A Guide to pet insurance usaa and AI-Powered Claims

A Guide to pet insurance usaa and AI-Powered Claims

Explore pet insurance usaa with USAA partners and how AI speeds claims for faster, smarter coverage.

If you're a USAA member looking for pet insurance, you don't have to start your search from square one. USAA has teamed up with Embrace Pet Insurance, a well-regarded specialist in the field, to offer plans directly to its members. This partnership means you get the benefit of a dedicated pet insurance provider, often with an exclusive discount, all while staying within the USAA family you already trust.

How USAA Pet Insurance Really Works

When you sign up for pet insurance through USAA, you’re actually getting a policy underwritten and managed by Embrace. Think of it this way: USAA did the homework for you, using their high standards to pick a top-tier partner to handle your pet's health coverage. This lets USAA extend its trusted service to another part of your life without having to become a pet insurance company from the ground up.

The whole point is to give you a financial backstop for those out-of-the-blue vet bills. It’s about peace of mind. Knowing that a sudden accident or a serious illness won't force you into a heartbreaking financial choice lets you focus on what really matters—your pet's recovery.

The Role of Technology in Modern Coverage

These days, the best ai insurance companies like Embrace are completely changing the game for customers. Technology has made everything from getting a quote to filing a claim feel almost effortless.

By automating insurance claims with AI and offering instant support, insurers handle the process with more speed and accuracy. For you, this means getting your money back faster, which really helps take the pressure off during a stressful time.

This tech-forward approach is a huge part of what makes modern pet insurance so valuable. Innovations in claims and customer service are setting a whole new bar. For example, AI customer care can instantly answer questions about your policy, and some automated tools can even scan a vet bill and kick off the reimbursement process in just a few minutes. Our complete guide to vet insurance dives much deeper into how this works.

As you look into pet insurance USAA provides, keep in mind that the technology powering the plan is just as crucial as the coverage details. A great policy doesn't mean much if the service behind it is slow and frustrating.

The Rise of AI in the Insurance Industry

The insurance world is in the middle of a massive shake-up, and artificial intelligence is at the center of it all. The most innovative ai insurance companies aren't just dipping their toes in the water anymore; they're diving in headfirst. They’re using AI for automating insurance claims with AI and enhancing customer care, especially for financial services.

This isn’t about replacing people. It’s about giving them superpowers. AI takes on the repetitive, data-crunching tasks with incredible speed, freeing up human teams to solve the genuinely tricky problems that require a personal touch.

Agentic AI: A New Kind of Digital Workforce

The real game-changer here is something called agentic AI. Don't think of a generic chatbot. Instead, picture a team of highly trained digital specialists. Each AI agent is taught a company's unique processes, compliance guidelines, and operational rules—essentially, its entire playbook. It’s like having a crew of tireless assistants working around the clock, executing tasks perfectly every single time.

What does this mean for you? If you file a claim, the process kicks off immediately, whether it's 2 PM or 2 AM. For the insurer, it means a workflow that used to drag on for days is now finished in minutes.

A Radically Better Customer Experience

One of the first places you’ll notice the difference is in AI customer care. We’ve all been there: stuck on hold, listening to bad music, or trying to navigate a confusing phone menu just to ask a simple question. AI-powered platforms are making that a thing of the past by providing instant, correct answers to a huge number of common questions.

But it goes deeper than just answering FAQs. This tech can walk a policyholder step-by-step through filing a claim, making sure all the right documents are uploaded from the get-go. That one improvement cuts out the frustrating email chains and phone calls that so often slow down getting your money back.

Instant Verification: The AI can check your submitted info against your policy details in a flash, catching any potential hiccups right away.

24/7 Availability: You get help when you actually need it, not just between nine and five.

Fewer Mistakes: By handling the data entry, AI slashes the simple human errors that can put a claim on hold.

This all adds up to a much smoother, more transparent process. When you're already worried about your pet's health, a fast and straightforward claims experience is a massive relief. It’s how insurance companies build real, lasting trust.

Automating the Entire Claims Journey

Behind the scenes, AI is completely overhauling the back-office work. This is where claims ai really shines. Insurers are plugging intelligent automation platforms directly into their main systems (like Guidewire or Duck Creek) to build one seamless, automated claims pipeline. If you're curious about the nuts and bolts, you can learn more about how intelligent automation in insurance is reshaping the entire field.

Once a claim is filed, an AI agent can autonomously handle a whole checklist of critical jobs. It can read and understand a vet's invoice, make a decision on the claim based on the policy rules, check for red flags that might indicate fraud, and make sure the whole process follows regulations. Unsurprisingly, claims ai reviews consistently point to huge reductions in how long it takes to get a claim paid.

This efficiency translates directly into cost savings. With AI managing the high volume of simple, everyday claims, human adjusters can pour their time and expertise into the complex cases that truly need a sharp mind. The result is a faster, more accurate, and more affordable system for everyone. For USAA members with a pet insurance USAA policy, this is the technology that empowers partners like Embrace to provide the quick, dependable service they've come to expect.

What's Actually Covered? A Look at Your Policy Options and Exclusions

When you look into pet insurance USAA members can get, you’ll find the options are provided through their partnership with Embrace. It really boils down to two main types of plans, each offering a different level of protection for your wallet.

First, you have the accident-only plan. This is your basic safety net, designed purely for those unexpected mishaps. Think of it as coverage for the "oops" moments—like when your dog decides a sock looks like a tasty snack or your cat takes a clumsy leap off the bookshelf.

The more popular choice, however, is the comprehensive accident-and-illness plan. This plan wraps everything from the accident-only policy into a much broader package that also covers sickness. It's there for you whether it's a minor ear infection or a more serious diagnosis like diabetes or cancer. For most pet owners, this all-in-one approach delivers true peace of mind.

To make things clearer, let's break down what these plans generally cover versus what they leave out.

USAA Pet Insurance Coverage At a Glance

Coverage Category | What's Usually Covered | What's Typically Excluded (Or Optional) |

|---|---|---|

Accidents & Injuries | Broken bones, toxic ingestions, cuts, swallowed objects, and other physical injuries. | Injuries from organized fighting, racing, or commercial activities. |

Illnesses | Infections, digestive issues, cancer, hip dysplasia, allergies, and chronic conditions. | Pre-existing conditions (any issue that showed symptoms before coverage began or during a waiting period). |

Veterinary Care | Exams, diagnostics (X-rays, blood tests), surgery, hospitalization, prescription medications, and emergency vet visits. | Routine/Wellness Care (check-ups, vaccines, spay/neuter). This is often available as an optional add-on. |

Hereditary Conditions | Conditions common to certain breeds, such as cherry eye or hip dysplasia (as long as they aren't pre-existing). | Conditions that were diagnosed or symptomatic before the policy started. |

Alternative Therapies | Treatments like acupuncture, chiropractic care, and physical therapy when prescribed by a vet. | Experimental treatments or therapies not administered by a licensed veterinarian. |

Other Exclusions | N/A | Costs related to breeding, cosmetic procedures (like ear cropping), and behavioral training (unless specified as covered). |

This table gives you a solid starting point, but always remember to read the fine print of your specific policy to understand the exact terms and limits.

Understanding Key Exclusions

No pet insurance policy on the market covers absolutely everything, and it’s critical to know what’s not included to avoid any frustrating surprises down the line. The biggest one, by far, is for pre-existing conditions.

A pre-existing condition is any illness or injury your pet showed signs of before the policy's start date or during its waiting period. You can't buy home insurance while your house is already on fire, and the same logic applies here. This standard industry practice is why enrolling your pet while they are young and healthy is often the best strategy.

Other common things that aren't covered usually include:

Breeding Costs: Any expenses connected to pregnancy, birth, or whelping.

Cosmetic Procedures: Elective surgeries that aren't medically necessary, like tail docking.

Behavioral Training: Professional help for issues like separation anxiety or aggression usually isn't part of the standard plan.

Keeping good records of your pet's health from day one is incredibly helpful. If you're looking for ways to stay organized, you can learn more about how to collect and manage insurance details effortlessly with the right tools.

Adding Proactive Care with Wellness Plans

So what about all the predictable costs, like annual check-ups and shots? For that, Embrace offers an optional wellness rewards plan. Think of this less like traditional insurance and more like a clever budgeting tool.

You decide how much you want to set aside for routine care, and that amount becomes your annual allowance for things like vaccinations, flea and tick prevention, and even dental cleanings. It’s a great way to spread out those known expenses over the year so you’re never caught off guard. This proactive approach helps ensure you never have to skip preventative care because of cost.

The Real Cost of Pet Care and How Insurance Helps

It’s amazing what modern veterinarians can do for our pets. Treatments that were science fiction just a generation ago are now available, but that progress comes with a hefty price tag. For many of us, pet insurance is no longer a "nice-to-have"—it's a financial lifeline that protects us from unexpected and often overwhelming vet bills.

You can see this shift in the numbers. The U.S. pet insurance market, which includes the policies offered to USAA members, recently hit a staggering $4.7 billion in premiums. That’s a 20.5% jump in just one year. With over 6.4 million pets now covered, it's clear that more owners are looking for a safety net. If you're curious, you can explore the full industry report to see just how quickly the market is growing.

This massive growth puts a ton of pressure on insurance companies to keep up. They have to process an avalanche of claims quickly and accurately, all while keeping customers happy. This is where technology steps in to make it all work.

How Your Premium Is Calculated

When you get a quote for a USAA pet insurance plan, the price isn't random. The insurer looks at a few key things to figure out the risk and potential cost of covering your furry family member.

Pet's Breed: Let's be honest, some breeds are just more prone to certain problems. Think German Shepherds and hip dysplasia or Bulldogs and breathing issues. These genetic predispositions often mean a higher premium.

Pet's Age: It's almost always cheaper to insure a puppy or kitten. They're less likely to have pre-existing conditions, so the risk is lower from the insurer's perspective.

Your Location: A vet visit in New York City is going to cost a lot more than one in rural Nebraska. Your premium is adjusted to reflect the average cost of veterinary care right where you live.

Knowing these factors helps explain why your quote might look different from your neighbor's, even if you both have Labradors. It’s all about creating a fair price that matches the specific risk.

Key Financial Terms Explained

To really get a handle on your policy, you need to know the lingo. Words like "deductible" and "reimbursement" might sound like jargon, but they're pretty simple once you break them down.

Think of your deductible as what you agree to pay out-of-pocket first each year. Once you hit that amount, your insurance starts paying. The reimbursement level is the percentage of the remaining vet bill that the insurance company pays you back.

Let's walk through an example. Say you have a $250 deductible and a 90% reimbursement level. Your dog has an emergency that results in a $1,250 vet bill.

You'd first pay the $250 deductible. Of the remaining $1,000, the insurer covers 90%, sending you a check for $900. Suddenly, a scary bill becomes much more manageable.

Behind the scenes, technology is constantly crunching data to help insurers set these prices. By automating risk analysis and claims processing, they can offer plans that are both affordable for pet owners and sustainable for their business, especially in such a fast-growing market.

How AI Makes Filing a Claim Surprisingly Simple

Filing a pet insurance claim used to be a real headache. I’m sure many of us remember the stacks of paperwork, the confusing phone calls, and the long, anxious wait for a check. Thankfully, that's changing. The best ai insurance companies are now automating insurance claims with AI to completely overhaul the process, turning what was once a frustrating chore into something remarkably quick and easy.

Let’s walk through what this looks like today. Picture this: your dog gets sick, you rush to the vet, and you leave with a detailed invoice. Instead of hunting for a form and a pen, you just pull out your phone, snap a picture of the bill, and upload it to the insurer's app.

That’s when the real magic starts.

From a Photo to Your Bank Account

The second you upload that invoice, an AI tool known as Optical Character Recognition (OCR) kicks in. Think of it as a super-fast digital assistant that reads the document for you. It instantly scans the invoice, pulls out all the critical information—like the diagnosis, the treatments, and the costs—and enters it into the system. You don't have to type a thing.

This first step is huge because it gets rid of the simple data entry mistakes that used to hold up claims for weeks. The information is captured accurately from the start, paving the way for a speedy resolution.

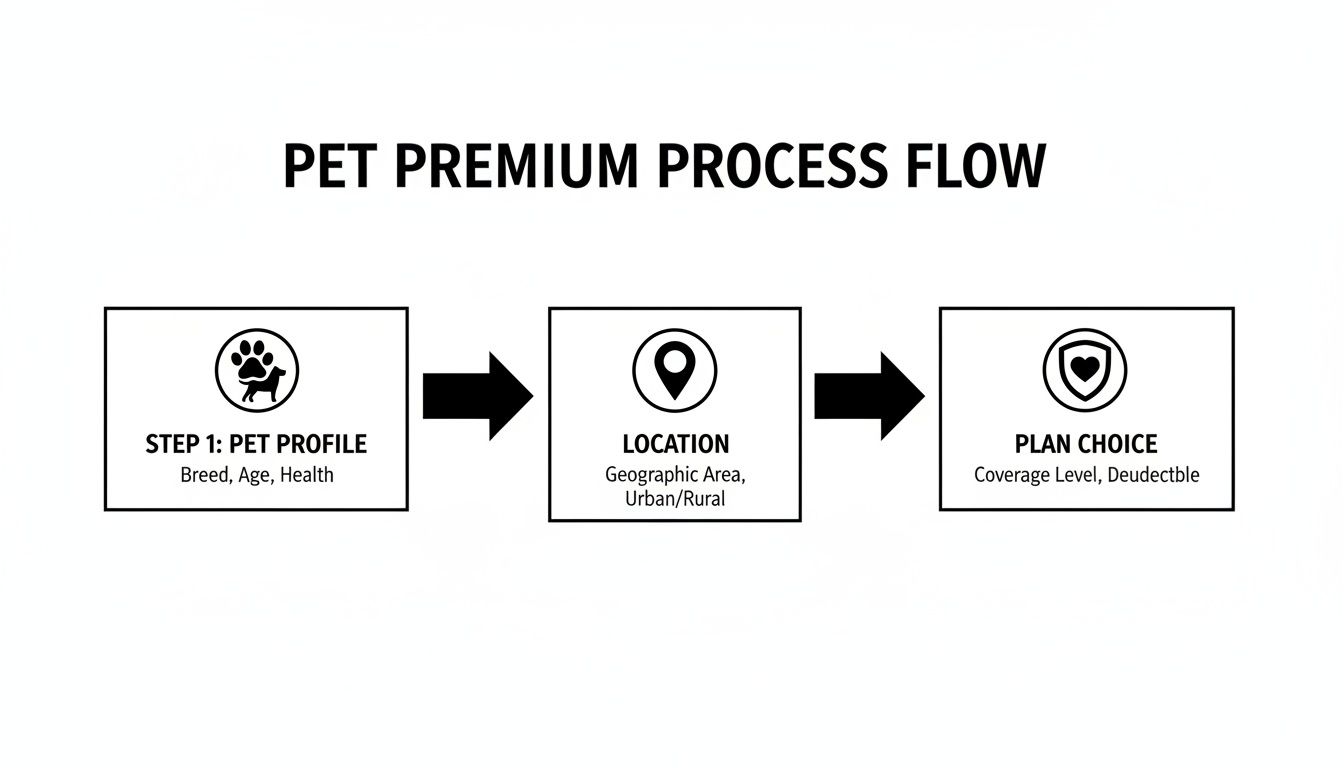

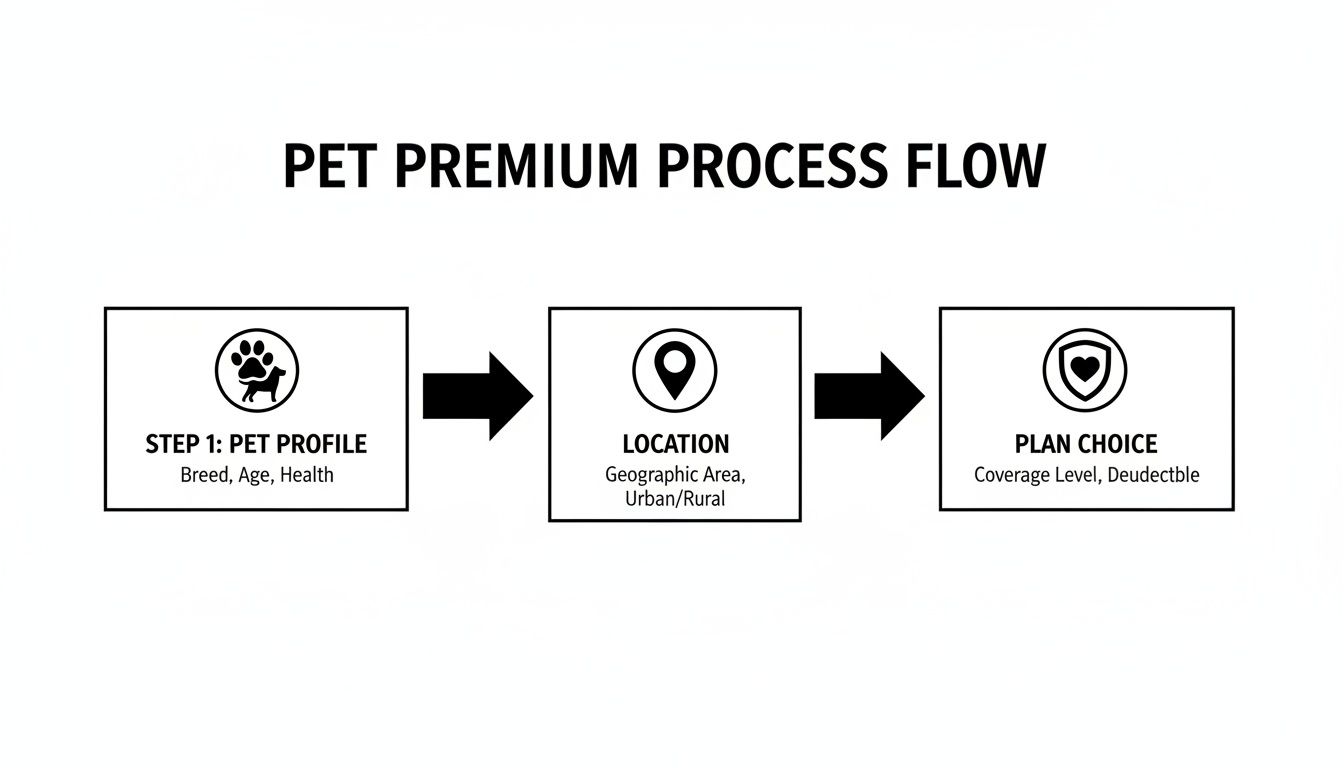

This diagram shows how your pet's profile, location, and plan choice all come together to determine your premium.

The infographic breaks down the key factors AI systems analyze to figure out risk and pricing for policies, including the pet insurance USAA members have access to.

Once the data is in the system, a specialized AI agent takes the reins. It essentially acts like an expert claims adjuster, but one that works at incredible speed. The AI cross-references the details from your vet bill against your specific policy terms in a matter of seconds.

Here’s what it checks almost instantly:

Coverage Check: Is this specific treatment covered under your plan?

Deductible Status: Have you already met your annual deductible for the year?

Policy Limits: How does this claim stack up against your reimbursement level and annual caps?

For most common claims, the AI can approve the reimbursement on the spot and get the payment process started. The end result? You can often submit a claim and have the money in your account in a few hours, not weeks. It's no wonder that a fast, easy claims process is one of the most praised features in claims ai reviews.

The Human Touch of AI Customer Care

This automation isn't just about processing claims faster. If you have a question about anything, AI customer care platforms are there to help 24/7. These aren't the clunky chatbots of the past; they're sophisticated systems that actually understand your policy details and can give you clear answers.

For anyone on the business side of insurance, this is a game-changer. Automating the claims workflow from start to finish doesn't just make things more efficient and cut costs—it creates happier, more loyal customers.

This high-tech foundation is what allows providers to manage a huge number of claims with both precision and speed. If you want to dive deeper into the nuts and bolts, you can read more about the real-world impact of transforming insurance claims with agentic AI. Ultimately, this is the technology that enables USAA's partners to provide the kind of quick, dependable service their members count on.

Answering Your Questions About USAA Pet Insurance and AI

When you're looking into something as important as your pet's health coverage, it's normal to have a few questions. Especially with technology playing a bigger role in how insurance works, you want to be sure you understand the nuts and bolts. Let's clear up some of the most common questions people have about the pet insurance USAA members can get.

Our goal here is to give you straightforward answers so you can feel completely comfortable with your decision.

Is This Insurance Actually from USAA?

This is probably the number one question we hear, and it’s a great one. While USAA offers access to the plan, the insurance itself is actually provided by Embrace Pet Insurance. Think of USAA as a trusted partner that has already done the legwork to find and vet a top-notch pet insurance specialist for its members.

So, when you sign up, file a claim, or call with a question, you'll be working directly with the team at Embrace. They handle everything from start to finish, and USAA members often get a special discount for going through them.

How Does AI Really Speed Up My Claim?

It might seem like magic, but the quick turnaround on modern claims comes down to smart technology. This is where AI makes a real difference for pet owners, and it's a big reason for so many positive claims ai reviews.

AI works behind the scenes in a couple of ways. First, it can scan your vet’s invoice and instantly pull out all the important details—no more slow, manual data entry. Then, an AI agent checks those details against your policy's coverage in a matter of seconds. If it's a straightforward, covered claim, the AI can often approve it and kick off the payment process right away, cutting the wait time from weeks down to a day or even less.

This kind of speed and efficiency is what sets leading ai insurance companies apart. If you're curious about the tech behind it, our guide on improving insurance claims processing goes into more detail.

What Exactly Is a Pre-Existing Condition?

In the simplest terms, a pre-existing condition is any health problem your pet showed signs of before your insurance policy started (or during the waiting period). It's a standard rule across the industry to make sure policies are for future, unexpected issues, not ones that are already known and being treated.

Insurers figure this out by looking at your pet's medical records from your vet. This is exactly why getting insurance when your pet is young and healthy is such a smart move—it locks in coverage before problems have a chance to show up, ensuring you get the full value of your plan when you need it most.

At Nolana, we build the AI-native operating system that empowers financial services to automate high-stakes operations. Our compliant AI agents execute tasks end-to-end within claims, case management, and customer service workflows, delivering speed and accuracy without compromising control. Discover how Nolana can transform your operations.

If you're a USAA member looking for pet insurance, you don't have to start your search from square one. USAA has teamed up with Embrace Pet Insurance, a well-regarded specialist in the field, to offer plans directly to its members. This partnership means you get the benefit of a dedicated pet insurance provider, often with an exclusive discount, all while staying within the USAA family you already trust.

How USAA Pet Insurance Really Works

When you sign up for pet insurance through USAA, you’re actually getting a policy underwritten and managed by Embrace. Think of it this way: USAA did the homework for you, using their high standards to pick a top-tier partner to handle your pet's health coverage. This lets USAA extend its trusted service to another part of your life without having to become a pet insurance company from the ground up.

The whole point is to give you a financial backstop for those out-of-the-blue vet bills. It’s about peace of mind. Knowing that a sudden accident or a serious illness won't force you into a heartbreaking financial choice lets you focus on what really matters—your pet's recovery.

The Role of Technology in Modern Coverage

These days, the best ai insurance companies like Embrace are completely changing the game for customers. Technology has made everything from getting a quote to filing a claim feel almost effortless.

By automating insurance claims with AI and offering instant support, insurers handle the process with more speed and accuracy. For you, this means getting your money back faster, which really helps take the pressure off during a stressful time.

This tech-forward approach is a huge part of what makes modern pet insurance so valuable. Innovations in claims and customer service are setting a whole new bar. For example, AI customer care can instantly answer questions about your policy, and some automated tools can even scan a vet bill and kick off the reimbursement process in just a few minutes. Our complete guide to vet insurance dives much deeper into how this works.

As you look into pet insurance USAA provides, keep in mind that the technology powering the plan is just as crucial as the coverage details. A great policy doesn't mean much if the service behind it is slow and frustrating.

The Rise of AI in the Insurance Industry

The insurance world is in the middle of a massive shake-up, and artificial intelligence is at the center of it all. The most innovative ai insurance companies aren't just dipping their toes in the water anymore; they're diving in headfirst. They’re using AI for automating insurance claims with AI and enhancing customer care, especially for financial services.

This isn’t about replacing people. It’s about giving them superpowers. AI takes on the repetitive, data-crunching tasks with incredible speed, freeing up human teams to solve the genuinely tricky problems that require a personal touch.

Agentic AI: A New Kind of Digital Workforce

The real game-changer here is something called agentic AI. Don't think of a generic chatbot. Instead, picture a team of highly trained digital specialists. Each AI agent is taught a company's unique processes, compliance guidelines, and operational rules—essentially, its entire playbook. It’s like having a crew of tireless assistants working around the clock, executing tasks perfectly every single time.

What does this mean for you? If you file a claim, the process kicks off immediately, whether it's 2 PM or 2 AM. For the insurer, it means a workflow that used to drag on for days is now finished in minutes.

A Radically Better Customer Experience

One of the first places you’ll notice the difference is in AI customer care. We’ve all been there: stuck on hold, listening to bad music, or trying to navigate a confusing phone menu just to ask a simple question. AI-powered platforms are making that a thing of the past by providing instant, correct answers to a huge number of common questions.

But it goes deeper than just answering FAQs. This tech can walk a policyholder step-by-step through filing a claim, making sure all the right documents are uploaded from the get-go. That one improvement cuts out the frustrating email chains and phone calls that so often slow down getting your money back.

Instant Verification: The AI can check your submitted info against your policy details in a flash, catching any potential hiccups right away.

24/7 Availability: You get help when you actually need it, not just between nine and five.

Fewer Mistakes: By handling the data entry, AI slashes the simple human errors that can put a claim on hold.

This all adds up to a much smoother, more transparent process. When you're already worried about your pet's health, a fast and straightforward claims experience is a massive relief. It’s how insurance companies build real, lasting trust.

Automating the Entire Claims Journey

Behind the scenes, AI is completely overhauling the back-office work. This is where claims ai really shines. Insurers are plugging intelligent automation platforms directly into their main systems (like Guidewire or Duck Creek) to build one seamless, automated claims pipeline. If you're curious about the nuts and bolts, you can learn more about how intelligent automation in insurance is reshaping the entire field.

Once a claim is filed, an AI agent can autonomously handle a whole checklist of critical jobs. It can read and understand a vet's invoice, make a decision on the claim based on the policy rules, check for red flags that might indicate fraud, and make sure the whole process follows regulations. Unsurprisingly, claims ai reviews consistently point to huge reductions in how long it takes to get a claim paid.

This efficiency translates directly into cost savings. With AI managing the high volume of simple, everyday claims, human adjusters can pour their time and expertise into the complex cases that truly need a sharp mind. The result is a faster, more accurate, and more affordable system for everyone. For USAA members with a pet insurance USAA policy, this is the technology that empowers partners like Embrace to provide the quick, dependable service they've come to expect.

What's Actually Covered? A Look at Your Policy Options and Exclusions

When you look into pet insurance USAA members can get, you’ll find the options are provided through their partnership with Embrace. It really boils down to two main types of plans, each offering a different level of protection for your wallet.

First, you have the accident-only plan. This is your basic safety net, designed purely for those unexpected mishaps. Think of it as coverage for the "oops" moments—like when your dog decides a sock looks like a tasty snack or your cat takes a clumsy leap off the bookshelf.

The more popular choice, however, is the comprehensive accident-and-illness plan. This plan wraps everything from the accident-only policy into a much broader package that also covers sickness. It's there for you whether it's a minor ear infection or a more serious diagnosis like diabetes or cancer. For most pet owners, this all-in-one approach delivers true peace of mind.

To make things clearer, let's break down what these plans generally cover versus what they leave out.

USAA Pet Insurance Coverage At a Glance

Coverage Category | What's Usually Covered | What's Typically Excluded (Or Optional) |

|---|---|---|

Accidents & Injuries | Broken bones, toxic ingestions, cuts, swallowed objects, and other physical injuries. | Injuries from organized fighting, racing, or commercial activities. |

Illnesses | Infections, digestive issues, cancer, hip dysplasia, allergies, and chronic conditions. | Pre-existing conditions (any issue that showed symptoms before coverage began or during a waiting period). |

Veterinary Care | Exams, diagnostics (X-rays, blood tests), surgery, hospitalization, prescription medications, and emergency vet visits. | Routine/Wellness Care (check-ups, vaccines, spay/neuter). This is often available as an optional add-on. |

Hereditary Conditions | Conditions common to certain breeds, such as cherry eye or hip dysplasia (as long as they aren't pre-existing). | Conditions that were diagnosed or symptomatic before the policy started. |

Alternative Therapies | Treatments like acupuncture, chiropractic care, and physical therapy when prescribed by a vet. | Experimental treatments or therapies not administered by a licensed veterinarian. |

Other Exclusions | N/A | Costs related to breeding, cosmetic procedures (like ear cropping), and behavioral training (unless specified as covered). |

This table gives you a solid starting point, but always remember to read the fine print of your specific policy to understand the exact terms and limits.

Understanding Key Exclusions

No pet insurance policy on the market covers absolutely everything, and it’s critical to know what’s not included to avoid any frustrating surprises down the line. The biggest one, by far, is for pre-existing conditions.

A pre-existing condition is any illness or injury your pet showed signs of before the policy's start date or during its waiting period. You can't buy home insurance while your house is already on fire, and the same logic applies here. This standard industry practice is why enrolling your pet while they are young and healthy is often the best strategy.

Other common things that aren't covered usually include:

Breeding Costs: Any expenses connected to pregnancy, birth, or whelping.

Cosmetic Procedures: Elective surgeries that aren't medically necessary, like tail docking.

Behavioral Training: Professional help for issues like separation anxiety or aggression usually isn't part of the standard plan.

Keeping good records of your pet's health from day one is incredibly helpful. If you're looking for ways to stay organized, you can learn more about how to collect and manage insurance details effortlessly with the right tools.

Adding Proactive Care with Wellness Plans

So what about all the predictable costs, like annual check-ups and shots? For that, Embrace offers an optional wellness rewards plan. Think of this less like traditional insurance and more like a clever budgeting tool.

You decide how much you want to set aside for routine care, and that amount becomes your annual allowance for things like vaccinations, flea and tick prevention, and even dental cleanings. It’s a great way to spread out those known expenses over the year so you’re never caught off guard. This proactive approach helps ensure you never have to skip preventative care because of cost.

The Real Cost of Pet Care and How Insurance Helps

It’s amazing what modern veterinarians can do for our pets. Treatments that were science fiction just a generation ago are now available, but that progress comes with a hefty price tag. For many of us, pet insurance is no longer a "nice-to-have"—it's a financial lifeline that protects us from unexpected and often overwhelming vet bills.

You can see this shift in the numbers. The U.S. pet insurance market, which includes the policies offered to USAA members, recently hit a staggering $4.7 billion in premiums. That’s a 20.5% jump in just one year. With over 6.4 million pets now covered, it's clear that more owners are looking for a safety net. If you're curious, you can explore the full industry report to see just how quickly the market is growing.

This massive growth puts a ton of pressure on insurance companies to keep up. They have to process an avalanche of claims quickly and accurately, all while keeping customers happy. This is where technology steps in to make it all work.

How Your Premium Is Calculated

When you get a quote for a USAA pet insurance plan, the price isn't random. The insurer looks at a few key things to figure out the risk and potential cost of covering your furry family member.

Pet's Breed: Let's be honest, some breeds are just more prone to certain problems. Think German Shepherds and hip dysplasia or Bulldogs and breathing issues. These genetic predispositions often mean a higher premium.

Pet's Age: It's almost always cheaper to insure a puppy or kitten. They're less likely to have pre-existing conditions, so the risk is lower from the insurer's perspective.

Your Location: A vet visit in New York City is going to cost a lot more than one in rural Nebraska. Your premium is adjusted to reflect the average cost of veterinary care right where you live.

Knowing these factors helps explain why your quote might look different from your neighbor's, even if you both have Labradors. It’s all about creating a fair price that matches the specific risk.

Key Financial Terms Explained

To really get a handle on your policy, you need to know the lingo. Words like "deductible" and "reimbursement" might sound like jargon, but they're pretty simple once you break them down.

Think of your deductible as what you agree to pay out-of-pocket first each year. Once you hit that amount, your insurance starts paying. The reimbursement level is the percentage of the remaining vet bill that the insurance company pays you back.

Let's walk through an example. Say you have a $250 deductible and a 90% reimbursement level. Your dog has an emergency that results in a $1,250 vet bill.

You'd first pay the $250 deductible. Of the remaining $1,000, the insurer covers 90%, sending you a check for $900. Suddenly, a scary bill becomes much more manageable.

Behind the scenes, technology is constantly crunching data to help insurers set these prices. By automating risk analysis and claims processing, they can offer plans that are both affordable for pet owners and sustainable for their business, especially in such a fast-growing market.

How AI Makes Filing a Claim Surprisingly Simple

Filing a pet insurance claim used to be a real headache. I’m sure many of us remember the stacks of paperwork, the confusing phone calls, and the long, anxious wait for a check. Thankfully, that's changing. The best ai insurance companies are now automating insurance claims with AI to completely overhaul the process, turning what was once a frustrating chore into something remarkably quick and easy.

Let’s walk through what this looks like today. Picture this: your dog gets sick, you rush to the vet, and you leave with a detailed invoice. Instead of hunting for a form and a pen, you just pull out your phone, snap a picture of the bill, and upload it to the insurer's app.

That’s when the real magic starts.

From a Photo to Your Bank Account

The second you upload that invoice, an AI tool known as Optical Character Recognition (OCR) kicks in. Think of it as a super-fast digital assistant that reads the document for you. It instantly scans the invoice, pulls out all the critical information—like the diagnosis, the treatments, and the costs—and enters it into the system. You don't have to type a thing.

This first step is huge because it gets rid of the simple data entry mistakes that used to hold up claims for weeks. The information is captured accurately from the start, paving the way for a speedy resolution.

This diagram shows how your pet's profile, location, and plan choice all come together to determine your premium.

The infographic breaks down the key factors AI systems analyze to figure out risk and pricing for policies, including the pet insurance USAA members have access to.

Once the data is in the system, a specialized AI agent takes the reins. It essentially acts like an expert claims adjuster, but one that works at incredible speed. The AI cross-references the details from your vet bill against your specific policy terms in a matter of seconds.

Here’s what it checks almost instantly:

Coverage Check: Is this specific treatment covered under your plan?

Deductible Status: Have you already met your annual deductible for the year?

Policy Limits: How does this claim stack up against your reimbursement level and annual caps?

For most common claims, the AI can approve the reimbursement on the spot and get the payment process started. The end result? You can often submit a claim and have the money in your account in a few hours, not weeks. It's no wonder that a fast, easy claims process is one of the most praised features in claims ai reviews.

The Human Touch of AI Customer Care

This automation isn't just about processing claims faster. If you have a question about anything, AI customer care platforms are there to help 24/7. These aren't the clunky chatbots of the past; they're sophisticated systems that actually understand your policy details and can give you clear answers.

For anyone on the business side of insurance, this is a game-changer. Automating the claims workflow from start to finish doesn't just make things more efficient and cut costs—it creates happier, more loyal customers.

This high-tech foundation is what allows providers to manage a huge number of claims with both precision and speed. If you want to dive deeper into the nuts and bolts, you can read more about the real-world impact of transforming insurance claims with agentic AI. Ultimately, this is the technology that enables USAA's partners to provide the kind of quick, dependable service their members count on.

Answering Your Questions About USAA Pet Insurance and AI

When you're looking into something as important as your pet's health coverage, it's normal to have a few questions. Especially with technology playing a bigger role in how insurance works, you want to be sure you understand the nuts and bolts. Let's clear up some of the most common questions people have about the pet insurance USAA members can get.

Our goal here is to give you straightforward answers so you can feel completely comfortable with your decision.

Is This Insurance Actually from USAA?

This is probably the number one question we hear, and it’s a great one. While USAA offers access to the plan, the insurance itself is actually provided by Embrace Pet Insurance. Think of USAA as a trusted partner that has already done the legwork to find and vet a top-notch pet insurance specialist for its members.

So, when you sign up, file a claim, or call with a question, you'll be working directly with the team at Embrace. They handle everything from start to finish, and USAA members often get a special discount for going through them.

How Does AI Really Speed Up My Claim?

It might seem like magic, but the quick turnaround on modern claims comes down to smart technology. This is where AI makes a real difference for pet owners, and it's a big reason for so many positive claims ai reviews.

AI works behind the scenes in a couple of ways. First, it can scan your vet’s invoice and instantly pull out all the important details—no more slow, manual data entry. Then, an AI agent checks those details against your policy's coverage in a matter of seconds. If it's a straightforward, covered claim, the AI can often approve it and kick off the payment process right away, cutting the wait time from weeks down to a day or even less.

This kind of speed and efficiency is what sets leading ai insurance companies apart. If you're curious about the tech behind it, our guide on improving insurance claims processing goes into more detail.

What Exactly Is a Pre-Existing Condition?

In the simplest terms, a pre-existing condition is any health problem your pet showed signs of before your insurance policy started (or during the waiting period). It's a standard rule across the industry to make sure policies are for future, unexpected issues, not ones that are already known and being treated.

Insurers figure this out by looking at your pet's medical records from your vet. This is exactly why getting insurance when your pet is young and healthy is such a smart move—it locks in coverage before problems have a chance to show up, ensuring you get the full value of your plan when you need it most.

At Nolana, we build the AI-native operating system that empowers financial services to automate high-stakes operations. Our compliant AI agents execute tasks end-to-end within claims, case management, and customer service workflows, delivering speed and accuracy without compromising control. Discover how Nolana can transform your operations.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP