Ai Customer Service Automation: A Guide for Insurance & Financial Services

Ai Customer Service Automation: A Guide for Insurance & Financial Services

Explore ai customer service automation and how it boosts efficiency in finance and insurance. Practical steps to implement AI for better customer experiences.

If you're an operations leader in finance, you know the feeling: staring down a seemingly endless mountain of insurance claims and complex banking inquiries is just another Tuesday. This guide is built for you. We'll break down how AI customer service automation is no longer a futuristic concept but a practical, essential tool for the financial services world.

The New Reality of Financial Customer Service

The core challenge hasn't changed: how do you deliver exceptional customer care while operational demands keep piling up? The answer isn't a generic, off-the-shelf chatbot. It's about deploying a specialized digital workforce—AI agents trained to execute your specific Standard Operating Procedures (SOPs) with precision.

Think of it this way: you can assign all the high-volume, repetitive tasks to your new AI agents. This immediately frees up your human experts to focus on what they do best—building customer relationships and navigating tricky escalations that require a human touch.

This guide is your roadmap to deploying AI strategically, cutting operational costs, boosting efficiency, and raising the bar for customer experience in a heavily regulated industry.

AI Automation in Insurance and Banking

For ai insurance companies, this means completely overhauling the first steps of a claim. An AI agent can instantly capture incident details, verify policy information, and get the case to the right adjuster without any human intervention. Automating insurance claims with AI turns a process that once took days, or even weeks, into a matter of minutes.

In banking, AI customer care agents are perfect for managing transaction disputes, processing routine account updates, and performing initial identity checks. They deliver both the speed customers expect and the accuracy regulators demand.

The results speak for themselves. We've seen organizations achieve a staggering 30% reduction in operational costs after bringing in AI automation—a game-changing figure for carriers and banks. These savings aren't magic; they come from AI handling the routine work, which lets your teams focus on high-value financial operations. To get a broader view, you can explore more AI customer service statistics and trends.

At its core, AI customer service automation in finance isn't about replacing people. It’s about augmenting their capabilities, allowing skilled professionals to apply their expertise where it matters most—solving complex problems and delivering empathetic support.

Ultimately, this approach helps financial institutions finally get ahead of the constant pressure of high-volume inquiries. It paves the way for a more efficient, compliant, and customer-focused way of working, which is exactly what we'll unpack throughout this guide.

How AI Gets Real Work Done in Insurance and Banking

Let's move past the theory. The real value of AI customer service automation comes alive when you see it handling complex, regulated work in the real world. In insurance and banking, AI agents aren’t just fielding basic questions; they’re executing the core operational tasks that keep these industries running.

Think of these agents as a specialized digital workforce. They plug directly into your core systems and take over the procedural, repetitive work that ties up your human teams for thousands of hours. This frees your people to focus on strategic initiatives and building genuine customer relationships—the work that truly matters.

Overhauling the Insurance Claims Lifecycle

For ai insurance companies, the claims process is a classic bottleneck. It's often slow, bogged down by paperwork, and riddled with handoffs that frustrate customers and drive up costs. Automating insurance claims with AI is completely changing this dynamic, starting from the moment a customer files a claim.

The journey begins at the First Notice of Loss (FNOL). An AI agent can immediately capture and verify claim details from any channel—a phone call, a web form, or a mobile app. But it doesn't stop there. The agent takes instant action on tasks that used to require manual review:

Policy Verification: The agent pings your policy administration system to instantly confirm the customer’s coverage is active and relevant to the incident.

Initial Triage: It analyzes the claim details to gauge severity. A minor fender-bender gets fast-tracked for quick resolution, while a major property fire is immediately flagged for a senior adjuster.

Document Collection: The agent can request photos or police reports and even use computer vision to run a preliminary damage assessment, dramatically speeding up the evaluation.

By automating these front-end tasks, insurers are slashing claim cycle times from weeks down to a matter of days or even hours. This doesn’t just cut operational costs; it delivers the kind of fast, effortless experience that today’s policyholders demand.

Instead of an employee manually keying data into systems like Guidewire or Duck Creek, the AI agent does it instantly and without errors. This creates a clean, accurate, and fully auditable record from day one. To learn more about modernizing this critical function, check out our guide on insurance claims processing automation.

Elevating AI Customer Care in Financial Services

In the banking and financial services world, AI customer care is about much more than a simple chatbot. AI agents are becoming crucial for managing sensitive, high-stakes processes that are foundational to customer trust and regulatory compliance. They handle everything from transaction disputes to identity verification with incredible speed and accuracy.

One of the most impactful use cases is in Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. An AI agent can kick off the verification process, check customer data against global watchlists, and analyze ID documents for authenticity. This lets your compliance officers stop chasing paperwork and start investigating genuinely high-risk alerts.

Here are a few other common financial service scenarios where these agents make a huge difference:

Transaction Disputes: A customer reports a fraudulent charge. The AI agent can immediately gather the transaction data, place a temporary hold on the card, and initiate the dispute resolution process.

Account Updates: Routine requests like an address change or adding an authorized user are handled from start to finish, ensuring data is updated correctly across every connected system.

Information Requests: AI can securely give customers their account balance, pull up a transaction history, or provide a loan payoff amount—anytime, day or night, with no human intervention needed.

Crucially, every single action the AI agent takes is permanently logged. This creates a transparent, immutable audit trail that keeps regulators happy. It’s how modern financial services firms can manage a massive volume of customer interactions efficiently while staying firmly on the right side of compliance.

Unpacking the Real-World Business Value and ROI of AI

Let's be honest—any new technology investment comes down to the bottom line. When we talk about AI customer service automation, the business case isn’t just compelling; it’s built on three pillars that deliver a measurable Return on Investment (ROI): deep cost reductions, huge jumps in efficiency, and a customer experience that builds genuine loyalty.

By letting AI handle the routine, front-end interactions, you immediately drive down your cost per interaction. This isn't about replacing your people; it's about freeing them up. AI agents can manage the high-volume, repetitive tasks, allowing you to handle more customer needs without having to constantly hire more staff, especially during predictable peaks like storm season or open enrollment.

Radically Reducing Operational Costs

The most immediate financial win comes from taking procedural work off your team's shoulders. Every single claim intake, policy check, or account update handled by an AI agent is a task your human experts no longer have to touch. This creates real, tangible savings that you can redirect toward growth instead of just keeping the lights on. For a closer look at these operational wins, see our guide on the business process automation benefits.

This is exactly why AI adoption in customer service has exploded. Today, a staggering 85% of customer service leaders are already using conversational AI to reshape their contact centers. This isn't a fad; it's a direct response to the clear financial upside and what customers now demand. It's also why the global call center AI market is set to skyrocket from $1.95 billion in 2024 to over $10 billion by 2032, with financial services leading the charge. You can read more about the growth of AI in contact centers.

The true ROI of AI isn't just about doing the same work for less money. It's about fundamentally changing how work gets done, creating capacity for your team to focus on complex problem-solving and high-value customer engagement that drives long-term loyalty.

Achieving Massive Efficiency Gains

In financial services, efficiency is the engine of profitability. Manual workflows are notoriously slow, filled with potential for human error, and create frustrating bottlenecks for everyone involved. AI insurance companies, for instance, are seeing incredible results by automating the claims lifecycle. Processes that used to take weeks of chasing paperwork and endless phone calls can now be wrapped up in a matter of hours, sometimes even minutes.

This speed creates a powerful ripple effect. Faster claims mean faster payouts, which is a huge driver of policyholder satisfaction. In banking, getting through KYC and onboarding quickly means new customers can start using their accounts right away, boosting engagement from the very beginning. That kind of speed and precision cuts out the hidden costs of rework, compliance headaches, and long, drawn-out resolution times.

The difference AI makes becomes crystal clear when you compare workflows side-by-side.

Manual vs AI-Automated Financial Workflows

Metric | Traditional Manual Process | AI-Automated Process |

|---|---|---|

Claim First Notice of Loss (FNOL) | 20-30 minutes (agent intake) | 1-3 minutes (AI-powered form) |

KYC/Onboarding Time | 2-5 business days | Under 5 minutes |

Customer Wait Time (Peak Hours) | 15+ minutes | Instant response (0 minutes) |

Agent Time on Routine Queries | 60-70% of total time | <10% of total time |

Error Rate (Data Entry) | 3-5% | <0.1% |

Resolution Time (Simple Claims) | 7-14 days | 24-48 hours |

This table highlights just how significant the shift is. We're not talking about small, incremental improvements; AI completely redefines what's possible for speed and accuracy.

Elevating the Customer Experience

At the end of the day, the ultimate measure of success is how your customers feel. Top-notch AI customer care provides the instant, 24/7 support that people now expect as standard. An AI agent is always on, ready to answer a question, start a claim, or check an account balance, no matter the time of day or how many other people are calling in.

This immediate, always-on availability directly improves the metrics that matter most:

Higher Customer Satisfaction (CSAT) Scores: Customers solve their problems faster and with far less effort.

Improved Net Promoter Score (NPS): A frictionless experience is the fastest way to turn a neutral customer into a vocal advocate for your brand.

Increased First Contact Resolution (FCR): AI agents are designed to resolve common issues on the first try, which means fewer frustrated customers get escalated to your team.

When customers feel that their bank or insurer respects their time, it builds a foundation of trust and makes them far less likely to leave. Looking at various claims ai reviews, this elevated experience is consistently ranked as the most powerful and lasting benefit of getting automation right.

Your Roadmap for Compliant AI Implementation

Bringing AI customer service automation into a highly regulated industry isn't as simple as flipping a switch. It takes a deliberate, phased approach—a roadmap that builds confidence, locks in compliance, and starts delivering value from day one.

The smartest way to begin is by targeting high-impact, low-risk workflows. Think initial claims intake or standard account inquiries. Get those wins on the board before you even think about scaling up to more complex processes.

This playbook breaks the journey down into four essential stages. Follow it, and you'll build AI agents that not only perform their tasks flawlessly but also operate securely within the strict confines of financial services regulations. This structured method is your key to a strong, sustainable return on investment.

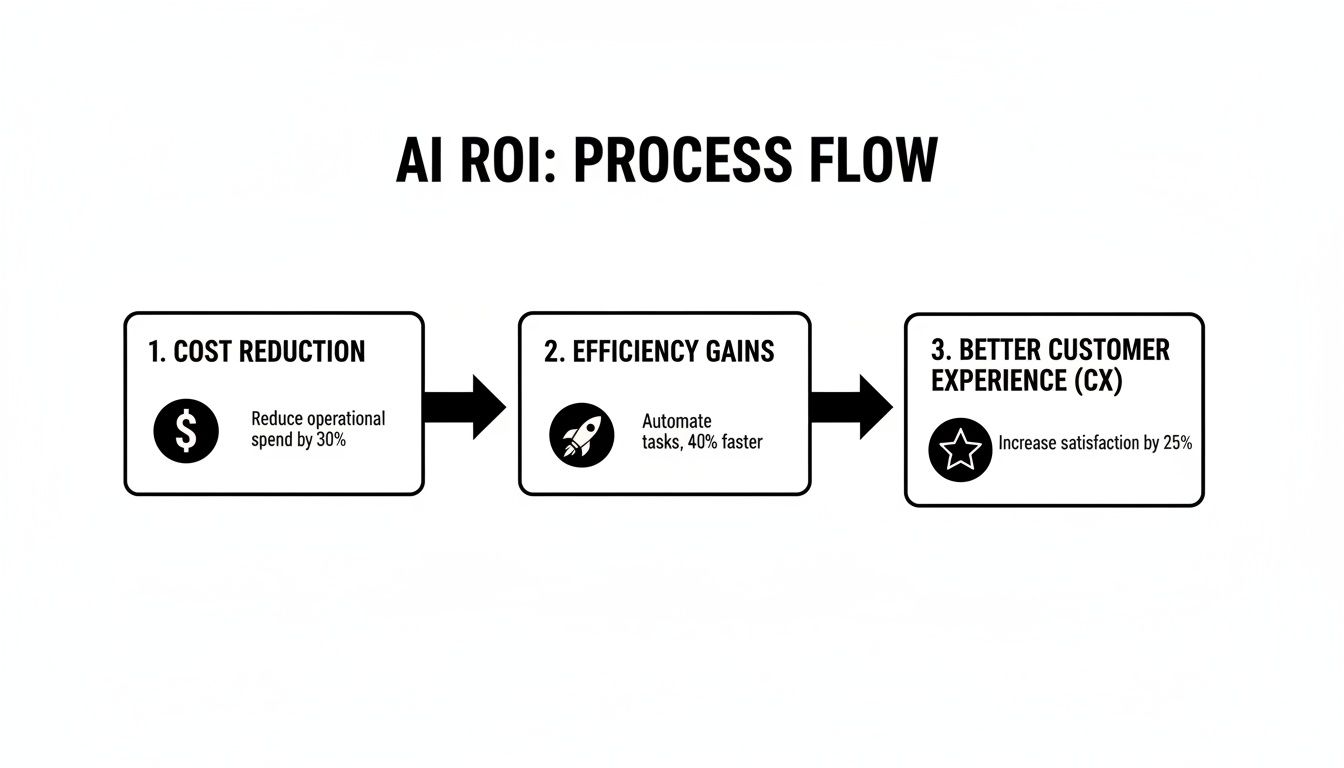

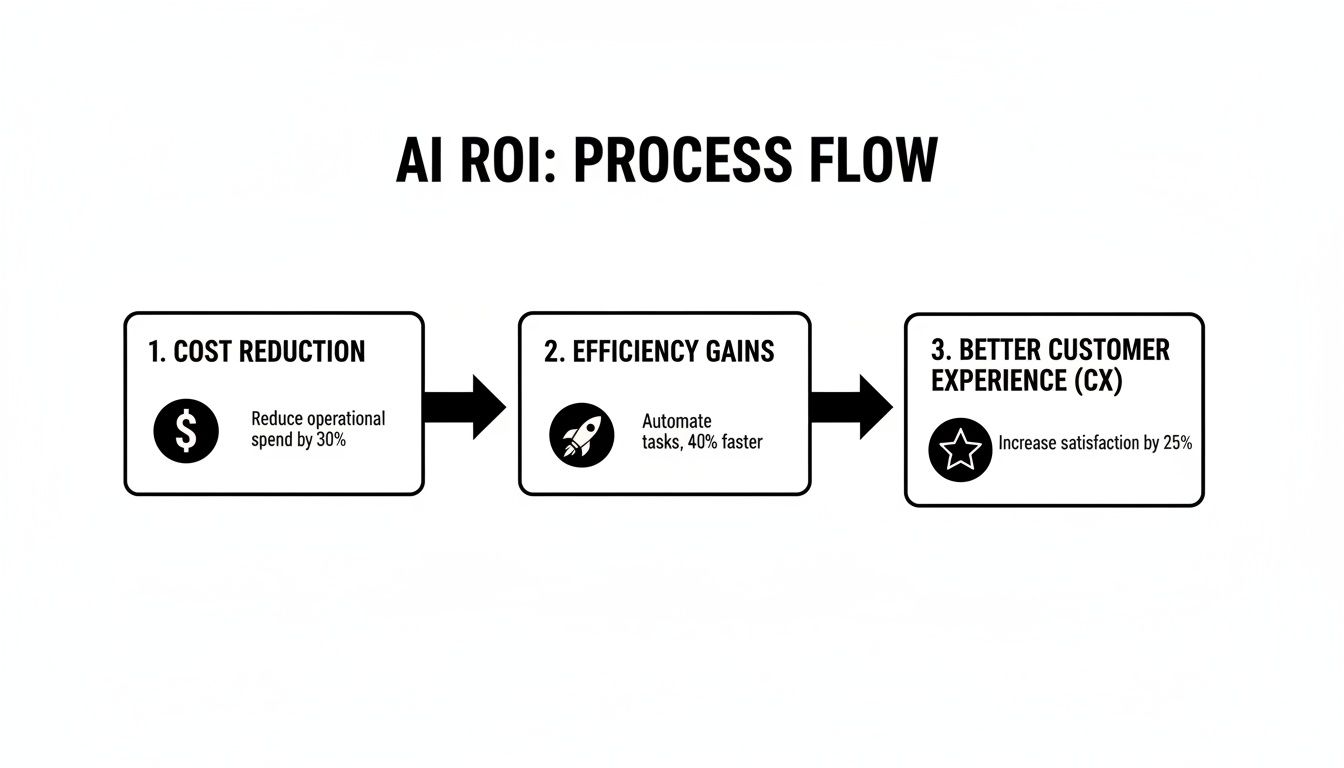

This infographic shows how the core pillars of AI's return on investment connect, mapping the journey from immediate cost savings to lasting value.

As you can see, the benefits feed into each other. When you reduce operational costs and boost efficiency, the direct result is a better, faster, and more satisfying customer experience.

Step 1: Seamless Data Integration

First things first: your AI agents need to plug into your existing technology stack. A well-designed AI platform won’t ask you to rip and replace your core systems; it works with them. This means setting up secure API connections to essential platforms like ServiceNow for ticketing, Genesys for your contact center, or industry-specific workhorses like Guidewire or Duck Creek for managing claims.

This integration is what allows an AI agent to act just like a human employee. It can pull up a customer's policy details, log every interaction note in your CRM, and update case files in real-time. This keeps your data perfectly consistent across the entire ecosystem.

Step 2: SOP-Based Training

Generic chatbots that pull from broad language models are a non-starter in finance and insurance. Your AI agents have to be trained on your specific rules. This stage is all about feeding the AI your organization's approved Standard Operating Procedures (SOPs). The system literally learns by observing the steps your best team members take to resolve cases.

This approach guarantees the AI doesn't go off-script and invent its own processes. For ai insurance companies, this means the agent follows your exact protocol for verifying a claim, step-by-step. For a bank, it means the AI adheres strictly to your KYC verification checklist without deviation. This SOP-based training is the bedrock of compliant automation.

The goal of training isn't to create an AI that knows everything; it's to create a digital team member that perfectly executes a specific set of tasks according to your company's established best practices. This focus on procedural mastery is what makes AI safe and effective in regulated fields.

To make this a reality, you need more than just software; you need specialized expertise. The right AI Engineering services are what turn powerful technology into a reliable business tool that you can actually count on.

Step 3: Establishing Clear Guardrails

Once the AI is trained, it needs to operate within clearly defined boundaries, or "guardrails." These are the hard-and-fast rules that prevent the AI from acting outside its designated scope.

A guardrail could be a simple rule, like prohibiting an AI agent from approving an insurance claim above $5,000. Or it could be more nuanced, like preventing it from handling a customer complaint that contains keywords indicating high emotional distress. These guardrails are your most important risk management tool, ensuring the AI sticks to the predictable, procedural work it was built for.

Step 4: Designing Human Escalation Paths

No automation strategy is complete without a bulletproof handoff from AI to human experts. This final step is about designing clean, efficient escalation paths for any situation that falls outside the AI's guardrails.

When the AI hits a roadblock, it must instantly transfer the entire case—along with a full summary of every action taken so far—to the right human agent. This ensures there are absolutely no dead ends for the customer. For AI customer care, this could mean routing a call to a senior agent trained in de-escalation. When it comes to claims ai reviews, a smooth handoff to a human adjuster is consistently cited as a critical factor in keeping customer satisfaction high, even when the process starts with automation.

Navigating Compliance Risk and Auditability

For anyone in risk and compliance, "control" and "transparency" are everything. The very idea of handing regulated work to an AI can feel like a leap of faith, sparking real concerns about accountability. But today’s AI customer service automation platforms are built from the ground up to tackle these exact fears.

Instead of operating like a mysterious "black box," these systems are engineered for complete visibility. This is absolutely critical for ai insurance companies and financial services firms, where every single step—from a basic customer question to a complex claim—has to be documented and justified. A well-designed AI solution gives you the tools to prove, beyond any doubt, that your automated processes are secure, compliant, and firmly under your control.

This isn't just about adding an "audit feature." It's a fundamental shift that makes automation possible in high-stakes industries, building the deep trust needed to get your most risk-averse stakeholders on board.

Creating an Unbreakable Audit Trail

The bedrock of any compliant AI is an immutable audit log. Think of it as a permanent, unchangeable digital ledger that records every single action the AI agent takes. Every piece of data it touches, every system it updates, and every decision it makes gets logged and time-stamped.

This microscopic level of detail is a game-changer when regulators come knocking. If an auditor asks why a specific insurance claim was assigned to a particular team, you can pull up the log instantly. You'll see the exact SOP-based logic the AI followed, step-by-step. No ambiguity, no guesswork.

This gives your compliance teams a massive advantage:

Total Transparency: See precisely what the AI did, when, and why.

Simplified Reporting: Pull detailed reports for internal reviews or external regulators in minutes, not days.

Rapid Error Analysis: If something goes wrong, you can trace the process from start to finish to pinpoint the root cause immediately.

This granular, always-on logging system means you can confidently demonstrate that your AI operates strictly within the predefined SOPs and guardrails you established. It transforms the AI from a potential risk into a highly controlled and verifiable operational asset.

The Pillars of Security and Data Privacy

Beyond a clear audit trail, a rock-solid security posture is non-negotiable. Leading AI customer care platforms know that trust is earned through serious security certifications and data protection measures. These aren't just nice-to-haves; they're essential for handling sensitive financial and personal data.

Two of the most important credentials to look for are SOC 2 Type II and GDPR compliance. Think of these not as one-time awards, but as proof of an ongoing commitment to upholding the highest standards of data security.

SOC 2 Type II: This certification confirms that a vendor has rigorous internal controls for security, availability, processing integrity, confidentiality, and privacy. To get a better sense of what's involved, you can learn more about what SOC 2 compliance is and why it's a must-have for any tech partner.

GDPR Compliance: This ensures the platform follows the European Union's strict data protection and privacy rules, which have become a global benchmark for handling customer information responsibly.

When you choose a platform with these credentials, you're sending a clear message to leadership and regulators: data privacy is a core principle, not an afterthought. It shows that security is baked into the technology from day one, keeping your company—and your customers—protected.

Finding the Right AI Partner and Measuring What Matters

You’ve got a solid roadmap and a compliance strategy. Now comes the critical moment: picking the right technology partner and defining what success actually looks like for your AI customer service automation project. This isn't just about comparing features on a spec sheet. It's about finding a partner whose technology understands the intense operational and regulatory pressures of financial services.

Choosing the right vendor means cutting through the marketing hype to find a platform with proven, real-world capabilities. A good evaluation checklist will help you focus on what's essential in a high-stakes environment. Think of it this way: you’re not just buying software; you’re bringing on a specialist who will help ensure your investment delivers real, measurable value that you can confidently report to stakeholders and the board.

Your Vendor Evaluation Checklist

Not all AI platforms are built for the intricate workflows common in banking and insurance. Before you sign on the dotted line, your due diligence needs to zero in on four key areas that separate true enterprise-grade solutions from more generic tools.

Deep Integration Capabilities: How well does the platform play with your existing core systems? To avoid creating frustrating data islands, it absolutely must connect with industry workhorses like Guidewire, Duck Creek, Salesforce, and Genesys.

SOP-Based Training: Can you train the AI using your team's real-world actions and approved standard operating procedures? This is a deal-breaker for compliance. The AI must learn to do the job exactly the way your best human agents do, following your specific rulebook.

Human-in-the-Loop Collaboration: What happens when a case needs to be escalated? The best systems make the handoff from AI to a human expert completely seamless. Look for platforms that deliver a perfectly organized case summary, so your team can jump in and take over without missing a beat.

Proven Security and Compliance: Does the vendor have essential certifications like SOC 2 Type II? This isn't just a nice-to-have; it’s proof of a fundamental commitment to data security and a baseline requirement for handling sensitive financial information. To see how these criteria make a difference, check out these real-world case studies.

Defining KPIs That Truly Matter

With the right partner on board, you need to measure success with the right Key Performance Indicators (KPIs). Of course, cost savings are a big part of the picture, but the real magic of AI customer care is its power to transform how you operate and improve the customer experience. Focusing on the right metrics helps you tell a much more compelling ROI story.

The most effective KPIs look beyond simple cost-cutting. They capture the full impact on operational efficiency, accuracy, and customer loyalty, giving you a complete picture of how automation is improving the business.

Instead of only tracking changes in headcount, concentrate on metrics that show improvements in speed, accuracy, and satisfaction. These KPIs provide hard evidence of the project's success:

Reduced Average Handling Time (AHT): AI agents can take over the tedious work of collecting and verifying information, which dramatically cuts down the time your human agents spend on each case.

Increased First Contact Resolution (FCR): When AI handles routine queries instantly, it frees up your experts to solve more complex problems the first time a customer calls. That means fewer frustrating escalations.

Shorter Claims Processing Cycles: For ai insurance companies, this is a game-changing metric. Tracking the time from the first notice of loss to final settlement shows a direct improvement in how quickly you can serve policyholders. In fact, most claims ai reviews point to this as a top driver of customer satisfaction.

Improved Customer Satisfaction (CSAT) Scores: At the end of the day, faster and more accurate service makes for happier customers. A rising CSAT score is the ultimate proof that your automation strategy is working.

Your Top Questions About AI Automation, Answered

When you're a leader in financial services or insurance, looking into AI customer service automation isn't just about technology—it's about managing risk, protecting your investments, and ensuring compliance. You have practical, high-stakes questions, and you need straight answers.

This section tackles the most common concerns we hear from executives across operations, risk, and technology.

How Does AI Actually Handle a Complex Insurance Claim?

Let's be clear: the goal here isn't to have an AI navigate a highly emotional or legally complicated claim. That's what your experts are for.

Instead, the AI is designed to master the predictable, high-volume stages of the claims process. Think initial data gathering, document verification, and cross-referencing policy details. It handles the procedural heavy lifting flawlessly.

When a case hits a certain threshold of complexity or involves a sensitive customer interaction, the system is built to instantly escalate it. The AI agent packages everything up—a complete, organized summary—and hands it off to a human specialist. This way, your team can skip the admin and jump straight to applying their critical thinking and empathy where it truly matters.

Will We Have to Rip and Replace Our Core Systems?

Absolutely not. Modern AI automation platforms are designed to be an intelligent layer that sits on top of your existing technology, not a disruptive replacement for it. The last thing you need is another massive, multi-year migration project.

These systems use secure APIs to plug directly into the tools your team already uses every day—platforms like Guidewire, Duck Creek, Salesforce, and Genesys. It enhances your current tech stack, making your past investments even more valuable. Essentially, the AI agents work within your environment, pulling information and completing tasks just like a highly efficient employee would.

How Can We Prove to Regulators That AI Decisions Are Compliant?

This is the most critical question, and the answer lies in building compliance into the AI's DNA from day one. It all comes down to a structure that ensures every single action is auditable, transparent, and controlled.

Here’s how it works:

Training on Your Rules: The AI agents are trained exclusively on your company’s approved Standard Operating Procedures (SOPs). They don’t guess or improvise; they learn to execute your processes exactly as you've defined them.

Setting Clear Guardrails: We establish strict operational boundaries from the outset. This prevents the AI from ever stepping outside its defined scope or making a judgment call it isn’t authorized to make.

Keeping an Immutable Record: Every click, every data entry, every action the AI takes is recorded in an unchangeable audit log. This creates a crystal-clear, verifiable trail for internal reviews or regulatory inquiries.

This framework gives ai insurance companies the confidence to automate sensitive work while maintaining airtight control. As you evaluate different options, understanding these foundational principles of AI customer service is key to seeing what makes these systems truly safe and effective. In fact, based on countless claims ai reviews, this built-in auditability is a non-negotiable for any risk-conscious organization.

Ready to see how compliant AI agents can transform your operations? Nolana deploys a specialized digital workforce trained on your SOPs to automate claims, case management, and customer care while ensuring every action is secure and auditable. Book a demo today.

If you're an operations leader in finance, you know the feeling: staring down a seemingly endless mountain of insurance claims and complex banking inquiries is just another Tuesday. This guide is built for you. We'll break down how AI customer service automation is no longer a futuristic concept but a practical, essential tool for the financial services world.

The New Reality of Financial Customer Service

The core challenge hasn't changed: how do you deliver exceptional customer care while operational demands keep piling up? The answer isn't a generic, off-the-shelf chatbot. It's about deploying a specialized digital workforce—AI agents trained to execute your specific Standard Operating Procedures (SOPs) with precision.

Think of it this way: you can assign all the high-volume, repetitive tasks to your new AI agents. This immediately frees up your human experts to focus on what they do best—building customer relationships and navigating tricky escalations that require a human touch.

This guide is your roadmap to deploying AI strategically, cutting operational costs, boosting efficiency, and raising the bar for customer experience in a heavily regulated industry.

AI Automation in Insurance and Banking

For ai insurance companies, this means completely overhauling the first steps of a claim. An AI agent can instantly capture incident details, verify policy information, and get the case to the right adjuster without any human intervention. Automating insurance claims with AI turns a process that once took days, or even weeks, into a matter of minutes.

In banking, AI customer care agents are perfect for managing transaction disputes, processing routine account updates, and performing initial identity checks. They deliver both the speed customers expect and the accuracy regulators demand.

The results speak for themselves. We've seen organizations achieve a staggering 30% reduction in operational costs after bringing in AI automation—a game-changing figure for carriers and banks. These savings aren't magic; they come from AI handling the routine work, which lets your teams focus on high-value financial operations. To get a broader view, you can explore more AI customer service statistics and trends.

At its core, AI customer service automation in finance isn't about replacing people. It’s about augmenting their capabilities, allowing skilled professionals to apply their expertise where it matters most—solving complex problems and delivering empathetic support.

Ultimately, this approach helps financial institutions finally get ahead of the constant pressure of high-volume inquiries. It paves the way for a more efficient, compliant, and customer-focused way of working, which is exactly what we'll unpack throughout this guide.

How AI Gets Real Work Done in Insurance and Banking

Let's move past the theory. The real value of AI customer service automation comes alive when you see it handling complex, regulated work in the real world. In insurance and banking, AI agents aren’t just fielding basic questions; they’re executing the core operational tasks that keep these industries running.

Think of these agents as a specialized digital workforce. They plug directly into your core systems and take over the procedural, repetitive work that ties up your human teams for thousands of hours. This frees your people to focus on strategic initiatives and building genuine customer relationships—the work that truly matters.

Overhauling the Insurance Claims Lifecycle

For ai insurance companies, the claims process is a classic bottleneck. It's often slow, bogged down by paperwork, and riddled with handoffs that frustrate customers and drive up costs. Automating insurance claims with AI is completely changing this dynamic, starting from the moment a customer files a claim.

The journey begins at the First Notice of Loss (FNOL). An AI agent can immediately capture and verify claim details from any channel—a phone call, a web form, or a mobile app. But it doesn't stop there. The agent takes instant action on tasks that used to require manual review:

Policy Verification: The agent pings your policy administration system to instantly confirm the customer’s coverage is active and relevant to the incident.

Initial Triage: It analyzes the claim details to gauge severity. A minor fender-bender gets fast-tracked for quick resolution, while a major property fire is immediately flagged for a senior adjuster.

Document Collection: The agent can request photos or police reports and even use computer vision to run a preliminary damage assessment, dramatically speeding up the evaluation.

By automating these front-end tasks, insurers are slashing claim cycle times from weeks down to a matter of days or even hours. This doesn’t just cut operational costs; it delivers the kind of fast, effortless experience that today’s policyholders demand.

Instead of an employee manually keying data into systems like Guidewire or Duck Creek, the AI agent does it instantly and without errors. This creates a clean, accurate, and fully auditable record from day one. To learn more about modernizing this critical function, check out our guide on insurance claims processing automation.

Elevating AI Customer Care in Financial Services

In the banking and financial services world, AI customer care is about much more than a simple chatbot. AI agents are becoming crucial for managing sensitive, high-stakes processes that are foundational to customer trust and regulatory compliance. They handle everything from transaction disputes to identity verification with incredible speed and accuracy.

One of the most impactful use cases is in Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. An AI agent can kick off the verification process, check customer data against global watchlists, and analyze ID documents for authenticity. This lets your compliance officers stop chasing paperwork and start investigating genuinely high-risk alerts.

Here are a few other common financial service scenarios where these agents make a huge difference:

Transaction Disputes: A customer reports a fraudulent charge. The AI agent can immediately gather the transaction data, place a temporary hold on the card, and initiate the dispute resolution process.

Account Updates: Routine requests like an address change or adding an authorized user are handled from start to finish, ensuring data is updated correctly across every connected system.

Information Requests: AI can securely give customers their account balance, pull up a transaction history, or provide a loan payoff amount—anytime, day or night, with no human intervention needed.

Crucially, every single action the AI agent takes is permanently logged. This creates a transparent, immutable audit trail that keeps regulators happy. It’s how modern financial services firms can manage a massive volume of customer interactions efficiently while staying firmly on the right side of compliance.

Unpacking the Real-World Business Value and ROI of AI

Let's be honest—any new technology investment comes down to the bottom line. When we talk about AI customer service automation, the business case isn’t just compelling; it’s built on three pillars that deliver a measurable Return on Investment (ROI): deep cost reductions, huge jumps in efficiency, and a customer experience that builds genuine loyalty.

By letting AI handle the routine, front-end interactions, you immediately drive down your cost per interaction. This isn't about replacing your people; it's about freeing them up. AI agents can manage the high-volume, repetitive tasks, allowing you to handle more customer needs without having to constantly hire more staff, especially during predictable peaks like storm season or open enrollment.

Radically Reducing Operational Costs

The most immediate financial win comes from taking procedural work off your team's shoulders. Every single claim intake, policy check, or account update handled by an AI agent is a task your human experts no longer have to touch. This creates real, tangible savings that you can redirect toward growth instead of just keeping the lights on. For a closer look at these operational wins, see our guide on the business process automation benefits.

This is exactly why AI adoption in customer service has exploded. Today, a staggering 85% of customer service leaders are already using conversational AI to reshape their contact centers. This isn't a fad; it's a direct response to the clear financial upside and what customers now demand. It's also why the global call center AI market is set to skyrocket from $1.95 billion in 2024 to over $10 billion by 2032, with financial services leading the charge. You can read more about the growth of AI in contact centers.

The true ROI of AI isn't just about doing the same work for less money. It's about fundamentally changing how work gets done, creating capacity for your team to focus on complex problem-solving and high-value customer engagement that drives long-term loyalty.

Achieving Massive Efficiency Gains

In financial services, efficiency is the engine of profitability. Manual workflows are notoriously slow, filled with potential for human error, and create frustrating bottlenecks for everyone involved. AI insurance companies, for instance, are seeing incredible results by automating the claims lifecycle. Processes that used to take weeks of chasing paperwork and endless phone calls can now be wrapped up in a matter of hours, sometimes even minutes.

This speed creates a powerful ripple effect. Faster claims mean faster payouts, which is a huge driver of policyholder satisfaction. In banking, getting through KYC and onboarding quickly means new customers can start using their accounts right away, boosting engagement from the very beginning. That kind of speed and precision cuts out the hidden costs of rework, compliance headaches, and long, drawn-out resolution times.

The difference AI makes becomes crystal clear when you compare workflows side-by-side.

Manual vs AI-Automated Financial Workflows

Metric | Traditional Manual Process | AI-Automated Process |

|---|---|---|

Claim First Notice of Loss (FNOL) | 20-30 minutes (agent intake) | 1-3 minutes (AI-powered form) |

KYC/Onboarding Time | 2-5 business days | Under 5 minutes |

Customer Wait Time (Peak Hours) | 15+ minutes | Instant response (0 minutes) |

Agent Time on Routine Queries | 60-70% of total time | <10% of total time |

Error Rate (Data Entry) | 3-5% | <0.1% |

Resolution Time (Simple Claims) | 7-14 days | 24-48 hours |

This table highlights just how significant the shift is. We're not talking about small, incremental improvements; AI completely redefines what's possible for speed and accuracy.

Elevating the Customer Experience

At the end of the day, the ultimate measure of success is how your customers feel. Top-notch AI customer care provides the instant, 24/7 support that people now expect as standard. An AI agent is always on, ready to answer a question, start a claim, or check an account balance, no matter the time of day or how many other people are calling in.

This immediate, always-on availability directly improves the metrics that matter most:

Higher Customer Satisfaction (CSAT) Scores: Customers solve their problems faster and with far less effort.

Improved Net Promoter Score (NPS): A frictionless experience is the fastest way to turn a neutral customer into a vocal advocate for your brand.

Increased First Contact Resolution (FCR): AI agents are designed to resolve common issues on the first try, which means fewer frustrated customers get escalated to your team.

When customers feel that their bank or insurer respects their time, it builds a foundation of trust and makes them far less likely to leave. Looking at various claims ai reviews, this elevated experience is consistently ranked as the most powerful and lasting benefit of getting automation right.

Your Roadmap for Compliant AI Implementation

Bringing AI customer service automation into a highly regulated industry isn't as simple as flipping a switch. It takes a deliberate, phased approach—a roadmap that builds confidence, locks in compliance, and starts delivering value from day one.

The smartest way to begin is by targeting high-impact, low-risk workflows. Think initial claims intake or standard account inquiries. Get those wins on the board before you even think about scaling up to more complex processes.

This playbook breaks the journey down into four essential stages. Follow it, and you'll build AI agents that not only perform their tasks flawlessly but also operate securely within the strict confines of financial services regulations. This structured method is your key to a strong, sustainable return on investment.

This infographic shows how the core pillars of AI's return on investment connect, mapping the journey from immediate cost savings to lasting value.

As you can see, the benefits feed into each other. When you reduce operational costs and boost efficiency, the direct result is a better, faster, and more satisfying customer experience.

Step 1: Seamless Data Integration

First things first: your AI agents need to plug into your existing technology stack. A well-designed AI platform won’t ask you to rip and replace your core systems; it works with them. This means setting up secure API connections to essential platforms like ServiceNow for ticketing, Genesys for your contact center, or industry-specific workhorses like Guidewire or Duck Creek for managing claims.

This integration is what allows an AI agent to act just like a human employee. It can pull up a customer's policy details, log every interaction note in your CRM, and update case files in real-time. This keeps your data perfectly consistent across the entire ecosystem.

Step 2: SOP-Based Training

Generic chatbots that pull from broad language models are a non-starter in finance and insurance. Your AI agents have to be trained on your specific rules. This stage is all about feeding the AI your organization's approved Standard Operating Procedures (SOPs). The system literally learns by observing the steps your best team members take to resolve cases.

This approach guarantees the AI doesn't go off-script and invent its own processes. For ai insurance companies, this means the agent follows your exact protocol for verifying a claim, step-by-step. For a bank, it means the AI adheres strictly to your KYC verification checklist without deviation. This SOP-based training is the bedrock of compliant automation.

The goal of training isn't to create an AI that knows everything; it's to create a digital team member that perfectly executes a specific set of tasks according to your company's established best practices. This focus on procedural mastery is what makes AI safe and effective in regulated fields.

To make this a reality, you need more than just software; you need specialized expertise. The right AI Engineering services are what turn powerful technology into a reliable business tool that you can actually count on.

Step 3: Establishing Clear Guardrails

Once the AI is trained, it needs to operate within clearly defined boundaries, or "guardrails." These are the hard-and-fast rules that prevent the AI from acting outside its designated scope.

A guardrail could be a simple rule, like prohibiting an AI agent from approving an insurance claim above $5,000. Or it could be more nuanced, like preventing it from handling a customer complaint that contains keywords indicating high emotional distress. These guardrails are your most important risk management tool, ensuring the AI sticks to the predictable, procedural work it was built for.

Step 4: Designing Human Escalation Paths

No automation strategy is complete without a bulletproof handoff from AI to human experts. This final step is about designing clean, efficient escalation paths for any situation that falls outside the AI's guardrails.

When the AI hits a roadblock, it must instantly transfer the entire case—along with a full summary of every action taken so far—to the right human agent. This ensures there are absolutely no dead ends for the customer. For AI customer care, this could mean routing a call to a senior agent trained in de-escalation. When it comes to claims ai reviews, a smooth handoff to a human adjuster is consistently cited as a critical factor in keeping customer satisfaction high, even when the process starts with automation.

Navigating Compliance Risk and Auditability

For anyone in risk and compliance, "control" and "transparency" are everything. The very idea of handing regulated work to an AI can feel like a leap of faith, sparking real concerns about accountability. But today’s AI customer service automation platforms are built from the ground up to tackle these exact fears.

Instead of operating like a mysterious "black box," these systems are engineered for complete visibility. This is absolutely critical for ai insurance companies and financial services firms, where every single step—from a basic customer question to a complex claim—has to be documented and justified. A well-designed AI solution gives you the tools to prove, beyond any doubt, that your automated processes are secure, compliant, and firmly under your control.

This isn't just about adding an "audit feature." It's a fundamental shift that makes automation possible in high-stakes industries, building the deep trust needed to get your most risk-averse stakeholders on board.

Creating an Unbreakable Audit Trail

The bedrock of any compliant AI is an immutable audit log. Think of it as a permanent, unchangeable digital ledger that records every single action the AI agent takes. Every piece of data it touches, every system it updates, and every decision it makes gets logged and time-stamped.

This microscopic level of detail is a game-changer when regulators come knocking. If an auditor asks why a specific insurance claim was assigned to a particular team, you can pull up the log instantly. You'll see the exact SOP-based logic the AI followed, step-by-step. No ambiguity, no guesswork.

This gives your compliance teams a massive advantage:

Total Transparency: See precisely what the AI did, when, and why.

Simplified Reporting: Pull detailed reports for internal reviews or external regulators in minutes, not days.

Rapid Error Analysis: If something goes wrong, you can trace the process from start to finish to pinpoint the root cause immediately.

This granular, always-on logging system means you can confidently demonstrate that your AI operates strictly within the predefined SOPs and guardrails you established. It transforms the AI from a potential risk into a highly controlled and verifiable operational asset.

The Pillars of Security and Data Privacy

Beyond a clear audit trail, a rock-solid security posture is non-negotiable. Leading AI customer care platforms know that trust is earned through serious security certifications and data protection measures. These aren't just nice-to-haves; they're essential for handling sensitive financial and personal data.

Two of the most important credentials to look for are SOC 2 Type II and GDPR compliance. Think of these not as one-time awards, but as proof of an ongoing commitment to upholding the highest standards of data security.

SOC 2 Type II: This certification confirms that a vendor has rigorous internal controls for security, availability, processing integrity, confidentiality, and privacy. To get a better sense of what's involved, you can learn more about what SOC 2 compliance is and why it's a must-have for any tech partner.

GDPR Compliance: This ensures the platform follows the European Union's strict data protection and privacy rules, which have become a global benchmark for handling customer information responsibly.

When you choose a platform with these credentials, you're sending a clear message to leadership and regulators: data privacy is a core principle, not an afterthought. It shows that security is baked into the technology from day one, keeping your company—and your customers—protected.

Finding the Right AI Partner and Measuring What Matters

You’ve got a solid roadmap and a compliance strategy. Now comes the critical moment: picking the right technology partner and defining what success actually looks like for your AI customer service automation project. This isn't just about comparing features on a spec sheet. It's about finding a partner whose technology understands the intense operational and regulatory pressures of financial services.

Choosing the right vendor means cutting through the marketing hype to find a platform with proven, real-world capabilities. A good evaluation checklist will help you focus on what's essential in a high-stakes environment. Think of it this way: you’re not just buying software; you’re bringing on a specialist who will help ensure your investment delivers real, measurable value that you can confidently report to stakeholders and the board.

Your Vendor Evaluation Checklist

Not all AI platforms are built for the intricate workflows common in banking and insurance. Before you sign on the dotted line, your due diligence needs to zero in on four key areas that separate true enterprise-grade solutions from more generic tools.

Deep Integration Capabilities: How well does the platform play with your existing core systems? To avoid creating frustrating data islands, it absolutely must connect with industry workhorses like Guidewire, Duck Creek, Salesforce, and Genesys.

SOP-Based Training: Can you train the AI using your team's real-world actions and approved standard operating procedures? This is a deal-breaker for compliance. The AI must learn to do the job exactly the way your best human agents do, following your specific rulebook.

Human-in-the-Loop Collaboration: What happens when a case needs to be escalated? The best systems make the handoff from AI to a human expert completely seamless. Look for platforms that deliver a perfectly organized case summary, so your team can jump in and take over without missing a beat.

Proven Security and Compliance: Does the vendor have essential certifications like SOC 2 Type II? This isn't just a nice-to-have; it’s proof of a fundamental commitment to data security and a baseline requirement for handling sensitive financial information. To see how these criteria make a difference, check out these real-world case studies.

Defining KPIs That Truly Matter

With the right partner on board, you need to measure success with the right Key Performance Indicators (KPIs). Of course, cost savings are a big part of the picture, but the real magic of AI customer care is its power to transform how you operate and improve the customer experience. Focusing on the right metrics helps you tell a much more compelling ROI story.

The most effective KPIs look beyond simple cost-cutting. They capture the full impact on operational efficiency, accuracy, and customer loyalty, giving you a complete picture of how automation is improving the business.

Instead of only tracking changes in headcount, concentrate on metrics that show improvements in speed, accuracy, and satisfaction. These KPIs provide hard evidence of the project's success:

Reduced Average Handling Time (AHT): AI agents can take over the tedious work of collecting and verifying information, which dramatically cuts down the time your human agents spend on each case.

Increased First Contact Resolution (FCR): When AI handles routine queries instantly, it frees up your experts to solve more complex problems the first time a customer calls. That means fewer frustrating escalations.

Shorter Claims Processing Cycles: For ai insurance companies, this is a game-changing metric. Tracking the time from the first notice of loss to final settlement shows a direct improvement in how quickly you can serve policyholders. In fact, most claims ai reviews point to this as a top driver of customer satisfaction.

Improved Customer Satisfaction (CSAT) Scores: At the end of the day, faster and more accurate service makes for happier customers. A rising CSAT score is the ultimate proof that your automation strategy is working.

Your Top Questions About AI Automation, Answered

When you're a leader in financial services or insurance, looking into AI customer service automation isn't just about technology—it's about managing risk, protecting your investments, and ensuring compliance. You have practical, high-stakes questions, and you need straight answers.

This section tackles the most common concerns we hear from executives across operations, risk, and technology.

How Does AI Actually Handle a Complex Insurance Claim?

Let's be clear: the goal here isn't to have an AI navigate a highly emotional or legally complicated claim. That's what your experts are for.

Instead, the AI is designed to master the predictable, high-volume stages of the claims process. Think initial data gathering, document verification, and cross-referencing policy details. It handles the procedural heavy lifting flawlessly.

When a case hits a certain threshold of complexity or involves a sensitive customer interaction, the system is built to instantly escalate it. The AI agent packages everything up—a complete, organized summary—and hands it off to a human specialist. This way, your team can skip the admin and jump straight to applying their critical thinking and empathy where it truly matters.

Will We Have to Rip and Replace Our Core Systems?

Absolutely not. Modern AI automation platforms are designed to be an intelligent layer that sits on top of your existing technology, not a disruptive replacement for it. The last thing you need is another massive, multi-year migration project.

These systems use secure APIs to plug directly into the tools your team already uses every day—platforms like Guidewire, Duck Creek, Salesforce, and Genesys. It enhances your current tech stack, making your past investments even more valuable. Essentially, the AI agents work within your environment, pulling information and completing tasks just like a highly efficient employee would.

How Can We Prove to Regulators That AI Decisions Are Compliant?

This is the most critical question, and the answer lies in building compliance into the AI's DNA from day one. It all comes down to a structure that ensures every single action is auditable, transparent, and controlled.

Here’s how it works:

Training on Your Rules: The AI agents are trained exclusively on your company’s approved Standard Operating Procedures (SOPs). They don’t guess or improvise; they learn to execute your processes exactly as you've defined them.

Setting Clear Guardrails: We establish strict operational boundaries from the outset. This prevents the AI from ever stepping outside its defined scope or making a judgment call it isn’t authorized to make.

Keeping an Immutable Record: Every click, every data entry, every action the AI takes is recorded in an unchangeable audit log. This creates a crystal-clear, verifiable trail for internal reviews or regulatory inquiries.

This framework gives ai insurance companies the confidence to automate sensitive work while maintaining airtight control. As you evaluate different options, understanding these foundational principles of AI customer service is key to seeing what makes these systems truly safe and effective. In fact, based on countless claims ai reviews, this built-in auditability is a non-negotiable for any risk-conscious organization.

Ready to see how compliant AI agents can transform your operations? Nolana deploys a specialized digital workforce trained on your SOPs to automate claims, case management, and customer care while ensuring every action is secure and auditable. Book a demo today.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP