The New AI Customer Experience in Finance and Insurance

The New AI Customer Experience in Finance and Insurance

Discover how the AI customer experience is revolutionizing finance. Learn to automate insurance claims and banking care with compliant, efficient AI solutions.

Think of an expert apprentice, someone who studies your company's processes so deeply they can handle customer issues from the first call to the final resolution. This is the new reality of AI customer experience in finance. We've moved far beyond basic chatbots to intelligent agents that can manage complex, multi-step workflows like automating insurance claims or resolving a tricky banking dispute.

The New Standard in AI Customer Experience

Let's be honest, the old model of customer support is broken. Long queues, endless transfers, and repeating the same information over and over—it’s a frustrating experience that’s fast becoming a relic of the past. A smarter, more proactive system is taking its place, powered by AI agents trained on your specific business rules and operations. This isn't just about faster answers; it’s about resolving the customer's entire problem, often without needing a human touch.

This fundamental shift changes everything. For AI insurance companies, it means an AI agent can handle a First Notice of Loss (FNOL) report, instantly validate the policy, scan for potential fraud, and even trigger the payout for a straightforward claim. The entire process happens in minutes, not days, meeting the demand for the speed and transparency customers now expect.

To really grasp the difference, let's compare the old way with the new.

Traditional Support vs Modern AI Experience

Aspect | Traditional Customer Support | Modern AI Customer Experience |

|---|---|---|

Initial Contact | Long wait times, IVR menus, multiple transfers. | Instant engagement, 24/7 availability on any channel. |

Problem Solving | Follows rigid scripts, often requires escalation. | Understands context, executes complex multi-step tasks. |

Process Execution | Human agents manually enter data into multiple systems. | Autonomous execution directly in core systems like Guidewire or Salesforce. |

Human Role | Handles routine, repetitive queries. | Focuses on high-value, complex, or empathetic cases. |

Resolution Time | Can take days or weeks, multiple follow-ups needed. | Often resolved in a single interaction, within minutes. |

Consistency | Varies by agent skill and training. | 100% consistent and compliant with business rules. |

The table makes it clear: we're not just iterating on the old model, we're replacing it with something fundamentally better.

Automating High-Stakes Financial Operations

In banking and insurance, the stakes couldn't be higher. We're dealing with sensitive customer data, complex regulations, and zero room for error. The modern AI customer experience is engineered from the ground up to manage this complexity. Instead of just deflecting support tickets, these AI systems are built to get the job done.

Key capabilities now include:

End-to-end Process Execution: Taking a customer request from the initial touchpoint all the way to a final resolution logged in your core systems.

Informed Decision-Making: Applying your company's documented procedures and historical data to make judgments that are accurate and fully compliant.

Seamless Human Handoffs: Knowing exactly when to escalate a particularly complex or sensitive case to a human expert, providing the full context so the customer never has to repeat themselves.

This evolution is a game-changer for leaders who need to drive efficiency without compromising on governance. For a closer look at how AI is reshaping customer interactions specifically in the insurance world, this article offers some great insights: AI-Driven Customer Experience in Insurance Explained.

By automating the routine, high-volume tasks, AI agents free up your best people to focus on building customer relationships and solving the truly critical problems. It's the ideal partnership between human expertise and machine efficiency.

Ultimately, the goal of modern AI customer care isn't about replacing people—it's about empowering them. By taking on the procedural heavy lifting, AI enables financial institutions to deliver a far superior service that is both remarkably fast and incredibly accurate. This guide will walk you through how this is being done, from automating insurance claims to enhancing customer care in financial services, setting a new benchmark for what operational excellence looks like.

Automating Insurance Claims for Unmatched Efficiency

Anyone who's ever filed an insurance claim knows the drill: it’s slow, paper-heavy, and often deeply frustrating. You’re dealing with a stressful event, and the last thing you want is a clunky process filled with manual checks, endless data entry, and a whole lot of waiting. This is where an AI-driven customer experience really shines, turning what was once a multi-week ordeal into a fast, transparent resolution.

Picture this: a policyholder gets into a minor fender-bender. Instead of navigating a phone tree, they just open the insurer's app and snap a few photos of the damage. An AI agent immediately kicks off the First Notice of Loss (FNOL) process on its own. This isn't just a simple chatbot; it’s a sophisticated system built to handle sensitive financial tasks with precision.

The AI-Powered Claims Journey

From that first tap in the app, the AI agent orchestrates the entire workflow. It pulls key data from the photos and the customer's notes, instantly checks it against their policy details in a core system like Guidewire or Duck Creek, and confirms coverage in seconds. The system can even run a quick fraud analysis by scanning for red flags and comparing the claim against historical data patterns.

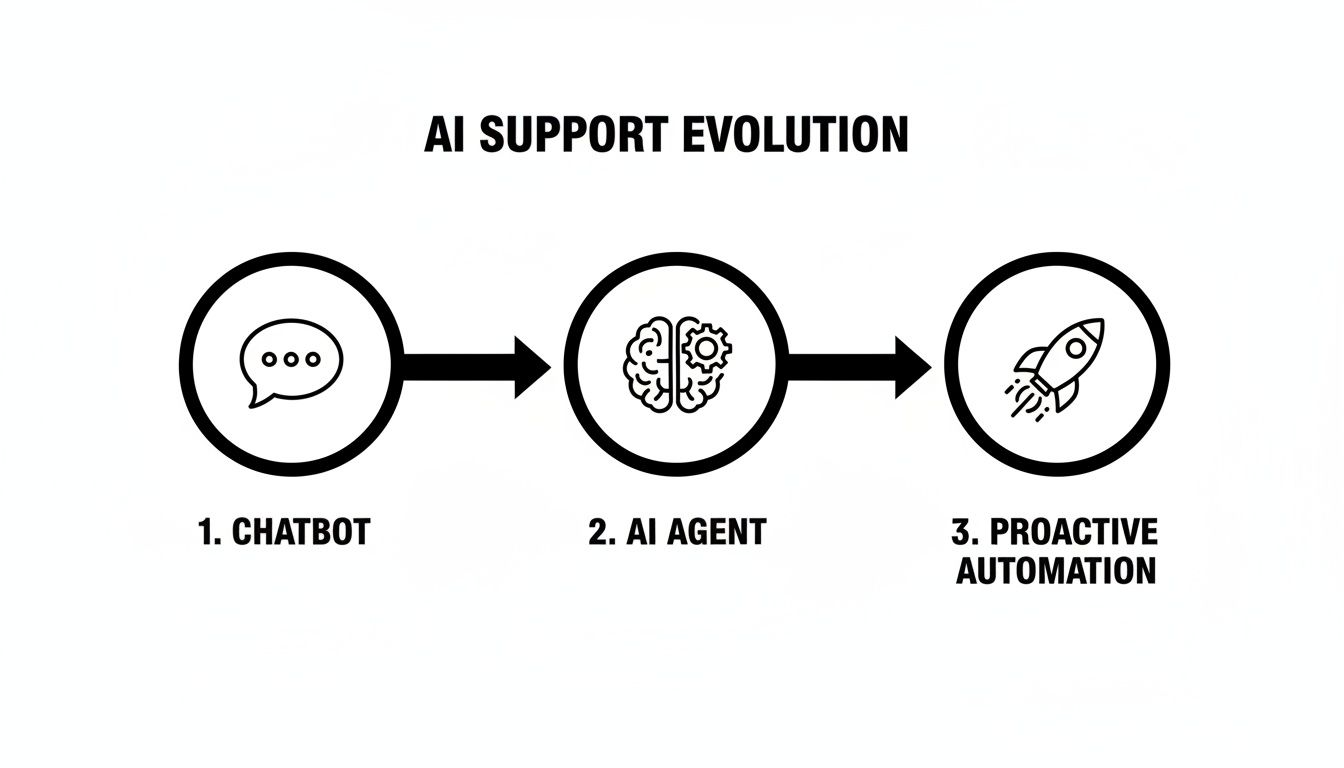

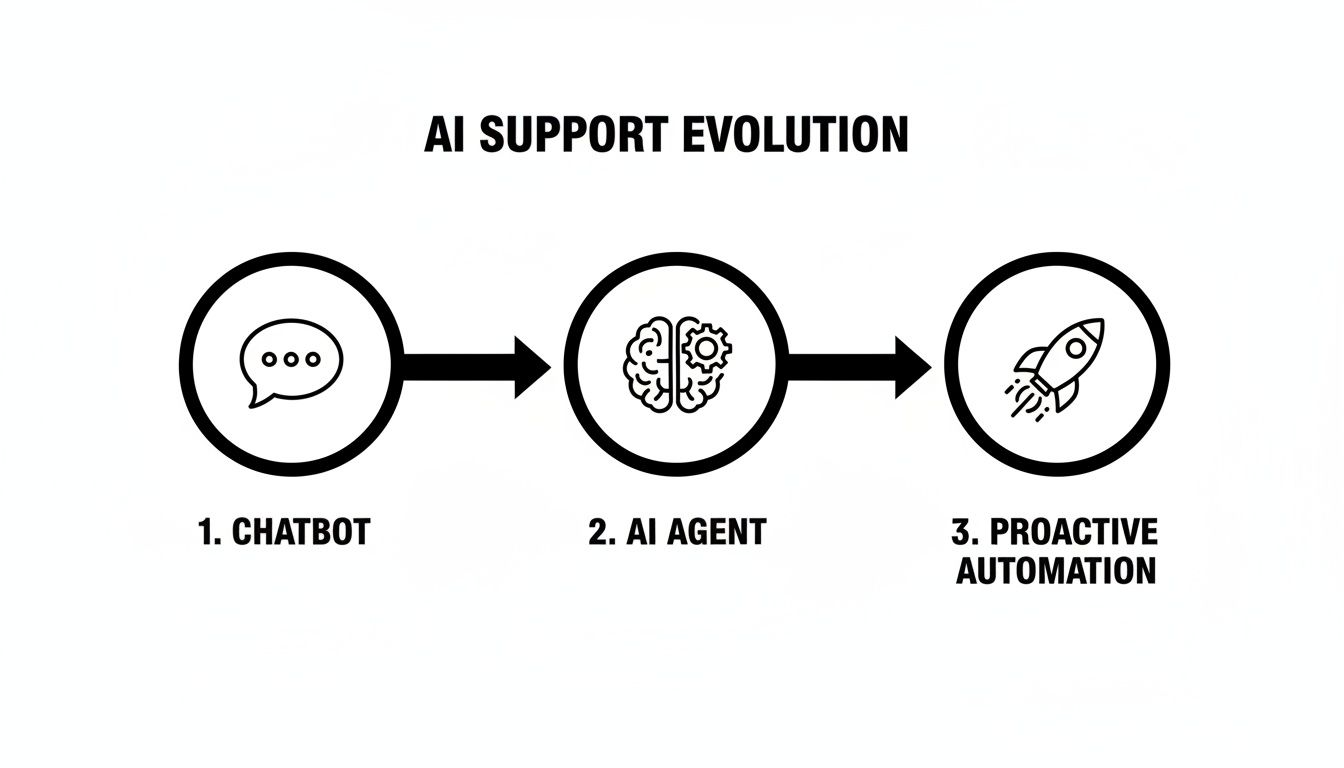

This whole process highlights a major shift in how AI support works, moving well beyond basic reactive bots toward fully autonomous agents that drive proactive automation.

As the diagram shows, the industry is leaving simple chatbots behind. We're now in the era of intelligent AI agents and, ultimately, systems that can proactively manage complex jobs from start to finish—exactly like modern claims handling.

For straightforward, low-cost claims, the process can be nearly instantaneous. The AI agent assesses the damage from the photos, calculates a repair estimate, and can even trigger the payment directly to the policyholder. This is a massive leap forward for AI insurance companies looking to boost both customer satisfaction and operational efficiency.

By automating the intake, validation, and payment for straightforward claims, insurers can slash their cycle times from weeks to just minutes. This not only gives customers a fantastic experience but also frees up human adjusters to focus on the complex, high-value cases that truly need their expertise and empathy.

Seamless Integration and Intelligent Escalation

Of course, not every claim is simple. The real strength of a top-tier AI customer experience platform is its ability to know its own limits. When an AI agent spots a major anomaly, flags a high probability of fraud, or comes across a claim that’s just too complex, it doesn’t just stop. It escalates.

The system smartly routes the case to a human adjuster, but it doesn't just dump the problem on their desk. It provides a complete, neatly summarized history of every action taken so far, so no context is lost. The adjuster gets a case file with all the preliminary legwork done, letting them make a fast, informed decision. This hybrid model gives you the best of both worlds: the raw speed of AI and the nuanced judgment of a human expert.

To make this work, the platform has to connect seamlessly with an insurer’s core systems. Critical integration points include:

Policy Administration Systems (e.g., Guidewire, Duck Creek): For verifying coverage, checking policy limits, and keeping records updated.

Customer Relationship Management (CRM) Systems (e.g., Salesforce): To maintain a single, complete view of every customer interaction.

Payment and Financial Systems: To handle the final payouts securely and efficiently.

This deep integration ensures every automated action is accurate, fully logged, and compliant. The result is a far more reliable and auditable claims process. As you can imagine, getting this right has a huge impact on both an insurer's bottom line and its reputation. To explore the technical side of this, you can learn more about the details of insurance claims processing automation in our comprehensive guide. Based on recent customer feedback and positive claims AI reviews, policyholders overwhelmingly prefer insurers who deliver this kind of fast, digital, and transparent experience.

How AI is Remaking Customer Care in Financial Services

In financial services, trust is everything. The speed and quality of every single interaction can either build that trust or erode it completely. The concept of an AI customer experience has grown up significantly; we're no longer talking about simple chatbots programmed to parrot FAQs. Today, intelligent AI agents are on the front lines of customer care with AI, handling high-stakes financial operations that, until recently, were strictly human territory.

This shift is most profound in complex, heavily regulated processes. Consider things like Know Your Customer (KYC) verifications, resolving a credit card dispute, or the initial review of a loan application. These aren't simple questions—they are intricate workflows demanding precision, compliance, and a perfect audit trail. This is precisely where modern AI customer care systems now shine.

Automating the High-Stakes Workflows

Let's walk through an example. A customer applies for a new credit card on your website. Instantly, an AI agent kicks off the verification process. It securely requests and collects the required documents from the applicant through a digital portal. If a document is blurry or missing, the agent messages the customer directly to resolve the issue, making sure the application is fully complete before it moves on.

As this happens, the agent is also running preliminary risk checks against your predefined business rules, flagging anything that might need a closer look from a human expert. The real game-changer is that these AI agents aren't just following a script; they are executing these tasks directly within your core banking systems. This direct system integration creates a tamper-proof audit log for every single action, which is a non-negotiable for regulatory compliance.

Key banking operations being reshaped by AI today include:

KYC and Onboarding: Automating document gathering, identity verification, and initial background checks to get new accounts opened faster.

Credit Card Dispute Resolution: Handling the entire chargeback workflow, from the customer’s initial report to gathering evidence and deciding on clear-cut cases.

Initial Loan Application Review: Running preliminary data validation and risk scoring, so loan officers only receive complete and accurate files.

Forging a Single, Intelligent View of the Customer

One of the biggest headaches in traditional banking support is fragmented information. A customer interacts with the mobile app, then the web portal, then calls an agent, and the data from each touchpoint lives in a different silo. It’s a recipe for a disjointed and frustrating customer journey.

A modern AI operating system fixes this by connecting directly with core banking and CRM platforms like Salesforce and ServiceNow. This creates a single, unified profile for every customer, ensuring that every interaction—whether with an AI or a human—is informed by the complete history of their relationship with the bank.

This data flow isn't a one-way street. The AI agent doesn't just pull information; it updates these systems in real-time as it works. When evaluating tools for this kind of digital overhaul, looking into platforms like Dynamics 365 Customer Service solutions can offer great insights into operational efficiency. For your human agents, this means that when a complex case lands on their desk, they see a complete, up-to-the-minute history. No more asking customers to repeat themselves.

The scale of this shift is already clear. In the fast-moving world of finance and insurance, AI is dramatically cutting down response times and improving satisfaction. Bank of America's virtual assistant, Erica, is a prime example. As of 2026, clients interact with her an incredible 56 million times a month. What's more, over 60% of those engagements are driven by proactive and personalized insights from the AI. This shows how powerfully AI can merge real-time personalization with the strict demands of a regulated industry.

At the end of the day, this elevated level of AI customer care delivers real business results: lower operational costs, stronger compliance, and a customer experience that builds the kind of trust and loyalty that lasts.

Finding the Right Balance: Human Expertise in an Automated World

Many leaders I talk to in financial services are worried that automation will create a cold, sterile experience for their customers. It's a legitimate concern, especially in an industry where trust is the ultimate currency. The truth is, the most effective AI customer experience strategies don't replace people—they empower them.

The goal is to build a hybrid model where AI and human agents work in tandem. Think of AI as the first line of defense, handling the high-volume, data-heavy tasks with incredible speed and accuracy. This could be anything from validating documents to checking on a policy detail. But the system is also smart enough to know its limits. When a situation becomes too complex or emotionally charged, it seamlessly passes the baton to a human expert.

This approach reframes AI as a powerful co-pilot, not a replacement. It absorbs the repetitive, administrative burden, freeing up your team to focus on what they do best: building relationships and solving complex problems.

The Real Risk of Over-Automation

Leaning too heavily on automation without a thoughtful escalation plan can seriously backfire. Customers dealing with a bank or an insurer are often in a vulnerable position, whether they're filing a claim or disputing a fraudulent charge. They need reassurance and nuanced understanding. If they hit a conversational brick wall with an AI that can't grasp their problem, frustration boils over.

The data paints a clear picture. While AI promises speed, a 2025 survey of over 600 U.S. consumers found that 75% have received fast AI responses that still left them completely frustrated. It turns out, customers value a complete resolution far more than a quick one—68% ranked it as their top priority. More telling is that nearly 90% of customers feel their loyalty wavers when human support is taken off the table, a key finding from the full customer service frustration report.

Designing a Seamless Handoff

The magic of a great hybrid model lies in the handoff. When an interaction moves from an AI to a human, the context must travel with it. The customer should never, ever have to repeat themselves.

When an AI agent escalates a case, it needs to pass along an organized summary of the entire interaction, including:

Customer Identity: Who they are and their account information.

Interaction History: A clear log of the conversation and any actions the AI has already taken.

The Core Problem: A concise summary of what the customer is trying to solve.

This single step is a game-changer. When a human agent gets the full context, they can jump right into problem-solving. It makes the customer feel heard and respected, turning a potentially frustrating moment into a unified, intelligent experience.

This is absolutely crucial for AI insurance companies, where a customer's emotional state can be incredibly high. Positive claims AI reviews almost always come down to the policyholder feeling understood and cared for—something only a human can truly deliver. By letting AI handle the paperwork, human adjusters have more time and energy to focus on that connection. For more on this, our guide on how to build rapport with customers is a great resource.

Ultimately, the best AI customer care systems are designed to amplify your team's skills, not replace them. By blending the efficiency of automation with the empathy of human expertise, you can deliver an experience that’s not just faster, but fundamentally better.

Building a Compliant and Secure AI Operations Framework

For any risk or compliance leader, the thought of implementing AI can feel like navigating a minefield. On one hand, you have the promise of a game-changing AI customer experience. On the other, the stakes couldn't be higher—crippling regulatory penalties, data breaches, and the kind of reputational damage that takes years to repair.

When you're deploying powerful automation in highly regulated industries like banking and insurance, you need a framework built on transparency, control, and rock-solid security from the very beginning. This isn't just about checking boxes on a compliance sheet; it's about building genuine, provable trust in your automated systems.

A robust governance framework ensures that every single action an AI agent takes is not only efficient but also accurate, auditable, and fully compliant with industry standards. Without it, even the most impressive technology is a ticking liability.

The Pillars of a Defensible AI Framework

To build an AI operation that can withstand regulatory scrutiny, you need more than good intentions. The system has to be built on specific, verifiable components, especially when you're an AI insurance company or a bank.

Transparent Guardrails: Your AI agents need to operate within clearly defined business rules. This gives you the control to set strict limits on what the AI can and can't do, ensuring it never oversteps its authority on sensitive tasks like approving a claim or processing a financial transaction.

Comprehensive Auditability: Every action, every decision, every piece of data an AI agent touches must be logged. This creates a perfect, end-to-end audit trail—an immutable, timestamped record that proves exactly what happened, when it happened, and why.

Ironclad Data Security: The entire platform has to protect sensitive customer data with enterprise-grade security protocols. Think data encryption, strict access controls, and full adherence to global privacy regulations.

These foundational elements are absolutely critical. For a deeper dive into navigating these challenges, our guide on operational risk management in banking offers some valuable context.

Why Explainable AI Is Non-Negotiable

One of the biggest red flags for regulators is the "black box" problem—an AI makes a decision, but no one can explain how it arrived at that conclusion. In finance or insurance, that’s a non-starter. This is precisely why explainable AI (XAI) is essential for any serious AI customer care platform.

XAI ensures that for every automated decision, there is a clear, human-understandable justification. Whether it’s flagging a claim for manual review or approving a wire transfer, you can trace the logic. This transparency is vital for internal audits and for maintaining trust. Customers need to know that claims AI reviews are fair and based on facts, not some unknowable algorithm.

A compliant AI platform must be able to answer one simple question for every action it takes: "Why did you do that?" If it can't, it's not ready for a regulated environment.

Finally, always check a vendor's credentials. Certifications like SOC 2 Type II and GDPR compliance aren't just marketing fluff. They are independent proof that a provider has undergone rigorous audits and is committed to the highest standards of data security and privacy. Choosing a platform with these certifications is a crucial first step toward building an AI framework you can actually depend on.

Your Roadmap to Implementing an AI Operating System

Turning a great AI strategy into a successful, on-the-ground reality requires a clear, practical roadmap. For leaders in financial services and insurance, this isn't just about plugging in new tech. It's about rethinking how your operations work to deliver a truly standout AI customer experience. A well-planned implementation is the difference between a flashy project and one that delivers real business value from the very start.

So, where do you begin? The key is to pinpoint high-impact use cases first. Forget about a massive, company-wide overhaul right away. Instead, find a specific, rule-based process that’s a known pain point—maybe it’s slow, expensive, or riddled with manual errors. This could be the initial intake for insurance claims or the tedious verification steps in customer onboarding. By focusing on a single, well-defined workflow, you can demonstrate a clear ROI quickly and build the momentum you need for broader adoption.

Once you’ve chosen your target, you have to define what success actually looks like. Will you measure it by slashing cycle times? Reducing error rates? Or maybe by watching customer satisfaction scores climb? Setting these benchmarks upfront is absolutely critical for proving the value of your investment and making smart, data-driven decisions as you expand.

Key Phases of AI Implementation

Implementing an AI operating system is a journey, not a light-switch moment. Taking a phased approach helps minimize disruption and dramatically increases your chances of success, especially in the complex, regulated worlds of AI insurance companies and banks.

Discovery and Planning: Start by identifying that one high-value workflow you want to automate. Map the existing process from end to end, establish your success metrics (KPIs), and get the right people in the room—a cross-functional team with experts from operations, IT, and compliance.

Training and Configuration: This is where the magic happens. You teach the AI agents your standard operating procedures (SOPs). The platform learns your business rules and securely connects to your core systems, whether it's Guidewire, Salesforce, or another platform, using APIs.

Testing and Validation: Before you go live, you need to put the AI agents through their paces in a controlled sandbox environment. This is your chance to validate their accuracy, test their decision-making logic, and fine-tune performance without any risk to your live operations.

Deployment and Monitoring: With testing complete, you can deploy the automated workflow. Monitor its performance closely against the KPIs you set earlier. Use this phase to gather real-world feedback and get ready to scale the solution to other parts of the business.

Following this kind of methodical approach ensures your AI customer care solution isn’t just powerful, but perfectly aligned with how your business actually runs.

Evaluating Vendors and Managing Change

Choosing the right technology partner is probably the single most important decision you'll make in this process. You have to look beyond the slick demos and focus on vendors with a proven track record in highly regulated industries. Your evaluation checklist should prioritize deep integration capabilities, a rock-solid compliance posture (like SOC 2 Type II certification), and the ability to handle complex, multi-step workflows.

A critical factor in selecting an AI vendor is their ability to demonstrate a clear path to value. Ask for case studies and references from companies with similar challenges. The best partners will work with you to build a solid business case before you ever sign a contract.

At the same time, you have to prepare your people for this shift. Don't underestimate the importance of change management. The key is to frame the AI agents not as replacements, but as collaborators—digital teammates that take on the repetitive, mundane tasks, which frees up your human experts to focus on the high-value, strategic work they were hired to do. For more on navigating this kind of change, our guide on financial services digital transformation offers a much deeper look.

Finally, consider the market context. The demand for agentic AI is exploding, projected to grow from $7.06 billion in 2025 to a massive $93.2 billion by 2032. But here’s the reality check: some studies show that as many as 95% of corporate AI projects fail to meet their objectives. This makes it absolutely essential to choose a robust platform built for regulated industries—one that can speed up your cycles and, according to recent customer experience statistics, help you become a leader in CX innovation.

Answering Your Key Questions About AI in Financial Services

As leaders in the financial world start looking seriously at AI, the same handful of questions always seem to pop up. Getting these answers right is the first step toward building the confidence needed to move forward and actually improve the customer experience with this technology.

It's a conversation that quickly moves beyond simple chatbots to discussing how sophisticated AI agents can handle complex, highly regulated tasks with incredible precision.

How Does AI Actually Improve Things Like Insurance Claims and Customer Care?

For AI insurance companies, the biggest and most immediate win is almost always in claims processing. Think about it: an AI agent can take over the entire initial intake process, from the First Notice of Loss (FNOL) all the way through policy validation and even flagging potential fraud. This can shrink cycle times from weeks down to just a few minutes for clear-cut cases. That's a massive boost to customer satisfaction and the kind of thing that generates positive claims AI reviews.

Over in banking, AI customer care is redefined by automating high-stakes processes like Know Your Customer (KYC) verification or credit card dispute resolution. We're not just talking about an AI that answers questions; these are agents that execute tasks directly in your core systems, all while creating a perfect, compliant audit trail for every single action.

The real shift here is moving from reactive support to proactive execution. AI doesn't just talk to customers—it solves their problems by doing the necessary operational work on its own, accurately and instantly.

What Is the Smartest Way to Get Started With AI?

Don't try to boil the ocean. The most successful approach we've seen is to pick one single, high-impact process and nail it. Find a workflow that's repetitive, follows a clear set of rules, and is a well-known bottleneck for your team. Initial claims intake and new customer onboarding are classic examples.

Focusing on one clear use case first allows you to:

Measure real ROI in terms of things like reduced processing times or fewer errors.

Build momentum internally by showcasing a quick and undeniable win.

Learn valuable lessons that will guide a more methodical and successful expansion into other areas of the business.

This strategy keeps the initial risk low while building a rock-solid business case for scaling your automation efforts with confidence.

Ready to see how compliant AI agents can automate your most critical operations? Explore how Nolana can transform your claims and case management workflows at https://nolana.com.

Think of an expert apprentice, someone who studies your company's processes so deeply they can handle customer issues from the first call to the final resolution. This is the new reality of AI customer experience in finance. We've moved far beyond basic chatbots to intelligent agents that can manage complex, multi-step workflows like automating insurance claims or resolving a tricky banking dispute.

The New Standard in AI Customer Experience

Let's be honest, the old model of customer support is broken. Long queues, endless transfers, and repeating the same information over and over—it’s a frustrating experience that’s fast becoming a relic of the past. A smarter, more proactive system is taking its place, powered by AI agents trained on your specific business rules and operations. This isn't just about faster answers; it’s about resolving the customer's entire problem, often without needing a human touch.

This fundamental shift changes everything. For AI insurance companies, it means an AI agent can handle a First Notice of Loss (FNOL) report, instantly validate the policy, scan for potential fraud, and even trigger the payout for a straightforward claim. The entire process happens in minutes, not days, meeting the demand for the speed and transparency customers now expect.

To really grasp the difference, let's compare the old way with the new.

Traditional Support vs Modern AI Experience

Aspect | Traditional Customer Support | Modern AI Customer Experience |

|---|---|---|

Initial Contact | Long wait times, IVR menus, multiple transfers. | Instant engagement, 24/7 availability on any channel. |

Problem Solving | Follows rigid scripts, often requires escalation. | Understands context, executes complex multi-step tasks. |

Process Execution | Human agents manually enter data into multiple systems. | Autonomous execution directly in core systems like Guidewire or Salesforce. |

Human Role | Handles routine, repetitive queries. | Focuses on high-value, complex, or empathetic cases. |

Resolution Time | Can take days or weeks, multiple follow-ups needed. | Often resolved in a single interaction, within minutes. |

Consistency | Varies by agent skill and training. | 100% consistent and compliant with business rules. |

The table makes it clear: we're not just iterating on the old model, we're replacing it with something fundamentally better.

Automating High-Stakes Financial Operations

In banking and insurance, the stakes couldn't be higher. We're dealing with sensitive customer data, complex regulations, and zero room for error. The modern AI customer experience is engineered from the ground up to manage this complexity. Instead of just deflecting support tickets, these AI systems are built to get the job done.

Key capabilities now include:

End-to-end Process Execution: Taking a customer request from the initial touchpoint all the way to a final resolution logged in your core systems.

Informed Decision-Making: Applying your company's documented procedures and historical data to make judgments that are accurate and fully compliant.

Seamless Human Handoffs: Knowing exactly when to escalate a particularly complex or sensitive case to a human expert, providing the full context so the customer never has to repeat themselves.

This evolution is a game-changer for leaders who need to drive efficiency without compromising on governance. For a closer look at how AI is reshaping customer interactions specifically in the insurance world, this article offers some great insights: AI-Driven Customer Experience in Insurance Explained.

By automating the routine, high-volume tasks, AI agents free up your best people to focus on building customer relationships and solving the truly critical problems. It's the ideal partnership between human expertise and machine efficiency.

Ultimately, the goal of modern AI customer care isn't about replacing people—it's about empowering them. By taking on the procedural heavy lifting, AI enables financial institutions to deliver a far superior service that is both remarkably fast and incredibly accurate. This guide will walk you through how this is being done, from automating insurance claims to enhancing customer care in financial services, setting a new benchmark for what operational excellence looks like.

Automating Insurance Claims for Unmatched Efficiency

Anyone who's ever filed an insurance claim knows the drill: it’s slow, paper-heavy, and often deeply frustrating. You’re dealing with a stressful event, and the last thing you want is a clunky process filled with manual checks, endless data entry, and a whole lot of waiting. This is where an AI-driven customer experience really shines, turning what was once a multi-week ordeal into a fast, transparent resolution.

Picture this: a policyholder gets into a minor fender-bender. Instead of navigating a phone tree, they just open the insurer's app and snap a few photos of the damage. An AI agent immediately kicks off the First Notice of Loss (FNOL) process on its own. This isn't just a simple chatbot; it’s a sophisticated system built to handle sensitive financial tasks with precision.

The AI-Powered Claims Journey

From that first tap in the app, the AI agent orchestrates the entire workflow. It pulls key data from the photos and the customer's notes, instantly checks it against their policy details in a core system like Guidewire or Duck Creek, and confirms coverage in seconds. The system can even run a quick fraud analysis by scanning for red flags and comparing the claim against historical data patterns.

This whole process highlights a major shift in how AI support works, moving well beyond basic reactive bots toward fully autonomous agents that drive proactive automation.

As the diagram shows, the industry is leaving simple chatbots behind. We're now in the era of intelligent AI agents and, ultimately, systems that can proactively manage complex jobs from start to finish—exactly like modern claims handling.

For straightforward, low-cost claims, the process can be nearly instantaneous. The AI agent assesses the damage from the photos, calculates a repair estimate, and can even trigger the payment directly to the policyholder. This is a massive leap forward for AI insurance companies looking to boost both customer satisfaction and operational efficiency.

By automating the intake, validation, and payment for straightforward claims, insurers can slash their cycle times from weeks to just minutes. This not only gives customers a fantastic experience but also frees up human adjusters to focus on the complex, high-value cases that truly need their expertise and empathy.

Seamless Integration and Intelligent Escalation

Of course, not every claim is simple. The real strength of a top-tier AI customer experience platform is its ability to know its own limits. When an AI agent spots a major anomaly, flags a high probability of fraud, or comes across a claim that’s just too complex, it doesn’t just stop. It escalates.

The system smartly routes the case to a human adjuster, but it doesn't just dump the problem on their desk. It provides a complete, neatly summarized history of every action taken so far, so no context is lost. The adjuster gets a case file with all the preliminary legwork done, letting them make a fast, informed decision. This hybrid model gives you the best of both worlds: the raw speed of AI and the nuanced judgment of a human expert.

To make this work, the platform has to connect seamlessly with an insurer’s core systems. Critical integration points include:

Policy Administration Systems (e.g., Guidewire, Duck Creek): For verifying coverage, checking policy limits, and keeping records updated.

Customer Relationship Management (CRM) Systems (e.g., Salesforce): To maintain a single, complete view of every customer interaction.

Payment and Financial Systems: To handle the final payouts securely and efficiently.

This deep integration ensures every automated action is accurate, fully logged, and compliant. The result is a far more reliable and auditable claims process. As you can imagine, getting this right has a huge impact on both an insurer's bottom line and its reputation. To explore the technical side of this, you can learn more about the details of insurance claims processing automation in our comprehensive guide. Based on recent customer feedback and positive claims AI reviews, policyholders overwhelmingly prefer insurers who deliver this kind of fast, digital, and transparent experience.

How AI is Remaking Customer Care in Financial Services

In financial services, trust is everything. The speed and quality of every single interaction can either build that trust or erode it completely. The concept of an AI customer experience has grown up significantly; we're no longer talking about simple chatbots programmed to parrot FAQs. Today, intelligent AI agents are on the front lines of customer care with AI, handling high-stakes financial operations that, until recently, were strictly human territory.

This shift is most profound in complex, heavily regulated processes. Consider things like Know Your Customer (KYC) verifications, resolving a credit card dispute, or the initial review of a loan application. These aren't simple questions—they are intricate workflows demanding precision, compliance, and a perfect audit trail. This is precisely where modern AI customer care systems now shine.

Automating the High-Stakes Workflows

Let's walk through an example. A customer applies for a new credit card on your website. Instantly, an AI agent kicks off the verification process. It securely requests and collects the required documents from the applicant through a digital portal. If a document is blurry or missing, the agent messages the customer directly to resolve the issue, making sure the application is fully complete before it moves on.

As this happens, the agent is also running preliminary risk checks against your predefined business rules, flagging anything that might need a closer look from a human expert. The real game-changer is that these AI agents aren't just following a script; they are executing these tasks directly within your core banking systems. This direct system integration creates a tamper-proof audit log for every single action, which is a non-negotiable for regulatory compliance.

Key banking operations being reshaped by AI today include:

KYC and Onboarding: Automating document gathering, identity verification, and initial background checks to get new accounts opened faster.

Credit Card Dispute Resolution: Handling the entire chargeback workflow, from the customer’s initial report to gathering evidence and deciding on clear-cut cases.

Initial Loan Application Review: Running preliminary data validation and risk scoring, so loan officers only receive complete and accurate files.

Forging a Single, Intelligent View of the Customer

One of the biggest headaches in traditional banking support is fragmented information. A customer interacts with the mobile app, then the web portal, then calls an agent, and the data from each touchpoint lives in a different silo. It’s a recipe for a disjointed and frustrating customer journey.

A modern AI operating system fixes this by connecting directly with core banking and CRM platforms like Salesforce and ServiceNow. This creates a single, unified profile for every customer, ensuring that every interaction—whether with an AI or a human—is informed by the complete history of their relationship with the bank.

This data flow isn't a one-way street. The AI agent doesn't just pull information; it updates these systems in real-time as it works. When evaluating tools for this kind of digital overhaul, looking into platforms like Dynamics 365 Customer Service solutions can offer great insights into operational efficiency. For your human agents, this means that when a complex case lands on their desk, they see a complete, up-to-the-minute history. No more asking customers to repeat themselves.

The scale of this shift is already clear. In the fast-moving world of finance and insurance, AI is dramatically cutting down response times and improving satisfaction. Bank of America's virtual assistant, Erica, is a prime example. As of 2026, clients interact with her an incredible 56 million times a month. What's more, over 60% of those engagements are driven by proactive and personalized insights from the AI. This shows how powerfully AI can merge real-time personalization with the strict demands of a regulated industry.

At the end of the day, this elevated level of AI customer care delivers real business results: lower operational costs, stronger compliance, and a customer experience that builds the kind of trust and loyalty that lasts.

Finding the Right Balance: Human Expertise in an Automated World

Many leaders I talk to in financial services are worried that automation will create a cold, sterile experience for their customers. It's a legitimate concern, especially in an industry where trust is the ultimate currency. The truth is, the most effective AI customer experience strategies don't replace people—they empower them.

The goal is to build a hybrid model where AI and human agents work in tandem. Think of AI as the first line of defense, handling the high-volume, data-heavy tasks with incredible speed and accuracy. This could be anything from validating documents to checking on a policy detail. But the system is also smart enough to know its limits. When a situation becomes too complex or emotionally charged, it seamlessly passes the baton to a human expert.

This approach reframes AI as a powerful co-pilot, not a replacement. It absorbs the repetitive, administrative burden, freeing up your team to focus on what they do best: building relationships and solving complex problems.

The Real Risk of Over-Automation

Leaning too heavily on automation without a thoughtful escalation plan can seriously backfire. Customers dealing with a bank or an insurer are often in a vulnerable position, whether they're filing a claim or disputing a fraudulent charge. They need reassurance and nuanced understanding. If they hit a conversational brick wall with an AI that can't grasp their problem, frustration boils over.

The data paints a clear picture. While AI promises speed, a 2025 survey of over 600 U.S. consumers found that 75% have received fast AI responses that still left them completely frustrated. It turns out, customers value a complete resolution far more than a quick one—68% ranked it as their top priority. More telling is that nearly 90% of customers feel their loyalty wavers when human support is taken off the table, a key finding from the full customer service frustration report.

Designing a Seamless Handoff

The magic of a great hybrid model lies in the handoff. When an interaction moves from an AI to a human, the context must travel with it. The customer should never, ever have to repeat themselves.

When an AI agent escalates a case, it needs to pass along an organized summary of the entire interaction, including:

Customer Identity: Who they are and their account information.

Interaction History: A clear log of the conversation and any actions the AI has already taken.

The Core Problem: A concise summary of what the customer is trying to solve.

This single step is a game-changer. When a human agent gets the full context, they can jump right into problem-solving. It makes the customer feel heard and respected, turning a potentially frustrating moment into a unified, intelligent experience.

This is absolutely crucial for AI insurance companies, where a customer's emotional state can be incredibly high. Positive claims AI reviews almost always come down to the policyholder feeling understood and cared for—something only a human can truly deliver. By letting AI handle the paperwork, human adjusters have more time and energy to focus on that connection. For more on this, our guide on how to build rapport with customers is a great resource.

Ultimately, the best AI customer care systems are designed to amplify your team's skills, not replace them. By blending the efficiency of automation with the empathy of human expertise, you can deliver an experience that’s not just faster, but fundamentally better.

Building a Compliant and Secure AI Operations Framework

For any risk or compliance leader, the thought of implementing AI can feel like navigating a minefield. On one hand, you have the promise of a game-changing AI customer experience. On the other, the stakes couldn't be higher—crippling regulatory penalties, data breaches, and the kind of reputational damage that takes years to repair.

When you're deploying powerful automation in highly regulated industries like banking and insurance, you need a framework built on transparency, control, and rock-solid security from the very beginning. This isn't just about checking boxes on a compliance sheet; it's about building genuine, provable trust in your automated systems.

A robust governance framework ensures that every single action an AI agent takes is not only efficient but also accurate, auditable, and fully compliant with industry standards. Without it, even the most impressive technology is a ticking liability.

The Pillars of a Defensible AI Framework

To build an AI operation that can withstand regulatory scrutiny, you need more than good intentions. The system has to be built on specific, verifiable components, especially when you're an AI insurance company or a bank.

Transparent Guardrails: Your AI agents need to operate within clearly defined business rules. This gives you the control to set strict limits on what the AI can and can't do, ensuring it never oversteps its authority on sensitive tasks like approving a claim or processing a financial transaction.

Comprehensive Auditability: Every action, every decision, every piece of data an AI agent touches must be logged. This creates a perfect, end-to-end audit trail—an immutable, timestamped record that proves exactly what happened, when it happened, and why.

Ironclad Data Security: The entire platform has to protect sensitive customer data with enterprise-grade security protocols. Think data encryption, strict access controls, and full adherence to global privacy regulations.

These foundational elements are absolutely critical. For a deeper dive into navigating these challenges, our guide on operational risk management in banking offers some valuable context.

Why Explainable AI Is Non-Negotiable

One of the biggest red flags for regulators is the "black box" problem—an AI makes a decision, but no one can explain how it arrived at that conclusion. In finance or insurance, that’s a non-starter. This is precisely why explainable AI (XAI) is essential for any serious AI customer care platform.

XAI ensures that for every automated decision, there is a clear, human-understandable justification. Whether it’s flagging a claim for manual review or approving a wire transfer, you can trace the logic. This transparency is vital for internal audits and for maintaining trust. Customers need to know that claims AI reviews are fair and based on facts, not some unknowable algorithm.

A compliant AI platform must be able to answer one simple question for every action it takes: "Why did you do that?" If it can't, it's not ready for a regulated environment.

Finally, always check a vendor's credentials. Certifications like SOC 2 Type II and GDPR compliance aren't just marketing fluff. They are independent proof that a provider has undergone rigorous audits and is committed to the highest standards of data security and privacy. Choosing a platform with these certifications is a crucial first step toward building an AI framework you can actually depend on.

Your Roadmap to Implementing an AI Operating System

Turning a great AI strategy into a successful, on-the-ground reality requires a clear, practical roadmap. For leaders in financial services and insurance, this isn't just about plugging in new tech. It's about rethinking how your operations work to deliver a truly standout AI customer experience. A well-planned implementation is the difference between a flashy project and one that delivers real business value from the very start.

So, where do you begin? The key is to pinpoint high-impact use cases first. Forget about a massive, company-wide overhaul right away. Instead, find a specific, rule-based process that’s a known pain point—maybe it’s slow, expensive, or riddled with manual errors. This could be the initial intake for insurance claims or the tedious verification steps in customer onboarding. By focusing on a single, well-defined workflow, you can demonstrate a clear ROI quickly and build the momentum you need for broader adoption.

Once you’ve chosen your target, you have to define what success actually looks like. Will you measure it by slashing cycle times? Reducing error rates? Or maybe by watching customer satisfaction scores climb? Setting these benchmarks upfront is absolutely critical for proving the value of your investment and making smart, data-driven decisions as you expand.

Key Phases of AI Implementation

Implementing an AI operating system is a journey, not a light-switch moment. Taking a phased approach helps minimize disruption and dramatically increases your chances of success, especially in the complex, regulated worlds of AI insurance companies and banks.

Discovery and Planning: Start by identifying that one high-value workflow you want to automate. Map the existing process from end to end, establish your success metrics (KPIs), and get the right people in the room—a cross-functional team with experts from operations, IT, and compliance.

Training and Configuration: This is where the magic happens. You teach the AI agents your standard operating procedures (SOPs). The platform learns your business rules and securely connects to your core systems, whether it's Guidewire, Salesforce, or another platform, using APIs.

Testing and Validation: Before you go live, you need to put the AI agents through their paces in a controlled sandbox environment. This is your chance to validate their accuracy, test their decision-making logic, and fine-tune performance without any risk to your live operations.

Deployment and Monitoring: With testing complete, you can deploy the automated workflow. Monitor its performance closely against the KPIs you set earlier. Use this phase to gather real-world feedback and get ready to scale the solution to other parts of the business.

Following this kind of methodical approach ensures your AI customer care solution isn’t just powerful, but perfectly aligned with how your business actually runs.

Evaluating Vendors and Managing Change

Choosing the right technology partner is probably the single most important decision you'll make in this process. You have to look beyond the slick demos and focus on vendors with a proven track record in highly regulated industries. Your evaluation checklist should prioritize deep integration capabilities, a rock-solid compliance posture (like SOC 2 Type II certification), and the ability to handle complex, multi-step workflows.

A critical factor in selecting an AI vendor is their ability to demonstrate a clear path to value. Ask for case studies and references from companies with similar challenges. The best partners will work with you to build a solid business case before you ever sign a contract.

At the same time, you have to prepare your people for this shift. Don't underestimate the importance of change management. The key is to frame the AI agents not as replacements, but as collaborators—digital teammates that take on the repetitive, mundane tasks, which frees up your human experts to focus on the high-value, strategic work they were hired to do. For more on navigating this kind of change, our guide on financial services digital transformation offers a much deeper look.

Finally, consider the market context. The demand for agentic AI is exploding, projected to grow from $7.06 billion in 2025 to a massive $93.2 billion by 2032. But here’s the reality check: some studies show that as many as 95% of corporate AI projects fail to meet their objectives. This makes it absolutely essential to choose a robust platform built for regulated industries—one that can speed up your cycles and, according to recent customer experience statistics, help you become a leader in CX innovation.

Answering Your Key Questions About AI in Financial Services

As leaders in the financial world start looking seriously at AI, the same handful of questions always seem to pop up. Getting these answers right is the first step toward building the confidence needed to move forward and actually improve the customer experience with this technology.

It's a conversation that quickly moves beyond simple chatbots to discussing how sophisticated AI agents can handle complex, highly regulated tasks with incredible precision.

How Does AI Actually Improve Things Like Insurance Claims and Customer Care?

For AI insurance companies, the biggest and most immediate win is almost always in claims processing. Think about it: an AI agent can take over the entire initial intake process, from the First Notice of Loss (FNOL) all the way through policy validation and even flagging potential fraud. This can shrink cycle times from weeks down to just a few minutes for clear-cut cases. That's a massive boost to customer satisfaction and the kind of thing that generates positive claims AI reviews.

Over in banking, AI customer care is redefined by automating high-stakes processes like Know Your Customer (KYC) verification or credit card dispute resolution. We're not just talking about an AI that answers questions; these are agents that execute tasks directly in your core systems, all while creating a perfect, compliant audit trail for every single action.

The real shift here is moving from reactive support to proactive execution. AI doesn't just talk to customers—it solves their problems by doing the necessary operational work on its own, accurately and instantly.

What Is the Smartest Way to Get Started With AI?

Don't try to boil the ocean. The most successful approach we've seen is to pick one single, high-impact process and nail it. Find a workflow that's repetitive, follows a clear set of rules, and is a well-known bottleneck for your team. Initial claims intake and new customer onboarding are classic examples.

Focusing on one clear use case first allows you to:

Measure real ROI in terms of things like reduced processing times or fewer errors.

Build momentum internally by showcasing a quick and undeniable win.

Learn valuable lessons that will guide a more methodical and successful expansion into other areas of the business.

This strategy keeps the initial risk low while building a rock-solid business case for scaling your automation efforts with confidence.

Ready to see how compliant AI agents can automate your most critical operations? Explore how Nolana can transform your claims and case management workflows at https://nolana.com.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP