A Guide to Insurance Software Development in the AI Era

A Guide to Insurance Software Development in the AI Era

Discover how AI-powered insurance software development is modernizing the industry. Learn to automate claims and enhance customer care with our expert guide.

At its core, insurance software development is all about building the digital machinery that runs a modern insurance company. This isn't just about websites or apps; it's about creating complex systems to handle everything from writing a new policy and managing billing to automating insurance claims with AI and delivering superior customer care. It’s the essential shift from paper-based, manual work to smart, automated operations.

The Future of Insurance Is Built on Advanced Software

The insurance world is in the middle of a massive upgrade, finally moving on from clunky, old legacy systems to more flexible and intelligent platforms. For any insurer looking to stay relevant, let alone grow, building or buying modern software isn't just a good idea—it's a must-have.

This change is being pushed from two directions. On one side, you have customers who are used to the slick, on-demand digital experiences they get from Amazon or their bank. On the other, you have a flood of agile insurtech startups using technology to launch faster, more tailored products, which completely changes the competitive game.

Why AI Is Reshaping the Industry

Artificial intelligence (AI) is the real engine behind this evolution, especially when it comes to claims and customer service. We're seeing AI insurance companies pop up that are building their entire business model around this tech, giving them a serious edge by rethinking how these core jobs get done.

The numbers back this up. The global market for insurance software is booming as carriers pour money into new tech. One key forecast predicts the market will jump from $14.14 billion in 2025 to $19.44 billion by 2030, a surge driven by cloud computing and AI-based automation.

By taking over repetitive tasks and delivering powerful data insights, AI gives insurers a new level of speed and accuracy. This lets their human experts step away from the busywork and focus on the complex, high-value challenges that need a human touch.

Automating Claims and Elevating Customer Care with AI

The real-world impact of AI is changing the day-to-day reality of insurance operations. For example, claims AI reviews can now instantly scan photos a policyholder uploads, assess the damage, confirm coverage details, and approve a payout for a straightforward claim in a matter of minutes. That used to take weeks. It's a huge win for cutting costs and, more importantly, for making a difficult experience better for the customer.

It's the same story with AI customer care, which has grown far beyond simple chatbots. Today's intelligent virtual assistants can answer tricky policy questions, walk customers through complicated forms, and even analyze the tone of a conversation to understand how a customer is feeling. This makes every interaction feel more personal and effective, a crucial component for any financial services business.

Clearly, the thoughtful use of AI in business operations is key to building an insurance company that's ready for the future. In this guide, we’ll break down exactly how these advanced systems are designed, constructed, and rolled out to create a smarter, more responsive insurance industry.

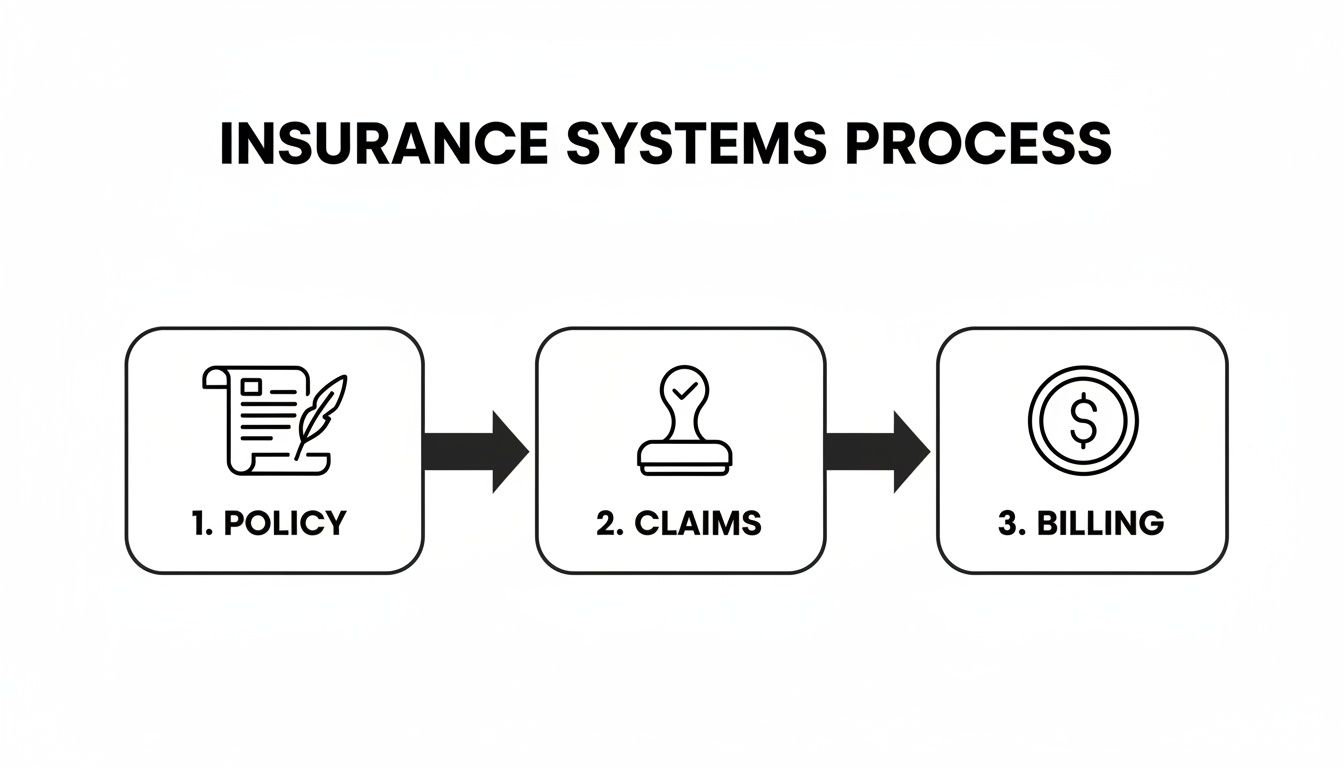

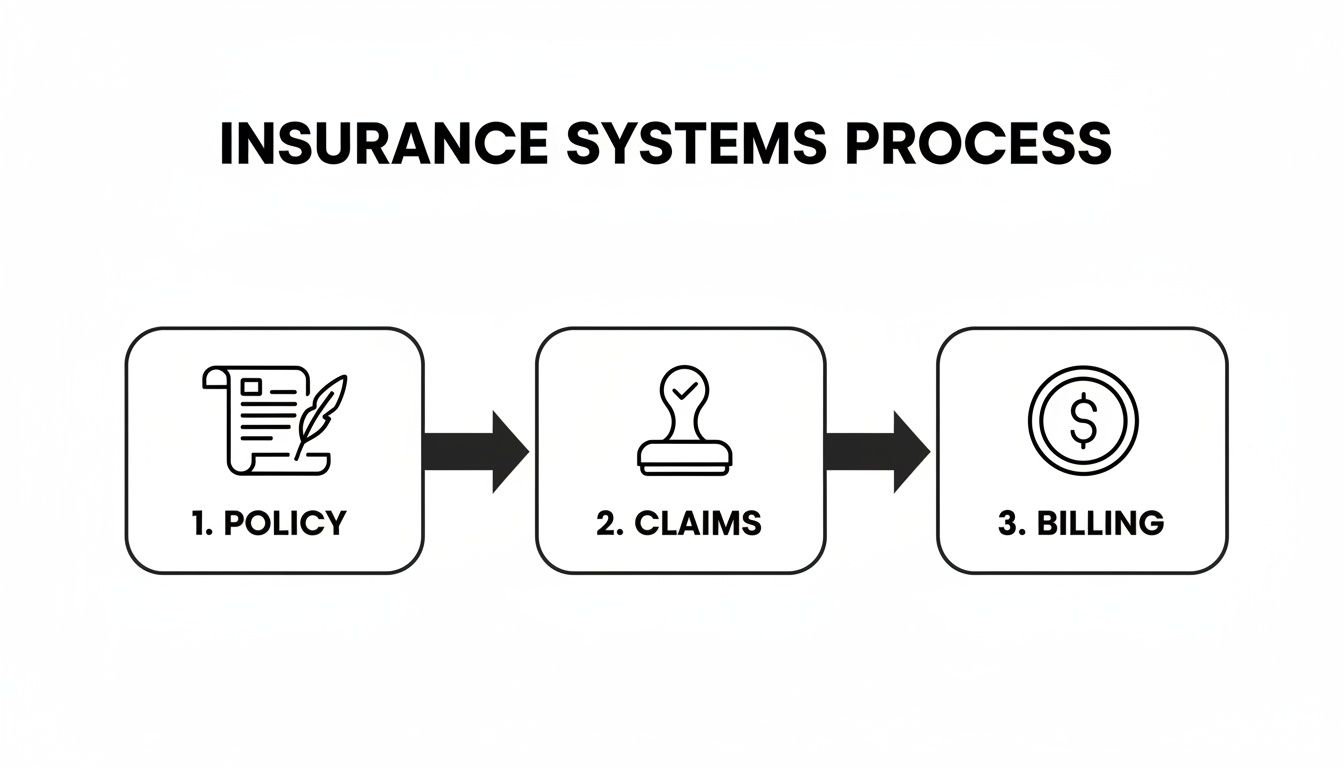

Understanding the Core Systems of Insurance Operations

Before we dive into advanced AI and automation, we need to get grounded in the foundational software that actually runs an insurance company. These core systems are the digital backbone of the entire business, acting like specialized departments in a well-oiled machine. Each one owns a critical piece of the process, and modern insurance software development is all about making them smarter and more connected.

Think of it this way: if an insurer were a factory, these systems would be the main assembly lines. Each has to run perfectly on its own, but they also have to integrate seamlessly to deliver the final product—a solid insurance policy and a great customer experience.

The Policy Administration System

The Policy Administration System (PAS) is the heart of the operation—it’s the system of record for every single policy the company writes.

This is where the entire policy lifecycle lives, from the moment a prospect asks for a quote to the day their policy is renewed or expires. The PAS is responsible for underwriting, rating, quoting, binding, and issuing policies, not to mention handling any changes (endorsements) or cancellations along the way. It is the ultimate source of truth for what’s covered and under what terms.

The Claims Management System

When a customer has a loss and needs to file a claim, the Claims Management System takes the lead. This is the operational command center for handling the company's promise to its policyholders.

The system manages the entire journey from the First Notice of Loss (FNOL) all the way through investigation and final payment. It’s where adjusters are assigned, investigations are documented, and communication with the policyholder is tracked. A fast, transparent claims system is absolutely critical for keeping customers happy during what's often a very stressful time. For a closer look, check out our guide on modern claims management systems.

The Billing System

The Billing System is the finance department. Its job is one of the most fundamental in the business: collecting the money.

This system makes sure premiums are calculated correctly, invoices go out on time, and payments are processed without a hitch. It also manages different payment plans, handles collections, and disburses commissions to agents. A rock-solid billing system stops revenue from slipping through the cracks and keeps the financial side of things smooth for everyone.

These three systems—Policy, Claims, and Billing—are the engine room of any insurer. They drive the day-to-day business, and how well they run has a direct line to profitability and customer loyalty.

Customer Relationship Management Systems

Finally, the Customer Relationship Management (CRM) system is the client relations expert. While the other systems focus on the technical side of insurance, the CRM is all about managing the human element.

It’s designed to create a 360-degree view of the customer by pulling all their interactions—emails, phone calls, policy details, and claims history—into one unified profile. This gives agents and service reps the context they need to provide personalized, well-informed support.

Here’s how a CRM helps the whole operation click:

Centralized Data: It connects to the PAS and Claims systems, giving service teams the full story before they even pick up the phone.

Proactive Communication: It can be set up to send automated renewal reminders or follow-ups, making the customer journey feel more guided.

Sales and Marketing: It’s essential for tracking new leads, managing sales pipelines, and running marketing campaigns that actually hit the mark.

Together, these four systems build the complete framework. The PAS defines the promise, the Billing System collects the premium for it, the Claims System delivers on that promise, and the CRM manages the relationship from start to finish. Knowing how they all fit together is the first real step toward making them better with smart automation.

Using AI to Automate Insurance Claims Processing

For decades, processing an insurance claim was a notoriously slow and paper-heavy ordeal. It was a manual grind of phone calls, paperwork, and lengthy reviews that created a ton of operational friction and left customers frustrated. Now, the new wave of AI insurance companies is completely overhauling this process by automating insurance claims with AI, bringing speed and intelligence to what was once a bottleneck.

This isn't just about making small tweaks; it’s about rethinking one of the industry's most essential functions from the ground up. With AI, insurers can automate the predictable, repetitive tasks, analyze mountains of data in a flash, and get decisions out the door in minutes instead of weeks. It’s a shift from a reactive, cumbersome system to a proactive and efficient one.

The starting point for any modern claims operation is solid workflow automation, which helps organize tasks and cut down on manual work. AI takes this a step further by adding a layer of smart, cognitive capability that was never possible before.

How AI Damage Assessment Is Modernizing the First Notice of Loss

The claims process always kicks off with the First Notice of Loss (FNOL)—the moment a customer reports an incident. This first interaction is crucial and really sets the stage for their entire experience. Thoughtful insurance software development is now giving insurers AI-powered tools to make this step feel almost instant.

Think about a common fender bender. Instead of calling an agent and filling out endless forms, the policyholder just opens their insurance app and uploads a few photos of the damage. Behind the scenes, the magic happens:

Computer Vision Analysis: An AI model gets to work, instantly analyzing the photos to pinpoint the exact location and severity of the damage. It knows the difference between a minor scratch and a cracked frame.

Automated Cost Estimation: The system then compares the damage against a huge database of parts and labor costs, generating a preliminary repair estimate on the spot.

Policy Verification: At the same time, another AI checks the customer’s policy, confirming their coverage and deductible to make sure the claim is valid.

This whole automated sequence cuts out days of phone tag and uncertainty. The policyholder gets clear, immediate direction, and adjusters are freed up to handle the more complex, nuanced cases.

The Impact of AI on Claims Reviews

After a claim is submitted, it moves to adjudication, where it gets reviewed and a settlement decision is made. This is where claims AI reviews truly shine. AI algorithms can sift through thousands of data points—the claim details, the customer's history, and patterns from past claims—to make instant decisions on straightforward cases.

You can think of an AI-driven claims system as a digital partner for human adjusters. It autonomously handles the high-volume, low-complexity claims, while flagging the tricky or high-risk ones for an expert to review.

This "human-in-the-loop" approach gives you the best of both worlds: the raw efficiency of technology combined with the critical thinking and empathy of a seasoned professional. To go deeper, check out our guide on automating insurance claims processing.

This workflow shows how the core insurance functions—policy, claims, and billing—are all connected and ready for automation.

As you can see, making claims processing smarter has a positive ripple effect across the entire operation.

The table below breaks down exactly how AI is being applied at each stage of the claims lifecycle, showing the move from old-school manual work to intelligent automation.

AI Impact on the Insurance Claims Lifecycle

Claims Stage | Traditional Manual Process | AI-Driven Automated Process | Key AI Technologies |

|---|---|---|---|

FNOL & Data Capture | Manual data entry from phone calls, emails, and paper forms. | AI-powered chatbots and mobile apps capture structured data, photos, and documents instantly. | Natural Language Processing (NLP), Computer Vision, Chatbots |

Damage Assessment | Adjuster manually inspects photos or travels to the site for assessment. | Computer vision models analyze uploaded images/videos to estimate damage severity and cost. | Computer Vision, Predictive Analytics |

Claim Segmentation | Claims are routed based on simple rules or manual assignment by a supervisor. | AI algorithms triage and route claims based on complexity, severity, and fraud risk. | Machine Learning, Predictive Routing |

Adjudication & Settlement | Adjuster manually reviews policy details, claim history, and external reports to make a decision. | AI handles straight-through processing for simple claims; flags complex cases for human review. | Rules Engines, Machine Learning, Predictive Analytics |

Fraud Detection | Relies on adjuster experience and manual red flag checklists. | AI models analyze data in real-time to identify suspicious patterns and network connections. | Anomaly Detection, Network Analysis, Machine Learning |

Payment & Closure | Manual payment processing and communication with vendors and policyholders. | Automated payment issuance and status updates triggered by system events. | Robotic Process Automation (RPA), Automated Communications |

This side-by-side comparison makes it clear that AI isn’t just speeding things up; it’s adding a layer of intelligence that was previously out of reach, leading to better, faster, and more accurate outcomes.

Catching Fraud with Intelligent Algorithms

Insurance fraud is a massive, multi-billion dollar problem that ultimately raises costs for everyone. AI is one of our best defenses, capable of spotting suspicious patterns that are almost impossible for a human to catch in real-time.

Fraud detection models are trained on massive datasets containing both legitimate and fraudulent claims. Over time, they learn to recognize the subtle red flags:

A mismatch between the photos submitted and the written description of the incident.

Claims that originate from a geographic area with a known history of fraud.

Hidden links between parties in different claims, like the same doctor or repair shop showing up in multiple questionable cases.

When the AI flags a claim, it doesn't just get denied. Instead, it’s routed to a special investigations unit with a full report detailing exactly what looks suspicious. This allows investigators to spend their time on the cases that matter most, making them far more effective and protecting the company’s bottom line. By automating insurance claims with AI and improving customer care, AI is proving itself to be an essential part of modern financial services.

Enhancing Customer Care with AI

While fast claims AI reviews can make a huge difference during a crisis, the real measure of a leading insurance company is how it handles every single interaction. This is where AI customer care comes in, and it's a world away from the clunky, frustrating chatbots we've all dealt with. The goal isn't to replace your agents; it's to give them superpowers, especially within high-stakes financial services.

Think of modern AI as a 24/7 concierge for your policyholders. Instead of just spitting out canned answers, these systems are built to provide real value by anticipating needs and guiding customers through complex moments. This approach frees up your human experts to handle the sensitive, high-stakes conversations where empathy is everything.

Moving Beyond Basic Chatbots

First-generation bots were pretty limited, only capable of handling a handful of scripted questions. Today's AI virtual assistants are a different breed entirely, built on sophisticated Natural Language Processing (NLP) that understands context, intent, and even slang.

These intelligent assistants can now handle a surprising range of tasks that used to require a person, such as:

Answering Complex Policy Questions: A customer can ask, "Am I covered if my laptop is stolen while I'm traveling abroad?" The AI can instantly scan their specific policy documents to deliver an accurate, personalized answer.

Guiding Users Through Processes: The AI can walk a policyholder step-by-step through filing a claim or updating their coverage, making sure they fill out everything correctly the first time.

Seamless Human Handoff: If a conversation gets too complicated or a customer shows signs of frustration, the AI can transfer the entire interaction—complete with context and history—to a live agent without missing a beat.

This setup ensures customers get instant, correct answers to common questions while guaranteeing human expertise is always ready for the trickier issues.

Understanding Customer Emotions with Sentiment Analysis

One of the most powerful uses for AI in customer service is sentiment analysis. By analyzing word choice, tone, and even pacing in real-time during a chat or phone call, AI algorithms can get a read on a customer's emotional state.

Think of it as an emotional co-pilot for your agents. The system might flash an alert that a customer is getting confused or upset, giving the agent a chance to shift their approach. If the AI flags rising frustration, for instance, the agent can pivot from technical jargon to more empathetic reassurance. For a closer look at how AI is reshaping these interactions, check out a practical guide to AI in customer service.

By equipping agents with real-time emotional insights, AI helps turn potentially negative interactions into positive, loyalty-building experiences. It’s about giving your team the tools to be more human, not less.

This proactive emotional management helps de-escalate problems before they even start, making customers feel truly heard. It's no wonder that over 70% of CRM systems are now expected to include AI capabilities to deliver these kinds of personalized experiences.

Proactive and Personalized Communication

The most forward-thinking AI insurance companies don't just wait for customers to call. They use AI to anticipate needs and reach out first. By analyzing a customer's data—like policy details, life events, and past interactions—an AI-driven engine can deliver timely, relevant advice.

For example, the system might see a customer has a new teenage driver and proactively send information about adding them to the policy, along with tips for keeping premiums down. Or it could notice a new homeowner is underinsured on liability and suggest an affordable umbrella policy. To learn more about how these systems are built, you can explore our detailed guide on AI customer care.

This kind of personalized outreach shifts the insurer-customer dynamic from purely transactional to a genuine partnership. It shows you're actively looking out for their best interests—a powerful way to build lasting loyalty and keep customers for life.

Navigating Compliance and Legacy System Integration

Building powerful insurance software development solutions is only half the battle. For any new technology to actually work in the real world, it has to navigate a minefield of regulatory requirements and, just as importantly, plug into core platforms that might be decades old.

Getting this right isn't just a technical challenge—it's essential for protecting sensitive data and keeping the business running. Modern tools for AI customer care or automated claims AI reviews handle a massive amount of personal information, which puts compliance squarely in the spotlight. This is where frameworks like SOC 2 and GDPR come in. They aren't just red tape; they are fundamental trust signals that prove an insurer is a responsible steward of customer data.

Demystifying Key Compliance Frameworks

Think of compliance as the guardrails for innovation. It allows AI insurance companies to build new things without putting customers or the business at risk. Two of the most critical frameworks you'll encounter are SOC 2, which is all about data security and operational integrity, and GDPR, which sets the rules for data privacy for anyone in the EU.

Achieving compliance is no small feat. It requires intensive audits and a deep-seated commitment to secure development from the get-go. It’s about proving you have rock-solid controls for managing customer data at every stage. For a deeper look at what this involves, you can learn more about what SOC 2 compliance entails and why it's a non-negotiable proof point for any vendor's security.

For any insurer, proving compliance is fundamental. It's the foundation upon which customer trust is built and the license to operate in a highly regulated industry.

The stakes are incredibly high. Failing to meet these standards can lead to crippling fines, a tarnished reputation, and a catastrophic loss of customer confidence. Security can't be an add-on; it has to be part of the software's DNA from day one.

Bridging the Gap with Legacy Systems

While shiny new AI-driven software holds a ton of promise, it can't just exist on an island. Most established insurers run on deeply rooted legacy systems—think Guidewire or Duck Creek—for the nuts and bolts of policy administration and billing. These old workhorses are reliable, but they create some serious integration headaches.

You'll often run into a few common problems:

Data Silos: Information is locked away in different systems that don't talk to each other, preventing modern AI tools from seeing the full picture.

Outdated Architectures: Many of these platforms weren't built with modern APIs, making it a real struggle to connect them to new cloud-based applications.

Technical Debt: Years of quick fixes and custom code have made these systems fragile. Trying to change one thing can feel like a high-stakes game of Jenga.

The Role of Modern APIs in Integration

The answer isn't to rip everything out and start over. That would be a recipe for disaster. Instead, the smart play is to build a strategic integration layer using modern APIs to act as a bridge between the old and the new. This lets insurers roll out advanced AI features without tearing up their foundational operations.

APIs create a common language, allowing the new AI software to "talk" to the legacy platforms seamlessly. For instance, an AI customer care chatbot can use an API to instantly fetch a customer's policy information from an old Guidewire system. In the same way, a claims AI reviews tool can push its automated analysis back into the legacy claims system. It’s a strategy that allows for a steady, controlled evolution, delivering value right away while keeping risk to a minimum.

Answering the Tough Questions About Insurance Software

When business and technology leaders start talking about modernizing their operations, the same questions always come up. Everyone sees the potential of intelligent automation, but figuring out the practical steps, potential pitfalls, and real-world returns is what separates a successful project from a failed experiment.

Let's cut through the noise and get straight to the answers you actually need.

What’s the Right Way to Start an AI Automation Project?

The single most important first step is to pick the right problem to solve. Forget about trying to overhaul the entire claims department in one go. That's a recipe for disaster. Instead, find a high-impact, well-defined use case where you can get a quick win.

A great starting point might be automating the First Notice of Loss (FNOL) intake or deploying a specific AI tool to flag suspicious patterns in a single category of claims. By starting with a focused pilot project, you prove the technology's value and ROI on a smaller scale. This approach minimizes risk, builds momentum and trust with stakeholders, and teaches you invaluable lessons before you commit to a full-scale rollout.

How Do You Actually Measure the ROI of AI in Customer Care?

Measuring the return on AI customer care isn't just about cost savings; it's a blend of hard numbers and softer, but equally important, customer experience metrics. You need to see a positive impact on both sides of the coin.

Here are the key indicators you should be tracking:

The Hard Numbers (Quantitative): Look for concrete improvements like shorter average call handling times, lower operational costs as chatbots handle more routine inquiries, and a higher first-contact resolution rate. These tell you if you're getting more efficient.

The Customer's View (Qualitative): It’s just as critical to monitor how customers feel. Keep a close eye on your Customer Satisfaction (CSAT) scores, Net Promoter Score (NPS), and customer churn. If these numbers are going up, you know the AI isn't just efficient—it's actually helping people.

What Are the Biggest Headaches with Legacy System Integration?

The usual suspects here are data silos, ancient data formats, and a frustrating lack of modern APIs. Legacy platforms are notorious for locking information away in proprietary systems, making it a nightmare for new AI models to get the clean, structured data they need to do their job.

The most practical solution is often to build a middleware layer that acts as a translator, pulling data from old systems and transforming it into a format the new tools can understand. A smart API strategy is your best friend here. It creates a stable bridge, allowing new AI software to talk to your core systems without forcing you into a costly and disruptive "rip-and-replace" project.

The smartest integration strategies don't try to tear down legacy systems. They wrap around them, using APIs to unlock valuable data and add modern, intelligent capabilities on top of the infrastructure you already have.

Are Claims AI Reviews Really "Lights Out" and Fully Automated?

Not for anything complex, and that's by design. For claims AI reviews, the industry best practice is a "human-in-the-loop" model. Think of the AI as a co-pilot, not the pilot.

While an AI can certainly handle simple, low-risk claims from start to finish, its real power in complex cases is augmenting the human adjuster. The AI can review a claim in seconds, flag potential fraud, check policy details, and even suggest a fair settlement. But a human expert is still there to validate the AI’s work, handle any sensitive customer conversations, and give the final sign-off.

This hybrid approach gives you the best of both worlds: the incredible speed and data-processing power of AI, combined with the critical thinking and empathy of a seasoned professional. It’s how leading AI insurance companies boost efficiency without sacrificing accuracy or the customer relationship.

At Nolana, we deploy compliant AI agents to automate high-stakes operations in insurance and banking. Our platform integrates with your existing core systems to automate case management, claims, and customer service workflows, delivering real-time results with clear guardrails and seamless human escalation. Discover how Nolana can help you cut costs, accelerate cycle times, and improve customer experiences by visiting us at https://nolana.com.

At its core, insurance software development is all about building the digital machinery that runs a modern insurance company. This isn't just about websites or apps; it's about creating complex systems to handle everything from writing a new policy and managing billing to automating insurance claims with AI and delivering superior customer care. It’s the essential shift from paper-based, manual work to smart, automated operations.

The Future of Insurance Is Built on Advanced Software

The insurance world is in the middle of a massive upgrade, finally moving on from clunky, old legacy systems to more flexible and intelligent platforms. For any insurer looking to stay relevant, let alone grow, building or buying modern software isn't just a good idea—it's a must-have.

This change is being pushed from two directions. On one side, you have customers who are used to the slick, on-demand digital experiences they get from Amazon or their bank. On the other, you have a flood of agile insurtech startups using technology to launch faster, more tailored products, which completely changes the competitive game.

Why AI Is Reshaping the Industry

Artificial intelligence (AI) is the real engine behind this evolution, especially when it comes to claims and customer service. We're seeing AI insurance companies pop up that are building their entire business model around this tech, giving them a serious edge by rethinking how these core jobs get done.

The numbers back this up. The global market for insurance software is booming as carriers pour money into new tech. One key forecast predicts the market will jump from $14.14 billion in 2025 to $19.44 billion by 2030, a surge driven by cloud computing and AI-based automation.

By taking over repetitive tasks and delivering powerful data insights, AI gives insurers a new level of speed and accuracy. This lets their human experts step away from the busywork and focus on the complex, high-value challenges that need a human touch.

Automating Claims and Elevating Customer Care with AI

The real-world impact of AI is changing the day-to-day reality of insurance operations. For example, claims AI reviews can now instantly scan photos a policyholder uploads, assess the damage, confirm coverage details, and approve a payout for a straightforward claim in a matter of minutes. That used to take weeks. It's a huge win for cutting costs and, more importantly, for making a difficult experience better for the customer.

It's the same story with AI customer care, which has grown far beyond simple chatbots. Today's intelligent virtual assistants can answer tricky policy questions, walk customers through complicated forms, and even analyze the tone of a conversation to understand how a customer is feeling. This makes every interaction feel more personal and effective, a crucial component for any financial services business.

Clearly, the thoughtful use of AI in business operations is key to building an insurance company that's ready for the future. In this guide, we’ll break down exactly how these advanced systems are designed, constructed, and rolled out to create a smarter, more responsive insurance industry.

Understanding the Core Systems of Insurance Operations

Before we dive into advanced AI and automation, we need to get grounded in the foundational software that actually runs an insurance company. These core systems are the digital backbone of the entire business, acting like specialized departments in a well-oiled machine. Each one owns a critical piece of the process, and modern insurance software development is all about making them smarter and more connected.

Think of it this way: if an insurer were a factory, these systems would be the main assembly lines. Each has to run perfectly on its own, but they also have to integrate seamlessly to deliver the final product—a solid insurance policy and a great customer experience.

The Policy Administration System

The Policy Administration System (PAS) is the heart of the operation—it’s the system of record for every single policy the company writes.

This is where the entire policy lifecycle lives, from the moment a prospect asks for a quote to the day their policy is renewed or expires. The PAS is responsible for underwriting, rating, quoting, binding, and issuing policies, not to mention handling any changes (endorsements) or cancellations along the way. It is the ultimate source of truth for what’s covered and under what terms.

The Claims Management System

When a customer has a loss and needs to file a claim, the Claims Management System takes the lead. This is the operational command center for handling the company's promise to its policyholders.

The system manages the entire journey from the First Notice of Loss (FNOL) all the way through investigation and final payment. It’s where adjusters are assigned, investigations are documented, and communication with the policyholder is tracked. A fast, transparent claims system is absolutely critical for keeping customers happy during what's often a very stressful time. For a closer look, check out our guide on modern claims management systems.

The Billing System

The Billing System is the finance department. Its job is one of the most fundamental in the business: collecting the money.

This system makes sure premiums are calculated correctly, invoices go out on time, and payments are processed without a hitch. It also manages different payment plans, handles collections, and disburses commissions to agents. A rock-solid billing system stops revenue from slipping through the cracks and keeps the financial side of things smooth for everyone.

These three systems—Policy, Claims, and Billing—are the engine room of any insurer. They drive the day-to-day business, and how well they run has a direct line to profitability and customer loyalty.

Customer Relationship Management Systems

Finally, the Customer Relationship Management (CRM) system is the client relations expert. While the other systems focus on the technical side of insurance, the CRM is all about managing the human element.

It’s designed to create a 360-degree view of the customer by pulling all their interactions—emails, phone calls, policy details, and claims history—into one unified profile. This gives agents and service reps the context they need to provide personalized, well-informed support.

Here’s how a CRM helps the whole operation click:

Centralized Data: It connects to the PAS and Claims systems, giving service teams the full story before they even pick up the phone.

Proactive Communication: It can be set up to send automated renewal reminders or follow-ups, making the customer journey feel more guided.

Sales and Marketing: It’s essential for tracking new leads, managing sales pipelines, and running marketing campaigns that actually hit the mark.

Together, these four systems build the complete framework. The PAS defines the promise, the Billing System collects the premium for it, the Claims System delivers on that promise, and the CRM manages the relationship from start to finish. Knowing how they all fit together is the first real step toward making them better with smart automation.

Using AI to Automate Insurance Claims Processing

For decades, processing an insurance claim was a notoriously slow and paper-heavy ordeal. It was a manual grind of phone calls, paperwork, and lengthy reviews that created a ton of operational friction and left customers frustrated. Now, the new wave of AI insurance companies is completely overhauling this process by automating insurance claims with AI, bringing speed and intelligence to what was once a bottleneck.

This isn't just about making small tweaks; it’s about rethinking one of the industry's most essential functions from the ground up. With AI, insurers can automate the predictable, repetitive tasks, analyze mountains of data in a flash, and get decisions out the door in minutes instead of weeks. It’s a shift from a reactive, cumbersome system to a proactive and efficient one.

The starting point for any modern claims operation is solid workflow automation, which helps organize tasks and cut down on manual work. AI takes this a step further by adding a layer of smart, cognitive capability that was never possible before.

How AI Damage Assessment Is Modernizing the First Notice of Loss

The claims process always kicks off with the First Notice of Loss (FNOL)—the moment a customer reports an incident. This first interaction is crucial and really sets the stage for their entire experience. Thoughtful insurance software development is now giving insurers AI-powered tools to make this step feel almost instant.

Think about a common fender bender. Instead of calling an agent and filling out endless forms, the policyholder just opens their insurance app and uploads a few photos of the damage. Behind the scenes, the magic happens:

Computer Vision Analysis: An AI model gets to work, instantly analyzing the photos to pinpoint the exact location and severity of the damage. It knows the difference between a minor scratch and a cracked frame.

Automated Cost Estimation: The system then compares the damage against a huge database of parts and labor costs, generating a preliminary repair estimate on the spot.

Policy Verification: At the same time, another AI checks the customer’s policy, confirming their coverage and deductible to make sure the claim is valid.

This whole automated sequence cuts out days of phone tag and uncertainty. The policyholder gets clear, immediate direction, and adjusters are freed up to handle the more complex, nuanced cases.

The Impact of AI on Claims Reviews

After a claim is submitted, it moves to adjudication, where it gets reviewed and a settlement decision is made. This is where claims AI reviews truly shine. AI algorithms can sift through thousands of data points—the claim details, the customer's history, and patterns from past claims—to make instant decisions on straightforward cases.

You can think of an AI-driven claims system as a digital partner for human adjusters. It autonomously handles the high-volume, low-complexity claims, while flagging the tricky or high-risk ones for an expert to review.

This "human-in-the-loop" approach gives you the best of both worlds: the raw efficiency of technology combined with the critical thinking and empathy of a seasoned professional. To go deeper, check out our guide on automating insurance claims processing.

This workflow shows how the core insurance functions—policy, claims, and billing—are all connected and ready for automation.

As you can see, making claims processing smarter has a positive ripple effect across the entire operation.

The table below breaks down exactly how AI is being applied at each stage of the claims lifecycle, showing the move from old-school manual work to intelligent automation.

AI Impact on the Insurance Claims Lifecycle

Claims Stage | Traditional Manual Process | AI-Driven Automated Process | Key AI Technologies |

|---|---|---|---|

FNOL & Data Capture | Manual data entry from phone calls, emails, and paper forms. | AI-powered chatbots and mobile apps capture structured data, photos, and documents instantly. | Natural Language Processing (NLP), Computer Vision, Chatbots |

Damage Assessment | Adjuster manually inspects photos or travels to the site for assessment. | Computer vision models analyze uploaded images/videos to estimate damage severity and cost. | Computer Vision, Predictive Analytics |

Claim Segmentation | Claims are routed based on simple rules or manual assignment by a supervisor. | AI algorithms triage and route claims based on complexity, severity, and fraud risk. | Machine Learning, Predictive Routing |

Adjudication & Settlement | Adjuster manually reviews policy details, claim history, and external reports to make a decision. | AI handles straight-through processing for simple claims; flags complex cases for human review. | Rules Engines, Machine Learning, Predictive Analytics |

Fraud Detection | Relies on adjuster experience and manual red flag checklists. | AI models analyze data in real-time to identify suspicious patterns and network connections. | Anomaly Detection, Network Analysis, Machine Learning |

Payment & Closure | Manual payment processing and communication with vendors and policyholders. | Automated payment issuance and status updates triggered by system events. | Robotic Process Automation (RPA), Automated Communications |

This side-by-side comparison makes it clear that AI isn’t just speeding things up; it’s adding a layer of intelligence that was previously out of reach, leading to better, faster, and more accurate outcomes.

Catching Fraud with Intelligent Algorithms

Insurance fraud is a massive, multi-billion dollar problem that ultimately raises costs for everyone. AI is one of our best defenses, capable of spotting suspicious patterns that are almost impossible for a human to catch in real-time.

Fraud detection models are trained on massive datasets containing both legitimate and fraudulent claims. Over time, they learn to recognize the subtle red flags:

A mismatch between the photos submitted and the written description of the incident.

Claims that originate from a geographic area with a known history of fraud.

Hidden links between parties in different claims, like the same doctor or repair shop showing up in multiple questionable cases.

When the AI flags a claim, it doesn't just get denied. Instead, it’s routed to a special investigations unit with a full report detailing exactly what looks suspicious. This allows investigators to spend their time on the cases that matter most, making them far more effective and protecting the company’s bottom line. By automating insurance claims with AI and improving customer care, AI is proving itself to be an essential part of modern financial services.

Enhancing Customer Care with AI

While fast claims AI reviews can make a huge difference during a crisis, the real measure of a leading insurance company is how it handles every single interaction. This is where AI customer care comes in, and it's a world away from the clunky, frustrating chatbots we've all dealt with. The goal isn't to replace your agents; it's to give them superpowers, especially within high-stakes financial services.

Think of modern AI as a 24/7 concierge for your policyholders. Instead of just spitting out canned answers, these systems are built to provide real value by anticipating needs and guiding customers through complex moments. This approach frees up your human experts to handle the sensitive, high-stakes conversations where empathy is everything.

Moving Beyond Basic Chatbots

First-generation bots were pretty limited, only capable of handling a handful of scripted questions. Today's AI virtual assistants are a different breed entirely, built on sophisticated Natural Language Processing (NLP) that understands context, intent, and even slang.

These intelligent assistants can now handle a surprising range of tasks that used to require a person, such as:

Answering Complex Policy Questions: A customer can ask, "Am I covered if my laptop is stolen while I'm traveling abroad?" The AI can instantly scan their specific policy documents to deliver an accurate, personalized answer.

Guiding Users Through Processes: The AI can walk a policyholder step-by-step through filing a claim or updating their coverage, making sure they fill out everything correctly the first time.

Seamless Human Handoff: If a conversation gets too complicated or a customer shows signs of frustration, the AI can transfer the entire interaction—complete with context and history—to a live agent without missing a beat.

This setup ensures customers get instant, correct answers to common questions while guaranteeing human expertise is always ready for the trickier issues.

Understanding Customer Emotions with Sentiment Analysis

One of the most powerful uses for AI in customer service is sentiment analysis. By analyzing word choice, tone, and even pacing in real-time during a chat or phone call, AI algorithms can get a read on a customer's emotional state.

Think of it as an emotional co-pilot for your agents. The system might flash an alert that a customer is getting confused or upset, giving the agent a chance to shift their approach. If the AI flags rising frustration, for instance, the agent can pivot from technical jargon to more empathetic reassurance. For a closer look at how AI is reshaping these interactions, check out a practical guide to AI in customer service.

By equipping agents with real-time emotional insights, AI helps turn potentially negative interactions into positive, loyalty-building experiences. It’s about giving your team the tools to be more human, not less.

This proactive emotional management helps de-escalate problems before they even start, making customers feel truly heard. It's no wonder that over 70% of CRM systems are now expected to include AI capabilities to deliver these kinds of personalized experiences.

Proactive and Personalized Communication

The most forward-thinking AI insurance companies don't just wait for customers to call. They use AI to anticipate needs and reach out first. By analyzing a customer's data—like policy details, life events, and past interactions—an AI-driven engine can deliver timely, relevant advice.

For example, the system might see a customer has a new teenage driver and proactively send information about adding them to the policy, along with tips for keeping premiums down. Or it could notice a new homeowner is underinsured on liability and suggest an affordable umbrella policy. To learn more about how these systems are built, you can explore our detailed guide on AI customer care.

This kind of personalized outreach shifts the insurer-customer dynamic from purely transactional to a genuine partnership. It shows you're actively looking out for their best interests—a powerful way to build lasting loyalty and keep customers for life.

Navigating Compliance and Legacy System Integration

Building powerful insurance software development solutions is only half the battle. For any new technology to actually work in the real world, it has to navigate a minefield of regulatory requirements and, just as importantly, plug into core platforms that might be decades old.

Getting this right isn't just a technical challenge—it's essential for protecting sensitive data and keeping the business running. Modern tools for AI customer care or automated claims AI reviews handle a massive amount of personal information, which puts compliance squarely in the spotlight. This is where frameworks like SOC 2 and GDPR come in. They aren't just red tape; they are fundamental trust signals that prove an insurer is a responsible steward of customer data.

Demystifying Key Compliance Frameworks

Think of compliance as the guardrails for innovation. It allows AI insurance companies to build new things without putting customers or the business at risk. Two of the most critical frameworks you'll encounter are SOC 2, which is all about data security and operational integrity, and GDPR, which sets the rules for data privacy for anyone in the EU.

Achieving compliance is no small feat. It requires intensive audits and a deep-seated commitment to secure development from the get-go. It’s about proving you have rock-solid controls for managing customer data at every stage. For a deeper look at what this involves, you can learn more about what SOC 2 compliance entails and why it's a non-negotiable proof point for any vendor's security.

For any insurer, proving compliance is fundamental. It's the foundation upon which customer trust is built and the license to operate in a highly regulated industry.

The stakes are incredibly high. Failing to meet these standards can lead to crippling fines, a tarnished reputation, and a catastrophic loss of customer confidence. Security can't be an add-on; it has to be part of the software's DNA from day one.

Bridging the Gap with Legacy Systems

While shiny new AI-driven software holds a ton of promise, it can't just exist on an island. Most established insurers run on deeply rooted legacy systems—think Guidewire or Duck Creek—for the nuts and bolts of policy administration and billing. These old workhorses are reliable, but they create some serious integration headaches.

You'll often run into a few common problems:

Data Silos: Information is locked away in different systems that don't talk to each other, preventing modern AI tools from seeing the full picture.

Outdated Architectures: Many of these platforms weren't built with modern APIs, making it a real struggle to connect them to new cloud-based applications.

Technical Debt: Years of quick fixes and custom code have made these systems fragile. Trying to change one thing can feel like a high-stakes game of Jenga.

The Role of Modern APIs in Integration

The answer isn't to rip everything out and start over. That would be a recipe for disaster. Instead, the smart play is to build a strategic integration layer using modern APIs to act as a bridge between the old and the new. This lets insurers roll out advanced AI features without tearing up their foundational operations.

APIs create a common language, allowing the new AI software to "talk" to the legacy platforms seamlessly. For instance, an AI customer care chatbot can use an API to instantly fetch a customer's policy information from an old Guidewire system. In the same way, a claims AI reviews tool can push its automated analysis back into the legacy claims system. It’s a strategy that allows for a steady, controlled evolution, delivering value right away while keeping risk to a minimum.

Answering the Tough Questions About Insurance Software

When business and technology leaders start talking about modernizing their operations, the same questions always come up. Everyone sees the potential of intelligent automation, but figuring out the practical steps, potential pitfalls, and real-world returns is what separates a successful project from a failed experiment.

Let's cut through the noise and get straight to the answers you actually need.

What’s the Right Way to Start an AI Automation Project?

The single most important first step is to pick the right problem to solve. Forget about trying to overhaul the entire claims department in one go. That's a recipe for disaster. Instead, find a high-impact, well-defined use case where you can get a quick win.

A great starting point might be automating the First Notice of Loss (FNOL) intake or deploying a specific AI tool to flag suspicious patterns in a single category of claims. By starting with a focused pilot project, you prove the technology's value and ROI on a smaller scale. This approach minimizes risk, builds momentum and trust with stakeholders, and teaches you invaluable lessons before you commit to a full-scale rollout.

How Do You Actually Measure the ROI of AI in Customer Care?

Measuring the return on AI customer care isn't just about cost savings; it's a blend of hard numbers and softer, but equally important, customer experience metrics. You need to see a positive impact on both sides of the coin.

Here are the key indicators you should be tracking:

The Hard Numbers (Quantitative): Look for concrete improvements like shorter average call handling times, lower operational costs as chatbots handle more routine inquiries, and a higher first-contact resolution rate. These tell you if you're getting more efficient.

The Customer's View (Qualitative): It’s just as critical to monitor how customers feel. Keep a close eye on your Customer Satisfaction (CSAT) scores, Net Promoter Score (NPS), and customer churn. If these numbers are going up, you know the AI isn't just efficient—it's actually helping people.

What Are the Biggest Headaches with Legacy System Integration?

The usual suspects here are data silos, ancient data formats, and a frustrating lack of modern APIs. Legacy platforms are notorious for locking information away in proprietary systems, making it a nightmare for new AI models to get the clean, structured data they need to do their job.

The most practical solution is often to build a middleware layer that acts as a translator, pulling data from old systems and transforming it into a format the new tools can understand. A smart API strategy is your best friend here. It creates a stable bridge, allowing new AI software to talk to your core systems without forcing you into a costly and disruptive "rip-and-replace" project.

The smartest integration strategies don't try to tear down legacy systems. They wrap around them, using APIs to unlock valuable data and add modern, intelligent capabilities on top of the infrastructure you already have.

Are Claims AI Reviews Really "Lights Out" and Fully Automated?

Not for anything complex, and that's by design. For claims AI reviews, the industry best practice is a "human-in-the-loop" model. Think of the AI as a co-pilot, not the pilot.

While an AI can certainly handle simple, low-risk claims from start to finish, its real power in complex cases is augmenting the human adjuster. The AI can review a claim in seconds, flag potential fraud, check policy details, and even suggest a fair settlement. But a human expert is still there to validate the AI’s work, handle any sensitive customer conversations, and give the final sign-off.

This hybrid approach gives you the best of both worlds: the incredible speed and data-processing power of AI, combined with the critical thinking and empathy of a seasoned professional. It’s how leading AI insurance companies boost efficiency without sacrificing accuracy or the customer relationship.

At Nolana, we deploy compliant AI agents to automate high-stakes operations in insurance and banking. Our platform integrates with your existing core systems to automate case management, claims, and customer service workflows, delivering real-time results with clear guardrails and seamless human escalation. Discover how Nolana can help you cut costs, accelerate cycle times, and improve customer experiences by visiting us at https://nolana.com.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP