Explore ai customer service chatbot to Transform Finance CX & ROI

Explore ai customer service chatbot to Transform Finance CX & ROI

See how ai customer service chatbot automates claims, boosts CX, and ensures compliance in finance and insurance. Learn implementation tips and ROI.

Customers today, especially in banking and insurance, expect service on their terms—instant, around the clock, and on any device. Whether it’s a simple balance inquiry or the start of a complex insurance claim, they want it handled now. For most institutions, traditional customer service just can’t keep up, leading to frustrated customers and ballooning operational costs.

This guide is about a different approach: treating an AI customer service chatbot as a highly skilled digital team member, not just a glorified FAQ.

The New Frontline for Banks and Insurers

The first point of contact for a bank or insurer isn't always a person in a call center or a local branch anymore. It's the digital interface on a customer's phone or laptop, and it never closes.

People expect immediate help, whether they're reporting a minor car accident late on a Saturday night or flagging a strange credit card charge while on vacation. This "always-on" expectation creates a serious challenge for banks and ai insurance companies trying to deliver great service without breaking the budget.

Traditional support models, with their 9-to-5 hours and manual workflows, simply can't handle the volume or the speed required. The result? Annoyed customers and lost chances to strengthen relationships. This is precisely why financial institutions are turning to automation for their most critical customer interactions.

Why Standard Chatbots Fail in Finance

The simple, scripted chatbots you see on e-commerce sites are completely out of their depth in a regulated industry like finance. They’re fine for answering "Where is my order?", but they stumble the moment a conversation involves multiple steps, security, and strict compliance rules.

A true AI customer service chatbot for this world is much more than a script-follower; it's a trained digital agent.

These advanced AI agents are built to carry out specific, end-to-end business procedures with total precision. They can manage complex tasks that require strict adherence to your company's operational and regulatory protocols.

Insurance Claims Intake: An AI agent can kick off the First Notice of Loss (FNOL) process right when an incident happens. It guides the policyholder through submitting photos and incident details, instantly verifies their coverage, and creates the case file—all without human intervention. This is a core function for automating insurance claims with AI.

Banking Identity Verification: Instead of putting a customer on hold, an AI agent can securely verify their identity through an automated, conversational flow to approve a high-value transaction or unblock an account, enhancing customer care with AI for financial services.

Loan Application Guidance: The AI can walk a client through filling out a loan application, making sure every required document is uploaded and all fields are completed correctly before it ever lands on an underwriter's desk.

This isn't just about answering questions anymore. It's about getting things done. AI agents don't just provide information; they perform compliant, auditable actions that push critical business processes forward.

By automating these repetitive, high-volume workflows, financial institutions can free up their human experts to handle the nuanced, high-stakes work that requires real empathy and strategic thinking. This shift is a core part of the industry’s wider evolution.

To get a better sense of the big picture, it's helpful to understand the key drivers behind financial services digital transformation. From here, we'll dive into how you can automate these exact processes and, just as importantly, measure the real-world ROI.

What Exactly Is an Enterprise AI Chatbot?

When most people hear the word "chatbot," they picture the simple pop-up on a retail site asking, "How can I help you?" That's a far cry from the enterprise AI customer service chatbot built for the high-stakes world of banking and insurance. Think of a basic chatbot as a receptionist with a fixed script—it can only answer a few questions it's been explicitly programmed to recognize.

An enterprise AI agent, on the other hand, is more like a highly trained junior associate who has memorized your company's entire operational playbook. These systems don't just talk; they act. They are built from the ground up to execute complex, multi-step tasks within the secure and regulated framework you already operate in. This is what truly separates a simple conversational tool from a powerful automation engine.

Core Capabilities That Go Beyond Conversation

The real value of an enterprise AI agent is its ability to understand context, connect systems, and execute tasks. It moves past simple Q&A to become a genuine participant in your core business processes—a non-negotiable for AI insurance companies and banks where precision and compliance are everything.

This is all made possible through a few key functions:

Natural Language Understanding (NLU): The agent doesn't just look for keywords; it grasps a customer's real intent. So, whether someone says, "I need to file a claim," or, "I was in an accident," the AI understands the underlying goal and kicks off the correct workflow.

System Integration via APIs: This is where the magic happens. The AI agent connects directly to your core systems. It can query a claims platform like Guidewire, pull customer data from Salesforce, or create a support ticket in ServiceNow, acting as a secure bridge between the customer and your internal infrastructure.

End-to-End Task Execution: This is the most important differentiator. The AI agent can manage an entire business process from start to finish. For example, it can handle a complete First Notice of Loss (FNOL) intake for an insurance claim, guiding the policyholder through every single step without needing a human.

An enterprise AI agent's primary job isn't to chat—it's to resolve. It's an operational tool that uses conversation as the interface to get work done efficiently and compliantly, which has a direct impact on the quality of AI customer care.

To get the most out of these sophisticated systems, it’s not just about the technology itself, but how you communicate with it. Effectively guiding an AI requires a specific skill set, and mastering prompt engineering is essential for ensuring your agent delivers precise and helpful service every time.

Traditional Chatbots vs Enterprise AI Agents

Putting these two technologies side-by-side really clarifies the difference. One is built for basic information retrieval, while the other is an operational workhorse designed for complex execution—a critical distinction when looking at claims AI reviews.

Here's a look at how they stack up.

Capability | Traditional Chatbot (e.g., FAQ Bot) | Enterprise AI Agent (e.g., Nolana) |

|---|---|---|

Primary Function | Answers predefined questions based on a script. | Executes multi-step, end-to-end business processes. |

Integration | Limited or no connection to core business systems. | Deeply integrated with systems like Guidewire, Duck Creek, and Salesforce via APIs. |

Task Complexity | Handles simple, single-turn queries like "What are your hours?" | Manages complex workflows like FNOL intake or KYC verification. |

Adaptability | Follows a rigid decision tree; struggles with unexpected queries. | Uses NLU to understand intent and adapts the conversation dynamically. |

Auditability | Basic chat logs. | Creates a complete, unchangeable audit trail of every interaction and action. |

This comparison shows a fundamental shift in how we should think about automated interactions. We're moving away from a passive, informational model and toward an active, executional one.

For a deeper dive into the technology powering these interactions, you can learn more about conversational AI in our detailed guide. This foundational knowledge is key to understanding how you can automate high-stakes processes like insurance claims and financial transactions safely and effectively.

Automating Insurance Claims with AI Agents

Let's be honest: the traditional insurance claims process is a headache. For a policyholder who just had a car accident or a pipe burst in their home, the last thing they want is a slow, clunky, and confusing process to get help. And for insurers, this initial friction point is a huge operational drag, tying up skilled adjusters with repetitive data collection.

This is where a purpose-built AI agent completely changes the game. It is the key to automating insurance claims with AI, turning a multi-day ordeal into a matter of minutes. This isn't just a chatbot that answers questions; it's a digital worker that executes the critical first steps of a claim with speed and precision, any time of day or night.

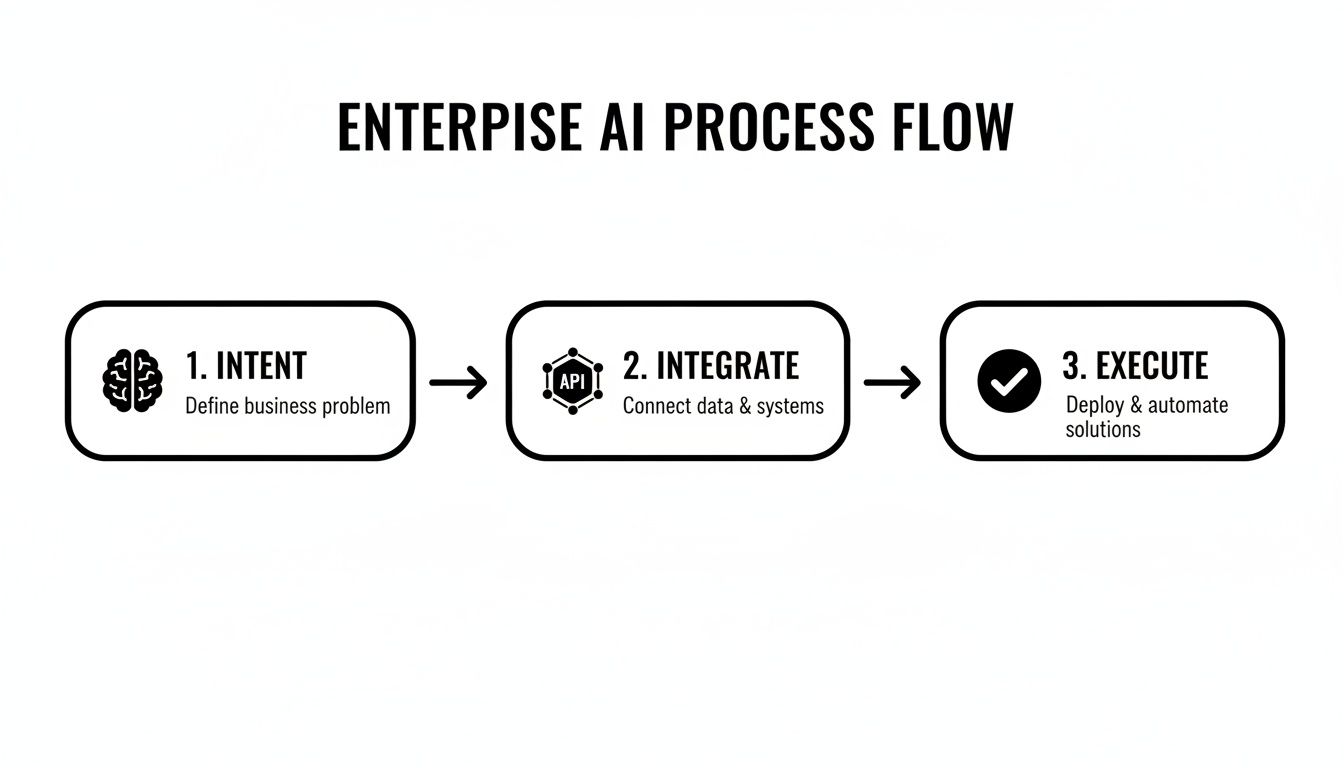

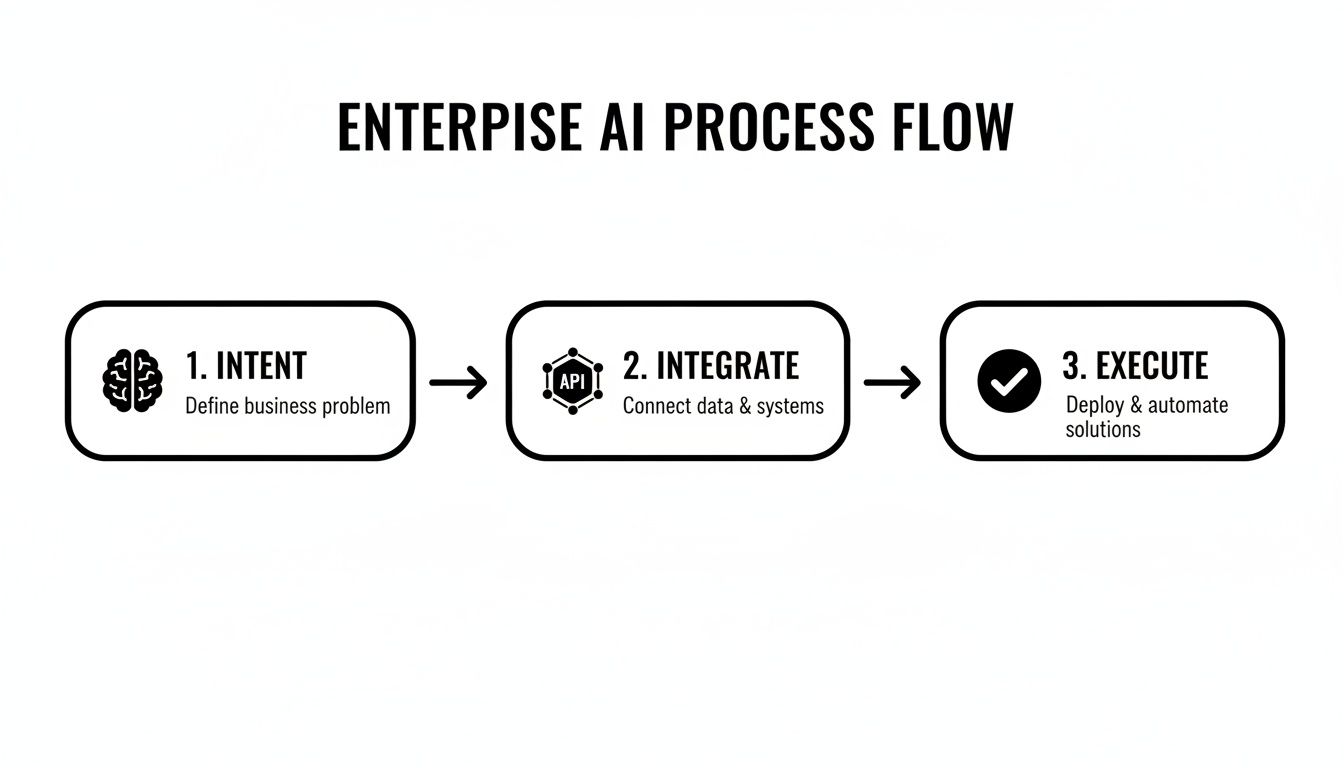

The power behind this automation is a clear, three-stage workflow that allows the AI agent to understand the customer's goal, connect to the right systems, and take action.

This flow highlights a critical distinction: the agent's primary function isn't just to talk, but to do. It’s this focus on operational execution that makes it so valuable for high-stakes industries like insurance.

A Real-World Claims Scenario

Picture this: your policyholder, Sarah, gets into a minor fender-bender at 10 PM on a Friday. Instead of stewing about it all weekend and waiting for business hours on Monday, she opens your mobile app and starts a chat.

Instant Understanding: Sarah types, "I was in an accident and need to start a claim." The AI agent immediately recognizes her intent and kicks off the FNOL workflow. It asks for key details—date, time, location—in a simple, conversational way.

Guided Evidence Collection: Next, the agent walks Sarah through submitting evidence right in the chat. "Please upload a few photos of the damage," it might say, followed by prompts for her driver's license and the other party's info. This guided process ensures you get all the necessary documents correctly on the first try.

Core System Integration and Case Creation: Behind the scenes, the AI is already at work. As Sarah provides information, the agent connects via API to your core claims system, whether it’s Duck Creek or Guidewire. It instantly verifies her policy, confirms her coverage, and once all the info is validated, it creates a new claim file and gives her a claim number.

The entire exchange takes minutes. Sarah hangs up with a claim number and peace of mind. She didn't have to wait on hold, repeat her story, or decipher a confusing web form. For the insurer, the process has begun without any human intervention, setting a positive tone right from a moment of high stress.

Enhancing the Accuracy of Claims Reviews

A fair question about automation is always, "What about accuracy?" How can you trust an automated system to gather information correctly? This is where an enterprise-grade AI agent provides another layer of value, especially in preparing the case for a human adjuster.

The AI agent isn't just passing along raw data; it's a pre-processor that structures all the submitted information—photos, statements, policy data—into a clean, organized, and actionable file for more accurate claims AI reviews.

Flagging Inconsistencies: The AI can spot potential issues for human review, like a blurry photo of a license plate or a conflict in the incident description.

Structuring Unstructured Data: It takes all the submitted materials and organizes them logically, saving an adjuster the time of piecing everything together.

Running Completeness Checks: Before creating the case, the agent ensures every required field in the FNOL is filled out, cutting down on the frustrating back-and-forth that plagues manual claims.

This intelligent pre-processing means that when a human adjuster finally opens the file, they're not starting from zero. They're jumping in with a complete, validated, and neatly organized record. This allows them to focus their expertise where it truly matters: on complex tasks like assessing liability and negotiating settlements.

This blend of 24/7 automation and intelligent assistance is what makes the technology so powerful for AI insurance companies. It frees up your most skilled professionals from low-value administrative work, which has a direct and positive impact on your operational efficiency and customer experience.

By getting the initial, most time-consuming stage of a claim handled instantly, insurers can dramatically reduce cycle times—a key driver of both cost savings and customer satisfaction. To see how leading carriers are putting this into practice, you can get a comprehensive look at the various applications of AI in insurance claims. This approach doesn't just fix a broken process; it transforms the claims journey from a point of friction into a genuine opportunity to build trust.

How AI Is Reshaping Customer Care in Financial Services

While automating an insurance claim is a clear win for an AI customer service chatbot, its impact on banking and other financial services runs even deeper. Here, the game isn't about handling a single, high-stakes event. It’s about managing a continuous relationship built on a foundation of trust, security, and effortless convenience. Banks and financial firms are now looking past simple balance inquiries and using AI to deliver exceptional customer care with AI for financial services, navigating the complex, sensitive conversations that define a modern customer relationship.

This shift is all about balancing exceptional service with ironclad compliance. AI agents are becoming the new front line for critical banking operations, turning processes that were once major headaches for customers and huge operational drains for banks into smooth, efficient interactions.

High-Impact Use Cases in Banking

In the world of finance, an AI agent's worth is proven by its ability to run compliant workflows that make a customer’s life easier and improve the bank’s bottom line. The real goal is to make complicated processes feel simple, secure, and fast.

Here are a few areas where this is already happening:

Streamlining KYC Onboarding: We all know Know Your Customer (KYC) processes are a regulatory must, but they often make for a clunky and frustrating start to a new banking relationship. An AI agent can act as a concierge, guiding new clients through every step—prompting for document uploads, running initial validation checks, and building the case file for final human sign-off.

Managing Real-Time Fraud Alerts: When a fraud alert hits, a customer needs immediate answers and decisive action. An AI agent can engage them instantly, verify transaction details, and, if needed, freeze the account and kick off a dispute—all within a secure, conversational chat. No waiting on hold.

Guiding Loan Applications: The path to getting a loan is notoriously complex and full of potential pitfalls. An AI agent serves as a personal guide, helping applicants gather the correct documents, fill out forms properly, and understand what comes next. This dramatically cuts down on application errors and speeds up processing times.

The benefit here is twofold. Customers get faster, more transparent service whenever they need it. At the same time, the bank boosts operational efficiency and significantly reduces the risk of human error in tasks where compliance is non-negotiable.

Weaving a Truly Unified Omnichannel Experience

The gold standard for AI customer care is creating a seamless experience, no matter how a customer decides to get in touch. A well-designed AI customer service chatbot acts as the central hub connecting all these different channels, ensuring the context of a conversation is never lost. This is precisely where integrations with platforms like Salesforce and Genesys become indispensable.

Think about it from the customer’s perspective. Someone starts asking about a loan on their mobile banking app. The AI agent helps them with the initial questions but eventually reaches a point where a human loan officer needs to step in.

Instead of making the customer start all over again—the ultimate frustration—the AI executes a warm handoff. The entire chat history, along with the customer’s profile from Salesforce and their interaction data from Genesys, is instantly packaged and sent to the human agent. The loan officer sees everything and can pick up the conversation exactly where the AI left off. That’s how you create a unified, intelligent experience that shows customers you value their time. It's a cornerstone of any effective AI customer experience strategy.

The results of this integrated approach speak for themselves. Customer satisfaction is on the rise, with 69% of companies reporting better service quality after bringing in AI chatbots. This translates to satisfaction boosts of 12-27%, driven by more personalized interactions. In fact, 73% of shoppers say AI improves their experience, and 62% actually prefer bots to people when speed is the priority—thanks to responses that are, on average, 47% faster.

Building Your Blueprint for Compliant AI Integration

For any bank or one of the growing number of AI insurance companies, bringing in new technology isn't just about moving faster—it’s about maintaining control. The biggest roadblocks to adopting an AI customer service chatbot always come down to risk, governance, and auditability. Leaders need to know, with absolute certainty, that automated actions are held to the same exacting standards as their human teams.

This is where the fear of a "black box" AI just doesn't apply anymore. Enterprise AI isn't some mysterious, uncontrollable force. It’s a precision instrument built from the ground up for heavily regulated industries. The entire system is designed for transparency, giving you the controls to create an irrefutable record of every single action.

Training AI on Your Playbook

The bedrock of a compliant AI agent is its training data. This isn't a consumer chatbot that scraped its knowledge from the public internet. A true enterprise AI learns from your specific Standard Operating Procedures (SOPs). It digests your internal playbooks, your scripts, and your precise workflows for handling everything from a simple policy question to a complex fraud alert.

This approach ensures the AI doesn’t just guess what to do; it knows how your organization does it. Every response it gives and every task it completes is a direct reflection of your approved, compliant processes. That’s non-negotiable for delivering reliable AI customer care in financial services.

A compliant AI agent is a mirror of your best-trained employee. It follows the rules, documents its work, and never deviates from the approved procedure, guaranteeing consistency at a scale humans cannot match.

Guardrails and Intelligent Escalation

No automated system should ever have free rein. A core component of any enterprise-grade AI platform is a set of strict guardrails—predefined boundaries that dictate exactly what the AI can and cannot do.

If a customer's request veers outside that scope, like a highly emotional complaint or a tricky legal question, the system is designed to stop. But it doesn't just fail and frustrate the customer. This is where intelligent human escalation kicks in. The AI performs a seamless handoff to a live agent, transferring the full conversation history and context. The customer never has to repeat themselves, and your team member has everything they need to take over.

When you're ready to integrate AI, finding the right partner is half the battle. Properly selecting the right information technology company is critical for building these complex escalation paths and ensuring your integrations are secure from day one.

Ensuring Auditability and Compliance

For regulators and internal auditors, "we think it's compliant" simply won't cut it. You need proof. A properly architected AI system provides a complete, unchangeable audit trail for every single interaction. Every message, every system call, and every action the AI takes is logged and time-stamped.

This meticulous record-keeping is crucial for meeting key compliance standards:

GDPR: The platform has to manage personal data according to strict privacy rules, with clear records of consent and data processing activities.

SOC 2 Type II: This certification demonstrates that the system maintains high standards for security, availability, confidentiality, and privacy over an extended period.

This complete audit trail gives your risk and compliance officers total visibility. It allows them to conduct thorough claims AI reviews and prove that every automated process is working exactly as designed. The whole point is to build for transparency, giving you the hard evidence needed to satisfy auditors and show stakeholders that you're always in control.

Measuring Success and Calculating ROI

Bringing an AI customer service chatbot into your operations is a serious investment. So, how do you know if it's actually paying off? For banks and insurers, success isn't just about technical wins; it has to be measured in real business terms. We need to move past simple metrics like how many tickets were deflected and zero in on the key performance indicators (KPIs) that really move the needle on operational health and customer loyalty.

The key is to translate the tech's benefits into a tangible return on investment (ROI). This isn't just for a report—it's what you'll need to justify the project and make the case for scaling it up.

A solid measurement framework starts by tracking the KPIs that your financial leaders actually care about. Instead of just counting deflected tickets, you need to show the real-world impact on your core processes.

Key Metrics for Financial Services

Reduced Claims Cycle Time: How much faster does a claim get from First Notice of Loss to settlement? Shorter cycles don't just cut administrative costs; they're a massive driver of policyholder satisfaction.

Lower Cost Per Interaction: This is a straightforward comparison. Calculate the exact cost of a fully automated interaction versus one handled by a person. The difference gives you a clear picture of direct operational savings.

Improved Customer Satisfaction (CSAT): Don't guess. Survey customers right after they interact with your AI agent. High CSAT scores are hard proof that the AI is providing effective and positive AI customer care.

Higher First Contact Resolution (FCR): What percentage of issues does the AI agent solve on its own, without escalating to a human? A high FCR rate is a direct measure of the agent's competence and efficiency.

The ultimate goal here is to connect these operational improvements directly to financial outcomes. A 20% reduction in claims cycle time isn't just a nice-to-have. It directly lowers operational overhead and frees up your experienced adjusters to focus on the most complex cases, which flows right to the bottom line.

Calculating Your Return on Investment

Calculating the ROI gives you the definitive proof of your AI agent's value. The formula is simple enough: weigh the total cost of implementation against the financial gains you’re seeing from operational savings and new business value. These savings often show up faster than you’d think, especially when you look at the cost-efficiency of automated interactions.

Let's talk numbers. AI chatbots are fundamentally changing the economics of customer service by slashing operational costs. On average, businesses see savings of around 30% on support expenses just by automating routine inquiries. The cost per interaction can drop to as low as $0.50, which is a tiny fraction of what human-led support costs. This can lead to an impressive ROI of $3.50 for every $1 invested, with the best implementations hitting returns as high as 8x.

Specifically in our world, financial services leaders report average cost reductions of 25%, freeing up significant budget that can be put toward strategic growth. You can find more data on AI's impact on customer service costs on desk365.io.

When you ground your analysis in hard data from claims AI reviews and CSAT scores, you build a powerful, undeniable case for how automation drives real business growth. To see a detailed example of this in action, check out our case study on transforming insurance claims processing with Agentic AI.

Frequently Asked Questions

It’s only natural to have questions when you’re thinking about bringing an AI customer service chatbot into a highly regulated environment. Here are some of the most common ones we hear from leaders across banking and insurance.

How Can an AI Chatbot Possibly Handle a Complex Insurance Claim?

It’s a fair question, but enterprise-grade AI agents are a world away from the simple FAQ bots you might be used to. Think of them less as a script-follower and more as a highly-trained digital team member.

We train the AI on your company’s exact claims processing Standard Operating Procedures (SOPs). It then plugs directly into your core systems to securely access policy data. This allows the agent to guide customers through submitting a First Notice of Loss (FNOL) and even run the initial validation checks automatically.

This doesn't replace your adjusters; it empowers them. By automating the tedious, repetitive data collection, it frees up your human experts to focus their time on the complex investigation and settlement decisions that truly matter. This approach speeds up the entire claims lifecycle for AI insurance companies.

The AI agent essentially becomes the digital front door for every new claim, making sure all the necessary information is gathered and structured perfectly before a human adjuster even opens the file. This is fundamental to running accurate and efficient claims AI reviews.

What Happens When the AI Gets Stuck and Can't Solve a Problem?

This is a critical point. A well-designed system always has a clear and seamless path to a human expert. We build in specific "guardrails" that define the absolute limits of what the AI is allowed to handle on its own.

When a customer's issue gets too complex, requires a level of empathy only a person can provide, or simply falls outside its pre-defined scope, the AI agent instantly hands off the entire conversation.

The key here is that it’s not a cold transfer. The AI routes the interaction to the right human agent and passes along the full context and customer history. Your customer never has to repeat themselves, which is a cornerstone of quality AI customer care.

How Can We Be Sure an AI Chatbot Stays Compliant?

For industries like ours, compliance isn't just a feature—it has to be part of the system's DNA. It’s built in from the very beginning, not bolted on as an afterthought. This is managed through a few core principles working together:

Training on Approved Procedures: The AI is trained exclusively on your company's approved SOPs. This means every action it takes is a direct reflection of your internal governance and best practices.

Strict Data Governance: The platform is built to enforce rigorous data handling protocols, designed to meet standards like GDPR and SOC 2 Type II.

Immutable Audit Trails: Every single interaction and decision is meticulously logged. This creates a detailed, unchangeable audit trail that gives you total transparency for internal reviews or regulatory inquiries.

This approach ensures the AI is a fully auditable tool under your control, not an unpredictable "black box."

Ready to see how compliant AI agents can automate your most critical operations? Nolana deploys enterprise AI trained on your procedures to execute tasks in claims, case management, and customer service. Schedule a demo today.

Customers today, especially in banking and insurance, expect service on their terms—instant, around the clock, and on any device. Whether it’s a simple balance inquiry or the start of a complex insurance claim, they want it handled now. For most institutions, traditional customer service just can’t keep up, leading to frustrated customers and ballooning operational costs.

This guide is about a different approach: treating an AI customer service chatbot as a highly skilled digital team member, not just a glorified FAQ.

The New Frontline for Banks and Insurers

The first point of contact for a bank or insurer isn't always a person in a call center or a local branch anymore. It's the digital interface on a customer's phone or laptop, and it never closes.

People expect immediate help, whether they're reporting a minor car accident late on a Saturday night or flagging a strange credit card charge while on vacation. This "always-on" expectation creates a serious challenge for banks and ai insurance companies trying to deliver great service without breaking the budget.

Traditional support models, with their 9-to-5 hours and manual workflows, simply can't handle the volume or the speed required. The result? Annoyed customers and lost chances to strengthen relationships. This is precisely why financial institutions are turning to automation for their most critical customer interactions.

Why Standard Chatbots Fail in Finance

The simple, scripted chatbots you see on e-commerce sites are completely out of their depth in a regulated industry like finance. They’re fine for answering "Where is my order?", but they stumble the moment a conversation involves multiple steps, security, and strict compliance rules.

A true AI customer service chatbot for this world is much more than a script-follower; it's a trained digital agent.

These advanced AI agents are built to carry out specific, end-to-end business procedures with total precision. They can manage complex tasks that require strict adherence to your company's operational and regulatory protocols.

Insurance Claims Intake: An AI agent can kick off the First Notice of Loss (FNOL) process right when an incident happens. It guides the policyholder through submitting photos and incident details, instantly verifies their coverage, and creates the case file—all without human intervention. This is a core function for automating insurance claims with AI.

Banking Identity Verification: Instead of putting a customer on hold, an AI agent can securely verify their identity through an automated, conversational flow to approve a high-value transaction or unblock an account, enhancing customer care with AI for financial services.

Loan Application Guidance: The AI can walk a client through filling out a loan application, making sure every required document is uploaded and all fields are completed correctly before it ever lands on an underwriter's desk.

This isn't just about answering questions anymore. It's about getting things done. AI agents don't just provide information; they perform compliant, auditable actions that push critical business processes forward.

By automating these repetitive, high-volume workflows, financial institutions can free up their human experts to handle the nuanced, high-stakes work that requires real empathy and strategic thinking. This shift is a core part of the industry’s wider evolution.

To get a better sense of the big picture, it's helpful to understand the key drivers behind financial services digital transformation. From here, we'll dive into how you can automate these exact processes and, just as importantly, measure the real-world ROI.

What Exactly Is an Enterprise AI Chatbot?

When most people hear the word "chatbot," they picture the simple pop-up on a retail site asking, "How can I help you?" That's a far cry from the enterprise AI customer service chatbot built for the high-stakes world of banking and insurance. Think of a basic chatbot as a receptionist with a fixed script—it can only answer a few questions it's been explicitly programmed to recognize.

An enterprise AI agent, on the other hand, is more like a highly trained junior associate who has memorized your company's entire operational playbook. These systems don't just talk; they act. They are built from the ground up to execute complex, multi-step tasks within the secure and regulated framework you already operate in. This is what truly separates a simple conversational tool from a powerful automation engine.

Core Capabilities That Go Beyond Conversation

The real value of an enterprise AI agent is its ability to understand context, connect systems, and execute tasks. It moves past simple Q&A to become a genuine participant in your core business processes—a non-negotiable for AI insurance companies and banks where precision and compliance are everything.

This is all made possible through a few key functions:

Natural Language Understanding (NLU): The agent doesn't just look for keywords; it grasps a customer's real intent. So, whether someone says, "I need to file a claim," or, "I was in an accident," the AI understands the underlying goal and kicks off the correct workflow.

System Integration via APIs: This is where the magic happens. The AI agent connects directly to your core systems. It can query a claims platform like Guidewire, pull customer data from Salesforce, or create a support ticket in ServiceNow, acting as a secure bridge between the customer and your internal infrastructure.

End-to-End Task Execution: This is the most important differentiator. The AI agent can manage an entire business process from start to finish. For example, it can handle a complete First Notice of Loss (FNOL) intake for an insurance claim, guiding the policyholder through every single step without needing a human.

An enterprise AI agent's primary job isn't to chat—it's to resolve. It's an operational tool that uses conversation as the interface to get work done efficiently and compliantly, which has a direct impact on the quality of AI customer care.

To get the most out of these sophisticated systems, it’s not just about the technology itself, but how you communicate with it. Effectively guiding an AI requires a specific skill set, and mastering prompt engineering is essential for ensuring your agent delivers precise and helpful service every time.

Traditional Chatbots vs Enterprise AI Agents

Putting these two technologies side-by-side really clarifies the difference. One is built for basic information retrieval, while the other is an operational workhorse designed for complex execution—a critical distinction when looking at claims AI reviews.

Here's a look at how they stack up.

Capability | Traditional Chatbot (e.g., FAQ Bot) | Enterprise AI Agent (e.g., Nolana) |

|---|---|---|

Primary Function | Answers predefined questions based on a script. | Executes multi-step, end-to-end business processes. |

Integration | Limited or no connection to core business systems. | Deeply integrated with systems like Guidewire, Duck Creek, and Salesforce via APIs. |

Task Complexity | Handles simple, single-turn queries like "What are your hours?" | Manages complex workflows like FNOL intake or KYC verification. |

Adaptability | Follows a rigid decision tree; struggles with unexpected queries. | Uses NLU to understand intent and adapts the conversation dynamically. |

Auditability | Basic chat logs. | Creates a complete, unchangeable audit trail of every interaction and action. |

This comparison shows a fundamental shift in how we should think about automated interactions. We're moving away from a passive, informational model and toward an active, executional one.

For a deeper dive into the technology powering these interactions, you can learn more about conversational AI in our detailed guide. This foundational knowledge is key to understanding how you can automate high-stakes processes like insurance claims and financial transactions safely and effectively.

Automating Insurance Claims with AI Agents

Let's be honest: the traditional insurance claims process is a headache. For a policyholder who just had a car accident or a pipe burst in their home, the last thing they want is a slow, clunky, and confusing process to get help. And for insurers, this initial friction point is a huge operational drag, tying up skilled adjusters with repetitive data collection.

This is where a purpose-built AI agent completely changes the game. It is the key to automating insurance claims with AI, turning a multi-day ordeal into a matter of minutes. This isn't just a chatbot that answers questions; it's a digital worker that executes the critical first steps of a claim with speed and precision, any time of day or night.

The power behind this automation is a clear, three-stage workflow that allows the AI agent to understand the customer's goal, connect to the right systems, and take action.

This flow highlights a critical distinction: the agent's primary function isn't just to talk, but to do. It’s this focus on operational execution that makes it so valuable for high-stakes industries like insurance.

A Real-World Claims Scenario

Picture this: your policyholder, Sarah, gets into a minor fender-bender at 10 PM on a Friday. Instead of stewing about it all weekend and waiting for business hours on Monday, she opens your mobile app and starts a chat.

Instant Understanding: Sarah types, "I was in an accident and need to start a claim." The AI agent immediately recognizes her intent and kicks off the FNOL workflow. It asks for key details—date, time, location—in a simple, conversational way.

Guided Evidence Collection: Next, the agent walks Sarah through submitting evidence right in the chat. "Please upload a few photos of the damage," it might say, followed by prompts for her driver's license and the other party's info. This guided process ensures you get all the necessary documents correctly on the first try.

Core System Integration and Case Creation: Behind the scenes, the AI is already at work. As Sarah provides information, the agent connects via API to your core claims system, whether it’s Duck Creek or Guidewire. It instantly verifies her policy, confirms her coverage, and once all the info is validated, it creates a new claim file and gives her a claim number.

The entire exchange takes minutes. Sarah hangs up with a claim number and peace of mind. She didn't have to wait on hold, repeat her story, or decipher a confusing web form. For the insurer, the process has begun without any human intervention, setting a positive tone right from a moment of high stress.

Enhancing the Accuracy of Claims Reviews

A fair question about automation is always, "What about accuracy?" How can you trust an automated system to gather information correctly? This is where an enterprise-grade AI agent provides another layer of value, especially in preparing the case for a human adjuster.

The AI agent isn't just passing along raw data; it's a pre-processor that structures all the submitted information—photos, statements, policy data—into a clean, organized, and actionable file for more accurate claims AI reviews.

Flagging Inconsistencies: The AI can spot potential issues for human review, like a blurry photo of a license plate or a conflict in the incident description.

Structuring Unstructured Data: It takes all the submitted materials and organizes them logically, saving an adjuster the time of piecing everything together.

Running Completeness Checks: Before creating the case, the agent ensures every required field in the FNOL is filled out, cutting down on the frustrating back-and-forth that plagues manual claims.

This intelligent pre-processing means that when a human adjuster finally opens the file, they're not starting from zero. They're jumping in with a complete, validated, and neatly organized record. This allows them to focus their expertise where it truly matters: on complex tasks like assessing liability and negotiating settlements.

This blend of 24/7 automation and intelligent assistance is what makes the technology so powerful for AI insurance companies. It frees up your most skilled professionals from low-value administrative work, which has a direct and positive impact on your operational efficiency and customer experience.

By getting the initial, most time-consuming stage of a claim handled instantly, insurers can dramatically reduce cycle times—a key driver of both cost savings and customer satisfaction. To see how leading carriers are putting this into practice, you can get a comprehensive look at the various applications of AI in insurance claims. This approach doesn't just fix a broken process; it transforms the claims journey from a point of friction into a genuine opportunity to build trust.

How AI Is Reshaping Customer Care in Financial Services

While automating an insurance claim is a clear win for an AI customer service chatbot, its impact on banking and other financial services runs even deeper. Here, the game isn't about handling a single, high-stakes event. It’s about managing a continuous relationship built on a foundation of trust, security, and effortless convenience. Banks and financial firms are now looking past simple balance inquiries and using AI to deliver exceptional customer care with AI for financial services, navigating the complex, sensitive conversations that define a modern customer relationship.

This shift is all about balancing exceptional service with ironclad compliance. AI agents are becoming the new front line for critical banking operations, turning processes that were once major headaches for customers and huge operational drains for banks into smooth, efficient interactions.

High-Impact Use Cases in Banking

In the world of finance, an AI agent's worth is proven by its ability to run compliant workflows that make a customer’s life easier and improve the bank’s bottom line. The real goal is to make complicated processes feel simple, secure, and fast.

Here are a few areas where this is already happening:

Streamlining KYC Onboarding: We all know Know Your Customer (KYC) processes are a regulatory must, but they often make for a clunky and frustrating start to a new banking relationship. An AI agent can act as a concierge, guiding new clients through every step—prompting for document uploads, running initial validation checks, and building the case file for final human sign-off.

Managing Real-Time Fraud Alerts: When a fraud alert hits, a customer needs immediate answers and decisive action. An AI agent can engage them instantly, verify transaction details, and, if needed, freeze the account and kick off a dispute—all within a secure, conversational chat. No waiting on hold.

Guiding Loan Applications: The path to getting a loan is notoriously complex and full of potential pitfalls. An AI agent serves as a personal guide, helping applicants gather the correct documents, fill out forms properly, and understand what comes next. This dramatically cuts down on application errors and speeds up processing times.

The benefit here is twofold. Customers get faster, more transparent service whenever they need it. At the same time, the bank boosts operational efficiency and significantly reduces the risk of human error in tasks where compliance is non-negotiable.

Weaving a Truly Unified Omnichannel Experience

The gold standard for AI customer care is creating a seamless experience, no matter how a customer decides to get in touch. A well-designed AI customer service chatbot acts as the central hub connecting all these different channels, ensuring the context of a conversation is never lost. This is precisely where integrations with platforms like Salesforce and Genesys become indispensable.

Think about it from the customer’s perspective. Someone starts asking about a loan on their mobile banking app. The AI agent helps them with the initial questions but eventually reaches a point where a human loan officer needs to step in.

Instead of making the customer start all over again—the ultimate frustration—the AI executes a warm handoff. The entire chat history, along with the customer’s profile from Salesforce and their interaction data from Genesys, is instantly packaged and sent to the human agent. The loan officer sees everything and can pick up the conversation exactly where the AI left off. That’s how you create a unified, intelligent experience that shows customers you value their time. It's a cornerstone of any effective AI customer experience strategy.

The results of this integrated approach speak for themselves. Customer satisfaction is on the rise, with 69% of companies reporting better service quality after bringing in AI chatbots. This translates to satisfaction boosts of 12-27%, driven by more personalized interactions. In fact, 73% of shoppers say AI improves their experience, and 62% actually prefer bots to people when speed is the priority—thanks to responses that are, on average, 47% faster.

Building Your Blueprint for Compliant AI Integration

For any bank or one of the growing number of AI insurance companies, bringing in new technology isn't just about moving faster—it’s about maintaining control. The biggest roadblocks to adopting an AI customer service chatbot always come down to risk, governance, and auditability. Leaders need to know, with absolute certainty, that automated actions are held to the same exacting standards as their human teams.

This is where the fear of a "black box" AI just doesn't apply anymore. Enterprise AI isn't some mysterious, uncontrollable force. It’s a precision instrument built from the ground up for heavily regulated industries. The entire system is designed for transparency, giving you the controls to create an irrefutable record of every single action.

Training AI on Your Playbook

The bedrock of a compliant AI agent is its training data. This isn't a consumer chatbot that scraped its knowledge from the public internet. A true enterprise AI learns from your specific Standard Operating Procedures (SOPs). It digests your internal playbooks, your scripts, and your precise workflows for handling everything from a simple policy question to a complex fraud alert.

This approach ensures the AI doesn’t just guess what to do; it knows how your organization does it. Every response it gives and every task it completes is a direct reflection of your approved, compliant processes. That’s non-negotiable for delivering reliable AI customer care in financial services.

A compliant AI agent is a mirror of your best-trained employee. It follows the rules, documents its work, and never deviates from the approved procedure, guaranteeing consistency at a scale humans cannot match.

Guardrails and Intelligent Escalation

No automated system should ever have free rein. A core component of any enterprise-grade AI platform is a set of strict guardrails—predefined boundaries that dictate exactly what the AI can and cannot do.

If a customer's request veers outside that scope, like a highly emotional complaint or a tricky legal question, the system is designed to stop. But it doesn't just fail and frustrate the customer. This is where intelligent human escalation kicks in. The AI performs a seamless handoff to a live agent, transferring the full conversation history and context. The customer never has to repeat themselves, and your team member has everything they need to take over.

When you're ready to integrate AI, finding the right partner is half the battle. Properly selecting the right information technology company is critical for building these complex escalation paths and ensuring your integrations are secure from day one.

Ensuring Auditability and Compliance

For regulators and internal auditors, "we think it's compliant" simply won't cut it. You need proof. A properly architected AI system provides a complete, unchangeable audit trail for every single interaction. Every message, every system call, and every action the AI takes is logged and time-stamped.

This meticulous record-keeping is crucial for meeting key compliance standards:

GDPR: The platform has to manage personal data according to strict privacy rules, with clear records of consent and data processing activities.

SOC 2 Type II: This certification demonstrates that the system maintains high standards for security, availability, confidentiality, and privacy over an extended period.

This complete audit trail gives your risk and compliance officers total visibility. It allows them to conduct thorough claims AI reviews and prove that every automated process is working exactly as designed. The whole point is to build for transparency, giving you the hard evidence needed to satisfy auditors and show stakeholders that you're always in control.

Measuring Success and Calculating ROI

Bringing an AI customer service chatbot into your operations is a serious investment. So, how do you know if it's actually paying off? For banks and insurers, success isn't just about technical wins; it has to be measured in real business terms. We need to move past simple metrics like how many tickets were deflected and zero in on the key performance indicators (KPIs) that really move the needle on operational health and customer loyalty.

The key is to translate the tech's benefits into a tangible return on investment (ROI). This isn't just for a report—it's what you'll need to justify the project and make the case for scaling it up.

A solid measurement framework starts by tracking the KPIs that your financial leaders actually care about. Instead of just counting deflected tickets, you need to show the real-world impact on your core processes.

Key Metrics for Financial Services

Reduced Claims Cycle Time: How much faster does a claim get from First Notice of Loss to settlement? Shorter cycles don't just cut administrative costs; they're a massive driver of policyholder satisfaction.

Lower Cost Per Interaction: This is a straightforward comparison. Calculate the exact cost of a fully automated interaction versus one handled by a person. The difference gives you a clear picture of direct operational savings.

Improved Customer Satisfaction (CSAT): Don't guess. Survey customers right after they interact with your AI agent. High CSAT scores are hard proof that the AI is providing effective and positive AI customer care.

Higher First Contact Resolution (FCR): What percentage of issues does the AI agent solve on its own, without escalating to a human? A high FCR rate is a direct measure of the agent's competence and efficiency.

The ultimate goal here is to connect these operational improvements directly to financial outcomes. A 20% reduction in claims cycle time isn't just a nice-to-have. It directly lowers operational overhead and frees up your experienced adjusters to focus on the most complex cases, which flows right to the bottom line.

Calculating Your Return on Investment

Calculating the ROI gives you the definitive proof of your AI agent's value. The formula is simple enough: weigh the total cost of implementation against the financial gains you’re seeing from operational savings and new business value. These savings often show up faster than you’d think, especially when you look at the cost-efficiency of automated interactions.

Let's talk numbers. AI chatbots are fundamentally changing the economics of customer service by slashing operational costs. On average, businesses see savings of around 30% on support expenses just by automating routine inquiries. The cost per interaction can drop to as low as $0.50, which is a tiny fraction of what human-led support costs. This can lead to an impressive ROI of $3.50 for every $1 invested, with the best implementations hitting returns as high as 8x.

Specifically in our world, financial services leaders report average cost reductions of 25%, freeing up significant budget that can be put toward strategic growth. You can find more data on AI's impact on customer service costs on desk365.io.

When you ground your analysis in hard data from claims AI reviews and CSAT scores, you build a powerful, undeniable case for how automation drives real business growth. To see a detailed example of this in action, check out our case study on transforming insurance claims processing with Agentic AI.

Frequently Asked Questions

It’s only natural to have questions when you’re thinking about bringing an AI customer service chatbot into a highly regulated environment. Here are some of the most common ones we hear from leaders across banking and insurance.

How Can an AI Chatbot Possibly Handle a Complex Insurance Claim?

It’s a fair question, but enterprise-grade AI agents are a world away from the simple FAQ bots you might be used to. Think of them less as a script-follower and more as a highly-trained digital team member.

We train the AI on your company’s exact claims processing Standard Operating Procedures (SOPs). It then plugs directly into your core systems to securely access policy data. This allows the agent to guide customers through submitting a First Notice of Loss (FNOL) and even run the initial validation checks automatically.

This doesn't replace your adjusters; it empowers them. By automating the tedious, repetitive data collection, it frees up your human experts to focus their time on the complex investigation and settlement decisions that truly matter. This approach speeds up the entire claims lifecycle for AI insurance companies.

The AI agent essentially becomes the digital front door for every new claim, making sure all the necessary information is gathered and structured perfectly before a human adjuster even opens the file. This is fundamental to running accurate and efficient claims AI reviews.

What Happens When the AI Gets Stuck and Can't Solve a Problem?

This is a critical point. A well-designed system always has a clear and seamless path to a human expert. We build in specific "guardrails" that define the absolute limits of what the AI is allowed to handle on its own.

When a customer's issue gets too complex, requires a level of empathy only a person can provide, or simply falls outside its pre-defined scope, the AI agent instantly hands off the entire conversation.

The key here is that it’s not a cold transfer. The AI routes the interaction to the right human agent and passes along the full context and customer history. Your customer never has to repeat themselves, which is a cornerstone of quality AI customer care.

How Can We Be Sure an AI Chatbot Stays Compliant?

For industries like ours, compliance isn't just a feature—it has to be part of the system's DNA. It’s built in from the very beginning, not bolted on as an afterthought. This is managed through a few core principles working together:

Training on Approved Procedures: The AI is trained exclusively on your company's approved SOPs. This means every action it takes is a direct reflection of your internal governance and best practices.

Strict Data Governance: The platform is built to enforce rigorous data handling protocols, designed to meet standards like GDPR and SOC 2 Type II.

Immutable Audit Trails: Every single interaction and decision is meticulously logged. This creates a detailed, unchangeable audit trail that gives you total transparency for internal reviews or regulatory inquiries.

This approach ensures the AI is a fully auditable tool under your control, not an unpredictable "black box."

Ready to see how compliant AI agents can automate your most critical operations? Nolana deploys enterprise AI trained on your procedures to execute tasks in claims, case management, and customer service. Schedule a demo today.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP