How AI Is Modernizing the MGA Insurance Model

How AI Is Modernizing the MGA Insurance Model

Discover how the modern MGA is using AI to automate claims, enhance customer care, and drive efficiency in the insurance ecosystem. Learn proven strategies.

A Managing General Agent, or MGA, is essentially a specialized partner for an insurance carrier. They’re given the authority—the "pen"—to underwrite policies and even handle claims on behalf of a larger insurer, but they typically focus on very specific, often tricky, niche markets. This setup is a win-win: carriers can expand their reach into new areas without having to build a whole new internal department from scratch.

Understanding the Modern MGA

MGAs have always been valuable for their agility and deep expertise. Think of them as the special forces of the insurance world, moving into complex markets like commercial trucking or high-risk coastal properties that require a unique understanding of risk. But the role of the modern MGA is rapidly moving beyond its traditional roots.

Today, the game is all about efficiency, speed, and delivering a top-notch customer experience. The single biggest factor driving this shift is the smart application of artificial intelligence. An MGA is no longer just an underwriting shop; it's transforming into a tech-forward business that operates with incredible precision, especially in financial services.

The Rise of AI in MGA Operations

AI isn't some far-off idea; it's here now, actively reshaping core MGA processes. For today's MGA, this means trading slow, manual tasks for automated, intelligent workflows that produce better outcomes in less time. This evolution is most obvious in two key areas: automating insurance claims with AI and enhancing customer care.

By automating these fundamental functions, an MGA can seriously strengthen its operational core. This allows them to grow their services, slash errors, and let their human experts concentrate on the complex, high-stakes decisions that truly matter.

Automating Insurance Claims with AI: AI platforms can now steer the entire claims journey, from the first notice of loss all the way to settlement, often with very little human touch.

AI Customer Care for Financial Services: AI-driven tools offer policyholders instant help, providing status updates and answering questions around the clock.

The modern MGA uses AI to turn operational challenges into a real competitive edge. Automating routine claims and customer service frees them up to focus on growth, new ideas, and building stronger relationships with their carrier partners.

To get a full picture of the modern MGA, it helps to look at the broader story of AI in the insurance industry, which is changing everything from risk assessment to underwriting. This technological wave is giving both ai insurance companies and their MGA partners powerful new ways to deliver value.

A quick look at claims ai reviews and performance metrics shows a clear pattern: businesses that embrace AI achieve major cuts in processing times and overhead costs. For an MGA, that efficiency directly boosts profitability and solidifies its place in the market. The goal is a smooth, data-driven operation where AI customer care and smart claims automation are simply the standard way of doing business.

To really get a handle on the modern MGA, you have to see where it plugs into the bigger insurance picture. The industry has a few key players, and while their roles can sometimes seem blurry, they each have a distinct job. The three main players you'll always find are insurance brokers, Managing General Agents (MGAs), and insurance carriers.

Think of it this way: a broker works for the customer, a carrier works to protect its own capital, and an MGA acts as a specialized agent for the carrier.

The Key Players in the Insurance Value Chain

Getting these roles straight is the first step. A broker is a matchmaker. Their job is to go out into the market and find the best possible coverage for their client, whether it's a person or a business. They are firmly on the policyholder's side.

Carriers are the big insurance companies that actually hold the risk. They design the insurance products, set the rates, and have the capital reserves to pay out claims. They're the financial backbone of the whole system.

The MGA sits in a unique spot right between the two. They don't work for the end customer, and they don't carry the ultimate financial risk on their own books. Instead, a carrier gives them underwriting authority—often called "the power of the pen"—to act on its behalf, usually in a very specific or niche market.

An MGA acts like an extension of the carrier, but with the focused expertise and speed of a specialist. This relationship lets carriers tap into new markets without having to build out an entire internal department, while the MGA gets to leverage the carrier's balance sheet and capacity.

This model has become a huge driver of growth and innovation. The Managing General Agents’ Association (MGAA) noted its MGA membership jumped from 233 to 249 in just one year, showing just how much the sector is booming. This growth comes from deep underwriting knowledge paired with smart technology. You can dig into the full report for more on these market trends.

Insurance Ecosystem Roles At A Glance

To make it even clearer, let's compare the core functions side-by-side. This table really breaks down who does what, from the moment a policy is conceived to when a claim gets paid.

Role | Primary Function | Represents | Key Responsibility | Risk Bearing |

|---|---|---|---|---|

Insurance Broker | Finds the best policy for a client. | The Policyholder | Client advocacy, needs analysis, and market shopping. | None |

MGA | Underwrites, prices, and binds policies for a carrier. | The Insurance Carrier | Niche risk assessment, policy issuance, often claims management. | None (delegated risk) |

Insurance Carrier | Creates insurance products and bears financial risk. | Itself | Capital management, risk pooling, and final claim payments. | Full risk |

This setup lets everyone focus on what they do best.

Now, AI is sharpening these roles even more by taking over routine work. For ai insurance companies and their MGA partners, intelligent systems can handle administrative tasks faster and more accurately than ever before.

For example, solid AI customer care platforms can field policyholder questions around the clock, offering instant information. At the same time, smart algorithms can perform initial claims ai reviews, flagging suspicious activity and green-lighting straightforward payouts. Automating insurance claims processing frees up human experts to focus their energy on the complex, nuanced cases where their judgment truly matters. The whole ecosystem becomes more efficient and responsive as a result.

Automating Insurance Claims with AI

For any MGA, the claims process is where the rubber meets the road. It's the most critical moment of truth for a policyholder and a huge operational nerve center for the business. This is also where automating insurance claims with AI can make its biggest splash, shifting from a simple back-office tool to a core driver of both efficiency and precision.

Let's be honest, claims handling has traditionally been a slow, manual slog. It was a world of endless paperwork, phone tag, and multiple handoffs between departments, which naturally led to delays and costly human errors. AI completely upends this old model by injecting intelligent automation into every single step.

To truly grasp how to modernize an MGA, you have to understand the concept of AI automation. Thinking through what is AI automation helps clarify how these tools can be applied to intricate insurance workflows. This isn't just about speeding things up; it's about building smarter, more resilient systems from the ground up.

Transforming the Claims Lifecycle

It all starts with the First Notice of Loss (FNOL). Instead of relying exclusively on call center staff, an MGA can now use AI-powered chatbots and smart forms to capture the initial claim details. These tools are available 24/7, guiding a stressed policyholder through the necessary steps and making sure all the critical information is collected correctly on the first try.

This data capture is not only immediate but also incredibly accurate, freeing up human agents to focus on the more complex, empathetic conversations that require a human touch. From there, the system automatically triages the incoming claims. Using a combination of predefined business rules and machine learning, the AI can instantly sort claims by complexity, potential severity, and type.

Simple, low-value claims can be fast-tracked for immediate review and payment—sometimes in just a few minutes. At the same time, more complicated cases are instantly flagged and routed to senior adjusters with the right expertise. This ensures the highest-risk situations get the immediate attention they demand.

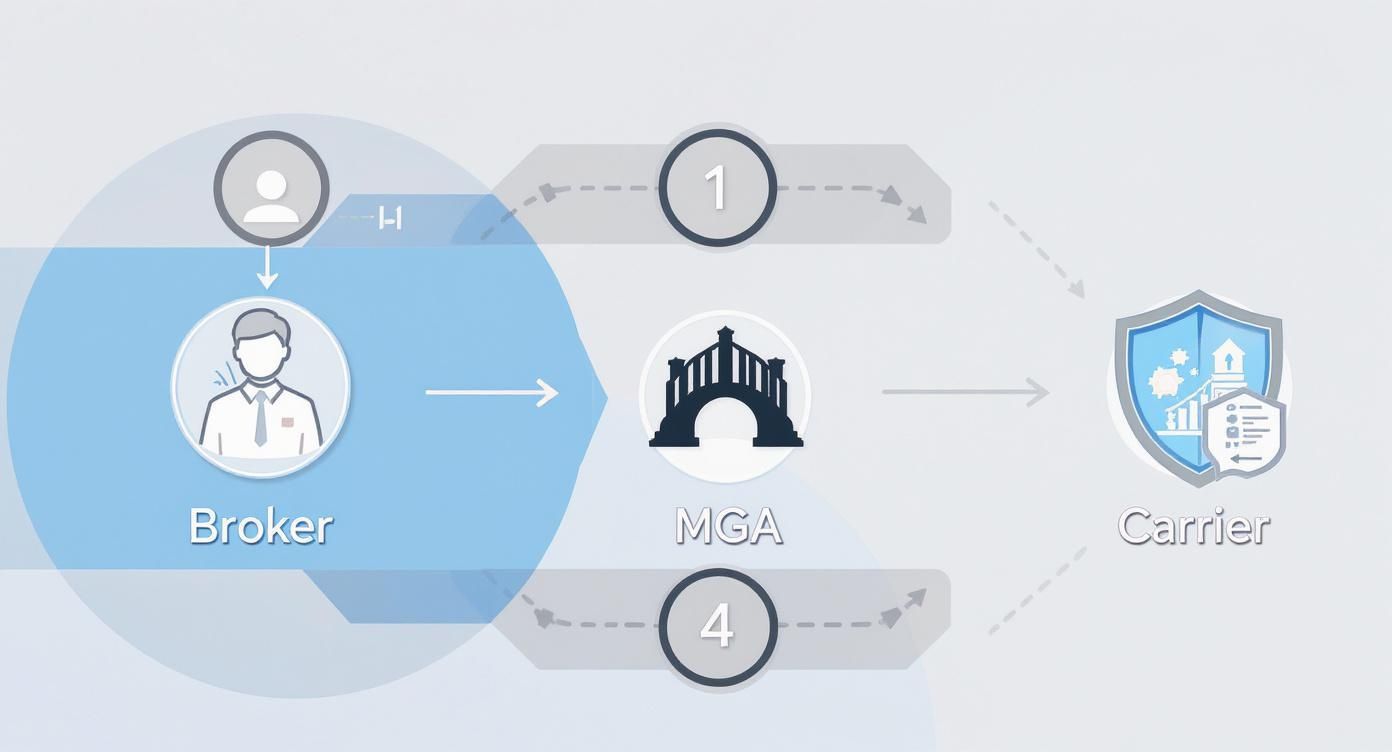

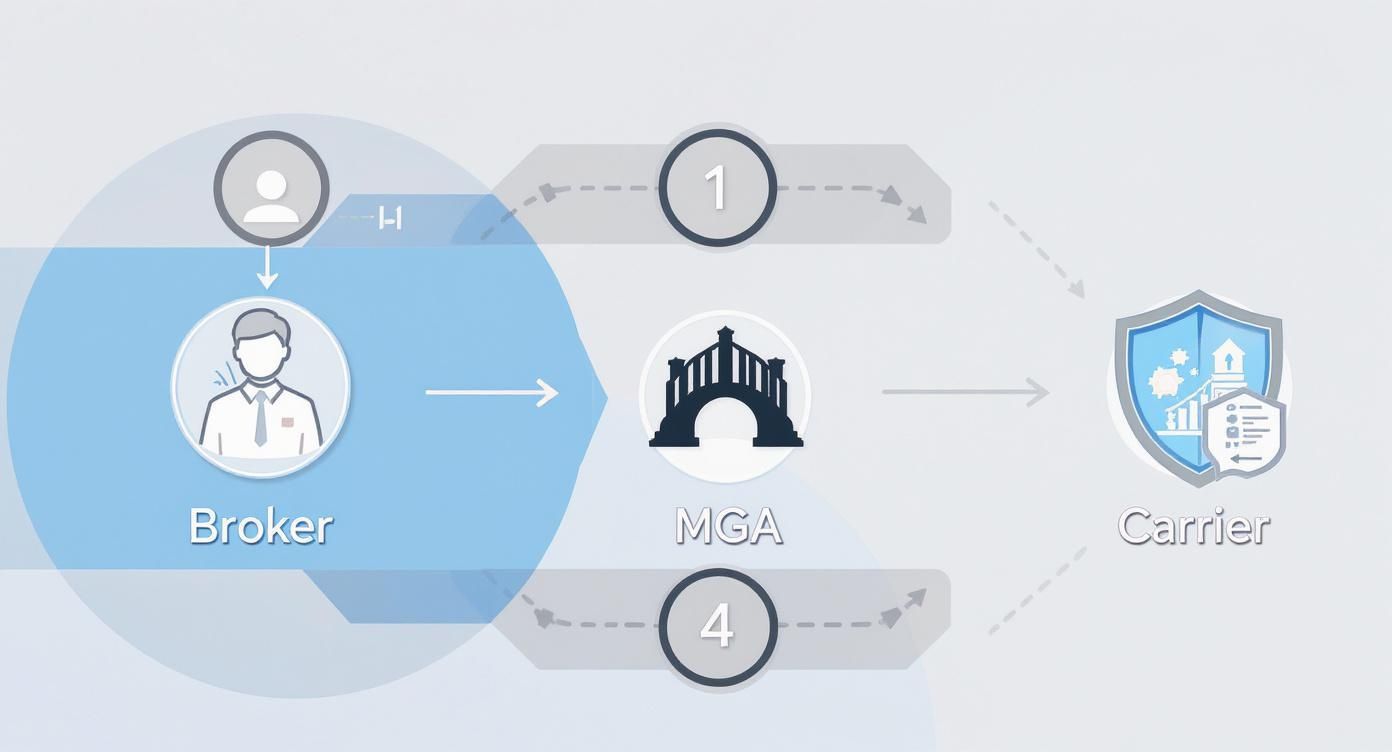

The diagram below illustrates how the MGA fits into the bigger picture, acting as a vital link between brokers and carriers.

As you can see, the MGA's role is central to managing specialized functions like claims processing on behalf of the carrier.

The Power of Claims AI Reviews

A key piece of this automated workflow is the use of claims AI reviews. This is where AI algorithms dive deep into all the documentation tied to a claim—photos, repair estimates, medical reports, policy documents, you name it. The system cross-references every piece of information against the policyholder's coverage, instantly spotting discrepancies or potential red flags.

This automated review slashes the time it takes to assess a claim. Better yet, AI is exceptionally good at sniffing out patterns that might point to fraud. By analyzing thousands of data points in seconds, it can flag suspicious claims that might look perfectly normal to the human eye, saving insurance carriers and their MGA partners from what could be significant losses.

The benefits are direct and easy to measure:

Reduced Processing Times: Claims that used to take weeks can now be wrapped up in days, sometimes even hours.

Increased Accuracy: Automation all but eliminates the risk of human error in data entry and policy interpretation.

Enhanced Fraud Detection: AI can spot suspicious patterns far more reliably than even the most experienced manual reviewer.

By automating the routine, predictable parts of claims processing, an MGA can handle a much higher volume of claims without needing to expand its team. This newfound capacity is what allows the business to scale efficiently while simultaneously improving service quality.

AI Customer Care in the Claims Process

But AI's role isn't just about backend processing. It has a massive impact on AI customer care throughout the claims journey. Policyholders are often anxious and vulnerable after an incident, and nothing is more important than clear, consistent communication.

AI-powered systems can provide automated, real-time status updates via text message, email, or a customer portal. This level of transparency dramatically cuts down on "where's my claim?" calls to the service center and gives policyholders much-needed peace of mind. For a practical look at how this plays out, one of our case studies details the journey of transforming insurance claims with agentic AI, showing real-world results.

And when a customer does need to speak with a human agent, AI makes that interaction better, too. It equips the agent with a complete, neatly organized view of the entire claim file. This means the agent can provide informed, genuinely helpful answers without putting the customer on hold to dig for information.

The result is a smooth, reassuring experience that builds trust and loyalty, turning a stressful event into a positive brand moment. For any MGA, that superior service is a powerful way to stand out from the competition.

Enhancing Customer Care with AI

While slick, automated claims processing delivers huge gains on the back end, the real test for any MGA is the policyholder's experience. AI's impact isn't just about operational efficiency; it’s completely changing how MGAs interact with their customers, making those conversations faster, more personal, and far more transparent. For today's MGA, great AI customer care isn't a "nice-to-have"—it's a core part of the growth strategy for financial services.

Let’s face it, the days of long hold times and 9-to-5 service hours are over. Policyholders now expect immediate answers and round-the-clock access to information, especially when they're in a stressful situation like filing a claim. AI-driven platforms meet these expectations head-on, delivering a level of service that builds real, lasting loyalty.

This move toward smarter customer service is happening at a critical time. The U.S. MGA market recently ballooned to an estimated $114.1 billion in direct premiums written. That’s a 16% jump, far outpacing the growth of the broader P&C market. This boom is fueled by sharp underwriting and market discipline, which means customer experience has become a key battleground for differentiation.

Building a Responsive and Transparent Service Journey

One of the most immediate wins with AI is the ability to offer 24/7, real-time updates. An intelligent platform can give a policyholder instant access to their claim status through a simple web portal or mobile app. This simple step eliminates the need to call an agent just for a quick status check, which not only reduces customer anxiety but also frees up your team to focus on more complex issues.

And it’s not just about status updates. Modern AI-powered virtual assistants and chatbots can resolve a whole host of policy questions on the spot. These aren't the clunky FAQ bots of yesterday; they can pull up specific policy details, explain what’s covered, and walk users through routine processes. That kind of immediate self-service is a game-changer for customer satisfaction.

The idea isn't to replace human agents. It’s to supercharge them. When a customer does need to speak with a person, the AI ensures that the agent has every relevant piece of information right in front of them, leading to a much faster and more satisfying resolution.

Proactively Addressing Customer Frustrations

Beyond simply reacting to inquiries, AI gives AI insurance companies and MGAs the tools to get ahead of problems. Sentiment analysis is a perfect example. These systems can scan customer communications—from emails to call transcripts—to pick up on tones of frustration, confusion, or disappointment.

By catching these negative signals early, an MGA can step in before a small snag turns into a major complaint. This proactive approach does more than just solve a problem; it shows customers you're actually listening and value their business, which is essential for retention.

Here’s how that proactive support delivers real value:

Early Intervention: AI flags at-risk customers, allowing your service teams to reach out with personalized support and turn a bad experience around.

Process Improvement: By spotting recurring points of frustration, you can identify and fix the underlying issues in your workflows or communication.

Reputation Management: Quickly handling negative experiences helps protect your brand and stops poor claims AI reviews from spreading online.

AI customer care is about creating a system where policyholders feel heard, informed, and valued at every step. This builds a foundation of trust that is difficult for competitors to replicate and is essential for long-term success in a crowded market.

By bringing these tools into the fold, an MGA can deliver a consistently excellent service experience that lives up to its specialized underwriting expertise. For a deeper dive into this topic, check out our guide on the core principles of AI customer care. The result is a more resilient, customer-focused operation that strengthens an MGA’s relationships with both its policyholders and carrier partners.

Navigating the Realities of AI Integration

Let’s be honest: bringing powerful new technology into an established MGA is never as simple as flicking a switch. It’s a journey, and like any major undertaking, it comes with its own set of very real obstacles. You’re often dealing with the technical headache of connecting modern platforms to older, legacy systems, all while ensuring your data security and privacy protocols are absolutely airtight.

At the heart of it all is the trust you’ve built with your carrier partners. That relationship is everything. It’s founded on transparency and total accountability, which means any AI you bring in has to be completely auditable. Your carriers will need to know why the AI made a certain decision, especially for something as critical as underwriting or claims. This is where the idea of explainable AI (XAI) becomes less of a buzzword and more of a business necessity.

Why Auditability is the Bedrock of Trust

The best AI solutions designed for the insurance world are built with explainability right at their core. Instead of acting like a mysterious "black box," these systems give you a clear, human-readable audit trail for every single action they take.

This means that for every automated decision—whether it’s flagging a claim for potential fraud or approving a payment—there’s a documented reason. In a heavily regulated industry, this level of transparency isn't just nice to have; it's non-negotiable. It gives an MGA the confidence to answer any carrier question, satisfy auditors, and prove that its automated processes are both compliant and reliable. Without it, that foundational trust between an MGA and its carrier can quickly start to crack.

The ability to produce a clear audit trail isn’t just a feature; it’s the foundation of trust in an AI-powered MGA. It proves that automation enhances control rather than diminishing it, ensuring every decision is transparent and defensible.

The need for these robust systems is only growing as the market shifts. Recent global commercial insurance trends paint a complex picture: while property insurance rates saw a drop of 8%, casualty rates climbed by 3% worldwide. In the U.S., the casualty market jumped 8% on its own, a reflection of its unique legal environment and claim patterns. These fluctuations highlight the very reason MGAs exist—to provide specialized expertise. And that makes reliable, auditable technology more critical than ever. You can dive deeper into these global insurance market insights from Marsh.

Overcoming the Hurdles—Both Technical and Human

Beyond the tech itself, a successful AI integration is also about a significant cultural shift. This isn’t about replacing your human experts; it’s about empowering them to work with new AI tools. The most sophisticated platform on the planet will fall flat if the team doesn’t understand it or, even worse, sees it as a threat.

This calls for a deliberate and thoughtful approach to change management. Upskilling your team is the first crucial step. Underwriters, claims adjusters, and customer service agents need training that goes beyond just software features—it needs to show them how AI can amplify their judgment and free them from the monotonous, repetitive parts of their jobs.

Getting this transition right involves a few key actions:

Communicate Clearly: Leadership has to paint a clear picture of how AI will support the business and its people, tackling concerns head-on.

Train for a New Reality: Develop training programs specific to each role, teaching employees how to work alongside AI, interpret what it produces, and know when to step in.

Create Feedback Loops: Open up channels for employees to share their experiences with the new systems. This not only helps you improve the tools but also gives your team a sense of ownership.

The ultimate goal is to foster a culture where your team sees AI as a powerful assistant—one that handles the routine work so they can focus on the high-value, strategic thinking that truly matters. To get a better handle on this process, check out our in-depth guide on change management in digital transformation. By proactively managing both the technical and human sides of this change, an MGA can build a practical roadmap for a much smoother and more successful journey.

The Future of the AI-Powered MGA

Looking down the road, it's clear AI won't just be another tool in the MGA's toolbox; it's on track to become the central nervous system of the entire operation. The MGAs that will define the future are the ones that move past simple automation and start treating AI as a core strategic asset—the engine for both growth and true differentiation.

This shift will touch every corner of the business. Take underwriting, for example. Predictive analytics, fueled by massive datasets, will bring a level of accuracy we've never seen before. AI will help MGAs spot emerging risks and price policies with surgical precision, paving the way for hyper-personalized insurance products built on the fly for individual customers.

Redefining Efficiency and Customer Value

One of the most dramatic changes will be in autonomous claims processing. Imagine a world where, for certain types of risk, the entire claims process—from the initial report to the final payout—is handled by AI agents. This means near-instant resolution for policyholders, a new standard that will completely reshape what customers expect from AI customer care.

When done right, AI allows a successful MGA to operate with incredible efficiency without sacrificing service quality. By automating the routine, repetitive work, AI frees up your human experts to focus on what they do best: tackling complex risks and nurturing those crucial carrier relationships. That’s a powerful competitive edge.

The bottom line is this: MGAs that learn to weave AI into the fabric of their operations won't just survive; they'll thrive. They're the ones who will set new benchmarks for efficiency, customer value, and resilience across the insurance industry.

The opportunities here are immense. You can see how intelligent systems are already solving real-world operational problems by exploring various agentic AI use cases that are making an impact in financial services today. The future belongs to the ai insurance companies and their MGA partners who build their business around this intelligent core, making every decision faster, smarter, and more in tune with what customers actually need.

A Few Common Questions About MGAs and AI

We get a lot of questions about how Managing General Agents (MGAs) fit into the insurance world and what AI really means for their day-to-day operations. Let's tackle some of the most common ones.

What’s the Main Difference Between an MGA and a Broker?

It all comes down to who they work for and what they’re allowed to do.

Think of an insurance broker as a personal shopper for the policyholder. Their job is to scour the market, comparing different carriers to find the best possible coverage for their client. The broker’s loyalty is always with the customer they represent.

An MGA, on the other hand, acts on behalf of an insurance carrier. The carrier gives them a special kind of authority—often called "the power of the pen"—to underwrite risks, bind policies, and even handle claims. Their primary relationship is with the insurer, effectively serving as a specialized extension of that carrier's team.

Why Do Insurance Carriers Even Partner with MGAs?

Carriers team up with MGAs for one simple reason: to tap into specialized markets quickly and efficiently.

Imagine a large carrier wants to start offering coverage for something very specific, like cybersecurity liability for tech startups. Building that expertise from scratch—hiring niche underwriters, establishing new agent relationships—is a huge investment of time and money.

An MGA that already lives and breathes that world offers an instant solution. They bring the deep underwriting talent and the right distribution network to the table. This partnership model lets the carrier expand its book of business without the massive overhead of building a whole new division internally.

How Does AI Actually Boost an MGA’s Bottom Line?

AI makes an MGA more profitable by tackling operational costs head-on while simultaneously expanding their capacity to handle more business.

For example, automating insurance claims with AI drastically cuts down the manual work and time needed to get a file from first notice of loss to settlement. This means a claims team can manage a much larger volume of work without adding headcount, which is a direct win for efficiency.

When ai insurance companies and their MGA partners embrace intelligent automation, the impact is undeniable. Faster claims cycles and better AI customer care don't just lower operational expenses—they also improve policyholder retention.

It works the same way for customer service. AI can handle routine questions instantly, freeing up skilled staff to focus on more complex issues that require a human touch. And when it comes to risk, claims AI reviews can spot patterns of potential fraud with far greater accuracy than manual checks, preventing unnecessary payouts.

This blend of lower operational friction, increased capacity, and smarter risk management leads directly to a healthier bottom line and a real competitive edge.

Ready to see how AI agents can automate complex insurance operations with precision and control? Learn how Nolana can help you reduce costs and accelerate cycle times by visiting https://nolana.com.

A Managing General Agent, or MGA, is essentially a specialized partner for an insurance carrier. They’re given the authority—the "pen"—to underwrite policies and even handle claims on behalf of a larger insurer, but they typically focus on very specific, often tricky, niche markets. This setup is a win-win: carriers can expand their reach into new areas without having to build a whole new internal department from scratch.

Understanding the Modern MGA

MGAs have always been valuable for their agility and deep expertise. Think of them as the special forces of the insurance world, moving into complex markets like commercial trucking or high-risk coastal properties that require a unique understanding of risk. But the role of the modern MGA is rapidly moving beyond its traditional roots.

Today, the game is all about efficiency, speed, and delivering a top-notch customer experience. The single biggest factor driving this shift is the smart application of artificial intelligence. An MGA is no longer just an underwriting shop; it's transforming into a tech-forward business that operates with incredible precision, especially in financial services.

The Rise of AI in MGA Operations

AI isn't some far-off idea; it's here now, actively reshaping core MGA processes. For today's MGA, this means trading slow, manual tasks for automated, intelligent workflows that produce better outcomes in less time. This evolution is most obvious in two key areas: automating insurance claims with AI and enhancing customer care.

By automating these fundamental functions, an MGA can seriously strengthen its operational core. This allows them to grow their services, slash errors, and let their human experts concentrate on the complex, high-stakes decisions that truly matter.

Automating Insurance Claims with AI: AI platforms can now steer the entire claims journey, from the first notice of loss all the way to settlement, often with very little human touch.

AI Customer Care for Financial Services: AI-driven tools offer policyholders instant help, providing status updates and answering questions around the clock.

The modern MGA uses AI to turn operational challenges into a real competitive edge. Automating routine claims and customer service frees them up to focus on growth, new ideas, and building stronger relationships with their carrier partners.

To get a full picture of the modern MGA, it helps to look at the broader story of AI in the insurance industry, which is changing everything from risk assessment to underwriting. This technological wave is giving both ai insurance companies and their MGA partners powerful new ways to deliver value.

A quick look at claims ai reviews and performance metrics shows a clear pattern: businesses that embrace AI achieve major cuts in processing times and overhead costs. For an MGA, that efficiency directly boosts profitability and solidifies its place in the market. The goal is a smooth, data-driven operation where AI customer care and smart claims automation are simply the standard way of doing business.

To really get a handle on the modern MGA, you have to see where it plugs into the bigger insurance picture. The industry has a few key players, and while their roles can sometimes seem blurry, they each have a distinct job. The three main players you'll always find are insurance brokers, Managing General Agents (MGAs), and insurance carriers.

Think of it this way: a broker works for the customer, a carrier works to protect its own capital, and an MGA acts as a specialized agent for the carrier.

The Key Players in the Insurance Value Chain

Getting these roles straight is the first step. A broker is a matchmaker. Their job is to go out into the market and find the best possible coverage for their client, whether it's a person or a business. They are firmly on the policyholder's side.

Carriers are the big insurance companies that actually hold the risk. They design the insurance products, set the rates, and have the capital reserves to pay out claims. They're the financial backbone of the whole system.

The MGA sits in a unique spot right between the two. They don't work for the end customer, and they don't carry the ultimate financial risk on their own books. Instead, a carrier gives them underwriting authority—often called "the power of the pen"—to act on its behalf, usually in a very specific or niche market.

An MGA acts like an extension of the carrier, but with the focused expertise and speed of a specialist. This relationship lets carriers tap into new markets without having to build out an entire internal department, while the MGA gets to leverage the carrier's balance sheet and capacity.

This model has become a huge driver of growth and innovation. The Managing General Agents’ Association (MGAA) noted its MGA membership jumped from 233 to 249 in just one year, showing just how much the sector is booming. This growth comes from deep underwriting knowledge paired with smart technology. You can dig into the full report for more on these market trends.

Insurance Ecosystem Roles At A Glance

To make it even clearer, let's compare the core functions side-by-side. This table really breaks down who does what, from the moment a policy is conceived to when a claim gets paid.

Role | Primary Function | Represents | Key Responsibility | Risk Bearing |

|---|---|---|---|---|

Insurance Broker | Finds the best policy for a client. | The Policyholder | Client advocacy, needs analysis, and market shopping. | None |

MGA | Underwrites, prices, and binds policies for a carrier. | The Insurance Carrier | Niche risk assessment, policy issuance, often claims management. | None (delegated risk) |

Insurance Carrier | Creates insurance products and bears financial risk. | Itself | Capital management, risk pooling, and final claim payments. | Full risk |

This setup lets everyone focus on what they do best.

Now, AI is sharpening these roles even more by taking over routine work. For ai insurance companies and their MGA partners, intelligent systems can handle administrative tasks faster and more accurately than ever before.

For example, solid AI customer care platforms can field policyholder questions around the clock, offering instant information. At the same time, smart algorithms can perform initial claims ai reviews, flagging suspicious activity and green-lighting straightforward payouts. Automating insurance claims processing frees up human experts to focus their energy on the complex, nuanced cases where their judgment truly matters. The whole ecosystem becomes more efficient and responsive as a result.

Automating Insurance Claims with AI

For any MGA, the claims process is where the rubber meets the road. It's the most critical moment of truth for a policyholder and a huge operational nerve center for the business. This is also where automating insurance claims with AI can make its biggest splash, shifting from a simple back-office tool to a core driver of both efficiency and precision.

Let's be honest, claims handling has traditionally been a slow, manual slog. It was a world of endless paperwork, phone tag, and multiple handoffs between departments, which naturally led to delays and costly human errors. AI completely upends this old model by injecting intelligent automation into every single step.

To truly grasp how to modernize an MGA, you have to understand the concept of AI automation. Thinking through what is AI automation helps clarify how these tools can be applied to intricate insurance workflows. This isn't just about speeding things up; it's about building smarter, more resilient systems from the ground up.

Transforming the Claims Lifecycle

It all starts with the First Notice of Loss (FNOL). Instead of relying exclusively on call center staff, an MGA can now use AI-powered chatbots and smart forms to capture the initial claim details. These tools are available 24/7, guiding a stressed policyholder through the necessary steps and making sure all the critical information is collected correctly on the first try.

This data capture is not only immediate but also incredibly accurate, freeing up human agents to focus on the more complex, empathetic conversations that require a human touch. From there, the system automatically triages the incoming claims. Using a combination of predefined business rules and machine learning, the AI can instantly sort claims by complexity, potential severity, and type.

Simple, low-value claims can be fast-tracked for immediate review and payment—sometimes in just a few minutes. At the same time, more complicated cases are instantly flagged and routed to senior adjusters with the right expertise. This ensures the highest-risk situations get the immediate attention they demand.

The diagram below illustrates how the MGA fits into the bigger picture, acting as a vital link between brokers and carriers.

As you can see, the MGA's role is central to managing specialized functions like claims processing on behalf of the carrier.

The Power of Claims AI Reviews

A key piece of this automated workflow is the use of claims AI reviews. This is where AI algorithms dive deep into all the documentation tied to a claim—photos, repair estimates, medical reports, policy documents, you name it. The system cross-references every piece of information against the policyholder's coverage, instantly spotting discrepancies or potential red flags.

This automated review slashes the time it takes to assess a claim. Better yet, AI is exceptionally good at sniffing out patterns that might point to fraud. By analyzing thousands of data points in seconds, it can flag suspicious claims that might look perfectly normal to the human eye, saving insurance carriers and their MGA partners from what could be significant losses.

The benefits are direct and easy to measure:

Reduced Processing Times: Claims that used to take weeks can now be wrapped up in days, sometimes even hours.

Increased Accuracy: Automation all but eliminates the risk of human error in data entry and policy interpretation.

Enhanced Fraud Detection: AI can spot suspicious patterns far more reliably than even the most experienced manual reviewer.

By automating the routine, predictable parts of claims processing, an MGA can handle a much higher volume of claims without needing to expand its team. This newfound capacity is what allows the business to scale efficiently while simultaneously improving service quality.

AI Customer Care in the Claims Process

But AI's role isn't just about backend processing. It has a massive impact on AI customer care throughout the claims journey. Policyholders are often anxious and vulnerable after an incident, and nothing is more important than clear, consistent communication.

AI-powered systems can provide automated, real-time status updates via text message, email, or a customer portal. This level of transparency dramatically cuts down on "where's my claim?" calls to the service center and gives policyholders much-needed peace of mind. For a practical look at how this plays out, one of our case studies details the journey of transforming insurance claims with agentic AI, showing real-world results.

And when a customer does need to speak with a human agent, AI makes that interaction better, too. It equips the agent with a complete, neatly organized view of the entire claim file. This means the agent can provide informed, genuinely helpful answers without putting the customer on hold to dig for information.

The result is a smooth, reassuring experience that builds trust and loyalty, turning a stressful event into a positive brand moment. For any MGA, that superior service is a powerful way to stand out from the competition.

Enhancing Customer Care with AI

While slick, automated claims processing delivers huge gains on the back end, the real test for any MGA is the policyholder's experience. AI's impact isn't just about operational efficiency; it’s completely changing how MGAs interact with their customers, making those conversations faster, more personal, and far more transparent. For today's MGA, great AI customer care isn't a "nice-to-have"—it's a core part of the growth strategy for financial services.

Let’s face it, the days of long hold times and 9-to-5 service hours are over. Policyholders now expect immediate answers and round-the-clock access to information, especially when they're in a stressful situation like filing a claim. AI-driven platforms meet these expectations head-on, delivering a level of service that builds real, lasting loyalty.

This move toward smarter customer service is happening at a critical time. The U.S. MGA market recently ballooned to an estimated $114.1 billion in direct premiums written. That’s a 16% jump, far outpacing the growth of the broader P&C market. This boom is fueled by sharp underwriting and market discipline, which means customer experience has become a key battleground for differentiation.

Building a Responsive and Transparent Service Journey

One of the most immediate wins with AI is the ability to offer 24/7, real-time updates. An intelligent platform can give a policyholder instant access to their claim status through a simple web portal or mobile app. This simple step eliminates the need to call an agent just for a quick status check, which not only reduces customer anxiety but also frees up your team to focus on more complex issues.

And it’s not just about status updates. Modern AI-powered virtual assistants and chatbots can resolve a whole host of policy questions on the spot. These aren't the clunky FAQ bots of yesterday; they can pull up specific policy details, explain what’s covered, and walk users through routine processes. That kind of immediate self-service is a game-changer for customer satisfaction.

The idea isn't to replace human agents. It’s to supercharge them. When a customer does need to speak with a person, the AI ensures that the agent has every relevant piece of information right in front of them, leading to a much faster and more satisfying resolution.

Proactively Addressing Customer Frustrations

Beyond simply reacting to inquiries, AI gives AI insurance companies and MGAs the tools to get ahead of problems. Sentiment analysis is a perfect example. These systems can scan customer communications—from emails to call transcripts—to pick up on tones of frustration, confusion, or disappointment.

By catching these negative signals early, an MGA can step in before a small snag turns into a major complaint. This proactive approach does more than just solve a problem; it shows customers you're actually listening and value their business, which is essential for retention.

Here’s how that proactive support delivers real value:

Early Intervention: AI flags at-risk customers, allowing your service teams to reach out with personalized support and turn a bad experience around.

Process Improvement: By spotting recurring points of frustration, you can identify and fix the underlying issues in your workflows or communication.

Reputation Management: Quickly handling negative experiences helps protect your brand and stops poor claims AI reviews from spreading online.

AI customer care is about creating a system where policyholders feel heard, informed, and valued at every step. This builds a foundation of trust that is difficult for competitors to replicate and is essential for long-term success in a crowded market.

By bringing these tools into the fold, an MGA can deliver a consistently excellent service experience that lives up to its specialized underwriting expertise. For a deeper dive into this topic, check out our guide on the core principles of AI customer care. The result is a more resilient, customer-focused operation that strengthens an MGA’s relationships with both its policyholders and carrier partners.

Navigating the Realities of AI Integration

Let’s be honest: bringing powerful new technology into an established MGA is never as simple as flicking a switch. It’s a journey, and like any major undertaking, it comes with its own set of very real obstacles. You’re often dealing with the technical headache of connecting modern platforms to older, legacy systems, all while ensuring your data security and privacy protocols are absolutely airtight.

At the heart of it all is the trust you’ve built with your carrier partners. That relationship is everything. It’s founded on transparency and total accountability, which means any AI you bring in has to be completely auditable. Your carriers will need to know why the AI made a certain decision, especially for something as critical as underwriting or claims. This is where the idea of explainable AI (XAI) becomes less of a buzzword and more of a business necessity.

Why Auditability is the Bedrock of Trust

The best AI solutions designed for the insurance world are built with explainability right at their core. Instead of acting like a mysterious "black box," these systems give you a clear, human-readable audit trail for every single action they take.

This means that for every automated decision—whether it’s flagging a claim for potential fraud or approving a payment—there’s a documented reason. In a heavily regulated industry, this level of transparency isn't just nice to have; it's non-negotiable. It gives an MGA the confidence to answer any carrier question, satisfy auditors, and prove that its automated processes are both compliant and reliable. Without it, that foundational trust between an MGA and its carrier can quickly start to crack.

The ability to produce a clear audit trail isn’t just a feature; it’s the foundation of trust in an AI-powered MGA. It proves that automation enhances control rather than diminishing it, ensuring every decision is transparent and defensible.

The need for these robust systems is only growing as the market shifts. Recent global commercial insurance trends paint a complex picture: while property insurance rates saw a drop of 8%, casualty rates climbed by 3% worldwide. In the U.S., the casualty market jumped 8% on its own, a reflection of its unique legal environment and claim patterns. These fluctuations highlight the very reason MGAs exist—to provide specialized expertise. And that makes reliable, auditable technology more critical than ever. You can dive deeper into these global insurance market insights from Marsh.

Overcoming the Hurdles—Both Technical and Human

Beyond the tech itself, a successful AI integration is also about a significant cultural shift. This isn’t about replacing your human experts; it’s about empowering them to work with new AI tools. The most sophisticated platform on the planet will fall flat if the team doesn’t understand it or, even worse, sees it as a threat.

This calls for a deliberate and thoughtful approach to change management. Upskilling your team is the first crucial step. Underwriters, claims adjusters, and customer service agents need training that goes beyond just software features—it needs to show them how AI can amplify their judgment and free them from the monotonous, repetitive parts of their jobs.

Getting this transition right involves a few key actions:

Communicate Clearly: Leadership has to paint a clear picture of how AI will support the business and its people, tackling concerns head-on.

Train for a New Reality: Develop training programs specific to each role, teaching employees how to work alongside AI, interpret what it produces, and know when to step in.

Create Feedback Loops: Open up channels for employees to share their experiences with the new systems. This not only helps you improve the tools but also gives your team a sense of ownership.

The ultimate goal is to foster a culture where your team sees AI as a powerful assistant—one that handles the routine work so they can focus on the high-value, strategic thinking that truly matters. To get a better handle on this process, check out our in-depth guide on change management in digital transformation. By proactively managing both the technical and human sides of this change, an MGA can build a practical roadmap for a much smoother and more successful journey.

The Future of the AI-Powered MGA

Looking down the road, it's clear AI won't just be another tool in the MGA's toolbox; it's on track to become the central nervous system of the entire operation. The MGAs that will define the future are the ones that move past simple automation and start treating AI as a core strategic asset—the engine for both growth and true differentiation.

This shift will touch every corner of the business. Take underwriting, for example. Predictive analytics, fueled by massive datasets, will bring a level of accuracy we've never seen before. AI will help MGAs spot emerging risks and price policies with surgical precision, paving the way for hyper-personalized insurance products built on the fly for individual customers.

Redefining Efficiency and Customer Value

One of the most dramatic changes will be in autonomous claims processing. Imagine a world where, for certain types of risk, the entire claims process—from the initial report to the final payout—is handled by AI agents. This means near-instant resolution for policyholders, a new standard that will completely reshape what customers expect from AI customer care.

When done right, AI allows a successful MGA to operate with incredible efficiency without sacrificing service quality. By automating the routine, repetitive work, AI frees up your human experts to focus on what they do best: tackling complex risks and nurturing those crucial carrier relationships. That’s a powerful competitive edge.

The bottom line is this: MGAs that learn to weave AI into the fabric of their operations won't just survive; they'll thrive. They're the ones who will set new benchmarks for efficiency, customer value, and resilience across the insurance industry.

The opportunities here are immense. You can see how intelligent systems are already solving real-world operational problems by exploring various agentic AI use cases that are making an impact in financial services today. The future belongs to the ai insurance companies and their MGA partners who build their business around this intelligent core, making every decision faster, smarter, and more in tune with what customers actually need.

A Few Common Questions About MGAs and AI

We get a lot of questions about how Managing General Agents (MGAs) fit into the insurance world and what AI really means for their day-to-day operations. Let's tackle some of the most common ones.

What’s the Main Difference Between an MGA and a Broker?

It all comes down to who they work for and what they’re allowed to do.

Think of an insurance broker as a personal shopper for the policyholder. Their job is to scour the market, comparing different carriers to find the best possible coverage for their client. The broker’s loyalty is always with the customer they represent.

An MGA, on the other hand, acts on behalf of an insurance carrier. The carrier gives them a special kind of authority—often called "the power of the pen"—to underwrite risks, bind policies, and even handle claims. Their primary relationship is with the insurer, effectively serving as a specialized extension of that carrier's team.

Why Do Insurance Carriers Even Partner with MGAs?

Carriers team up with MGAs for one simple reason: to tap into specialized markets quickly and efficiently.

Imagine a large carrier wants to start offering coverage for something very specific, like cybersecurity liability for tech startups. Building that expertise from scratch—hiring niche underwriters, establishing new agent relationships—is a huge investment of time and money.

An MGA that already lives and breathes that world offers an instant solution. They bring the deep underwriting talent and the right distribution network to the table. This partnership model lets the carrier expand its book of business without the massive overhead of building a whole new division internally.

How Does AI Actually Boost an MGA’s Bottom Line?

AI makes an MGA more profitable by tackling operational costs head-on while simultaneously expanding their capacity to handle more business.

For example, automating insurance claims with AI drastically cuts down the manual work and time needed to get a file from first notice of loss to settlement. This means a claims team can manage a much larger volume of work without adding headcount, which is a direct win for efficiency.

When ai insurance companies and their MGA partners embrace intelligent automation, the impact is undeniable. Faster claims cycles and better AI customer care don't just lower operational expenses—they also improve policyholder retention.

It works the same way for customer service. AI can handle routine questions instantly, freeing up skilled staff to focus on more complex issues that require a human touch. And when it comes to risk, claims AI reviews can spot patterns of potential fraud with far greater accuracy than manual checks, preventing unnecessary payouts.

This blend of lower operational friction, increased capacity, and smarter risk management leads directly to a healthier bottom line and a real competitive edge.

Ready to see how AI agents can automate complex insurance operations with precision and control? Learn how Nolana can help you reduce costs and accelerate cycle times by visiting https://nolana.com.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP