Data Analytics for Insurance Unlocking AI Automation

Data Analytics for Insurance Unlocking AI Automation

Discover how data analytics for insurance is revolutionizing the industry. Learn how AI automates claims and enhances customer care for maximum ROI.

Data analytics isn't just another tool for insurers anymore; it's the engine driving a fundamental shift in how the entire industry operates. It's about using historical and real-time data to move from a reactive stance—simply paying for losses after they happen—to a proactive one. This means predicting risk, automating processes, and personalizing customer interactions with a level of precision that was once unthinkable.

This data-first mindset is the new foundation for the future of insurance.

The New Reality of Insurance Driven by Data and AI

The insurance world is steadily moving away from its traditional, often manual, processes. In their place is a smarter, more efficient future built on data analytics and artificial intelligence. This isn't just about small upgrades; it's a complete reimagining of how insurers operate, connect with customers, and manage risk.

Today, the most successful ai insurance companies aren't just collecting data—they're treating it as their most valuable strategic asset.

This transformation is already making waves financially. The global market for data analytics for insurance was pegged at USD 13.84 billion in 2024. It’s expected to balloon to USD 31.33 billion by 2030, which is a staggering compound annual growth rate of 14.7%. This explosive growth shows just how heavily the industry is investing in AI and machine learning to sharpen its operations and deliver better outcomes for policyholders.

Shifting from Reaction to Prediction

For centuries, the insurance model was straightforward: collect premiums, pool the risk, and pay claims when they came in. It was a reactive business by nature. Data analytics completely flips this model on its head. Instead of just analyzing what already happened, leading insurers are now using predictive models to forecast what will happen.

This predictive power is being applied everywhere, but two areas, in particular, are seeing massive change:

Automating Claims Processing: This is where AI truly shines. By analyzing everything from photos of car damage to adjuster notes, it enables instant and accurate assessments. The ultimate goal is to make claims ai reviews so efficient that straightforward claims can be processed without any human touch, freeing up experienced adjusters for the really complex cases.

Reimagining Customer Care: AI is also changing the game on the front lines. By analyzing call transcripts, emails, and chat logs, AI customer care systems can give agents real-time guidance during conversations or power intelligent chatbots that provide 24/7 support.

At its core, data analytics allows an insurance company to understand its customers and its risks on a granular level. It’s the difference between using a static paper map to navigate and using a real-time GPS that sees traffic jams ahead and reroutes you instantly.

To make this all work, AI needs to understand more than just numbers in a spreadsheet. Much of the most valuable data—like the spoken words from a customer call—is unstructured. Technologies like Automatic Speech Recognition (ASR) technology are crucial here, converting speech into text that can then be analyzed. It’s this ability to unlock insights from previously hidden sources that makes the current wave of AI so powerful.

Data analytics is the bedrock of modern insurance. It's the technology that enables the automation, personalization, and efficiency needed to stay competitive. For a deeper look into its applications, you can read our comprehensive overview of https://nolana.com/articles/data-analytics-in-insurance.

Key Applications of AI in Insurance

AI-powered data analytics is creating value across the entire insurance lifecycle. Here's a quick look at the primary areas where it's making the biggest impact.

Application Area | Core Function | Business Impact |

|---|---|---|

Claims Processing | Automates intake, triage, and damage assessment using text and image analysis. | Faster settlement times, reduced operational costs, and higher customer satisfaction. |

Fraud Detection | Identifies suspicious patterns and anomalies in claims data in real-time. | Minimizes financial losses from fraudulent claims and helps maintain fair premiums. |

Underwriting & Pricing | Analyzes vast datasets to create highly accurate risk profiles and personalized premiums. | Improved risk selection, more competitive pricing, and increased profitability. |

Customer Experience | Powers intelligent chatbots, personalizes communications, and predicts customer needs. | Enhanced customer engagement and loyalty, and lower service costs. |

Ultimately, these applications work together, creating a more intelligent and responsive insurance ecosystem that benefits both the carrier and the policyholder.

How AI Is Automating Insurance Claims Processing

One of the most powerful ways data analytics for insurance is making an impact is by completely rethinking the claims journey. For years, processing a claim was a notoriously slow, paper-intensive slog, riddled with potential for delays and human error. Today, AI is stepping in as a sophisticated co-pilot, automating the entire workflow from the first report to the final settlement with incredible speed and accuracy.

This isn't just about moving faster; it's about fundamentally improving the customer experience right when it matters most. When a policyholder files a claim, they're often dealing with a stressful, disruptive event. A slow and confusing claims process just pours salt in the wound. ai insurance companies are tackling this head-on by creating an experience that's almost frictionless.

The automation kicks in the moment a claim is filed—often called the First Notice of Loss (FNOL). Instead of filling out endless forms, a customer can simply upload photos of a dented car or a water-damaged floor through a mobile app. From there, AI-powered computer vision models get to work, instantly analyzing the images to identify the type and severity of damage. In many cases, they can even produce an initial repair estimate within seconds.

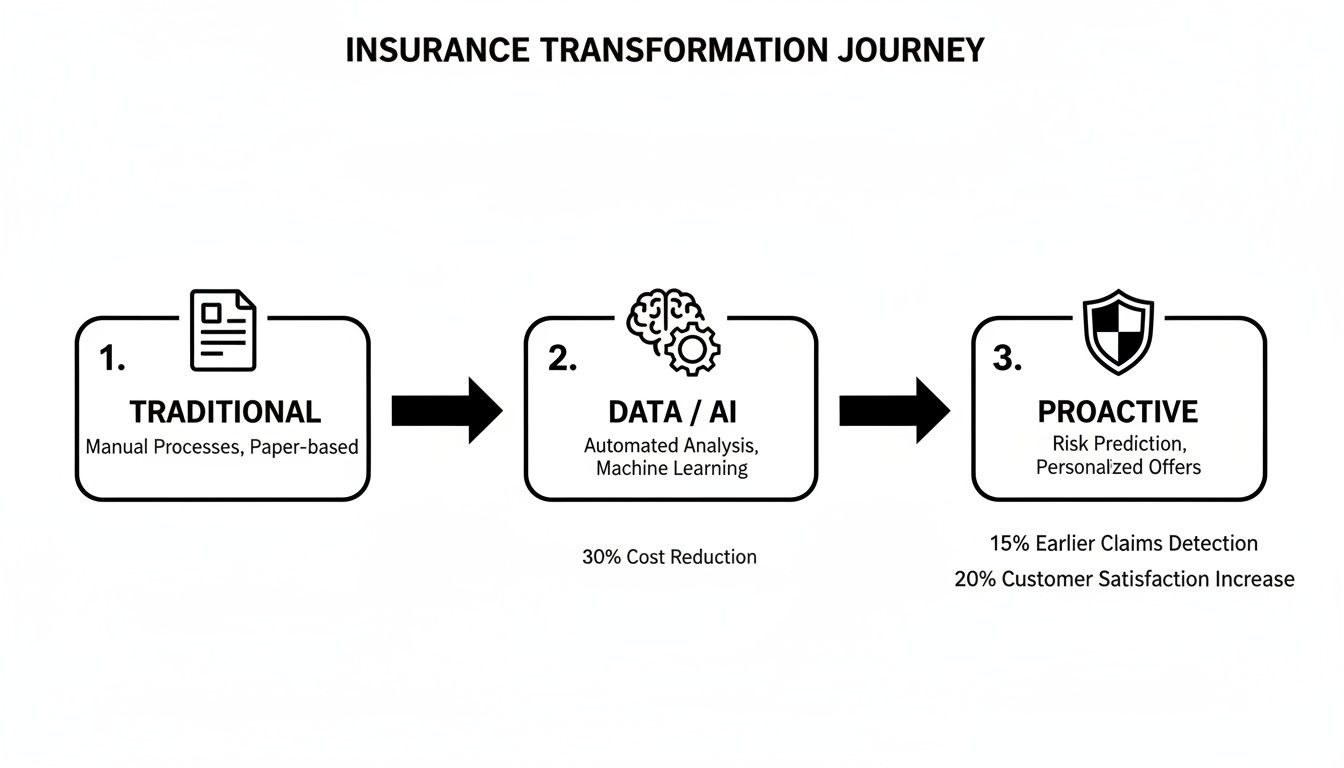

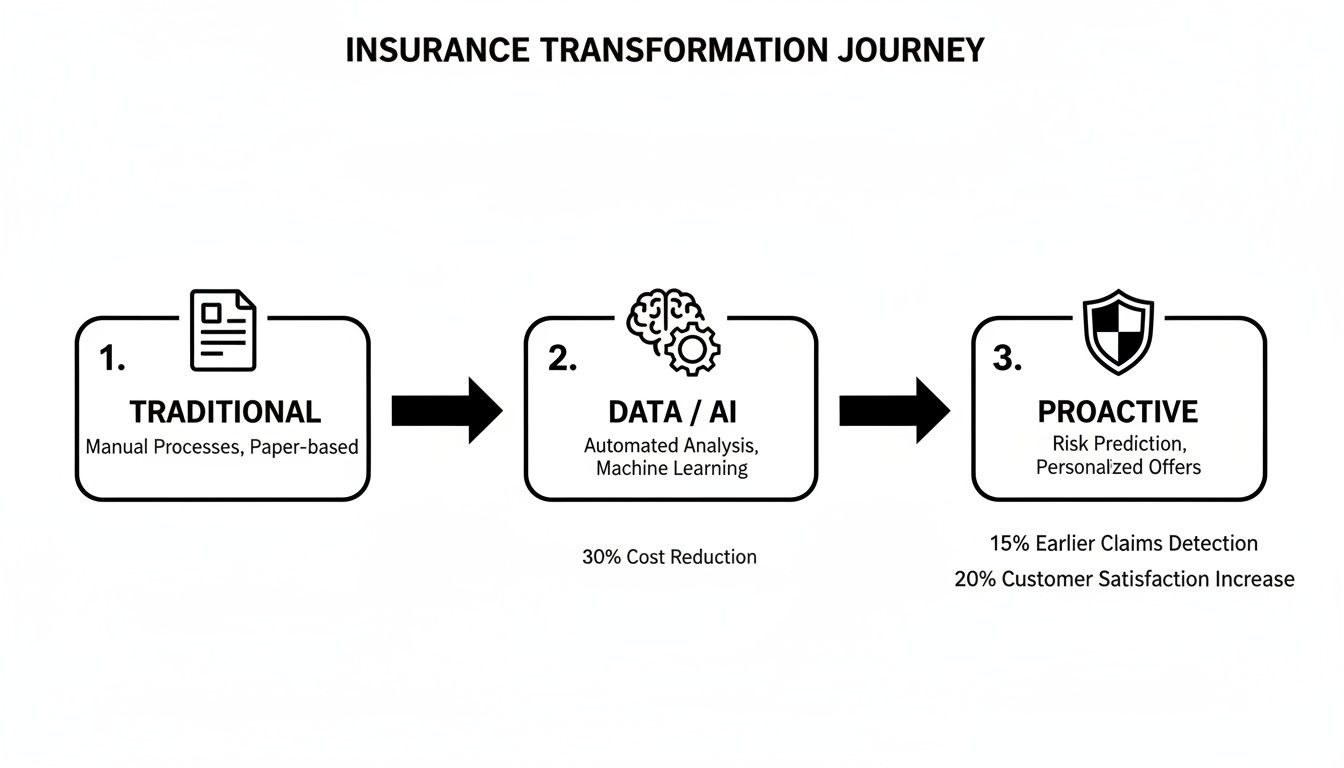

The image below shows this evolution perfectly, mapping the journey from old-school, document-heavy methods to a modern, AI-driven model.

This visual really drives home how data and AI act as the critical bridge, pulling the industry away from reactive manual tasks and toward intelligent, automated, and eventually preventative operations.

From Triage to Straight-Through Processing

After the initial data is collected, AI continues to direct the flow. Machine learning algorithms sift through unstructured data—like adjuster notes, customer emails, and repair shop invoices—to triage claims with precision. Simple, low-risk claims can be immediately flagged for "straight-through processing," where they are approved and paid out automatically, often without any human touch at all.

This hands-free approach has a huge impact. Insurers that have adopted predictive analytics are cutting their claim processing times by an average of 30%, which directly translates to happier, more loyal customers. It also frees up your most experienced adjusters to focus their valuable time on the complex, high-stakes claims that genuinely require their expert judgment.

The Power of AI in Fraud Detection

A crucial piece of the automated claims puzzle is sophisticated fraud detection. Fraud costs the property and casualty insurance industry billions of dollars every year, but AI offers a formidable defense. Analytics models can scan every incoming claim for subtle red flags and suspicious patterns that a human reviewer could easily overlook.

These systems work in real time, cross-referencing thousands of data points to spot anomalies like:

Inconsistencies between a claimant’s story and the photo evidence.

Hidden connections to known fraudulent networks or previously flagged claims.

Unusual billing patterns from repair shops or medical providers.

By catching potential fraud right at the front door, insurers prevent losses before they happen, which ultimately helps keep premiums more affordable for everyone. In fact, carriers using predictive analytics for fraud have boosted their success rates in identifying fraudulent claims from 50% to over 80%.

This entire automated workflow is built on a single, powerful idea: using data to make faster, more consistent, and more accurate decisions. The result is a system where claims ai reviews become a reliable and indispensable part of the modern insurance operation.

Revolutionizing Customer Communication During Claims

Beyond processing and fraud detection, data analytics is also changing how insurers talk to their customers during a claim. Instead of leaving policyholders waiting and wondering, AI customer care systems can send proactive, automated updates via text or email at each stage of the process.

For more complex questions, intelligent chatbots can offer instant, 24/7 support, answering queries about a claim’s status or what documents are needed next. This blend of smart automation and self-service dramatically improves the customer journey, transforming a traditionally painful process into a transparent and reassuring one. You can dive deeper into how AI in insurance claims is delivering this kind of tangible ROI for carriers. This continuous engagement builds trust and reinforces the value of the policy when it’s needed most.

How AI and Analytics Are Reshaping Customer Care

While streamlining claims is a huge operational win, the real magic of data analytics for insurance happens when it touches the customer relationship. The most innovative ai insurance companies are flipping the script on customer service, turning it from a reactive, costly necessity into a proactive engine for building loyalty. This isn't just a minor tweak; it's a fundamental shift powered by AI that can understand, anticipate, and respond to what customers need.

This evolution is about more than just closing tickets faster. It’s about creating experiences that make policyholders feel genuinely seen and understood—a massive advantage in a crowded market.

The Rise of Intelligent Virtual Assistants

The most common face of AI customer care is the intelligent chatbot or virtual assistant. Forget the clunky, frustrating bots of a few years ago. Today's AI agents can handle a huge range of questions with conversational skill, and they never sleep. They've become the indispensable first line of support for everyday tasks.

These smart assistants can instantly:

Answer specific questions about a policyholder’s coverage or deductible.

Walk a customer through the first steps of filing a simple claim.

Handle payments and update personal details securely.

Provide on-demand status updates for ongoing claims ai reviews.

This instant, self-service model doesn't just meet modern expectations; it frees up your human agents to focus on the complex, emotionally sensitive situations where their expertise truly matters.

Beyond Bots: Understanding Customer Sentiment

The real depth of AI customer care lies in its ability to read between the lines. AI models can analyze the sentiment in customer communications—from phone call transcripts to emails and chat logs—to get a clear read on the emotional tone of the conversation.

Think about it: a customer service agent gets a real-time, on-screen alert that a caller's frustration is spiking. The AI can immediately arm that agent with a summary of the customer's history, the root of the problem, and even suggest specific phrases or solutions that have worked to de-escalate similar issues before.

It's like giving your customer service team a set of emotional X-ray glasses. They can see what’s really going on beneath the surface and respond with more empathy and precision, turning a potential conflict into a moment that reinforces loyalty.

This capability turns every single interaction into a rich source of data. It helps pinpoint systemic problems causing friction and delivers powerful insights for coaching and training your team. It's no surprise that companies leaning into AI-powered strategies have boosted customer satisfaction by 15–20% while cutting service costs.

Crafting Hyper-Personalized Customer Journeys

Data analytics lets insurers finally move beyond generic, one-size-fits-all communication. By pulling together data from every touchpoint—claims history, policy details, past service interactions, even website activity—AI can build a complete, 360-degree view of each and every customer.

This unified profile makes proactive, relevant engagement possible. For example, the system might flag a customer with a young family who just bought a new home and automatically suggest adding an umbrella policy. Or, it could identify a policyholder at high risk of leaving and trigger a personalized retention offer before they even start shopping around.

This is a true game-changer. Insurers using predictive analytics to drive customer engagement have seen a 23% improvement in retention rates. By anticipating needs and offering genuinely helpful advice, ai insurance companies build deeper, more durable relationships.

For carriers looking to put these strategies into practice, it's crucial to understand the core principles. You can explore how to build a solid framework for AI customer care in our comprehensive guide on the topic. The goal is to ensure technology supports—not replaces—the vital human element of service, creating a balanced and highly effective operation.

Building the Technical Backbone for Insurance Analytics

Great ideas for using data are one thing, but making them a reality in insurance requires a powerful and flexible technical foundation. This "backbone" is the engine that actually collects, processes, and activates your data, powering everything from AI customer care to automated claims ai reviews. This isn't just about building pretty dashboards; it's about architecting an entire operation that runs on data.

The first step is gathering data from all the right places. Today’s ai insurance companies don’t just rely on structured policy files. They pull from a much richer ecosystem of information.

This includes:

Policy and Claims History: The core data that tells you about past performance and risk.

Customer Interactions: Incredibly valuable unstructured data from call logs, emails, and chat transcripts.

Telematics and IoT Data: Real-time streams from vehicles and smart home devices that offer a live view of risk.

Third-Party Data: External context from sources like weather services, public records, and economic trends.

All this raw information needs a home—a central place where it can be stored and analyzed. This is where data warehouses and data lakes enter the picture. A huge part of building this technical backbone is understanding data warehousing and its role in smarter decision-making. You can think of a data lake as a vast reservoir for raw, unstructured data, while a data warehouse is more like a refined library, neatly organized for specific analysis and reporting.

Overcoming Legacy System Hurdles

For many carriers, one of the biggest roadblocks is the technology they already have. Core systems like Guidewire or Duck Creek are workhorses for managing policies and claims, but they simply weren't designed for the high-speed demands of modern data analytics. Data often gets trapped inside these silos, making it a slow, painful process to get it into the hands of AI models.

Traditional integration methods are often brittle, expensive, and require a ton of custom code that becomes a nightmare to maintain. This technical debt kills innovation and makes it impossible for insurers to roll out new analytics features quickly. It's a problem that demands a completely new way of thinking.

The goal isn't to rip and replace these essential core systems. Instead, the smart strategy is to build an intelligent layer on top of them—one that can unlock the data without disrupting the entire operation.

This is exactly what modern AI-native platforms are built for. They serve as a flexible, intelligent bridge that connects your legacy systems to modern AI tools. Using pre-built connectors and open APIs, these platforms can seamlessly pull and unify data from different sources, creating a single, reliable source of truth for all your analytics work.

The impact on speed is dramatic. Instead of spending months wrestling with complex integrations, carriers can start deploying AI models and seeing a real return in a fraction of the time. In this market, that kind of agility is a massive competitive advantage.

Creating a Future-Proof Foundation

An AI-native platform does more than just connect old and new systems; it lays a foundation that’s built to last. By decoupling your analytics engine from your core legacy systems, you give yourself the freedom to adopt new technologies as they come along without being chained to old infrastructure.

This modern architecture is non-negotiable for any carrier that's serious about becoming a data-driven organization. It delivers the speed, flexibility, and scale you need to not just compete but to lead in an industry being fundamentally reshaped by data. To get there, leaders need a firm grasp on the principles of AI-powered decision making to build a solid technical and strategic framework. This investment in the right technical backbone is what allows ai insurance companies to deliver better outcomes for their business and, most importantly, for their customers.

A Practical Roadmap to Implementing Your Data Strategy

Moving from a great idea to a tangible result requires a clear, actionable plan. An effective data strategy isn't something you build overnight; it's a phased journey that methodically turns ambitious goals into real business outcomes. For insurance leaders, this means creating a playbook that gets technology, people, and processes all pulling in the same direction—whether the goal is automating claims ai reviews or elevating AI customer care.

This roadmap breaks down the implementation into manageable phases. The whole point is to build momentum, prove value early on, and make sure the entire organization comes along for the ride. Success here isn't about a single "big bang" launch. It’s about stringing together a series of well-executed, incremental wins.

Phase 1: Define Your Business Objectives

Before a single line of code is written or any new software is bought, you have to define what success actually looks like in plain business terms. Vague goals like “becoming more data-driven” are dead on arrival. You need to zero in on specific, measurable outcomes that solve a real pain point or unlock a new opportunity.

Get sharp and focused with your objectives. For example:

Slash claim cycle times for low-complexity auto claims by 40% within nine months.

Boost customer retention by 5% by spotting at-risk policyholders with sentiment analysis.

Cut fraudulent claim payouts by $10 million a year with real-time anomaly detection.

These kinds of precise targets give your data science and IT teams a clear destination. They also create a black-and-white way to measure ROI, which makes getting buy-in and justifying future investment a whole lot easier.

Phase 2: Assess Data Readiness and Governance

With clear goals locked in, it’s time for a reality check. This means taking a hard look at your current data infrastructure, its quality, and how accessible it is. Do you even have the data you need? Is it clean and reliable, or is it gathering dust in disconnected legacy systems?

This is also where you lay down the non-negotiable ground rules. Data governance is the framework that ensures your data is handled securely, ethically, and in line with regulations like GDPR. It answers critical questions: Who can see what data? How can they use it? How is its quality maintained?

A data strategy without governance is like building a skyscraper without a blueprint. It might look impressive for a short time, but it lacks the structural integrity to last and will inevitably lead to costly problems.

Phase 3: Select the Right Technology and Team

Now it's time to gather your tools and your talent. Choosing your tech stack means picking the right platforms for data storage (like data lakes or warehouses), processing, and analytics. For many ai insurance companies, this involves looking beyond traditional on-premise setups to more flexible, cloud-based AI-native platforms. The key is finding something that can integrate with your existing core systems, like Guidewire or Duck Creek, without forcing a complete rip-and-replace.

At the same time, you need to build the right team. This usually means data scientists to build the models, data engineers to manage the data pipelines, and business analysts who can translate what the business needs into technical specs. Building a collaborative culture between these technical experts and your leaders on the business side is absolutely critical for success.

Phase 4: Launch Pilot Projects to Prove Value

Instead of trying to boil the ocean with a massive, company-wide rollout, start small with high-impact pilot projects. Pick one or two of the business objectives from Phase 1 and pour your resources into delivering a clear, undeniable win. A successful pilot acts as a powerful proof of concept, showing the real-world value of data analytics for insurance to the rest of the company.

For instance, you could launch a pilot to automate the triage of incoming property claims. Its limited scope lets your team fine-tune the models, iron out integration kinks, and show measurable results—like a lighter workload for adjusters—in a controlled setting. Seeing these early wins builds confidence and creates champions for expanding the program. To see how this works in practice, you can explore a case study on transforming insurance claims with agentic AI.

The financial upside here is enormous. The risk assessment application market segment alone is expected to hit $7,242.0 million in revenue by 2025, a number fueled by the power to price risk accurately using everything from telematics to social media data. You can discover more insights about this booming market for risk assessment tools. This shows that even a focused pilot project is tapping into a much larger wave of value creation. This phased, methodical approach ensures your data strategy becomes a powerful, sustainable engine for growth, not just a plan on paper.

Frequently Asked Questions About AI in Insurance

As insurers lean more heavily into data-driven strategies, it’s only natural for leaders to have questions about how all this technology works in the real world. Let's tackle some of the most common ones to demystify how data analytics for insurance is truly changing core operations like claims and customer support.

How Do AI Insurance Companies Use Data to Automate Claims Reviews?

The goal of using AI in claims is to transform a traditionally slow, manual process into a fast, accurate, and largely automated workflow. It all kicks off the second a customer reports a loss—the First Notice of Loss (FNOL).

Right away, AI tools get to work. Natural Language Processing (NLP) can pull critical details from a customer's email or a recorded phone call. At the same time, computer vision models can analyze photos of a damaged car or a leaky roof, giving an instant, preliminary damage assessment. This initial data grab is dramatically faster and more consistent than having a person key it all in.

From there, the real intelligence takes over. Machine learning algorithms compare the new claim against a vast history of similar claims, the customer’s policy, and a library of known fraud patterns. This allows for incredibly effective claims ai reviews in real time, catching suspicious details or inconsistencies a human adjuster might easily overlook.

For straightforward, low-risk claims, this all leads to "straight-through processing." The AI can approve the claim and trigger a payment on its own, cutting the settlement time from weeks down to minutes.

For more complicated claims, the AI acts more like an intelligent assistant. It triages the case, gives a summary of the key facts, and sends it to the right human adjuster with a list of recommended next steps. This frees up your best adjusters to focus their expertise where it matters most, rather than on administrative legwork.

What Are the Primary Benefits of Implementing AI Customer Care?

Bringing AI customer care into your operations delivers a powerful one-two-three punch, turning what was once a cost center into a real strategic advantage.

First, you get a massive boost in efficiency and round-the-clock availability. AI-powered chatbots and virtual assistants can handle a huge volume of common policyholder questions—anytime, day or night. This lets your human agents step away from repetitive queries and dedicate their energy to the complex, high-stakes, or emotionally charged conversations that demand a human touch.

Second is the ability to offer deep personalization, but at scale. AI doesn’t just spit out canned answers; it understands the person it’s talking to. By looking at a customer’s entire journey—their policies, past claims, and previous interactions—the AI can provide truly tailored responses. It can even spot opportunities to suggest relevant product add-ons, which is great for both customer satisfaction and your bottom line.

Finally, AI customer care makes proactive support possible. Advanced analytics can actually monitor the sentiment in emails or chat logs to flag customers who seem frustrated or at risk of leaving. The system can then alert a human agent to jump in with a solution before the customer decides to shop around, a proven strategy for improving retention.

What Is the Biggest Challenge When Integrating Analytics with Legacy Insurance Systems?

Hands down, the single biggest hurdle is dealing with data silos and the rigid nature of older core systems. Platforms from providers like Guidewire or Duck Creek are fantastic systems of record for managing policies and claims, but they simply weren't built for the kind of flexibility and high-volume data flow that modern AI and analytics demand.

Often, critical data is locked away in proprietary formats, making it tough and expensive to get it out, clean it up, and move it into the data lakes or warehouses that machine learning models need to thrive. The old way of integrating involved writing custom code that was slow to build, costly to maintain, and would break with every system update. It’s a recipe for stalled innovation.

This is exactly why a new generation of AI-native platforms is catching on with forward-thinking ai insurance companies. They’re built with open APIs and flexible connectors, designed to sit on top of your existing core systems as a smart, agile layer. This approach lets you tap into all that valuable, trapped data without going through a painful and risky "rip-and-replace" project. By bridging the old with the new, these platforms help you deploy powerful data analytics for insurance solutions much, much faster.

Ready to automate your high-stakes insurance operations with compliant AI agents? Nolana provides an AI-native operating system that connects to your existing core systems to deliver real-time automation with clear guardrails and seamless human oversight. Learn more about how we can help you cut costs and accelerate cycle times at https://nolana.com.

Data analytics isn't just another tool for insurers anymore; it's the engine driving a fundamental shift in how the entire industry operates. It's about using historical and real-time data to move from a reactive stance—simply paying for losses after they happen—to a proactive one. This means predicting risk, automating processes, and personalizing customer interactions with a level of precision that was once unthinkable.

This data-first mindset is the new foundation for the future of insurance.

The New Reality of Insurance Driven by Data and AI

The insurance world is steadily moving away from its traditional, often manual, processes. In their place is a smarter, more efficient future built on data analytics and artificial intelligence. This isn't just about small upgrades; it's a complete reimagining of how insurers operate, connect with customers, and manage risk.

Today, the most successful ai insurance companies aren't just collecting data—they're treating it as their most valuable strategic asset.

This transformation is already making waves financially. The global market for data analytics for insurance was pegged at USD 13.84 billion in 2024. It’s expected to balloon to USD 31.33 billion by 2030, which is a staggering compound annual growth rate of 14.7%. This explosive growth shows just how heavily the industry is investing in AI and machine learning to sharpen its operations and deliver better outcomes for policyholders.

Shifting from Reaction to Prediction

For centuries, the insurance model was straightforward: collect premiums, pool the risk, and pay claims when they came in. It was a reactive business by nature. Data analytics completely flips this model on its head. Instead of just analyzing what already happened, leading insurers are now using predictive models to forecast what will happen.

This predictive power is being applied everywhere, but two areas, in particular, are seeing massive change:

Automating Claims Processing: This is where AI truly shines. By analyzing everything from photos of car damage to adjuster notes, it enables instant and accurate assessments. The ultimate goal is to make claims ai reviews so efficient that straightforward claims can be processed without any human touch, freeing up experienced adjusters for the really complex cases.

Reimagining Customer Care: AI is also changing the game on the front lines. By analyzing call transcripts, emails, and chat logs, AI customer care systems can give agents real-time guidance during conversations or power intelligent chatbots that provide 24/7 support.

At its core, data analytics allows an insurance company to understand its customers and its risks on a granular level. It’s the difference between using a static paper map to navigate and using a real-time GPS that sees traffic jams ahead and reroutes you instantly.

To make this all work, AI needs to understand more than just numbers in a spreadsheet. Much of the most valuable data—like the spoken words from a customer call—is unstructured. Technologies like Automatic Speech Recognition (ASR) technology are crucial here, converting speech into text that can then be analyzed. It’s this ability to unlock insights from previously hidden sources that makes the current wave of AI so powerful.

Data analytics is the bedrock of modern insurance. It's the technology that enables the automation, personalization, and efficiency needed to stay competitive. For a deeper look into its applications, you can read our comprehensive overview of https://nolana.com/articles/data-analytics-in-insurance.

Key Applications of AI in Insurance

AI-powered data analytics is creating value across the entire insurance lifecycle. Here's a quick look at the primary areas where it's making the biggest impact.

Application Area | Core Function | Business Impact |

|---|---|---|

Claims Processing | Automates intake, triage, and damage assessment using text and image analysis. | Faster settlement times, reduced operational costs, and higher customer satisfaction. |

Fraud Detection | Identifies suspicious patterns and anomalies in claims data in real-time. | Minimizes financial losses from fraudulent claims and helps maintain fair premiums. |

Underwriting & Pricing | Analyzes vast datasets to create highly accurate risk profiles and personalized premiums. | Improved risk selection, more competitive pricing, and increased profitability. |

Customer Experience | Powers intelligent chatbots, personalizes communications, and predicts customer needs. | Enhanced customer engagement and loyalty, and lower service costs. |

Ultimately, these applications work together, creating a more intelligent and responsive insurance ecosystem that benefits both the carrier and the policyholder.

How AI Is Automating Insurance Claims Processing

One of the most powerful ways data analytics for insurance is making an impact is by completely rethinking the claims journey. For years, processing a claim was a notoriously slow, paper-intensive slog, riddled with potential for delays and human error. Today, AI is stepping in as a sophisticated co-pilot, automating the entire workflow from the first report to the final settlement with incredible speed and accuracy.

This isn't just about moving faster; it's about fundamentally improving the customer experience right when it matters most. When a policyholder files a claim, they're often dealing with a stressful, disruptive event. A slow and confusing claims process just pours salt in the wound. ai insurance companies are tackling this head-on by creating an experience that's almost frictionless.

The automation kicks in the moment a claim is filed—often called the First Notice of Loss (FNOL). Instead of filling out endless forms, a customer can simply upload photos of a dented car or a water-damaged floor through a mobile app. From there, AI-powered computer vision models get to work, instantly analyzing the images to identify the type and severity of damage. In many cases, they can even produce an initial repair estimate within seconds.

The image below shows this evolution perfectly, mapping the journey from old-school, document-heavy methods to a modern, AI-driven model.

This visual really drives home how data and AI act as the critical bridge, pulling the industry away from reactive manual tasks and toward intelligent, automated, and eventually preventative operations.

From Triage to Straight-Through Processing

After the initial data is collected, AI continues to direct the flow. Machine learning algorithms sift through unstructured data—like adjuster notes, customer emails, and repair shop invoices—to triage claims with precision. Simple, low-risk claims can be immediately flagged for "straight-through processing," where they are approved and paid out automatically, often without any human touch at all.

This hands-free approach has a huge impact. Insurers that have adopted predictive analytics are cutting their claim processing times by an average of 30%, which directly translates to happier, more loyal customers. It also frees up your most experienced adjusters to focus their valuable time on the complex, high-stakes claims that genuinely require their expert judgment.

The Power of AI in Fraud Detection

A crucial piece of the automated claims puzzle is sophisticated fraud detection. Fraud costs the property and casualty insurance industry billions of dollars every year, but AI offers a formidable defense. Analytics models can scan every incoming claim for subtle red flags and suspicious patterns that a human reviewer could easily overlook.

These systems work in real time, cross-referencing thousands of data points to spot anomalies like:

Inconsistencies between a claimant’s story and the photo evidence.

Hidden connections to known fraudulent networks or previously flagged claims.

Unusual billing patterns from repair shops or medical providers.

By catching potential fraud right at the front door, insurers prevent losses before they happen, which ultimately helps keep premiums more affordable for everyone. In fact, carriers using predictive analytics for fraud have boosted their success rates in identifying fraudulent claims from 50% to over 80%.

This entire automated workflow is built on a single, powerful idea: using data to make faster, more consistent, and more accurate decisions. The result is a system where claims ai reviews become a reliable and indispensable part of the modern insurance operation.

Revolutionizing Customer Communication During Claims

Beyond processing and fraud detection, data analytics is also changing how insurers talk to their customers during a claim. Instead of leaving policyholders waiting and wondering, AI customer care systems can send proactive, automated updates via text or email at each stage of the process.

For more complex questions, intelligent chatbots can offer instant, 24/7 support, answering queries about a claim’s status or what documents are needed next. This blend of smart automation and self-service dramatically improves the customer journey, transforming a traditionally painful process into a transparent and reassuring one. You can dive deeper into how AI in insurance claims is delivering this kind of tangible ROI for carriers. This continuous engagement builds trust and reinforces the value of the policy when it’s needed most.

How AI and Analytics Are Reshaping Customer Care

While streamlining claims is a huge operational win, the real magic of data analytics for insurance happens when it touches the customer relationship. The most innovative ai insurance companies are flipping the script on customer service, turning it from a reactive, costly necessity into a proactive engine for building loyalty. This isn't just a minor tweak; it's a fundamental shift powered by AI that can understand, anticipate, and respond to what customers need.

This evolution is about more than just closing tickets faster. It’s about creating experiences that make policyholders feel genuinely seen and understood—a massive advantage in a crowded market.

The Rise of Intelligent Virtual Assistants

The most common face of AI customer care is the intelligent chatbot or virtual assistant. Forget the clunky, frustrating bots of a few years ago. Today's AI agents can handle a huge range of questions with conversational skill, and they never sleep. They've become the indispensable first line of support for everyday tasks.

These smart assistants can instantly:

Answer specific questions about a policyholder’s coverage or deductible.

Walk a customer through the first steps of filing a simple claim.

Handle payments and update personal details securely.

Provide on-demand status updates for ongoing claims ai reviews.

This instant, self-service model doesn't just meet modern expectations; it frees up your human agents to focus on the complex, emotionally sensitive situations where their expertise truly matters.

Beyond Bots: Understanding Customer Sentiment

The real depth of AI customer care lies in its ability to read between the lines. AI models can analyze the sentiment in customer communications—from phone call transcripts to emails and chat logs—to get a clear read on the emotional tone of the conversation.

Think about it: a customer service agent gets a real-time, on-screen alert that a caller's frustration is spiking. The AI can immediately arm that agent with a summary of the customer's history, the root of the problem, and even suggest specific phrases or solutions that have worked to de-escalate similar issues before.

It's like giving your customer service team a set of emotional X-ray glasses. They can see what’s really going on beneath the surface and respond with more empathy and precision, turning a potential conflict into a moment that reinforces loyalty.

This capability turns every single interaction into a rich source of data. It helps pinpoint systemic problems causing friction and delivers powerful insights for coaching and training your team. It's no surprise that companies leaning into AI-powered strategies have boosted customer satisfaction by 15–20% while cutting service costs.

Crafting Hyper-Personalized Customer Journeys

Data analytics lets insurers finally move beyond generic, one-size-fits-all communication. By pulling together data from every touchpoint—claims history, policy details, past service interactions, even website activity—AI can build a complete, 360-degree view of each and every customer.

This unified profile makes proactive, relevant engagement possible. For example, the system might flag a customer with a young family who just bought a new home and automatically suggest adding an umbrella policy. Or, it could identify a policyholder at high risk of leaving and trigger a personalized retention offer before they even start shopping around.

This is a true game-changer. Insurers using predictive analytics to drive customer engagement have seen a 23% improvement in retention rates. By anticipating needs and offering genuinely helpful advice, ai insurance companies build deeper, more durable relationships.

For carriers looking to put these strategies into practice, it's crucial to understand the core principles. You can explore how to build a solid framework for AI customer care in our comprehensive guide on the topic. The goal is to ensure technology supports—not replaces—the vital human element of service, creating a balanced and highly effective operation.

Building the Technical Backbone for Insurance Analytics

Great ideas for using data are one thing, but making them a reality in insurance requires a powerful and flexible technical foundation. This "backbone" is the engine that actually collects, processes, and activates your data, powering everything from AI customer care to automated claims ai reviews. This isn't just about building pretty dashboards; it's about architecting an entire operation that runs on data.

The first step is gathering data from all the right places. Today’s ai insurance companies don’t just rely on structured policy files. They pull from a much richer ecosystem of information.

This includes:

Policy and Claims History: The core data that tells you about past performance and risk.

Customer Interactions: Incredibly valuable unstructured data from call logs, emails, and chat transcripts.

Telematics and IoT Data: Real-time streams from vehicles and smart home devices that offer a live view of risk.

Third-Party Data: External context from sources like weather services, public records, and economic trends.

All this raw information needs a home—a central place where it can be stored and analyzed. This is where data warehouses and data lakes enter the picture. A huge part of building this technical backbone is understanding data warehousing and its role in smarter decision-making. You can think of a data lake as a vast reservoir for raw, unstructured data, while a data warehouse is more like a refined library, neatly organized for specific analysis and reporting.

Overcoming Legacy System Hurdles

For many carriers, one of the biggest roadblocks is the technology they already have. Core systems like Guidewire or Duck Creek are workhorses for managing policies and claims, but they simply weren't designed for the high-speed demands of modern data analytics. Data often gets trapped inside these silos, making it a slow, painful process to get it into the hands of AI models.

Traditional integration methods are often brittle, expensive, and require a ton of custom code that becomes a nightmare to maintain. This technical debt kills innovation and makes it impossible for insurers to roll out new analytics features quickly. It's a problem that demands a completely new way of thinking.

The goal isn't to rip and replace these essential core systems. Instead, the smart strategy is to build an intelligent layer on top of them—one that can unlock the data without disrupting the entire operation.

This is exactly what modern AI-native platforms are built for. They serve as a flexible, intelligent bridge that connects your legacy systems to modern AI tools. Using pre-built connectors and open APIs, these platforms can seamlessly pull and unify data from different sources, creating a single, reliable source of truth for all your analytics work.

The impact on speed is dramatic. Instead of spending months wrestling with complex integrations, carriers can start deploying AI models and seeing a real return in a fraction of the time. In this market, that kind of agility is a massive competitive advantage.

Creating a Future-Proof Foundation

An AI-native platform does more than just connect old and new systems; it lays a foundation that’s built to last. By decoupling your analytics engine from your core legacy systems, you give yourself the freedom to adopt new technologies as they come along without being chained to old infrastructure.

This modern architecture is non-negotiable for any carrier that's serious about becoming a data-driven organization. It delivers the speed, flexibility, and scale you need to not just compete but to lead in an industry being fundamentally reshaped by data. To get there, leaders need a firm grasp on the principles of AI-powered decision making to build a solid technical and strategic framework. This investment in the right technical backbone is what allows ai insurance companies to deliver better outcomes for their business and, most importantly, for their customers.

A Practical Roadmap to Implementing Your Data Strategy

Moving from a great idea to a tangible result requires a clear, actionable plan. An effective data strategy isn't something you build overnight; it's a phased journey that methodically turns ambitious goals into real business outcomes. For insurance leaders, this means creating a playbook that gets technology, people, and processes all pulling in the same direction—whether the goal is automating claims ai reviews or elevating AI customer care.

This roadmap breaks down the implementation into manageable phases. The whole point is to build momentum, prove value early on, and make sure the entire organization comes along for the ride. Success here isn't about a single "big bang" launch. It’s about stringing together a series of well-executed, incremental wins.

Phase 1: Define Your Business Objectives

Before a single line of code is written or any new software is bought, you have to define what success actually looks like in plain business terms. Vague goals like “becoming more data-driven” are dead on arrival. You need to zero in on specific, measurable outcomes that solve a real pain point or unlock a new opportunity.

Get sharp and focused with your objectives. For example:

Slash claim cycle times for low-complexity auto claims by 40% within nine months.

Boost customer retention by 5% by spotting at-risk policyholders with sentiment analysis.

Cut fraudulent claim payouts by $10 million a year with real-time anomaly detection.

These kinds of precise targets give your data science and IT teams a clear destination. They also create a black-and-white way to measure ROI, which makes getting buy-in and justifying future investment a whole lot easier.

Phase 2: Assess Data Readiness and Governance

With clear goals locked in, it’s time for a reality check. This means taking a hard look at your current data infrastructure, its quality, and how accessible it is. Do you even have the data you need? Is it clean and reliable, or is it gathering dust in disconnected legacy systems?

This is also where you lay down the non-negotiable ground rules. Data governance is the framework that ensures your data is handled securely, ethically, and in line with regulations like GDPR. It answers critical questions: Who can see what data? How can they use it? How is its quality maintained?

A data strategy without governance is like building a skyscraper without a blueprint. It might look impressive for a short time, but it lacks the structural integrity to last and will inevitably lead to costly problems.

Phase 3: Select the Right Technology and Team

Now it's time to gather your tools and your talent. Choosing your tech stack means picking the right platforms for data storage (like data lakes or warehouses), processing, and analytics. For many ai insurance companies, this involves looking beyond traditional on-premise setups to more flexible, cloud-based AI-native platforms. The key is finding something that can integrate with your existing core systems, like Guidewire or Duck Creek, without forcing a complete rip-and-replace.

At the same time, you need to build the right team. This usually means data scientists to build the models, data engineers to manage the data pipelines, and business analysts who can translate what the business needs into technical specs. Building a collaborative culture between these technical experts and your leaders on the business side is absolutely critical for success.

Phase 4: Launch Pilot Projects to Prove Value

Instead of trying to boil the ocean with a massive, company-wide rollout, start small with high-impact pilot projects. Pick one or two of the business objectives from Phase 1 and pour your resources into delivering a clear, undeniable win. A successful pilot acts as a powerful proof of concept, showing the real-world value of data analytics for insurance to the rest of the company.

For instance, you could launch a pilot to automate the triage of incoming property claims. Its limited scope lets your team fine-tune the models, iron out integration kinks, and show measurable results—like a lighter workload for adjusters—in a controlled setting. Seeing these early wins builds confidence and creates champions for expanding the program. To see how this works in practice, you can explore a case study on transforming insurance claims with agentic AI.

The financial upside here is enormous. The risk assessment application market segment alone is expected to hit $7,242.0 million in revenue by 2025, a number fueled by the power to price risk accurately using everything from telematics to social media data. You can discover more insights about this booming market for risk assessment tools. This shows that even a focused pilot project is tapping into a much larger wave of value creation. This phased, methodical approach ensures your data strategy becomes a powerful, sustainable engine for growth, not just a plan on paper.

Frequently Asked Questions About AI in Insurance

As insurers lean more heavily into data-driven strategies, it’s only natural for leaders to have questions about how all this technology works in the real world. Let's tackle some of the most common ones to demystify how data analytics for insurance is truly changing core operations like claims and customer support.

How Do AI Insurance Companies Use Data to Automate Claims Reviews?

The goal of using AI in claims is to transform a traditionally slow, manual process into a fast, accurate, and largely automated workflow. It all kicks off the second a customer reports a loss—the First Notice of Loss (FNOL).

Right away, AI tools get to work. Natural Language Processing (NLP) can pull critical details from a customer's email or a recorded phone call. At the same time, computer vision models can analyze photos of a damaged car or a leaky roof, giving an instant, preliminary damage assessment. This initial data grab is dramatically faster and more consistent than having a person key it all in.

From there, the real intelligence takes over. Machine learning algorithms compare the new claim against a vast history of similar claims, the customer’s policy, and a library of known fraud patterns. This allows for incredibly effective claims ai reviews in real time, catching suspicious details or inconsistencies a human adjuster might easily overlook.

For straightforward, low-risk claims, this all leads to "straight-through processing." The AI can approve the claim and trigger a payment on its own, cutting the settlement time from weeks down to minutes.

For more complicated claims, the AI acts more like an intelligent assistant. It triages the case, gives a summary of the key facts, and sends it to the right human adjuster with a list of recommended next steps. This frees up your best adjusters to focus their expertise where it matters most, rather than on administrative legwork.

What Are the Primary Benefits of Implementing AI Customer Care?

Bringing AI customer care into your operations delivers a powerful one-two-three punch, turning what was once a cost center into a real strategic advantage.

First, you get a massive boost in efficiency and round-the-clock availability. AI-powered chatbots and virtual assistants can handle a huge volume of common policyholder questions—anytime, day or night. This lets your human agents step away from repetitive queries and dedicate their energy to the complex, high-stakes, or emotionally charged conversations that demand a human touch.

Second is the ability to offer deep personalization, but at scale. AI doesn’t just spit out canned answers; it understands the person it’s talking to. By looking at a customer’s entire journey—their policies, past claims, and previous interactions—the AI can provide truly tailored responses. It can even spot opportunities to suggest relevant product add-ons, which is great for both customer satisfaction and your bottom line.

Finally, AI customer care makes proactive support possible. Advanced analytics can actually monitor the sentiment in emails or chat logs to flag customers who seem frustrated or at risk of leaving. The system can then alert a human agent to jump in with a solution before the customer decides to shop around, a proven strategy for improving retention.

What Is the Biggest Challenge When Integrating Analytics with Legacy Insurance Systems?

Hands down, the single biggest hurdle is dealing with data silos and the rigid nature of older core systems. Platforms from providers like Guidewire or Duck Creek are fantastic systems of record for managing policies and claims, but they simply weren't built for the kind of flexibility and high-volume data flow that modern AI and analytics demand.

Often, critical data is locked away in proprietary formats, making it tough and expensive to get it out, clean it up, and move it into the data lakes or warehouses that machine learning models need to thrive. The old way of integrating involved writing custom code that was slow to build, costly to maintain, and would break with every system update. It’s a recipe for stalled innovation.

This is exactly why a new generation of AI-native platforms is catching on with forward-thinking ai insurance companies. They’re built with open APIs and flexible connectors, designed to sit on top of your existing core systems as a smart, agile layer. This approach lets you tap into all that valuable, trapped data without going through a painful and risky "rip-and-replace" project. By bridging the old with the new, these platforms help you deploy powerful data analytics for insurance solutions much, much faster.

Ready to automate your high-stakes insurance operations with compliant AI agents? Nolana provides an AI-native operating system that connects to your existing core systems to deliver real-time automation with clear guardrails and seamless human oversight. Learn more about how we can help you cut costs and accelerate cycle times at https://nolana.com.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP