Supercharging Cloud Genesys with AI for Financial Services

Supercharging Cloud Genesys with AI for Financial Services

Discover how AI automation on Cloud Genesys transforms customer care for insurance and banking. Learn to automate claims and enhance financial services.

Financial institutions and insurance carriers are in a tough spot. Customer expectations are higher than ever, data is piling up, and old, clunky systems just can't keep up. The classic contact center model often leads to slow service, burned-out agents, and a constant battle with compliance. This is precisely where a platform like Cloud Genesys comes in, offering a modern foundation for communication that sets the stage for a massive leap in efficiency and customer happiness.

The New Standard for AI Customer Care in Finance

For banks and ai insurance companies, the real challenge isn't just fielding calls—it's about solving complex problems, and solving them fast. Think about the friction caused by slow claims processing, drawn-out fraud investigations, or mind-numbing data entry. That's the operational drag that costs real money, chipping away at both your bottom line and your customer's loyalty.

It's clear a smarter approach is needed. When you pair a system like Cloud Genesys with an AI-native automation platform like Nolana, you get something incredibly powerful. Genesys expertly handles the front-end customer interaction—the call, the chat, the email—while Nolana’s AI agents work behind the scenes, executing the complex tasks needed to actually resolve the customer's issue.

Automating High-Stakes Financial Workflows

This combination isn't about deploying another chatbot; it’s about true automation that fundamentally changes how financial services get work done. By connecting these two systems, organizations can tackle some of the industry's biggest headaches head-on.

Automated Claims Processing: An AI agent can manage the First Notice of Loss (FNOL) intake, collect the right documents, and run initial checks, dramatically cutting down the time it takes to process a claim.

Enhanced AI Customer Care: Imagine AI handling routine banking requests, like KYC verifications or fraud inquiries. This frees up your human agents to focus on the nuanced, relationship-driven conversations that truly matter.

Improved Compliance: Every step an AI agent takes is meticulously logged. This creates an airtight audit trail, perfect for claims ai reviews and satisfying regulators.

This isn't just about shaving seconds off call times. It’s about building a more resilient, responsive operation from the ground up. It lets financial institutions grow their services without having to proportionally grow their headcount, effectively turning the contact center from a cost center into a strategic asset.

The Power of Intelligent Data Analysis

To get the most out of these AI-driven solutions, you need to understand what’s happening in your customer interactions. Learning more about conversation intelligence can give you deep insights into your customer data, helping you fine-tune your automated processes and train your agents more effectively.

Ultimately, the aim is to create a fluid experience where technology handles the grunt work and humans focus on the relationship. This two-pronged approach is the key to modernizing financial operations. To dive deeper into the strategies shaping this space, check out our complete guide on AI customer care. By automating core workflows, you can set a completely new bar for service excellence.

Understanding Genesys Cloud for Banking and Insurance

So, what exactly is Genesys Cloud, and why is it so foundational for heavily regulated industries like banking and insurance? The best way to think of it is as the central nervous system for all your customer conversations. It’s so much more than a phone system; it’s the intelligent, organized platform that manages every single interaction, no matter where it comes from.

Imagine an air traffic controller for your customer experience. A customer might start a query on your website's chat, follow up with an email, and then finally call to speak with an agent. Without a unified system, that journey is choppy and frustrating for everyone involved. Genesys makes sure every touchpoint is part of one continuous conversation, giving agents the full history and context they need to solve problems effectively.

A Single Source of Truth for Customer Interactions

For financial institutions and AI insurance companies, this single, unified view isn't just a nice-to-have. It’s absolutely critical for accuracy, compliance, and sheer operational efficiency. By managing every communication channel—voice, email, chat, social—from one hub, Genesys creates an orderly environment where every piece of data can be tracked, analyzed, and acted upon.

This structure lays the perfect groundwork for sophisticated automation. It takes the chaotic, unpredictable flow of customer requests and organizes it into a clean, predictable stream that an AI-native platform like Nolana can understand and process. This transforms raw communication data into high-octane fuel for automating core financial workflows, from the first notice of a loss to a complex loan servicing request.

To really grasp its impact, let's look at how specific Genesys Cloud capabilities solve real-world problems in finance.

How Genesys Cloud Features Address Financial Industry Pains

The table below breaks down how core platform features directly map to the day-to-day headaches in insurance and banking operations.

Genesys Cloud Capability | Relevance for Insurance & Banking | Example Use Case |

|---|---|---|

Omnichannel Routing | Provides a consistent and seamless experience across all channels, which is crucial for building trust and ensuring regulatory compliance. | A customer starts a loan application via web chat, gets an automated follow-up email, and then calls to clarify a term, speaking to an agent who sees the entire interaction history instantly. |

Workforce Management | Optimizes agent scheduling and forecasting to handle fluctuating call volumes, especially during peak events like market volatility or claim surges after a natural disaster. | An insurance manager uses forecasting tools to schedule more agents ahead of a forecasted storm, ensuring they can handle the inevitable spike in claims AI reviews. |

Unified Analytics & Reporting | Delivers a complete audit trail and comprehensive view of the customer journey, which is essential for compliance, identifying process bottlenecks, and proving service-level agreements. | A compliance officer pulls a single report showing a customer's entire interaction history related to a dispute, providing a clear, auditable record for regulators. |

These capabilities work together to create an environment where both efficiency and great service can thrive.

Core Capabilities for Financial Services

While the platform is packed with features, a few are especially important for any serious AI customer care transformation effort.

Omnichannel Routing: This is what ensures customers get consistent service whether they connect by phone, email, chat, or social media. The system intelligently routes them to the right resource—be it a human expert or a specialized AI agent—based on their specific need and history with your company.

Workforce Management: These tools are a manager's best friend. They help forecast contact volumes, schedule agents to meet demand, and monitor performance in real time. This leads to smarter resource allocation and helps prevent agent burnout, which is a huge issue in high-stakes financial contact centers.

Unified Analytics and Reporting: Genesys gives you a bird's-eye view of the entire customer journey. This data is pure gold for spotting process bottlenecks, finding areas for improvement, and maintaining compliance, especially for workflows like claims AI reviews that demand a crystal-clear audit trail.

By mastering the flow of communication, Genesys Cloud sets the perfect stage for AI agents to perform. It handles the 'who' and 'what' of every conversation, freeing up AI to focus entirely on the 'how'—executing the actual work that needs to get done.

This organized approach is foundational. It also helps institutions adapt to critical regulatory frameworks like PSD2 banking integration, which continue to shape how financial services operate by demanding more complex and secure interactions.

Ultimately, Genesys Cloud isn’t just about managing calls and chats. It’s about building an operational backbone that is stable, scalable, and perfectly primed for the future of AI-driven automation in finance.

Automating Insurance Claims Processing on Genesys

For any insurance company, the claims process is the ultimate moment of truth. It's often the most emotionally charged, high-stakes interaction a customer will ever have with the brand, and it defines their perception for years to come. The problem is, this critical process is frequently bogged down by manual bottlenecks, redundant data entry, and slow handoffs, leading to frustrating delays and spiraling operational costs.

Think about the traditional lifecycle of a claim. It starts with a First Notice of Loss (FNOL), where a stressed customer has to recount a difficult incident. That call kicks off a long chain of manual tasks: an agent transcribes information, requests photos or police reports, validates policy details, and eventually hands the file off to an adjuster. Every single step is an opportunity for human error and delay, stretching a process that should take hours into days or even weeks.

This is exactly where the combination of Genesys Cloud and Nolana’s AI agents changes the game. Instead of a customer waiting on hold to speak with a person, an AI agent can instantly handle that initial contact right within Genesys. It can empathetically and accurately gather all the necessary information, check policy details against a core system like Guidewire in real time, and even request and receive documentation via text or email on the spot.

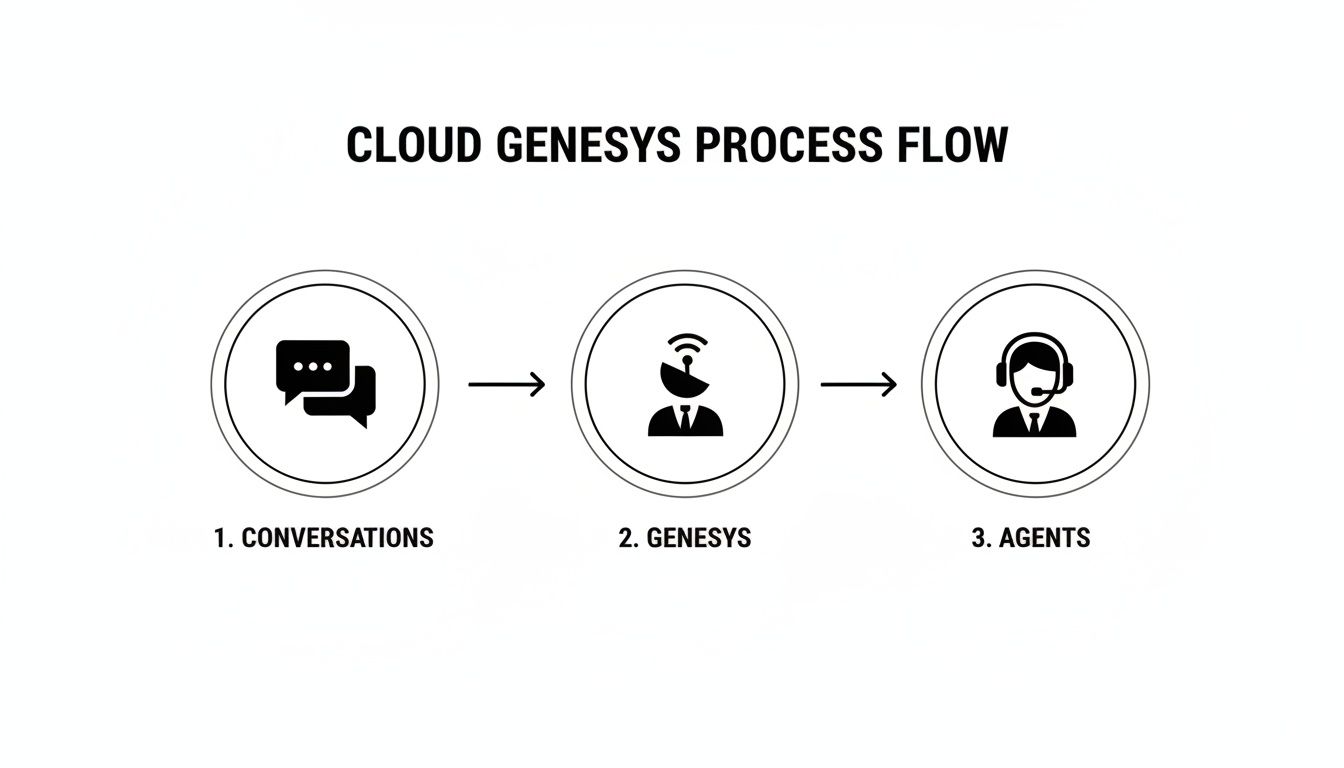

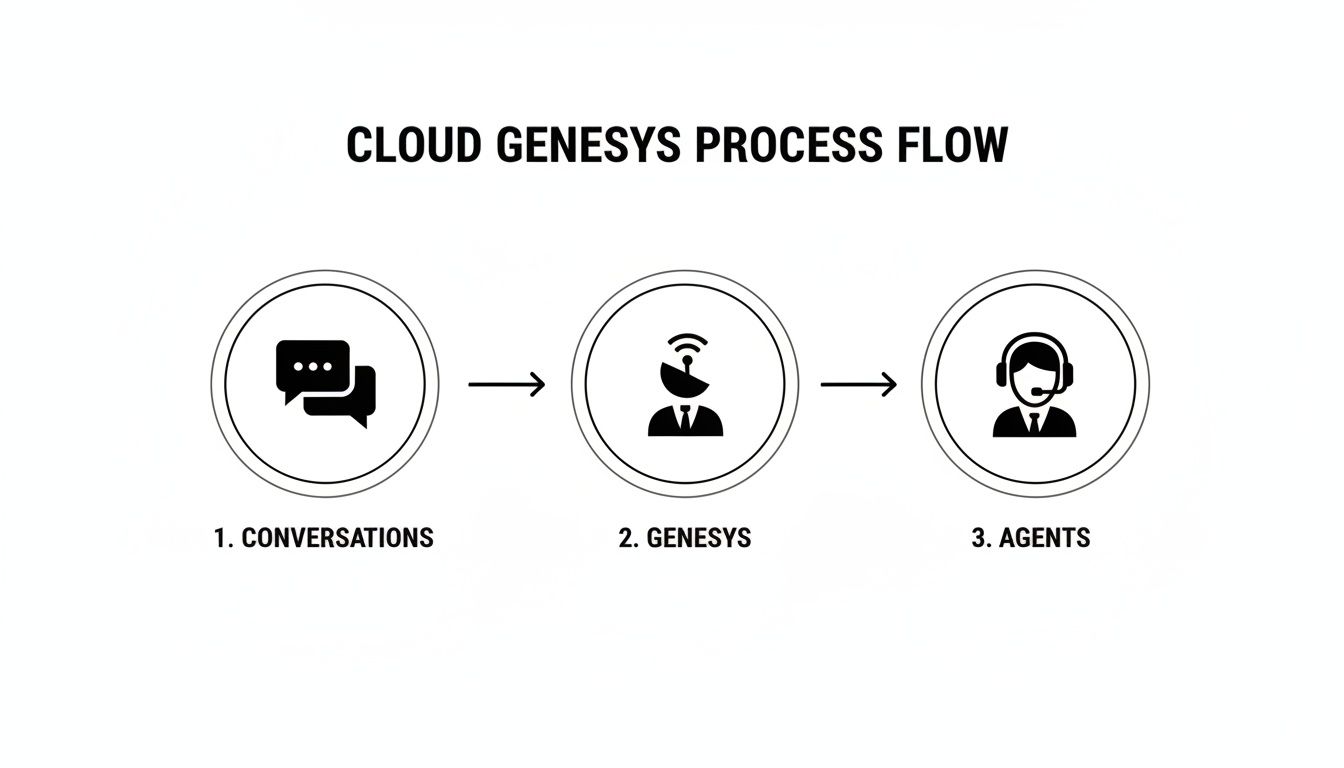

This diagram gives a high-level view of how Genesys acts as the central nervous system, directing customer conversations to the right agents—whether they're human or AI.

As you can see, the platform’s real power is its ability to intelligently route every interaction to the resource best equipped to handle it, ensuring things get resolved as efficiently as possible.

The Power of AI in Claims Adjudication

This kind of automation goes far beyond just collecting data. Once the initial information is gathered, Nolana's AI agent can perform the initial adjudication based on your company's specific business rules. For straightforward claims—think a cracked windshield on a vehicle with comprehensive coverage—the AI can approve the claim and trigger the payment process without any human intervention at all. This collapses the settlement time from weeks to mere minutes.

This isn't just about moving faster; it's about embedding accuracy and consistency into the process. By automating the rules-based parts of claims, you get rid of the variability of manual processing and create a fully auditable digital footprint for every decision.

The sheer volume of data in claims processing is staggering, echoing challenges in other data-heavy fields. The cloud genomics market, for instance, is exploding because of the need to securely manage petabytes of sensitive information. When the UK government invested £105 million to fast-track genetic disorder diagnoses, it underscored the critical need for scalable cloud platforms. Insurance leaders face the same challenge: managing massive data flows for risk assessment and claims. By integrating Genesys Cloud with Nolana, AI agents can process real-time data from core systems and KYC providers with the same level of security and efficiency.

Ensuring Comprehensive Claims AI Reviews

Of course, not every claim is simple. Complex or high-value cases will always require the nuanced judgment of an experienced human adjuster, and the integrated system is built for that reality. When a claim hits certain criteria—maybe a specific type of injury or a disputed liability—the AI agent instantly escalates the case.

But it doesn't just toss a raw file over the fence. The AI agent compiles a complete, organized case summary with all customer communications, validated data, and its initial findings. This entire package is delivered directly to a human adjuster right inside their Genesys workspace.

This seamless handoff delivers two huge advantages:

Accelerated Human Review: Adjusters get a pre-vetted, well-organized file, letting them focus their valuable expertise on critical decision-making instead of getting lost in administrative tasks.

Complete Audit Trail: Every action the AI takes is meticulously logged, creating a transparent record for internal claims AI reviews and regulatory scrutiny. This makes the whole process compliant and defensible.

This intelligent division of labor—where AI handles the procedural work and humans manage the exceptions and complex judgments—is the foundation of modern insurance claims processing automation. It transforms the claims department from a reactive cost center into a highly efficient, customer-centric operation. This new model doesn't just drive down costs; it delivers the fast, empathetic service that builds lasting loyalty.

Transforming Banking Customer Service with AI

The same principles that help automate insurance claims translate incredibly well to financial services. Banks wrestle with many of the same challenges: a flood of repetitive customer questions, mountains of regulations, and the ever-present need to combat fraud. A simple chatbot might be able to field a basic balance inquiry, but it falls flat when a customer needs real help with a complex, multi-step problem.

This is exactly where combining Genesys Cloud with Nolana changes the game for AI customer care. It’s not about just having a slightly smarter conversation; it’s about deploying a digital workforce of AI agents that can actually do things. These agents operate securely within the Genesys framework, figuring out what a customer needs, connecting to core banking systems, and seeing sophisticated tasks through from start to finish.

Automating High-Value Banking Operations

Instead of just trying to keep customers out of the human agent queue, this integrated approach focuses on automating the actual work behind the request. Your highly skilled human experts are then freed up to handle the truly sensitive escalations and focus on building genuine customer relationships—a critical goal for any modern bank.

Just look at a few of the high-impact areas in banking:

Fraud Investigations: An AI agent can take a customer's fraud report over the phone, immediately freeze the compromised account, pull transaction data from the core banking platform, and log a formal investigation ticket in a system like ServiceNow. This all happens in one seamless, automated flow.

Loan Application Processing: The AI can kick off the loan application process by verifying a customer's identity, running an initial check with credit bureaus, and making sure all the necessary documents are in place before a human loan officer even lays eyes on the file.

Complex KYC Verifications: For Know Your Customer (KYC) compliance, AI agents can manage routine identity checks, compare information across different databases, and automatically flag any issues for a human to review. This keeps onboarding smooth and compliant without creating bottlenecks.

At its core, this is about shifting the contact center's focus from merely managing conversations to resolving issues autonomously. The AI agent becomes a first-line problem-solver, capable of executing tasks that once required significant manual effort and multiple system logins.

The real power of these AI agents for customer service lies in their ability to securely plug into all the different backend systems. An agent can hear a customer’s request in Genesys, securely pop open their Salesforce profile to confirm key details, and then push an update to the core banking system to finalize the action.

Security and Compliance in an Automated World

In the world of finance, you can't trade security or compliance for the sake of automation. Any new technology has to make an institution’s risk posture stronger, not weaker. The Nolana platform was built from the ground up with this in mind, incorporating ironclad guardrails to ensure every single automated action is secure and completely auditable.

This is where the architecture of the combined solution really proves its worth. Every action an AI agent takes is dictated by pre-set business rules and recorded in a detailed, unchangeable audit trail. This gives you a perfect record for internal reviews and regulatory check-ins, often resulting in a process that’s more compliant than manual work, which can be prone to human error. With secure API connections and built-in controls, AI agents can only access the specific data and systems they've been authorized to use, keeping sensitive customer information locked down.

The challenge of securely managing vast amounts of sensitive data at scale is not unique to finance. In fact, a similar trend is visible in highly regulated fields like healthcare. In 2024, cloud-based SaaS platforms captured around 48% of the genomics data analysis market, where advanced encryption and HIPAA compliance are non-negotiable. You can learn more about how flexible cloud infrastructures are helping manage sensitive data by reading the latest research on genomics data analysis on towardshealthcare.com. Just as these platforms ensure seamless human-AI handoffs with full visibility, the Genesys Cloud and Nolana integration provides a secure, scalable framework for financial services to manage peak query loads without compromising control. This approach ensures that automation enhances regulatory adherence rather than introducing new risks.

How the Genesys and Nolana Integration Works

The real power of combining Genesys Cloud with Nolana isn't about a massive, complicated overhaul. It’s actually quite the opposite. The two platforms connect through a clean, elegant, and API-driven workflow, designed for immediate impact without disrupting what’s already working.

Think of Genesys Cloud as the front door for every customer interaction. When a customer calls about an insurance claim or sends a chat message about a banking transaction, Genesys is that first point of contact. It expertly manages the communication channel, figures out who the customer is, and gets a handle on what they need.

Once that initial groundwork is laid, the magic happens. Genesys hands off the specific task to a Nolana AI agent. These agents are your "digital workforce," ready and waiting to execute complex jobs. The handoff is just a simple, secure API call packed with all the context from the initial conversation.

Executing Tasks with an API-Driven Workflow

As soon as a Nolana AI agent gets the task, it gets right to work. This is where you see the automation of AI customer care in action. The agent is built to securely connect to your existing backend systems to gather information and take the next step.

Let's walk through an insurance claims example:

Receive Task: The AI agent gets the First Notice of Loss (FNOL) details from Genesys.

Connect to Core Systems: It uses APIs to tap into your core claims system (like Duck Creek or Guidewire) to pull and verify policy information.

Process Information: The agent then runs that information against your predefined business rules to make an initial adjudication.

Execute Action: For a straightforward claim, it might trigger a payment automatically. If it's more complex, it packages up all the relevant information and escalates it to a human adjuster, right inside their Genesys dashboard.

The entire data flow is API-driven. This means the AI agents can talk to virtually any modern system—from core banking platforms and CRMs like Salesforce to IT service management tools like ServiceNow.

The Strategic Value of a Modern Architecture

This integrated model brings huge strategic benefits to AI insurance companies and financial institutions. By keeping the communication layer (Genesys) separate from the action layer (Nolana), you gain incredible flexibility. You can update business rules, spin up new automated workflows, or connect to new backend systems without ever touching your customer-facing contact center operations.

The core advantage is the ability to innovate at speed. You are not locked into a single, monolithic system. Instead, you have a scalable, modular architecture that allows you to add new automation capabilities as your business needs evolve.

This approach—processing huge amounts of data securely and efficiently—mirrors advancements in other data-heavy, regulated fields. For example, the AI in genomics market is expected to jump from USD 733.4 million in 2023 to over USD 35 billion by 2033, powered by similar AI-and-cloud combinations that analyze massive datasets. You can see the latest findings on the AI in genomics market for more on that trend.

The parallel for financial services is clear. Nolana's agentic OS uses the same architectural principles. It integrates with Genesys Cloud to automate complex decisions with extremely high accuracy while always providing a clear, real-time escalation path to a human expert. As your operations grow, your automation capabilities can scale right alongside them, ensuring consistent, high-quality claims AI reviews and excellent customer service.

Measuring the ROI of AI-Powered Automation

Bringing a solution like Genesys Cloud and Nolana into your operation is a serious investment. So, the question every leader asks is simple: what’s the actual return? The success of this kind of AI-driven automation isn’t measured in fuzzy feelings—it's measured by tracking the key performance indicators (KPIs) that directly hit your bottom line and improve how you work.

This is all about getting to the hard numbers. By automating both the simple, repetitive tasks and the more complex workflows, financial institutions can finally move the needle on the metrics the C-suite really cares about. It’s how you prove the value of your investment in AI customer care.

Key Metrics for Financial Services

For AI insurance companies and banks, the right KPIs paint a clear picture of success. We're moving beyond basic call center stats to metrics that show real operational change.

Average Handle Time (AHT): Think about all the time agents spend just gathering information. When AI agents handle that initial data collection and processing, the time a human agent spends on each call drops dramatically.

First Contact Resolution (FCR): If an AI agent can fully resolve a customer’s request on the first try—like processing a straightforward claim—your FCR rates will climb. Better FCR almost always means happier customers.

Claims Settlement Cycle Times: This is a big one. Automating document validation and the first pass on adjudication for claims AI reviews can shrink settlement times from weeks down to a matter of hours.

Operational Overhead: Fewer manual tasks means less rework, lower error rates, and the freedom to grow your business without having to hire more people at the same rate.

The real goal here is to build a clear, data-driven story that shows exactly how automation leads to a leaner, more profitable operation. It shifts the discussion from tech features to tangible business results.

Data-Driven Examples of Success

The ROI really snaps into focus when you see the operational gains. For instance, a bank could deploy AI agents to manage the initial intake for fraud reports. Just by doing that, they could see a 50% acceleration in fraud investigation kickoff times. Not only does this tighten up security, but it also frees up your highly skilled fraud teams to concentrate on the truly complex cases.

In the same way, an insurance carrier might achieve a 40% decrease in manual data entry for new claims. That reduction directly cuts the cost per claim and slashes the risk of expensive human errors. The list of positive outcomes goes on, and you can dive deeper by exploring the top business process automation benefits in our guide.

At the end of the day, this technology gives financial institutions the tools to build a more resilient, efficient, and customer-centric operation.

Frequently Asked Questions

Whenever you're looking at a new, powerful solution, a lot of good questions come up. Let's walk through some of the most common ones we hear about integrating an AI automation platform with Genesys Cloud in the financial services and insurance worlds.

How Does This Solution Handle Financial Compliance and Data Security?

This is always the first and most important question, and for good reason. Security is baked into the very foundation of this architecture. You're starting with the robust, secure infrastructure of Genesys Cloud and adding Nolana's SOC 2 Type II compliant platform.

On top of that, every single action an AI agent takes is meticulously logged. This creates a detailed, unchangeable audit trail, which is exactly what you need for regulatory reviews and internal claims AI reviews. It’s all there in black and white.

We also encrypt all data, whether it's moving between systems or sitting at rest. The AI agents themselves operate within tightly controlled 'guardrails,' ensuring every step they take aligns perfectly with your company's established procedures and risk policies. In many ways, this is a huge leap forward from manual processes, which are always susceptible to human error.

Can This AI Integrate with Our Existing Core Systems?

Absolutely. The entire system is designed for seamless integration, not a painful overhaul. The platform connects to your existing tech stack using secure APIs.

This means it can talk to your key systems, whether they are industry-specific platforms for AI insurance companies like Guidewire or Duck Creek, or enterprise-wide tools like Salesforce and ServiceNow.

This API-first approach lets you inject automation and intelligence right into your current setup. You get to avoid a massive "rip-and-replace" project, which saves a ton of time and money, and you start getting more value out of the technology you already own.

What Makes This Different From a Standard Chatbot?

This is a critical distinction. A standard chatbot is essentially a Q&A machine running on a script. This solution provides AI agents that actually do things. It’s the difference between just giving out information and truly resolving a customer’s issue from start to finish.

Think of it this way: a chatbot might be able to tell a customer their claim status. An AI agent, however, can receive a new claim, instantly validate the customer's policy in your core system, pull in necessary third-party data, make an initial coverage decision based on your business rules, and even process the payment.

This is how you elevate AI customer care from a simple interaction to a genuine operational powerhouse.

Ready to see how AI agents can truly change your financial operations? Nolana deploys a compliant, AI-native workforce to automate your most critical workflows on Genesys Cloud. Learn more about Nolana's AI solutions.

Financial institutions and insurance carriers are in a tough spot. Customer expectations are higher than ever, data is piling up, and old, clunky systems just can't keep up. The classic contact center model often leads to slow service, burned-out agents, and a constant battle with compliance. This is precisely where a platform like Cloud Genesys comes in, offering a modern foundation for communication that sets the stage for a massive leap in efficiency and customer happiness.

The New Standard for AI Customer Care in Finance

For banks and ai insurance companies, the real challenge isn't just fielding calls—it's about solving complex problems, and solving them fast. Think about the friction caused by slow claims processing, drawn-out fraud investigations, or mind-numbing data entry. That's the operational drag that costs real money, chipping away at both your bottom line and your customer's loyalty.

It's clear a smarter approach is needed. When you pair a system like Cloud Genesys with an AI-native automation platform like Nolana, you get something incredibly powerful. Genesys expertly handles the front-end customer interaction—the call, the chat, the email—while Nolana’s AI agents work behind the scenes, executing the complex tasks needed to actually resolve the customer's issue.

Automating High-Stakes Financial Workflows

This combination isn't about deploying another chatbot; it’s about true automation that fundamentally changes how financial services get work done. By connecting these two systems, organizations can tackle some of the industry's biggest headaches head-on.

Automated Claims Processing: An AI agent can manage the First Notice of Loss (FNOL) intake, collect the right documents, and run initial checks, dramatically cutting down the time it takes to process a claim.

Enhanced AI Customer Care: Imagine AI handling routine banking requests, like KYC verifications or fraud inquiries. This frees up your human agents to focus on the nuanced, relationship-driven conversations that truly matter.

Improved Compliance: Every step an AI agent takes is meticulously logged. This creates an airtight audit trail, perfect for claims ai reviews and satisfying regulators.

This isn't just about shaving seconds off call times. It’s about building a more resilient, responsive operation from the ground up. It lets financial institutions grow their services without having to proportionally grow their headcount, effectively turning the contact center from a cost center into a strategic asset.

The Power of Intelligent Data Analysis

To get the most out of these AI-driven solutions, you need to understand what’s happening in your customer interactions. Learning more about conversation intelligence can give you deep insights into your customer data, helping you fine-tune your automated processes and train your agents more effectively.

Ultimately, the aim is to create a fluid experience where technology handles the grunt work and humans focus on the relationship. This two-pronged approach is the key to modernizing financial operations. To dive deeper into the strategies shaping this space, check out our complete guide on AI customer care. By automating core workflows, you can set a completely new bar for service excellence.

Understanding Genesys Cloud for Banking and Insurance

So, what exactly is Genesys Cloud, and why is it so foundational for heavily regulated industries like banking and insurance? The best way to think of it is as the central nervous system for all your customer conversations. It’s so much more than a phone system; it’s the intelligent, organized platform that manages every single interaction, no matter where it comes from.

Imagine an air traffic controller for your customer experience. A customer might start a query on your website's chat, follow up with an email, and then finally call to speak with an agent. Without a unified system, that journey is choppy and frustrating for everyone involved. Genesys makes sure every touchpoint is part of one continuous conversation, giving agents the full history and context they need to solve problems effectively.

A Single Source of Truth for Customer Interactions

For financial institutions and AI insurance companies, this single, unified view isn't just a nice-to-have. It’s absolutely critical for accuracy, compliance, and sheer operational efficiency. By managing every communication channel—voice, email, chat, social—from one hub, Genesys creates an orderly environment where every piece of data can be tracked, analyzed, and acted upon.

This structure lays the perfect groundwork for sophisticated automation. It takes the chaotic, unpredictable flow of customer requests and organizes it into a clean, predictable stream that an AI-native platform like Nolana can understand and process. This transforms raw communication data into high-octane fuel for automating core financial workflows, from the first notice of a loss to a complex loan servicing request.

To really grasp its impact, let's look at how specific Genesys Cloud capabilities solve real-world problems in finance.

How Genesys Cloud Features Address Financial Industry Pains

The table below breaks down how core platform features directly map to the day-to-day headaches in insurance and banking operations.

Genesys Cloud Capability | Relevance for Insurance & Banking | Example Use Case |

|---|---|---|

Omnichannel Routing | Provides a consistent and seamless experience across all channels, which is crucial for building trust and ensuring regulatory compliance. | A customer starts a loan application via web chat, gets an automated follow-up email, and then calls to clarify a term, speaking to an agent who sees the entire interaction history instantly. |

Workforce Management | Optimizes agent scheduling and forecasting to handle fluctuating call volumes, especially during peak events like market volatility or claim surges after a natural disaster. | An insurance manager uses forecasting tools to schedule more agents ahead of a forecasted storm, ensuring they can handle the inevitable spike in claims AI reviews. |

Unified Analytics & Reporting | Delivers a complete audit trail and comprehensive view of the customer journey, which is essential for compliance, identifying process bottlenecks, and proving service-level agreements. | A compliance officer pulls a single report showing a customer's entire interaction history related to a dispute, providing a clear, auditable record for regulators. |

These capabilities work together to create an environment where both efficiency and great service can thrive.

Core Capabilities for Financial Services

While the platform is packed with features, a few are especially important for any serious AI customer care transformation effort.

Omnichannel Routing: This is what ensures customers get consistent service whether they connect by phone, email, chat, or social media. The system intelligently routes them to the right resource—be it a human expert or a specialized AI agent—based on their specific need and history with your company.

Workforce Management: These tools are a manager's best friend. They help forecast contact volumes, schedule agents to meet demand, and monitor performance in real time. This leads to smarter resource allocation and helps prevent agent burnout, which is a huge issue in high-stakes financial contact centers.

Unified Analytics and Reporting: Genesys gives you a bird's-eye view of the entire customer journey. This data is pure gold for spotting process bottlenecks, finding areas for improvement, and maintaining compliance, especially for workflows like claims AI reviews that demand a crystal-clear audit trail.

By mastering the flow of communication, Genesys Cloud sets the perfect stage for AI agents to perform. It handles the 'who' and 'what' of every conversation, freeing up AI to focus entirely on the 'how'—executing the actual work that needs to get done.

This organized approach is foundational. It also helps institutions adapt to critical regulatory frameworks like PSD2 banking integration, which continue to shape how financial services operate by demanding more complex and secure interactions.

Ultimately, Genesys Cloud isn’t just about managing calls and chats. It’s about building an operational backbone that is stable, scalable, and perfectly primed for the future of AI-driven automation in finance.

Automating Insurance Claims Processing on Genesys

For any insurance company, the claims process is the ultimate moment of truth. It's often the most emotionally charged, high-stakes interaction a customer will ever have with the brand, and it defines their perception for years to come. The problem is, this critical process is frequently bogged down by manual bottlenecks, redundant data entry, and slow handoffs, leading to frustrating delays and spiraling operational costs.

Think about the traditional lifecycle of a claim. It starts with a First Notice of Loss (FNOL), where a stressed customer has to recount a difficult incident. That call kicks off a long chain of manual tasks: an agent transcribes information, requests photos or police reports, validates policy details, and eventually hands the file off to an adjuster. Every single step is an opportunity for human error and delay, stretching a process that should take hours into days or even weeks.

This is exactly where the combination of Genesys Cloud and Nolana’s AI agents changes the game. Instead of a customer waiting on hold to speak with a person, an AI agent can instantly handle that initial contact right within Genesys. It can empathetically and accurately gather all the necessary information, check policy details against a core system like Guidewire in real time, and even request and receive documentation via text or email on the spot.

This diagram gives a high-level view of how Genesys acts as the central nervous system, directing customer conversations to the right agents—whether they're human or AI.

As you can see, the platform’s real power is its ability to intelligently route every interaction to the resource best equipped to handle it, ensuring things get resolved as efficiently as possible.

The Power of AI in Claims Adjudication

This kind of automation goes far beyond just collecting data. Once the initial information is gathered, Nolana's AI agent can perform the initial adjudication based on your company's specific business rules. For straightforward claims—think a cracked windshield on a vehicle with comprehensive coverage—the AI can approve the claim and trigger the payment process without any human intervention at all. This collapses the settlement time from weeks to mere minutes.

This isn't just about moving faster; it's about embedding accuracy and consistency into the process. By automating the rules-based parts of claims, you get rid of the variability of manual processing and create a fully auditable digital footprint for every decision.

The sheer volume of data in claims processing is staggering, echoing challenges in other data-heavy fields. The cloud genomics market, for instance, is exploding because of the need to securely manage petabytes of sensitive information. When the UK government invested £105 million to fast-track genetic disorder diagnoses, it underscored the critical need for scalable cloud platforms. Insurance leaders face the same challenge: managing massive data flows for risk assessment and claims. By integrating Genesys Cloud with Nolana, AI agents can process real-time data from core systems and KYC providers with the same level of security and efficiency.

Ensuring Comprehensive Claims AI Reviews

Of course, not every claim is simple. Complex or high-value cases will always require the nuanced judgment of an experienced human adjuster, and the integrated system is built for that reality. When a claim hits certain criteria—maybe a specific type of injury or a disputed liability—the AI agent instantly escalates the case.

But it doesn't just toss a raw file over the fence. The AI agent compiles a complete, organized case summary with all customer communications, validated data, and its initial findings. This entire package is delivered directly to a human adjuster right inside their Genesys workspace.

This seamless handoff delivers two huge advantages:

Accelerated Human Review: Adjusters get a pre-vetted, well-organized file, letting them focus their valuable expertise on critical decision-making instead of getting lost in administrative tasks.

Complete Audit Trail: Every action the AI takes is meticulously logged, creating a transparent record for internal claims AI reviews and regulatory scrutiny. This makes the whole process compliant and defensible.

This intelligent division of labor—where AI handles the procedural work and humans manage the exceptions and complex judgments—is the foundation of modern insurance claims processing automation. It transforms the claims department from a reactive cost center into a highly efficient, customer-centric operation. This new model doesn't just drive down costs; it delivers the fast, empathetic service that builds lasting loyalty.

Transforming Banking Customer Service with AI

The same principles that help automate insurance claims translate incredibly well to financial services. Banks wrestle with many of the same challenges: a flood of repetitive customer questions, mountains of regulations, and the ever-present need to combat fraud. A simple chatbot might be able to field a basic balance inquiry, but it falls flat when a customer needs real help with a complex, multi-step problem.

This is exactly where combining Genesys Cloud with Nolana changes the game for AI customer care. It’s not about just having a slightly smarter conversation; it’s about deploying a digital workforce of AI agents that can actually do things. These agents operate securely within the Genesys framework, figuring out what a customer needs, connecting to core banking systems, and seeing sophisticated tasks through from start to finish.

Automating High-Value Banking Operations

Instead of just trying to keep customers out of the human agent queue, this integrated approach focuses on automating the actual work behind the request. Your highly skilled human experts are then freed up to handle the truly sensitive escalations and focus on building genuine customer relationships—a critical goal for any modern bank.

Just look at a few of the high-impact areas in banking:

Fraud Investigations: An AI agent can take a customer's fraud report over the phone, immediately freeze the compromised account, pull transaction data from the core banking platform, and log a formal investigation ticket in a system like ServiceNow. This all happens in one seamless, automated flow.

Loan Application Processing: The AI can kick off the loan application process by verifying a customer's identity, running an initial check with credit bureaus, and making sure all the necessary documents are in place before a human loan officer even lays eyes on the file.

Complex KYC Verifications: For Know Your Customer (KYC) compliance, AI agents can manage routine identity checks, compare information across different databases, and automatically flag any issues for a human to review. This keeps onboarding smooth and compliant without creating bottlenecks.

At its core, this is about shifting the contact center's focus from merely managing conversations to resolving issues autonomously. The AI agent becomes a first-line problem-solver, capable of executing tasks that once required significant manual effort and multiple system logins.

The real power of these AI agents for customer service lies in their ability to securely plug into all the different backend systems. An agent can hear a customer’s request in Genesys, securely pop open their Salesforce profile to confirm key details, and then push an update to the core banking system to finalize the action.

Security and Compliance in an Automated World

In the world of finance, you can't trade security or compliance for the sake of automation. Any new technology has to make an institution’s risk posture stronger, not weaker. The Nolana platform was built from the ground up with this in mind, incorporating ironclad guardrails to ensure every single automated action is secure and completely auditable.

This is where the architecture of the combined solution really proves its worth. Every action an AI agent takes is dictated by pre-set business rules and recorded in a detailed, unchangeable audit trail. This gives you a perfect record for internal reviews and regulatory check-ins, often resulting in a process that’s more compliant than manual work, which can be prone to human error. With secure API connections and built-in controls, AI agents can only access the specific data and systems they've been authorized to use, keeping sensitive customer information locked down.

The challenge of securely managing vast amounts of sensitive data at scale is not unique to finance. In fact, a similar trend is visible in highly regulated fields like healthcare. In 2024, cloud-based SaaS platforms captured around 48% of the genomics data analysis market, where advanced encryption and HIPAA compliance are non-negotiable. You can learn more about how flexible cloud infrastructures are helping manage sensitive data by reading the latest research on genomics data analysis on towardshealthcare.com. Just as these platforms ensure seamless human-AI handoffs with full visibility, the Genesys Cloud and Nolana integration provides a secure, scalable framework for financial services to manage peak query loads without compromising control. This approach ensures that automation enhances regulatory adherence rather than introducing new risks.

How the Genesys and Nolana Integration Works

The real power of combining Genesys Cloud with Nolana isn't about a massive, complicated overhaul. It’s actually quite the opposite. The two platforms connect through a clean, elegant, and API-driven workflow, designed for immediate impact without disrupting what’s already working.

Think of Genesys Cloud as the front door for every customer interaction. When a customer calls about an insurance claim or sends a chat message about a banking transaction, Genesys is that first point of contact. It expertly manages the communication channel, figures out who the customer is, and gets a handle on what they need.

Once that initial groundwork is laid, the magic happens. Genesys hands off the specific task to a Nolana AI agent. These agents are your "digital workforce," ready and waiting to execute complex jobs. The handoff is just a simple, secure API call packed with all the context from the initial conversation.

Executing Tasks with an API-Driven Workflow

As soon as a Nolana AI agent gets the task, it gets right to work. This is where you see the automation of AI customer care in action. The agent is built to securely connect to your existing backend systems to gather information and take the next step.

Let's walk through an insurance claims example:

Receive Task: The AI agent gets the First Notice of Loss (FNOL) details from Genesys.

Connect to Core Systems: It uses APIs to tap into your core claims system (like Duck Creek or Guidewire) to pull and verify policy information.

Process Information: The agent then runs that information against your predefined business rules to make an initial adjudication.

Execute Action: For a straightforward claim, it might trigger a payment automatically. If it's more complex, it packages up all the relevant information and escalates it to a human adjuster, right inside their Genesys dashboard.

The entire data flow is API-driven. This means the AI agents can talk to virtually any modern system—from core banking platforms and CRMs like Salesforce to IT service management tools like ServiceNow.

The Strategic Value of a Modern Architecture

This integrated model brings huge strategic benefits to AI insurance companies and financial institutions. By keeping the communication layer (Genesys) separate from the action layer (Nolana), you gain incredible flexibility. You can update business rules, spin up new automated workflows, or connect to new backend systems without ever touching your customer-facing contact center operations.

The core advantage is the ability to innovate at speed. You are not locked into a single, monolithic system. Instead, you have a scalable, modular architecture that allows you to add new automation capabilities as your business needs evolve.

This approach—processing huge amounts of data securely and efficiently—mirrors advancements in other data-heavy, regulated fields. For example, the AI in genomics market is expected to jump from USD 733.4 million in 2023 to over USD 35 billion by 2033, powered by similar AI-and-cloud combinations that analyze massive datasets. You can see the latest findings on the AI in genomics market for more on that trend.

The parallel for financial services is clear. Nolana's agentic OS uses the same architectural principles. It integrates with Genesys Cloud to automate complex decisions with extremely high accuracy while always providing a clear, real-time escalation path to a human expert. As your operations grow, your automation capabilities can scale right alongside them, ensuring consistent, high-quality claims AI reviews and excellent customer service.

Measuring the ROI of AI-Powered Automation

Bringing a solution like Genesys Cloud and Nolana into your operation is a serious investment. So, the question every leader asks is simple: what’s the actual return? The success of this kind of AI-driven automation isn’t measured in fuzzy feelings—it's measured by tracking the key performance indicators (KPIs) that directly hit your bottom line and improve how you work.

This is all about getting to the hard numbers. By automating both the simple, repetitive tasks and the more complex workflows, financial institutions can finally move the needle on the metrics the C-suite really cares about. It’s how you prove the value of your investment in AI customer care.

Key Metrics for Financial Services

For AI insurance companies and banks, the right KPIs paint a clear picture of success. We're moving beyond basic call center stats to metrics that show real operational change.

Average Handle Time (AHT): Think about all the time agents spend just gathering information. When AI agents handle that initial data collection and processing, the time a human agent spends on each call drops dramatically.

First Contact Resolution (FCR): If an AI agent can fully resolve a customer’s request on the first try—like processing a straightforward claim—your FCR rates will climb. Better FCR almost always means happier customers.

Claims Settlement Cycle Times: This is a big one. Automating document validation and the first pass on adjudication for claims AI reviews can shrink settlement times from weeks down to a matter of hours.

Operational Overhead: Fewer manual tasks means less rework, lower error rates, and the freedom to grow your business without having to hire more people at the same rate.

The real goal here is to build a clear, data-driven story that shows exactly how automation leads to a leaner, more profitable operation. It shifts the discussion from tech features to tangible business results.

Data-Driven Examples of Success

The ROI really snaps into focus when you see the operational gains. For instance, a bank could deploy AI agents to manage the initial intake for fraud reports. Just by doing that, they could see a 50% acceleration in fraud investigation kickoff times. Not only does this tighten up security, but it also frees up your highly skilled fraud teams to concentrate on the truly complex cases.

In the same way, an insurance carrier might achieve a 40% decrease in manual data entry for new claims. That reduction directly cuts the cost per claim and slashes the risk of expensive human errors. The list of positive outcomes goes on, and you can dive deeper by exploring the top business process automation benefits in our guide.

At the end of the day, this technology gives financial institutions the tools to build a more resilient, efficient, and customer-centric operation.

Frequently Asked Questions

Whenever you're looking at a new, powerful solution, a lot of good questions come up. Let's walk through some of the most common ones we hear about integrating an AI automation platform with Genesys Cloud in the financial services and insurance worlds.

How Does This Solution Handle Financial Compliance and Data Security?

This is always the first and most important question, and for good reason. Security is baked into the very foundation of this architecture. You're starting with the robust, secure infrastructure of Genesys Cloud and adding Nolana's SOC 2 Type II compliant platform.

On top of that, every single action an AI agent takes is meticulously logged. This creates a detailed, unchangeable audit trail, which is exactly what you need for regulatory reviews and internal claims AI reviews. It’s all there in black and white.

We also encrypt all data, whether it's moving between systems or sitting at rest. The AI agents themselves operate within tightly controlled 'guardrails,' ensuring every step they take aligns perfectly with your company's established procedures and risk policies. In many ways, this is a huge leap forward from manual processes, which are always susceptible to human error.

Can This AI Integrate with Our Existing Core Systems?

Absolutely. The entire system is designed for seamless integration, not a painful overhaul. The platform connects to your existing tech stack using secure APIs.

This means it can talk to your key systems, whether they are industry-specific platforms for AI insurance companies like Guidewire or Duck Creek, or enterprise-wide tools like Salesforce and ServiceNow.

This API-first approach lets you inject automation and intelligence right into your current setup. You get to avoid a massive "rip-and-replace" project, which saves a ton of time and money, and you start getting more value out of the technology you already own.

What Makes This Different From a Standard Chatbot?

This is a critical distinction. A standard chatbot is essentially a Q&A machine running on a script. This solution provides AI agents that actually do things. It’s the difference between just giving out information and truly resolving a customer’s issue from start to finish.

Think of it this way: a chatbot might be able to tell a customer their claim status. An AI agent, however, can receive a new claim, instantly validate the customer's policy in your core system, pull in necessary third-party data, make an initial coverage decision based on your business rules, and even process the payment.

This is how you elevate AI customer care from a simple interaction to a genuine operational powerhouse.

Ready to see how AI agents can truly change your financial operations? Nolana deploys a compliant, AI-native workforce to automate your most critical workflows on Genesys Cloud. Learn more about Nolana's AI solutions.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP