MGA Insurance: How AI Transforms Claims and Care

MGA Insurance: How AI Transforms Claims and Care

Discover how mga insurance works and how AI boosts claims efficiency and transparent, trusted customer care.

At its core, MGA insurance is a specialized partnership. It's an arrangement where an insurance carrier hands over the "pen"—the underwriting authority—to a Managing General Agent (MGA). This allows carriers to break into niche markets and leverage specialized expertise without having to build those complex capabilities from the ground up.

The Growing Role of MGA Insurance

Think of an MGA like a boutique architectural firm hired by a massive construction company (the carrier). The construction company trusts the firm's deep, specialized knowledge to design a unique, challenging part of a project, like a high-tech data center or a historic preservation. In the same way, insurance carriers partner with MGAs to write policies for unique markets that demand a specialist's touch—from classic car collections to intricate cyber liability risks. The whole model is built on this focused expertise and the ability to move quickly.

The MGA business model revolves around this concept of delegated authority. A standard agent just sells policies. An MGA, on the other hand, is empowered to underwrite, price, bind coverage, and sometimes even handle claims. They act almost as a mini-carrier, which gives them incredible autonomy but also saddles them with immense responsibility for operational excellence and smart risk management.

Driving Growth Through Specialization

The importance of this model isn't just theoretical; it's exploding in practice. Managing General Agents and other delegated authority programs have become a critical distribution channel in global insurance markets. In fact, we've seen sustained double-digit growth over the past decade as insurers increasingly outsource specialty underwriting to stay lean and capital-efficient.

But this rapid growth introduces its own set of problems. The manual, paper-heavy processes that might have worked for an MGA a decade ago are now a significant liability. The sheer volume of data, the complexity of modern claims, and ever-higher customer expectations demand a completely new way of operating.

The core value of an MGA lies in its ability to operate with speed and precision in a chosen niche. As the market tightens, the MGAs that thrive will be those that pair their human expertise with intelligent automation.

The Rise of AI in MGA Operations

This is exactly where artificial intelligence comes in, kicking off a major operational shift. AI is no longer just a "nice-to-have" tool; it’s quickly becoming the core engine for modern MGA insurance operations. For more context on the broader trends shaping the insurance industry, it's clear that technology is at the forefront of change.

AI is making its biggest mark in a few key areas:

Automating Insurance Claims with AI: AI-driven platforms can manage the entire claims journey, from the first notice of loss all the way to settlement. This dramatically speeds up processing, cuts down on human error, and frees up experienced claims professionals to focus on the complex, high-stakes cases that truly need their judgment.

Customer Care with AI for Financial Services: In any financial service, fast and accurate support is non-negotiable. AI customer care systems can provide 24/7 assistance, handle routine policyholder questions instantly, and deliver personalized support that improves the entire customer experience for both MGAs and their carrier partners.

By automating these essential functions, AI gives MGAs the power to scale their specialized services efficiently, maintain rigorous compliance, and deliver more value to everyone involved—carriers and policyholders alike. To get a better handle on the fundamentals, you can check out our guide on what makes the MGA model tick: https://nolana.com/articles/mga. It’s this unique structure that makes the MGA a perfect candidate for the next wave of AI-driven automation and oversight.

How an MGA Actually Works

To really get what an MGA does, you have to look past the official definition and see what's happening day-to-day. Think of an MGA as a specialized extension of its carrier partner, taking on the heavy lifting for some of the most critical functions in insurance. These core duties are the engine that makes the MGA insurance model run.

The first and most important job is underwriting. This isn't just about checking boxes; it's the art and science of evaluating risk. MGAs are masters at underwriting complex or unusual risks that most standard carriers wouldn't touch. This single step is the foundation for whether the entire partnership will be profitable.

Once a risk is approved, the MGA moves on to policy issuance. This means creating the official insurance contract and making sure every term, condition, and coverage detail is spot-on. It's the MGA that executes the legal agreement between the policyholder and the carrier.

From Premiums to Payouts

With a policy in place, the MGA is responsible for premium collection. They manage the entire billing and payment process, making sure the money flows in to keep the coverage active. This financial stewardship is vital for the health of the MGA's entire book of business.

But the most operationally demanding task is often claims administration. When a customer files a claim, it's frequently the MGA that handles everything from the first notice of loss to the final check. This requires a skilled team of adjusters and support staff to investigate the claim, assess the damages, and pay out according to the policy's rules.

Here’s a quick example to bring this to life.

Example: A Marine Insurance MGA Picture an MGA that only insures global shipping companies. They don't rely on standard risk charts. Instead, they’ve developed their own system that uses real-time satellite imagery and weather data to predict storm paths and calculate risk for specific shipping routes. A massive carrier could never justify building this kind of niche expertise in-house.

This kind of specialization is the MGA's secret sauce. It unlocks profitable, niche markets for carriers that they simply couldn't access on their own. The problem is, the sheer intensity of these tasks—especially underwriting and claims—creates major operational headaches.

The Bottleneck Problem and How AI Fixes It

Every one of these functions creates a mountain of data and relies on countless manual steps. For ai insurance companies and their MGA partners, this old-school approach just isn't cutting it anymore. Manual work is slow, full of potential errors, and makes it nearly impossible to deliver the smooth experience customers now demand.

This operational strain is exactly where automation becomes a no-brainer. These pain points are the perfect targets for AI-powered solutions that can boost both efficiency and carrier oversight.

Specifically, AI is set to overhaul two critical areas:

Automating Insurance Claims with AI: Modern AI platforms can manage the whole claims process—from intake and verification to fraud detection and payment. This is a game-changer in the MGA world, where specialized claims demand both speed and accuracy. The reliability of claims AI reviews has gotten so good that these systems can handle most standard claims, letting human experts focus on the truly complex cases.

Customer Care with AI for Financial Services: Policyholders want answers, and they want them now. AI customer care can provide 24/7 support, handle tough policy questions, and walk customers through the claims process. This delivers a consistently great experience and strengthens the bond between the customer, the MGA, and the carrier.

By bringing in intelligent automation, a modern MGA can turn its operational backbone from a source of friction into a true competitive advantage. It not only makes them more efficient but also makes them a far more valuable and dependable partner for carriers looking for that specialized edge.

How AI Is Automating MGA Claims Processing

When it comes to claims, an MGA's operational mettle is put to the test. This is where the rubber meets the road—a critical moment where speed, accuracy, and customer experience all collide. For decades, the process was notoriously slow and paper-heavy, but MGAs working with AI insurance companies are flipping the script, transforming a clunky workflow into a surprisingly efficient, automated operation.

The transformation kicks off right at the start with an AI-powered First Notice of Loss (FNOL). Instead of a policyholder getting bogged down with long forms or sitting on hold, an AI system can capture incident details in real-time through a simple chat or mobile app. This isn't just about being faster; it also leads to more accurate initial data, cutting down on the endless back-and-forth that plagues traditional claims.

From there, the automation dominoes start to fall. Let’s say there’s a property damage claim. The policyholder just has to upload a few photos of the damage from their phone. AI algorithms, having learned from millions of similar images, can then run an initial damage assessment in seconds. They can estimate the severity and potential repair costs far more quickly than any human could.

Speeding Up the Entire Claims Lifecycle

This initial burst of automation paves the way for a much faster resolution. Once the FNOL is in and the initial assessment is done, the AI can instantly check the policyholder’s coverage against the reported incident. It scans the policy to confirm that the specific type of damage is actually covered, validating the claim before it goes any further. That step alone prevents a world of headaches and delays down the line.

At the same time, the system runs the claim details through sophisticated fraud detection models. These algorithms are trained to spot unusual patterns and red flags that might point to a fraudulent claim, flagging it for a human expert to review. This smart triage lets legitimate claims fly through the system while focusing expert eyes exactly where they’re needed most.

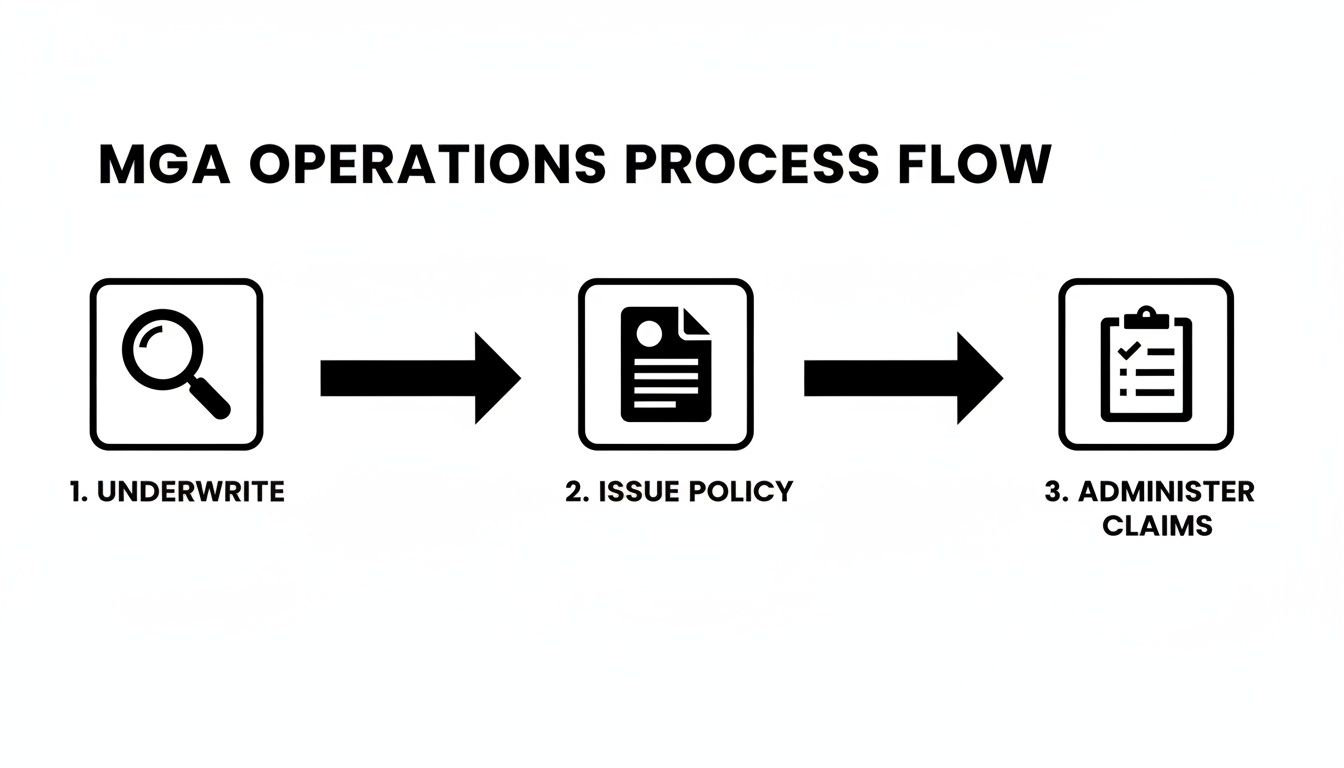

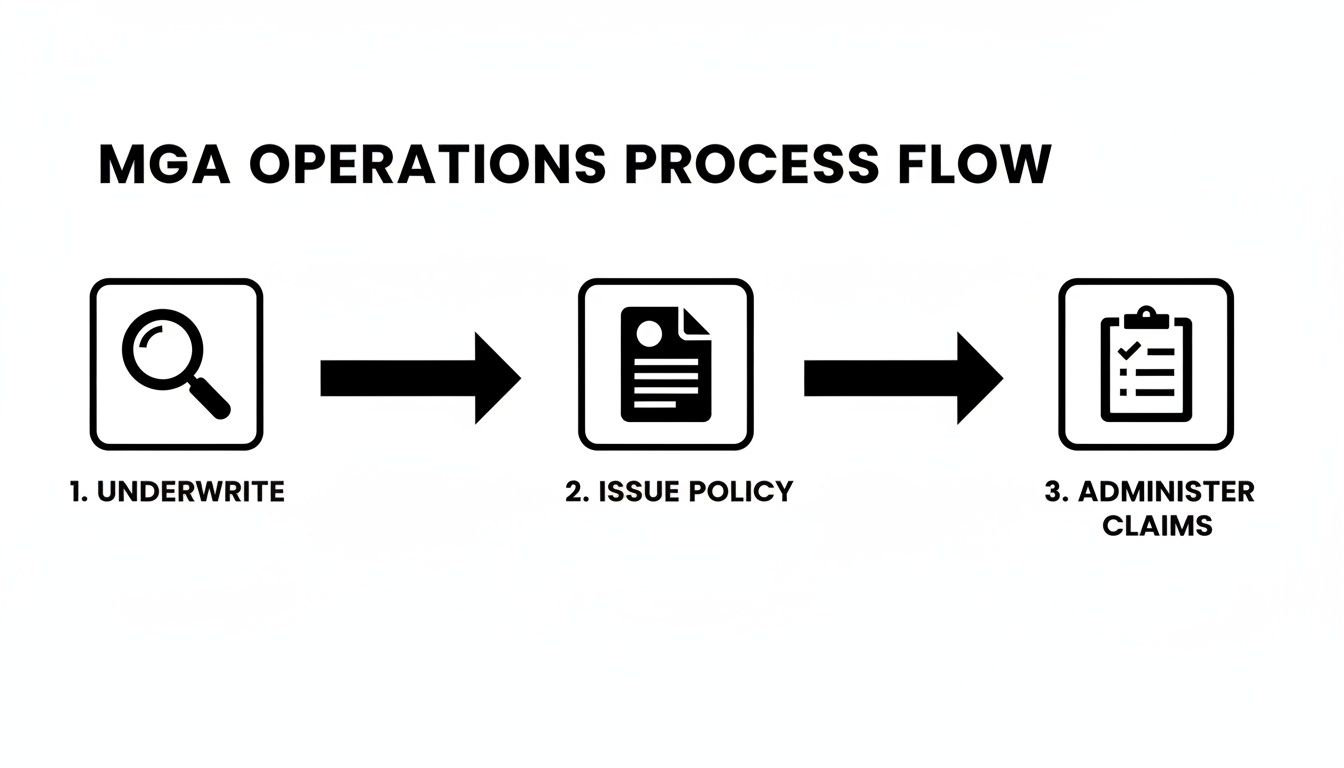

The process flow below shows the core operational steps an MGA handles—all of which are getting a major speed boost from AI.

This visual breaks down the journey from underwriting to claims administration. Each stage represents a huge opportunity for AI to drive new efficiencies.

For straightforward, low-complexity claims, the entire process—from intake to payment—can be wrapped up in a few hours, not weeks. This is a game-changer for the policyholder experience, especially during a stressful time. It also frees up seasoned adjusters to focus their energy on the complex, high-stakes claims that truly need their experience and judgment. You can see how these workflows come together in our guide to insurance claims processing automation.

Ensuring Fairness and Accuracy with Claims AI Reviews

A fair question people often ask is whether automation sacrifices fairness for speed. This is where claims AI reviews become non-negotiable. Today's AI platforms aren't just "black boxes"; they're built for transparency and constant oversight. Every single automated decision is logged, creating a crystal-clear audit trail that shows exactly why a particular decision was made.

This auditability is essential for compliance and for maintaining the trust between an MGA and its carrier partner. If an automated decision ever comes into question, a human reviewer can easily pull up the record and see the exact data and logic the AI used.

By creating a transparent and auditable record of every decision, AI transforms claims processing from an often opaque art into a clear, data-driven science. This enhances both efficiency and regulatory compliance simultaneously.

What's more, these systems are always learning. By analyzing the outcomes of both automated and human-led claims, the AI models are constantly fine-tuned to become more accurate and fair. This feedback loop helps the system adapt to new situations and root out biases over time, leading to more consistent and equitable outcomes for every policyholder.

Transforming Customer Care With AI

Smooth claims processing is just one piece of the puzzle for a successful MGA insurance operation. The other, equally vital piece is the policyholder's experience. Today, AI is completely re-imagining customer interactions, going far beyond simple chatbots to offer smart, proactive, and genuinely personal support that earns long-term loyalty.

For forward-thinking AI insurance companies and the MGAs they work with, the old standards for customer service no longer apply. Policyholders have come to expect immediate, correct answers whenever they need them, day or night. AI-powered virtual assistants are rising to the occasion, delivering a level of service that was once unimaginable at scale.

Think about a customer needing to file a claim at 2 AM after a fender-bender. Instead of anxiously waiting for office hours, they can engage with an intelligent AI agent. This isn't a clunky bot—it’s a system that can walk them through the entire submission, answer complex questions about their policy in plain English, and set clear expectations for what happens next. This is the new reality of AI customer care.

Proactive Support That Builds Trust

Where customer care with AI for financial services really shines isn't just in how it responds to questions, but in how it anticipates needs. This shift from reactive to proactive support turns a routine service touchpoint into a genuine opportunity for MGAs and their carriers to build a stronger relationship with the customer.

Picture this: a major hailstorm is forecast for a specific area. An AI system can instantly flag all policyholders in the affected zip codes. Within moments, it can automatically send personalized text messages or emails offering a heads-up, providing links to start a claim if needed, and sharing tips for staying safe.

This simple, automated gesture achieves a few critical things:

Eases Customer Stress: Policyholders feel looked after when their insurer is already on top of the situation, often before they even think to call.

Manages Call Volume: By getting information out ahead of time, the system prevents a massive spike in calls that would otherwise bog down service teams.

Boosts Brand Loyalty: This kind of proactive attention shows a real commitment to the customer’s well-being, which goes a long way in building trust and improving retention.

To see how this technology is being put to work across the industry, you can find more AI use cases for insurance that illustrate its practical applications.

Personalization at Scale

Beyond just reaching out first, AI gives MGAs the ability to create a uniquely personal experience for every single policyholder. By analyzing a customer's history, policy details, and past interactions, an AI agent can offer advice and answers that are truly relevant to them.

AI-driven customer care allows MGAs to manage millions of interactions with the personalized touch of a small, dedicated agent. It combines the scale of technology with the empathy of human-centric service, creating a powerful competitive advantage.

For instance, an AI system can push real-time status updates on a claim directly to a customer's preferred channel, whether that’s SMS, email, or a notification in their mobile app. When they ask a follow-up question, the AI already knows the full context of their claim, so the customer never has to repeat themselves. It’s this kind of seamless, consistent support that makes all the difference.

This ability to blend smart automation with a human feel is what separates modern platforms from older tech. To learn more about this approach, you can read our in-depth guide on AI customer care and how it’s changing service delivery. By investing in intelligent customer care, MGAs aren't just boosting their own efficiency—they're cementing their reputation as invaluable partners in the eyes of both policyholders and carriers.

Achieving Real-Time Oversight With AI Auditing

In any MGA partnership, trust is the foundation, but rigorous oversight is the framework that keeps it standing. When a carrier hands over the underwriting pen and claims authority, they’re also accepting a certain amount of risk. Without a clear line of sight into the MGA's daily work, carriers are flying blind, exposed to everything from underwriting decisions that stray from guidelines to claims leakage that silently eats away at profits.

For decades, oversight was a rear-view mirror activity—slow, periodic audits that only uncovered problems months after the damage was done.

Today, artificial intelligence is changing the game, setting a new standard for transparent and effective governance. Modern AI platforms give carriers a real-time window into their MGA partners' activities. Oversight is no longer a reactive chore but a proactive, collaborative process that ensures the MGA operates as a true, compliant extension of the carrier.

From Periodic Reviews to Continuous Monitoring

The traditional audit process is like taking a patient's vitals once a quarter. You might spot a major illness, but you’ll miss the subtle daily fluctuations that signal trouble is brewing. AI flips this model entirely. Instead of waiting for a quarterly report to land on their desk, carriers can now log into dynamic dashboards that track key performance indicators (KPIs) as they happen.

This continuous visibility allows carriers to monitor the metrics that matter most, right now:

Loss Ratios: Instantly see how claims payouts are stacking up against collected premiums for a specific book of business.

Submission-to-Bind Rates: Get a live look at how many quotes are converting into bound policies, which is a great indicator of underwriting efficiency.

Claims Cycle Times: Track the average time from the first notice of loss to final settlement, making sure service level agreements (SLAs) are consistently met.

This kind of immediate insight elevates the carrier-MGA relationship from one of periodic check-ins to one of constant alignment. It fosters a genuine partnership where both sides can spot and solve potential issues long before they become serious problems.

AI-Powered Underwriting and Claims Audits

One of the biggest risks that comes with delegated authority is underwriting drift. An MGA might—intentionally or not—start writing policies that fall outside the agreed-upon risk appetite. AI-powered tools act as a digital safety net, instantly flagging any decision that breaks the established rules. For instance, if an MGA binds a policy with a property value 20% higher than the maximum allowable limit, the carrier's AI system can flag it for review that same day.

The same logic applies to claims. Automating insurance claims with AI not only makes the process faster but also creates a perfect, unchangeable audit trail. Systems built on this technology meticulously document every step, from the initial damage assessment to the final payment calculation. This makes it incredibly simple for carriers to audit claims files for accuracy and compliance, confirming every payout is justified.

AI transforms auditing from a manual, sample-based exercise into an exhaustive, real-time process. It examines every transaction, not just a small fraction, providing a level of assurance that was previously impossible.

This is where agentic AI really shines. To see how this works in the real world, check out this detailed case study on transforming insurance claims with agentic AI. This approach gives carriers complete confidence that their MGA partners are operating squarely within the guardrails they’ve established.

The difference between the old way and the new, AI-powered approach is stark. This table breaks it down.

Traditional MGA Oversight vs AI-Powered Oversight

This comparison highlights the shift from slow, manual, and often reactive audits to the real-time, automated, and proactive capabilities that an AI-native platform provides.

Oversight Area | Traditional Method (Manual & Periodic) | AI-Powered Method (Automated & Real-Time) |

|---|---|---|

Underwriting Review | Manual spot-checks of a small sample of policies | Continuous scanning of 100% of bound policies |

Claims Auditing | Quarterly file reviews, often months after closure | Real-time alerts for payment anomalies or SLA breaches |

Performance Tracking | Based on static, backward-looking reports | Live dashboards with dynamic KPIs |

Compliance Checks | Labor-intensive manual process | Automated rule-based checks for instant flagging |

By moving to AI-driven oversight, carriers and their MGA partners can build a stronger, more transparent relationship—one built on data-driven trust and geared for mutual success.

Answering Key Questions About MGAs and AI

As the MGA insurance model continues to gain traction, it's only natural for questions to pop up about its relationship with technology—especially artificial intelligence. Let's break down some of the most common questions we hear from carriers, agents, and even policyholders.

What’s the Real Difference Between an MGA and a Broker?

It all comes down to one thing: delegated authority. Think of an insurance broker as a salesperson. They act as an intermediary, selling policies for an insurer, but they don't have the power to actually approve the risk or handle the claim if something goes wrong.

An MGA, on the other hand, is given "the pen" by a carrier. This is a huge deal. It means they're trusted to underwrite, price, and bind coverage on the carrier's behalf. Many also manage the entire claims lifecycle for that specific product line, essentially operating as a specialized, outsourced division of the insurer.

How Can AI Help a Carrier Trust an MGA?

This is where things get interesting. AI fundamentally changes the trust equation by shifting oversight from a once-a-quarter, backward-looking audit to a continuous, real-time feedback loop. It creates a new standard of transparency.

Instead of waiting for a report to land on their desk, carriers using AI-powered platforms can see what’s happening inside their MGA partner’s operations at any moment. Smart algorithms can instantly flag an underwriting decision or claim payment that falls outside the agreed-upon guidelines.

This builds an objective, data-driven layer of accountability. It dramatically lowers the carrier's risk exposure and fosters a truly collaborative partnership where both sides are looking at the same information.

This kind of constant, automated oversight proves that the MGA is operating as a compliant and effective extension of the carrier, which is the bedrock of a strong, lasting relationship.

Is AI Going to Replace the Experts at MGAs?

Not at all. The goal is to augment their expertise, not replace it. Think of AI as a tool for handling the high-volume, repetitive, and data-intensive work that can bog people down.

For example, AI is fantastic at processing straightforward property claims, spotting potential fraud patterns in mountains of data, or answering routine policy questions. This frees up the seasoned underwriters and experienced claims adjusters to focus their brainpower on the tough stuff—the complex, high-stakes cases that require deep expertise and nuanced judgment.

In this model, AI acts as a co-pilot. It handles the routine, allowing the human experts to apply their skills where they add the most value. It’s the combination of human intellect and machine efficiency that drives the best results.

What Does the Future Look Like for MGAs and AI?

The future of the MGA insurance model is all about becoming more specialized and data-driven. As AI gets smarter, MGAs will be able to pinpoint, price, and underwrite niche and emerging risks with a level of precision we’ve never seen before. For AI insurance companies, this is a golden opportunity to tap into new, profitable markets through their MGA partners.

The operational connection between carriers and MGAs will become practically seamless, with shared data platforms enabling real-time collaboration on everything from underwriting to claims. You can expect to see a wave of AI-powered product innovation, as MGAs use predictive analytics to design entirely new insurance solutions for markets that were previously misunderstood or too risky. Our detailed article on the role of AI in insurance claims dives deeper into how these changes are already impacting workflows.

Ultimately, AI is poised to cement the MGA's role as a critical engine of innovation for the entire insurance industry.

Are you ready to bring intelligent automation to your insurance operations? Nolana deploys compliant AI agents to automate complex workflows in claims, case management, and customer service. Learn more about how Nolana can help you cut costs and accelerate cycle times.

At its core, MGA insurance is a specialized partnership. It's an arrangement where an insurance carrier hands over the "pen"—the underwriting authority—to a Managing General Agent (MGA). This allows carriers to break into niche markets and leverage specialized expertise without having to build those complex capabilities from the ground up.

The Growing Role of MGA Insurance

Think of an MGA like a boutique architectural firm hired by a massive construction company (the carrier). The construction company trusts the firm's deep, specialized knowledge to design a unique, challenging part of a project, like a high-tech data center or a historic preservation. In the same way, insurance carriers partner with MGAs to write policies for unique markets that demand a specialist's touch—from classic car collections to intricate cyber liability risks. The whole model is built on this focused expertise and the ability to move quickly.

The MGA business model revolves around this concept of delegated authority. A standard agent just sells policies. An MGA, on the other hand, is empowered to underwrite, price, bind coverage, and sometimes even handle claims. They act almost as a mini-carrier, which gives them incredible autonomy but also saddles them with immense responsibility for operational excellence and smart risk management.

Driving Growth Through Specialization

The importance of this model isn't just theoretical; it's exploding in practice. Managing General Agents and other delegated authority programs have become a critical distribution channel in global insurance markets. In fact, we've seen sustained double-digit growth over the past decade as insurers increasingly outsource specialty underwriting to stay lean and capital-efficient.

But this rapid growth introduces its own set of problems. The manual, paper-heavy processes that might have worked for an MGA a decade ago are now a significant liability. The sheer volume of data, the complexity of modern claims, and ever-higher customer expectations demand a completely new way of operating.

The core value of an MGA lies in its ability to operate with speed and precision in a chosen niche. As the market tightens, the MGAs that thrive will be those that pair their human expertise with intelligent automation.

The Rise of AI in MGA Operations

This is exactly where artificial intelligence comes in, kicking off a major operational shift. AI is no longer just a "nice-to-have" tool; it’s quickly becoming the core engine for modern MGA insurance operations. For more context on the broader trends shaping the insurance industry, it's clear that technology is at the forefront of change.

AI is making its biggest mark in a few key areas:

Automating Insurance Claims with AI: AI-driven platforms can manage the entire claims journey, from the first notice of loss all the way to settlement. This dramatically speeds up processing, cuts down on human error, and frees up experienced claims professionals to focus on the complex, high-stakes cases that truly need their judgment.

Customer Care with AI for Financial Services: In any financial service, fast and accurate support is non-negotiable. AI customer care systems can provide 24/7 assistance, handle routine policyholder questions instantly, and deliver personalized support that improves the entire customer experience for both MGAs and their carrier partners.

By automating these essential functions, AI gives MGAs the power to scale their specialized services efficiently, maintain rigorous compliance, and deliver more value to everyone involved—carriers and policyholders alike. To get a better handle on the fundamentals, you can check out our guide on what makes the MGA model tick: https://nolana.com/articles/mga. It’s this unique structure that makes the MGA a perfect candidate for the next wave of AI-driven automation and oversight.

How an MGA Actually Works

To really get what an MGA does, you have to look past the official definition and see what's happening day-to-day. Think of an MGA as a specialized extension of its carrier partner, taking on the heavy lifting for some of the most critical functions in insurance. These core duties are the engine that makes the MGA insurance model run.

The first and most important job is underwriting. This isn't just about checking boxes; it's the art and science of evaluating risk. MGAs are masters at underwriting complex or unusual risks that most standard carriers wouldn't touch. This single step is the foundation for whether the entire partnership will be profitable.

Once a risk is approved, the MGA moves on to policy issuance. This means creating the official insurance contract and making sure every term, condition, and coverage detail is spot-on. It's the MGA that executes the legal agreement between the policyholder and the carrier.

From Premiums to Payouts

With a policy in place, the MGA is responsible for premium collection. They manage the entire billing and payment process, making sure the money flows in to keep the coverage active. This financial stewardship is vital for the health of the MGA's entire book of business.

But the most operationally demanding task is often claims administration. When a customer files a claim, it's frequently the MGA that handles everything from the first notice of loss to the final check. This requires a skilled team of adjusters and support staff to investigate the claim, assess the damages, and pay out according to the policy's rules.

Here’s a quick example to bring this to life.

Example: A Marine Insurance MGA Picture an MGA that only insures global shipping companies. They don't rely on standard risk charts. Instead, they’ve developed their own system that uses real-time satellite imagery and weather data to predict storm paths and calculate risk for specific shipping routes. A massive carrier could never justify building this kind of niche expertise in-house.

This kind of specialization is the MGA's secret sauce. It unlocks profitable, niche markets for carriers that they simply couldn't access on their own. The problem is, the sheer intensity of these tasks—especially underwriting and claims—creates major operational headaches.

The Bottleneck Problem and How AI Fixes It

Every one of these functions creates a mountain of data and relies on countless manual steps. For ai insurance companies and their MGA partners, this old-school approach just isn't cutting it anymore. Manual work is slow, full of potential errors, and makes it nearly impossible to deliver the smooth experience customers now demand.

This operational strain is exactly where automation becomes a no-brainer. These pain points are the perfect targets for AI-powered solutions that can boost both efficiency and carrier oversight.

Specifically, AI is set to overhaul two critical areas:

Automating Insurance Claims with AI: Modern AI platforms can manage the whole claims process—from intake and verification to fraud detection and payment. This is a game-changer in the MGA world, where specialized claims demand both speed and accuracy. The reliability of claims AI reviews has gotten so good that these systems can handle most standard claims, letting human experts focus on the truly complex cases.

Customer Care with AI for Financial Services: Policyholders want answers, and they want them now. AI customer care can provide 24/7 support, handle tough policy questions, and walk customers through the claims process. This delivers a consistently great experience and strengthens the bond between the customer, the MGA, and the carrier.

By bringing in intelligent automation, a modern MGA can turn its operational backbone from a source of friction into a true competitive advantage. It not only makes them more efficient but also makes them a far more valuable and dependable partner for carriers looking for that specialized edge.

How AI Is Automating MGA Claims Processing

When it comes to claims, an MGA's operational mettle is put to the test. This is where the rubber meets the road—a critical moment where speed, accuracy, and customer experience all collide. For decades, the process was notoriously slow and paper-heavy, but MGAs working with AI insurance companies are flipping the script, transforming a clunky workflow into a surprisingly efficient, automated operation.

The transformation kicks off right at the start with an AI-powered First Notice of Loss (FNOL). Instead of a policyholder getting bogged down with long forms or sitting on hold, an AI system can capture incident details in real-time through a simple chat or mobile app. This isn't just about being faster; it also leads to more accurate initial data, cutting down on the endless back-and-forth that plagues traditional claims.

From there, the automation dominoes start to fall. Let’s say there’s a property damage claim. The policyholder just has to upload a few photos of the damage from their phone. AI algorithms, having learned from millions of similar images, can then run an initial damage assessment in seconds. They can estimate the severity and potential repair costs far more quickly than any human could.

Speeding Up the Entire Claims Lifecycle

This initial burst of automation paves the way for a much faster resolution. Once the FNOL is in and the initial assessment is done, the AI can instantly check the policyholder’s coverage against the reported incident. It scans the policy to confirm that the specific type of damage is actually covered, validating the claim before it goes any further. That step alone prevents a world of headaches and delays down the line.

At the same time, the system runs the claim details through sophisticated fraud detection models. These algorithms are trained to spot unusual patterns and red flags that might point to a fraudulent claim, flagging it for a human expert to review. This smart triage lets legitimate claims fly through the system while focusing expert eyes exactly where they’re needed most.

The process flow below shows the core operational steps an MGA handles—all of which are getting a major speed boost from AI.

This visual breaks down the journey from underwriting to claims administration. Each stage represents a huge opportunity for AI to drive new efficiencies.

For straightforward, low-complexity claims, the entire process—from intake to payment—can be wrapped up in a few hours, not weeks. This is a game-changer for the policyholder experience, especially during a stressful time. It also frees up seasoned adjusters to focus their energy on the complex, high-stakes claims that truly need their experience and judgment. You can see how these workflows come together in our guide to insurance claims processing automation.

Ensuring Fairness and Accuracy with Claims AI Reviews

A fair question people often ask is whether automation sacrifices fairness for speed. This is where claims AI reviews become non-negotiable. Today's AI platforms aren't just "black boxes"; they're built for transparency and constant oversight. Every single automated decision is logged, creating a crystal-clear audit trail that shows exactly why a particular decision was made.

This auditability is essential for compliance and for maintaining the trust between an MGA and its carrier partner. If an automated decision ever comes into question, a human reviewer can easily pull up the record and see the exact data and logic the AI used.

By creating a transparent and auditable record of every decision, AI transforms claims processing from an often opaque art into a clear, data-driven science. This enhances both efficiency and regulatory compliance simultaneously.

What's more, these systems are always learning. By analyzing the outcomes of both automated and human-led claims, the AI models are constantly fine-tuned to become more accurate and fair. This feedback loop helps the system adapt to new situations and root out biases over time, leading to more consistent and equitable outcomes for every policyholder.

Transforming Customer Care With AI

Smooth claims processing is just one piece of the puzzle for a successful MGA insurance operation. The other, equally vital piece is the policyholder's experience. Today, AI is completely re-imagining customer interactions, going far beyond simple chatbots to offer smart, proactive, and genuinely personal support that earns long-term loyalty.

For forward-thinking AI insurance companies and the MGAs they work with, the old standards for customer service no longer apply. Policyholders have come to expect immediate, correct answers whenever they need them, day or night. AI-powered virtual assistants are rising to the occasion, delivering a level of service that was once unimaginable at scale.

Think about a customer needing to file a claim at 2 AM after a fender-bender. Instead of anxiously waiting for office hours, they can engage with an intelligent AI agent. This isn't a clunky bot—it’s a system that can walk them through the entire submission, answer complex questions about their policy in plain English, and set clear expectations for what happens next. This is the new reality of AI customer care.

Proactive Support That Builds Trust

Where customer care with AI for financial services really shines isn't just in how it responds to questions, but in how it anticipates needs. This shift from reactive to proactive support turns a routine service touchpoint into a genuine opportunity for MGAs and their carriers to build a stronger relationship with the customer.

Picture this: a major hailstorm is forecast for a specific area. An AI system can instantly flag all policyholders in the affected zip codes. Within moments, it can automatically send personalized text messages or emails offering a heads-up, providing links to start a claim if needed, and sharing tips for staying safe.

This simple, automated gesture achieves a few critical things:

Eases Customer Stress: Policyholders feel looked after when their insurer is already on top of the situation, often before they even think to call.

Manages Call Volume: By getting information out ahead of time, the system prevents a massive spike in calls that would otherwise bog down service teams.

Boosts Brand Loyalty: This kind of proactive attention shows a real commitment to the customer’s well-being, which goes a long way in building trust and improving retention.

To see how this technology is being put to work across the industry, you can find more AI use cases for insurance that illustrate its practical applications.

Personalization at Scale

Beyond just reaching out first, AI gives MGAs the ability to create a uniquely personal experience for every single policyholder. By analyzing a customer's history, policy details, and past interactions, an AI agent can offer advice and answers that are truly relevant to them.

AI-driven customer care allows MGAs to manage millions of interactions with the personalized touch of a small, dedicated agent. It combines the scale of technology with the empathy of human-centric service, creating a powerful competitive advantage.

For instance, an AI system can push real-time status updates on a claim directly to a customer's preferred channel, whether that’s SMS, email, or a notification in their mobile app. When they ask a follow-up question, the AI already knows the full context of their claim, so the customer never has to repeat themselves. It’s this kind of seamless, consistent support that makes all the difference.

This ability to blend smart automation with a human feel is what separates modern platforms from older tech. To learn more about this approach, you can read our in-depth guide on AI customer care and how it’s changing service delivery. By investing in intelligent customer care, MGAs aren't just boosting their own efficiency—they're cementing their reputation as invaluable partners in the eyes of both policyholders and carriers.

Achieving Real-Time Oversight With AI Auditing

In any MGA partnership, trust is the foundation, but rigorous oversight is the framework that keeps it standing. When a carrier hands over the underwriting pen and claims authority, they’re also accepting a certain amount of risk. Without a clear line of sight into the MGA's daily work, carriers are flying blind, exposed to everything from underwriting decisions that stray from guidelines to claims leakage that silently eats away at profits.

For decades, oversight was a rear-view mirror activity—slow, periodic audits that only uncovered problems months after the damage was done.

Today, artificial intelligence is changing the game, setting a new standard for transparent and effective governance. Modern AI platforms give carriers a real-time window into their MGA partners' activities. Oversight is no longer a reactive chore but a proactive, collaborative process that ensures the MGA operates as a true, compliant extension of the carrier.

From Periodic Reviews to Continuous Monitoring

The traditional audit process is like taking a patient's vitals once a quarter. You might spot a major illness, but you’ll miss the subtle daily fluctuations that signal trouble is brewing. AI flips this model entirely. Instead of waiting for a quarterly report to land on their desk, carriers can now log into dynamic dashboards that track key performance indicators (KPIs) as they happen.

This continuous visibility allows carriers to monitor the metrics that matter most, right now:

Loss Ratios: Instantly see how claims payouts are stacking up against collected premiums for a specific book of business.

Submission-to-Bind Rates: Get a live look at how many quotes are converting into bound policies, which is a great indicator of underwriting efficiency.

Claims Cycle Times: Track the average time from the first notice of loss to final settlement, making sure service level agreements (SLAs) are consistently met.

This kind of immediate insight elevates the carrier-MGA relationship from one of periodic check-ins to one of constant alignment. It fosters a genuine partnership where both sides can spot and solve potential issues long before they become serious problems.

AI-Powered Underwriting and Claims Audits

One of the biggest risks that comes with delegated authority is underwriting drift. An MGA might—intentionally or not—start writing policies that fall outside the agreed-upon risk appetite. AI-powered tools act as a digital safety net, instantly flagging any decision that breaks the established rules. For instance, if an MGA binds a policy with a property value 20% higher than the maximum allowable limit, the carrier's AI system can flag it for review that same day.

The same logic applies to claims. Automating insurance claims with AI not only makes the process faster but also creates a perfect, unchangeable audit trail. Systems built on this technology meticulously document every step, from the initial damage assessment to the final payment calculation. This makes it incredibly simple for carriers to audit claims files for accuracy and compliance, confirming every payout is justified.

AI transforms auditing from a manual, sample-based exercise into an exhaustive, real-time process. It examines every transaction, not just a small fraction, providing a level of assurance that was previously impossible.

This is where agentic AI really shines. To see how this works in the real world, check out this detailed case study on transforming insurance claims with agentic AI. This approach gives carriers complete confidence that their MGA partners are operating squarely within the guardrails they’ve established.

The difference between the old way and the new, AI-powered approach is stark. This table breaks it down.

Traditional MGA Oversight vs AI-Powered Oversight

This comparison highlights the shift from slow, manual, and often reactive audits to the real-time, automated, and proactive capabilities that an AI-native platform provides.

Oversight Area | Traditional Method (Manual & Periodic) | AI-Powered Method (Automated & Real-Time) |

|---|---|---|

Underwriting Review | Manual spot-checks of a small sample of policies | Continuous scanning of 100% of bound policies |

Claims Auditing | Quarterly file reviews, often months after closure | Real-time alerts for payment anomalies or SLA breaches |

Performance Tracking | Based on static, backward-looking reports | Live dashboards with dynamic KPIs |

Compliance Checks | Labor-intensive manual process | Automated rule-based checks for instant flagging |

By moving to AI-driven oversight, carriers and their MGA partners can build a stronger, more transparent relationship—one built on data-driven trust and geared for mutual success.

Answering Key Questions About MGAs and AI

As the MGA insurance model continues to gain traction, it's only natural for questions to pop up about its relationship with technology—especially artificial intelligence. Let's break down some of the most common questions we hear from carriers, agents, and even policyholders.

What’s the Real Difference Between an MGA and a Broker?

It all comes down to one thing: delegated authority. Think of an insurance broker as a salesperson. They act as an intermediary, selling policies for an insurer, but they don't have the power to actually approve the risk or handle the claim if something goes wrong.

An MGA, on the other hand, is given "the pen" by a carrier. This is a huge deal. It means they're trusted to underwrite, price, and bind coverage on the carrier's behalf. Many also manage the entire claims lifecycle for that specific product line, essentially operating as a specialized, outsourced division of the insurer.

How Can AI Help a Carrier Trust an MGA?

This is where things get interesting. AI fundamentally changes the trust equation by shifting oversight from a once-a-quarter, backward-looking audit to a continuous, real-time feedback loop. It creates a new standard of transparency.

Instead of waiting for a report to land on their desk, carriers using AI-powered platforms can see what’s happening inside their MGA partner’s operations at any moment. Smart algorithms can instantly flag an underwriting decision or claim payment that falls outside the agreed-upon guidelines.

This builds an objective, data-driven layer of accountability. It dramatically lowers the carrier's risk exposure and fosters a truly collaborative partnership where both sides are looking at the same information.

This kind of constant, automated oversight proves that the MGA is operating as a compliant and effective extension of the carrier, which is the bedrock of a strong, lasting relationship.

Is AI Going to Replace the Experts at MGAs?

Not at all. The goal is to augment their expertise, not replace it. Think of AI as a tool for handling the high-volume, repetitive, and data-intensive work that can bog people down.

For example, AI is fantastic at processing straightforward property claims, spotting potential fraud patterns in mountains of data, or answering routine policy questions. This frees up the seasoned underwriters and experienced claims adjusters to focus their brainpower on the tough stuff—the complex, high-stakes cases that require deep expertise and nuanced judgment.

In this model, AI acts as a co-pilot. It handles the routine, allowing the human experts to apply their skills where they add the most value. It’s the combination of human intellect and machine efficiency that drives the best results.

What Does the Future Look Like for MGAs and AI?

The future of the MGA insurance model is all about becoming more specialized and data-driven. As AI gets smarter, MGAs will be able to pinpoint, price, and underwrite niche and emerging risks with a level of precision we’ve never seen before. For AI insurance companies, this is a golden opportunity to tap into new, profitable markets through their MGA partners.

The operational connection between carriers and MGAs will become practically seamless, with shared data platforms enabling real-time collaboration on everything from underwriting to claims. You can expect to see a wave of AI-powered product innovation, as MGAs use predictive analytics to design entirely new insurance solutions for markets that were previously misunderstood or too risky. Our detailed article on the role of AI in insurance claims dives deeper into how these changes are already impacting workflows.

Ultimately, AI is poised to cement the MGA's role as a critical engine of innovation for the entire insurance industry.

Are you ready to bring intelligent automation to your insurance operations? Nolana deploys compliant AI agents to automate complex workflows in claims, case management, and customer service. Learn more about how Nolana can help you cut costs and accelerate cycle times.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP