How Snapsheet AI Is Redefining Insurance Claims Management

How Snapsheet AI Is Redefining Insurance Claims Management

Discover how Snapsheet uses AI to automate insurance claims and enhance customer care. Learn why top carriers trust Snapsheet to boost efficiency.

In the world of insurance, Snapsheet has emerged as a cloud-native platform built to automate the entire claims management journey. It applies AI to speed up every step, from the first notice of loss all the way to the final payout, offering a much-needed modern take on slow, traditional claims handling. As AI insurance companies look for a competitive edge, automating claims with AI has become a critical strategy.

A New Era for Insurance Claims With Snapsheet

Let's be honest: the insurance industry has long been bogged down by manual, often outdated processes. These systems create high operational costs and, worse, painfully slow resolutions for customers. For most policyholders, filing a claim is a frustrating maze of paperwork, phone tag, and long waits. This friction doesn't just hurt customer satisfaction; it also saddles adjusters and support staff with repetitive, low-impact work.

Carriers today are looking for a real answer to these fundamental problems. They need a system that can not only manage a high volume of claims efficiently but also deliver the speed and transparency that today's customers demand. This is exactly where a platform like Snapsheet comes in, representing less of an incremental upgrade and more of a complete rethinking of how claims should work, driven by AI.

A Modern Approach to Claims Management

Think of the old way of handling claims like navigating a city with a paper map—it works, but it’s slow, cumbersome, and easy to get wrong. Snapsheet is the real-time GPS for claims, offering a faster, smarter, and far more accurate route from start to finish. Its entire ecosystem is designed for end-to-end automation, fundamentally changing the operational workflow for AI insurance companies.

To really grasp this shift, you have to look at the bigger picture of digital transformation in customer experience, where speed and self-service are now the standard. Snapsheet brings this thinking to insurance by automating key moments, like using AI to appraise vehicle damage from photos or sending instant status updates that keep policyholders in the loop. This combination of powerful AI customer care on the front end and serious efficiency on the back end is setting a new industry benchmark.

The numbers speak for themselves. In 2023, Snapsheet reported 13% year-over-year growth, having managed over 4.3 million claims and processed $15.3 billion in indemnity. This kind of momentum, driven by its adoption among 15 of the top 20 P&C insurers in the US, shows just how significant its role has become in the market.

Automating the Entire Claims Lifecycle with AI

At its heart, Snapsheet’s real power is how it weaves intelligent automation into every single step of the claims process. Think of it as a digital expert adjuster, working around the clock to process information, assess damage, and push claims forward at a pace that manual methods just can't touch. This isn't just about speeding up a few tasks; it's about fundamentally redesigning the entire workflow for peak efficiency and a much better customer experience, a core goal for any modern financial services firm.

The whole thing kicks off at the First Notice of Loss (FNOL), that first critical moment that really sets the tone for the policyholder. Instead of forcing customers into call center queues and dealing with manual data entry, Snapsheet offers a completely digital intake powered by AI. A policyholder can file their claim whenever and wherever they are, just by using a simple interface on their phone to upload photos, videos, and the initial details of what happened.

This is where the AI gets to work instantly. It gathers and verifies all the incoming information on the fly, checking it against policy details and flagging anything that’s missing right away. That means adjusters get a complete, accurate file from the get-go, cutting out the painful back-and-forth that bogs down traditional claims intake.

Virtual Appraisals and Damage Assessment

Once the basic data is in, Snapsheet brings in one of its most powerful tools: virtual appraisals. The technology analyzes the photos and videos sent in by the claimant to assess the damage with surprising accuracy. The AI has been trained on millions of past claims, so it knows how to spot the type and severity of damage, estimate what repairs will cost, and even spit out a detailed scope of work.

For many claims, this completely eliminates the need for an in-person inspection—a huge source of delays and costs in the old model.

By automating appraisals with AI, Snapsheet can shrink claim cycle times from weeks down to just days or even hours. This doesn't just cut down on loss adjustment expenses; it dramatically improves the policyholder's experience by getting them a fast, fair resolution.

The platform's AI also takes on the role of a fraud watchdog. It scans the submitted media and claim data for any red flags—inconsistencies, odd metadata, or patterns that smell like fraud—helping carriers spot suspicious claims right at the start. This proactive defense lets investigators focus their energy where it’s truly needed. If you want to go deeper on this, our guide on insurance claims processing automation offers more insight into how these technologies operate.

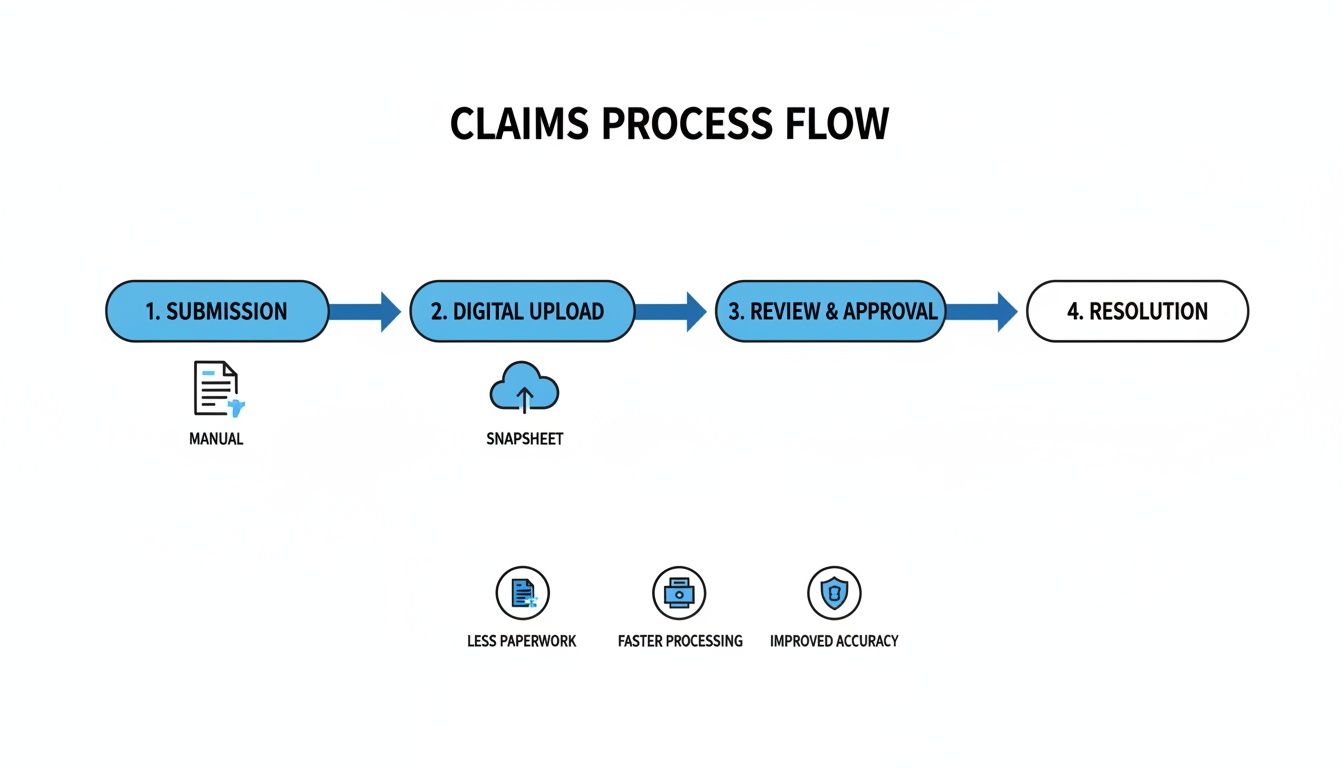

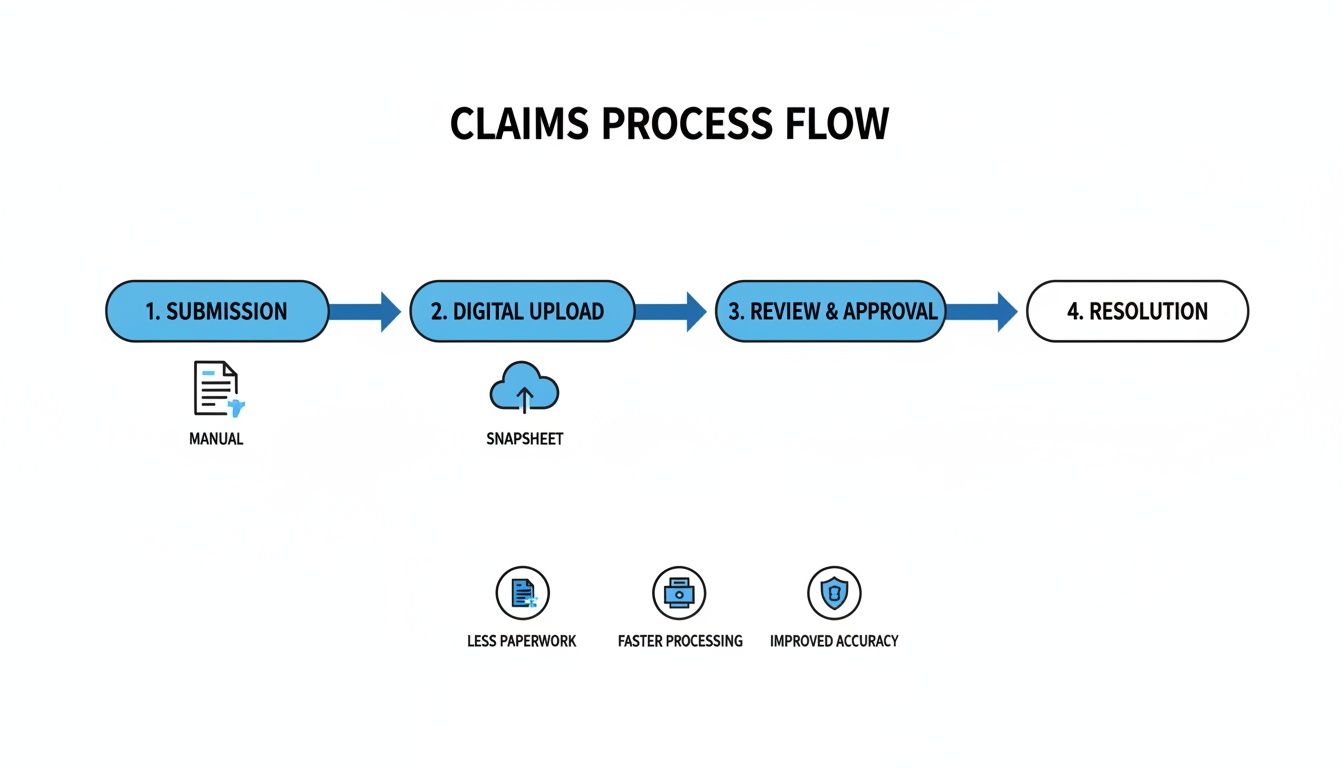

To really see the difference Snapsheet makes, it helps to understand the typical insurance claim timeline that platforms like this are designed to crush. The contrast between the slow, step-by-step manual process and an automated, parallel workflow is night and day.

This diagram shows just how different the process looks with Snapsheet's automated approach.

You can see how the platform replaces the old-school, linear handoffs with a central, cloud-based system that puts review and resolution on the fast track.

No-Code Configuration for Custom Workflows

One of Snapsheet's biggest selling points is its no-code platform. This is a game-changer because it gives insurers the power to design, build, and launch their own custom automated workflows without needing a small army of developers or constant IT support. Business users can literally use a drag-and-drop interface to set rules, define thresholds, and map out the exact journey a claim should follow based on its type, complexity, or dollar value.

This kind of flexibility is crucial for carriers that need to move fast when the market shifts or internal policies change. For example, an insurer could:

Set up a "fast track" for simple, low-value auto claims that get automatically approved and paid out within minutes of being filed.

Design a specialized workflow for property claims that automatically sends photos to specific structural engineers based on the damage type the AI detects.

Create rules to flag claims with certain red flags for immediate review by a senior adjuster, making sure an expert eye is on the most complex cases.

This level of control ensures the automation is smart. It’s not about replacing people. It’s about supercharging them. By handing off the repetitive, data-heavy tasks to the machine, Snapsheet lets experienced adjusters concentrate on what they do best: handling tough negotiations, providing empathetic customer support, and making critical judgment calls. That blend of AI efficiency and human expertise is what modern claims management is all about.

Transforming the Policyholder Experience With AI Customer Care

While efficient backend processing is table stakes, the real battleground for AI insurance companies today is the customer experience. A lightning-fast, automated claims system means little if the policyholder is left in the dark, feeling anxious and ignored. Snapsheet tackles this head-on, deploying its AI engine not just to process claims, but to create a genuinely supportive and proactive AI customer care experience for financial services.

This isn't just about speed; it's about shifting the entire dynamic of a claim. What's traditionally a stressful, uncertain event becomes a reassuring and positive interaction with the brand. It’s in these critical moments that Snapsheet helps insurers build the kind of trust that lasts.

Proactive Communication and Digital Engagement

Think about the old way of doing things: a policyholder has to call a contact center, navigate a phone tree, wait on hold, and then ask for a status update. Snapsheet flips that model on its head by making communication digital-first and, most importantly, proactive.

Instead of forcing customers to chase down information, the system automatically pushes updates to them through their preferred channel, like text or email. This one feature has a massive impact. Just knowing where your claim stands without having to ask melts away anxiety and builds confidence in the insurer.

This is a fundamental shift from a reactive, call-center-driven model to a proactive, digital one powered by AI. It’s about meeting customers where they are—on their phones—and giving them the instant feedback they expect from every other modern service.

The platform’s growth numbers tell the story. Back in 2021, Snapsheet saw a massive 159% year-over-year growth, processing over 2.5 million claims representing more than $10 billion in indemnity. This explosion, happening right in the middle of the pandemic, proved how critical its no-code platform was for carriers needing to deliver top-notch virtual service when face-to-face interactions weren't an option.

Self-Service Portals and Intelligent Chatbots

Another piece of the puzzle is giving policyholders the tools to help themselves. Snapsheet provides intuitive, easy-to-use portals where claimants can check their claim status, upload photos or documents, or message their adjuster—all on their own time, 24/7. That feeling of control can make all the difference during a stressful situation.

For immediate answers to common questions, Snapsheet also brings in intelligent chatbots. These bots can instantly handle routine queries like, "What's the status of my payment?" or "What documents do you need from me?". This not only gives the customer an instant answer but also acts as a smart filter, preventing contact centers from getting bogged down by a high volume of repetitive, simple questions.

This blend of AI and human expertise creates a powerful, balanced system.

AI Handles the Volume: Automated updates, self-service options, and chatbots manage the bulk of routine interactions, ensuring customers get quick resolutions.

Humans Handle the Complexity: This frees up your experienced adjusters to focus their time and emotional intelligence on the complex, sensitive claims where a human touch is absolutely essential.

This isn't about replacing people; it's about empowering them. Insurers can scale their operations efficiently without ever sacrificing the quality of their customer support. For those wanting to build out similar strategies, our guide on AI customer care offers a deeper dive into blending technology with the human element.

Ultimately, the combination of speed, transparency, and on-demand support is what sets leading insurers apart. Snapsheet gives carriers the tools to deliver an experience that not only resolves a claim but actively strengthens the customer relationship for the long run.

Measuring the Real-World Impact of Snapsheet

Features on a spec sheet are one thing, but the real test for any claims platform is its impact on the bottom line. For AI insurance companies, bringing a platform like Snapsheet into the fold isn't just a tech upgrade—it's a powerful financial decision. The platform is designed to produce tangible business outcomes that hit the industry's biggest pain points head-on: high costs, sluggish cycle times, and shaky customer satisfaction.

Instead of talking in hypotheticals, let's look at the actual, measurable improvements carriers see. When you automate the core of your claims process with AI, the results show up almost immediately in operational efficiency and adjuster capacity. Here’s a breakdown of the return on investment you can realistically expect.

Driving Down Operational Costs

One of the first and most welcome changes with Snapsheet is a serious drop in operational expenses. Traditional claims handling is notoriously labor-intensive, bogged down by manual touchpoints that inflate costs at every turn. By automating tasks like data entry, initial damage triage, and payment processing, the platform lifts a massive administrative weight off the organization.

This has a direct impact on Loss Adjustment Expenses (LAE), which is one of the biggest line items for any insurer. When adjusters spend less time on paperwork, they can manage larger caseloads without getting overwhelmed, cutting the need for extra staff and overtime.

The numbers back this up. Snapsheet consistently delivers a strong ROI, with partner insurers reporting up to a 15% reduction in operational costs. This comes directly from smart automation and smoother workflows. By working with over 70 carriers across the US, Canada, and Europe, Snapsheet has proven it can deliver these results in months, not years.

Accelerating Claims Cycle Times and Boosting NPS

In claims, speed is the name of the game. Resolving a claim faster doesn't just cut costs; it has a massive effect on customer loyalty. Snapsheet tackles cycle time from every angle, from instant digital FNOL to AI-powered virtual appraisals that can produce an estimate in hours, not days.

That speed translates directly into a better experience for the policyholder. When a customer gets a settlement that feels fast, fair, and transparent, their entire view of their insurer changes for the better. This is immediately visible in higher Net Promoter Scores (NPS), a vital metric for measuring loyalty and brand health.

By turning a historically slow and frustrating process into a quick and seamless one, insurers can turn a potential brand-detractor into a loyal advocate. The ability to pay a straightforward claim in a single day is a powerful differentiator in a competitive market.

Most claims AI reviews point to this clear link between speed and satisfaction. A happy customer is far less likely to complain or shop around for a new carrier. This blend of faster cycles and improved AI customer care creates a positive feedback loop where operational wins build a stronger brand. Our own case studies on transforming insurance claims with agentic AI dig deeper into how this kind of automation creates these positive outcomes.

Enhancing Adjuster Productivity and Focus

Automation doesn't replace good adjusters—it frees them up. By taking over the repetitive, low-value work, Snapsheet lets experienced claims professionals concentrate on what they do best: navigating complex negotiations, offering genuine empathy to customers in distress, and making tough judgment calls.

This shift has a huge impact on job satisfaction and retention. Adjusters get to spend their days on more meaningful work, which boosts morale and improves performance. It also ensures that complex claims get the expert attention they need, minimizing the risk of costly errors or oversights. At the end of the day, the platform helps you deploy your most valuable resource—your people—much more intelligently.

When comparing Snapsheet's impact, it's helpful to see a side-by-side view against traditional methods. The following table highlights the typical performance shifts insurers can expect.

Snapsheet vs. Traditional Claims Processing KPIs

Metric | Traditional Claims Process | Snapsheet AI-Powered Process |

|---|---|---|

Cycle Time (Simple Auto) | 10-15 days | 1-3 days |

Loss Adjustment Expense (LAE) | Standard Industry Average | Up to 15% Reduction |

Customer Satisfaction (NPS) | Varies, often neutral or negative | Consistent 20-30 point increase |

Adjuster Caseload Capacity | 100-150 files per month | 200-250+ files per month |

FNOL to Estimate Time | 3-5 days | Under 24 hours |

As the data shows, the improvements aren't just incremental. They represent a fundamental change in how claims are managed, leading to a more efficient, cost-effective, and customer-centric operation.

Integrating Snapsheet into Your Existing Tech Ecosystem

For any operations or IT leader at an AI insurance company, the idea of bringing in new tech immediately raises a crucial question: how will it fit with what we already have? The fear of a painful, rip-and-replace project is very real. Snapsheet was built from the ground up to sidestep this exact problem. It’s designed to be a flexible innovation layer that enhances—not displaces—your core systems.

Its cloud-native, API-first architecture is the key to this smooth adoption. Think of it less like a disruptive new foundation and more like a smart, modern extension to your existing infrastructure. It communicates effortlessly with legacy platforms, whether it's your policy administration system or your billing software. This lets insurers add powerful automation and superior AI customer care without having to tackle a risky and expensive overhaul of their entire tech stack.

Built for Seamless Connectivity

At its heart, Snapsheet is engineered to be a good neighbor to your current technology. The whole platform is built around a comprehensive set of APIs (Application Programming Interfaces). These APIs act like universal translators, allowing totally different software systems to talk to each other without a hitch. This is precisely what makes its integration capabilities so powerful.

Because of this API-first design, Snapsheet can easily pull policy details from your core system, send payment instructions to your financial software, and push status updates to your CRM. The platform effectively becomes the central hub for claims automation, while your other systems keep doing what they do best. The result is a connected ecosystem where data flows freely, which cuts out manual re-entry and slashes the risk of human error.

The goal is not to replace your foundational systems but to augment them. Snapsheet provides the agility and speed needed for modern claims processing, letting you get more value from the technology investments you've already made.

This design philosophy is a common thread in positive claims AI reviews, which frequently praise the platform’s ability to deliver quick wins without causing massive operational headaches. It gives carriers a way to modernize the critical claims part of their business while they map out bigger, longer-term transformation projects.

Enterprise-Grade Security and Compliance

In financial services, security and data governance are non-negotiable. Period. Bringing any new platform into the fold requires absolute certainty that it meets the highest standards for data protection and regulatory compliance. Snapsheet was clearly built with this in mind, offering an enterprise-grade security posture designed for a highly regulated industry.

The platform comes with stringent data governance controls baked in, making sure sensitive policyholder information is handled responsibly from start to finish. This includes robust encryption for data both at rest and in transit, strict access controls, and detailed audit trails that provide a clear record of every action taken in the system.

Furthermore, Snapsheet is built to comply with major data privacy regulations, which gives decision-makers the peace of mind they need. This adherence to global standards includes:

General Data Protection Regulation (GDPR): Ensures compliance with the strict data privacy and security laws protecting individuals in the European Union.

California Consumer Privacy Act (CCPA): Gives California consumers robust data privacy rights and control over their personal information.

This deep-seated commitment to security means you can integrate Snapsheet with confidence, knowing it upholds the same rigorous standards you demand from your own internal systems.

A Partnership Approach to Implementation

Rolling out a platform like Snapsheet is a collaborative effort, not just a software handoff. The company champions a supportive partnership model that guides insurers from the initial setup all the way to ongoing optimization. A typical implementation timeline is measured in months, not years, because the focus is on delivering real, measurable value as quickly as possible.

The whole process kicks off with a deep discovery phase to get a solid understanding of your specific workflows, pain points, and business goals. From there, the Snapsheet implementation team works side-by-side with your experts to configure the no-code platform to your exact needs. This partnership ensures the final solution is perfectly aligned with your business, paving the way for a successful launch and a clear path to a strong return on investment.

Choosing the Right Claims Automation Platform

The market is flooded with insurtech solutions, and picking the right claims automation platform feels like a high-stakes decision. It is. You’re not just trying to solve today’s headaches; you’re looking for a partner that can grow with you for the next decade. This means you have to move past the flashy demos and dig into what really matters—core capabilities, true value, and a shared vision for the future.

While a platform like Snapsheet presents a compelling, all-in-one package with its slick no-code tools and massive partner network, it's on you—the AI insurance company—to do the homework. A smart buyer is an empowered one, ready to pick a partner that fits their unique business needs. That means asking the tough questions that peel back the marketing layer and reveal a vendor's real strengths and weaknesses.

Key Evaluation Criteria for Your Next Platform

When you start vetting potential platforms, your analysis needs to be sharp and focused on a few critical areas. These questions are designed to help you see beyond the sales pitch and understand how a solution will actually function in the wild—for your team and, most importantly, for your policyholders.

First up is scalability and future-proofing. Is the platform built on a modern, cloud-native architecture that can handle a sudden spike in claims without grinding to a halt? You need to ask vendors for their product roadmap. A clear, transparent roadmap shows they're committed to improving the platform and have a pulse on where the industry is going. This ensures you're investing in a platform for tomorrow, not just a tool for today.

Next, get obsessed with the user experience. How intuitive is the interface for your adjusters? How much time will you lose to training? Just as critical is the policyholder's side of the equation. A great platform has to deliver a smooth, reassuring journey for your customer, especially when it comes to AI customer care.

A platform's true value is measured by its adoption. If it's clunky for adjusters or frustrating for customers, you'll never see the ROI you were promised, no matter how many bells and whistles it has.

Many claims AI reviews point to the user interface as the single make-or-break factor. A system that makes an adjuster's job easier while keeping the claimant informed is the one that will drive both efficiency and satisfaction.

A Practical Checklist for Vendor Discussions

To keep your evaluation structured, walk into every vendor meeting with a checklist of targeted questions. This simple step ensures you gather the same data points from each potential partner, allowing for a genuine apples-to-apples comparison.

Questions for Your Vendor Shortlist:

Scope and Configurability: Does your platform cover the entire claims lifecycle, from FNOL straight through to payment? How much can we really configure ourselves without calling in developers?

Integration Capabilities: Show me specific examples of how you've integrated with core systems like ours. What does a realistic integration timeline look like?

Policyholder Experience: How does your platform help us communicate proactively and offer self-service options to claimants? What tools do you have for AI customer care?

Total Cost of Ownership (TCO): Let's talk beyond the license fees. What are the real costs for implementation, training, and ongoing maintenance?

Vendor Partnership and Support: What does your support model look like after we go live? How do you actually use customer feedback to make your product better?

By asking these direct questions, you can cut through the noise and find a platform that fits your operational DNA. Getting into the weeds on different platforms is crucial, and you can learn more about the broader landscape in our guide to intelligent process automation. This methodical approach helps you choose a partner, not just a product—one that will deliver real results for your organization.

Frequently Asked Questions About Snapsheet

When you're exploring claims automation with AI, a lot of questions come up. As carriers look to modernize their operations, it's crucial to get a real feel for what a platform like Snapsheet can actually do. Here are some of the most common questions we hear from decision-makers.

How Does Snapsheet Improve Customer Service?

Snapsheet flips the script on customer communication, making it proactive instead of reactive. Instead of leaving a policyholder wondering what's happening, the platform uses AI to send automatic status updates via text or email. This small change dramatically reduces customer anxiety and takes a huge load off your contact center staff, a core benefit of advanced AI customer care.

It also gives customers the tools they need to help themselves. With self-service portals and smart chatbots available 24/7, policyholders can get instant answers to basic questions. This frees up your human adjusters to focus their time and energy on the more complex claims that require a human touch.

What Makes Snapsheet Different From Other Claims Platforms?

Three things really make Snapsheet stand out: its all-in-one approach, its no-code flexibility, and its deep ecosystem of partners. Many platforms only handle one piece of the claims puzzle, but Snapsheet is built to manage the entire journey, from the first notice of loss all the way to the final payment.

The no-code tools are a game-changer, too. They empower your business teams to build and tweak workflows themselves, without having to wait in line for IT resources. That kind of agility means you can respond to market shifts or new internal goals almost immediately.

A common theme in claims AI reviews is how well the platform plays with others. Its ability to plug into existing systems without demanding a full "rip-and-replace" overhaul is a huge win, leading to faster deployments and a quicker path to seeing a return on investment.

Can Snapsheet Handle Both Auto and Property Claims?

Yes, absolutely. The Snapsheet platform was built from the ground up to be flexible. It can manage a wide range of claim types, including both auto and property.

Its AI has been trained on massive datasets covering different lines of business, so it can handle virtual appraisals for a dented fender just as well as it can assess damage to a roof. Because the workflows are so configurable, insurers can set up distinct, specialized processes that fit the unique needs of each claim type, ensuring everything runs smoothly and accurately across the board.

Ready to see how an AI-native operating system can automate your high-stakes financial services operations? Nolana deploys compliant AI agents to execute tasks end-to-end within your existing workflows. Learn more at Nolana.

In the world of insurance, Snapsheet has emerged as a cloud-native platform built to automate the entire claims management journey. It applies AI to speed up every step, from the first notice of loss all the way to the final payout, offering a much-needed modern take on slow, traditional claims handling. As AI insurance companies look for a competitive edge, automating claims with AI has become a critical strategy.

A New Era for Insurance Claims With Snapsheet

Let's be honest: the insurance industry has long been bogged down by manual, often outdated processes. These systems create high operational costs and, worse, painfully slow resolutions for customers. For most policyholders, filing a claim is a frustrating maze of paperwork, phone tag, and long waits. This friction doesn't just hurt customer satisfaction; it also saddles adjusters and support staff with repetitive, low-impact work.

Carriers today are looking for a real answer to these fundamental problems. They need a system that can not only manage a high volume of claims efficiently but also deliver the speed and transparency that today's customers demand. This is exactly where a platform like Snapsheet comes in, representing less of an incremental upgrade and more of a complete rethinking of how claims should work, driven by AI.

A Modern Approach to Claims Management

Think of the old way of handling claims like navigating a city with a paper map—it works, but it’s slow, cumbersome, and easy to get wrong. Snapsheet is the real-time GPS for claims, offering a faster, smarter, and far more accurate route from start to finish. Its entire ecosystem is designed for end-to-end automation, fundamentally changing the operational workflow for AI insurance companies.

To really grasp this shift, you have to look at the bigger picture of digital transformation in customer experience, where speed and self-service are now the standard. Snapsheet brings this thinking to insurance by automating key moments, like using AI to appraise vehicle damage from photos or sending instant status updates that keep policyholders in the loop. This combination of powerful AI customer care on the front end and serious efficiency on the back end is setting a new industry benchmark.

The numbers speak for themselves. In 2023, Snapsheet reported 13% year-over-year growth, having managed over 4.3 million claims and processed $15.3 billion in indemnity. This kind of momentum, driven by its adoption among 15 of the top 20 P&C insurers in the US, shows just how significant its role has become in the market.

Automating the Entire Claims Lifecycle with AI

At its heart, Snapsheet’s real power is how it weaves intelligent automation into every single step of the claims process. Think of it as a digital expert adjuster, working around the clock to process information, assess damage, and push claims forward at a pace that manual methods just can't touch. This isn't just about speeding up a few tasks; it's about fundamentally redesigning the entire workflow for peak efficiency and a much better customer experience, a core goal for any modern financial services firm.

The whole thing kicks off at the First Notice of Loss (FNOL), that first critical moment that really sets the tone for the policyholder. Instead of forcing customers into call center queues and dealing with manual data entry, Snapsheet offers a completely digital intake powered by AI. A policyholder can file their claim whenever and wherever they are, just by using a simple interface on their phone to upload photos, videos, and the initial details of what happened.

This is where the AI gets to work instantly. It gathers and verifies all the incoming information on the fly, checking it against policy details and flagging anything that’s missing right away. That means adjusters get a complete, accurate file from the get-go, cutting out the painful back-and-forth that bogs down traditional claims intake.

Virtual Appraisals and Damage Assessment

Once the basic data is in, Snapsheet brings in one of its most powerful tools: virtual appraisals. The technology analyzes the photos and videos sent in by the claimant to assess the damage with surprising accuracy. The AI has been trained on millions of past claims, so it knows how to spot the type and severity of damage, estimate what repairs will cost, and even spit out a detailed scope of work.

For many claims, this completely eliminates the need for an in-person inspection—a huge source of delays and costs in the old model.

By automating appraisals with AI, Snapsheet can shrink claim cycle times from weeks down to just days or even hours. This doesn't just cut down on loss adjustment expenses; it dramatically improves the policyholder's experience by getting them a fast, fair resolution.

The platform's AI also takes on the role of a fraud watchdog. It scans the submitted media and claim data for any red flags—inconsistencies, odd metadata, or patterns that smell like fraud—helping carriers spot suspicious claims right at the start. This proactive defense lets investigators focus their energy where it’s truly needed. If you want to go deeper on this, our guide on insurance claims processing automation offers more insight into how these technologies operate.

To really see the difference Snapsheet makes, it helps to understand the typical insurance claim timeline that platforms like this are designed to crush. The contrast between the slow, step-by-step manual process and an automated, parallel workflow is night and day.

This diagram shows just how different the process looks with Snapsheet's automated approach.

You can see how the platform replaces the old-school, linear handoffs with a central, cloud-based system that puts review and resolution on the fast track.

No-Code Configuration for Custom Workflows

One of Snapsheet's biggest selling points is its no-code platform. This is a game-changer because it gives insurers the power to design, build, and launch their own custom automated workflows without needing a small army of developers or constant IT support. Business users can literally use a drag-and-drop interface to set rules, define thresholds, and map out the exact journey a claim should follow based on its type, complexity, or dollar value.

This kind of flexibility is crucial for carriers that need to move fast when the market shifts or internal policies change. For example, an insurer could:

Set up a "fast track" for simple, low-value auto claims that get automatically approved and paid out within minutes of being filed.

Design a specialized workflow for property claims that automatically sends photos to specific structural engineers based on the damage type the AI detects.

Create rules to flag claims with certain red flags for immediate review by a senior adjuster, making sure an expert eye is on the most complex cases.

This level of control ensures the automation is smart. It’s not about replacing people. It’s about supercharging them. By handing off the repetitive, data-heavy tasks to the machine, Snapsheet lets experienced adjusters concentrate on what they do best: handling tough negotiations, providing empathetic customer support, and making critical judgment calls. That blend of AI efficiency and human expertise is what modern claims management is all about.

Transforming the Policyholder Experience With AI Customer Care

While efficient backend processing is table stakes, the real battleground for AI insurance companies today is the customer experience. A lightning-fast, automated claims system means little if the policyholder is left in the dark, feeling anxious and ignored. Snapsheet tackles this head-on, deploying its AI engine not just to process claims, but to create a genuinely supportive and proactive AI customer care experience for financial services.

This isn't just about speed; it's about shifting the entire dynamic of a claim. What's traditionally a stressful, uncertain event becomes a reassuring and positive interaction with the brand. It’s in these critical moments that Snapsheet helps insurers build the kind of trust that lasts.

Proactive Communication and Digital Engagement

Think about the old way of doing things: a policyholder has to call a contact center, navigate a phone tree, wait on hold, and then ask for a status update. Snapsheet flips that model on its head by making communication digital-first and, most importantly, proactive.

Instead of forcing customers to chase down information, the system automatically pushes updates to them through their preferred channel, like text or email. This one feature has a massive impact. Just knowing where your claim stands without having to ask melts away anxiety and builds confidence in the insurer.

This is a fundamental shift from a reactive, call-center-driven model to a proactive, digital one powered by AI. It’s about meeting customers where they are—on their phones—and giving them the instant feedback they expect from every other modern service.

The platform’s growth numbers tell the story. Back in 2021, Snapsheet saw a massive 159% year-over-year growth, processing over 2.5 million claims representing more than $10 billion in indemnity. This explosion, happening right in the middle of the pandemic, proved how critical its no-code platform was for carriers needing to deliver top-notch virtual service when face-to-face interactions weren't an option.

Self-Service Portals and Intelligent Chatbots

Another piece of the puzzle is giving policyholders the tools to help themselves. Snapsheet provides intuitive, easy-to-use portals where claimants can check their claim status, upload photos or documents, or message their adjuster—all on their own time, 24/7. That feeling of control can make all the difference during a stressful situation.

For immediate answers to common questions, Snapsheet also brings in intelligent chatbots. These bots can instantly handle routine queries like, "What's the status of my payment?" or "What documents do you need from me?". This not only gives the customer an instant answer but also acts as a smart filter, preventing contact centers from getting bogged down by a high volume of repetitive, simple questions.

This blend of AI and human expertise creates a powerful, balanced system.

AI Handles the Volume: Automated updates, self-service options, and chatbots manage the bulk of routine interactions, ensuring customers get quick resolutions.

Humans Handle the Complexity: This frees up your experienced adjusters to focus their time and emotional intelligence on the complex, sensitive claims where a human touch is absolutely essential.

This isn't about replacing people; it's about empowering them. Insurers can scale their operations efficiently without ever sacrificing the quality of their customer support. For those wanting to build out similar strategies, our guide on AI customer care offers a deeper dive into blending technology with the human element.

Ultimately, the combination of speed, transparency, and on-demand support is what sets leading insurers apart. Snapsheet gives carriers the tools to deliver an experience that not only resolves a claim but actively strengthens the customer relationship for the long run.

Measuring the Real-World Impact of Snapsheet

Features on a spec sheet are one thing, but the real test for any claims platform is its impact on the bottom line. For AI insurance companies, bringing a platform like Snapsheet into the fold isn't just a tech upgrade—it's a powerful financial decision. The platform is designed to produce tangible business outcomes that hit the industry's biggest pain points head-on: high costs, sluggish cycle times, and shaky customer satisfaction.

Instead of talking in hypotheticals, let's look at the actual, measurable improvements carriers see. When you automate the core of your claims process with AI, the results show up almost immediately in operational efficiency and adjuster capacity. Here’s a breakdown of the return on investment you can realistically expect.

Driving Down Operational Costs

One of the first and most welcome changes with Snapsheet is a serious drop in operational expenses. Traditional claims handling is notoriously labor-intensive, bogged down by manual touchpoints that inflate costs at every turn. By automating tasks like data entry, initial damage triage, and payment processing, the platform lifts a massive administrative weight off the organization.

This has a direct impact on Loss Adjustment Expenses (LAE), which is one of the biggest line items for any insurer. When adjusters spend less time on paperwork, they can manage larger caseloads without getting overwhelmed, cutting the need for extra staff and overtime.

The numbers back this up. Snapsheet consistently delivers a strong ROI, with partner insurers reporting up to a 15% reduction in operational costs. This comes directly from smart automation and smoother workflows. By working with over 70 carriers across the US, Canada, and Europe, Snapsheet has proven it can deliver these results in months, not years.

Accelerating Claims Cycle Times and Boosting NPS

In claims, speed is the name of the game. Resolving a claim faster doesn't just cut costs; it has a massive effect on customer loyalty. Snapsheet tackles cycle time from every angle, from instant digital FNOL to AI-powered virtual appraisals that can produce an estimate in hours, not days.

That speed translates directly into a better experience for the policyholder. When a customer gets a settlement that feels fast, fair, and transparent, their entire view of their insurer changes for the better. This is immediately visible in higher Net Promoter Scores (NPS), a vital metric for measuring loyalty and brand health.

By turning a historically slow and frustrating process into a quick and seamless one, insurers can turn a potential brand-detractor into a loyal advocate. The ability to pay a straightforward claim in a single day is a powerful differentiator in a competitive market.

Most claims AI reviews point to this clear link between speed and satisfaction. A happy customer is far less likely to complain or shop around for a new carrier. This blend of faster cycles and improved AI customer care creates a positive feedback loop where operational wins build a stronger brand. Our own case studies on transforming insurance claims with agentic AI dig deeper into how this kind of automation creates these positive outcomes.

Enhancing Adjuster Productivity and Focus

Automation doesn't replace good adjusters—it frees them up. By taking over the repetitive, low-value work, Snapsheet lets experienced claims professionals concentrate on what they do best: navigating complex negotiations, offering genuine empathy to customers in distress, and making tough judgment calls.

This shift has a huge impact on job satisfaction and retention. Adjusters get to spend their days on more meaningful work, which boosts morale and improves performance. It also ensures that complex claims get the expert attention they need, minimizing the risk of costly errors or oversights. At the end of the day, the platform helps you deploy your most valuable resource—your people—much more intelligently.

When comparing Snapsheet's impact, it's helpful to see a side-by-side view against traditional methods. The following table highlights the typical performance shifts insurers can expect.

Snapsheet vs. Traditional Claims Processing KPIs

Metric | Traditional Claims Process | Snapsheet AI-Powered Process |

|---|---|---|

Cycle Time (Simple Auto) | 10-15 days | 1-3 days |

Loss Adjustment Expense (LAE) | Standard Industry Average | Up to 15% Reduction |

Customer Satisfaction (NPS) | Varies, often neutral or negative | Consistent 20-30 point increase |

Adjuster Caseload Capacity | 100-150 files per month | 200-250+ files per month |

FNOL to Estimate Time | 3-5 days | Under 24 hours |

As the data shows, the improvements aren't just incremental. They represent a fundamental change in how claims are managed, leading to a more efficient, cost-effective, and customer-centric operation.

Integrating Snapsheet into Your Existing Tech Ecosystem

For any operations or IT leader at an AI insurance company, the idea of bringing in new tech immediately raises a crucial question: how will it fit with what we already have? The fear of a painful, rip-and-replace project is very real. Snapsheet was built from the ground up to sidestep this exact problem. It’s designed to be a flexible innovation layer that enhances—not displaces—your core systems.

Its cloud-native, API-first architecture is the key to this smooth adoption. Think of it less like a disruptive new foundation and more like a smart, modern extension to your existing infrastructure. It communicates effortlessly with legacy platforms, whether it's your policy administration system or your billing software. This lets insurers add powerful automation and superior AI customer care without having to tackle a risky and expensive overhaul of their entire tech stack.

Built for Seamless Connectivity

At its heart, Snapsheet is engineered to be a good neighbor to your current technology. The whole platform is built around a comprehensive set of APIs (Application Programming Interfaces). These APIs act like universal translators, allowing totally different software systems to talk to each other without a hitch. This is precisely what makes its integration capabilities so powerful.

Because of this API-first design, Snapsheet can easily pull policy details from your core system, send payment instructions to your financial software, and push status updates to your CRM. The platform effectively becomes the central hub for claims automation, while your other systems keep doing what they do best. The result is a connected ecosystem where data flows freely, which cuts out manual re-entry and slashes the risk of human error.

The goal is not to replace your foundational systems but to augment them. Snapsheet provides the agility and speed needed for modern claims processing, letting you get more value from the technology investments you've already made.

This design philosophy is a common thread in positive claims AI reviews, which frequently praise the platform’s ability to deliver quick wins without causing massive operational headaches. It gives carriers a way to modernize the critical claims part of their business while they map out bigger, longer-term transformation projects.

Enterprise-Grade Security and Compliance

In financial services, security and data governance are non-negotiable. Period. Bringing any new platform into the fold requires absolute certainty that it meets the highest standards for data protection and regulatory compliance. Snapsheet was clearly built with this in mind, offering an enterprise-grade security posture designed for a highly regulated industry.

The platform comes with stringent data governance controls baked in, making sure sensitive policyholder information is handled responsibly from start to finish. This includes robust encryption for data both at rest and in transit, strict access controls, and detailed audit trails that provide a clear record of every action taken in the system.

Furthermore, Snapsheet is built to comply with major data privacy regulations, which gives decision-makers the peace of mind they need. This adherence to global standards includes:

General Data Protection Regulation (GDPR): Ensures compliance with the strict data privacy and security laws protecting individuals in the European Union.

California Consumer Privacy Act (CCPA): Gives California consumers robust data privacy rights and control over their personal information.

This deep-seated commitment to security means you can integrate Snapsheet with confidence, knowing it upholds the same rigorous standards you demand from your own internal systems.

A Partnership Approach to Implementation

Rolling out a platform like Snapsheet is a collaborative effort, not just a software handoff. The company champions a supportive partnership model that guides insurers from the initial setup all the way to ongoing optimization. A typical implementation timeline is measured in months, not years, because the focus is on delivering real, measurable value as quickly as possible.

The whole process kicks off with a deep discovery phase to get a solid understanding of your specific workflows, pain points, and business goals. From there, the Snapsheet implementation team works side-by-side with your experts to configure the no-code platform to your exact needs. This partnership ensures the final solution is perfectly aligned with your business, paving the way for a successful launch and a clear path to a strong return on investment.

Choosing the Right Claims Automation Platform

The market is flooded with insurtech solutions, and picking the right claims automation platform feels like a high-stakes decision. It is. You’re not just trying to solve today’s headaches; you’re looking for a partner that can grow with you for the next decade. This means you have to move past the flashy demos and dig into what really matters—core capabilities, true value, and a shared vision for the future.

While a platform like Snapsheet presents a compelling, all-in-one package with its slick no-code tools and massive partner network, it's on you—the AI insurance company—to do the homework. A smart buyer is an empowered one, ready to pick a partner that fits their unique business needs. That means asking the tough questions that peel back the marketing layer and reveal a vendor's real strengths and weaknesses.

Key Evaluation Criteria for Your Next Platform

When you start vetting potential platforms, your analysis needs to be sharp and focused on a few critical areas. These questions are designed to help you see beyond the sales pitch and understand how a solution will actually function in the wild—for your team and, most importantly, for your policyholders.

First up is scalability and future-proofing. Is the platform built on a modern, cloud-native architecture that can handle a sudden spike in claims without grinding to a halt? You need to ask vendors for their product roadmap. A clear, transparent roadmap shows they're committed to improving the platform and have a pulse on where the industry is going. This ensures you're investing in a platform for tomorrow, not just a tool for today.

Next, get obsessed with the user experience. How intuitive is the interface for your adjusters? How much time will you lose to training? Just as critical is the policyholder's side of the equation. A great platform has to deliver a smooth, reassuring journey for your customer, especially when it comes to AI customer care.

A platform's true value is measured by its adoption. If it's clunky for adjusters or frustrating for customers, you'll never see the ROI you were promised, no matter how many bells and whistles it has.

Many claims AI reviews point to the user interface as the single make-or-break factor. A system that makes an adjuster's job easier while keeping the claimant informed is the one that will drive both efficiency and satisfaction.

A Practical Checklist for Vendor Discussions

To keep your evaluation structured, walk into every vendor meeting with a checklist of targeted questions. This simple step ensures you gather the same data points from each potential partner, allowing for a genuine apples-to-apples comparison.

Questions for Your Vendor Shortlist:

Scope and Configurability: Does your platform cover the entire claims lifecycle, from FNOL straight through to payment? How much can we really configure ourselves without calling in developers?

Integration Capabilities: Show me specific examples of how you've integrated with core systems like ours. What does a realistic integration timeline look like?

Policyholder Experience: How does your platform help us communicate proactively and offer self-service options to claimants? What tools do you have for AI customer care?

Total Cost of Ownership (TCO): Let's talk beyond the license fees. What are the real costs for implementation, training, and ongoing maintenance?

Vendor Partnership and Support: What does your support model look like after we go live? How do you actually use customer feedback to make your product better?

By asking these direct questions, you can cut through the noise and find a platform that fits your operational DNA. Getting into the weeds on different platforms is crucial, and you can learn more about the broader landscape in our guide to intelligent process automation. This methodical approach helps you choose a partner, not just a product—one that will deliver real results for your organization.

Frequently Asked Questions About Snapsheet

When you're exploring claims automation with AI, a lot of questions come up. As carriers look to modernize their operations, it's crucial to get a real feel for what a platform like Snapsheet can actually do. Here are some of the most common questions we hear from decision-makers.

How Does Snapsheet Improve Customer Service?

Snapsheet flips the script on customer communication, making it proactive instead of reactive. Instead of leaving a policyholder wondering what's happening, the platform uses AI to send automatic status updates via text or email. This small change dramatically reduces customer anxiety and takes a huge load off your contact center staff, a core benefit of advanced AI customer care.

It also gives customers the tools they need to help themselves. With self-service portals and smart chatbots available 24/7, policyholders can get instant answers to basic questions. This frees up your human adjusters to focus their time and energy on the more complex claims that require a human touch.

What Makes Snapsheet Different From Other Claims Platforms?

Three things really make Snapsheet stand out: its all-in-one approach, its no-code flexibility, and its deep ecosystem of partners. Many platforms only handle one piece of the claims puzzle, but Snapsheet is built to manage the entire journey, from the first notice of loss all the way to the final payment.

The no-code tools are a game-changer, too. They empower your business teams to build and tweak workflows themselves, without having to wait in line for IT resources. That kind of agility means you can respond to market shifts or new internal goals almost immediately.

A common theme in claims AI reviews is how well the platform plays with others. Its ability to plug into existing systems without demanding a full "rip-and-replace" overhaul is a huge win, leading to faster deployments and a quicker path to seeing a return on investment.

Can Snapsheet Handle Both Auto and Property Claims?

Yes, absolutely. The Snapsheet platform was built from the ground up to be flexible. It can manage a wide range of claim types, including both auto and property.

Its AI has been trained on massive datasets covering different lines of business, so it can handle virtual appraisals for a dented fender just as well as it can assess damage to a roof. Because the workflows are so configurable, insurers can set up distinct, specialized processes that fit the unique needs of each claim type, ensuring everything runs smoothly and accurately across the board.

Ready to see how an AI-native operating system can automate your high-stakes financial services operations? Nolana deploys compliant AI agents to execute tasks end-to-end within your existing workflows. Learn more at Nolana.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP