Ai Customer Service Solutions: Automating Claims and Financial Care

Ai Customer Service Solutions: Automating Claims and Financial Care

Discover how ai customer service solutions streamline claims, boost efficiency, and improve customer satisfaction with AI-powered tools.

In the high-stakes worlds of finance and insurance, the old ways of handling customer service just don't cut it anymore. What was once a futuristic concept is now an operational necessity: AI customer service solutions. These intelligent systems are the direct answer to ever-present challenges like sky-high manual processing costs and customer demands for instant, round-the-clock support, especially for automating insurance claims with AI and enhancing customer care in financial services.

The New Standard in Financial and Insurance Customer Service

For leaders in these sectors, the pressure is on. Customers expect immediate, accurate answers, while internal teams are often bogged down by complex, error-prone workflows. Manual claims processing is notoriously slow and expensive, and the sheer volume of daily inquiries can quickly overwhelm even the most capable human teams. This is exactly where AI makes its mark.

Imagine processing an insurance claim in minutes, not days. Picture a world where a customer's banking question is resolved instantly, at any hour, without waiting on hold. This isn't a future vision; it's the reality that AI customer care delivers right now. By automating routine but critical tasks, these solutions free up your human experts to focus on the nuanced, high-value work that truly moves the needle.

Shifting From Manual Operations to Intelligent Automation

The move toward AI in customer service isn't just a trend; it's an industry-wide shift. In fact, a staggering 80% of companies are projected to use AI-powered chatbots for customer service by 2025. That's a massive jump from just 5% in 2020, highlighting just how quickly organizations are realizing the power of this technology. If you're looking for practical artificial intelligence business solutions, understanding this shift is the first step.

The table below gives a quick snapshot of how fundamentally different these two approaches are.

Manual vs AI-Powered Customer Operations Snapshot

Operational Aspect | Traditional Manual Approach | AI-Powered Solution |

|---|---|---|

Response Time | Hours or days, dependent on agent availability and business hours. | Instant, 24/7 responses for common and complex queries. |

Cost Per Interaction | High, driven by labor, training, and infrastructure costs. | Significantly lower, with automation handling the bulk of interactions. |

Scalability | Limited by headcount; slow and costly to scale up or down. | Highly elastic; can handle massive volume spikes without performance drops. |

Consistency & Accuracy | Varies by agent; prone to human error and inconsistent answers. | Extremely consistent, adhering strictly to predefined rules and SOPs. |

Agent Focus | Repetitive, low-value tasks like data entry and password resets. | Complex problem-solving, empathy-driven support, and relationship building. |

This comparison makes it clear: AI isn't just a minor upgrade. It’s a complete operational overhaul that allows financial and insurance firms to work smarter, not just harder.

AI is not about replacing human expertise but augmenting it. It handles the repetitive, procedural work with speed and accuracy, allowing your team to apply their skills where they have the greatest effect—building relationships and solving complex problems.

This guide is designed to move beyond theory and get into practical application. For ai insurance companies, this means automating insurance claims with AI for faster settlements and happier policyholders. For financial institutions, it translates to frictionless onboarding and more efficient dispute resolution.

Getting a handle on the fundamentals is the first step. Our detailed guide on AI customer care offers a deeper dive into these core concepts and how to apply them.

How AI Agents Handle Complex Financial Workflows

Forget simple chatbots. To really get what AI customer service solutions do in tightly regulated industries like banking and insurance, you need to think differently. Picture a ‘digital specialist’—an AI agent that has meticulously learned your company’s specific Standard Operating Procedures (SOPs) until it knows them cold. This isn't about just answering FAQs; it's about executing complicated, multi-step tasks from beginning to end, especially in financial services and claims processing.

That’s the essence of agentic automation. A basic bot is stuck on a rigid script, but a true AI agent can reason, make decisions, and see a whole workflow through. It can process an insurance claim, manage a complex financial case file, or offer support across email, chat, and phone calls without ever losing the plot. This is what makes AI a genuinely practical tool for high-stakes work.

The Digital Specialist That Knows Your Rules

The real power behind these AI agents isn't some generic, off-the-shelf knowledge. It’s a deep, practical understanding of your business, learned from the ground up. They are trained on your specific SOPs, historical team data, and compliance guidelines. This ensures every move the AI makes is perfectly in sync with your company's rules and regulatory obligations.

Let's take a new insurance claim as an example. When it arrives, the AI agent sees more than just a form. It understands the entire process:

Document Ingestion: It reads and makes sense of all kinds of documents—police reports, medical bills, photos of car damage, you name it.

Data Validation: The agent then checks the submitted details against the customer’s policy in your core system, verifying coverage and looking for inconsistencies.

Task Execution: From there, it can create a new case file, assign a claim number, and even send the first acknowledgment letters to the policyholder.

This completely changes how ai insurance companies can work, compressing what used to be a multi-day manual slog into a job done in minutes. You get more than just speed; you also get a massive drop in the human errors that inevitably creep into manual data entry.

Plugging Directly into Your Core Systems

There’s a common myth that bringing in AI means you have to tear out your existing tech stack. It's actually the opposite. A well-designed AI agent works with your current infrastructure, connecting to your core platforms through APIs (Application Programming Interfaces).

Think of APIs as secure bridges that let the AI agent talk to your systems of record. It doesn't matter if you use Guidewire or Duck Creek for claims management, or Salesforce for your CRM—the AI can securely pull data out and push updates back in.

An AI agent is best seen as an intelligent layer that sits on top of your existing technology. It directs tasks across different systems, keeps data consistent, and builds a single, unified workflow without forcing you into a costly tech overhaul.

This integration is the key to making everything work together smoothly. The AI agent can grab policy details from one system, update a customer's contact info in another, and log every single action in an audit trail for compliance. It works with your tools, not against them. AI agents are reshaping all kinds of industries, and you can see more examples in our guide on AI agent use cases.

Freeing Up Your Experts for High-Value Work

At the end of the day, the point of AI customer care isn't to replace your people. It's to empower them. By taking over the repetitive, high-volume work, AI agents free up your skilled professionals to focus on what humans do best: exercising judgment, showing empathy, and solving truly complex problems.

For example, while an AI agent handles the initial data gathering and verification for a tricky claim, your human adjuster can spend their time negotiating with repair shops, talking to anxious policyholders, or investigating potential fraud. This partnership between human and machine is where the real value is unlocked. It lets you scale your operations without sacrificing service quality, giving you a serious competitive edge in a tough market.

How AI Is Reshaping Insurance Claims and Financial Customer Care

In both insurance and banking, AI is no longer a futuristic concept—it's a practical tool driving serious efficiency gains. Let's move beyond the buzzwords and look at how these solutions actually work on the ground, automating insurance claims with AI and transforming customer care for financial services.

The Modern Insurance Claims Journey

It all begins the moment a policyholder files a First Notice of Loss (FNOL). Instead of a manual hand-off, an AI agent immediately gets to work, ingesting claim documents and automatically classifying each file.

From there, it validates the information against policy data stored in your core systems. This simple step is a game-changer for accuracy and speed, cutting down on the tedious manual data entry that eats up so much time. One insurer we worked with saw a 55% drop in entry errors just weeks after implementation.

Here’s a quick breakdown of what the AI handles:

Document Ingestion: Pulls in all submitted files and extracts key metadata.

Policy Verification: Instantly checks coverage rules and policy details.

Fraud Detection: Flags unusual patterns that might warrant a closer look.

Automated Updates: Keeps the policyholder in the loop without anyone lifting a finger.

This entire initial setup can be wrapped up in less than ten minutes, a process that used to take hours or even days. It also gives your experienced adjusters a pre-sorted queue, with potential fraud cases flagged right from the start.

If you want to dive deeper, we have a complete guide on insurance claims processing automation that breaks down the entire workflow.

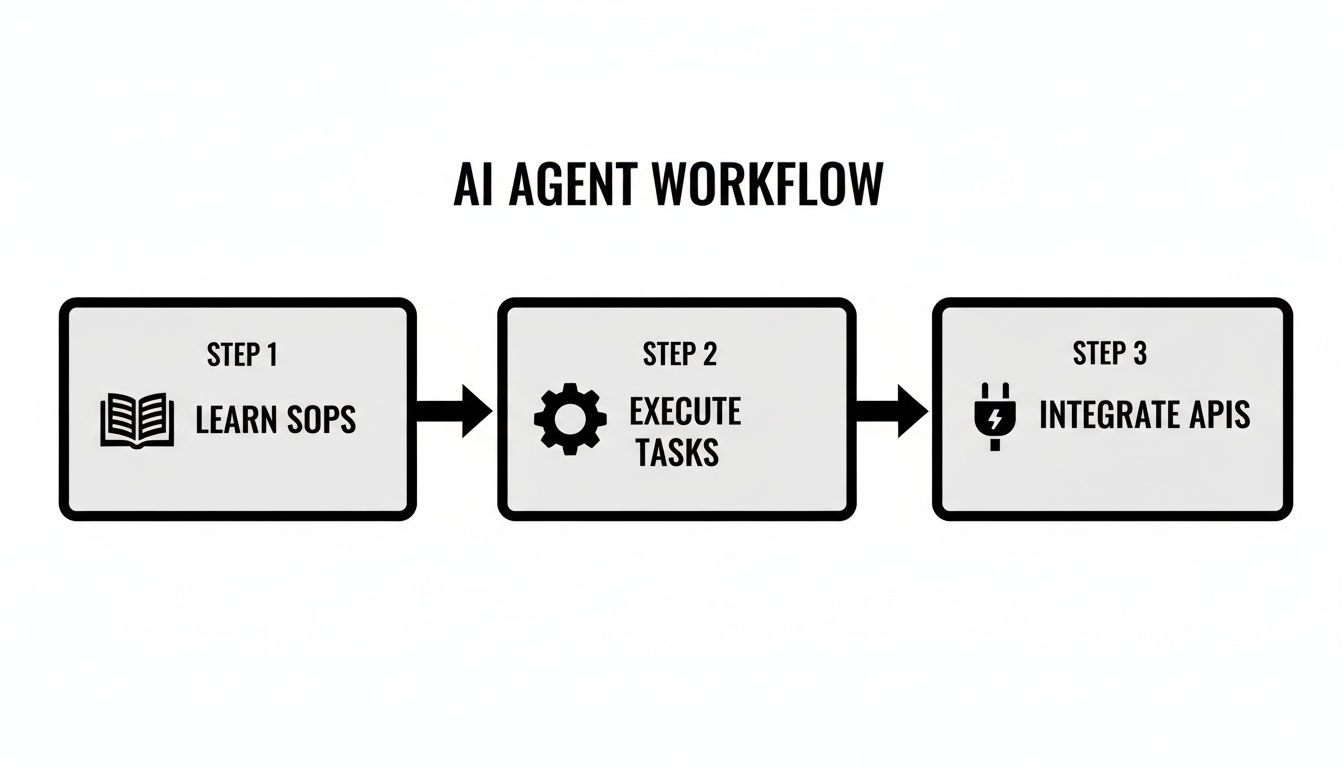

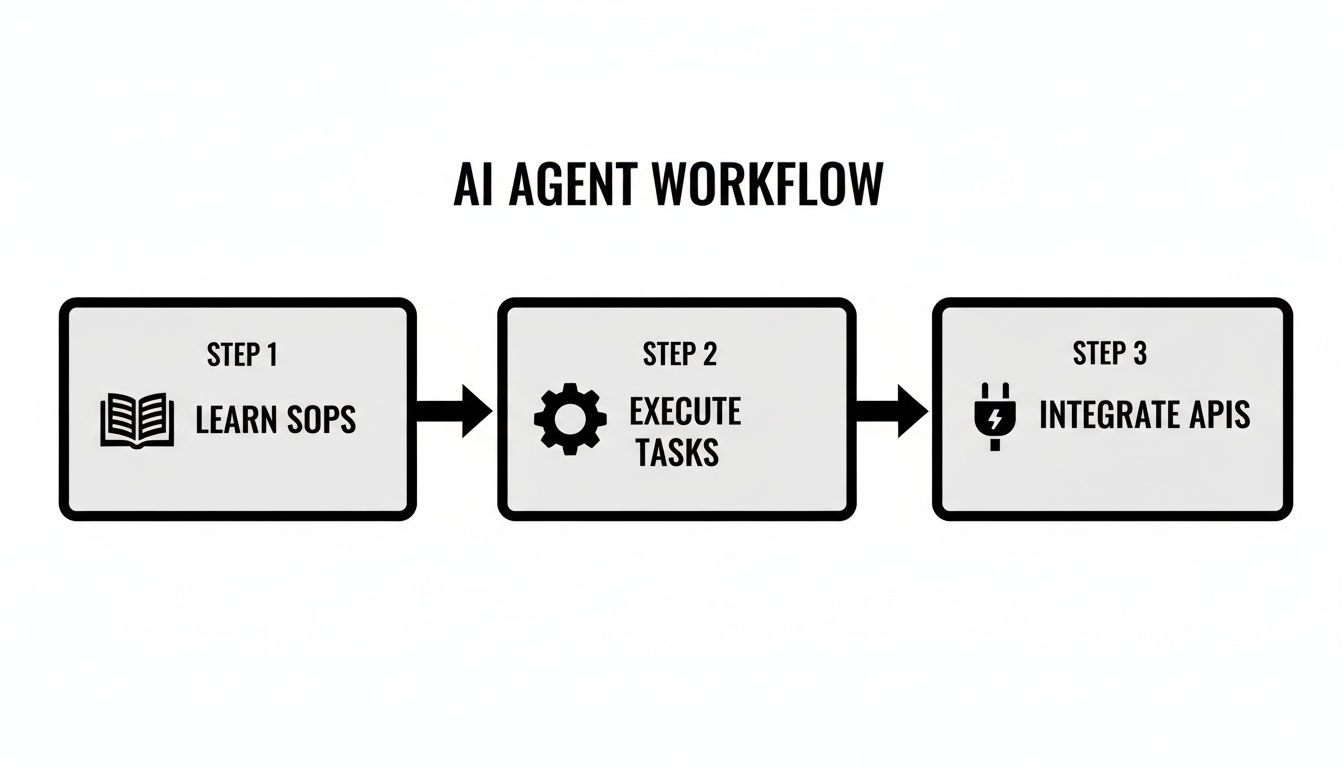

Visualizing the AI Workflow

So, how does the AI know what to do? It's not magic. The process is quite logical, as this chart shows. It learns your procedures, executes the repetitive work, and connects with your existing software to get the job done.

Essentially, the workflow has three core stages. First, the AI ingests your Standard Operating Procedures (SOPs) to build its logic. Second, it automates the routine steps. Finally, API integrations tie it all together with your core systems, creating a seamless flow.

Financial Customer Care Workflows

The benefits of AI customer care are just as clear in financial services, especially for tasks like onboarding, KYC checks, and dispute resolution.

Setting up a new account can be 3x faster when an AI pre-fills forms from uploaded documents and verifies IDs in real-time. For KYC, the AI uses OCR to pull details from an ID, runs them against global watchlists, and flags any potential alerts for human review. It’s no surprise that major financial institutions have reported a 70% improvement in KYC throughput using these automated checks.

The key steps the AI takes over include:

Automated form completion and identity verification.

Real-time risk scoring and watchlist screening.

Initial dispute triage and evidence gathering.

Sending automated customer alerts via email and SMS.

The real value here is that AI agents handle the high-volume, low-complexity work. This frees up your skilled team to focus on the nuanced cases that actually require their expertise.

Overcoming Implementation Challenges

Of course, deploying AI in highly regulated industries isn't as simple as flipping a switch. You need strong guardrails. Any platform you consider must have built-in audit trails, clear human approval steps, and role-based access controls.

This is where a platform like Nolana is designed to fit right in. It’s built to train directly on your SOPs, log every single action for compliance, and provide clear escalation paths for when a human needs to step in.

Start by defining crystal-clear SOPs to train the AI agents.

Thoroughly test all integration points with your core banking or insurance platforms.

Establish human-in-the-loop checkpoints for exceptions and high-stakes decisions.

Conduct regular claims ai reviews to monitor performance and maintain accuracy.

Measuring the Impact

How do you know if it’s working? You have to track the right metrics. Go beyond vanity numbers and focus on things like average FNOL processing time, KYC verification rates, and dispute resolution cycle times.

You should also keep a close eye on CSAT scores and cost-per-interaction to connect your operational improvements directly to business value. A good dashboard will show you trends over time and help you pinpoint bottlenecks before they become major problems. By making performance visible, teams can iterate and refine their processes much more quickly.

Real-World Example: Auto Claim Processing

Picture this: a driver gets into a fender bender and files a claim on their phone at midnight.

Within seconds, an AI agent ingests the uploaded photos and the police report. It then cross-references the customer’s policy, confirms coverage, and can even draft a preliminary settlement offer. The policyholder gets an update and an initial payout estimate in minutes, not days.

T+0 min: Claim submitted via the mobile app.

T+2 min: AI extracts all relevant details from the documents.

T+5 min: An initial fraud check is completed.

T+7 min: A settlement estimate is sent to the customer for review.

One company using this workflow saw their average cycle time shrink from 48 hours to under 10 minutes. The result? A 95% satisfaction score on that crucial first interaction.

Case Study: Rapid Onboarding at a Regional Bank

A regional bank was struggling with a backlog of new account applications. They deployed an AI solution to automate the opening process.

Now, when applicants upload their ID, the AI extracts the data and matches it in under 30 seconds. Any discrepancies or high-risk profiles are automatically routed to the compliance team, but standard, low-risk accounts are opened almost instantly. This slashed their manual backlog by 80%.

The biggest win wasn't just the efficiency. It freed their human agents from mind-numbing paperwork, allowing them to focus on building relationships and providing personalized financial advice.

Dramatically faster turnaround for new customers.

A sharp reduction in verification errors.

A measurable improvement in their customer experience score.

These aren't hypothetical scenarios. They show that well-implemented AI solutions deliver tangible gains in speed, accuracy, and customer satisfaction.

Your Next Steps

Getting started doesn't have to be a massive undertaking.

Begin by mapping out your current workflows to identify the most repetitive, high-volume tasks. From there, pilot an AI agent on a single, well-defined process, like one specific claim type or service queue.

Once you start collecting performance data, you can refine your SOPs and gradually expand the automation. Finally, make sure to establish regular audits to maintain compliance and quality over the long term. Now is the time to put AI to work and accelerate your customer operations.

Maintaining Control and Compliance with AI

For any leader in finance or insurance, the first question about new technology is always the same: how do we stay in control? Risk and compliance aren’t just boxes to check; they're the bedrock of customer trust. It's this concern that often causes hesitation, a fear that automation means giving up essential oversight.

But that’s a misconception. Modern AI customer service solutions are engineered from the ground up for heavily regulated industries. Instead of working around your controls, these systems are built to enforce them with a level of consistency that’s difficult to achieve manually. The key is creating total transparency, where every action is logged, every decision is traceable, and human experts remain in the driver’s seat.

Creating an Unbreakable Audit Trail

One of the most compelling features of an enterprise-grade AI platform is its ability to create a bulletproof audit trail. Think of it as a detailed, unchangeable logbook that captures every single touchpoint an AI agent has with a case or claim.

This digital record shows exactly what information was accessed, what decision was made, and the precise timestamp. For ai insurance companies facing regulatory scrutiny or internal audits, this kind of granular detail is priceless. It provides hard evidence that your team followed every step of your Standard Operating Procedures (SOPs) to the letter.

Balancing Automation with Human Expertise

Truly effective AI customer care isn't about replacing people; it's about intelligent collaboration between humans and machines. A critical piece of maintaining control is the "human-in-the-loop" workflow, which guarantees that a human expert can step in to review, approve, or override any automated process.

This approach strikes the perfect balance between efficiency and safety. The AI can manage 90% of a routine workflow—like validating policy details or gathering initial documents—but it can be programmed to automatically escalate certain situations for a final human sign-off.

High-Value Claims: Any claim over a specific dollar amount can be flagged for immediate review by a senior adjuster.

Potential Fraud: If the AI spots patterns that look suspicious, it can instantly pause the process and route the case to your fraud investigation team.

Customer Complaints: An incoming message with strong negative sentiment can be escalated directly to a customer relations specialist who can provide a needed human touch.

This collaborative model lets automation handle the high-volume, repetitive work, freeing up your team's valuable judgment for the complex, sensitive, or high-risk decisions where it matters most.

Built-in Security and Compliance Frameworks

When you’re doing claims AI reviews of potential vendors, security certifications need to be at the very top of your checklist. Enterprise-ready platforms are built with compliance baked in, not bolted on as an afterthought. This means they are designed to meet strict global standards for data security and privacy from day one.

Look for key certifications that show a real commitment to protecting sensitive customer data. A platform must be GDPR compliant to operate internationally, for instance. Just as important is a certification like SOC 2 Type II, which confirms that a vendor has ironclad controls for managing the security, availability, and confidentiality of the data they handle. You can learn more about these requirements and what is SOC 2 compliance in our detailed guide.

Choosing a solution with these built-in guardrails gives you confidence that you’re not just adopting powerful technology, but also strengthening your organization’s commitment to security and regulatory discipline.

Your Checklist for Choosing the Right Enterprise AI

Picking an AI customer service solution is a serious commitment, especially when you're in finance or insurance. Precision and compliance aren't just goals; they're the law. Not every platform is cut out for the job. A simple chatbot might be fine for answering basic questions, but it will crumble when it tries to handle a multi-step insurance claim or a detailed banking inquiry. What you need is an enterprise-grade system built for these kinds of high-stakes workflows.

To make the right call, you need to go beyond the slick demos and conduct thorough claims AI reviews. The best partner will offer a solution that truly learns the unique DNA of your operations, plugs into your core systems without friction, and operates within the strict guardrails your business demands. This checklist breaks down the essential capabilities that separate a genuine automation platform from a basic tool.

Core Platform Capabilities

The heart of any worthwhile AI solution is its ability to learn and execute your specific processes. Before you sign anything, you need to be sure the platform can handle these fundamental requirements. After all, an AI is only as smart as its training and as useful as its ability to connect with your existing tech stack.

SOP Training and Adaptability: Can you train the AI directly on your company's own Standard Operating Procedures (SOPs)? The system should become a digital expert that knows your rules backward and forward, not a rigid tool that makes you bend your proven workflows to fit its limitations.

Seamless API Integrations: The platform has to talk to your other systems. For ai insurance companies, that means having native integrations with platforms like Guidewire or Duck Creek. For banks, it's about connecting to your CRM, like Salesforce, and your core banking software.

True Agentic Automation: Does the AI do more than just answer questions? It needs to be able to run entire processes from start to finish—like handling a claim from the first notice of loss all the way to the initial payment calculation—without a human holding its hand at every step.

Security and Compliance Must-Haves

In financial services, security isn't a feature; it's the price of entry. Any platform that touches sensitive customer data has to be built on a rock-solid foundation of security and regulatory know-how. These points are absolutely non-negotiable.

A platform's security posture is a direct reflection of its suitability for enterprise use. Certifications like SOC 2 Type II and GDPR compliance aren't just acronyms; they are proof of a vendor's commitment to protecting your data and your reputation.

When you're talking to vendors, ask for hard evidence of their security frameworks.

Comprehensive Audit Trails: The system must log every single action the AI takes. This creates an unchangeable record for compliance audits, showing exactly what happened, when, and why.

Configurable Human Escalation: You need to be in complete control of when a person takes over. The platform must let you set up custom rules that automatically flag high-value claims, fraud alerts, or sensitive customer complaints for an expert to review.

Robust Security Certifications: Look for verifiable credentials like SOC 2 Type II and GDPR compliance. These aren't just nice-to-haves; they prove the vendor has rigorous internal controls for keeping data safe, available, and confidential.

To help distill these critical requirements, here’s a quick-reference table outlining the essential features you should look for in any enterprise-grade AI automation platform.

Essential Features for Enterprise AI Automation Platforms

Capability | Why It Matters | Example Implementation |

|---|---|---|

SOP-Based Training | Ensures the AI follows your exact business logic and compliance rules, not a generic template. | Uploading a PDF of your FNOL process to train the AI on how to open a new claim. |

Native API Integrations | Allows the AI to read/write data in core systems (e.g., Guidewire, Salesforce) to execute tasks. | An AI automatically updates a customer's contact information in the CRM after a phone call. |

Agentic Automation | Moves beyond simple chatbots to handle multi-step, end-to-end workflows autonomously. | An AI that processes a simple auto glass claim from intake to payment without human touch. |

Immutable Audit Trails | Provides a complete, unchangeable log of every AI action for regulatory and internal audits. | A compliance officer can pull a log showing every step the AI took to resolve a specific claim. |

Role-Based Access Control | Restricts system access and capabilities based on user roles, protecting sensitive data. | Granting view-only access to auditors while giving full configuration rights to operations managers. |

Human-in-the-Loop Escalation | Gives you control to define when a task is automatically routed to a human for review. | Setting a rule to escalate any claim estimated over $10,000 to a senior adjuster. |

This checklist isn't just about ticking boxes; it's about ensuring the platform you choose is a true partner in your operations—one that is secure, compliant, and capable enough to handle the work you throw at it.

Performance and Usability Criteria

Finally, the solution has to be practical and show a real return. A powerful tool that’s a nightmare to use or whose impact you can't measure is a failed investment. Your evaluation should zero in on how the platform works in the real world and whether it actually makes your team's life easier. Effective AI customer care should reduce complexity, not add to it.

Deep Performance Analytics: The platform should give you a clear dashboard with KPIs that matter. You need to track metrics like claims processing time, cost-per-interaction, and customer satisfaction (CSAT) scores to prove ROI to stakeholders.

Intuitive User Interface: Your team—from operations managers to compliance officers—is going to be using this system. It should be straightforward to set up rules, review the AI's work, and pull performance reports without needing a data science degree.

How to Measure the Real ROI of AI Automation

Bringing an AI customer service solution on board is a major commitment. Sooner or later, you'll need to prove its worth in clear business terms. It's not enough to just say it "improves efficiency"—you need to connect that benefit to tangible numbers that stakeholders understand.

The true return on investment (ROI) isn't just about cutting costs. It's a blend of operational excellence, better customer experiences, and tighter compliance. To build a solid business case, you have to track a balanced mix of KPIs that paint the full picture. These metrics show how automating insurance claims with AI directly boosts the bottom line while making customers happier.

Key Operational Metrics to Track

The first place you'll see the impact of AI customer care is in your daily operations. These metrics are easy to measure and offer quick proof of efficiency gains. For ai insurance companies, this is where the speed and accuracy of automation truly shine.

Shorter Cycle Times: How long does it take to get from First Notice of Loss (FNOL) to a settled claim? One of our clients cut their simple claims cycle time from a sluggish 48 hours down to under 10 minutes.

Lower Cost Per Interaction: This is your total operational cost divided by the number of customer interactions. AI brings this number down dramatically by handling all those routine, high-volume questions.

Higher Straight-Through Processing (STP) Rate: What percentage of claims or cases fly through the system without a single human touch? A rising STP rate is the clearest sign that your automation is working exactly as it should.

Customer-Focused Performance Indicators

Operational speed is great, but it doesn't mean much if your customers are frustrated. The real end goal is to make their journey smoother, and your metrics need to reflect that. These KPIs link your internal improvements directly to customer loyalty and retention.

A successful AI implementation doesn't just make your processes faster—it makes your customers' lives easier. Positive shifts in satisfaction scores are a powerful sign that your investment is paying off where it matters most.

Keep an eye on these indicators:

Customer Satisfaction (CSAT) Scores: Are customers rating their interactions more highly? This is a direct pulse on service quality.

First Contact Resolution (FCR): What percentage of issues get solved on the very first try? AI agents trained on your specific SOPs are fantastic at this.

Net Promoter Score (NPS): Is your improved service turning everyday customers into genuine advocates for your brand?

Risk and Compliance Metrics

In highly regulated industries like banking and insurance, ROI is also measured by how much risk you take off the table. A thorough claims AI review should always include metrics that show better compliance and audit readiness. An AI agent is your most consistent employee—it follows the rules every single time, minimizing human error and shoring up your defenses.

Fewer Compliance Errors: Track the number of mistakes or policy deviations flagged during your internal audits.

Complete Audit Trails: What percentage of cases have a perfect, end-to-end log? This is your proof that procedures were followed to the letter.

Tracking this mix of KPIs gives you a 360-degree view of your AI's performance. By connecting the dots between operational speed, customer happiness, and compliance, you can build an undeniable case for its business value.

To see how these numbers play out in the real world, check out these in-depth case studies.

Frequently Asked Questions

When exploring AI for customer service, especially in high-stakes industries like banking and insurance, a lot of questions come up. It's completely normal. Let's tackle some of the most common ones I hear from leaders trying to figure out how this technology actually works in the real world.

How Does AI Handle Sensitive Customer Data Securely?

This is often the first and most important question. Enterprise AI platforms are built from the ground up with security at their core. We're talking end-to-end encryption for all data, whether it's being sent across a network or just sitting on a server.

On top of that, these systems are designed to meet strict global standards like SOC 2 Type II and GDPR. This ensures every single action is tracked, compliant, and ready for an audit. The AI works inside a secure bubble, only accessing the specific information it’s been given permission to use for a task—nothing more.

Will AI Replace My Human Customer Service Team?

Absolutely not. The goal here is partnership, not replacement. Think of AI as the ultimate assistant for your team. It’s fantastic at blazing through the high-volume, repetitive tasks that can bog people down.

This frees up your experienced agents to focus on the tricky, high-empathy situations where a human touch is essential. AI customer care acts as a force multiplier, letting your team accomplish more, resolve complex escalations faster, and ultimately provide a better, more thoughtful service.

The biggest myth out there is that AI is an all-or-nothing deal. The truth is, the best results come from a smart blend—AI handles the routine, and your human experts step in for critical decisions and nuanced conversations.

How Is AI in Insurance Different from a Standard Chatbot?

It’s the difference between answering a simple question and actually getting a job done. A standard chatbot is pretty limited; it follows a script to answer basic FAQs.

An AI agent for ai insurance companies, on the other hand, can run complex, multi-step processes. It can read and understand messy, unstructured documents like claim forms or police reports, check that information against your internal systems, and make decisions based on the rules you've set. It's an active problem-solver, not just a passive Q&A tool.

What Is the First Step to Implementing AI for Claims?

Start small and aim for a quick win. The best approach is to pick a process that's high-volume but not overly complicated. For many ai insurance companies, a simple auto glass claim or a minor property damage report is the perfect place to begin.

By piloting the AI on a clear, well-understood workflow, you can measure its impact, fine-tune your procedures, and build momentum and trust in the technology. Proving value on a smaller scale is the smartest way to set yourself up for success before expanding to more complex claims.

Ready to see how intelligent automation can transform your financial operations? Nolana deploys compliant AI agents trained on your specific procedures to handle complex claims, case management, and customer care workflows from end to end. Discover how Nolana can help you accelerate cycle times and reduce costs.

In the high-stakes worlds of finance and insurance, the old ways of handling customer service just don't cut it anymore. What was once a futuristic concept is now an operational necessity: AI customer service solutions. These intelligent systems are the direct answer to ever-present challenges like sky-high manual processing costs and customer demands for instant, round-the-clock support, especially for automating insurance claims with AI and enhancing customer care in financial services.

The New Standard in Financial and Insurance Customer Service

For leaders in these sectors, the pressure is on. Customers expect immediate, accurate answers, while internal teams are often bogged down by complex, error-prone workflows. Manual claims processing is notoriously slow and expensive, and the sheer volume of daily inquiries can quickly overwhelm even the most capable human teams. This is exactly where AI makes its mark.

Imagine processing an insurance claim in minutes, not days. Picture a world where a customer's banking question is resolved instantly, at any hour, without waiting on hold. This isn't a future vision; it's the reality that AI customer care delivers right now. By automating routine but critical tasks, these solutions free up your human experts to focus on the nuanced, high-value work that truly moves the needle.

Shifting From Manual Operations to Intelligent Automation

The move toward AI in customer service isn't just a trend; it's an industry-wide shift. In fact, a staggering 80% of companies are projected to use AI-powered chatbots for customer service by 2025. That's a massive jump from just 5% in 2020, highlighting just how quickly organizations are realizing the power of this technology. If you're looking for practical artificial intelligence business solutions, understanding this shift is the first step.

The table below gives a quick snapshot of how fundamentally different these two approaches are.

Manual vs AI-Powered Customer Operations Snapshot

Operational Aspect | Traditional Manual Approach | AI-Powered Solution |

|---|---|---|

Response Time | Hours or days, dependent on agent availability and business hours. | Instant, 24/7 responses for common and complex queries. |

Cost Per Interaction | High, driven by labor, training, and infrastructure costs. | Significantly lower, with automation handling the bulk of interactions. |

Scalability | Limited by headcount; slow and costly to scale up or down. | Highly elastic; can handle massive volume spikes without performance drops. |

Consistency & Accuracy | Varies by agent; prone to human error and inconsistent answers. | Extremely consistent, adhering strictly to predefined rules and SOPs. |

Agent Focus | Repetitive, low-value tasks like data entry and password resets. | Complex problem-solving, empathy-driven support, and relationship building. |

This comparison makes it clear: AI isn't just a minor upgrade. It’s a complete operational overhaul that allows financial and insurance firms to work smarter, not just harder.

AI is not about replacing human expertise but augmenting it. It handles the repetitive, procedural work with speed and accuracy, allowing your team to apply their skills where they have the greatest effect—building relationships and solving complex problems.

This guide is designed to move beyond theory and get into practical application. For ai insurance companies, this means automating insurance claims with AI for faster settlements and happier policyholders. For financial institutions, it translates to frictionless onboarding and more efficient dispute resolution.

Getting a handle on the fundamentals is the first step. Our detailed guide on AI customer care offers a deeper dive into these core concepts and how to apply them.

How AI Agents Handle Complex Financial Workflows

Forget simple chatbots. To really get what AI customer service solutions do in tightly regulated industries like banking and insurance, you need to think differently. Picture a ‘digital specialist’—an AI agent that has meticulously learned your company’s specific Standard Operating Procedures (SOPs) until it knows them cold. This isn't about just answering FAQs; it's about executing complicated, multi-step tasks from beginning to end, especially in financial services and claims processing.

That’s the essence of agentic automation. A basic bot is stuck on a rigid script, but a true AI agent can reason, make decisions, and see a whole workflow through. It can process an insurance claim, manage a complex financial case file, or offer support across email, chat, and phone calls without ever losing the plot. This is what makes AI a genuinely practical tool for high-stakes work.

The Digital Specialist That Knows Your Rules

The real power behind these AI agents isn't some generic, off-the-shelf knowledge. It’s a deep, practical understanding of your business, learned from the ground up. They are trained on your specific SOPs, historical team data, and compliance guidelines. This ensures every move the AI makes is perfectly in sync with your company's rules and regulatory obligations.

Let's take a new insurance claim as an example. When it arrives, the AI agent sees more than just a form. It understands the entire process:

Document Ingestion: It reads and makes sense of all kinds of documents—police reports, medical bills, photos of car damage, you name it.

Data Validation: The agent then checks the submitted details against the customer’s policy in your core system, verifying coverage and looking for inconsistencies.

Task Execution: From there, it can create a new case file, assign a claim number, and even send the first acknowledgment letters to the policyholder.

This completely changes how ai insurance companies can work, compressing what used to be a multi-day manual slog into a job done in minutes. You get more than just speed; you also get a massive drop in the human errors that inevitably creep into manual data entry.

Plugging Directly into Your Core Systems

There’s a common myth that bringing in AI means you have to tear out your existing tech stack. It's actually the opposite. A well-designed AI agent works with your current infrastructure, connecting to your core platforms through APIs (Application Programming Interfaces).

Think of APIs as secure bridges that let the AI agent talk to your systems of record. It doesn't matter if you use Guidewire or Duck Creek for claims management, or Salesforce for your CRM—the AI can securely pull data out and push updates back in.

An AI agent is best seen as an intelligent layer that sits on top of your existing technology. It directs tasks across different systems, keeps data consistent, and builds a single, unified workflow without forcing you into a costly tech overhaul.

This integration is the key to making everything work together smoothly. The AI agent can grab policy details from one system, update a customer's contact info in another, and log every single action in an audit trail for compliance. It works with your tools, not against them. AI agents are reshaping all kinds of industries, and you can see more examples in our guide on AI agent use cases.

Freeing Up Your Experts for High-Value Work

At the end of the day, the point of AI customer care isn't to replace your people. It's to empower them. By taking over the repetitive, high-volume work, AI agents free up your skilled professionals to focus on what humans do best: exercising judgment, showing empathy, and solving truly complex problems.

For example, while an AI agent handles the initial data gathering and verification for a tricky claim, your human adjuster can spend their time negotiating with repair shops, talking to anxious policyholders, or investigating potential fraud. This partnership between human and machine is where the real value is unlocked. It lets you scale your operations without sacrificing service quality, giving you a serious competitive edge in a tough market.

How AI Is Reshaping Insurance Claims and Financial Customer Care

In both insurance and banking, AI is no longer a futuristic concept—it's a practical tool driving serious efficiency gains. Let's move beyond the buzzwords and look at how these solutions actually work on the ground, automating insurance claims with AI and transforming customer care for financial services.

The Modern Insurance Claims Journey

It all begins the moment a policyholder files a First Notice of Loss (FNOL). Instead of a manual hand-off, an AI agent immediately gets to work, ingesting claim documents and automatically classifying each file.

From there, it validates the information against policy data stored in your core systems. This simple step is a game-changer for accuracy and speed, cutting down on the tedious manual data entry that eats up so much time. One insurer we worked with saw a 55% drop in entry errors just weeks after implementation.

Here’s a quick breakdown of what the AI handles:

Document Ingestion: Pulls in all submitted files and extracts key metadata.

Policy Verification: Instantly checks coverage rules and policy details.

Fraud Detection: Flags unusual patterns that might warrant a closer look.

Automated Updates: Keeps the policyholder in the loop without anyone lifting a finger.

This entire initial setup can be wrapped up in less than ten minutes, a process that used to take hours or even days. It also gives your experienced adjusters a pre-sorted queue, with potential fraud cases flagged right from the start.

If you want to dive deeper, we have a complete guide on insurance claims processing automation that breaks down the entire workflow.

Visualizing the AI Workflow

So, how does the AI know what to do? It's not magic. The process is quite logical, as this chart shows. It learns your procedures, executes the repetitive work, and connects with your existing software to get the job done.

Essentially, the workflow has three core stages. First, the AI ingests your Standard Operating Procedures (SOPs) to build its logic. Second, it automates the routine steps. Finally, API integrations tie it all together with your core systems, creating a seamless flow.

Financial Customer Care Workflows

The benefits of AI customer care are just as clear in financial services, especially for tasks like onboarding, KYC checks, and dispute resolution.

Setting up a new account can be 3x faster when an AI pre-fills forms from uploaded documents and verifies IDs in real-time. For KYC, the AI uses OCR to pull details from an ID, runs them against global watchlists, and flags any potential alerts for human review. It’s no surprise that major financial institutions have reported a 70% improvement in KYC throughput using these automated checks.

The key steps the AI takes over include:

Automated form completion and identity verification.

Real-time risk scoring and watchlist screening.

Initial dispute triage and evidence gathering.

Sending automated customer alerts via email and SMS.

The real value here is that AI agents handle the high-volume, low-complexity work. This frees up your skilled team to focus on the nuanced cases that actually require their expertise.

Overcoming Implementation Challenges

Of course, deploying AI in highly regulated industries isn't as simple as flipping a switch. You need strong guardrails. Any platform you consider must have built-in audit trails, clear human approval steps, and role-based access controls.

This is where a platform like Nolana is designed to fit right in. It’s built to train directly on your SOPs, log every single action for compliance, and provide clear escalation paths for when a human needs to step in.

Start by defining crystal-clear SOPs to train the AI agents.

Thoroughly test all integration points with your core banking or insurance platforms.

Establish human-in-the-loop checkpoints for exceptions and high-stakes decisions.

Conduct regular claims ai reviews to monitor performance and maintain accuracy.

Measuring the Impact

How do you know if it’s working? You have to track the right metrics. Go beyond vanity numbers and focus on things like average FNOL processing time, KYC verification rates, and dispute resolution cycle times.

You should also keep a close eye on CSAT scores and cost-per-interaction to connect your operational improvements directly to business value. A good dashboard will show you trends over time and help you pinpoint bottlenecks before they become major problems. By making performance visible, teams can iterate and refine their processes much more quickly.

Real-World Example: Auto Claim Processing

Picture this: a driver gets into a fender bender and files a claim on their phone at midnight.

Within seconds, an AI agent ingests the uploaded photos and the police report. It then cross-references the customer’s policy, confirms coverage, and can even draft a preliminary settlement offer. The policyholder gets an update and an initial payout estimate in minutes, not days.

T+0 min: Claim submitted via the mobile app.

T+2 min: AI extracts all relevant details from the documents.

T+5 min: An initial fraud check is completed.

T+7 min: A settlement estimate is sent to the customer for review.

One company using this workflow saw their average cycle time shrink from 48 hours to under 10 minutes. The result? A 95% satisfaction score on that crucial first interaction.

Case Study: Rapid Onboarding at a Regional Bank

A regional bank was struggling with a backlog of new account applications. They deployed an AI solution to automate the opening process.

Now, when applicants upload their ID, the AI extracts the data and matches it in under 30 seconds. Any discrepancies or high-risk profiles are automatically routed to the compliance team, but standard, low-risk accounts are opened almost instantly. This slashed their manual backlog by 80%.

The biggest win wasn't just the efficiency. It freed their human agents from mind-numbing paperwork, allowing them to focus on building relationships and providing personalized financial advice.

Dramatically faster turnaround for new customers.

A sharp reduction in verification errors.

A measurable improvement in their customer experience score.

These aren't hypothetical scenarios. They show that well-implemented AI solutions deliver tangible gains in speed, accuracy, and customer satisfaction.

Your Next Steps

Getting started doesn't have to be a massive undertaking.

Begin by mapping out your current workflows to identify the most repetitive, high-volume tasks. From there, pilot an AI agent on a single, well-defined process, like one specific claim type or service queue.

Once you start collecting performance data, you can refine your SOPs and gradually expand the automation. Finally, make sure to establish regular audits to maintain compliance and quality over the long term. Now is the time to put AI to work and accelerate your customer operations.

Maintaining Control and Compliance with AI

For any leader in finance or insurance, the first question about new technology is always the same: how do we stay in control? Risk and compliance aren’t just boxes to check; they're the bedrock of customer trust. It's this concern that often causes hesitation, a fear that automation means giving up essential oversight.

But that’s a misconception. Modern AI customer service solutions are engineered from the ground up for heavily regulated industries. Instead of working around your controls, these systems are built to enforce them with a level of consistency that’s difficult to achieve manually. The key is creating total transparency, where every action is logged, every decision is traceable, and human experts remain in the driver’s seat.

Creating an Unbreakable Audit Trail

One of the most compelling features of an enterprise-grade AI platform is its ability to create a bulletproof audit trail. Think of it as a detailed, unchangeable logbook that captures every single touchpoint an AI agent has with a case or claim.

This digital record shows exactly what information was accessed, what decision was made, and the precise timestamp. For ai insurance companies facing regulatory scrutiny or internal audits, this kind of granular detail is priceless. It provides hard evidence that your team followed every step of your Standard Operating Procedures (SOPs) to the letter.

Balancing Automation with Human Expertise

Truly effective AI customer care isn't about replacing people; it's about intelligent collaboration between humans and machines. A critical piece of maintaining control is the "human-in-the-loop" workflow, which guarantees that a human expert can step in to review, approve, or override any automated process.

This approach strikes the perfect balance between efficiency and safety. The AI can manage 90% of a routine workflow—like validating policy details or gathering initial documents—but it can be programmed to automatically escalate certain situations for a final human sign-off.

High-Value Claims: Any claim over a specific dollar amount can be flagged for immediate review by a senior adjuster.

Potential Fraud: If the AI spots patterns that look suspicious, it can instantly pause the process and route the case to your fraud investigation team.

Customer Complaints: An incoming message with strong negative sentiment can be escalated directly to a customer relations specialist who can provide a needed human touch.

This collaborative model lets automation handle the high-volume, repetitive work, freeing up your team's valuable judgment for the complex, sensitive, or high-risk decisions where it matters most.

Built-in Security and Compliance Frameworks

When you’re doing claims AI reviews of potential vendors, security certifications need to be at the very top of your checklist. Enterprise-ready platforms are built with compliance baked in, not bolted on as an afterthought. This means they are designed to meet strict global standards for data security and privacy from day one.

Look for key certifications that show a real commitment to protecting sensitive customer data. A platform must be GDPR compliant to operate internationally, for instance. Just as important is a certification like SOC 2 Type II, which confirms that a vendor has ironclad controls for managing the security, availability, and confidentiality of the data they handle. You can learn more about these requirements and what is SOC 2 compliance in our detailed guide.

Choosing a solution with these built-in guardrails gives you confidence that you’re not just adopting powerful technology, but also strengthening your organization’s commitment to security and regulatory discipline.

Your Checklist for Choosing the Right Enterprise AI

Picking an AI customer service solution is a serious commitment, especially when you're in finance or insurance. Precision and compliance aren't just goals; they're the law. Not every platform is cut out for the job. A simple chatbot might be fine for answering basic questions, but it will crumble when it tries to handle a multi-step insurance claim or a detailed banking inquiry. What you need is an enterprise-grade system built for these kinds of high-stakes workflows.

To make the right call, you need to go beyond the slick demos and conduct thorough claims AI reviews. The best partner will offer a solution that truly learns the unique DNA of your operations, plugs into your core systems without friction, and operates within the strict guardrails your business demands. This checklist breaks down the essential capabilities that separate a genuine automation platform from a basic tool.

Core Platform Capabilities

The heart of any worthwhile AI solution is its ability to learn and execute your specific processes. Before you sign anything, you need to be sure the platform can handle these fundamental requirements. After all, an AI is only as smart as its training and as useful as its ability to connect with your existing tech stack.

SOP Training and Adaptability: Can you train the AI directly on your company's own Standard Operating Procedures (SOPs)? The system should become a digital expert that knows your rules backward and forward, not a rigid tool that makes you bend your proven workflows to fit its limitations.

Seamless API Integrations: The platform has to talk to your other systems. For ai insurance companies, that means having native integrations with platforms like Guidewire or Duck Creek. For banks, it's about connecting to your CRM, like Salesforce, and your core banking software.

True Agentic Automation: Does the AI do more than just answer questions? It needs to be able to run entire processes from start to finish—like handling a claim from the first notice of loss all the way to the initial payment calculation—without a human holding its hand at every step.

Security and Compliance Must-Haves

In financial services, security isn't a feature; it's the price of entry. Any platform that touches sensitive customer data has to be built on a rock-solid foundation of security and regulatory know-how. These points are absolutely non-negotiable.

A platform's security posture is a direct reflection of its suitability for enterprise use. Certifications like SOC 2 Type II and GDPR compliance aren't just acronyms; they are proof of a vendor's commitment to protecting your data and your reputation.

When you're talking to vendors, ask for hard evidence of their security frameworks.

Comprehensive Audit Trails: The system must log every single action the AI takes. This creates an unchangeable record for compliance audits, showing exactly what happened, when, and why.

Configurable Human Escalation: You need to be in complete control of when a person takes over. The platform must let you set up custom rules that automatically flag high-value claims, fraud alerts, or sensitive customer complaints for an expert to review.

Robust Security Certifications: Look for verifiable credentials like SOC 2 Type II and GDPR compliance. These aren't just nice-to-haves; they prove the vendor has rigorous internal controls for keeping data safe, available, and confidential.

To help distill these critical requirements, here’s a quick-reference table outlining the essential features you should look for in any enterprise-grade AI automation platform.

Essential Features for Enterprise AI Automation Platforms

Capability | Why It Matters | Example Implementation |

|---|---|---|

SOP-Based Training | Ensures the AI follows your exact business logic and compliance rules, not a generic template. | Uploading a PDF of your FNOL process to train the AI on how to open a new claim. |

Native API Integrations | Allows the AI to read/write data in core systems (e.g., Guidewire, Salesforce) to execute tasks. | An AI automatically updates a customer's contact information in the CRM after a phone call. |

Agentic Automation | Moves beyond simple chatbots to handle multi-step, end-to-end workflows autonomously. | An AI that processes a simple auto glass claim from intake to payment without human touch. |

Immutable Audit Trails | Provides a complete, unchangeable log of every AI action for regulatory and internal audits. | A compliance officer can pull a log showing every step the AI took to resolve a specific claim. |

Role-Based Access Control | Restricts system access and capabilities based on user roles, protecting sensitive data. | Granting view-only access to auditors while giving full configuration rights to operations managers. |

Human-in-the-Loop Escalation | Gives you control to define when a task is automatically routed to a human for review. | Setting a rule to escalate any claim estimated over $10,000 to a senior adjuster. |

This checklist isn't just about ticking boxes; it's about ensuring the platform you choose is a true partner in your operations—one that is secure, compliant, and capable enough to handle the work you throw at it.

Performance and Usability Criteria

Finally, the solution has to be practical and show a real return. A powerful tool that’s a nightmare to use or whose impact you can't measure is a failed investment. Your evaluation should zero in on how the platform works in the real world and whether it actually makes your team's life easier. Effective AI customer care should reduce complexity, not add to it.

Deep Performance Analytics: The platform should give you a clear dashboard with KPIs that matter. You need to track metrics like claims processing time, cost-per-interaction, and customer satisfaction (CSAT) scores to prove ROI to stakeholders.

Intuitive User Interface: Your team—from operations managers to compliance officers—is going to be using this system. It should be straightforward to set up rules, review the AI's work, and pull performance reports without needing a data science degree.

How to Measure the Real ROI of AI Automation

Bringing an AI customer service solution on board is a major commitment. Sooner or later, you'll need to prove its worth in clear business terms. It's not enough to just say it "improves efficiency"—you need to connect that benefit to tangible numbers that stakeholders understand.

The true return on investment (ROI) isn't just about cutting costs. It's a blend of operational excellence, better customer experiences, and tighter compliance. To build a solid business case, you have to track a balanced mix of KPIs that paint the full picture. These metrics show how automating insurance claims with AI directly boosts the bottom line while making customers happier.

Key Operational Metrics to Track

The first place you'll see the impact of AI customer care is in your daily operations. These metrics are easy to measure and offer quick proof of efficiency gains. For ai insurance companies, this is where the speed and accuracy of automation truly shine.

Shorter Cycle Times: How long does it take to get from First Notice of Loss (FNOL) to a settled claim? One of our clients cut their simple claims cycle time from a sluggish 48 hours down to under 10 minutes.

Lower Cost Per Interaction: This is your total operational cost divided by the number of customer interactions. AI brings this number down dramatically by handling all those routine, high-volume questions.

Higher Straight-Through Processing (STP) Rate: What percentage of claims or cases fly through the system without a single human touch? A rising STP rate is the clearest sign that your automation is working exactly as it should.

Customer-Focused Performance Indicators

Operational speed is great, but it doesn't mean much if your customers are frustrated. The real end goal is to make their journey smoother, and your metrics need to reflect that. These KPIs link your internal improvements directly to customer loyalty and retention.

A successful AI implementation doesn't just make your processes faster—it makes your customers' lives easier. Positive shifts in satisfaction scores are a powerful sign that your investment is paying off where it matters most.

Keep an eye on these indicators:

Customer Satisfaction (CSAT) Scores: Are customers rating their interactions more highly? This is a direct pulse on service quality.

First Contact Resolution (FCR): What percentage of issues get solved on the very first try? AI agents trained on your specific SOPs are fantastic at this.

Net Promoter Score (NPS): Is your improved service turning everyday customers into genuine advocates for your brand?

Risk and Compliance Metrics

In highly regulated industries like banking and insurance, ROI is also measured by how much risk you take off the table. A thorough claims AI review should always include metrics that show better compliance and audit readiness. An AI agent is your most consistent employee—it follows the rules every single time, minimizing human error and shoring up your defenses.

Fewer Compliance Errors: Track the number of mistakes or policy deviations flagged during your internal audits.

Complete Audit Trails: What percentage of cases have a perfect, end-to-end log? This is your proof that procedures were followed to the letter.

Tracking this mix of KPIs gives you a 360-degree view of your AI's performance. By connecting the dots between operational speed, customer happiness, and compliance, you can build an undeniable case for its business value.

To see how these numbers play out in the real world, check out these in-depth case studies.

Frequently Asked Questions

When exploring AI for customer service, especially in high-stakes industries like banking and insurance, a lot of questions come up. It's completely normal. Let's tackle some of the most common ones I hear from leaders trying to figure out how this technology actually works in the real world.

How Does AI Handle Sensitive Customer Data Securely?

This is often the first and most important question. Enterprise AI platforms are built from the ground up with security at their core. We're talking end-to-end encryption for all data, whether it's being sent across a network or just sitting on a server.

On top of that, these systems are designed to meet strict global standards like SOC 2 Type II and GDPR. This ensures every single action is tracked, compliant, and ready for an audit. The AI works inside a secure bubble, only accessing the specific information it’s been given permission to use for a task—nothing more.

Will AI Replace My Human Customer Service Team?

Absolutely not. The goal here is partnership, not replacement. Think of AI as the ultimate assistant for your team. It’s fantastic at blazing through the high-volume, repetitive tasks that can bog people down.

This frees up your experienced agents to focus on the tricky, high-empathy situations where a human touch is essential. AI customer care acts as a force multiplier, letting your team accomplish more, resolve complex escalations faster, and ultimately provide a better, more thoughtful service.

The biggest myth out there is that AI is an all-or-nothing deal. The truth is, the best results come from a smart blend—AI handles the routine, and your human experts step in for critical decisions and nuanced conversations.

How Is AI in Insurance Different from a Standard Chatbot?

It’s the difference between answering a simple question and actually getting a job done. A standard chatbot is pretty limited; it follows a script to answer basic FAQs.

An AI agent for ai insurance companies, on the other hand, can run complex, multi-step processes. It can read and understand messy, unstructured documents like claim forms or police reports, check that information against your internal systems, and make decisions based on the rules you've set. It's an active problem-solver, not just a passive Q&A tool.

What Is the First Step to Implementing AI for Claims?

Start small and aim for a quick win. The best approach is to pick a process that's high-volume but not overly complicated. For many ai insurance companies, a simple auto glass claim or a minor property damage report is the perfect place to begin.

By piloting the AI on a clear, well-understood workflow, you can measure its impact, fine-tune your procedures, and build momentum and trust in the technology. Proving value on a smaller scale is the smartest way to set yourself up for success before expanding to more complex claims.

Ready to see how intelligent automation can transform your financial operations? Nolana deploys compliant AI agents trained on your specific procedures to handle complex claims, case management, and customer care workflows from end to end. Discover how Nolana can help you accelerate cycle times and reduce costs.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP