A Guide to Operational Risk Management in Banking

A Guide to Operational Risk Management in Banking

Master operational risk management in banking with this guide. Learn how AI transforms risk assessment, automates claims, and enhances customer care.

Operational risk management in banking is the discipline of finding, evaluating, and neutralizing risks that come from shaky internal processes, human error, system failures, or outside events. This isn't just about stopping fraud or fixing system glitches; it's a vital strategic function that safeguards a bank’s capital, protects its reputation, and maintains customer trust. It’s the framework that keeps the entire organization running, from the simplest daily transaction to the most complex digital project.

The Foundations of Operational risk management in banking

Think of a bank as an intricate machine with countless interconnected parts. Operational risk management is the master maintenance schedule that keeps every single one of those parts from failing. Just one broken gear (a bad process), one lapse in concentration from an operator (human error), or a sudden power outage (an external shock) could grind the entire machine to a halt. The whole point is to see these potential failures coming and build a tough, resilient system that can absorb the unexpected.

This isn't merely an internal suggestion; it's a core requirement for keeping the financial sector stable. The scope of operational risk is huge, covering everything from a minor data entry typo to a full-blown cyberattack. To get a better handle on the core concepts, you can learn more about how risk management in operations applies more broadly, which provides a great foundation for its specific role in banking.

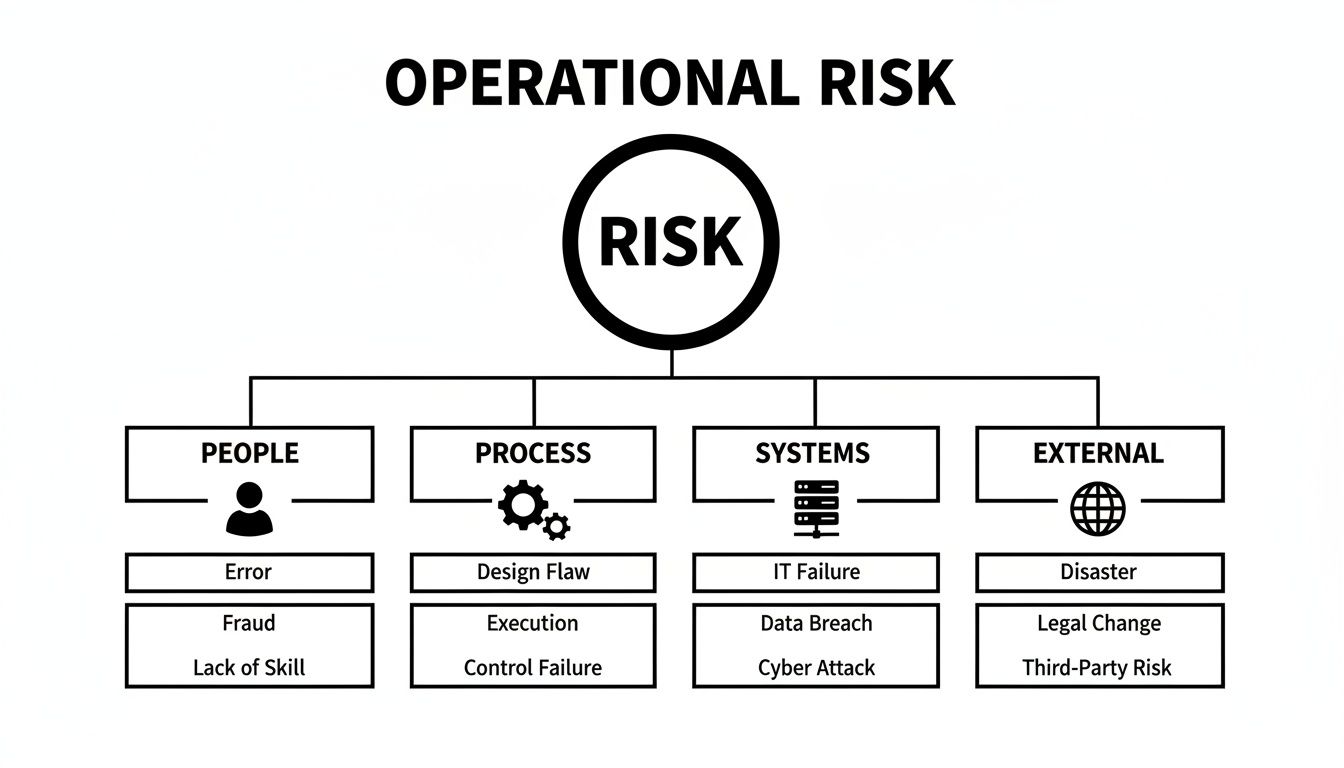

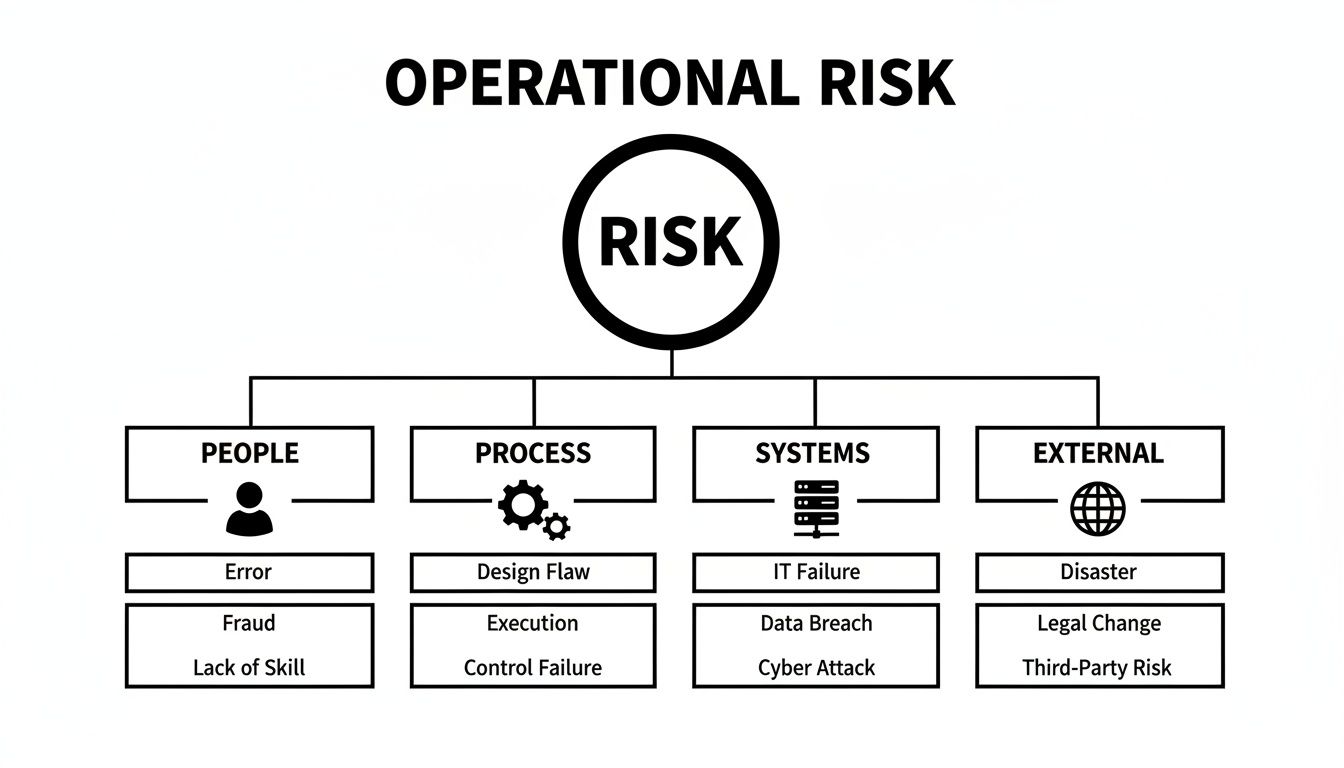

The Four Pillars of Operational Risk

A solid operational risk management in banking framework is built on four distinct sources of risk. Each of these pillars represents a critical area where things can go wrong, often creating a domino effect that spreads throughout the bank.

People: Risks that start with human behavior. This can be deliberate, like internal fraud, or completely accidental, like a mistake made during a transaction. It also covers things like insufficient training or a weak ethical culture.

Processes: Weaknesses baked into the bank's established procedures and controls. You might see this in a poorly thought-out workflow for approving loans, a gap in a compliance checklist, or a clumsy process for bringing new customers on board.

Systems: Breakdowns related to technology and the bank’s core infrastructure. This bucket includes everything from server crashes and software bugs to serious cybersecurity breaches and problems with data accuracy.

External Events: Things that happen outside the bank's direct control. We're talking about natural disasters, global pandemics, major new regulations, or economic shifts that directly impact the bank's ability to do business.

Why It Matters More Than Ever

Operational risk has moved from the back office to the front lines, largely because of relentless digital transformation. As AI insurance companies start to automate their claims processing and banks roll out AI customer care chatbots, a whole new set of operational challenges appears. While these technologies are great for efficiency, they bring fresh risks tied to algorithm accuracy, data privacy, and how well they connect with existing systems.

A key part of modern operational risk is navigating these new technological frontiers. According to claims AI reviews, the most successful projects are the ones with strong risk oversight, preventing automated systems from introducing major errors that could damage both the bank and its customers.

In the end, a robust operational risk framework is more than just a defensive measure—it's what allows a bank to move forward. It gives leaders the confidence to innovate, adopt new tools responsibly, and prove to regulators, investors, and customers that the institution is built to withstand whatever comes next.

Understanding Modern ORM Frameworks

To get a real handle on operational risk, banks can't just be reactive. Waiting for something to break is a losing strategy. Instead, they need a structured, proactive system—a modern operational risk management (ORM) framework. Think of it as the architectural blueprint for a fortress, designed not just to repel attacks but to anticipate where they'll come from next.

The foundation for many of these frameworks comes from the Basel Accords, the international standards that dictate how banks should manage capital and risk. But while Basel provides the high-level strategy, the day-to-day defense is built around a powerful concept known as the "Three Lines of Defense."

This model is critical because it clarifies who is responsible for what, ensuring there are no gaps in the bank’s armor. It creates the system of checks and balances that is absolutely fundamental to robust operational risk management in banking.

The Three Lines of Defense Explained

Let's stick with the fortress analogy. The Three Lines of Defense model works much like a castle preparing for a siege, protecting the institution from operational threats.

First Line of Defense (The Soldiers on the Wall): These are the business units and frontline staff who own and manage risk directly. They're the loan officers, traders, and customer service agents facing potential issues every single day. Their job is to follow procedures, apply controls, and flag problems on the spot.

Second Line of Defense (The Watchtower Guards): This line is made up of the dedicated risk management and compliance functions. They aren’t in the daily trenches but provide crucial oversight, expertise, and tools to the first line. They’re the ones setting policies, monitoring risk levels, and making sure the soldiers have the right training and equipment.

Third Line of Defense (The Independent Inspectors): This is the internal audit function. Operating completely independently from the other two lines, they give the board and senior management objective assurance that the whole system is working as intended. Think of them as the inspectors who check the walls for weaknesses and the guards for readiness.

This layered approach ensures risk management is woven into the fabric of the organization, from the C-suite all the way to customer-facing operations.

Core Tools in the ORM Toolkit

Building this defensive structure isn't possible without a specialized set of tools. These are the instruments that help banks identify, measure, and control their operational risks before they blow up.

Risk and Control Self-Assessments (RCSA): This is a routine process where business units assess their own operational risks and check how well their controls are actually working. To get a feel for how these are structured, this risk assessment form template shows how risks and controls get documented.

Scenario Analysis: Banks use this to game out the potential impact of severe but plausible events—think a major cyberattack or a sudden, dramatic regulatory change. It’s all about stress-testing their defenses against worst-case situations.

Key Risk Indicators (KRIs): These are the metrics that act as an early warning system. For example, a sudden spike in customer complaints could be a KRI signaling a process failure or a system bug that needs immediate attention.

The diagram below breaks down the four primary sources where these operational risks typically originate.

As you can see, failures can stem from people, processes, systems, or external events. A solid ORM framework has to account for all of them.

Adapting Frameworks for New Technologies

As the financial world evolves, so do its risks. The rise of automation, for instance, creates entirely new challenges that traditional frameworks weren’t built for. When a bank or insurer deploys a new AI system for something like claims processing, the ORM framework has to evolve right alongside it to provide proper oversight.

A common operational risk we see is when an automated system misinterprets policy documents, leading to a wave of incorrect payments. A modern framework would use KRIs to track the AI's decision accuracy and set clear thresholds for when a human needs to step in, stopping small errors from becoming massive financial problems.

Keeping up is non-negotiable. For example, looking into how leading banks are engaging with stablecoins and digital assets reveals a whole new frontier of risk. These assets introduce unique operational challenges around things like cryptographic key management and blockchain vulnerabilities, demanding that ORM frameworks adapt quickly to cover these new system and process weaknesses.

Navigating the Regulatory and Compliance Maze

Managing operational risk in banking isn’t just about making internal processes smoother; it's a direct answer to an ever-present and demanding regulatory environment. Regulators have sharpened their focus on compliance and fraud, turning what used to be routine checks into high-stakes arenas where one wrong move can have devastating results. The reason for this intense scrutiny is simple: failures here don’t just endanger a single bank, they threaten the stability of the entire financial system.

This pressure isn't just talk. It’s backed by serious financial penalties. Violations related to Anti-Money Laundering (AML) and the Bank Secrecy Act (BSA) consistently make headlines with their staggering fines, hammering home the message that non-compliance is simply not an option.

The Staggering Price of Getting it Wrong

The financial toll of operational missteps is eye-watering. In a recent year, global banks were hit with $4.5 billion in fines, and institutions in the United States were responsible for a whopping 90% of that total.

Most of these penalties stemmed directly from failures in AML procedures, BSA violations, and breaches of consumer protection laws. These numbers paint a clear picture of the immense challenge banks are up against, with fraud remaining one of the industry's most persistent and damaging threats.

These fines aren't just a business expense. They're a clear signal from regulators that the old ways of managing compliance risk are broken. A reactive, "check-the-box" approach is a surefire path to trouble.

The Critical Shift from Reaction to Prevention

We're now seeing a crucial pivot across the industry. Forward-thinking banks are leaving behind a culture of reactive compliance and are instead building a proactive, deeply integrated risk strategy. This is about more than just dodging fines—it’s about creating a truly resilient organization that can see threats coming and neutralize them before they cause harm.

This change demands a fundamental rethink of how banks function. It means weaving risk awareness into the fabric of every decision, from the earliest stages of product development all the way to daily customer interactions. A proactive stance like this requires sophisticated tools that can monitor things in real time and detect issues early. The objective is to spot suspicious patterns, process breakdowns, or potential compliance gaps as they emerge, not discover them weeks or months down the road in an audit. This is where modern technology, especially AI-driven automation, becomes essential. Of course, it’s also vital that any new systems meet tough security standards. For a closer look at this, our guide on what SOC 2 compliance entails explains why it’s so important for technology partners.

Turning Compliance Tech into a Competitive Edge

When banks adopt a proactive approach to operational risk, they turn what feels like a regulatory burden into a genuine competitive advantage. By putting advanced technology to work, they can operate with a level of efficiency and precision that manual processes could never achieve.

Think about the impact in a few key areas:

Real-Time AML Monitoring: AI algorithms can sift through millions of transactions as they happen, flagging suspicious activity that would be completely invisible to a human team. This not only bolsters compliance but also shields the bank from being used for illicit purposes.

Automated Compliance Reporting: Pulling together regulatory reports is a tedious and error-prone job. Automation makes sure these reports are accurate, consistent, and on time, which frees up the compliance team to work on more strategic challenges.

Smarter Fraud Detection: Machine learning models can pick up on subtle, complex patterns of fraudulent behavior across different channels, stopping fraud in its tracks before it leads to major losses.

Ultimately, by integrating advanced technology into their operational risk frameworks, banks are doing more than just keeping regulators happy. They're building a more secure, efficient, and trustworthy institution—creating the kind of solid foundation needed for lasting growth in a financial world that only gets more complex.

How AI Is Reshaping Risk Management

For years, the standard playbook for operational risk management in banking has relied on manual checks, periodic reviews, and human oversight. While these methods were once sufficient, they’re now buckling under the pressure of modern finance's speed and complexity. The old ways just can't keep up.

This is where Artificial Intelligence steps in—not as a minor tweak, but as a complete overhaul of how banks and insurers manage operational risk. AI-native platforms are quickly becoming the new standard for overseeing high-stakes financial operations.

These aren't just simple bots. We're talking about intelligent agents that can understand context, execute complex, multi-step processes, and make decisions based on your company's standard operating procedures (SOPs). This capability is forging a new benchmark for operational resilience and efficiency.

AI allows for continuous, real-time monitoring of millions of data points, flagging potential issues long before they become critical incidents. It's a proactive stance that enables a level of oversight that was simply impossible before.

"Leading financial institutions are now aiming to achieve more than 50% automation of governance, risk, and compliance (GRC) processes within the next five years, fundamentally redesigning their control and assurance models to keep pace with accelerating business environments.”

This shift underscores a critical reality: traditional risk management is no longer enough. The table below illustrates just how significant this change is.

Traditional vs AI-Powered Operational Risk Management

This comparison shows how AI-driven automation is transforming core risk management functions in banking and insurance, moving from reactive, manual processes to proactive, data-driven oversight.

Function | Traditional Approach | AI-Powered Approach | Key Benefit |

|---|---|---|---|

Risk Identification | Manual workshops, periodic Risk and Control Self-Assessments (RCSAs). | Continuous scanning of internal/external data to identify emerging risk patterns. | Early detection of novel risks before they impact the business. |

Control Monitoring | Manual sample testing, periodic audits. | Real-time, continuous monitoring of all transactions and processes against control parameters. | 100% control testing, immediate exception alerts. |

Incident Reporting | Manual entry by employees, often delayed or inconsistent. | Automated incident detection from system logs, emails, and customer complaints. | Faster, more accurate, and complete incident data capture. |

Fraud Detection | Rule-based systems and manual review of flagged transactions. | Machine learning models that identify complex, anomalous patterns indicative of fraud. | Drastically reduced false positives and detection of sophisticated fraud schemes. |

Compliance Checks | Manual review of communications and transactions against regulatory checklists. | Natural Language Processing (NLP) to scan all communications for compliance breaches. | Comprehensive, real-time compliance assurance at scale. |

Ultimately, the AI-powered approach provides a far more dynamic and comprehensive view of operational risk, enabling financial institutions to be more resilient and agile.

Automating Insurance Claims with AI

Nowhere is the impact of AI more tangible than in insurance, a close cousin to banking in its risk and regulatory profile. For AI insurance companies, automating the claims process has been a game-changer. Manual claims processing is a minefield of potential failures—from simple data entry typos to inconsistent policy interpretations and missed fraud cues.

AI-powered systems tackle these vulnerabilities head-on. By ingesting and analyzing claims documents—photos, reports, invoices, and policy terms—AI agents can validate information, spot inconsistencies, and process straightforward claims in minutes, not days. This is where tools like AI-powered data extraction engines become invaluable, pulling structured data from messy, unstructured documents.

This level of automation delivers several huge risk-reduction wins:

Reduced Human Error: AI agents are sticklers for the rules. They process every claim with the exact same standards, eliminating the risk of different outcomes depending on which adjuster is on the case.

Enhanced Fraud Detection: AI can analyze thousands of data points within a single claim, comparing them to historical patterns to flag anomalies a human would likely miss. According to claims AI reviews, this has proven incredibly effective at catching sophisticated fraud schemes early.

Full Auditability: Every single action an AI agent takes is logged, creating a perfect, unchangeable audit trail. This is a massive benefit for regulatory reviews and internal quality control, proving that processes are being followed to the letter.

AI Customer Care and Conduct Risk

Another critical area is the use of AI customer care in financial services. Customer interactions are a major source of operational and conduct risk. One wrong statement from a service agent or a failure to provide a required disclosure can spiral into customer complaints, regulatory fines, and a damaged reputation.

Intelligent AI agents are now being used to handle customer inquiries with compliance baked right in. These agents can:

Provide Consistent, Approved Information: The AI only pulls from a verified knowledge base, so every customer gets accurate, regulator-approved information, every time.

Handle Routine Inquiries at Scale: This frees up human agents to focus on more complex and sensitive customer issues, which helps reduce staff burnout and error rates.

Log Every Interaction for Review: Just like in claims, every conversation is recorded and categorized. This creates a rich data source for monitoring service quality and spotting emerging customer problems.

These systems often integrate with core platforms like Salesforce or Genesys, creating a smooth workflow where an AI agent handles the initial query before escalating to a human with the full conversation context. By automating these frontline interactions, banks can dramatically lower the risk of non-compliant communication and ensure a consistent customer experience. This is a core part of building a stronger operational risk management program because it tackles a key failure point right at the customer interface.

To learn more about this, you can explore our guide on integrating AI in business operations.

Building Resilience with Stress Testing and Governance

How does a bank know it can actually weather a major financial or operational storm? The answer isn't found in a textbook; it's forged through rigorous stress testing and a rock-solid governance framework. These aren't just box-ticking exercises—they're the very foundation of survival when severe, yet plausible, market events hit.

In the tangled web of today's financial system, operational risk has become a far more complex beast to tame. Banks now have to grapple with lightning-fast market shifts and new weak spots, especially those tied to third-party vendors and outsourced services.

Ramping Up Stress Tests for Today's Realities

At the heart of this resilience strategy is modern liquidity stress testing (LST). We're seeing banks move past the standard, predictable scenarios and start modeling more extreme, painful conditions that mirror the economic anxieties we all feel. It's a proactive stance that helps spot potential shortfalls long before they become a full-blown crisis.

The numbers back this up. A recent survey showed that 61% of banks have dialed up the severity of their LST scenarios over the last two years. On top of that, 46% completely overhauled their contingency funding plans to brace for faster deposit runs, while 36% re-engineered their deposit strategies altogether. You can dig deeper into these risk management trends and statistics to see just how the industry is adapting.

This move toward more aggressive testing isn't a coincidence; it's a direct reaction to recent market volatility and a core tenet of effective operational risk management in banking.

Automating Resilience Where It Counts

While stress tests prepare a bank for outside shocks, what happens inside is just as important for keeping the lights on. This is where automation and AI are becoming indispensable, especially in high-volume, high-stakes areas like insurance claims and customer support.

For AI insurance companies, for instance, automating the claims process is a massive leap forward in building resilience. Let's face it, manual processes are magnets for human error, delays, and inconsistent decisions—all problems that get amplified during a crisis.

Imagine a major hurricane hits. Instead of being swamped, an AI-powered system can instantly scale to handle a flood of claims, validating them without the errors or bottlenecks of a manual process. That’s resilience in action.

This isn’t just about speed; it's about maintaining operational continuity and holding onto customer trust when they need you most.

AI Customer Care as a Pillar of Governance

In the same way, using AI customer care acts as a powerful governance tool for frontline interactions. A single misstep by a support agent can snowball into a compliance violation or a public relations nightmare. AI agents, however, operate strictly from approved scripts and company policies, ensuring every conversation is consistent and by the book.

This delivers some huge wins for operational resilience:

Standardized Responses: AI puts an end to the "he said, she said" problem. Every customer gets the same accurate, regulator-approved information.

24/7 Availability: When a disruption happens, AI can field a massive influx of customer questions, freeing up human agents to handle the truly complex and sensitive cases that require empathy.

A Perfect Audit Trail: Every interaction between AI and a customer is logged, creating an airtight record for compliance audits. Insights from claims AI reviews frequently prove how valuable this level of detail is for resolving disputes and making processes better.

By weaving AI into these core functions, financial institutions aren't just chasing efficiency gains. They are actively building a more robust, resilient operational model. It's this combination of forward-looking stress tests and AI-driven internal controls that creates a truly formidable defense against the shocks of an uncertain world.

Your Roadmap to an AI-Enhanced ORM Program

Bringing AI into your operational risk management isn't just a tech upgrade; it's a fundamental shift in how you operate. It demands a clear, phased roadmap to move from legacy manual processes to a smarter, automated future. The real goal here is to create a system where your human experts are amplified by AI agents, building a more resilient and efficient organization.

This journey begins with an honest look at your current operational risk landscape. You need to get granular and pinpoint the areas that are bogging your team down—the high-volume repetitive tasks, the processes ripe for human error, and the spots with the most significant compliance exposure. You'll often find the juiciest opportunities in places like insurance claims processing or customer service workflows, where consistency and accuracy are everything.

Phase 1: Identify High-Impact Automation Opportunities

Once you have a map of your current state, the next move is to zero in on specific use cases where AI can make an immediate and meaningful difference. We're talking about those rule-based, high-volume processes that eat up your team's time and create operational friction.

Look for areas like these:

Insurance Claims Processing: Imagine automating the initial intake, data validation, and even the simple judgments for straightforward claims. This can slash cycle times and error rates. The best AI insurance companies are already doing this, freeing up their experienced adjusters to handle the complex, high-dollar cases that truly need a human touch.

AI Customer Care: Using intelligent agents for routine customer questions ensures every interaction is compliant and handled the same way, every time. This is a direct line to mitigating conduct risk and simply delivering a better customer experience.

Compliance Monitoring: AI can work around the clock, scanning communications and transactions in real-time to flag potential policy violations. It gives you a continuous monitoring capability that manual spot-checks could never hope to achieve.

Phase 2: Select the Right Technology Partner

Choosing the right tech is a make-or-break decision. Not all AI platforms are built the same, especially when you're working in a tightly regulated industry like finance. Your ideal partner needs to offer a solution that was designed from the ground up for the unique pressures of financial services.

Auditability is a crucial piece of the puzzle. Every single action an AI agent takes must be logged and completely traceable. You need an unchangeable record for your regulators and internal audit teams. This is a non-negotiable feature that often comes up in claims AI reviews as what separates the serious, enterprise-grade platforms from the rest.

The platform you choose also has to play nicely with your existing core systems, whether that's Guidewire, Salesforce, or ServiceNow. This is critical for preventing new data silos and making sure the AI agents have the information they need to see a task through from start to finish. You can dive deeper into how this works in our guide on integrating AI in business operations.

Finally, don't forget the human element. A successful rollout depends on solid change management. You need to build a culture where your team sees AI as a powerful tool that helps them do their jobs better, not as a threat. In the end, success isn't about the tech itself—it's measured by real-world outcomes like lower error rates, faster processing, and a much stronger, more proactive compliance posture.

Frequently Asked Questions

Navigating the crossroads of technology and risk is a core challenge in modern banking. Let's tackle some of the most common questions about operational risk and how AI is changing the game in financial services.

What Are The Biggest Operational Risks For Banks Today?

The old classics like internal fraud and simple process mistakes are still on the board, but the biggest headaches today are almost always tied to technology and outside partners. Think massive cybersecurity breaches, crippling system outages, and the domino effect of a critical third-party vendor failing.

On top of that, the sheer complexity of regulations like AML and BSA creates enormous compliance risk. Getting this wrong isn't just a slap on the wrist; it's a major source of operational loss, with fines easily climbing into the billions.

How Can AI Improve Customer Service While Also Managing Risk?

This is a great question because it gets to the heart of what well-designed AI customer care can do. It’s all about consistency. AI agents work from a single, approved source of information, which means they can’t go off-script or misquote a policy detail. This simple fact is a powerful tool against conduct risk.

Every single interaction is also logged automatically, creating a flawless audit trail. This is a dream for compliance teams. It also takes the pressure off your human agents, letting them focus their energy on the complex, emotionally charged cases where they're needed most. This helps reduce the burnout that so often leads to costly human errors.

What’s The First Step To Automating Claims With AI?

Don't try to boil the ocean. The best first step is to pick a small, manageable slice of your claims process that is high-volume and highly repetitive.

Target a specific claim type: Think simple auto glass replacements or minor property damage claims. These are usually governed by very clear, black-and-white rules.

Document everything: Map out the Standard Operating Procedures (SOPs) for that process in painstaking detail. This document becomes the instruction manual for training your AI.

Most of the successful AI insurance companies started this way—with a focused pilot project. It lets you prove the concept, measure exactly how many errors you're eliminating, and build an airtight business case for expanding the program. According to various claims AI reviews, this phased approach is hands-down the smartest way to guarantee a smooth rollout and show real risk reduction from day one.

At Nolana, we've built a compliant, AI-native operating system that automates these kinds of high-stakes operations in banking and insurance. Our AI agents are designed to execute complex tasks right inside your existing workflows, giving you a huge boost in both efficiency and control. Discover how Nolana can transform your operational risk management.

Operational risk management in banking is the discipline of finding, evaluating, and neutralizing risks that come from shaky internal processes, human error, system failures, or outside events. This isn't just about stopping fraud or fixing system glitches; it's a vital strategic function that safeguards a bank’s capital, protects its reputation, and maintains customer trust. It’s the framework that keeps the entire organization running, from the simplest daily transaction to the most complex digital project.

The Foundations of Operational risk management in banking

Think of a bank as an intricate machine with countless interconnected parts. Operational risk management is the master maintenance schedule that keeps every single one of those parts from failing. Just one broken gear (a bad process), one lapse in concentration from an operator (human error), or a sudden power outage (an external shock) could grind the entire machine to a halt. The whole point is to see these potential failures coming and build a tough, resilient system that can absorb the unexpected.

This isn't merely an internal suggestion; it's a core requirement for keeping the financial sector stable. The scope of operational risk is huge, covering everything from a minor data entry typo to a full-blown cyberattack. To get a better handle on the core concepts, you can learn more about how risk management in operations applies more broadly, which provides a great foundation for its specific role in banking.

The Four Pillars of Operational Risk

A solid operational risk management in banking framework is built on four distinct sources of risk. Each of these pillars represents a critical area where things can go wrong, often creating a domino effect that spreads throughout the bank.

People: Risks that start with human behavior. This can be deliberate, like internal fraud, or completely accidental, like a mistake made during a transaction. It also covers things like insufficient training or a weak ethical culture.

Processes: Weaknesses baked into the bank's established procedures and controls. You might see this in a poorly thought-out workflow for approving loans, a gap in a compliance checklist, or a clumsy process for bringing new customers on board.

Systems: Breakdowns related to technology and the bank’s core infrastructure. This bucket includes everything from server crashes and software bugs to serious cybersecurity breaches and problems with data accuracy.

External Events: Things that happen outside the bank's direct control. We're talking about natural disasters, global pandemics, major new regulations, or economic shifts that directly impact the bank's ability to do business.

Why It Matters More Than Ever

Operational risk has moved from the back office to the front lines, largely because of relentless digital transformation. As AI insurance companies start to automate their claims processing and banks roll out AI customer care chatbots, a whole new set of operational challenges appears. While these technologies are great for efficiency, they bring fresh risks tied to algorithm accuracy, data privacy, and how well they connect with existing systems.

A key part of modern operational risk is navigating these new technological frontiers. According to claims AI reviews, the most successful projects are the ones with strong risk oversight, preventing automated systems from introducing major errors that could damage both the bank and its customers.

In the end, a robust operational risk framework is more than just a defensive measure—it's what allows a bank to move forward. It gives leaders the confidence to innovate, adopt new tools responsibly, and prove to regulators, investors, and customers that the institution is built to withstand whatever comes next.

Understanding Modern ORM Frameworks

To get a real handle on operational risk, banks can't just be reactive. Waiting for something to break is a losing strategy. Instead, they need a structured, proactive system—a modern operational risk management (ORM) framework. Think of it as the architectural blueprint for a fortress, designed not just to repel attacks but to anticipate where they'll come from next.

The foundation for many of these frameworks comes from the Basel Accords, the international standards that dictate how banks should manage capital and risk. But while Basel provides the high-level strategy, the day-to-day defense is built around a powerful concept known as the "Three Lines of Defense."

This model is critical because it clarifies who is responsible for what, ensuring there are no gaps in the bank’s armor. It creates the system of checks and balances that is absolutely fundamental to robust operational risk management in banking.

The Three Lines of Defense Explained

Let's stick with the fortress analogy. The Three Lines of Defense model works much like a castle preparing for a siege, protecting the institution from operational threats.

First Line of Defense (The Soldiers on the Wall): These are the business units and frontline staff who own and manage risk directly. They're the loan officers, traders, and customer service agents facing potential issues every single day. Their job is to follow procedures, apply controls, and flag problems on the spot.

Second Line of Defense (The Watchtower Guards): This line is made up of the dedicated risk management and compliance functions. They aren’t in the daily trenches but provide crucial oversight, expertise, and tools to the first line. They’re the ones setting policies, monitoring risk levels, and making sure the soldiers have the right training and equipment.

Third Line of Defense (The Independent Inspectors): This is the internal audit function. Operating completely independently from the other two lines, they give the board and senior management objective assurance that the whole system is working as intended. Think of them as the inspectors who check the walls for weaknesses and the guards for readiness.

This layered approach ensures risk management is woven into the fabric of the organization, from the C-suite all the way to customer-facing operations.

Core Tools in the ORM Toolkit

Building this defensive structure isn't possible without a specialized set of tools. These are the instruments that help banks identify, measure, and control their operational risks before they blow up.

Risk and Control Self-Assessments (RCSA): This is a routine process where business units assess their own operational risks and check how well their controls are actually working. To get a feel for how these are structured, this risk assessment form template shows how risks and controls get documented.

Scenario Analysis: Banks use this to game out the potential impact of severe but plausible events—think a major cyberattack or a sudden, dramatic regulatory change. It’s all about stress-testing their defenses against worst-case situations.

Key Risk Indicators (KRIs): These are the metrics that act as an early warning system. For example, a sudden spike in customer complaints could be a KRI signaling a process failure or a system bug that needs immediate attention.

The diagram below breaks down the four primary sources where these operational risks typically originate.

As you can see, failures can stem from people, processes, systems, or external events. A solid ORM framework has to account for all of them.

Adapting Frameworks for New Technologies

As the financial world evolves, so do its risks. The rise of automation, for instance, creates entirely new challenges that traditional frameworks weren’t built for. When a bank or insurer deploys a new AI system for something like claims processing, the ORM framework has to evolve right alongside it to provide proper oversight.

A common operational risk we see is when an automated system misinterprets policy documents, leading to a wave of incorrect payments. A modern framework would use KRIs to track the AI's decision accuracy and set clear thresholds for when a human needs to step in, stopping small errors from becoming massive financial problems.

Keeping up is non-negotiable. For example, looking into how leading banks are engaging with stablecoins and digital assets reveals a whole new frontier of risk. These assets introduce unique operational challenges around things like cryptographic key management and blockchain vulnerabilities, demanding that ORM frameworks adapt quickly to cover these new system and process weaknesses.

Navigating the Regulatory and Compliance Maze

Managing operational risk in banking isn’t just about making internal processes smoother; it's a direct answer to an ever-present and demanding regulatory environment. Regulators have sharpened their focus on compliance and fraud, turning what used to be routine checks into high-stakes arenas where one wrong move can have devastating results. The reason for this intense scrutiny is simple: failures here don’t just endanger a single bank, they threaten the stability of the entire financial system.

This pressure isn't just talk. It’s backed by serious financial penalties. Violations related to Anti-Money Laundering (AML) and the Bank Secrecy Act (BSA) consistently make headlines with their staggering fines, hammering home the message that non-compliance is simply not an option.

The Staggering Price of Getting it Wrong

The financial toll of operational missteps is eye-watering. In a recent year, global banks were hit with $4.5 billion in fines, and institutions in the United States were responsible for a whopping 90% of that total.

Most of these penalties stemmed directly from failures in AML procedures, BSA violations, and breaches of consumer protection laws. These numbers paint a clear picture of the immense challenge banks are up against, with fraud remaining one of the industry's most persistent and damaging threats.

These fines aren't just a business expense. They're a clear signal from regulators that the old ways of managing compliance risk are broken. A reactive, "check-the-box" approach is a surefire path to trouble.

The Critical Shift from Reaction to Prevention

We're now seeing a crucial pivot across the industry. Forward-thinking banks are leaving behind a culture of reactive compliance and are instead building a proactive, deeply integrated risk strategy. This is about more than just dodging fines—it’s about creating a truly resilient organization that can see threats coming and neutralize them before they cause harm.

This change demands a fundamental rethink of how banks function. It means weaving risk awareness into the fabric of every decision, from the earliest stages of product development all the way to daily customer interactions. A proactive stance like this requires sophisticated tools that can monitor things in real time and detect issues early. The objective is to spot suspicious patterns, process breakdowns, or potential compliance gaps as they emerge, not discover them weeks or months down the road in an audit. This is where modern technology, especially AI-driven automation, becomes essential. Of course, it’s also vital that any new systems meet tough security standards. For a closer look at this, our guide on what SOC 2 compliance entails explains why it’s so important for technology partners.

Turning Compliance Tech into a Competitive Edge

When banks adopt a proactive approach to operational risk, they turn what feels like a regulatory burden into a genuine competitive advantage. By putting advanced technology to work, they can operate with a level of efficiency and precision that manual processes could never achieve.

Think about the impact in a few key areas:

Real-Time AML Monitoring: AI algorithms can sift through millions of transactions as they happen, flagging suspicious activity that would be completely invisible to a human team. This not only bolsters compliance but also shields the bank from being used for illicit purposes.

Automated Compliance Reporting: Pulling together regulatory reports is a tedious and error-prone job. Automation makes sure these reports are accurate, consistent, and on time, which frees up the compliance team to work on more strategic challenges.

Smarter Fraud Detection: Machine learning models can pick up on subtle, complex patterns of fraudulent behavior across different channels, stopping fraud in its tracks before it leads to major losses.

Ultimately, by integrating advanced technology into their operational risk frameworks, banks are doing more than just keeping regulators happy. They're building a more secure, efficient, and trustworthy institution—creating the kind of solid foundation needed for lasting growth in a financial world that only gets more complex.

How AI Is Reshaping Risk Management

For years, the standard playbook for operational risk management in banking has relied on manual checks, periodic reviews, and human oversight. While these methods were once sufficient, they’re now buckling under the pressure of modern finance's speed and complexity. The old ways just can't keep up.

This is where Artificial Intelligence steps in—not as a minor tweak, but as a complete overhaul of how banks and insurers manage operational risk. AI-native platforms are quickly becoming the new standard for overseeing high-stakes financial operations.

These aren't just simple bots. We're talking about intelligent agents that can understand context, execute complex, multi-step processes, and make decisions based on your company's standard operating procedures (SOPs). This capability is forging a new benchmark for operational resilience and efficiency.

AI allows for continuous, real-time monitoring of millions of data points, flagging potential issues long before they become critical incidents. It's a proactive stance that enables a level of oversight that was simply impossible before.

"Leading financial institutions are now aiming to achieve more than 50% automation of governance, risk, and compliance (GRC) processes within the next five years, fundamentally redesigning their control and assurance models to keep pace with accelerating business environments.”

This shift underscores a critical reality: traditional risk management is no longer enough. The table below illustrates just how significant this change is.

Traditional vs AI-Powered Operational Risk Management

This comparison shows how AI-driven automation is transforming core risk management functions in banking and insurance, moving from reactive, manual processes to proactive, data-driven oversight.

Function | Traditional Approach | AI-Powered Approach | Key Benefit |

|---|---|---|---|

Risk Identification | Manual workshops, periodic Risk and Control Self-Assessments (RCSAs). | Continuous scanning of internal/external data to identify emerging risk patterns. | Early detection of novel risks before they impact the business. |

Control Monitoring | Manual sample testing, periodic audits. | Real-time, continuous monitoring of all transactions and processes against control parameters. | 100% control testing, immediate exception alerts. |

Incident Reporting | Manual entry by employees, often delayed or inconsistent. | Automated incident detection from system logs, emails, and customer complaints. | Faster, more accurate, and complete incident data capture. |

Fraud Detection | Rule-based systems and manual review of flagged transactions. | Machine learning models that identify complex, anomalous patterns indicative of fraud. | Drastically reduced false positives and detection of sophisticated fraud schemes. |

Compliance Checks | Manual review of communications and transactions against regulatory checklists. | Natural Language Processing (NLP) to scan all communications for compliance breaches. | Comprehensive, real-time compliance assurance at scale. |

Ultimately, the AI-powered approach provides a far more dynamic and comprehensive view of operational risk, enabling financial institutions to be more resilient and agile.

Automating Insurance Claims with AI

Nowhere is the impact of AI more tangible than in insurance, a close cousin to banking in its risk and regulatory profile. For AI insurance companies, automating the claims process has been a game-changer. Manual claims processing is a minefield of potential failures—from simple data entry typos to inconsistent policy interpretations and missed fraud cues.

AI-powered systems tackle these vulnerabilities head-on. By ingesting and analyzing claims documents—photos, reports, invoices, and policy terms—AI agents can validate information, spot inconsistencies, and process straightforward claims in minutes, not days. This is where tools like AI-powered data extraction engines become invaluable, pulling structured data from messy, unstructured documents.

This level of automation delivers several huge risk-reduction wins:

Reduced Human Error: AI agents are sticklers for the rules. They process every claim with the exact same standards, eliminating the risk of different outcomes depending on which adjuster is on the case.

Enhanced Fraud Detection: AI can analyze thousands of data points within a single claim, comparing them to historical patterns to flag anomalies a human would likely miss. According to claims AI reviews, this has proven incredibly effective at catching sophisticated fraud schemes early.

Full Auditability: Every single action an AI agent takes is logged, creating a perfect, unchangeable audit trail. This is a massive benefit for regulatory reviews and internal quality control, proving that processes are being followed to the letter.

AI Customer Care and Conduct Risk

Another critical area is the use of AI customer care in financial services. Customer interactions are a major source of operational and conduct risk. One wrong statement from a service agent or a failure to provide a required disclosure can spiral into customer complaints, regulatory fines, and a damaged reputation.

Intelligent AI agents are now being used to handle customer inquiries with compliance baked right in. These agents can:

Provide Consistent, Approved Information: The AI only pulls from a verified knowledge base, so every customer gets accurate, regulator-approved information, every time.

Handle Routine Inquiries at Scale: This frees up human agents to focus on more complex and sensitive customer issues, which helps reduce staff burnout and error rates.

Log Every Interaction for Review: Just like in claims, every conversation is recorded and categorized. This creates a rich data source for monitoring service quality and spotting emerging customer problems.

These systems often integrate with core platforms like Salesforce or Genesys, creating a smooth workflow where an AI agent handles the initial query before escalating to a human with the full conversation context. By automating these frontline interactions, banks can dramatically lower the risk of non-compliant communication and ensure a consistent customer experience. This is a core part of building a stronger operational risk management program because it tackles a key failure point right at the customer interface.

To learn more about this, you can explore our guide on integrating AI in business operations.

Building Resilience with Stress Testing and Governance

How does a bank know it can actually weather a major financial or operational storm? The answer isn't found in a textbook; it's forged through rigorous stress testing and a rock-solid governance framework. These aren't just box-ticking exercises—they're the very foundation of survival when severe, yet plausible, market events hit.

In the tangled web of today's financial system, operational risk has become a far more complex beast to tame. Banks now have to grapple with lightning-fast market shifts and new weak spots, especially those tied to third-party vendors and outsourced services.

Ramping Up Stress Tests for Today's Realities

At the heart of this resilience strategy is modern liquidity stress testing (LST). We're seeing banks move past the standard, predictable scenarios and start modeling more extreme, painful conditions that mirror the economic anxieties we all feel. It's a proactive stance that helps spot potential shortfalls long before they become a full-blown crisis.

The numbers back this up. A recent survey showed that 61% of banks have dialed up the severity of their LST scenarios over the last two years. On top of that, 46% completely overhauled their contingency funding plans to brace for faster deposit runs, while 36% re-engineered their deposit strategies altogether. You can dig deeper into these risk management trends and statistics to see just how the industry is adapting.

This move toward more aggressive testing isn't a coincidence; it's a direct reaction to recent market volatility and a core tenet of effective operational risk management in banking.

Automating Resilience Where It Counts

While stress tests prepare a bank for outside shocks, what happens inside is just as important for keeping the lights on. This is where automation and AI are becoming indispensable, especially in high-volume, high-stakes areas like insurance claims and customer support.

For AI insurance companies, for instance, automating the claims process is a massive leap forward in building resilience. Let's face it, manual processes are magnets for human error, delays, and inconsistent decisions—all problems that get amplified during a crisis.

Imagine a major hurricane hits. Instead of being swamped, an AI-powered system can instantly scale to handle a flood of claims, validating them without the errors or bottlenecks of a manual process. That’s resilience in action.

This isn’t just about speed; it's about maintaining operational continuity and holding onto customer trust when they need you most.

AI Customer Care as a Pillar of Governance

In the same way, using AI customer care acts as a powerful governance tool for frontline interactions. A single misstep by a support agent can snowball into a compliance violation or a public relations nightmare. AI agents, however, operate strictly from approved scripts and company policies, ensuring every conversation is consistent and by the book.

This delivers some huge wins for operational resilience:

Standardized Responses: AI puts an end to the "he said, she said" problem. Every customer gets the same accurate, regulator-approved information.

24/7 Availability: When a disruption happens, AI can field a massive influx of customer questions, freeing up human agents to handle the truly complex and sensitive cases that require empathy.

A Perfect Audit Trail: Every interaction between AI and a customer is logged, creating an airtight record for compliance audits. Insights from claims AI reviews frequently prove how valuable this level of detail is for resolving disputes and making processes better.

By weaving AI into these core functions, financial institutions aren't just chasing efficiency gains. They are actively building a more robust, resilient operational model. It's this combination of forward-looking stress tests and AI-driven internal controls that creates a truly formidable defense against the shocks of an uncertain world.

Your Roadmap to an AI-Enhanced ORM Program

Bringing AI into your operational risk management isn't just a tech upgrade; it's a fundamental shift in how you operate. It demands a clear, phased roadmap to move from legacy manual processes to a smarter, automated future. The real goal here is to create a system where your human experts are amplified by AI agents, building a more resilient and efficient organization.

This journey begins with an honest look at your current operational risk landscape. You need to get granular and pinpoint the areas that are bogging your team down—the high-volume repetitive tasks, the processes ripe for human error, and the spots with the most significant compliance exposure. You'll often find the juiciest opportunities in places like insurance claims processing or customer service workflows, where consistency and accuracy are everything.

Phase 1: Identify High-Impact Automation Opportunities

Once you have a map of your current state, the next move is to zero in on specific use cases where AI can make an immediate and meaningful difference. We're talking about those rule-based, high-volume processes that eat up your team's time and create operational friction.

Look for areas like these:

Insurance Claims Processing: Imagine automating the initial intake, data validation, and even the simple judgments for straightforward claims. This can slash cycle times and error rates. The best AI insurance companies are already doing this, freeing up their experienced adjusters to handle the complex, high-dollar cases that truly need a human touch.

AI Customer Care: Using intelligent agents for routine customer questions ensures every interaction is compliant and handled the same way, every time. This is a direct line to mitigating conduct risk and simply delivering a better customer experience.

Compliance Monitoring: AI can work around the clock, scanning communications and transactions in real-time to flag potential policy violations. It gives you a continuous monitoring capability that manual spot-checks could never hope to achieve.

Phase 2: Select the Right Technology Partner

Choosing the right tech is a make-or-break decision. Not all AI platforms are built the same, especially when you're working in a tightly regulated industry like finance. Your ideal partner needs to offer a solution that was designed from the ground up for the unique pressures of financial services.

Auditability is a crucial piece of the puzzle. Every single action an AI agent takes must be logged and completely traceable. You need an unchangeable record for your regulators and internal audit teams. This is a non-negotiable feature that often comes up in claims AI reviews as what separates the serious, enterprise-grade platforms from the rest.

The platform you choose also has to play nicely with your existing core systems, whether that's Guidewire, Salesforce, or ServiceNow. This is critical for preventing new data silos and making sure the AI agents have the information they need to see a task through from start to finish. You can dive deeper into how this works in our guide on integrating AI in business operations.

Finally, don't forget the human element. A successful rollout depends on solid change management. You need to build a culture where your team sees AI as a powerful tool that helps them do their jobs better, not as a threat. In the end, success isn't about the tech itself—it's measured by real-world outcomes like lower error rates, faster processing, and a much stronger, more proactive compliance posture.

Frequently Asked Questions

Navigating the crossroads of technology and risk is a core challenge in modern banking. Let's tackle some of the most common questions about operational risk and how AI is changing the game in financial services.

What Are The Biggest Operational Risks For Banks Today?

The old classics like internal fraud and simple process mistakes are still on the board, but the biggest headaches today are almost always tied to technology and outside partners. Think massive cybersecurity breaches, crippling system outages, and the domino effect of a critical third-party vendor failing.

On top of that, the sheer complexity of regulations like AML and BSA creates enormous compliance risk. Getting this wrong isn't just a slap on the wrist; it's a major source of operational loss, with fines easily climbing into the billions.

How Can AI Improve Customer Service While Also Managing Risk?

This is a great question because it gets to the heart of what well-designed AI customer care can do. It’s all about consistency. AI agents work from a single, approved source of information, which means they can’t go off-script or misquote a policy detail. This simple fact is a powerful tool against conduct risk.

Every single interaction is also logged automatically, creating a flawless audit trail. This is a dream for compliance teams. It also takes the pressure off your human agents, letting them focus their energy on the complex, emotionally charged cases where they're needed most. This helps reduce the burnout that so often leads to costly human errors.

What’s The First Step To Automating Claims With AI?

Don't try to boil the ocean. The best first step is to pick a small, manageable slice of your claims process that is high-volume and highly repetitive.

Target a specific claim type: Think simple auto glass replacements or minor property damage claims. These are usually governed by very clear, black-and-white rules.

Document everything: Map out the Standard Operating Procedures (SOPs) for that process in painstaking detail. This document becomes the instruction manual for training your AI.

Most of the successful AI insurance companies started this way—with a focused pilot project. It lets you prove the concept, measure exactly how many errors you're eliminating, and build an airtight business case for expanding the program. According to various claims AI reviews, this phased approach is hands-down the smartest way to guarantee a smooth rollout and show real risk reduction from day one.

At Nolana, we've built a compliant, AI-native operating system that automates these kinds of high-stakes operations in banking and insurance. Our AI agents are designed to execute complex tasks right inside your existing workflows, giving you a huge boost in both efficiency and control. Discover how Nolana can transform your operational risk management.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP