | Manual review by an adjuster | Instant AI photo analysis and estimation |

Workflow Assignment | Manual routing by a supervisor | Automated triage and routing |

Communication | Phone calls and emails | Proactive, automated status updates |

Payment Issuance | Manual processing and check mailing | Instant digital payments |

As you can see, the efficiency gains at every stage are significant, freeing up human teams to focus on more complex issues.

By automating the repetitive, low-value tasks, Snapsheet's platform lets human adjusters focus where they're needed most—on activities that require empathy and complex decision-making, like managing severe claims or providing top-tier customer care.

This balance between human expertise and machine efficiency is the key. As we look at the future of AI software development, the goal for AI insurance companies is to build systems where people and AI work together seamlessly. This approach not only makes operations more efficient but also leads to a much better experience for the policyholder, a critical factor often highlighted in claims AI reviews. To dig deeper, you can read about how AI is being applied in insurance claims in our detailed article.

Transforming the Policyholder Experience with AI Customer Care

Sure, speed is a huge selling point for automation, but the real magic for AI insurance companies is in crafting a better customer journey. A car accident or property damage is a make-or-break moment for an insurer's reputation. This is exactly where Snapsheet Chicago shines, helping carriers transform a potentially negative event into a genuinely positive interaction through thoughtful AI customer care.

Think of it as an intelligent system working quietly in the background. Instead of leaving a policyholder wondering what’s happening, the platform sends proactive text or email updates at every key milestone. When it’s time to submit photos, AI-powered guides give immediate feedback to make sure the images are clear and useful on the first try.

This shifts the entire dynamic from passive waiting to active, informed engagement. For straightforward, low-complexity claims, the system can even generate and send an instant settlement offer straight to the policyholder's phone. They can accept and get paid in a matter of minutes.

Empowering Adjusters Through Smart Automation

This kind of intelligent communication doesn’t just help the customer—it completely redefines the role of the human adjuster. By taking over repetitive communication and routine follow-ups, the platform frees up skilled professionals to focus on work that truly requires their expertise.

Here’s how that plays out:

High-Touch Service for Complex Cases: Adjusters can pour their energy into managing severe or emotionally difficult claims that need real empathy and sharp negotiation skills.

Proactive Problem-Solving: With the routine stuff handled, adjusters have the bandwidth to spot potential snags and resolve them before they become bigger problems.

Building Customer Loyalty: Instead of just relaying information, adjusters become true advocates for the policyholder, building trust and boosting retention.

This mix of automated efficiency and human expertise is essential for any modern financial services company. For carriers already using platforms like Zendesk, integrating a chatbot for Zendesk can further smooth out these interactions and create an even more automated claims lifecycle.

The goal of AI in claims is not to replace the human element but to amplify it. By handling the predictable and mundane, automation allows human teams to deliver exceptional service during a customer's time of need.

This approach hits on a key theme in claims AI reviews: policyholders want speed, but they also crave clear and consistent communication. The Chicago-based Snapsheet platform delivers the tools for both. As the industry evolves, it’s obvious that the best results come from a smart collaboration between people and technology. You can learn more about this crucial dynamic by exploring our detailed guide on building an effective AI customer care strategy.

Decoding Claims AI Reviews and Carrier Success Stories

It’s one thing to hear about the theoretical benefits of automating insurance claims with AI, but what claims leaders really need to see is proof. They want to hear from their peers and look at real results. Digging into actual claims AI reviews and carrier success stories shows how AI insurance companies are turning technology into a real competitive edge.

The common thread isn't just about processing claims faster; it's about fundamentally rewiring the business model for the better.

Instead of a generic feature list, these stories reveal how carriers are solving specific, nagging problems. A regional insurer, for example, might be laser-focused on slashing its loss adjustment expenses (LAE) by automating routine appraisals. At the same time, a national brand might be more concerned with cutting claim cycle times to keep policyholders happy and loyal.

This is what turns a platform like Chicago-based Snapsheet from a simple software expense into a strategic investment. The proof is in the numbers and the feedback from people on the front lines.

Key Themes from Carrier Success Stories

When you look at the outcomes carriers are reporting after bringing on platforms like Snapsheet, a few powerful themes keep popping up. These wins go far beyond internal efficiency—they have a massive impact on customer experience and the company's ability to adapt.

Common successes include:

Drastic Cycle Time Reduction: Many carriers talk about cutting the time from First Notice of Loss (FNOL) to payment from weeks down to a matter of days. For simpler claims, it can even be just hours.

Improved Customer Satisfaction (CSAT) Scores: Fast, transparent communication is a natural byproduct of AI customer care. It consistently leads to happier, more loyal policyholders.

Significant Expense Reduction: Automating tasks that used to eat up adjuster time—like photo analysis, estimate generation, and payment processing—directly lowers the cost of handling each claim.

"We are proud to equip... our clients across the globe, with a platform that allows them to build a claims operating model for the digital world." – Andy Cohen, President of Snapsheet

Andy’s point gets to the heart of it. This isn't just about bolting on a new tool; it's about building an entirely new, more effective way of operating. That kind of shift is what it takes to stay ahead.

From Social Proof to Strategic Investment

The real power of these success stories is the social proof they provide. When a claims VP sees that a company just like theirs solved a familiar headache using AI automation, the tech suddenly feels much more real and achievable. It stops being an abstract concept and becomes a proven solution with a clear path to getting it done and seeing a return.

For leaders wanting to see how the newest AI approaches are shaking things up, case studies on transforming insurance claims with agentic AI offer a great window into modern automation strategies.

This kind of evidence completely changes the internal conversation. It shifts from, "Can we really afford to do this?" to "How can we afford not to?" For the team at Snapsheet Chicago, these carrier testimonials and positive claims AI reviews are their most valuable asset. They show, in no uncertain terms, that investing in intelligent automation is a direct line to growth and profitability. The results speak for themselves.

A Practical Guide to Adopting Claims Automation

If you're a Head of Claims or COO looking at AI insurance companies, the path forward can feel overwhelming. You're probably asking the same questions everyone does: What does a real-world implementation actually look like? And how do we bring in new tech without grinding our current operations to a halt?

Let's break down that journey. Adopting a platform like Snapsheet Chicago is less about a technology install and more about a strategic evolution of your claims process. It begins with a hard look at your current workflows to pinpoint the biggest bottlenecks and the spots where AI can make an immediate, tangible impact.

From there, the conversation turns to integration. A major concern for carriers is how a new system will play with legacy core systems, whether it's Guidewire, Duck Creek, or something else. The good news is that modern, API-first platforms are built for this. They act as an intelligent orchestration layer on top of your existing infrastructure, avoiding the dreaded—and costly—"rip and replace" scenario.

Navigating Systems Integration and Data Security

A smooth integration really comes down to a few core ideas. The aim is to build a single, connected ecosystem where information moves securely and instantly between the new AI platform and your current systems. This breaks down data silos and gives everyone a single source of truth for every claim.

Of course, data security has to be front and center. Top-tier platforms are built with stringent protocols to guard sensitive policyholder information. This means you should expect robust encryption, routine security audits, and full compliance with industry regulations. Automation should enhance your security posture, not introduce new risks.

By focusing on seamless integration and stringent security from day one, carriers can ensure that the adoption of claims automation strengthens their operational backbone and builds, rather than erodes, policyholder trust.

This two-pronged approach is non-negotiable. It’s what lets AI insurance companies tap into the efficiencies of automation while upholding the highest standards of data stewardship—a theme you'll see consistently in honest claims AI reviews.

Fostering Collaboration Between Humans and AI

The final piece of the puzzle—and honestly, the most important—is change management. Bringing in claims AI is as much about your people as it is about the technology. You need to train your team not just on how to use a new tool, but on how to work with their new AI partner.

It's all about shifting roles to focus on what humans do best:

Adjusters as Strategists: Instead of getting bogged down in data entry and routine follow-ups, your human adjusters can focus on the complex, high-stakes claims that demand critical thinking and real empathy.

AI as an Assistant: The AI takes over the repetitive work—initial data gathering, analyzing photos, sending out status updates—which frees up your team's time and mental energy.

A Unified Workflow: The ideal state is a hybrid model where AI handles the predictable, rules-based tasks and knows exactly when to escalate to a human expert for judgment calls.

This kind of collaborative model gives you the best of both worlds: the speed and precision of a machine paired with the nuanced expertise of a seasoned professional. For a closer look at how this works in practice, our guide on insurance claims processing automation offers some great insights.

When carriers view a partner like Snapsheet Chicago as a long-term collaborator, they're not just buying a piece of software. They're building a claims operation that's more efficient today and ready for whatever comes next.

Common Questions About Snapsheet and AI in Claims

When carriers start looking into claims automation, a lot of the same questions pop up. Let's break down how platforms from leaders like Chicago's own Snapsheet really work, focusing on how AI is practically applied to claims and customer interactions.

What Kind of Insurance Claims Can Snapsheet Handle?

Snapsheet’s platform is built to be flexible, covering a wide range of Property & Casualty (P&C) lines. You’ll see it used for everything from personal and commercial auto to homeowners and renters insurance. While their AI-powered virtual appraisal is a huge part of their auto physical damage offering, the platform's workflow engine can automate the entire claims process.

This means it handles the journey from the first notice of loss (FNOL) and payments all the way to AI customer care and communications. The system is designed to manage claims of varying complexity for carriers, third-party administrators (TPAs), and managing general agents (MGAs), making it a solid option for many AI insurance companies.

How Accurate Are Snapsheet’s AI Damage Estimates?

Accuracy comes from a smart mix of machine learning, a massive amount of historical claims data, and a critical layer of human oversight. The AI models have been trained on millions of past claims, so they’re incredibly good at spotting damage patterns and estimating repair costs—a topic that always comes up in claims AI reviews.

This initial analysis is then checked against up-to-date parts pricing and local labor rates. But here’s the key part: a "human-in-the-loop" process lets expert appraisers review and sign off on the AI's estimates. This approach blends the speed of technology with the seasoned judgment of a professional, ensuring the final numbers are reliable.

The best AI systems don't replace human experts; they give them superpowers. By combining machine precision with expert validation, carriers get the best of both worlds: speed and accuracy. That's the real win for claims automation in financial services.

This balanced method means that even though the process is fast, the results are firmly rooted in real-world data and expertise.

Is It a Headache to Integrate Snapsheet with Our Current Systems?

Not at all. Snapsheet was built from the ground up to play well with others. As a cloud-native platform with an API-first design, it connects smoothly with just about anything, from older legacy systems to modern core platforms like Guidewire and Duck Creek. The goal is to minimize disruption, letting you add new capabilities to your tech stack instead of ripping and replacing what you already have.

The platform also comes with no-code tools, which gives your own team the power to set up and adjust workflows without waiting on IT. This makes you much more agile, allowing you to roll out new processes faster and react to market changes on the fly. It's built to enhance your current operations, not complicate them.

At Nolana, we see the future of insurance operations as a partnership between human experts and intelligent AI agents. Our platform is designed to automate high-stakes financial services workflows, from claims processing to customer service, by deploying compliant AI agents that work right alongside your team. By connecting with your core systems, Nolana provides real-time automation with clear guardrails and simple human hand-offs. This helps you lower costs and speed up cycle times while keeping full control and the highest standards of accuracy.

Headquartered right in Chicago, Illinois, Snapsheet has carved out a serious name for itself in the insurance technology world. The company built its reputation on a cloud-native platform designed from the ground up to automate insurance claims with AI, simplifying the entire journey for carriers, TPAs, and MGAs.

The Rise of Snapsheet in the Chicago Insurtech Scene

Snapsheet wasn't just another tech startup jumping on the bandwagon; it was born from a genuine need to fix a broken, age-old industry problem. Anyone who's dealt with a traditional insurance claim knows the drill: slow, paper-intensive, and frustrating for everyone involved.

Snapsheet’s whole idea was to scrap that outdated model. They envisioned a digital-first approach that acts like a real-time GPS for claims management, replacing the cumbersome paper map that carriers and customers had been forced to use for decades.

This strategy started with a laser focus on automating insurance claims with AI. By simply letting customers snap and submit photos of damage through a mobile app, Snapsheet introduced a level of speed and convenience that was unheard of at the time. That initial win was the foundation for the much broader platform they offer today, one that can manage the entire claims lifecycle from start to finish.

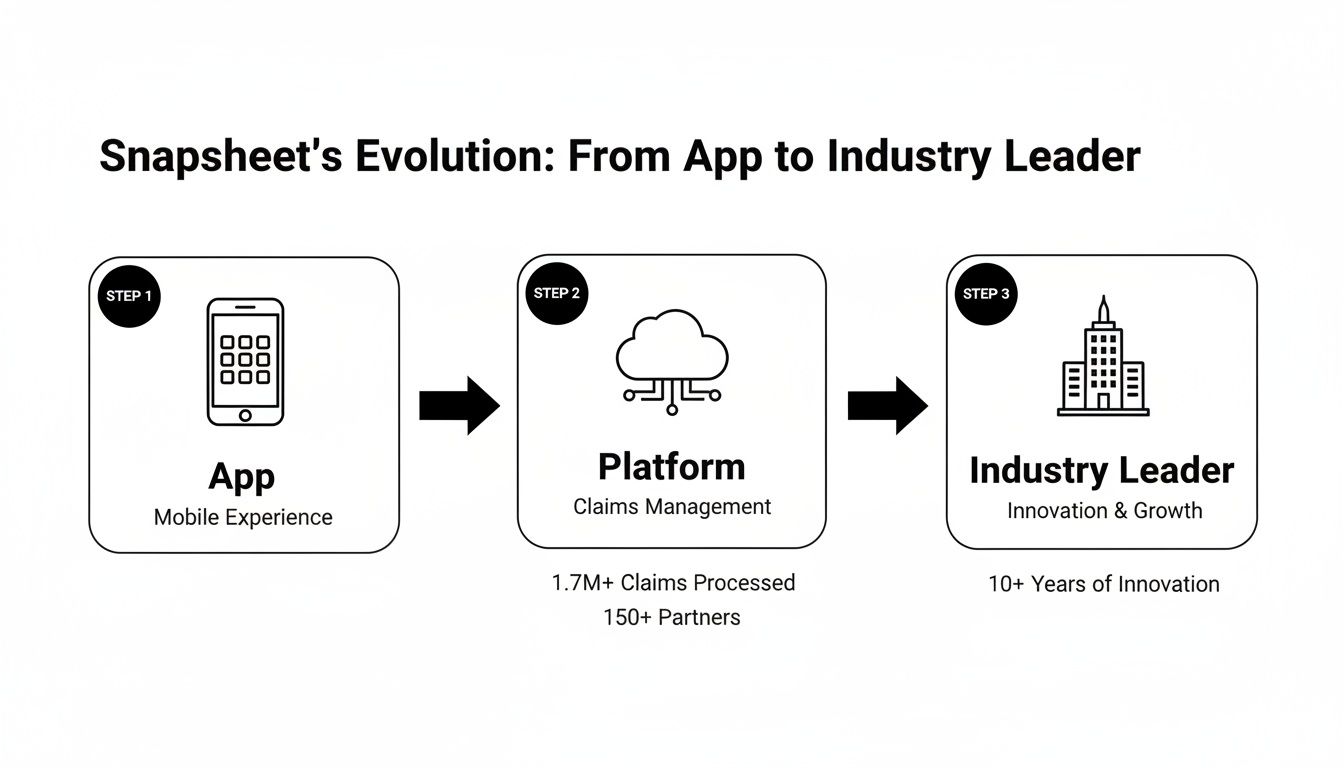

From App to Industry Powerhouse

Snapsheet's growth from a scrappy startup to an industry staple tells the whole story. Founded back in 2011, the company has come a long way from its simple mobile app roots. It's now a complete cloud-native platform, backed by $125.6 million in funding that has fueled its impressive expansion.

Now based at 1 North Dearborn Street, Snapsheet pulls in $124.6 million in revenue, cementing its role as a key player in the US insurtech market. You can find more of Snapsheet's key business insights on zoominfo.com.

Being in Chicago gave the company a huge advantage, putting it right in the middle of a hub for both tech talent and deep insurance industry knowledge. Today, its platform is a go-to tool for automating complex workflows and elevating the customer experience.

By transforming a series of manual, sequential tasks into a fluid, automated workflow, Snapsheet helps AI insurance companies reduce operational friction and accelerate resolution times, directly impacting policyholder satisfaction.

This relentless focus on efficiency and better customer outcomes has made Snapsheet a trusted partner for financial services organizations trying to modernize their operations. To get the full picture, you can explore the capabilities of the Snapsheet platform in our detailed guide.

Ultimately, Snapsheet’s journey from a local Chicago startup to an industry leader is a masterclass in how to apply technology to solve thorny, real-world business challenges.

How AI Is Automating the Entire Claims Lifecycle

At its core, Snapsheet's AI engine is designed to take the traditionally slow, manual claims process and turn it into a fast, automated workflow. Think of it as a hyper-efficient digital adjuster working around the clock. This system can instantly analyze photos, calculate damages, and route tasks, all without needing a human to step in.

This level of automation delivers more than just speed—it produces real business results. For AI insurance companies, this translates to dramatically shorter cycle times and much lower operational costs. It effectively turns the claims department from a necessary cost center into a real competitive advantage.

One of the platform's biggest strengths is its no-code configurability. This is a huge deal for carriers. It gives them the power to design, test, and roll out their own custom workflows without getting stuck in a long IT development queue. When market conditions shift or new business rules are needed, they can adapt on the fly.

From First Notice to Final Payment

The automation kicks in right from the very first step: the First Notice of Loss (FNOL). Instead of a policyholder spending time on a long phone call, they can now submit a claim through a mobile app in just a few minutes, photos and all. From there, the AI takes the wheel.

Triage and Assignment: The system immediately assesses the claim's complexity. It then decides whether to push it through a fully automated workflow or flag it for a human adjuster to review.

Damage Analysis: AI models get to work, scanning photos to identify the extent of the damage. They can generate a preliminary appraisal and estimate repair costs in a fraction of the time it would take a person.

Workflow Orchestration: The platform then manages every step that follows, from scheduling inspections and coordinating with shops to issuing payments. Critically, it keeps everyone in the loop along the way.

This diagram shows just how far Snapsheet has come, evolving from a simple app into a comprehensive platform for the entire industry.

The image really captures the company's journey, growing from a niche tool into a foundational piece of technology for modern claims management.

Real-World Impact and Scalability

This isn't just theory; the impact is proven and measurable. Snapsheet, a Chicago-based leader in this space, had its strongest year ever in 2021, posting a massive 159% year-over-year growth as the industry accelerated its digital adoption. Headquartered at 1 N Dearborn St Ste 600 in Chicago, the company has processed over 2.5 million claims and handled more than $10 billion in indemnity, demonstrating it can scale to meet the demands of even the largest carriers.

The table below breaks down the difference between the old way of doing things and the new, AI-powered approach.

Traditional Claims vs Snapsheet AI-Powered Claims

Process Step | Traditional Method | Snapsheet AI Method |

|---|---|---|

FNOL Intake | Manual data entry via phone call | Customer-led mobile submission |

Damage Assessment | Manual review by an adjuster | Instant AI photo analysis and estimation |

Workflow Assignment | Manual routing by a supervisor | Automated triage and routing |

Communication | Phone calls and emails | Proactive, automated status updates |

Payment Issuance | Manual processing and check mailing | Instant digital payments |

As you can see, the efficiency gains at every stage are significant, freeing up human teams to focus on more complex issues.

By automating the repetitive, low-value tasks, Snapsheet's platform lets human adjusters focus where they're needed most—on activities that require empathy and complex decision-making, like managing severe claims or providing top-tier customer care.

This balance between human expertise and machine efficiency is the key. As we look at the future of AI software development, the goal for AI insurance companies is to build systems where people and AI work together seamlessly. This approach not only makes operations more efficient but also leads to a much better experience for the policyholder, a critical factor often highlighted in claims AI reviews. To dig deeper, you can read about how AI is being applied in insurance claims in our detailed article.

Transforming the Policyholder Experience with AI Customer Care

Sure, speed is a huge selling point for automation, but the real magic for AI insurance companies is in crafting a better customer journey. A car accident or property damage is a make-or-break moment for an insurer's reputation. This is exactly where Snapsheet Chicago shines, helping carriers transform a potentially negative event into a genuinely positive interaction through thoughtful AI customer care.

Think of it as an intelligent system working quietly in the background. Instead of leaving a policyholder wondering what’s happening, the platform sends proactive text or email updates at every key milestone. When it’s time to submit photos, AI-powered guides give immediate feedback to make sure the images are clear and useful on the first try.

This shifts the entire dynamic from passive waiting to active, informed engagement. For straightforward, low-complexity claims, the system can even generate and send an instant settlement offer straight to the policyholder's phone. They can accept and get paid in a matter of minutes.

Empowering Adjusters Through Smart Automation

This kind of intelligent communication doesn’t just help the customer—it completely redefines the role of the human adjuster. By taking over repetitive communication and routine follow-ups, the platform frees up skilled professionals to focus on work that truly requires their expertise.

Here’s how that plays out:

High-Touch Service for Complex Cases: Adjusters can pour their energy into managing severe or emotionally difficult claims that need real empathy and sharp negotiation skills.

Proactive Problem-Solving: With the routine stuff handled, adjusters have the bandwidth to spot potential snags and resolve them before they become bigger problems.

Building Customer Loyalty: Instead of just relaying information, adjusters become true advocates for the policyholder, building trust and boosting retention.

This mix of automated efficiency and human expertise is essential for any modern financial services company. For carriers already using platforms like Zendesk, integrating a chatbot for Zendesk can further smooth out these interactions and create an even more automated claims lifecycle.

The goal of AI in claims is not to replace the human element but to amplify it. By handling the predictable and mundane, automation allows human teams to deliver exceptional service during a customer's time of need.

This approach hits on a key theme in claims AI reviews: policyholders want speed, but they also crave clear and consistent communication. The Chicago-based Snapsheet platform delivers the tools for both. As the industry evolves, it’s obvious that the best results come from a smart collaboration between people and technology. You can learn more about this crucial dynamic by exploring our detailed guide on building an effective AI customer care strategy.

Decoding Claims AI Reviews and Carrier Success Stories

It’s one thing to hear about the theoretical benefits of automating insurance claims with AI, but what claims leaders really need to see is proof. They want to hear from their peers and look at real results. Digging into actual claims AI reviews and carrier success stories shows how AI insurance companies are turning technology into a real competitive edge.

The common thread isn't just about processing claims faster; it's about fundamentally rewiring the business model for the better.

Instead of a generic feature list, these stories reveal how carriers are solving specific, nagging problems. A regional insurer, for example, might be laser-focused on slashing its loss adjustment expenses (LAE) by automating routine appraisals. At the same time, a national brand might be more concerned with cutting claim cycle times to keep policyholders happy and loyal.

This is what turns a platform like Chicago-based Snapsheet from a simple software expense into a strategic investment. The proof is in the numbers and the feedback from people on the front lines.

Key Themes from Carrier Success Stories

When you look at the outcomes carriers are reporting after bringing on platforms like Snapsheet, a few powerful themes keep popping up. These wins go far beyond internal efficiency—they have a massive impact on customer experience and the company's ability to adapt.

Common successes include:

Drastic Cycle Time Reduction: Many carriers talk about cutting the time from First Notice of Loss (FNOL) to payment from weeks down to a matter of days. For simpler claims, it can even be just hours.

Improved Customer Satisfaction (CSAT) Scores: Fast, transparent communication is a natural byproduct of AI customer care. It consistently leads to happier, more loyal policyholders.

Significant Expense Reduction: Automating tasks that used to eat up adjuster time—like photo analysis, estimate generation, and payment processing—directly lowers the cost of handling each claim.

"We are proud to equip... our clients across the globe, with a platform that allows them to build a claims operating model for the digital world." – Andy Cohen, President of Snapsheet

Andy’s point gets to the heart of it. This isn't just about bolting on a new tool; it's about building an entirely new, more effective way of operating. That kind of shift is what it takes to stay ahead.

From Social Proof to Strategic Investment

The real power of these success stories is the social proof they provide. When a claims VP sees that a company just like theirs solved a familiar headache using AI automation, the tech suddenly feels much more real and achievable. It stops being an abstract concept and becomes a proven solution with a clear path to getting it done and seeing a return.

For leaders wanting to see how the newest AI approaches are shaking things up, case studies on transforming insurance claims with agentic AI offer a great window into modern automation strategies.

This kind of evidence completely changes the internal conversation. It shifts from, "Can we really afford to do this?" to "How can we afford not to?" For the team at Snapsheet Chicago, these carrier testimonials and positive claims AI reviews are their most valuable asset. They show, in no uncertain terms, that investing in intelligent automation is a direct line to growth and profitability. The results speak for themselves.

A Practical Guide to Adopting Claims Automation

If you're a Head of Claims or COO looking at AI insurance companies, the path forward can feel overwhelming. You're probably asking the same questions everyone does: What does a real-world implementation actually look like? And how do we bring in new tech without grinding our current operations to a halt?

Let's break down that journey. Adopting a platform like Snapsheet Chicago is less about a technology install and more about a strategic evolution of your claims process. It begins with a hard look at your current workflows to pinpoint the biggest bottlenecks and the spots where AI can make an immediate, tangible impact.

From there, the conversation turns to integration. A major concern for carriers is how a new system will play with legacy core systems, whether it's Guidewire, Duck Creek, or something else. The good news is that modern, API-first platforms are built for this. They act as an intelligent orchestration layer on top of your existing infrastructure, avoiding the dreaded—and costly—"rip and replace" scenario.

Navigating Systems Integration and Data Security

A smooth integration really comes down to a few core ideas. The aim is to build a single, connected ecosystem where information moves securely and instantly between the new AI platform and your current systems. This breaks down data silos and gives everyone a single source of truth for every claim.

Of course, data security has to be front and center. Top-tier platforms are built with stringent protocols to guard sensitive policyholder information. This means you should expect robust encryption, routine security audits, and full compliance with industry regulations. Automation should enhance your security posture, not introduce new risks.

By focusing on seamless integration and stringent security from day one, carriers can ensure that the adoption of claims automation strengthens their operational backbone and builds, rather than erodes, policyholder trust.

This two-pronged approach is non-negotiable. It’s what lets AI insurance companies tap into the efficiencies of automation while upholding the highest standards of data stewardship—a theme you'll see consistently in honest claims AI reviews.

Fostering Collaboration Between Humans and AI

The final piece of the puzzle—and honestly, the most important—is change management. Bringing in claims AI is as much about your people as it is about the technology. You need to train your team not just on how to use a new tool, but on how to work with their new AI partner.

It's all about shifting roles to focus on what humans do best:

Adjusters as Strategists: Instead of getting bogged down in data entry and routine follow-ups, your human adjusters can focus on the complex, high-stakes claims that demand critical thinking and real empathy.

AI as an Assistant: The AI takes over the repetitive work—initial data gathering, analyzing photos, sending out status updates—which frees up your team's time and mental energy.

A Unified Workflow: The ideal state is a hybrid model where AI handles the predictable, rules-based tasks and knows exactly when to escalate to a human expert for judgment calls.

This kind of collaborative model gives you the best of both worlds: the speed and precision of a machine paired with the nuanced expertise of a seasoned professional. For a closer look at how this works in practice, our guide on insurance claims processing automation offers some great insights.

When carriers view a partner like Snapsheet Chicago as a long-term collaborator, they're not just buying a piece of software. They're building a claims operation that's more efficient today and ready for whatever comes next.

Common Questions About Snapsheet and AI in Claims

When carriers start looking into claims automation, a lot of the same questions pop up. Let's break down how platforms from leaders like Chicago's own Snapsheet really work, focusing on how AI is practically applied to claims and customer interactions.

What Kind of Insurance Claims Can Snapsheet Handle?

Snapsheet’s platform is built to be flexible, covering a wide range of Property & Casualty (P&C) lines. You’ll see it used for everything from personal and commercial auto to homeowners and renters insurance. While their AI-powered virtual appraisal is a huge part of their auto physical damage offering, the platform's workflow engine can automate the entire claims process.

This means it handles the journey from the first notice of loss (FNOL) and payments all the way to AI customer care and communications. The system is designed to manage claims of varying complexity for carriers, third-party administrators (TPAs), and managing general agents (MGAs), making it a solid option for many AI insurance companies.

How Accurate Are Snapsheet’s AI Damage Estimates?

Accuracy comes from a smart mix of machine learning, a massive amount of historical claims data, and a critical layer of human oversight. The AI models have been trained on millions of past claims, so they’re incredibly good at spotting damage patterns and estimating repair costs—a topic that always comes up in claims AI reviews.

This initial analysis is then checked against up-to-date parts pricing and local labor rates. But here’s the key part: a "human-in-the-loop" process lets expert appraisers review and sign off on the AI's estimates. This approach blends the speed of technology with the seasoned judgment of a professional, ensuring the final numbers are reliable.

The best AI systems don't replace human experts; they give them superpowers. By combining machine precision with expert validation, carriers get the best of both worlds: speed and accuracy. That's the real win for claims automation in financial services.

This balanced method means that even though the process is fast, the results are firmly rooted in real-world data and expertise.

Is It a Headache to Integrate Snapsheet with Our Current Systems?

Not at all. Snapsheet was built from the ground up to play well with others. As a cloud-native platform with an API-first design, it connects smoothly with just about anything, from older legacy systems to modern core platforms like Guidewire and Duck Creek. The goal is to minimize disruption, letting you add new capabilities to your tech stack instead of ripping and replacing what you already have.

The platform also comes with no-code tools, which gives your own team the power to set up and adjust workflows without waiting on IT. This makes you much more agile, allowing you to roll out new processes faster and react to market changes on the fly. It's built to enhance your current operations, not complicate them.

At Nolana, we see the future of insurance operations as a partnership between human experts and intelligent AI agents. Our platform is designed to automate high-stakes financial services workflows, from claims processing to customer service, by deploying compliant AI agents that work right alongside your team. By connecting with your core systems, Nolana provides real-time automation with clear guardrails and simple human hand-offs. This helps you lower costs and speed up cycle times while keeping full control and the highest standards of accuracy.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP