Unlocking AI with Integrated Insurance Solutions

Unlocking AI with Integrated Insurance Solutions

Discover how integrated insurance solutions leverage AI to automate claims, transform customer care, and drive operational efficiency for modern insurers.

For too long, the insurance industry has operated in silos. Claims, underwriting, and customer service departments often work from separate systems, leading to a fragmented view of the customer and a ton of duplicated effort. Integrated insurance solutions are designed to fix this by creating a central nervous system for the entire operation.

This unified approach provides a single, reliable source of information for every policyholder, setting the stage for genuinely impactful AI and automation in insurance claims and customer care.

What Are Integrated Insurance Solutions

Think about a company where sales, support, and finance all use different, disconnected spreadsheets to track customer interactions. It would be a mess. This is exactly the problem many AI insurance companies still grapple with because of their aging, patchwork infrastructure.

Integrated insurance solutions break down these walls. Instead of having adjusters, underwriters, and service agents all pulling from separate databases, these platforms build a single, unified hub where everyone sees the same information in real-time.

It’s like the central hub in a smart home that gets your lights, thermostat, and security system talking to each other. An integrated insurance platform does the same thing, connecting core systems (like Guidewire), CRMs (like Salesforce), and contact center software into one functional ecosystem. This eliminates endless re-keying of data and creates the solid foundation that advanced tech needs to do its job.

The Role of AI in Integrated Platforms

This is where things get interesting. The real magic of a modern integrated solution comes from Artificial Intelligence. Once you have all your data in one place, you can finally put AI to work on complex processes that used to be painfully manual. Suddenly, automating insurance claims with AI and providing intelligent AI customer care for financial services aren't just buzzwords—they're real possibilities.

Automated Claims Processing: Imagine AI agents that can review a new claim, analyze photos and documents, cross-reference policy details, and approve payment for straightforward cases—all without a human touching it. This is the goal of modern claims AI reviews.

Intelligent AI Customer Care: AI-driven virtual agents can answer policy questions, give claim status updates, or even recommend personalized coverage options because they have a complete, 360-degree view of the customer from the integrated system.

By connecting every operational touchpoint, integrated platforms provide the fuel—clean, consistent data—that AI needs to automate high-stakes workflows accurately and efficiently. This is what separates AI as a niche tool from AI as a core business driver.

Why Integration Is Not Optional

In a world where customers expect immediate answers and a smooth digital experience, a clunky, disconnected backend is a huge handicap. Without integration, insurers simply can't deliver the speed and personal touch that people now demand. To make this work, unifying all that scattered information is the first step; you can learn more about effective customer data integration solutions to see how this foundational layer is built.

This move toward connected systems isn’t just a tech project; it's a strategic imperative for staying relevant. As shown in our case study on transforming insurance claims with agentic AI, linking disparate systems is the key to unlocking massive gains in efficiency and customer happiness. The future of insurance belongs to the companies that can build a truly connected enterprise.

Automating the Entire Claims Lifecycle with AI

For a long time, the claims process has been a major friction point in the insurance world—a headache for both customers and adjusters. This is precisely where automating insurance claims with AI makes its biggest impact. Integrated platforms turn a notoriously slow, paper-heavy ordeal into a surprisingly fast and transparent experience.

Let's walk through a common scenario: a minor car accident. Instead of dialing a 1-800 number and sitting on hold, the policyholder simply opens their insurer's app to file the First Notice of Loss (FNOL). That single action triggers a highly automated workflow, showing the real power of integrated insurance solutions.

The First Notice of Loss Reimagined

The app prompts the customer to snap a few photos of the damage. The moment those images are uploaded, an AI vision tool gets to work. It analyzes the visuals, identifies the damaged parts—a cracked bumper, a shattered headlight—and estimates the severity, all within seconds.

At the same time, an AI agent is already pulling the customer’s policy details from the core system. It confirms the policy is active, checks the coverage for this specific type of incident, and runs a quick fraud analysis against historical data. This entire initial assessment, something that used to take hours or even days, is now done in less than a minute.

Straight-Through Processing for Simple Claims

When a claim is straightforward, like a chipped windshield or a small fender bender, the system can resolve it almost instantly. This is the magic of straight-through processing (STP), a core objective for modern AI insurance companies.

An AI agent can autonomously approve the claim, calculate a fair settlement based on pre-set business rules and real-time parts pricing, and initiate a payment directly to the customer or their chosen repair shop. It’s entirely possible for a policyholder to get a confirmation—and the money—in under an hour.

This data-first approach is the foundation of effective claims AI reviews. It ensures every decision is consistent, fair, and based strictly on policy terms and visual evidence. This removes the risk of human bias or error in low-complexity situations. For a closer look at how this works, check out our guide on automating the insurance claims process.

Enhancing Complex Claims with AI Assistance

But what about more complicated accidents? Integrated AI isn’t just for the simple stuff. It also serves as a powerful co-pilot for human adjusters, giving them the tools and data to make better, faster decisions.

Here’s how the AI helps:

Compiles a complete case file: It automatically gathers every relevant document—the FNOL report, policy details, photos, and even third-party data like police reports or local weather conditions.

Suggests next steps: Based on the claim’s unique details, the AI can recommend the best course of action, like dispatching a field adjuster or requesting specific documentation.

Flags potential issues: The system is trained to spot anomalies that might point to fraud or highlight tricky liability questions, ensuring high-risk cases get escalated to an expert right away.

This frees up your human experts to do what they do best: handle complex negotiations, provide empathetic customer support, and apply nuanced judgment to cases that truly need it.

The Financial Impact of AI in Insurance

This level of automation creates tremendous business value. By embedding intelligent automation into claims, underwriting, and AI customer care, artificial intelligence is completely reshaping the industry. According to Technavio, the global AI in insurance market is projected to grow by USD 30.07 billion between 2025 and 2029, and this efficiency push is a major driver.

Automated claims processing can slash settlement times from weeks to days. Meanwhile, AI-powered fraud detection helps insurers prevent losses that typically account for 5-10% of all annual premiums. You can find more details in the AI in insurance market analysis.

By automating insurance claims with AI from start to finish, integrated insurance solutions do more than just cut operational costs. They fundamentally change the customer experience, turning a moment of high stress into one of speed, clarity, and reassurance.

How AI Agents are Reshaping Customer Care

The power of a truly connected platform goes far beyond just speeding up claims. When every piece of customer data lives in one central, accessible hub, integrated insurance solutions can completely reshape the customer service experience. The entire model shifts from reactive problem-solving to proactive, personalized support, all powered by intelligent AI agents.

This new standard of AI customer care means policyholders are no longer constrained by a 9-to-5 schedule. AI-powered virtual agents are on standby 24/7, ready to handle a massive volume of routine requests on the spot. Whether a customer needs to check their coverage, make a payment, or get a quick update on a claim's status, they get an accurate answer instantly.

That kind of instant access is no longer a "nice-to-have." In a world of on-demand everything, forcing a customer to wait for basic information is a fast track to frustration. AI insurance companies that deploy these agents cut out that friction, delivering a level of responsiveness that builds genuine trust and loyalty.

From Answering Questions to Anticipating Needs

Deep integration is what allows an AI agent to move beyond just spitting back data; it lets them actually understand context. Because the AI has a 360-degree view of the customer—their policies, claims history, and every past interaction—it can provide a genuinely personal touch.

Think about it this way: an AI agent can send a proactive alert about an upcoming auto policy renewal. But a truly integrated agent can also analyze that customer's data and see they just bought a home. With that insight, the agent can intelligently suggest bundling their auto and homeowner's policies to save money. Just like that, a standard notification becomes a valuable, revenue-generating conversation.

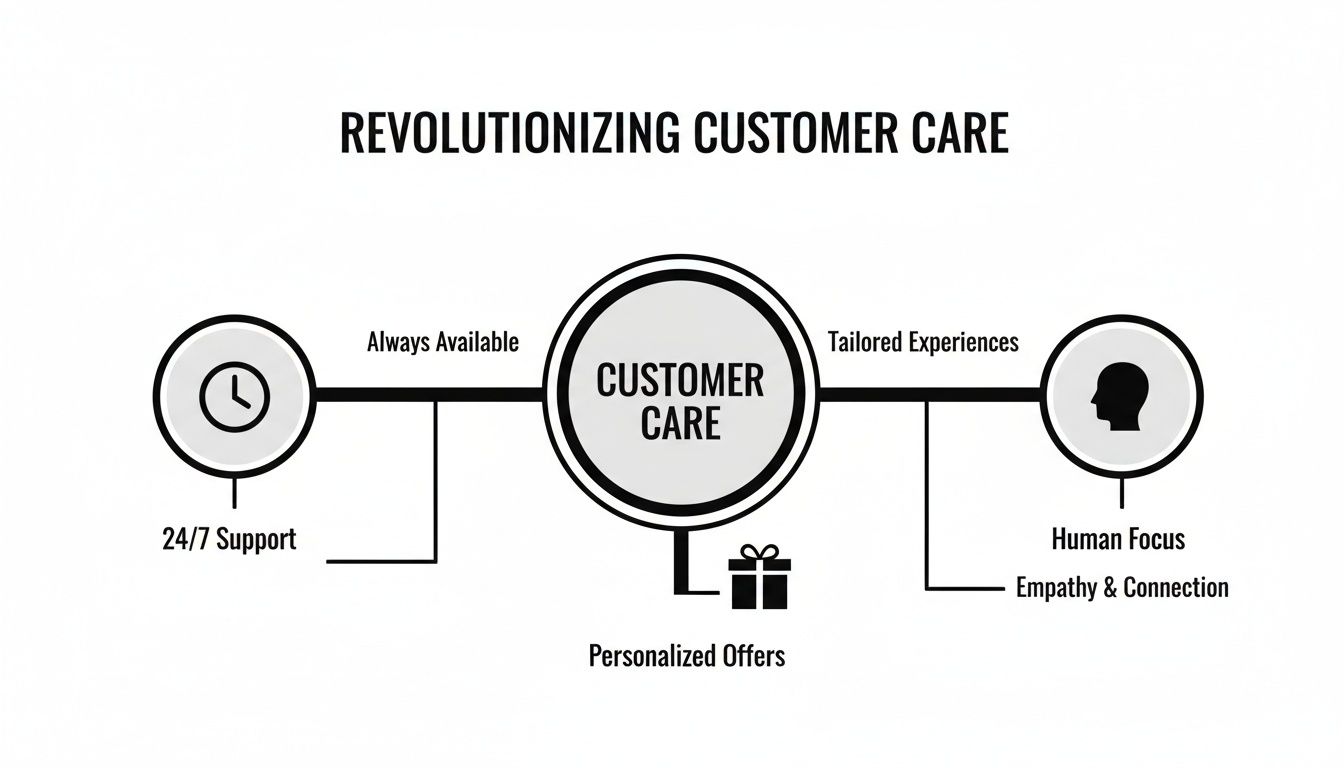

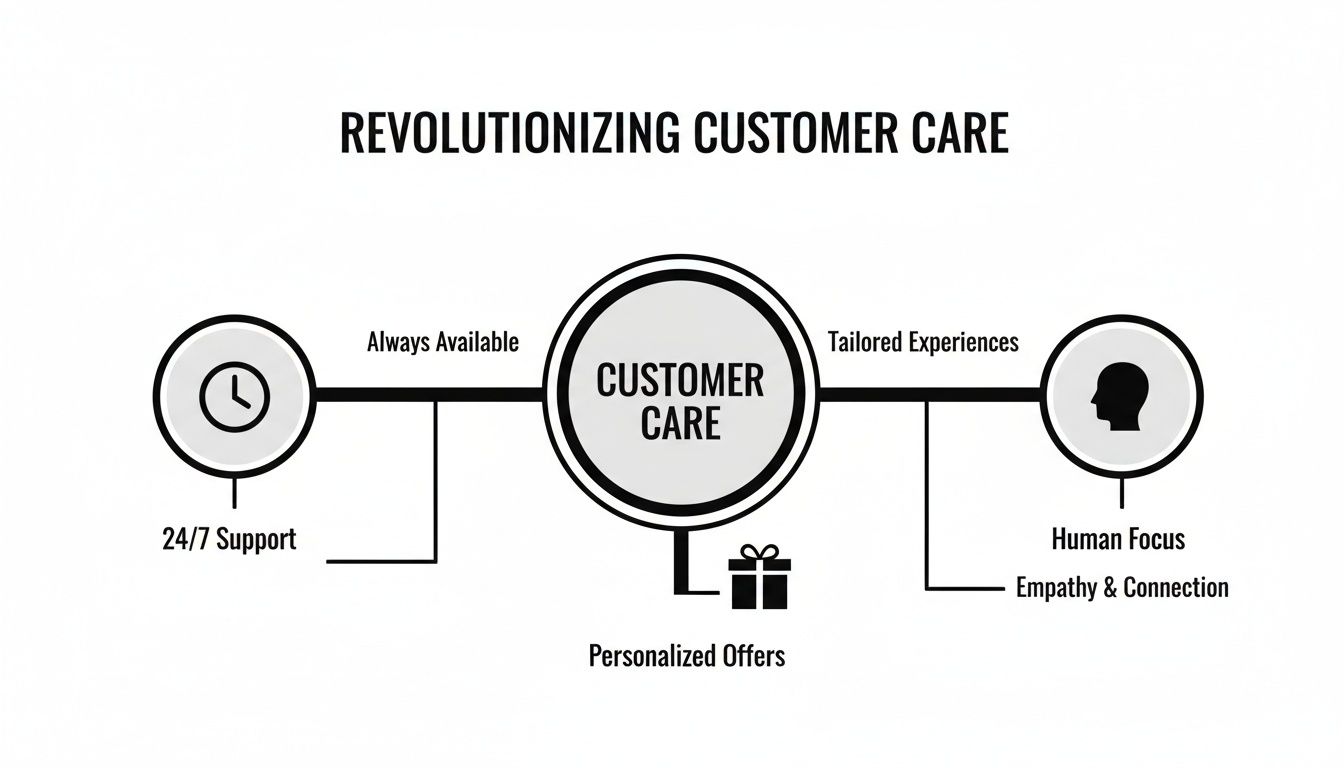

This is the core of the modern AI customer care for financial services model, as shown below.

The image breaks down how around-the-clock availability, smart, personalized offers, and a renewed emphasis on human expertise all work together to create a far better service experience.

Freeing Up Your People to Be More Human

By handing off the routine work to AI agents, you unlock your human team’s true potential. Instead of spending their days resetting passwords or confirming payment dates, your most experienced people can focus their energy on the complex, high-stakes situations where they’re needed most.

These are the make-or-break moments that define a customer’s relationship with their insurer:

Navigating a complex claim: Helping a family recover after a devastating house fire requires a level of empathy and creative problem-solving that AI simply can't match.

Discussing sensitive policy changes: Walking a client through the fine print of a life insurance policy or a major liability change demands a human touch.

Resolving unique complaints: When a customer has a one-of-a-kind problem, a skilled agent can listen, understand, and find a solution that works.

This smart division of labor creates a service model that is both incredibly efficient and deeply personal. AI handles the speed and scale, while your team provides the empathy, judgment, and expertise that build relationships for life.

This approach means simple claims AI reviews are handled automatically, while the more complicated cases get the expert human attention they require. If you want to dive deeper into this subject, our guide on AI customer care for financial services provides a lot more detail.

The Technology Making It Happen

The AI agents driving this new service model are built on sophisticated conversational AI. These aren't the clunky, rule-based chatbots of a few years ago. Modern platforms are designed with natural language understanding at their core, allowing them to grasp a user’s intent and carry on a fluid, helpful conversation. To see what powers these advanced systems, it’s worth looking at some of the top AI chatbot platforms on the market today.

Ultimately, by building AI into the fabric of the customer care workflow, insurers can deliver a service that’s faster, smarter, and more empathetic. This doesn't just boost customer satisfaction and retention; it also drives significant operational efficiency, creating a powerful competitive edge in a very crowded industry.

The Technical Backbone of AI Integration

The seamless automation we see in modern AI customer care and claims processing isn't magic. It's the product of a well-designed technical architecture built for connection. At the center of it all are Application Programming Interfaces (APIs).

Think of APIs as the universal translators of the software world. They're the digital handshakes that allow a brand-new AI platform to talk to a 20-year-old legacy system. An API can let an AI agent pull a policyholder’s history from Guidewire, check their recent calls in Salesforce, and then log a new ticket in ServiceNow—all in a single, fluid motion. This creates an uninterrupted flow of information across systems that were never built to speak to each other.

The AI-Native Operating System: A Central Command

An AI-native operating system is the central command for all of this automated work. It's the conductor of the digital orchestra, telling each specialized AI agent what to do, when to do it, and what data to use. This core platform manages a whole workforce of digital agents, each one trained for a specific role in the insurance value chain.

These agents are built to handle complex, multi-step jobs from start to finish. For example, an agent assigned to claims AI reviews can take an initial claim, automatically pull all the necessary documents from different databases, and assemble a complete file for a human adjuster. The entire process happens without anyone having to lift a finger.

The market is taking notice. The insurance platform market is expected to grow from USD 116.16 billion in 2025 to USD 207.52 billion by 2030, a clear signal that AI insurance companies are investing heavily to modernize. You can read more about these market dynamics to get a sense of just how big this shift is.

This table shows the stark contrast between the old way of doing things and what a modern integrated platform can do.

Table: Legacy Systems vs. Integrated AI Platforms

Feature | Legacy Systems | Integrated AI Platforms (e.g., Nolana) |

|---|---|---|

Data Access | Siloed; manual lookups required across systems | Centralized; single view of the customer |

Process Automation | Limited to simple, rule-based tasks | End-to-end automation of complex workflows |

Customer Experience | Disjointed; long wait times | Seamless; instant, 24/7 self-service |

Scalability | Difficult and expensive to scale | Elastic; scales on demand to handle volume |

Integration | Rigid, point-to-point connections | Flexible, API-first connectivity |

Human Role | Repetitive data entry and processing | Strategic decision-making and exceptions |

The difference is clear: one model is built on constraints, while the other is built for speed and intelligence.

Keeping Control in a Highly Regulated World

For any leader in financial services, handing processes over to AI can feel like a leap of faith. But modern platforms are built with strict governance at their core, providing the guardrails needed to make every action compliant and auditable. The goal isn't to replace humans, but to give them superpowers.

True integrated insurance solutions don’t operate in a black box. They are designed for transparency, providing complete audit logs of every AI-driven action and clear, pre-defined pathways for escalating complex cases to human experts.

This means that while routine work gets done with machine-level speed and accuracy, the truly complex decisions are always left in the hands of your skilled professionals. Key governance features include:

Comprehensive Audit Trails: Every single action an AI agent takes is logged and time-stamped, creating a permanent record for compliance checks and internal reviews.

Clear Human Escalation Paths: Business rules determine exactly when a case needs a human touch. If a fraud score is too high or a customer uses frustrated language, the system automatically routes the interaction to the right person.

Role-Based Access Controls: AI agents have permissions just like human employees. They can only access the specific data and systems required to do their jobs—nothing more.

This is the technical foundation that makes robust and scalable integrated insurance solutions possible. By connecting systems with APIs and managing them with a secure AI-native platform, insurers can finally break free from the limitations of their old technology. To see what this looks like in practice, take a look at our guide on modern insurance software development.

The Business Case for AI in Insurance

For any forward-thinking insurance company, bringing in integrated AI solutions isn't just a tech upgrade. It’s a core business strategy with a clear and compelling return on investment. The case for making this move really comes down to three powerful pillars: efficiency, customer loyalty, and smarter risk control.

The first and most obvious win is a massive drop in operational costs. Think about the thousands of hours your teams spend on repetitive work like data entry or document checks. By automating insurance claims with AI, you free up your most valuable resource—your people—to focus on strategic work that actually requires their expertise. This also slashes the cost of human error.

This automation naturally flows into the second major benefit: accelerating just about everything. Claims that used to drag on for days or weeks can now be wrapped up in a fraction of the time. The same goes for policy updates and customer questions. This speed is a total game-changer for the customer experience.

A New Standard for Customer Experience

Quick, transparent service is what builds loyalty. When a policyholder gets a claim approved and paid in hours instead of weeks, you've earned their trust. That positive experience directly impacts retention and boosts your Net Promoter Score (NPS).

This is where great AI customer care makes all the difference. Integrated AI agents can provide instant, 24/7 support, so customers are never left waiting for an answer. The result is a service that feels immediate and personal, setting an entirely new standard for the industry. You can dig deeper into these advantages in our guide on what defines modern AI insurance companies.

Superior Risk Management and Compliance

Finally, integrated insurance solutions give you a much stronger handle on risk. AI algorithms are incredibly good at spotting complex fraud patterns that even a seasoned expert might miss, protecting the company from major financial hits.

Beyond fraud, these platforms create a perfect, timestamped audit trail for every single decision. Every step in a claims AI reviews process is logged and accounted for, which makes satisfying regulators a whole lot easier. This built-in governance provides peace of mind for everyone, from the C-suite to the stakeholders.

The InsurTech movement is completely changing the game by fusing banking, claims, and service workflows into agile, API-first ecosystems. The global InsurTech market is on track to hit USD 92.6 billion by 2029, growing at an incredible 37.8% CAGR.

This explosive growth is a clear signal that legacy systems just can't keep up. This is exactly where platforms like Nolana come in, using AI agents to automate critical operations, cut costs, and shrink cycle times by as much as 50%. You can explore more data on this trend in the latest InsurTech market report. It’s all about creating a better customer experience without taking your eye off risk and compliance.

Frequently Asked Questions

How Does AI Actually Improve the Claims Process?

Artificial intelligence injects much-needed speed and precision into the entire claims lifecycle. By automating insurance claims with AI, specialized agents can take over the initial First Notice of Loss (FNOL), instantly interpret damage from photos, confirm policy details, and flag potential fraud—all in real time.

For simpler claims, this unlocks true straight-through processing. Imagine a claim being submitted, verified, and paid out in just a few minutes. That’s the power of modern claims AI reviews, which can slash settlement times from weeks down to hours while grounding every decision in clean, consistent data.

What Is AI's Role in Insurance Customer Care?

In AI customer care, think of intelligent agents as your new front line. They offer round-the-clock support for common needs like policy questions, payments, or checking on a claim's status. Since they plug into a unified data platform, these agents see the full picture of every customer interaction.

This comprehensive view allows them to provide genuinely personalized help, like suggesting a relevant policy bundle based on a customer's life events. By fielding all the routine inquiries, AI insurance companies free up their human teams to handle the complex, sensitive situations where a human touch is irreplaceable, which is a key goal of AI customer care for financial services.

How Do AI Agents Connect with Our Existing Insurance Systems?

This is a common concern, but modern AI platforms don't force you to rip and replace your core systems. They’re built to work with what you already have, integrating smoothly with giants like Guidewire, Duck Creek, Salesforce, and ServiceNow using APIs.

An AI-native operating system acts as the conductor. It tells the agents to pull data from one system, perform a task in another, and then record the entire interaction in a third. This creates a seamless, automated workflow that spans your whole technology stack, ensuring integrated insurance solutions enhance your operations instead of disrupting them.

The real value of a modern AI platform lies in its ability to be the connective tissue for your business. It lets specialized AI agents talk to legacy systems, run complex processes across multiple applications, and keep a perfect audit trail of every single action—giving you complete control and compliance in a highly regulated industry.

Ready to automate your high-stakes insurance operations with compliant AI agents? Nolana provides an AI-native operating system that connects to your core systems to deliver real-time automation with clear guardrails and seamless human escalation. Explore the Nolana platform to see how you can cut costs, accelerate cycle times, and improve customer experiences.

For too long, the insurance industry has operated in silos. Claims, underwriting, and customer service departments often work from separate systems, leading to a fragmented view of the customer and a ton of duplicated effort. Integrated insurance solutions are designed to fix this by creating a central nervous system for the entire operation.

This unified approach provides a single, reliable source of information for every policyholder, setting the stage for genuinely impactful AI and automation in insurance claims and customer care.

What Are Integrated Insurance Solutions

Think about a company where sales, support, and finance all use different, disconnected spreadsheets to track customer interactions. It would be a mess. This is exactly the problem many AI insurance companies still grapple with because of their aging, patchwork infrastructure.

Integrated insurance solutions break down these walls. Instead of having adjusters, underwriters, and service agents all pulling from separate databases, these platforms build a single, unified hub where everyone sees the same information in real-time.

It’s like the central hub in a smart home that gets your lights, thermostat, and security system talking to each other. An integrated insurance platform does the same thing, connecting core systems (like Guidewire), CRMs (like Salesforce), and contact center software into one functional ecosystem. This eliminates endless re-keying of data and creates the solid foundation that advanced tech needs to do its job.

The Role of AI in Integrated Platforms

This is where things get interesting. The real magic of a modern integrated solution comes from Artificial Intelligence. Once you have all your data in one place, you can finally put AI to work on complex processes that used to be painfully manual. Suddenly, automating insurance claims with AI and providing intelligent AI customer care for financial services aren't just buzzwords—they're real possibilities.

Automated Claims Processing: Imagine AI agents that can review a new claim, analyze photos and documents, cross-reference policy details, and approve payment for straightforward cases—all without a human touching it. This is the goal of modern claims AI reviews.

Intelligent AI Customer Care: AI-driven virtual agents can answer policy questions, give claim status updates, or even recommend personalized coverage options because they have a complete, 360-degree view of the customer from the integrated system.

By connecting every operational touchpoint, integrated platforms provide the fuel—clean, consistent data—that AI needs to automate high-stakes workflows accurately and efficiently. This is what separates AI as a niche tool from AI as a core business driver.

Why Integration Is Not Optional

In a world where customers expect immediate answers and a smooth digital experience, a clunky, disconnected backend is a huge handicap. Without integration, insurers simply can't deliver the speed and personal touch that people now demand. To make this work, unifying all that scattered information is the first step; you can learn more about effective customer data integration solutions to see how this foundational layer is built.

This move toward connected systems isn’t just a tech project; it's a strategic imperative for staying relevant. As shown in our case study on transforming insurance claims with agentic AI, linking disparate systems is the key to unlocking massive gains in efficiency and customer happiness. The future of insurance belongs to the companies that can build a truly connected enterprise.

Automating the Entire Claims Lifecycle with AI

For a long time, the claims process has been a major friction point in the insurance world—a headache for both customers and adjusters. This is precisely where automating insurance claims with AI makes its biggest impact. Integrated platforms turn a notoriously slow, paper-heavy ordeal into a surprisingly fast and transparent experience.

Let's walk through a common scenario: a minor car accident. Instead of dialing a 1-800 number and sitting on hold, the policyholder simply opens their insurer's app to file the First Notice of Loss (FNOL). That single action triggers a highly automated workflow, showing the real power of integrated insurance solutions.

The First Notice of Loss Reimagined

The app prompts the customer to snap a few photos of the damage. The moment those images are uploaded, an AI vision tool gets to work. It analyzes the visuals, identifies the damaged parts—a cracked bumper, a shattered headlight—and estimates the severity, all within seconds.

At the same time, an AI agent is already pulling the customer’s policy details from the core system. It confirms the policy is active, checks the coverage for this specific type of incident, and runs a quick fraud analysis against historical data. This entire initial assessment, something that used to take hours or even days, is now done in less than a minute.

Straight-Through Processing for Simple Claims

When a claim is straightforward, like a chipped windshield or a small fender bender, the system can resolve it almost instantly. This is the magic of straight-through processing (STP), a core objective for modern AI insurance companies.

An AI agent can autonomously approve the claim, calculate a fair settlement based on pre-set business rules and real-time parts pricing, and initiate a payment directly to the customer or their chosen repair shop. It’s entirely possible for a policyholder to get a confirmation—and the money—in under an hour.

This data-first approach is the foundation of effective claims AI reviews. It ensures every decision is consistent, fair, and based strictly on policy terms and visual evidence. This removes the risk of human bias or error in low-complexity situations. For a closer look at how this works, check out our guide on automating the insurance claims process.

Enhancing Complex Claims with AI Assistance

But what about more complicated accidents? Integrated AI isn’t just for the simple stuff. It also serves as a powerful co-pilot for human adjusters, giving them the tools and data to make better, faster decisions.

Here’s how the AI helps:

Compiles a complete case file: It automatically gathers every relevant document—the FNOL report, policy details, photos, and even third-party data like police reports or local weather conditions.

Suggests next steps: Based on the claim’s unique details, the AI can recommend the best course of action, like dispatching a field adjuster or requesting specific documentation.

Flags potential issues: The system is trained to spot anomalies that might point to fraud or highlight tricky liability questions, ensuring high-risk cases get escalated to an expert right away.

This frees up your human experts to do what they do best: handle complex negotiations, provide empathetic customer support, and apply nuanced judgment to cases that truly need it.

The Financial Impact of AI in Insurance

This level of automation creates tremendous business value. By embedding intelligent automation into claims, underwriting, and AI customer care, artificial intelligence is completely reshaping the industry. According to Technavio, the global AI in insurance market is projected to grow by USD 30.07 billion between 2025 and 2029, and this efficiency push is a major driver.

Automated claims processing can slash settlement times from weeks to days. Meanwhile, AI-powered fraud detection helps insurers prevent losses that typically account for 5-10% of all annual premiums. You can find more details in the AI in insurance market analysis.

By automating insurance claims with AI from start to finish, integrated insurance solutions do more than just cut operational costs. They fundamentally change the customer experience, turning a moment of high stress into one of speed, clarity, and reassurance.

How AI Agents are Reshaping Customer Care

The power of a truly connected platform goes far beyond just speeding up claims. When every piece of customer data lives in one central, accessible hub, integrated insurance solutions can completely reshape the customer service experience. The entire model shifts from reactive problem-solving to proactive, personalized support, all powered by intelligent AI agents.

This new standard of AI customer care means policyholders are no longer constrained by a 9-to-5 schedule. AI-powered virtual agents are on standby 24/7, ready to handle a massive volume of routine requests on the spot. Whether a customer needs to check their coverage, make a payment, or get a quick update on a claim's status, they get an accurate answer instantly.

That kind of instant access is no longer a "nice-to-have." In a world of on-demand everything, forcing a customer to wait for basic information is a fast track to frustration. AI insurance companies that deploy these agents cut out that friction, delivering a level of responsiveness that builds genuine trust and loyalty.

From Answering Questions to Anticipating Needs

Deep integration is what allows an AI agent to move beyond just spitting back data; it lets them actually understand context. Because the AI has a 360-degree view of the customer—their policies, claims history, and every past interaction—it can provide a genuinely personal touch.

Think about it this way: an AI agent can send a proactive alert about an upcoming auto policy renewal. But a truly integrated agent can also analyze that customer's data and see they just bought a home. With that insight, the agent can intelligently suggest bundling their auto and homeowner's policies to save money. Just like that, a standard notification becomes a valuable, revenue-generating conversation.

This is the core of the modern AI customer care for financial services model, as shown below.

The image breaks down how around-the-clock availability, smart, personalized offers, and a renewed emphasis on human expertise all work together to create a far better service experience.

Freeing Up Your People to Be More Human

By handing off the routine work to AI agents, you unlock your human team’s true potential. Instead of spending their days resetting passwords or confirming payment dates, your most experienced people can focus their energy on the complex, high-stakes situations where they’re needed most.

These are the make-or-break moments that define a customer’s relationship with their insurer:

Navigating a complex claim: Helping a family recover after a devastating house fire requires a level of empathy and creative problem-solving that AI simply can't match.

Discussing sensitive policy changes: Walking a client through the fine print of a life insurance policy or a major liability change demands a human touch.

Resolving unique complaints: When a customer has a one-of-a-kind problem, a skilled agent can listen, understand, and find a solution that works.

This smart division of labor creates a service model that is both incredibly efficient and deeply personal. AI handles the speed and scale, while your team provides the empathy, judgment, and expertise that build relationships for life.

This approach means simple claims AI reviews are handled automatically, while the more complicated cases get the expert human attention they require. If you want to dive deeper into this subject, our guide on AI customer care for financial services provides a lot more detail.

The Technology Making It Happen

The AI agents driving this new service model are built on sophisticated conversational AI. These aren't the clunky, rule-based chatbots of a few years ago. Modern platforms are designed with natural language understanding at their core, allowing them to grasp a user’s intent and carry on a fluid, helpful conversation. To see what powers these advanced systems, it’s worth looking at some of the top AI chatbot platforms on the market today.

Ultimately, by building AI into the fabric of the customer care workflow, insurers can deliver a service that’s faster, smarter, and more empathetic. This doesn't just boost customer satisfaction and retention; it also drives significant operational efficiency, creating a powerful competitive edge in a very crowded industry.

The Technical Backbone of AI Integration

The seamless automation we see in modern AI customer care and claims processing isn't magic. It's the product of a well-designed technical architecture built for connection. At the center of it all are Application Programming Interfaces (APIs).

Think of APIs as the universal translators of the software world. They're the digital handshakes that allow a brand-new AI platform to talk to a 20-year-old legacy system. An API can let an AI agent pull a policyholder’s history from Guidewire, check their recent calls in Salesforce, and then log a new ticket in ServiceNow—all in a single, fluid motion. This creates an uninterrupted flow of information across systems that were never built to speak to each other.

The AI-Native Operating System: A Central Command

An AI-native operating system is the central command for all of this automated work. It's the conductor of the digital orchestra, telling each specialized AI agent what to do, when to do it, and what data to use. This core platform manages a whole workforce of digital agents, each one trained for a specific role in the insurance value chain.

These agents are built to handle complex, multi-step jobs from start to finish. For example, an agent assigned to claims AI reviews can take an initial claim, automatically pull all the necessary documents from different databases, and assemble a complete file for a human adjuster. The entire process happens without anyone having to lift a finger.

The market is taking notice. The insurance platform market is expected to grow from USD 116.16 billion in 2025 to USD 207.52 billion by 2030, a clear signal that AI insurance companies are investing heavily to modernize. You can read more about these market dynamics to get a sense of just how big this shift is.

This table shows the stark contrast between the old way of doing things and what a modern integrated platform can do.

Table: Legacy Systems vs. Integrated AI Platforms

Feature | Legacy Systems | Integrated AI Platforms (e.g., Nolana) |

|---|---|---|

Data Access | Siloed; manual lookups required across systems | Centralized; single view of the customer |

Process Automation | Limited to simple, rule-based tasks | End-to-end automation of complex workflows |

Customer Experience | Disjointed; long wait times | Seamless; instant, 24/7 self-service |

Scalability | Difficult and expensive to scale | Elastic; scales on demand to handle volume |

Integration | Rigid, point-to-point connections | Flexible, API-first connectivity |

Human Role | Repetitive data entry and processing | Strategic decision-making and exceptions |

The difference is clear: one model is built on constraints, while the other is built for speed and intelligence.

Keeping Control in a Highly Regulated World

For any leader in financial services, handing processes over to AI can feel like a leap of faith. But modern platforms are built with strict governance at their core, providing the guardrails needed to make every action compliant and auditable. The goal isn't to replace humans, but to give them superpowers.

True integrated insurance solutions don’t operate in a black box. They are designed for transparency, providing complete audit logs of every AI-driven action and clear, pre-defined pathways for escalating complex cases to human experts.

This means that while routine work gets done with machine-level speed and accuracy, the truly complex decisions are always left in the hands of your skilled professionals. Key governance features include:

Comprehensive Audit Trails: Every single action an AI agent takes is logged and time-stamped, creating a permanent record for compliance checks and internal reviews.

Clear Human Escalation Paths: Business rules determine exactly when a case needs a human touch. If a fraud score is too high or a customer uses frustrated language, the system automatically routes the interaction to the right person.

Role-Based Access Controls: AI agents have permissions just like human employees. They can only access the specific data and systems required to do their jobs—nothing more.

This is the technical foundation that makes robust and scalable integrated insurance solutions possible. By connecting systems with APIs and managing them with a secure AI-native platform, insurers can finally break free from the limitations of their old technology. To see what this looks like in practice, take a look at our guide on modern insurance software development.

The Business Case for AI in Insurance

For any forward-thinking insurance company, bringing in integrated AI solutions isn't just a tech upgrade. It’s a core business strategy with a clear and compelling return on investment. The case for making this move really comes down to three powerful pillars: efficiency, customer loyalty, and smarter risk control.

The first and most obvious win is a massive drop in operational costs. Think about the thousands of hours your teams spend on repetitive work like data entry or document checks. By automating insurance claims with AI, you free up your most valuable resource—your people—to focus on strategic work that actually requires their expertise. This also slashes the cost of human error.

This automation naturally flows into the second major benefit: accelerating just about everything. Claims that used to drag on for days or weeks can now be wrapped up in a fraction of the time. The same goes for policy updates and customer questions. This speed is a total game-changer for the customer experience.

A New Standard for Customer Experience

Quick, transparent service is what builds loyalty. When a policyholder gets a claim approved and paid in hours instead of weeks, you've earned their trust. That positive experience directly impacts retention and boosts your Net Promoter Score (NPS).

This is where great AI customer care makes all the difference. Integrated AI agents can provide instant, 24/7 support, so customers are never left waiting for an answer. The result is a service that feels immediate and personal, setting an entirely new standard for the industry. You can dig deeper into these advantages in our guide on what defines modern AI insurance companies.

Superior Risk Management and Compliance

Finally, integrated insurance solutions give you a much stronger handle on risk. AI algorithms are incredibly good at spotting complex fraud patterns that even a seasoned expert might miss, protecting the company from major financial hits.

Beyond fraud, these platforms create a perfect, timestamped audit trail for every single decision. Every step in a claims AI reviews process is logged and accounted for, which makes satisfying regulators a whole lot easier. This built-in governance provides peace of mind for everyone, from the C-suite to the stakeholders.

The InsurTech movement is completely changing the game by fusing banking, claims, and service workflows into agile, API-first ecosystems. The global InsurTech market is on track to hit USD 92.6 billion by 2029, growing at an incredible 37.8% CAGR.

This explosive growth is a clear signal that legacy systems just can't keep up. This is exactly where platforms like Nolana come in, using AI agents to automate critical operations, cut costs, and shrink cycle times by as much as 50%. You can explore more data on this trend in the latest InsurTech market report. It’s all about creating a better customer experience without taking your eye off risk and compliance.

Frequently Asked Questions

How Does AI Actually Improve the Claims Process?

Artificial intelligence injects much-needed speed and precision into the entire claims lifecycle. By automating insurance claims with AI, specialized agents can take over the initial First Notice of Loss (FNOL), instantly interpret damage from photos, confirm policy details, and flag potential fraud—all in real time.

For simpler claims, this unlocks true straight-through processing. Imagine a claim being submitted, verified, and paid out in just a few minutes. That’s the power of modern claims AI reviews, which can slash settlement times from weeks down to hours while grounding every decision in clean, consistent data.

What Is AI's Role in Insurance Customer Care?

In AI customer care, think of intelligent agents as your new front line. They offer round-the-clock support for common needs like policy questions, payments, or checking on a claim's status. Since they plug into a unified data platform, these agents see the full picture of every customer interaction.

This comprehensive view allows them to provide genuinely personalized help, like suggesting a relevant policy bundle based on a customer's life events. By fielding all the routine inquiries, AI insurance companies free up their human teams to handle the complex, sensitive situations where a human touch is irreplaceable, which is a key goal of AI customer care for financial services.

How Do AI Agents Connect with Our Existing Insurance Systems?

This is a common concern, but modern AI platforms don't force you to rip and replace your core systems. They’re built to work with what you already have, integrating smoothly with giants like Guidewire, Duck Creek, Salesforce, and ServiceNow using APIs.

An AI-native operating system acts as the conductor. It tells the agents to pull data from one system, perform a task in another, and then record the entire interaction in a third. This creates a seamless, automated workflow that spans your whole technology stack, ensuring integrated insurance solutions enhance your operations instead of disrupting them.

The real value of a modern AI platform lies in its ability to be the connective tissue for your business. It lets specialized AI agents talk to legacy systems, run complex processes across multiple applications, and keep a perfect audit trail of every single action—giving you complete control and compliance in a highly regulated industry.

Ready to automate your high-stakes insurance operations with compliant AI agents? Nolana provides an AI-native operating system that connects to your core systems to deliver real-time automation with clear guardrails and seamless human escalation. Explore the Nolana platform to see how you can cut costs, accelerate cycle times, and improve customer experiences.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP