Ai Support Chatbot: How AI Transforms Insurance Claims and Financial Services

Ai Support Chatbot: How AI Transforms Insurance Claims and Financial Services

Discover how an ai support chatbot streamlines insurance claims and financial services, cutting costs, boosting compliance, and elevating customer care.

An AI support chatbot isn't just another pop-up window on a website. In heavily regulated industries like finance and insurance, it's a sophisticated digital assistant built to handle complex, high-stakes work. Forget the simple Q&A bots that just follow a script. We're talking about AI agents that can automate entire workflows—from processing an insurance claim to resolving a detailed customer complaint—acting more like a highly skilled digital team member.

The New Digital Coworker in Financial Services

Imagine an employee who works around the clock, flawlessly processes thousands of requests, and documents every action for perfect compliance. This isn't science fiction; it's what an advanced AI support chatbot brings to the table in financial services. The industry is moving past basic, scripted bots and embracing intelligent agents that can run critical business operations on their own.

Let's put it this way: a traditional chatbot is like a call center agent who can't deviate from a pre-written script. An AI support chatbot, on the other hand, is like a seasoned operations analyst. It understands the nuances of a situation, connects with your core business systems, and makes decisions based on established company policies. For ai insurance companies and banks, this is the new digital coworker.

Redefining Claims and Customer Interactions

You can really see the business impact when these AI agents tackle high-value, complex jobs. A great example is automating insurance claims with AI. Instead of a policyholder waiting days for a human adjuster to get back to them, an AI agent can walk them through submitting photos and documents, instantly check their policy details, and get the payout process started—all within minutes.

This new way of operating creates real value that boosts both the bottom line and customer loyalty. The advantages are clear:

Faster Resolution Times: AI works 24/7, slashing the time it takes to process claims and service requests from days down to just minutes.

Lower Operational Costs: By taking over repetitive administrative work, AI frees up your human experts to handle the truly complex issues that require empathy and judgment.

Tighter Compliance and Auditability: Every conversation and decision the AI makes is recorded, creating an impeccable audit trail that ensures you're always following strict regulatory rules.

A Better Customer Experience: Customers get instant, accurate help whenever they need it, building trust and satisfaction. Speedy and efficient service is consistently a top theme in positive claims ai reviews.

This technology gives financial institutions the power to not just meet customer expectations, but to consistently exceed them. Delivering instant, compliant, and accurate AI customer care at scale is a massive competitive edge.

From Simple Questions to Complex Workflows

The real goal of this automation is to move beyond just answering basic questions. The focus now is on giving the AI full ownership of a process from start to finish, letting it manage multi-step tasks that used to require a human touch.

This shift is a key part of the larger financial services digital transformation sweeping the industry, as technology becomes deeply integrated into core business functions. From the first moment a customer reaches out to the final resolution of their case, these AI agents are managing workflows with incredible precision and control. This guide will show you how this powerful change is not just happening—it's becoming a necessity to stay competitive.

Understanding the Core AI Chatbot Architecture

To really get a handle on what an AI support chatbot can do in finance and insurance, you have to look under the hood. It’s easy to focus on the chat window, but the real magic is in the underlying structure. This isn't just some standalone program; it's a "digital central nervous system" designed to connect, process, and act within a complex and tightly regulated environment.

Think of it less as a single tool and more as an operational engine. At its heart, the architecture is built for security, scale, and deep integration with the systems you already run. It takes in customer requests, figures out what they mean, checks that information against company policies, gets work done in your core systems, and logs every single step for auditors. This is what separates a true AI agent from a basic, script-following bot.

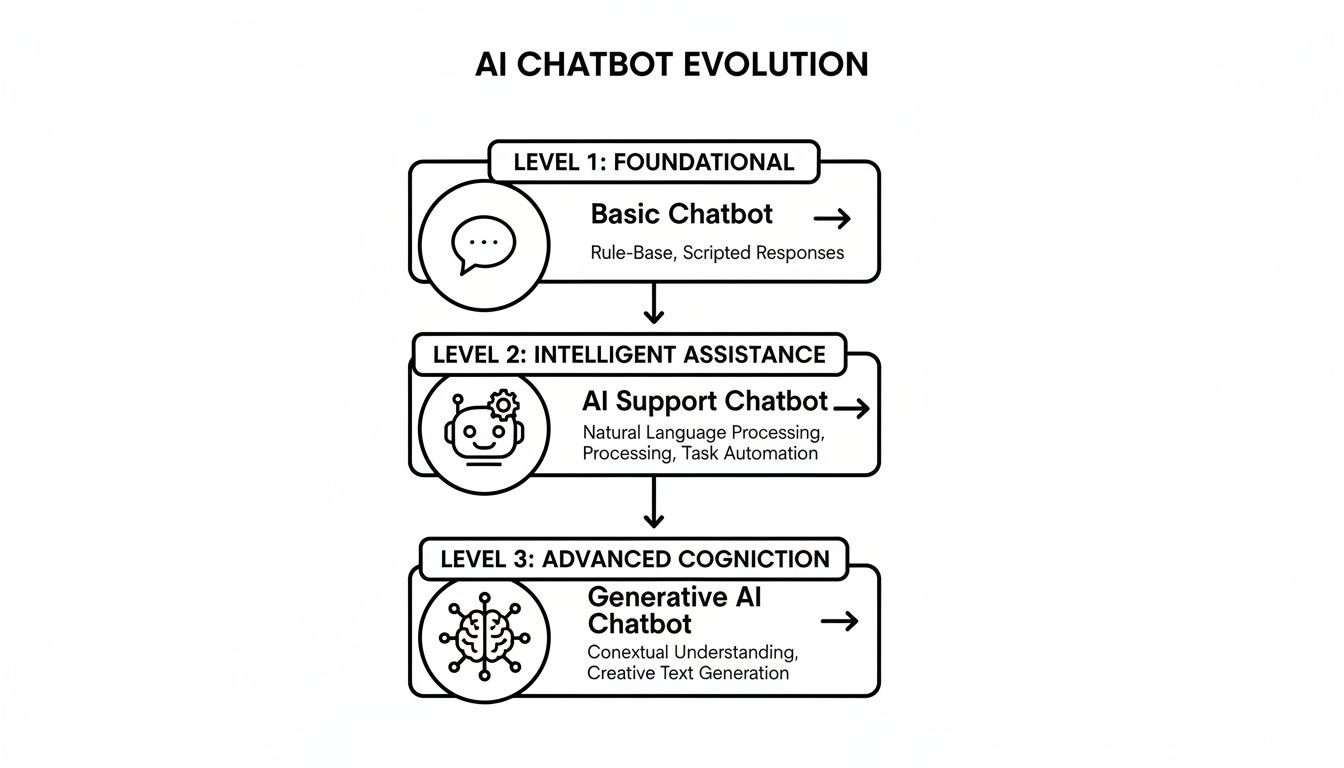

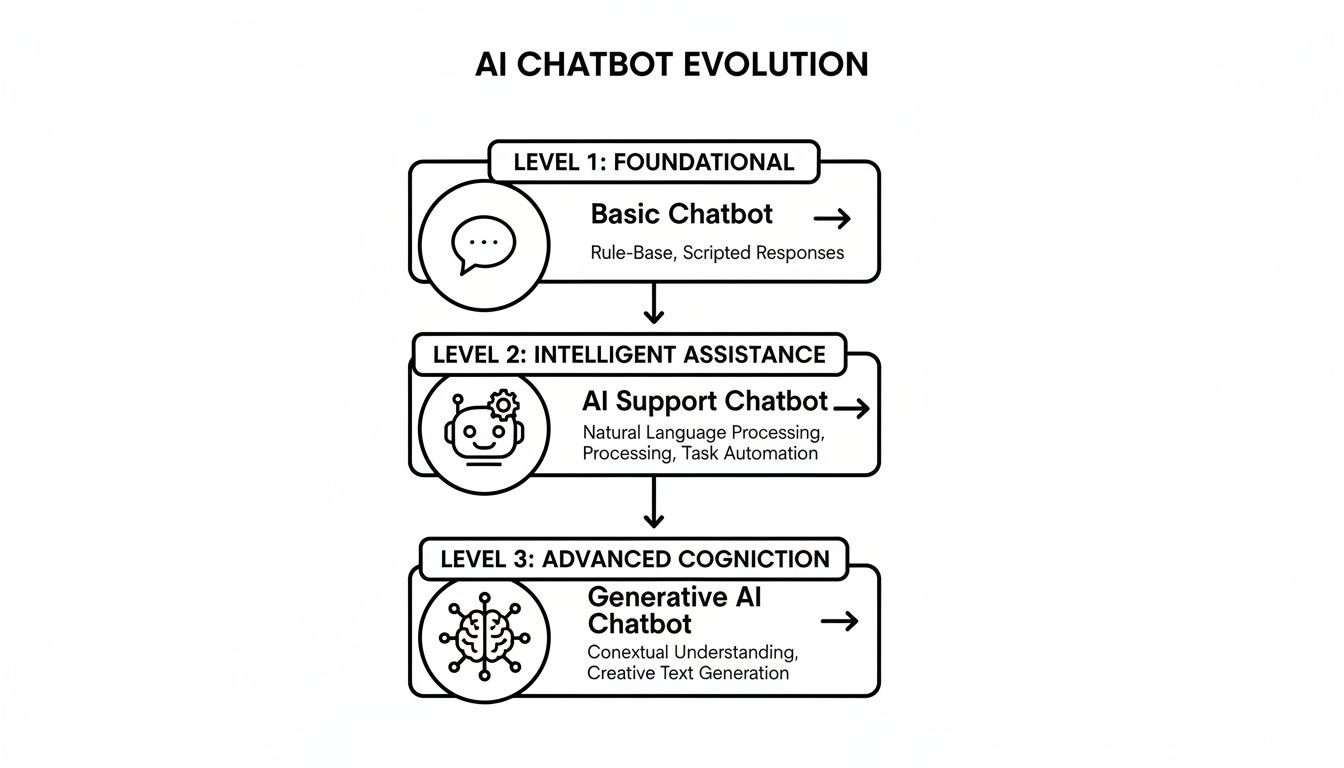

The image below shows just how far we've come—from simple chatbots to the advanced AI agents used by leading financial institutions today.

You can see the clear jump from rule-based chats to intelligent, task-oriented automation. That’s the leap that defines a modern AI agent.

The Natural Language Processing Engine

The first piece of the puzzle, and the one most people see, is the Natural Language Processing (NLP) engine. This is the AI's brain for understanding human language. When a customer types, "I need to file a claim for a rear-end collision that happened yesterday," the NLP engine is smart enough to see more than just words. It pinpoints the intent (file a claim), extracts entities (rear-end collision), and pulls out key data (yesterday).

This is a massive step forward for AI customer care. Instead of making customers guess the right keywords, the system gets the nuances of real conversation, typos and all. If you're curious about the technology that makes this possible, our guide on what conversational AI is breaks it all down.

The Integration and Action Layer

Understanding the request is just the start. The real value is unlocked when the AI can actually do something. That's where the integration layer comes in, acting as the bridge between the chatbot and your core business systems. For AI insurance companies and banks, this is arguably the most critical component.

This layer uses APIs (Application Programming Interfaces) to securely talk to platforms like:

Claims Management Systems: Think Guidewire, Duck Creek, or Sapiens to kick off a First Notice of Loss (FNOL).

Customer Relationship Management (CRM): Systems like Salesforce or ServiceNow to pull a customer's history and log the new interaction.

Contact Center Platforms: Tools like Genesys or Five9 to ensure a smooth handoff to a human agent if things get complicated.

By plugging into these systems, the AI support chatbot can execute real work. It can verify policy details, check a claim's history, and update case files on its own, all while following your established procedures to the letter.

An enterprise AI architecture is defined by its ability to do more than just talk; it must be able to securely access and modify records within the systems that run your business. This is the difference between a conversational tool and an automated operations platform.

The Compliance and Auditability Framework

In finance, nothing matters more than compliance. A well-built AI architecture has an unwavering focus on auditability baked right in. Every single interaction, every decision, and every action the AI agent takes is logged in an immutable, timestamped record.

This framework gives you a complete and transparent history of every case. If a regulator ever asks about a specific customer interaction or a claims decision, you can pull up a detailed log showing exactly what the AI did, what data it used, and which business rule it followed. This built-in audit trail is non-negotiable for operating in regulated industries. It provides the proof you need to keep compliance officers happy and build real trust in the technology. It’s also a major reason we see such positive claims AI reviews from both internal risk teams and external auditors.

Automating Insurance Claims with AI

Let's be honest: the traditional insurance claims process is a nightmare. It's slow, bogged down by paperwork, and often frustrating for everyone involved. This is precisely where an AI support chatbot can make its biggest impact, turning a clunky, manual process into a smooth, automated workflow. For AI insurance companies, this isn't just about better communication; it's about building a powerful operational engine that slashes resolution times and transforms the customer experience.

Picture this: a customer has a minor fender bender. Instead of dialing a call center and navigating a phone tree, they just open their insurer's app and start a chat. Within minutes, the AI has kicked off a fully automated workflow, handling the crucial first steps that used to take days.

The First Notice of Loss, Reimagined

Everything starts with the First Notice of Loss (FNOL), the moment a customer reports what happened. A well-built AI support chatbot makes this interaction quick, painless, and—most importantly—accurate.

The AI guides the policyholder through a simple, structured conversation, making sure nothing gets missed:

Incident Details: It asks for the basics—date, time, and location of the accident.

Document Collection: The user is prompted to upload photos of the damage, the other car's license plate, and the police report, all directly within the chat. No emails, no attachments.

Policy Verification: As this is happening, the AI is already talking to the core insurance platform, verifying the customer's coverage in real time.

This automated FNOL process cuts out the endless phone tag and email chains that drag down the initial filing. It sets a positive, efficient tone for the rest of the claims journey.

A huge win here is that insurers can process initial reports 24/7. The customer gets a claim number and a clear sense of what's next, right away. This kind of instant feedback is a game-changer for customer satisfaction and a common theme in positive claims AI reviews.

From Data Collection to Intelligent Decisions

Once the information is in, the AI chatbot shifts gears from a simple data collector to an intelligent decision-maker. This is where automating insurance claims with AI really shines. The system starts applying predefined business rules with perfect consistency.

Without needing a human to step in, the AI agent can:

Assess Damage: Using computer vision, it analyzes the uploaded photos to get a preliminary sense of the damage. For a simple cracked bumper, it might flag the claim as low-complexity and fast-track it.

Detect Fraud: The AI compares claim details against historical data and known fraud indicators. If something seems off—like inconsistencies in the story or multiple claims for the same incident—it flags the case for human review.

Allocate Resources: Based on the claim's complexity, the AI can automatically schedule a human adjuster or point the customer to the nearest in-network repair shop.

This intelligent triage doesn't just make things faster. It improves the quality of claims AI reviews by ensuring every claim is handled against the same objective criteria, every single time. It reduces human error and promotes fairness. To see how this is reshaping the entire industry, check out our deep dive on the role of AI in insurance claims.

For straightforward, low-value claims like a cracked windshield, the AI can often handle the entire process from start to finish. It verifies coverage, reviews the evidence, approves the claim, and triggers an electronic payment—all without human intervention. This frees up your experienced claims handlers to focus on the complex cases that truly need their empathy and judgment, which ultimately delivers a higher standard of AI customer care across the board.

Elevating Customer Care in Financial Services

While sorting out claims is a huge win for automation, an AI support chatbot is just as skilled at handling the delicate, high-stakes customer conversations that are the lifeblood of the financial world. In sectors like banking and wealth management, trust is everything. AI agents are now capably filling roles that demand precision, regulatory adherence, and a real grasp of customer needs, completely reshaping what we expect from AI customer care.

These bots are not just for answering simple questions about account balances anymore. They are built to manage complex, multi-step processes that have always required a human touch, allowing financial firms to deliver quicker, more reliable service while keeping a tight grip on compliance.

To understand the shift, it helps to compare the old way with the new.

Traditional vs AI-Powered Customer Care in Financial Services

Metric | Traditional Support Model | AI Support Chatbot Model |

|---|---|---|

Availability | Limited to business hours (e.g., 9-5) | 24/7/365, instant availability |

Response Time | Minutes to hours (queue-dependent) | Seconds (instantaneous) |

Consistency | Varies by agent knowledge and mood | 100% consistent, follows a script perfectly |

Cost Per Interaction | High (agent salary, benefits, overhead) | Low (fractions of a cent per interaction) |

Scalability | Linear; requires hiring more agents | Elastic; scales instantly to meet demand |

Audit Trail | Manual note-taking, call recordings | Automated, immutable, and detailed logs |

Error Rate | Prone to human error and oversight | Near-zero for defined processes |

This comparison really highlights how AI isn't just a minor upgrade—it’s a fundamental change in operational capability and customer experience.

Automating High-Stakes Financial Workflows

In the financial industry, customer journeys are often complicated and wrapped in red tape. A well-trained AI support chatbot can navigate these paths flawlessly, acting as a dependable digital specialist that’s always on duty. This is the key to scaling your operations without letting quality or compliance slip.

Think about these critical use cases:

Know Your Customer (KYC) Checks: An AI agent can walk a new customer through the entire verification process. It requests documents, uses computer vision to confirm IDs, and checks data against external databases, all while flagging any outliers for a human to review.

Loan Applications: The bot can explain different loan products, help applicants gather the right financial documents, and make sure the application is perfect before it’s submitted. This cuts down on errors and speeds up the entire underwriting cycle.

Transaction Disputes: Instead of sitting on hold, a customer can report a suspicious charge directly to an AI agent. The bot can instantly freeze the transaction, gather the necessary details, and open a formal dispute case in your core banking system.

By getting these initial steps right every single time, the AI sets a positive tone for the entire customer relationship.

Combining Automation with the Human Touch

Of course, even the smartest AI knows when to step aside. A core design principle for a modern AI support chatbot is the ability to recognize when a conversation needs human empathy or sophisticated judgment. The idea is never to replace your experts but to free them up by handling all the repetitive, data-heavy groundwork.

This teamwork is what makes the whole system work. The AI can manage the first part of the conversation, collecting all the important context and creating a neat transcript. If the customer's problem gets too thorny or emotional, the AI executes a "warm handoff" to a human agent.

The human agent gets the full conversation history and a quick summary, so the customer never has to repeat their story. This creates a smooth, stress-free experience and lets your best people focus on solving the toughest problems.

This hybrid model is the secret to delivering truly great AI customer care. It blends the speed and precision of AI with the irreplaceable value of a genuine human connection.

Ensuring Auditability and Control in Every Conversation

For any financial institution, every single customer interaction is a record that could be audited. Modern AI platforms are built from the ground up with this in mind. Every single action an AI support chatbot takes—from the information it shares to the tasks it completes—is carefully logged.

This creates a permanent audit trail that proves you’re compliant with regulations like GDPR and SOC 2. If a regulator ever questions a specific interaction, you can instantly produce a complete record showing what was said, what data was used, and which business rules were followed. This kind of transparency isn't just a nice-to-have; it's the operational backbone that allows you to deploy AI with confidence in a heavily regulated field.

Measuring the Business Impact of Your AI Chatbot

Bringing an AI support chatbot into your operations is a serious investment. To justify it, you need to prove its worth with more than just vanity metrics. For leaders in financial services, that means tracking key performance indicators (KPIs) that connect automation directly to business results.

A solid measurement framework is what separates a pilot project from a strategic asset. It helps you build the business case by showing exactly how this technology makes you more efficient, cuts costs, and keeps customers happy.

The real goal is to measure what actually moves the needle. For AI insurance companies, that could be a massive drop in claims processing time. For a bank, it might mean a lower cost-per-interaction for AI customer care without sacrificing quality. Tracking these concrete outcomes is how you demonstrate real value.

Key Performance Indicators for Financial Services

While your specific goals will vary, a few core KPIs will always give you a clear picture of how your AI chatbot is performing. These aren't just about counting conversations; they measure genuine operational impact.

First Contact Resolution (FCR): What percentage of customer issues does the AI solve in a single conversation, with no human handoff? A high FCR is one of the best signs that your bot is both knowledgeable and effective.

Containment Rate: This closely related metric shows how many conversations are handled entirely by the AI from start to finish. It’s a direct measure of how much work the chatbot is taking off your team's shoulders.

Average Handle Time (AHT): AI agents can resolve many issues far faster than a person can. A sharp decline in AHT for automated tasks is a clear win for operational efficiency.

Tracking these core metrics is how you get to the hard numbers on cost savings. Multiply the number of contained interactions by your average cost for a human-led conversation, and you've got a tangible figure for the chatbot's financial contribution.

Measuring Customer and Compliance Impact

Efficiency is only half the story. The best AI platforms also improve the customer experience and help you manage risk—qualitative wins that are just as crucial as the hard numbers. For example, positive claims AI reviews from customers are powerful proof that your automation is working as intended.

You should be tracking these carefully, too.

Customer Satisfaction (CSAT): Quick surveys right after an interaction are the easiest way to find out how customers feel about the automated experience. High CSAT scores prove the bot isn't just fast; it's genuinely helpful.

Compliance Adherence: Keep an eye on the number of compliance errors in processes handled by the AI compared to those handled by humans. A well-built chatbot should have a near-zero error rate on scripted tasks. To see how this works in practice, you can explore case studies on transforming insurance claims with agentic AI.

The market for this technology is exploding precisely because of these proven benefits. Already, 80% of companies worldwide are using or planning to use AI-powered chatbots. And with forecasts showing that 95% of customer interactions will soon be AI-powered, this technology is quickly becoming table stakes. It’s a clear sign that organizations are seeing a real return on their investment. You can learn more about these global trends and see detailed chatbot statistics on Jotform.

Answering Your Top Questions About AI Chatbot Implementation

Bringing an AI support chatbot into a regulated environment like banking or insurance isn't a small decision. It's perfectly normal for executives to have tough questions about how this technology actually works in the real world, how it connects with existing systems, and how it will empower their teams. Let's tackle the most common concerns head-on.

One of the first things people ask is about data security. It’s a valid concern. Enterprise-grade AI platforms are built from the ground up with security at their core. Think end-to-end encryption, strict user access controls, and compliance with standards like SOC 2 and GDPR. They also have smart features that can automatically redact or tokenize sensitive personal information, which drastically reduces your risk profile.

What Happens When the AI Doesn't Know an Answer?

A well-built AI support chatbot for financial services is designed never to guess. Its entire world is defined by your business rules and established Standard Operating Procedures (SOPs). This isn't a limitation; it's a crucial feature that ensures reliability and builds trust in your AI customer care.

When a question falls outside its expertise, the AI is programmed to execute a clean, seamless handoff to a human agent. This isn't a system failure—it's a core part of its design. The transition is smooth, and the customer never has to repeat themselves, which is key to a great service experience.

Will an AI Chatbot Replace Our Customer Service Team?

The goal is to empower your team, not replace it. An AI support chatbot is brilliant at handling the high-volume, repetitive tasks that often bog down your best people. This frees up your human agents to focus on the complex, high-empathy conversations where their skills truly shine. The entire system is built for human-AI collaboration.

A great example is in insurance claims. The AI can handle the initial data gathering, verify the policy details against your core system, and then escalate the case—with all the context included—to a human specialist. This makes the whole process faster and less frustrating for everyone, a common theme in positive claims AI reviews.

Modern AI platforms are also designed for easy integration. They use a flexible, API-first architecture, allowing them to connect directly into the systems you already use, whether that's Guidewire, Salesforce, or other industry-specific platforms. The implementation process is more about mapping your business logic to the AI's workflows than it is about a massive custom build. The result is a chatbot that acts like a true digital coworker, executing tasks right where the work gets done.

Ready to see how compliant AI agents can automate your most critical operations? Nolana delivers an AI-native operating system designed to automate claims, case management, and customer service workflows with precision and control. Discover how Nolana can transform your financial services operations.

An AI support chatbot isn't just another pop-up window on a website. In heavily regulated industries like finance and insurance, it's a sophisticated digital assistant built to handle complex, high-stakes work. Forget the simple Q&A bots that just follow a script. We're talking about AI agents that can automate entire workflows—from processing an insurance claim to resolving a detailed customer complaint—acting more like a highly skilled digital team member.

The New Digital Coworker in Financial Services

Imagine an employee who works around the clock, flawlessly processes thousands of requests, and documents every action for perfect compliance. This isn't science fiction; it's what an advanced AI support chatbot brings to the table in financial services. The industry is moving past basic, scripted bots and embracing intelligent agents that can run critical business operations on their own.

Let's put it this way: a traditional chatbot is like a call center agent who can't deviate from a pre-written script. An AI support chatbot, on the other hand, is like a seasoned operations analyst. It understands the nuances of a situation, connects with your core business systems, and makes decisions based on established company policies. For ai insurance companies and banks, this is the new digital coworker.

Redefining Claims and Customer Interactions

You can really see the business impact when these AI agents tackle high-value, complex jobs. A great example is automating insurance claims with AI. Instead of a policyholder waiting days for a human adjuster to get back to them, an AI agent can walk them through submitting photos and documents, instantly check their policy details, and get the payout process started—all within minutes.

This new way of operating creates real value that boosts both the bottom line and customer loyalty. The advantages are clear:

Faster Resolution Times: AI works 24/7, slashing the time it takes to process claims and service requests from days down to just minutes.

Lower Operational Costs: By taking over repetitive administrative work, AI frees up your human experts to handle the truly complex issues that require empathy and judgment.

Tighter Compliance and Auditability: Every conversation and decision the AI makes is recorded, creating an impeccable audit trail that ensures you're always following strict regulatory rules.

A Better Customer Experience: Customers get instant, accurate help whenever they need it, building trust and satisfaction. Speedy and efficient service is consistently a top theme in positive claims ai reviews.

This technology gives financial institutions the power to not just meet customer expectations, but to consistently exceed them. Delivering instant, compliant, and accurate AI customer care at scale is a massive competitive edge.

From Simple Questions to Complex Workflows

The real goal of this automation is to move beyond just answering basic questions. The focus now is on giving the AI full ownership of a process from start to finish, letting it manage multi-step tasks that used to require a human touch.

This shift is a key part of the larger financial services digital transformation sweeping the industry, as technology becomes deeply integrated into core business functions. From the first moment a customer reaches out to the final resolution of their case, these AI agents are managing workflows with incredible precision and control. This guide will show you how this powerful change is not just happening—it's becoming a necessity to stay competitive.

Understanding the Core AI Chatbot Architecture

To really get a handle on what an AI support chatbot can do in finance and insurance, you have to look under the hood. It’s easy to focus on the chat window, but the real magic is in the underlying structure. This isn't just some standalone program; it's a "digital central nervous system" designed to connect, process, and act within a complex and tightly regulated environment.

Think of it less as a single tool and more as an operational engine. At its heart, the architecture is built for security, scale, and deep integration with the systems you already run. It takes in customer requests, figures out what they mean, checks that information against company policies, gets work done in your core systems, and logs every single step for auditors. This is what separates a true AI agent from a basic, script-following bot.

The image below shows just how far we've come—from simple chatbots to the advanced AI agents used by leading financial institutions today.

You can see the clear jump from rule-based chats to intelligent, task-oriented automation. That’s the leap that defines a modern AI agent.

The Natural Language Processing Engine

The first piece of the puzzle, and the one most people see, is the Natural Language Processing (NLP) engine. This is the AI's brain for understanding human language. When a customer types, "I need to file a claim for a rear-end collision that happened yesterday," the NLP engine is smart enough to see more than just words. It pinpoints the intent (file a claim), extracts entities (rear-end collision), and pulls out key data (yesterday).

This is a massive step forward for AI customer care. Instead of making customers guess the right keywords, the system gets the nuances of real conversation, typos and all. If you're curious about the technology that makes this possible, our guide on what conversational AI is breaks it all down.

The Integration and Action Layer

Understanding the request is just the start. The real value is unlocked when the AI can actually do something. That's where the integration layer comes in, acting as the bridge between the chatbot and your core business systems. For AI insurance companies and banks, this is arguably the most critical component.

This layer uses APIs (Application Programming Interfaces) to securely talk to platforms like:

Claims Management Systems: Think Guidewire, Duck Creek, or Sapiens to kick off a First Notice of Loss (FNOL).

Customer Relationship Management (CRM): Systems like Salesforce or ServiceNow to pull a customer's history and log the new interaction.

Contact Center Platforms: Tools like Genesys or Five9 to ensure a smooth handoff to a human agent if things get complicated.

By plugging into these systems, the AI support chatbot can execute real work. It can verify policy details, check a claim's history, and update case files on its own, all while following your established procedures to the letter.

An enterprise AI architecture is defined by its ability to do more than just talk; it must be able to securely access and modify records within the systems that run your business. This is the difference between a conversational tool and an automated operations platform.

The Compliance and Auditability Framework

In finance, nothing matters more than compliance. A well-built AI architecture has an unwavering focus on auditability baked right in. Every single interaction, every decision, and every action the AI agent takes is logged in an immutable, timestamped record.

This framework gives you a complete and transparent history of every case. If a regulator ever asks about a specific customer interaction or a claims decision, you can pull up a detailed log showing exactly what the AI did, what data it used, and which business rule it followed. This built-in audit trail is non-negotiable for operating in regulated industries. It provides the proof you need to keep compliance officers happy and build real trust in the technology. It’s also a major reason we see such positive claims AI reviews from both internal risk teams and external auditors.

Automating Insurance Claims with AI

Let's be honest: the traditional insurance claims process is a nightmare. It's slow, bogged down by paperwork, and often frustrating for everyone involved. This is precisely where an AI support chatbot can make its biggest impact, turning a clunky, manual process into a smooth, automated workflow. For AI insurance companies, this isn't just about better communication; it's about building a powerful operational engine that slashes resolution times and transforms the customer experience.

Picture this: a customer has a minor fender bender. Instead of dialing a call center and navigating a phone tree, they just open their insurer's app and start a chat. Within minutes, the AI has kicked off a fully automated workflow, handling the crucial first steps that used to take days.

The First Notice of Loss, Reimagined

Everything starts with the First Notice of Loss (FNOL), the moment a customer reports what happened. A well-built AI support chatbot makes this interaction quick, painless, and—most importantly—accurate.

The AI guides the policyholder through a simple, structured conversation, making sure nothing gets missed:

Incident Details: It asks for the basics—date, time, and location of the accident.

Document Collection: The user is prompted to upload photos of the damage, the other car's license plate, and the police report, all directly within the chat. No emails, no attachments.

Policy Verification: As this is happening, the AI is already talking to the core insurance platform, verifying the customer's coverage in real time.

This automated FNOL process cuts out the endless phone tag and email chains that drag down the initial filing. It sets a positive, efficient tone for the rest of the claims journey.

A huge win here is that insurers can process initial reports 24/7. The customer gets a claim number and a clear sense of what's next, right away. This kind of instant feedback is a game-changer for customer satisfaction and a common theme in positive claims AI reviews.

From Data Collection to Intelligent Decisions

Once the information is in, the AI chatbot shifts gears from a simple data collector to an intelligent decision-maker. This is where automating insurance claims with AI really shines. The system starts applying predefined business rules with perfect consistency.

Without needing a human to step in, the AI agent can:

Assess Damage: Using computer vision, it analyzes the uploaded photos to get a preliminary sense of the damage. For a simple cracked bumper, it might flag the claim as low-complexity and fast-track it.

Detect Fraud: The AI compares claim details against historical data and known fraud indicators. If something seems off—like inconsistencies in the story or multiple claims for the same incident—it flags the case for human review.

Allocate Resources: Based on the claim's complexity, the AI can automatically schedule a human adjuster or point the customer to the nearest in-network repair shop.

This intelligent triage doesn't just make things faster. It improves the quality of claims AI reviews by ensuring every claim is handled against the same objective criteria, every single time. It reduces human error and promotes fairness. To see how this is reshaping the entire industry, check out our deep dive on the role of AI in insurance claims.

For straightforward, low-value claims like a cracked windshield, the AI can often handle the entire process from start to finish. It verifies coverage, reviews the evidence, approves the claim, and triggers an electronic payment—all without human intervention. This frees up your experienced claims handlers to focus on the complex cases that truly need their empathy and judgment, which ultimately delivers a higher standard of AI customer care across the board.

Elevating Customer Care in Financial Services

While sorting out claims is a huge win for automation, an AI support chatbot is just as skilled at handling the delicate, high-stakes customer conversations that are the lifeblood of the financial world. In sectors like banking and wealth management, trust is everything. AI agents are now capably filling roles that demand precision, regulatory adherence, and a real grasp of customer needs, completely reshaping what we expect from AI customer care.

These bots are not just for answering simple questions about account balances anymore. They are built to manage complex, multi-step processes that have always required a human touch, allowing financial firms to deliver quicker, more reliable service while keeping a tight grip on compliance.

To understand the shift, it helps to compare the old way with the new.

Traditional vs AI-Powered Customer Care in Financial Services

Metric | Traditional Support Model | AI Support Chatbot Model |

|---|---|---|

Availability | Limited to business hours (e.g., 9-5) | 24/7/365, instant availability |

Response Time | Minutes to hours (queue-dependent) | Seconds (instantaneous) |

Consistency | Varies by agent knowledge and mood | 100% consistent, follows a script perfectly |

Cost Per Interaction | High (agent salary, benefits, overhead) | Low (fractions of a cent per interaction) |

Scalability | Linear; requires hiring more agents | Elastic; scales instantly to meet demand |

Audit Trail | Manual note-taking, call recordings | Automated, immutable, and detailed logs |

Error Rate | Prone to human error and oversight | Near-zero for defined processes |

This comparison really highlights how AI isn't just a minor upgrade—it’s a fundamental change in operational capability and customer experience.

Automating High-Stakes Financial Workflows

In the financial industry, customer journeys are often complicated and wrapped in red tape. A well-trained AI support chatbot can navigate these paths flawlessly, acting as a dependable digital specialist that’s always on duty. This is the key to scaling your operations without letting quality or compliance slip.

Think about these critical use cases:

Know Your Customer (KYC) Checks: An AI agent can walk a new customer through the entire verification process. It requests documents, uses computer vision to confirm IDs, and checks data against external databases, all while flagging any outliers for a human to review.

Loan Applications: The bot can explain different loan products, help applicants gather the right financial documents, and make sure the application is perfect before it’s submitted. This cuts down on errors and speeds up the entire underwriting cycle.

Transaction Disputes: Instead of sitting on hold, a customer can report a suspicious charge directly to an AI agent. The bot can instantly freeze the transaction, gather the necessary details, and open a formal dispute case in your core banking system.

By getting these initial steps right every single time, the AI sets a positive tone for the entire customer relationship.

Combining Automation with the Human Touch

Of course, even the smartest AI knows when to step aside. A core design principle for a modern AI support chatbot is the ability to recognize when a conversation needs human empathy or sophisticated judgment. The idea is never to replace your experts but to free them up by handling all the repetitive, data-heavy groundwork.

This teamwork is what makes the whole system work. The AI can manage the first part of the conversation, collecting all the important context and creating a neat transcript. If the customer's problem gets too thorny or emotional, the AI executes a "warm handoff" to a human agent.

The human agent gets the full conversation history and a quick summary, so the customer never has to repeat their story. This creates a smooth, stress-free experience and lets your best people focus on solving the toughest problems.

This hybrid model is the secret to delivering truly great AI customer care. It blends the speed and precision of AI with the irreplaceable value of a genuine human connection.

Ensuring Auditability and Control in Every Conversation

For any financial institution, every single customer interaction is a record that could be audited. Modern AI platforms are built from the ground up with this in mind. Every single action an AI support chatbot takes—from the information it shares to the tasks it completes—is carefully logged.

This creates a permanent audit trail that proves you’re compliant with regulations like GDPR and SOC 2. If a regulator ever questions a specific interaction, you can instantly produce a complete record showing what was said, what data was used, and which business rules were followed. This kind of transparency isn't just a nice-to-have; it's the operational backbone that allows you to deploy AI with confidence in a heavily regulated field.

Measuring the Business Impact of Your AI Chatbot

Bringing an AI support chatbot into your operations is a serious investment. To justify it, you need to prove its worth with more than just vanity metrics. For leaders in financial services, that means tracking key performance indicators (KPIs) that connect automation directly to business results.

A solid measurement framework is what separates a pilot project from a strategic asset. It helps you build the business case by showing exactly how this technology makes you more efficient, cuts costs, and keeps customers happy.

The real goal is to measure what actually moves the needle. For AI insurance companies, that could be a massive drop in claims processing time. For a bank, it might mean a lower cost-per-interaction for AI customer care without sacrificing quality. Tracking these concrete outcomes is how you demonstrate real value.

Key Performance Indicators for Financial Services

While your specific goals will vary, a few core KPIs will always give you a clear picture of how your AI chatbot is performing. These aren't just about counting conversations; they measure genuine operational impact.

First Contact Resolution (FCR): What percentage of customer issues does the AI solve in a single conversation, with no human handoff? A high FCR is one of the best signs that your bot is both knowledgeable and effective.

Containment Rate: This closely related metric shows how many conversations are handled entirely by the AI from start to finish. It’s a direct measure of how much work the chatbot is taking off your team's shoulders.

Average Handle Time (AHT): AI agents can resolve many issues far faster than a person can. A sharp decline in AHT for automated tasks is a clear win for operational efficiency.

Tracking these core metrics is how you get to the hard numbers on cost savings. Multiply the number of contained interactions by your average cost for a human-led conversation, and you've got a tangible figure for the chatbot's financial contribution.

Measuring Customer and Compliance Impact

Efficiency is only half the story. The best AI platforms also improve the customer experience and help you manage risk—qualitative wins that are just as crucial as the hard numbers. For example, positive claims AI reviews from customers are powerful proof that your automation is working as intended.

You should be tracking these carefully, too.

Customer Satisfaction (CSAT): Quick surveys right after an interaction are the easiest way to find out how customers feel about the automated experience. High CSAT scores prove the bot isn't just fast; it's genuinely helpful.

Compliance Adherence: Keep an eye on the number of compliance errors in processes handled by the AI compared to those handled by humans. A well-built chatbot should have a near-zero error rate on scripted tasks. To see how this works in practice, you can explore case studies on transforming insurance claims with agentic AI.

The market for this technology is exploding precisely because of these proven benefits. Already, 80% of companies worldwide are using or planning to use AI-powered chatbots. And with forecasts showing that 95% of customer interactions will soon be AI-powered, this technology is quickly becoming table stakes. It’s a clear sign that organizations are seeing a real return on their investment. You can learn more about these global trends and see detailed chatbot statistics on Jotform.

Answering Your Top Questions About AI Chatbot Implementation

Bringing an AI support chatbot into a regulated environment like banking or insurance isn't a small decision. It's perfectly normal for executives to have tough questions about how this technology actually works in the real world, how it connects with existing systems, and how it will empower their teams. Let's tackle the most common concerns head-on.

One of the first things people ask is about data security. It’s a valid concern. Enterprise-grade AI platforms are built from the ground up with security at their core. Think end-to-end encryption, strict user access controls, and compliance with standards like SOC 2 and GDPR. They also have smart features that can automatically redact or tokenize sensitive personal information, which drastically reduces your risk profile.

What Happens When the AI Doesn't Know an Answer?

A well-built AI support chatbot for financial services is designed never to guess. Its entire world is defined by your business rules and established Standard Operating Procedures (SOPs). This isn't a limitation; it's a crucial feature that ensures reliability and builds trust in your AI customer care.

When a question falls outside its expertise, the AI is programmed to execute a clean, seamless handoff to a human agent. This isn't a system failure—it's a core part of its design. The transition is smooth, and the customer never has to repeat themselves, which is key to a great service experience.

Will an AI Chatbot Replace Our Customer Service Team?

The goal is to empower your team, not replace it. An AI support chatbot is brilliant at handling the high-volume, repetitive tasks that often bog down your best people. This frees up your human agents to focus on the complex, high-empathy conversations where their skills truly shine. The entire system is built for human-AI collaboration.

A great example is in insurance claims. The AI can handle the initial data gathering, verify the policy details against your core system, and then escalate the case—with all the context included—to a human specialist. This makes the whole process faster and less frustrating for everyone, a common theme in positive claims AI reviews.

Modern AI platforms are also designed for easy integration. They use a flexible, API-first architecture, allowing them to connect directly into the systems you already use, whether that's Guidewire, Salesforce, or other industry-specific platforms. The implementation process is more about mapping your business logic to the AI's workflows than it is about a massive custom build. The result is a chatbot that acts like a true digital coworker, executing tasks right where the work gets done.

Ready to see how compliant AI agents can automate your most critical operations? Nolana delivers an AI-native operating system designed to automate claims, case management, and customer service workflows with precision and control. Discover how Nolana can transform your financial services operations.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP