How AI Customer Service Agents Transform Banking and Insurance

How AI Customer Service Agents Transform Banking and Insurance

Discover how an AI customer service agent delivers ROI, compliance, and superior customer care by automating insurance claims and banking operations.

An AI customer service agent isn't just another chatbot. Think of it as a highly trained digital employee, built to run entire workflows from start to finish. In high-stakes industries like finance and insurance, these agents do more than just answer questions—they're trained on your specific Standard Operating Procedures (SOPs) to understand requests, make decisions, and take direct action inside your core systems.

This represents a major leap, moving away from simply assisting human agents to providing complete, end-to-end automation for complex processes like automating insurance claims with AI or delivering high-touch customer care with AI for financial services.

Meet Your New Digital Workforce

Imagine a team member who works around the clock, executes intricate procedures with flawless precision, and adheres to compliance rules every single time. This isn't science fiction; it’s the reality of the modern ai customer service agent, a digital worker designed for the unique pressures of banking and insurance.

Unlike a simple chatbot that provides information, a true AI agent is agentic—it has the authority and the technical connections to perform tasks. It's less of a conversational script and more of a digital employee plugged directly into your operational backbone. It can interpret what a customer needs, decide the correct next step based on your established procedures, and then execute that step in core platforms like Guidewire, Salesforce, or Duck Creek.

More Than Just a Chatbot

This distinction is crucial for industries where regulations are strict and the tolerance for error is practically zero.

For instance, a chatbot might tell a customer how to file an insurance claim. An AI agent, on the other hand, can actually do it. It can initiate the First Notice of Loss (FNOL), validate the policyholder's identity, check their coverage details, and even trigger the initial reserve amount—all without a human touching the keyboard. This is the new benchmark for AI customer care.

This kind of deep automation directly tackles the biggest headaches financial institutions face:

Regulatory Scrutiny: Every action the agent takes is logged, creating a perfect, unchangeable audit trail that makes proving compliance simple.

Demand for Accuracy: By automating data entry and process steps, agents eliminate the human errors that can creep into manual work.

Need for Speed: Customers get instant, reliable service for common requests, slashing the long wait times that hurt satisfaction scores.

The Tangible Impact on Operations

The value here isn't just theoretical; the financial upside is substantial. Projections show that contact centers deploying autonomous AI agents will see their cost-per-contact drop by 20% to 40% by 2026. This huge savings comes from automating Tier-1 resolutions, a common bottleneck for both ai insurance companies and banks.

In fact, many financial firms are already achieving a remarkable 77% ROI from their agent deployments by turning over tasks like compliance checks and customer issue resolution to their digital workforce. You can find more compelling statistics about AI agent impact by reviewing industry research.

Ultimately, these digital workers are built to own entire processes, from the moment a customer reaches out to the final resolution. By taking over the high-volume, repetitive tasks that bog down your human teams, an ai customer service agent frees up your experts to focus on what people do best: handling nuanced exceptions and building lasting customer relationships. Understanding the full scope of what these agents can do is the first step toward transforming your operations, which is explored in our detailed guide on AI agents for customer service.

Streamlining Insurance Claims from Start to Finish

For claims operations leaders in ai insurance companies, the journey from a customer's first call to a final settlement is a marathon of manual handoffs and delays. Automating insurance claims with AI changes this dynamic completely, deploying a digital processor that works accurately and around the clock.

Think about a typical auto insurance claim. It always starts with a stressful event for your customer—a car accident. That one moment kicks off a long, frustrating chain of phone calls and manual reviews. With an AI agent in place, that experience is different from the very start.

The process begins at the First Notice of Loss (FNOL). Instead of waiting on hold, the customer can report the incident immediately through a web portal or app. The AI agent instantly captures the critical details, asks clarifying questions guided by your company's SOPs, and validates the claimant's information against their policy in real time. No more waiting. No more friction.

From Data Capture to Decision Making

Once the initial report is filed, the AI agent gets to work. It doesn't just sit on the information; it acts on it. The agent can connect directly to your core insurance platforms—think Duck Creek or Guidewire—to cross-reference policy details, checking for coverage limits, deductibles, and any specific exclusions. This single step eliminates a huge source of human error and delay right off the bat.

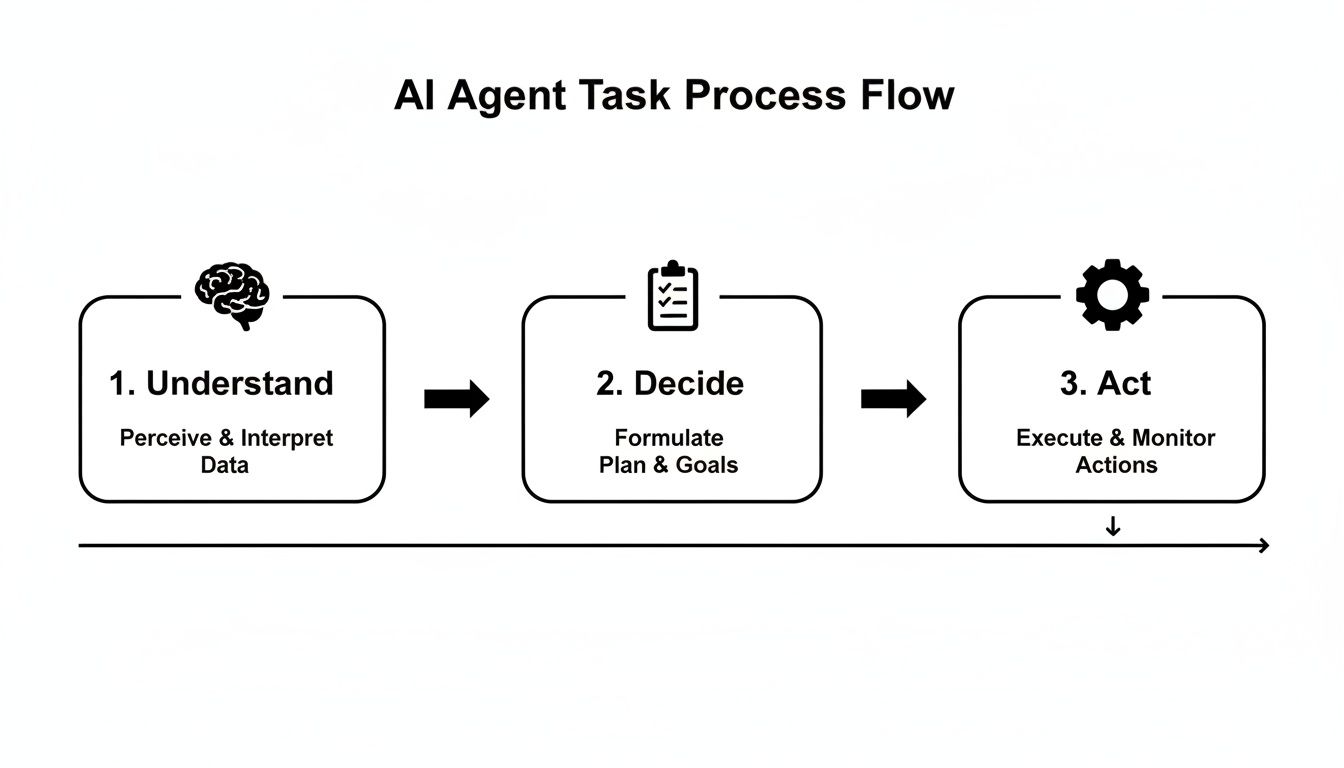

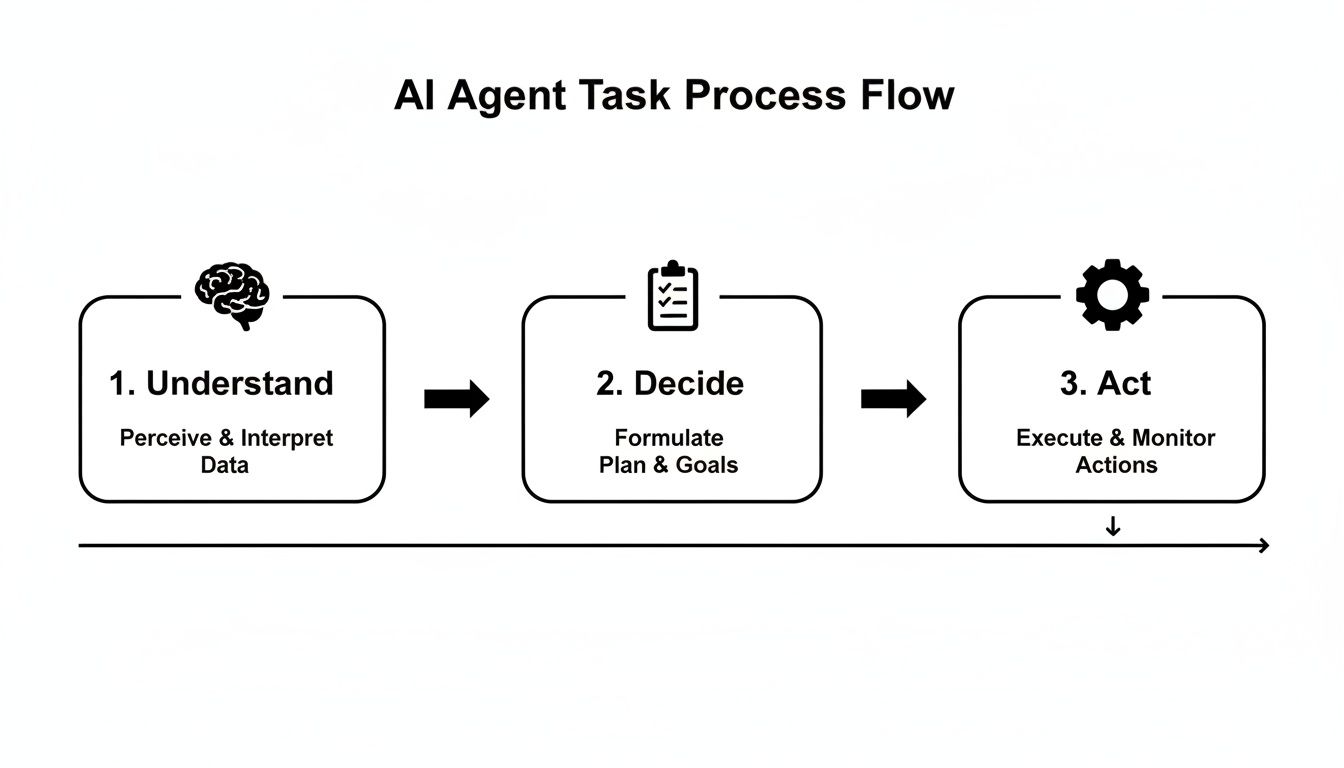

This simple workflow shows how the agent breaks down every task.

The agent methodically moves from understanding a request to executing a task, making sure every action is rule-based and completely auditable. For low-complexity claims, like a cracked windshield or a minor fender bender, the agent can autonomously assess the situation against your predefined business rules. If the claim meets the criteria for automatic approval, it can even trigger the initial payment or schedule a repair appointment on the spot.

By automating these high-volume, low-complexity claims, insurers can collapse cycle times from days to mere minutes. This isn't just about efficiency—it's about dramatically improving the policyholder experience at their most critical moment of need.

Boosting Accuracy and Mitigating Risk

A huge advantage seen in many claims AI reviews is the sharp reduction in processing errors. Manual data entry is simply prone to mistakes that can lead to incorrect payments or compliance headaches. An AI agent, on the other hand, performs its tasks with 100% fidelity every single time, ensuring data is entered and validated correctly across every system it touches.

This precision is also a powerful tool for fraud mitigation. The agent can instantly flag inconsistencies in a claimant's story or cross-reference claim details against historical data to identify patterns associated with fraudulent activity. These flagged cases are then escalated to a human expert for investigation, letting your specialized teams focus their skills where they matter most.

The end result is a faster, more transparent, and highly efficient workflow. The entire process, from FNOL to payment, becomes a consistent and auditable operation. To see this in action, explore this case study on transforming insurance claims with agentic AI. It provides a deeper look into the operational gains and real business outcomes.

By handing over the repetitive, rule-based work to a digital workforce, insurance companies can finally deliver the speed and reliability their customers have come to expect.

Bringing AI Customer Service into Banking

In banking and finance, customer conversations are anything but casual. Every single interaction hinges on sensitive data, tight compliance mandates, and ultimately, someone's financial security. An AI customer service agent steps into this high-stakes environment not as a simple chatbot, but as a sophisticated, integrated part of your service delivery.

This advanced application of AI customer care isn't about deflecting calls or just answering basic questions faster. It’s about owning and resolving complex problems from start to finish.

Think about a customer who gets a fraud alert. Instead of getting stuck in a confusing phone tree, they can interact with an AI agent that authenticates their identity on the spot, pinpoints the suspicious transaction, and guides them through securing their account—all in a single, fluid conversation.

This is where the true value of an AI customer service agent shines. It operates like a digital specialist, rigorously trained on your bank’s exact standard operating procedures for everything from handling payment disputes to onboarding new clients. The agent doesn't just pass along information; it executes tasks.

High-Impact Use Cases in Financial Services

By automating entire workflows, customer care with AI for financial services delivers real, measurable improvements in both operational efficiency and customer loyalty. The applications are practical and directly solve some of the most common headaches in the banking journey.

A few key examples include:

Managing Fraud Alerts: The AI agent can instantly reach out to a customer on their preferred channel, use multi-factor authentication to verify their identity, and immediately block a card or flag a transaction based on their live response.

Resolving Transaction Disputes: Rather than making a customer fill out a cumbersome form, the agent can listen to their issue, collect the required details conversationally, and then create a dispute case directly in your core banking system. It even provides the customer with a case number and a clear timeline.

Streamlining Customer Onboarding: The agent can walk new customers through the entire application, helping them complete forms and verify identity documents in real time, all while providing proactive status updates without needing a human to step in.

This level of intelligent automation frees up your human experts to concentrate on relationship-building and tackling the nuanced, high-empathy challenges that demand a human touch.

Measuring the Gains in Efficiency and Satisfaction

The impact here isn't just theoretical; it’s about tangible results. AI is driving massive improvements in contact center performance, with some organizations reporting up to 50% reductions in resolution times. Even more telling, 80% of customers who interact with AI-powered service walk away with a positive experience, citing the speed of response as a key factor. You can explore more data on how AI is boosting customer service statistics.

For financial institutions, this translates into a powerful competitive advantage. Instant, accurate, and fully compliant service is no longer a goal—it’s an operational reality.

The table below breaks down how AI agents directly improve critical contact center KPIs.

AI Agent Impact on Customer Service Metrics

This table highlights the tangible improvements that AI customer service agents bring to key performance indicators in banking and insurance contact centers.

Metric | Improvement with AI Agent | Example Application |

|---|---|---|

First Contact Resolution (FCR) | Increased by 15-20% | AI resolves the issue in one interaction by accessing all necessary systems, preventing the need for callbacks or escalations. |

Average Handle Time (AHT) | Reduced by 30-40% | The AI agent automates data gathering and system updates, dramatically shortening the time spent on routine transactional tasks. |

Customer Satisfaction (CSAT) | Improved by 10-15 points | 24/7 availability and instant, accurate answers to common queries lead to a less frustrating and more positive customer experience. |

Agent Training Time | Reduced by 50% | New human agents can rely on the AI for procedural guidance, allowing them to become proficient faster and focus on soft skills. |

Ultimately, an AI agent becomes a tireless extension of your team, executing complex tasks with perfect accuracy, 24/7. This means a customer can check on a loan application, get an update on a wire transfer, or resolve a card issue at midnight on a Sunday. For a deeper dive into this topic, check out our guide on AI customer care.

This consistent, high-quality service is what builds modern customer loyalty. The result is a more resilient, efficient, and customer-focused banking operation that’s truly equipped for today’s expectations.

Achieving Bulletproof Compliance in AI Operations

In the high-stakes worlds of banking and insurance, automation only gets a green light if it's compliant. For risk and compliance leaders, the very idea of an AI customer service agent making independent decisions can feel like a major loss of control. The reality, however, is that modern AI platforms are built from the ground up for these tightly regulated environments, turning automation into a tool that actually strengthens governance.

The secret lies in training the agent on your specific Standard Operating Procedures (SOPs). This isn't some generalized AI trying to figure things out. Instead, it’s a digital worker taught to follow your exact rules with perfect fidelity, ensuring every action—from automating insurance claims with AI to verifying a customer’s identity—is executed precisely according to your established, compliant workflows.

Building Trust with Immutable Audit Trails

One of the most valuable features for any compliance team is the creation of an immutable audit trail. Think of it as a permanent, unchangeable diary of the AI's every move. Every decision, action, and data point an agent touches is logged, creating a complete, time-stamped record that makes preparing for an audit almost trivial. It’s how you prove adherence to regulations like GDPR and SOC 2.

This incredibly detailed logging provides crystal-clear answers to the questions an auditor will inevitably ask:

What action was taken? The log shows the specific task the agent performed.

Why was it taken? The agent's decision is tied directly to the SOP rule it was following.

When did it happen? Every step is timestamped for a precise chronological record.

Frankly, this granular visibility offers more oversight than you often get with manual processes, where tracking down who did what and why can be a real headache.

Setting Clear Operational Guardrails

A common worry is the AI agent "going rogue" or operating outside its intended scope. This is where operational guardrails come in. You can think of these as clear, programmable boundaries that define exactly what an AI agent can and cannot do. You’re always in the driver’s seat.

For example, AI insurance companies can set a hard rule that any claim exceeding $5,000 is automatically escalated to a human claims adjuster for review. In banking, an agent can be programmed to flag any transaction dispute involving certain merchant codes, immediately routing it to a fraud specialist. These guardrails ensure the AI handles high-volume, routine work while saving complex or high-risk exceptions for human expertise.

This isn't about giving up control; it's about delegating rule-based tasks within a secure, predefined framework. The system is designed to identify exceptions and escalate them, creating a foolproof human-in-the-loop pattern that enhances, rather than compromises, risk management.

Designing Foolproof Escalation Paths

When an agent hits a situation outside its guardrails, a seamless handoff to a human expert is vital. The system is designed to pass the entire case context—including all prior actions and customer information—to the right person on your team. This means the customer never has to repeat themselves, and your team member is instantly equipped to resolve the issue.

This collaborative model is a central part of modern AI customer care. You get the speed and accuracy of automation combined with the critical thinking and empathy of your best people. This structured approach to governance is a key part of a robust strategy. For those in banking, you can explore more about building a strong defense in our article on operational risk management in banking.

Ultimately, a well-designed AI customer service agent introduces a new level of control and transparency. With immutable logs, strict access controls, and clear guardrails, automation becomes a powerful asset for achieving bulletproof compliance. By automating according to your exact rules, you can reduce human error, guarantee consistency, and build a far more resilient and auditable operation.

Weaving AI Agents into Your Tech Stack

For any IT or transformation leader, the big question isn't if an AI customer service agent can add value. It's how it plugs into an already sprawling and complex technology ecosystem. Getting this right is the key to deploying a new digital workforce that complements—rather than complicates—your existing operations.

The secret is seamless connectivity. Modern AI platforms are built with an API-first philosophy. Think of the platform as a central nervous system, designed to communicate effortlessly with the tools your teams already rely on every single day. This approach means you don't have to rip and replace your core systems.

Connecting to Your Core Systems

An AI agent is only as good as the data it can access and the actions it can take. This is where APIs (Application Programming Interfaces) act as the critical bridge, giving the agent "hands" to perform real work inside your most important software.

For example, leading AI insurance companies integrate their agents with claims management systems like Guidewire or Sapiens. When a customer initiates a new claim, the agent can use these API connections to:

Validate Policy Details: Instantly check the customer's coverage and deductible without a person having to look it up.

Create New Records: Open a new claim file directly in Guidewire, automatically filling it with the information gathered from the customer.

Update Claim Status: Keep the claim record updated in real-time as it moves through each step of the process.

It's the same story in banking. An agent connected to a CRM like Salesforce can manage a customer service case from start to finish. It logs the first contact, updates the case with every action taken, and closes it once resolved, creating a perfect audit trail.

Training Agents on Real-World Actions

So, how does an AI agent learn its job? A lot like a new human employee: by watching your best people work. Instead of requiring developers to write complex code, modern platforms train agents by simply observing your team members complete tasks in their everyday applications.

The platform records these clicks and keystrokes, translates them into a repeatable process, and cross-references this with your written Standard Operating Procedures (SOPs). This way, the agent learns the what and the why behind each task, absorbing the specific nuances of your business. This is a crucial point that often comes up in claims AI reviews, where precision is everything.

The goal is to create a digital worker that executes tasks exactly as your top-performing human agent would, but with the speed and consistency of automation. This ensures operational continuity and immediate value from day one.

This "show, don't tell" training method makes the AI highly specialized. The AI customer care it provides is based on your own proven, compliant workflows, not some generic, out-of-the-box script.

Building a Collaborative Hybrid Workforce

Let's be realistic: no automation is perfect. That's why the most successful deployments are designed with a "human-in-the-loop" pattern, creating a collaborative model where AI agents and your people work together. The entire architecture is built for smooth, intelligent escalations.

When an AI agent hits a wall—maybe it's a uniquely complex insurance claim or a highly emotional customer—it doesn't just fail and create a dead end. Instead, it intelligently routes the entire case, with full context, to a designated human expert. The handoff is seamless. Your team member gets the complete interaction history and a summary of what the AI has already done, so they can step in and solve the problem without forcing the customer to start over.

This hybrid approach effectively transforms your contact center software, like Genesys, from a simple routing tool into a command center for human-AI collaboration. You don't end up with two separate, disjointed systems. You get one unified, hybrid workforce where technology handles the routine work and your people focus on the moments that matter most.

Building Your AI Implementation Roadmap

Getting from a great idea to a fully functional AI customer service agent doesn't happen by accident. It takes a clear, strategic plan. For technology leaders, a solid practical AI implementation roadmap is the bridge between high-level strategy and real-world business value, a gap that’s especially critical in banking and insurance.

The first step isn't about the tech at all—it's about the problem you're trying to solve. Look for the high-volume, low-complexity tasks that are gumming up the works. For AI insurance companies, this is often the initial claims intake or answering routine questions about a policy. In banking, it could be as simple as processing a change of address or walking a customer through a standard transaction dispute.

Phased Rollout from Pilot to Scale

Once you’ve zeroed in on a strong use case, the real work begins with a controlled pilot program. The whole point here is to test the AI agent in a live but limited setting. This is your chance to gather performance data, fine-tune the agent's training based on your company's actual SOPs, and start building internal confidence in the solution.

When you're choosing a vendor for the pilot, you need to be picky. Look for partners who check these boxes:

Deep Financial Services Expertise: They need to get the compliance and security pressures you're under. It's non-negotiable.

Seamless Integration Capabilities: The vendor has to prove they can hook into your core systems via APIs without turning your operations upside down.

Commitment to Security: You want to see a platform with security baked in from the ground up and a track record of compliant operations.

A successful pilot program does more than just prove the technology works. It gives you the hard data you need to build a business case that executives can’t ignore, shifting the conversation from "what if" to "what's next."

Defining and Measuring Success

If you want to scale your AI workforce, you have to measure what matters. Vague goals won't cut it. You need to track specific, quantifiable Key Performance Indicators (KPIs) that tie directly to operational efficiency and customer happiness. You can learn more about how to get the most from your digital workforce by reading about the role of AI in business operations.

Here are the KPIs that will really move the needle:

Cycle Time Reduction: How much faster are claims getting processed or disputes getting resolved? Measure it in hours or days.

Cost Per Transaction: What does it now cost to handle a standard inquiry? The goal is a number that’s significantly lower.

First Contact Resolution (FCR) Rate: What percentage of issues does the AI agent solve completely, with no human handoff required?

By tracking these kinds of metrics, you can clearly demonstrate ROI. This builds momentum and paves the way for a future where your human experts and AI agents work side-by-side as a core part of how you do business.

Common Questions We Hear

When leaders in banking and insurance first explore bringing on an AI customer service agent, a few key questions always come up. Let's walk through them.

How Can We Trust an AI Agent with Sensitive Customer Data?

This is understandably the first question on everyone's mind. The short answer is: these platforms are built from the ground up for the rigorous security demands of financial services.

Think of it less like a generic chatbot and more like a secure, digital employee. Platforms designed for this space are built to meet strict compliance standards like SOC 2 Type II and GDPR. All data is encrypted, both when it's moving between systems and when it's stored.

Access is tightly controlled through role-based permissions, meaning the AI agent only sees what it absolutely needs to perform a specific task, and not a byte more. Every action is logged in a fully auditable trail, giving you complete visibility and control.

Are These AI Agents Going to Replace Our Human Teams?

Not at all. The real value isn't in replacement, but in partnership. The goal is to create a more effective, less-burdened human workforce.

These agents are designed to take on the high-volume, repetitive, and rule-based tasks that often lead to burnout. Think about initial data intake for an insurance claim or processing a simple address change—work that needs to be done perfectly every time but doesn't require deep human expertise.

The best results come from a collaborative model. Your AI agents handle the repetitive, behind-the-scenes work, freeing up your skilled human experts to focus on complex cases, build customer relationships, and handle the exceptions that truly need a human touch.

This approach to AI customer care actually boosts employee satisfaction. As you'll see in claims AI reviews from top AI insurance companies, it lets your best people focus on what they do best: solving complex problems and taking care of customers.

How Painful Is It to Integrate an AI Agent with Our Existing Systems?

This is a valid concern, especially with legacy technology. Fortunately, modern AI platforms are built with this reality in mind. They don't expect you to rip and replace your core systems.

Instead, they use a flexible, API-first approach. This means they are designed to connect smoothly with the tools you already rely on, whether it's core platforms like Guidewire or Duck Creek, CRMs like Salesforce, or contact center software from providers like Genesys.

The integration process is methodical. We map your workflows, train the AI customer service agent on your specific Standard Operating Procedures (SOPs), and then configure the API connections. This allows for a phased rollout that minimizes disruption and delivers value quickly.

Ready to see how a digital workforce can transform your operations? Nolana deploys compliant, SOP-trained AI agents that automate complex tasks in banking and insurance, from claims processing to customer service. Learn more about Nolana and request a demo today.

An AI customer service agent isn't just another chatbot. Think of it as a highly trained digital employee, built to run entire workflows from start to finish. In high-stakes industries like finance and insurance, these agents do more than just answer questions—they're trained on your specific Standard Operating Procedures (SOPs) to understand requests, make decisions, and take direct action inside your core systems.

This represents a major leap, moving away from simply assisting human agents to providing complete, end-to-end automation for complex processes like automating insurance claims with AI or delivering high-touch customer care with AI for financial services.

Meet Your New Digital Workforce

Imagine a team member who works around the clock, executes intricate procedures with flawless precision, and adheres to compliance rules every single time. This isn't science fiction; it’s the reality of the modern ai customer service agent, a digital worker designed for the unique pressures of banking and insurance.

Unlike a simple chatbot that provides information, a true AI agent is agentic—it has the authority and the technical connections to perform tasks. It's less of a conversational script and more of a digital employee plugged directly into your operational backbone. It can interpret what a customer needs, decide the correct next step based on your established procedures, and then execute that step in core platforms like Guidewire, Salesforce, or Duck Creek.

More Than Just a Chatbot

This distinction is crucial for industries where regulations are strict and the tolerance for error is practically zero.

For instance, a chatbot might tell a customer how to file an insurance claim. An AI agent, on the other hand, can actually do it. It can initiate the First Notice of Loss (FNOL), validate the policyholder's identity, check their coverage details, and even trigger the initial reserve amount—all without a human touching the keyboard. This is the new benchmark for AI customer care.

This kind of deep automation directly tackles the biggest headaches financial institutions face:

Regulatory Scrutiny: Every action the agent takes is logged, creating a perfect, unchangeable audit trail that makes proving compliance simple.

Demand for Accuracy: By automating data entry and process steps, agents eliminate the human errors that can creep into manual work.

Need for Speed: Customers get instant, reliable service for common requests, slashing the long wait times that hurt satisfaction scores.

The Tangible Impact on Operations

The value here isn't just theoretical; the financial upside is substantial. Projections show that contact centers deploying autonomous AI agents will see their cost-per-contact drop by 20% to 40% by 2026. This huge savings comes from automating Tier-1 resolutions, a common bottleneck for both ai insurance companies and banks.

In fact, many financial firms are already achieving a remarkable 77% ROI from their agent deployments by turning over tasks like compliance checks and customer issue resolution to their digital workforce. You can find more compelling statistics about AI agent impact by reviewing industry research.

Ultimately, these digital workers are built to own entire processes, from the moment a customer reaches out to the final resolution. By taking over the high-volume, repetitive tasks that bog down your human teams, an ai customer service agent frees up your experts to focus on what people do best: handling nuanced exceptions and building lasting customer relationships. Understanding the full scope of what these agents can do is the first step toward transforming your operations, which is explored in our detailed guide on AI agents for customer service.

Streamlining Insurance Claims from Start to Finish

For claims operations leaders in ai insurance companies, the journey from a customer's first call to a final settlement is a marathon of manual handoffs and delays. Automating insurance claims with AI changes this dynamic completely, deploying a digital processor that works accurately and around the clock.

Think about a typical auto insurance claim. It always starts with a stressful event for your customer—a car accident. That one moment kicks off a long, frustrating chain of phone calls and manual reviews. With an AI agent in place, that experience is different from the very start.

The process begins at the First Notice of Loss (FNOL). Instead of waiting on hold, the customer can report the incident immediately through a web portal or app. The AI agent instantly captures the critical details, asks clarifying questions guided by your company's SOPs, and validates the claimant's information against their policy in real time. No more waiting. No more friction.

From Data Capture to Decision Making

Once the initial report is filed, the AI agent gets to work. It doesn't just sit on the information; it acts on it. The agent can connect directly to your core insurance platforms—think Duck Creek or Guidewire—to cross-reference policy details, checking for coverage limits, deductibles, and any specific exclusions. This single step eliminates a huge source of human error and delay right off the bat.

This simple workflow shows how the agent breaks down every task.

The agent methodically moves from understanding a request to executing a task, making sure every action is rule-based and completely auditable. For low-complexity claims, like a cracked windshield or a minor fender bender, the agent can autonomously assess the situation against your predefined business rules. If the claim meets the criteria for automatic approval, it can even trigger the initial payment or schedule a repair appointment on the spot.

By automating these high-volume, low-complexity claims, insurers can collapse cycle times from days to mere minutes. This isn't just about efficiency—it's about dramatically improving the policyholder experience at their most critical moment of need.

Boosting Accuracy and Mitigating Risk

A huge advantage seen in many claims AI reviews is the sharp reduction in processing errors. Manual data entry is simply prone to mistakes that can lead to incorrect payments or compliance headaches. An AI agent, on the other hand, performs its tasks with 100% fidelity every single time, ensuring data is entered and validated correctly across every system it touches.

This precision is also a powerful tool for fraud mitigation. The agent can instantly flag inconsistencies in a claimant's story or cross-reference claim details against historical data to identify patterns associated with fraudulent activity. These flagged cases are then escalated to a human expert for investigation, letting your specialized teams focus their skills where they matter most.

The end result is a faster, more transparent, and highly efficient workflow. The entire process, from FNOL to payment, becomes a consistent and auditable operation. To see this in action, explore this case study on transforming insurance claims with agentic AI. It provides a deeper look into the operational gains and real business outcomes.

By handing over the repetitive, rule-based work to a digital workforce, insurance companies can finally deliver the speed and reliability their customers have come to expect.

Bringing AI Customer Service into Banking

In banking and finance, customer conversations are anything but casual. Every single interaction hinges on sensitive data, tight compliance mandates, and ultimately, someone's financial security. An AI customer service agent steps into this high-stakes environment not as a simple chatbot, but as a sophisticated, integrated part of your service delivery.

This advanced application of AI customer care isn't about deflecting calls or just answering basic questions faster. It’s about owning and resolving complex problems from start to finish.

Think about a customer who gets a fraud alert. Instead of getting stuck in a confusing phone tree, they can interact with an AI agent that authenticates their identity on the spot, pinpoints the suspicious transaction, and guides them through securing their account—all in a single, fluid conversation.

This is where the true value of an AI customer service agent shines. It operates like a digital specialist, rigorously trained on your bank’s exact standard operating procedures for everything from handling payment disputes to onboarding new clients. The agent doesn't just pass along information; it executes tasks.

High-Impact Use Cases in Financial Services

By automating entire workflows, customer care with AI for financial services delivers real, measurable improvements in both operational efficiency and customer loyalty. The applications are practical and directly solve some of the most common headaches in the banking journey.

A few key examples include:

Managing Fraud Alerts: The AI agent can instantly reach out to a customer on their preferred channel, use multi-factor authentication to verify their identity, and immediately block a card or flag a transaction based on their live response.

Resolving Transaction Disputes: Rather than making a customer fill out a cumbersome form, the agent can listen to their issue, collect the required details conversationally, and then create a dispute case directly in your core banking system. It even provides the customer with a case number and a clear timeline.

Streamlining Customer Onboarding: The agent can walk new customers through the entire application, helping them complete forms and verify identity documents in real time, all while providing proactive status updates without needing a human to step in.

This level of intelligent automation frees up your human experts to concentrate on relationship-building and tackling the nuanced, high-empathy challenges that demand a human touch.

Measuring the Gains in Efficiency and Satisfaction

The impact here isn't just theoretical; it’s about tangible results. AI is driving massive improvements in contact center performance, with some organizations reporting up to 50% reductions in resolution times. Even more telling, 80% of customers who interact with AI-powered service walk away with a positive experience, citing the speed of response as a key factor. You can explore more data on how AI is boosting customer service statistics.

For financial institutions, this translates into a powerful competitive advantage. Instant, accurate, and fully compliant service is no longer a goal—it’s an operational reality.

The table below breaks down how AI agents directly improve critical contact center KPIs.

AI Agent Impact on Customer Service Metrics

This table highlights the tangible improvements that AI customer service agents bring to key performance indicators in banking and insurance contact centers.

Metric | Improvement with AI Agent | Example Application |

|---|---|---|

First Contact Resolution (FCR) | Increased by 15-20% | AI resolves the issue in one interaction by accessing all necessary systems, preventing the need for callbacks or escalations. |

Average Handle Time (AHT) | Reduced by 30-40% | The AI agent automates data gathering and system updates, dramatically shortening the time spent on routine transactional tasks. |

Customer Satisfaction (CSAT) | Improved by 10-15 points | 24/7 availability and instant, accurate answers to common queries lead to a less frustrating and more positive customer experience. |

Agent Training Time | Reduced by 50% | New human agents can rely on the AI for procedural guidance, allowing them to become proficient faster and focus on soft skills. |

Ultimately, an AI agent becomes a tireless extension of your team, executing complex tasks with perfect accuracy, 24/7. This means a customer can check on a loan application, get an update on a wire transfer, or resolve a card issue at midnight on a Sunday. For a deeper dive into this topic, check out our guide on AI customer care.

This consistent, high-quality service is what builds modern customer loyalty. The result is a more resilient, efficient, and customer-focused banking operation that’s truly equipped for today’s expectations.

Achieving Bulletproof Compliance in AI Operations

In the high-stakes worlds of banking and insurance, automation only gets a green light if it's compliant. For risk and compliance leaders, the very idea of an AI customer service agent making independent decisions can feel like a major loss of control. The reality, however, is that modern AI platforms are built from the ground up for these tightly regulated environments, turning automation into a tool that actually strengthens governance.

The secret lies in training the agent on your specific Standard Operating Procedures (SOPs). This isn't some generalized AI trying to figure things out. Instead, it’s a digital worker taught to follow your exact rules with perfect fidelity, ensuring every action—from automating insurance claims with AI to verifying a customer’s identity—is executed precisely according to your established, compliant workflows.

Building Trust with Immutable Audit Trails

One of the most valuable features for any compliance team is the creation of an immutable audit trail. Think of it as a permanent, unchangeable diary of the AI's every move. Every decision, action, and data point an agent touches is logged, creating a complete, time-stamped record that makes preparing for an audit almost trivial. It’s how you prove adherence to regulations like GDPR and SOC 2.

This incredibly detailed logging provides crystal-clear answers to the questions an auditor will inevitably ask:

What action was taken? The log shows the specific task the agent performed.

Why was it taken? The agent's decision is tied directly to the SOP rule it was following.

When did it happen? Every step is timestamped for a precise chronological record.

Frankly, this granular visibility offers more oversight than you often get with manual processes, where tracking down who did what and why can be a real headache.

Setting Clear Operational Guardrails

A common worry is the AI agent "going rogue" or operating outside its intended scope. This is where operational guardrails come in. You can think of these as clear, programmable boundaries that define exactly what an AI agent can and cannot do. You’re always in the driver’s seat.

For example, AI insurance companies can set a hard rule that any claim exceeding $5,000 is automatically escalated to a human claims adjuster for review. In banking, an agent can be programmed to flag any transaction dispute involving certain merchant codes, immediately routing it to a fraud specialist. These guardrails ensure the AI handles high-volume, routine work while saving complex or high-risk exceptions for human expertise.

This isn't about giving up control; it's about delegating rule-based tasks within a secure, predefined framework. The system is designed to identify exceptions and escalate them, creating a foolproof human-in-the-loop pattern that enhances, rather than compromises, risk management.

Designing Foolproof Escalation Paths

When an agent hits a situation outside its guardrails, a seamless handoff to a human expert is vital. The system is designed to pass the entire case context—including all prior actions and customer information—to the right person on your team. This means the customer never has to repeat themselves, and your team member is instantly equipped to resolve the issue.

This collaborative model is a central part of modern AI customer care. You get the speed and accuracy of automation combined with the critical thinking and empathy of your best people. This structured approach to governance is a key part of a robust strategy. For those in banking, you can explore more about building a strong defense in our article on operational risk management in banking.

Ultimately, a well-designed AI customer service agent introduces a new level of control and transparency. With immutable logs, strict access controls, and clear guardrails, automation becomes a powerful asset for achieving bulletproof compliance. By automating according to your exact rules, you can reduce human error, guarantee consistency, and build a far more resilient and auditable operation.

Weaving AI Agents into Your Tech Stack

For any IT or transformation leader, the big question isn't if an AI customer service agent can add value. It's how it plugs into an already sprawling and complex technology ecosystem. Getting this right is the key to deploying a new digital workforce that complements—rather than complicates—your existing operations.

The secret is seamless connectivity. Modern AI platforms are built with an API-first philosophy. Think of the platform as a central nervous system, designed to communicate effortlessly with the tools your teams already rely on every single day. This approach means you don't have to rip and replace your core systems.

Connecting to Your Core Systems

An AI agent is only as good as the data it can access and the actions it can take. This is where APIs (Application Programming Interfaces) act as the critical bridge, giving the agent "hands" to perform real work inside your most important software.

For example, leading AI insurance companies integrate their agents with claims management systems like Guidewire or Sapiens. When a customer initiates a new claim, the agent can use these API connections to:

Validate Policy Details: Instantly check the customer's coverage and deductible without a person having to look it up.

Create New Records: Open a new claim file directly in Guidewire, automatically filling it with the information gathered from the customer.

Update Claim Status: Keep the claim record updated in real-time as it moves through each step of the process.

It's the same story in banking. An agent connected to a CRM like Salesforce can manage a customer service case from start to finish. It logs the first contact, updates the case with every action taken, and closes it once resolved, creating a perfect audit trail.

Training Agents on Real-World Actions

So, how does an AI agent learn its job? A lot like a new human employee: by watching your best people work. Instead of requiring developers to write complex code, modern platforms train agents by simply observing your team members complete tasks in their everyday applications.

The platform records these clicks and keystrokes, translates them into a repeatable process, and cross-references this with your written Standard Operating Procedures (SOPs). This way, the agent learns the what and the why behind each task, absorbing the specific nuances of your business. This is a crucial point that often comes up in claims AI reviews, where precision is everything.

The goal is to create a digital worker that executes tasks exactly as your top-performing human agent would, but with the speed and consistency of automation. This ensures operational continuity and immediate value from day one.

This "show, don't tell" training method makes the AI highly specialized. The AI customer care it provides is based on your own proven, compliant workflows, not some generic, out-of-the-box script.

Building a Collaborative Hybrid Workforce

Let's be realistic: no automation is perfect. That's why the most successful deployments are designed with a "human-in-the-loop" pattern, creating a collaborative model where AI agents and your people work together. The entire architecture is built for smooth, intelligent escalations.

When an AI agent hits a wall—maybe it's a uniquely complex insurance claim or a highly emotional customer—it doesn't just fail and create a dead end. Instead, it intelligently routes the entire case, with full context, to a designated human expert. The handoff is seamless. Your team member gets the complete interaction history and a summary of what the AI has already done, so they can step in and solve the problem without forcing the customer to start over.

This hybrid approach effectively transforms your contact center software, like Genesys, from a simple routing tool into a command center for human-AI collaboration. You don't end up with two separate, disjointed systems. You get one unified, hybrid workforce where technology handles the routine work and your people focus on the moments that matter most.

Building Your AI Implementation Roadmap

Getting from a great idea to a fully functional AI customer service agent doesn't happen by accident. It takes a clear, strategic plan. For technology leaders, a solid practical AI implementation roadmap is the bridge between high-level strategy and real-world business value, a gap that’s especially critical in banking and insurance.

The first step isn't about the tech at all—it's about the problem you're trying to solve. Look for the high-volume, low-complexity tasks that are gumming up the works. For AI insurance companies, this is often the initial claims intake or answering routine questions about a policy. In banking, it could be as simple as processing a change of address or walking a customer through a standard transaction dispute.

Phased Rollout from Pilot to Scale

Once you’ve zeroed in on a strong use case, the real work begins with a controlled pilot program. The whole point here is to test the AI agent in a live but limited setting. This is your chance to gather performance data, fine-tune the agent's training based on your company's actual SOPs, and start building internal confidence in the solution.

When you're choosing a vendor for the pilot, you need to be picky. Look for partners who check these boxes:

Deep Financial Services Expertise: They need to get the compliance and security pressures you're under. It's non-negotiable.

Seamless Integration Capabilities: The vendor has to prove they can hook into your core systems via APIs without turning your operations upside down.

Commitment to Security: You want to see a platform with security baked in from the ground up and a track record of compliant operations.

A successful pilot program does more than just prove the technology works. It gives you the hard data you need to build a business case that executives can’t ignore, shifting the conversation from "what if" to "what's next."

Defining and Measuring Success

If you want to scale your AI workforce, you have to measure what matters. Vague goals won't cut it. You need to track specific, quantifiable Key Performance Indicators (KPIs) that tie directly to operational efficiency and customer happiness. You can learn more about how to get the most from your digital workforce by reading about the role of AI in business operations.

Here are the KPIs that will really move the needle:

Cycle Time Reduction: How much faster are claims getting processed or disputes getting resolved? Measure it in hours or days.

Cost Per Transaction: What does it now cost to handle a standard inquiry? The goal is a number that’s significantly lower.

First Contact Resolution (FCR) Rate: What percentage of issues does the AI agent solve completely, with no human handoff required?

By tracking these kinds of metrics, you can clearly demonstrate ROI. This builds momentum and paves the way for a future where your human experts and AI agents work side-by-side as a core part of how you do business.

Common Questions We Hear

When leaders in banking and insurance first explore bringing on an AI customer service agent, a few key questions always come up. Let's walk through them.

How Can We Trust an AI Agent with Sensitive Customer Data?

This is understandably the first question on everyone's mind. The short answer is: these platforms are built from the ground up for the rigorous security demands of financial services.

Think of it less like a generic chatbot and more like a secure, digital employee. Platforms designed for this space are built to meet strict compliance standards like SOC 2 Type II and GDPR. All data is encrypted, both when it's moving between systems and when it's stored.

Access is tightly controlled through role-based permissions, meaning the AI agent only sees what it absolutely needs to perform a specific task, and not a byte more. Every action is logged in a fully auditable trail, giving you complete visibility and control.

Are These AI Agents Going to Replace Our Human Teams?

Not at all. The real value isn't in replacement, but in partnership. The goal is to create a more effective, less-burdened human workforce.

These agents are designed to take on the high-volume, repetitive, and rule-based tasks that often lead to burnout. Think about initial data intake for an insurance claim or processing a simple address change—work that needs to be done perfectly every time but doesn't require deep human expertise.

The best results come from a collaborative model. Your AI agents handle the repetitive, behind-the-scenes work, freeing up your skilled human experts to focus on complex cases, build customer relationships, and handle the exceptions that truly need a human touch.

This approach to AI customer care actually boosts employee satisfaction. As you'll see in claims AI reviews from top AI insurance companies, it lets your best people focus on what they do best: solving complex problems and taking care of customers.

How Painful Is It to Integrate an AI Agent with Our Existing Systems?

This is a valid concern, especially with legacy technology. Fortunately, modern AI platforms are built with this reality in mind. They don't expect you to rip and replace your core systems.

Instead, they use a flexible, API-first approach. This means they are designed to connect smoothly with the tools you already rely on, whether it's core platforms like Guidewire or Duck Creek, CRMs like Salesforce, or contact center software from providers like Genesys.

The integration process is methodical. We map your workflows, train the AI customer service agent on your specific Standard Operating Procedures (SOPs), and then configure the API connections. This allows for a phased rollout that minimizes disruption and delivers value quickly.

Ready to see how a digital workforce can transform your operations? Nolana deploys compliant, SOP-trained AI agents that automate complex tasks in banking and insurance, from claims processing to customer service. Learn more about Nolana and request a demo today.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP