Discover AI Customer Service: Boost CX with Smart Automation in Finance

Discover AI Customer Service: Boost CX with Smart Automation in Finance

Explore ai customer service strategies to automate insurance claims, improve banking support, and boost efficiency and CX.

Think of AI customer service not just as a chatbot, but as a dedicated, intelligent team of software agents built to see complex customer problems through from start to finish. In the world of finance and insurance, this goes way beyond answering simple questions. We're talking about a fully integrated digital workforce that can run high-stakes processes like insurance claims or banking disputes, often with little to no human hand-holding.

A New Operational Standard for Financial Services

The traditional service model is straining under the weight of customer expectations and operational costs. The old way—more people, more problems—simply doesn't scale. Instead, leading firms are bringing in a digital workforce to augment their human teams, creating a powerful new partnership.

This hybrid model allows AI to take over the repetitive, data-heavy lifting, freeing up your people to focus on strategy, innovation, and the high-touch relationships that truly matter. What you get is a more resilient, efficient, and responsive operation that's actually built for the future. This approach has become a cornerstone of the broader financial services digital transformation happening right now.

Automating High-Stakes Insurance Workflows

Nowhere is the impact more dramatic than in insurance, especially with claims processing. For AI insurance companies, this is a game-changer. What was once a slow, paper-choked ordeal becomes a model of speed and precision. The moment a claim is filed, an AI agent can spring into action.

Data Verification: It instantly checks policy details against your core systems to confirm coverage.

Initial Triage: The AI agent categorizes the claim by severity and complexity using established business rules.

Documentation Gathering: It automatically pings the policyholder for any needed documents, cutting down on endless back-and-forth emails and calls.

This kind of front-end automation tees up a much faster resolution, boosts the accuracy of claims AI reviews, and lets your human adjusters focus their brainpower on the truly complex cases that demand a human touch.

Redefining Financial Customer Care

In banking and finance, AI customer care is completely changing the client interaction playbook. These are not your average FAQ bots. AI agents are now executing the complex, multi-step tasks that used to be the exclusive domain of a back-office team. Think processing transaction disputes, handling KYC updates, or walking a customer through a loan application from start to finish.

By plugging directly into core banking platforms, AI customer service agents work with real-time data to give customers definitive answers and take immediate action. This ensures every interaction is not just helpful, but also compliant and conclusive.

This shift takes you from just "supporting" customers to actually resolving their issues on the spot. It builds trust through incredible speed and reliability, all while keeping you squarely within regulatory lines.

Why AI Is Now a Competitive Necessity

In financial services, relying on manual, high-touch processes for every single interaction is no longer a viable strategy—it’s a competitive liability. The pressure to deliver faster, more accurate service while keeping a lid on operational costs has hit a breaking point. This is where AI customer service stops being a "nice to have" and becomes a core part of modern operations.

The business case isn't just about sounding innovative; it’s driven by real economic shifts. AI-powered workflows are fundamentally changing the cost-to-serve model. They allow institutions to manage much higher volumes with better precision and speed than ever before. For AI insurance companies, this means turning the claims process from a necessary cost center into a powerful source of customer loyalty and efficiency.

Revolutionizing Operational Economics

At its heart, the value of AI here is its ability to perform complex, rules-based work at a massive scale, 24/7, without getting tired or making human errors. This brings a level of predictability and control to your operations that's nearly impossible with teams of people alone. Automating insurance claims with AI, for example, has a direct and positive impact on performance indicators across the business.

Think about the first few minutes of a claim. An AI agent can handle data intake, verify the policy details, and run initial fraud checks in seconds. Those same tasks could take a human adjuster hours to complete. This isn't just about speeding things up; it sets an entirely new expectation for customers and a new pace for your internal operations. By automating these repetitive steps, your expert adjusters are freed up to focus on the high-judgment work that really matters, improving the quality and consistency of claims AI reviews.

The same logic holds true for AI customer care in banking. When AI can autonomously resolve common but detailed issues like transaction disputes or account updates, it frees up skilled agents. They can then focus on more sensitive, high-value conversations that build relationships and actually grow the business. You end up with a smarter, more strategic use of your most valuable resource: your people.

The impact of AI isn't just about deflecting simple questions. It is materially changing the speed, quality, and economics of high-volume financial operations. This shift is creating a clear divide between firms that embrace intelligent automation and those who fall behind.

The Undeniable ROI of Intelligent Automation

The data tells a compelling story. Agents assisted by AI can resolve customer issues 47% faster and achieve a 25% higher first-contact resolution rate. For simpler inquiries, automation can cut response times by as much as 69%. Some firms have even reported speed improvements of nearly 99.4% after implementing AI for front-line support tasks. All told, AI customer service deployments are delivering up to 8x ROI, with an average return of around $3.50 for every $1 invested. You can discover more about these customer service statistics and what they mean for the industry.

These numbers create direct, measurable advantages for your business.

Drastically Lower Cost-to-Serve: Automating tasks reduces the hours of manual work needed for each case, which directly cuts your operational expenses.

Improved SLA Adherence: AI operates consistently within your defined business rules, ensuring rock-solid compliance with service-level agreements.

Enhanced Customer Satisfaction: Faster resolutions and round-the-clock availability lead to happier customers and better retention rates.

Ultimately, bringing AI into your operations is less about the technology itself and more about building a resilient operational foundation. It’s about creating a system where human expertise is amplified, not replaced, letting your organization scale efficiently without compromising on quality or compliance. For a deeper look at this model, check out our guide on how businesses are using AI in business operations to gain a competitive edge.

How AI Is Reshaping Insurance Claims Processing

Picture this: a policyholder’s basement floods, and they pull out their phone to file a claim. Instead of waiting in a queue for a human agent, an AI instantly kicks off the process. This isn't science fiction; it’s the new reality of AI customer service and a complete overhaul of the claims lifecycle.

For AI insurance companies, this is more than just a fancy upgrade. It's about fundamentally re-engineering the entire journey, from that initial report all the way to the final payout, to cut down on friction and keep policyholders happy when it matters most.

Automating the First Notice of Loss

The first point of contact after an incident is make-or-break for the customer experience. This step used to be a bottleneck filled with manual data entry and frustrating delays. Today, AI agents can engage with a customer right away, collecting all the crucial details through a simple, conversational chat.

The AI instantly cross-references policy information with your core systems, confirms coverage, and walks the policyholder through capturing photos and videos of the damage. What used to take days now takes minutes, setting a completely different tone for the rest of the claims process.

Speeding Up Damage Assessment and Reviews

With the initial information gathered, the real magic of claims AI reviews begins. Sophisticated algorithms analyze the photos and videos to generate a preliminary damage estimate. By comparing the new images against a massive historical dataset of similar claims, the AI can assess the extent of the damage and predict repair costs with surprising accuracy.

This data-driven approach removes the guesswork and inconsistency that often come with human-only assessments. It gives adjusters a solid, unbiased starting point, freeing them up to focus their expertise on verifying the details and handling the truly complex decisions.

Every piece of data and every action is logged automatically, creating a perfect audit trail. This not only speeds up the cycle time but also significantly reduces the chances of human error and helps flag potentially fraudulent claims early on.

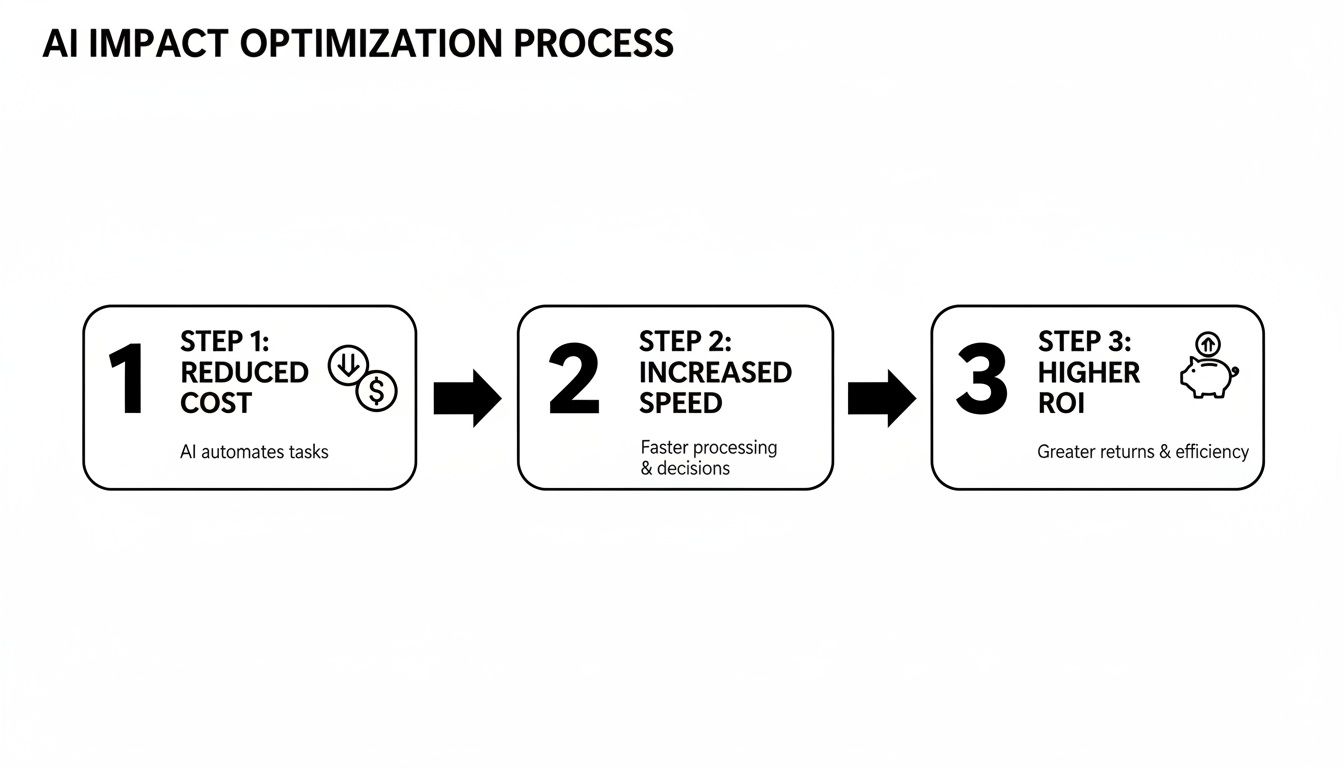

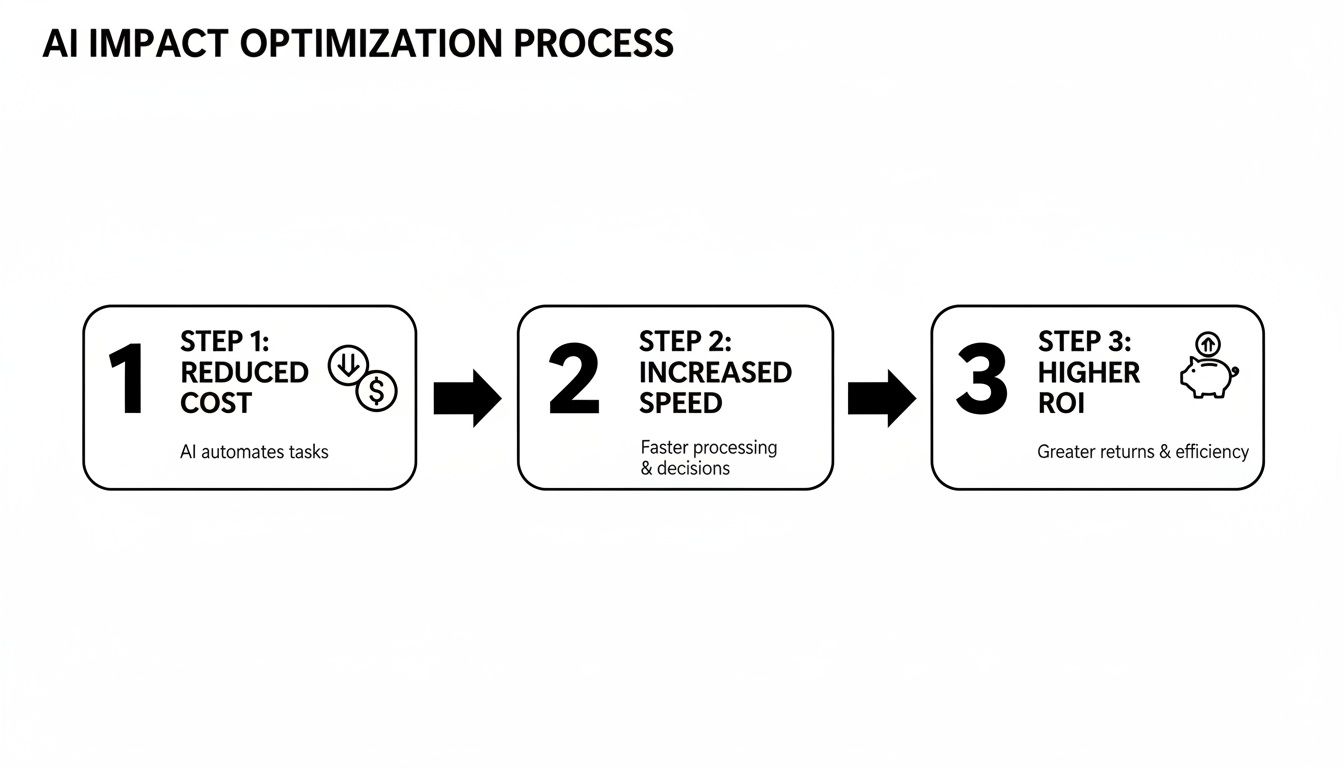

The image below shows how this shift toward automation directly improves key business metrics—cost, speed, and return on investment.

As you can see, implementing AI isn't just about modernizing; it's about delivering measurable operational gains across the entire claims value chain.

Driving Efficiency from Triage to Payout

The AI's job doesn't stop after the initial review. It continues to manage the workflow, and for simple, clear-cut claims that fit predefined rules, it can even process the payment automatically. This "touchless" handling of low-complexity claims is a massive boost to efficiency.

So, how does this look in practice? The table below breaks down the before-and-after of a typical claims journey.

Traditional vs AI-Powered Claims Processing

Claims Stage | Traditional Manual Process | AI-Automated Process (e.g., Nolana) | Key Benefit |

|---|---|---|---|

First Notice of Loss (FNOL) | Phone calls, emails, manual data entry; wait times of hours or days. | Instant engagement via chatbot/app; guided data collection. | Immediate response, reduced administrative load. |

Data Verification | Manual lookup in multiple systems to verify policy and coverage. | Automated, real-time verification against core insurance platforms. | 100% accuracy, zero delays. |

Damage Assessment | On-site adjuster visit or manual review of photos; subjective. | AI analyzes images/videos, generates initial estimate in minutes. | Faster evaluation, objective and consistent analysis. |

Adjudication & Routing | Claim sits in a queue, manually assigned to an available adjuster. | Simple claims are auto-approved; complex cases routed to specialists. | Dramatically reduced cycle times, efficient resource use. |

Settlement & Payout | Manual payment processing, often taking days or weeks. | Automated payment triggers for approved "touchless" claims. | Instant settlement, improved customer satisfaction. |

This side-by-side comparison makes it clear: AI automation transforms a linear, delay-prone process into a fast, intelligent, and customer-centric workflow.

For more complex situations, the AI assembles a complete digital file and routes it to the right human adjuster, who gets all the context needed to make a quick, informed decision. This intelligent partnership is the future of AI customer care in insurance, blending the raw speed of automation with the nuanced expertise of seasoned professionals. By offloading the high-volume, repetitive work, AI allows your best people to focus on being strategic problem-solvers. For a deeper dive, check out our guide on insurance claims processing automation.

This model is no longer an experiment; it's essential infrastructure. By 2025, analysts expect that 85% of all customer interactions will be managed without a human agent. Better still, AI-powered service can slash operational costs by around 30%—a major win for the bottom line. This shift proves that AI doesn't just meet customer demands for speed; it delivers real financial benefits.

Elevating Customer Care in Banking and Finance

It’s not just the insurance world getting a shake-up. AI customer care is making a huge impact in banking and finance, where everything hinges on speed, security, and ironclad compliance. Today’s banking clients live in an always-on world; they expect instant answers and 24/7 access, something human teams alone simply can't scale to provide. AI is stepping in to bridge that gap and is fundamentally changing the client experience.

Let's be clear: this isn't about replacing the human touch in financial advice or relationship management. Far from it. This is about handing off the high-volume, repetitive tasks that clog up the system. AI agents can tackle everything from simple account balance questions and transaction disputes to more involved processes like client onboarding and Know Your Customer (KYC) checks, all while following regulatory rules to the letter.

Meeting Modern Customer Expectations

Your customers have a new set of expectations, and AI customer service is perfectly built to meet them. They want immediate, accurate help that respects their time. The numbers don't lie. One recent survey found that 73% of shoppers believe AI could make their customer experience better, and a massive 80% of those who've actually used AI support called the interaction a positive one.

What’s driving this? Speed and convenience. The same study showed 51% of consumers prefer bots for immediate service, and over 62% turn to AI chat for simple questions. You can read the full research on evolving AI customer service expectations to get a deeper dive.

But speed without substance is just frustrating. The data also reveals that 75% of consumers have been annoyed by a fast AI response that didn't actually solve their problem. This is where modern AI agents are different. They don't just point you to a generic FAQ page; they integrate directly with core banking systems to give real answers and get things done in the moment.

The goal is to create interactions that are not only fast but also contextual and conclusive. An effective AI agent understands the customer's history, accesses their account details securely, and resolves their issue on the first try, building trust and loyalty.

This is what turns a basic chatbot into a real operational asset. True AI customer care is about resolution, not just deflection.

Creating Seamless Human-AI Collaboration

Even the smartest AI has its limits, and knowing those limits is crucial. A well-designed system knows exactly when to pass a complex or sensitive conversation to a human expert. For instance, if a customer is disputing a large, unusual transaction or is clearly getting frustrated, the AI agent can escalate the case in a heartbeat.

This isn’t a system failure; it’s a core feature. The AI neatly packages the entire conversation history—every question asked, every detail verified—and hands it over to the human agent. This creates a seamless transition with zero loss of context, so the customer never has to repeat themselves. The human expert can then jump in with the empathy and nuanced judgment needed for those high-stakes conversations.

This collaborative model gives you the best of both worlds:

For the Customer: They get instant help for most things and a fast, informed handoff to a person when they need one.

For the Institution: You see a massive boost in operational efficiency, keep costs in check, and free up your best people for the work that truly requires their expertise.

This intelligent partnership lets financial institutions deliver amazing service at scale, all without losing the personal connection that builds lasting relationships. To learn more about this approach, explore our detailed article on the capabilities of modern AI agents for customer service.

Implementing AI with Confidence and Control

For any leader in banking or insurance, the thought of automating high-stakes processes can set off alarm bells. Risk and compliance aren't just boxes to check; they're the bedrock of the industry. So, when we talk about deploying AI customer service, the conversation has to start with control.

This isn't about handing over the keys and hoping for the best. Far from it. The new generation of enterprise AI is built with robust guardrails from the very beginning, giving you complete oversight. The real goal is to build a digital workforce that acts as a fully compliant extension of your team, trained on your playbooks and bound by your rules.

Building a Compliant AI Operation

Achieving true operational control means putting a practical framework in place—one that stands up to the scrutiny of both internal auditors and external regulators. This comes down to establishing a few essential pillars of trust and security.

Modern AI platforms designed for financial services aren't mysterious black boxes. They are transparent engines built with accountability in mind, featuring built-in controls to provide this very assurance.

You should look for platforms that offer:

Immutable Audit Trails: Every single action an AI agent takes—whether it's looking up a policy detail or processing a payment—is logged permanently. This creates a concrete, unchangeable record perfect for claims AI reviews or regulatory deep dives.

Role-Based Access Controls: You wouldn't give a new human hire access to everything on day one. The same principle applies here. You define precisely what data and systems an AI agent can touch, keeping it securely within its designated operational lane.

Data Privacy and Security: The best platforms are engineered to meet strict standards like SOC 2 Type II and GDPR. This ensures that sensitive customer information is always handled with the highest degree of protection.

A compliant AI operation is one where you have total visibility into every decision. It's about ensuring the AI adheres to the same strict standards you hold for your human team, making it a reliable and auditable part of your workflow.

The Importance of Human Escalation Paths

Perhaps the most critical safety net in any AI customer care system is a smart, seamless path for human escalation. No AI is infallible, and a well-built system not only recognizes its limits but knows exactly when to tag in a human expert.

The process should feel effortless. When an AI agent hits a scenario outside its programming—a particularly complex insurance claim or a uniquely sensitive customer complaint—it doesn't just freeze. Instead, it automatically packages the entire case, complete with the full conversation history and context, and routes it to the right person. For AI insurance companies, this guarantees that high-stakes claims always benefit from the nuanced judgment of a seasoned adjuster.

This human-in-the-loop model gives you the best of both worlds. You get the speed and efficiency of automation for routine work, paired with the critical thinking and empathy of your best people for the moments that matter most.

Of course, getting the technology right is only part of the equation; success also hinges on selecting the right information technology partner for deployment and ongoing support. And for teams that want to build these intelligent workflows without a heavy lift from developers, a modern platform is key. You can learn more about how to create and manage these compliant digital workers by exploring a no-code AI agent builder.

Your Roadmap to AI-Powered Operations

Getting from an idea to a live AI system that actually drives value demands a clear, practical plan. A successful roadmap for AI customer service doesn't kick off with a tech wish list. It starts by zeroing in on your biggest operational headaches and the ripest opportunities for a quick win.

For AI insurance companies, the claims process is almost always the best place to start. The initial goal is to offload the high-volume, low-complexity tasks that bog down your adjusters. By automating these first, you deliver faster resolutions for policyholders and create measurable efficiencies that build internal support for what comes next.

Start with High-Impact Use Cases

Before you do anything else, you need to pinpoint the exact workflows where automation will make the biggest difference. Don't try to solve every problem at once. Look for processes that are both highly repetitive and absolutely critical to your customer's experience.

Here are a few proven starting points:

Automating Insurance Claims with AI: Go right for the First Notice of Loss (FNOL). An AI agent can handle the initial data intake, policy verification, and document gathering 24/7. This gives customers an immediate response during a stressful moment and eliminates a huge chunk of manual data entry for your team.

Enhancing Financial Services Customer Care: Target the common, yet time-draining, inquiries. Think transaction disputes or routine Know Your Customer (KYC) updates. Automating these frees your skilled human agents to focus on the more complex, relationship-focused conversations where they add the most value.

Define Your Wins and Plan the Plumbing

Once you've picked your starting point, get specific about what success looks like. Are you trying to cut claim cycle time by 30%? Or maybe your goal is to boost first-contact resolution for banking questions by 25%? You have to set clear, measurable goals to prove the value of the investment.

Next, you need to think about integration from day one. An AI agent is useless if it can't access your core systems. Your roadmap has to map out how you'll connect the AI platform to your systems of record, whether that’s Guidewire for claims or your main banking platform. This is the "plumbing" that allows the AI to handle a task from start to finish, rather than just answering simple questions.

The most effective AI rollouts I've seen all share a common thread: they start with a focused, phased approach. Secure an early victory—like dramatically improving claims AI reviews—and you'll have tangible ROI to show for it. That success builds the business case to expand AI customer care into other parts of the organization, turning a massive project into a series of smart, manageable steps.

Frequently Asked Questions About AI in Finance

Stepping into the world of AI-powered customer service is bound to bring up some tough questions, especially for leaders in banking and insurance who operate under tight regulations. Let's tackle some of the most common concerns about how this technology works in practice, from system integration to the role of your human experts.

How Does AI Actually Connect to Our Core Systems?

This is probably the number one question I hear from banks and AI insurance companies. You've spent years, maybe decades, building your operations around core platforms like Guidewire or Salesforce. The good news is, you don't have to rip and replace anything.

Think of a modern AI platform not as a replacement, but as an intelligent layer that works with the systems you already have.

It connects through secure APIs, giving it the ability to read and write information in real-time. This means an AI agent can pull up policy details, log notes in a customer record, or kick off a workflow, all while using your existing system as the single source of truth. It’s about enhancing what you have, not starting from scratch.

What Happens When the AI Gets Stuck?

This is a crucial point and speaks to how these systems are designed from the ground up. An enterprise-grade AI customer care platform isn't just set loose to handle things on its own. A core part of its programming is knowing when to ask for help.

We build in specific triggers for a seamless handoff to a human expert. For example, if a claim comes in over a certain dollar amount, or if a customer's sentiment indicates high frustration, the AI doesn't guess. It immediately routes the entire conversation, along with all the context it has gathered, to the right person on your team.

This ensures the customer never has to repeat their story, and your expert can step in precisely when their judgment is needed most.

The goal is never 100% automation. It’s about creating an intelligent partnership where AI handles the high-volume, repetitive work, freeing up your experts to focus on the complex, high-value situations that truly require a human touch.

How Do You Audit an AI’s Decisions?

For any financial institution, this is non-negotiable. Compliance and auditability have to be baked in from day one. A well-designed AI operating system solves this by creating an unchangeable record of every single action the AI agent takes.

Total Transparency: Every data point it touches, every task it completes, and every message it sends is logged in a detailed audit trail.

Compliance by Design: The AI is trained on your business rules. Its actions are a direct reflection of your approved procedures, which keeps it aligned with both internal policies and external regulations.

Simple to Review: This complete record-keeping means your compliance team can pull up any case and see exactly what happened, from start to finish. In many ways, it offers a more reliable and granular view than you get with manual processes.

This built-in transparency provides the detailed records you need for internal reviews, claims AI reviews, and satisfying regulators. It’s how you gain the speed and efficiency of automation without ever giving up control.

Ready to see how compliant AI agents can automate your most complex workflows? Nolana deploys an AI-native operating system built for high-stakes financial services operations, connecting to your core systems to deliver end-to-end automation with clear guardrails and seamless human oversight. Learn more at https://nolana.com.

Think of AI customer service not just as a chatbot, but as a dedicated, intelligent team of software agents built to see complex customer problems through from start to finish. In the world of finance and insurance, this goes way beyond answering simple questions. We're talking about a fully integrated digital workforce that can run high-stakes processes like insurance claims or banking disputes, often with little to no human hand-holding.

A New Operational Standard for Financial Services

The traditional service model is straining under the weight of customer expectations and operational costs. The old way—more people, more problems—simply doesn't scale. Instead, leading firms are bringing in a digital workforce to augment their human teams, creating a powerful new partnership.

This hybrid model allows AI to take over the repetitive, data-heavy lifting, freeing up your people to focus on strategy, innovation, and the high-touch relationships that truly matter. What you get is a more resilient, efficient, and responsive operation that's actually built for the future. This approach has become a cornerstone of the broader financial services digital transformation happening right now.

Automating High-Stakes Insurance Workflows

Nowhere is the impact more dramatic than in insurance, especially with claims processing. For AI insurance companies, this is a game-changer. What was once a slow, paper-choked ordeal becomes a model of speed and precision. The moment a claim is filed, an AI agent can spring into action.

Data Verification: It instantly checks policy details against your core systems to confirm coverage.

Initial Triage: The AI agent categorizes the claim by severity and complexity using established business rules.

Documentation Gathering: It automatically pings the policyholder for any needed documents, cutting down on endless back-and-forth emails and calls.

This kind of front-end automation tees up a much faster resolution, boosts the accuracy of claims AI reviews, and lets your human adjusters focus their brainpower on the truly complex cases that demand a human touch.

Redefining Financial Customer Care

In banking and finance, AI customer care is completely changing the client interaction playbook. These are not your average FAQ bots. AI agents are now executing the complex, multi-step tasks that used to be the exclusive domain of a back-office team. Think processing transaction disputes, handling KYC updates, or walking a customer through a loan application from start to finish.

By plugging directly into core banking platforms, AI customer service agents work with real-time data to give customers definitive answers and take immediate action. This ensures every interaction is not just helpful, but also compliant and conclusive.

This shift takes you from just "supporting" customers to actually resolving their issues on the spot. It builds trust through incredible speed and reliability, all while keeping you squarely within regulatory lines.

Why AI Is Now a Competitive Necessity

In financial services, relying on manual, high-touch processes for every single interaction is no longer a viable strategy—it’s a competitive liability. The pressure to deliver faster, more accurate service while keeping a lid on operational costs has hit a breaking point. This is where AI customer service stops being a "nice to have" and becomes a core part of modern operations.

The business case isn't just about sounding innovative; it’s driven by real economic shifts. AI-powered workflows are fundamentally changing the cost-to-serve model. They allow institutions to manage much higher volumes with better precision and speed than ever before. For AI insurance companies, this means turning the claims process from a necessary cost center into a powerful source of customer loyalty and efficiency.

Revolutionizing Operational Economics

At its heart, the value of AI here is its ability to perform complex, rules-based work at a massive scale, 24/7, without getting tired or making human errors. This brings a level of predictability and control to your operations that's nearly impossible with teams of people alone. Automating insurance claims with AI, for example, has a direct and positive impact on performance indicators across the business.

Think about the first few minutes of a claim. An AI agent can handle data intake, verify the policy details, and run initial fraud checks in seconds. Those same tasks could take a human adjuster hours to complete. This isn't just about speeding things up; it sets an entirely new expectation for customers and a new pace for your internal operations. By automating these repetitive steps, your expert adjusters are freed up to focus on the high-judgment work that really matters, improving the quality and consistency of claims AI reviews.

The same logic holds true for AI customer care in banking. When AI can autonomously resolve common but detailed issues like transaction disputes or account updates, it frees up skilled agents. They can then focus on more sensitive, high-value conversations that build relationships and actually grow the business. You end up with a smarter, more strategic use of your most valuable resource: your people.

The impact of AI isn't just about deflecting simple questions. It is materially changing the speed, quality, and economics of high-volume financial operations. This shift is creating a clear divide between firms that embrace intelligent automation and those who fall behind.

The Undeniable ROI of Intelligent Automation

The data tells a compelling story. Agents assisted by AI can resolve customer issues 47% faster and achieve a 25% higher first-contact resolution rate. For simpler inquiries, automation can cut response times by as much as 69%. Some firms have even reported speed improvements of nearly 99.4% after implementing AI for front-line support tasks. All told, AI customer service deployments are delivering up to 8x ROI, with an average return of around $3.50 for every $1 invested. You can discover more about these customer service statistics and what they mean for the industry.

These numbers create direct, measurable advantages for your business.

Drastically Lower Cost-to-Serve: Automating tasks reduces the hours of manual work needed for each case, which directly cuts your operational expenses.

Improved SLA Adherence: AI operates consistently within your defined business rules, ensuring rock-solid compliance with service-level agreements.

Enhanced Customer Satisfaction: Faster resolutions and round-the-clock availability lead to happier customers and better retention rates.

Ultimately, bringing AI into your operations is less about the technology itself and more about building a resilient operational foundation. It’s about creating a system where human expertise is amplified, not replaced, letting your organization scale efficiently without compromising on quality or compliance. For a deeper look at this model, check out our guide on how businesses are using AI in business operations to gain a competitive edge.

How AI Is Reshaping Insurance Claims Processing

Picture this: a policyholder’s basement floods, and they pull out their phone to file a claim. Instead of waiting in a queue for a human agent, an AI instantly kicks off the process. This isn't science fiction; it’s the new reality of AI customer service and a complete overhaul of the claims lifecycle.

For AI insurance companies, this is more than just a fancy upgrade. It's about fundamentally re-engineering the entire journey, from that initial report all the way to the final payout, to cut down on friction and keep policyholders happy when it matters most.

Automating the First Notice of Loss

The first point of contact after an incident is make-or-break for the customer experience. This step used to be a bottleneck filled with manual data entry and frustrating delays. Today, AI agents can engage with a customer right away, collecting all the crucial details through a simple, conversational chat.

The AI instantly cross-references policy information with your core systems, confirms coverage, and walks the policyholder through capturing photos and videos of the damage. What used to take days now takes minutes, setting a completely different tone for the rest of the claims process.

Speeding Up Damage Assessment and Reviews

With the initial information gathered, the real magic of claims AI reviews begins. Sophisticated algorithms analyze the photos and videos to generate a preliminary damage estimate. By comparing the new images against a massive historical dataset of similar claims, the AI can assess the extent of the damage and predict repair costs with surprising accuracy.

This data-driven approach removes the guesswork and inconsistency that often come with human-only assessments. It gives adjusters a solid, unbiased starting point, freeing them up to focus their expertise on verifying the details and handling the truly complex decisions.

Every piece of data and every action is logged automatically, creating a perfect audit trail. This not only speeds up the cycle time but also significantly reduces the chances of human error and helps flag potentially fraudulent claims early on.

The image below shows how this shift toward automation directly improves key business metrics—cost, speed, and return on investment.

As you can see, implementing AI isn't just about modernizing; it's about delivering measurable operational gains across the entire claims value chain.

Driving Efficiency from Triage to Payout

The AI's job doesn't stop after the initial review. It continues to manage the workflow, and for simple, clear-cut claims that fit predefined rules, it can even process the payment automatically. This "touchless" handling of low-complexity claims is a massive boost to efficiency.

So, how does this look in practice? The table below breaks down the before-and-after of a typical claims journey.

Traditional vs AI-Powered Claims Processing

Claims Stage | Traditional Manual Process | AI-Automated Process (e.g., Nolana) | Key Benefit |

|---|---|---|---|

First Notice of Loss (FNOL) | Phone calls, emails, manual data entry; wait times of hours or days. | Instant engagement via chatbot/app; guided data collection. | Immediate response, reduced administrative load. |

Data Verification | Manual lookup in multiple systems to verify policy and coverage. | Automated, real-time verification against core insurance platforms. | 100% accuracy, zero delays. |

Damage Assessment | On-site adjuster visit or manual review of photos; subjective. | AI analyzes images/videos, generates initial estimate in minutes. | Faster evaluation, objective and consistent analysis. |

Adjudication & Routing | Claim sits in a queue, manually assigned to an available adjuster. | Simple claims are auto-approved; complex cases routed to specialists. | Dramatically reduced cycle times, efficient resource use. |

Settlement & Payout | Manual payment processing, often taking days or weeks. | Automated payment triggers for approved "touchless" claims. | Instant settlement, improved customer satisfaction. |

This side-by-side comparison makes it clear: AI automation transforms a linear, delay-prone process into a fast, intelligent, and customer-centric workflow.

For more complex situations, the AI assembles a complete digital file and routes it to the right human adjuster, who gets all the context needed to make a quick, informed decision. This intelligent partnership is the future of AI customer care in insurance, blending the raw speed of automation with the nuanced expertise of seasoned professionals. By offloading the high-volume, repetitive work, AI allows your best people to focus on being strategic problem-solvers. For a deeper dive, check out our guide on insurance claims processing automation.

This model is no longer an experiment; it's essential infrastructure. By 2025, analysts expect that 85% of all customer interactions will be managed without a human agent. Better still, AI-powered service can slash operational costs by around 30%—a major win for the bottom line. This shift proves that AI doesn't just meet customer demands for speed; it delivers real financial benefits.

Elevating Customer Care in Banking and Finance

It’s not just the insurance world getting a shake-up. AI customer care is making a huge impact in banking and finance, where everything hinges on speed, security, and ironclad compliance. Today’s banking clients live in an always-on world; they expect instant answers and 24/7 access, something human teams alone simply can't scale to provide. AI is stepping in to bridge that gap and is fundamentally changing the client experience.

Let's be clear: this isn't about replacing the human touch in financial advice or relationship management. Far from it. This is about handing off the high-volume, repetitive tasks that clog up the system. AI agents can tackle everything from simple account balance questions and transaction disputes to more involved processes like client onboarding and Know Your Customer (KYC) checks, all while following regulatory rules to the letter.

Meeting Modern Customer Expectations

Your customers have a new set of expectations, and AI customer service is perfectly built to meet them. They want immediate, accurate help that respects their time. The numbers don't lie. One recent survey found that 73% of shoppers believe AI could make their customer experience better, and a massive 80% of those who've actually used AI support called the interaction a positive one.

What’s driving this? Speed and convenience. The same study showed 51% of consumers prefer bots for immediate service, and over 62% turn to AI chat for simple questions. You can read the full research on evolving AI customer service expectations to get a deeper dive.

But speed without substance is just frustrating. The data also reveals that 75% of consumers have been annoyed by a fast AI response that didn't actually solve their problem. This is where modern AI agents are different. They don't just point you to a generic FAQ page; they integrate directly with core banking systems to give real answers and get things done in the moment.

The goal is to create interactions that are not only fast but also contextual and conclusive. An effective AI agent understands the customer's history, accesses their account details securely, and resolves their issue on the first try, building trust and loyalty.

This is what turns a basic chatbot into a real operational asset. True AI customer care is about resolution, not just deflection.

Creating Seamless Human-AI Collaboration

Even the smartest AI has its limits, and knowing those limits is crucial. A well-designed system knows exactly when to pass a complex or sensitive conversation to a human expert. For instance, if a customer is disputing a large, unusual transaction or is clearly getting frustrated, the AI agent can escalate the case in a heartbeat.

This isn’t a system failure; it’s a core feature. The AI neatly packages the entire conversation history—every question asked, every detail verified—and hands it over to the human agent. This creates a seamless transition with zero loss of context, so the customer never has to repeat themselves. The human expert can then jump in with the empathy and nuanced judgment needed for those high-stakes conversations.

This collaborative model gives you the best of both worlds:

For the Customer: They get instant help for most things and a fast, informed handoff to a person when they need one.

For the Institution: You see a massive boost in operational efficiency, keep costs in check, and free up your best people for the work that truly requires their expertise.

This intelligent partnership lets financial institutions deliver amazing service at scale, all without losing the personal connection that builds lasting relationships. To learn more about this approach, explore our detailed article on the capabilities of modern AI agents for customer service.

Implementing AI with Confidence and Control

For any leader in banking or insurance, the thought of automating high-stakes processes can set off alarm bells. Risk and compliance aren't just boxes to check; they're the bedrock of the industry. So, when we talk about deploying AI customer service, the conversation has to start with control.

This isn't about handing over the keys and hoping for the best. Far from it. The new generation of enterprise AI is built with robust guardrails from the very beginning, giving you complete oversight. The real goal is to build a digital workforce that acts as a fully compliant extension of your team, trained on your playbooks and bound by your rules.

Building a Compliant AI Operation

Achieving true operational control means putting a practical framework in place—one that stands up to the scrutiny of both internal auditors and external regulators. This comes down to establishing a few essential pillars of trust and security.

Modern AI platforms designed for financial services aren't mysterious black boxes. They are transparent engines built with accountability in mind, featuring built-in controls to provide this very assurance.

You should look for platforms that offer:

Immutable Audit Trails: Every single action an AI agent takes—whether it's looking up a policy detail or processing a payment—is logged permanently. This creates a concrete, unchangeable record perfect for claims AI reviews or regulatory deep dives.

Role-Based Access Controls: You wouldn't give a new human hire access to everything on day one. The same principle applies here. You define precisely what data and systems an AI agent can touch, keeping it securely within its designated operational lane.

Data Privacy and Security: The best platforms are engineered to meet strict standards like SOC 2 Type II and GDPR. This ensures that sensitive customer information is always handled with the highest degree of protection.

A compliant AI operation is one where you have total visibility into every decision. It's about ensuring the AI adheres to the same strict standards you hold for your human team, making it a reliable and auditable part of your workflow.

The Importance of Human Escalation Paths

Perhaps the most critical safety net in any AI customer care system is a smart, seamless path for human escalation. No AI is infallible, and a well-built system not only recognizes its limits but knows exactly when to tag in a human expert.

The process should feel effortless. When an AI agent hits a scenario outside its programming—a particularly complex insurance claim or a uniquely sensitive customer complaint—it doesn't just freeze. Instead, it automatically packages the entire case, complete with the full conversation history and context, and routes it to the right person. For AI insurance companies, this guarantees that high-stakes claims always benefit from the nuanced judgment of a seasoned adjuster.

This human-in-the-loop model gives you the best of both worlds. You get the speed and efficiency of automation for routine work, paired with the critical thinking and empathy of your best people for the moments that matter most.

Of course, getting the technology right is only part of the equation; success also hinges on selecting the right information technology partner for deployment and ongoing support. And for teams that want to build these intelligent workflows without a heavy lift from developers, a modern platform is key. You can learn more about how to create and manage these compliant digital workers by exploring a no-code AI agent builder.

Your Roadmap to AI-Powered Operations

Getting from an idea to a live AI system that actually drives value demands a clear, practical plan. A successful roadmap for AI customer service doesn't kick off with a tech wish list. It starts by zeroing in on your biggest operational headaches and the ripest opportunities for a quick win.

For AI insurance companies, the claims process is almost always the best place to start. The initial goal is to offload the high-volume, low-complexity tasks that bog down your adjusters. By automating these first, you deliver faster resolutions for policyholders and create measurable efficiencies that build internal support for what comes next.

Start with High-Impact Use Cases

Before you do anything else, you need to pinpoint the exact workflows where automation will make the biggest difference. Don't try to solve every problem at once. Look for processes that are both highly repetitive and absolutely critical to your customer's experience.

Here are a few proven starting points:

Automating Insurance Claims with AI: Go right for the First Notice of Loss (FNOL). An AI agent can handle the initial data intake, policy verification, and document gathering 24/7. This gives customers an immediate response during a stressful moment and eliminates a huge chunk of manual data entry for your team.

Enhancing Financial Services Customer Care: Target the common, yet time-draining, inquiries. Think transaction disputes or routine Know Your Customer (KYC) updates. Automating these frees your skilled human agents to focus on the more complex, relationship-focused conversations where they add the most value.

Define Your Wins and Plan the Plumbing

Once you've picked your starting point, get specific about what success looks like. Are you trying to cut claim cycle time by 30%? Or maybe your goal is to boost first-contact resolution for banking questions by 25%? You have to set clear, measurable goals to prove the value of the investment.

Next, you need to think about integration from day one. An AI agent is useless if it can't access your core systems. Your roadmap has to map out how you'll connect the AI platform to your systems of record, whether that’s Guidewire for claims or your main banking platform. This is the "plumbing" that allows the AI to handle a task from start to finish, rather than just answering simple questions.

The most effective AI rollouts I've seen all share a common thread: they start with a focused, phased approach. Secure an early victory—like dramatically improving claims AI reviews—and you'll have tangible ROI to show for it. That success builds the business case to expand AI customer care into other parts of the organization, turning a massive project into a series of smart, manageable steps.

Frequently Asked Questions About AI in Finance

Stepping into the world of AI-powered customer service is bound to bring up some tough questions, especially for leaders in banking and insurance who operate under tight regulations. Let's tackle some of the most common concerns about how this technology works in practice, from system integration to the role of your human experts.

How Does AI Actually Connect to Our Core Systems?

This is probably the number one question I hear from banks and AI insurance companies. You've spent years, maybe decades, building your operations around core platforms like Guidewire or Salesforce. The good news is, you don't have to rip and replace anything.

Think of a modern AI platform not as a replacement, but as an intelligent layer that works with the systems you already have.

It connects through secure APIs, giving it the ability to read and write information in real-time. This means an AI agent can pull up policy details, log notes in a customer record, or kick off a workflow, all while using your existing system as the single source of truth. It’s about enhancing what you have, not starting from scratch.

What Happens When the AI Gets Stuck?

This is a crucial point and speaks to how these systems are designed from the ground up. An enterprise-grade AI customer care platform isn't just set loose to handle things on its own. A core part of its programming is knowing when to ask for help.

We build in specific triggers for a seamless handoff to a human expert. For example, if a claim comes in over a certain dollar amount, or if a customer's sentiment indicates high frustration, the AI doesn't guess. It immediately routes the entire conversation, along with all the context it has gathered, to the right person on your team.

This ensures the customer never has to repeat their story, and your expert can step in precisely when their judgment is needed most.

The goal is never 100% automation. It’s about creating an intelligent partnership where AI handles the high-volume, repetitive work, freeing up your experts to focus on the complex, high-value situations that truly require a human touch.

How Do You Audit an AI’s Decisions?

For any financial institution, this is non-negotiable. Compliance and auditability have to be baked in from day one. A well-designed AI operating system solves this by creating an unchangeable record of every single action the AI agent takes.

Total Transparency: Every data point it touches, every task it completes, and every message it sends is logged in a detailed audit trail.

Compliance by Design: The AI is trained on your business rules. Its actions are a direct reflection of your approved procedures, which keeps it aligned with both internal policies and external regulations.

Simple to Review: This complete record-keeping means your compliance team can pull up any case and see exactly what happened, from start to finish. In many ways, it offers a more reliable and granular view than you get with manual processes.

This built-in transparency provides the detailed records you need for internal reviews, claims AI reviews, and satisfying regulators. It’s how you gain the speed and efficiency of automation without ever giving up control.

Ready to see how compliant AI agents can automate your most complex workflows? Nolana deploys an AI-native operating system built for high-stakes financial services operations, connecting to your core systems to deliver end-to-end automation with clear guardrails and seamless human oversight. Learn more at https://nolana.com.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP