How Guidewire Software Inc Is Powering Modern Insurance

How Guidewire Software Inc Is Powering Modern Insurance

Discover how Guidewire Software Inc leads the P&C insurance industry with its AI-driven platform for claims automation and enhanced customer care.

For a long time, the Property and Casualty (P&C) insurance industry has run on a patchwork of aging, disconnected systems. Guidewire Software Inc. was built to fix that, offering a core platform that brings an insurer's most critical operations under one roof.

Think of it as the central operating system for an AI insurance company. It handles the entire lifecycle—from the moment a policy is written and billed to the day a claim is filed and settled. This unified approach finally gives carriers a way to move on from their brittle legacy infrastructure and build a modern, cohesive business focused on automating insurance claims with AI.

The Digital Foundation For Modern Insurance

In the P&C world, the winners are decided by speed, accuracy, and the quality of their customer experience. That's a tall order when your core systems are decades old and can't keep up with changing market demands or customer expectations. Guidewire Software Inc. steps in to provide that foundational layer, InsuranceSuite, which essentially acts as the central nervous system for a carrier’s entire operation.

An insurer's business is incredibly complex. You have underwriting, policy issuance, billing, and claims all happening at once. Guidewire is the engine that makes sure all those moving parts work in harmony. Instead of juggling siloed spreadsheets and clunky old software, everyone works from a single source of truth for every policy and every claim.

A Focus on Intelligent Automation

One of the most powerful themes running through the Guidewire platform is its deep integration of artificial intelligence. This isn't just about automating simple, repetitive tasks; it's about embedding real intelligence into the core workflows that define an insurance business. This capability is making a huge impact on two of the most vital areas of the industry.

Automating Claims with AI: Guidewire helps insurers process claims with far greater speed and precision. For example, AI can analyze a photo of vehicle damage and generate a repair estimate on the spot—a process that used to take days of back-and-forth. This kind of efficiency is why you see so many positive claims AI reviews today. We cover this in-depth in our guide to AI in insurance claims.

Elevating Customer Care with AI: The platform is also driving a new standard for AI customer care in financial services. By crunching data, the system can anticipate a policyholder's needs, suggest a timely coverage update, or empower them with self-service tools that make the whole experience feel more intuitive and transparent.

Guidewire’s philosophy isn't just about digitizing old processes. It’s about completely rethinking them with AI at their heart. This helps insurers shift from being reactive—just waiting for a claim to happen—to being proactive, where they can better predict risk and serve their customers ahead of time.

This strategic shift is what separates forward-thinking AI insurance companies from the rest of the pack. By building these intelligent capabilities into their daily operations, carriers get the tools they need to not only manage risk effectively but to find new ways to grow and innovate.

Understanding The Guidewire Insurance Platform

To really get what makes Guidewire Software Inc. tick, you have to look under the hood at its core components. The platform, known as Guidewire InsuranceSuite, isn’t just one monolithic piece of software. It’s a powerful trio of interconnected systems designed to manage the entire insurance lifecycle, from the first quote to the final claim payment.

Each module has its own job to do, but they’re built to talk to each other seamlessly. This creates a single, unified system for the insurer, which is a world away from the disconnected legacy systems many are still wrestling with.

Think about the life of a typical auto insurance policy. That journey perfectly illustrates how Guidewire's main pillars work together. It starts with an agent creating the policy, moves on to managing the monthly payments, and, if an accident happens, ends with handling the claim.

The Three Pillars of InsuranceSuite

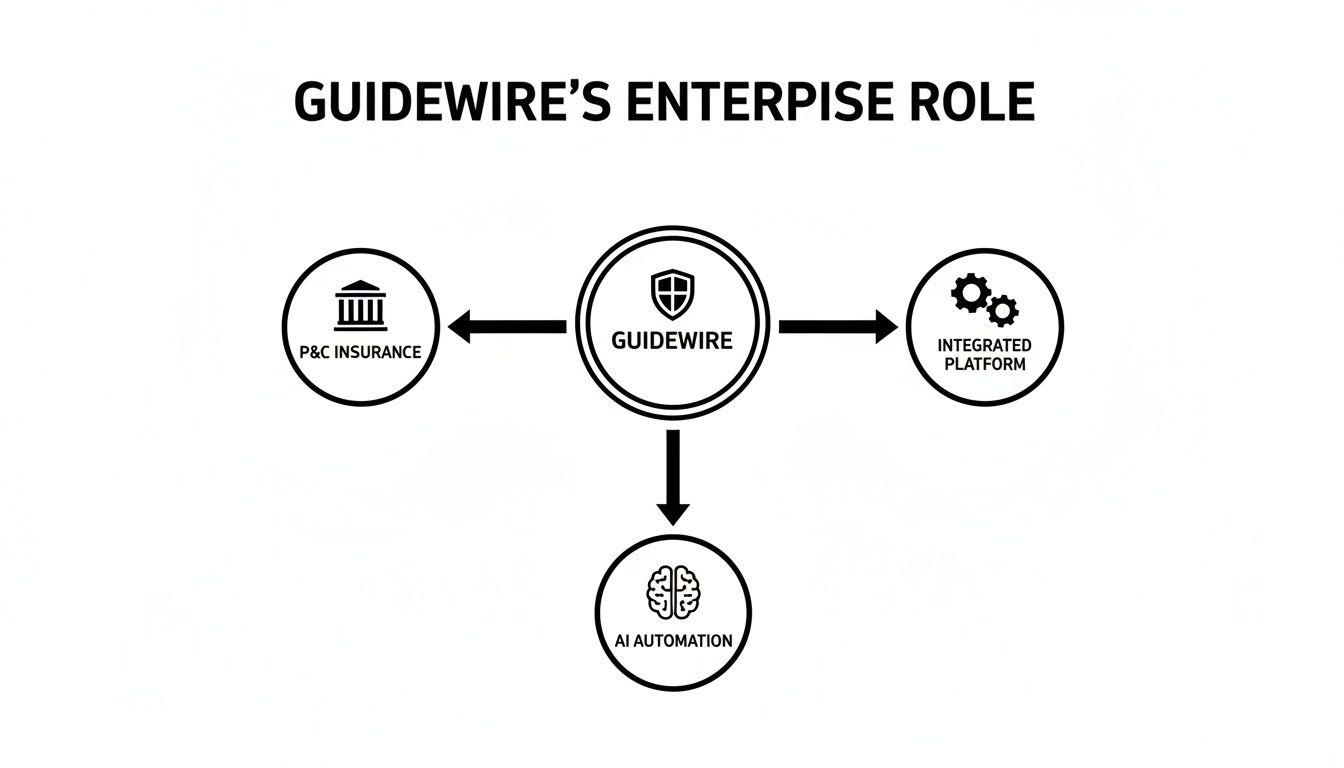

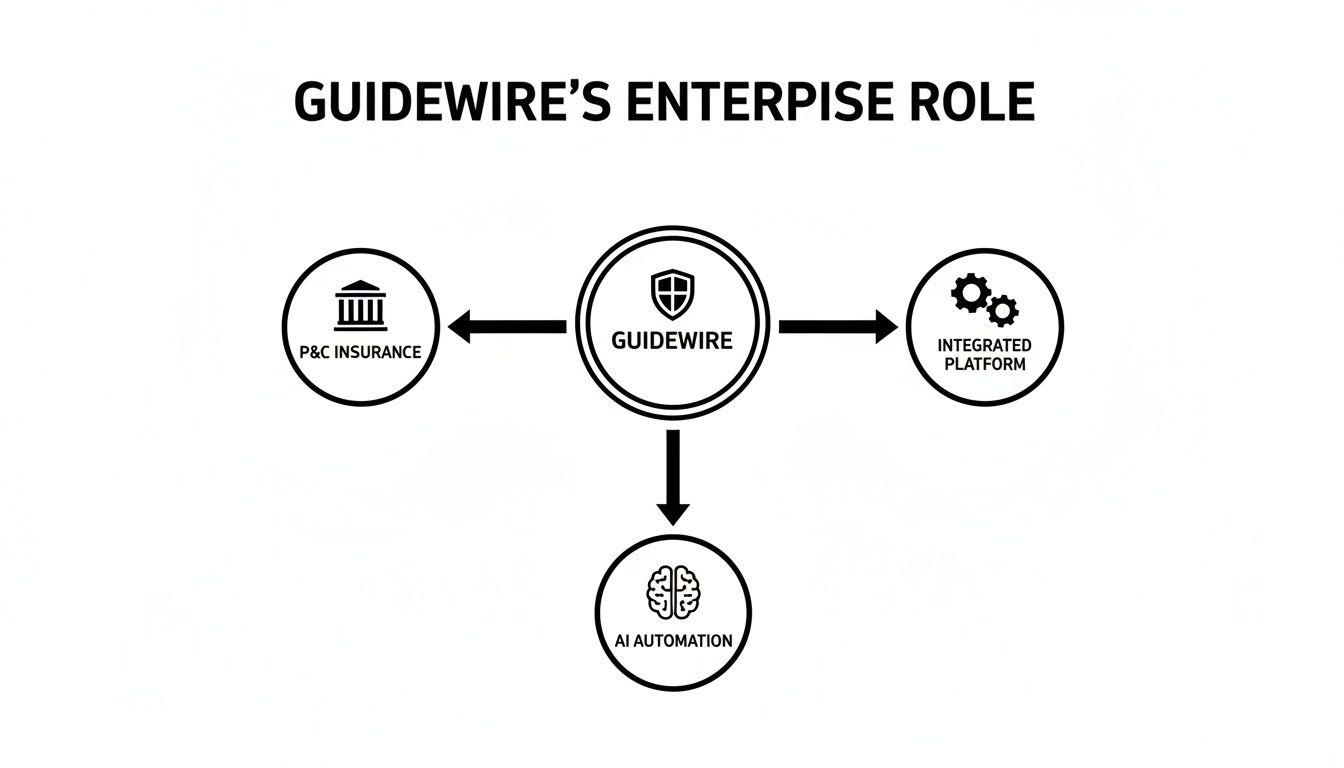

The real magic of the Guidewire platform is how its components constantly share data and workflows. This tight integration breaks down the frustrating data silos and clumsy manual handoffs that slow things down in older systems. The result? A single source of truth for every policyholder.

This diagram shows how Guidewire sits at the center, connecting core P&C insurance functions with modern platform technology and AI-driven automation.

As you can see, Guidewire acts as a foundational hub, giving insurers the tools to build a smarter, more connected business.

This integrated design is a huge reason why the platform has seen such widespread adoption. With a sharp focus on AI-powered tools and a clear path to the cloud, Guidewire now serves over 500 insurers worldwide. For the fiscal year ending July 31, 2025, the company's annual revenue hit $1.20 billion—a 22.64% jump from the prior year, proving its vital role in the industry's shift.

Let's unpack the three core modules.

The table below provides a quick summary of the primary modules within Guidewire's InsuranceSuite, their main jobs, and the business value they deliver.

Guidewire InsuranceSuite Core Components

Component | Core Function | Key Business Value |

|---|---|---|

PolicyCenter | Underwriting and policy administration | Speeds up quoting, binding, and issuance. Ensures underwriting consistency and product agility. |

BillingCenter | Billing, receivables, and commissions | Automates invoicing, payment processing, and collections. Provides flexible billing plans and reduces manual errors. |

ClaimCenter | End-to-end claims management | Streamlines the entire claims process from FNOL to settlement. Improves adjuster efficiency and reduces claim leakage. |

These components are more than just loosely connected; they are designed to operate as a single, cohesive system, delivering a true 360-degree view of the customer.

Information from PolicyCenter, like coverage limits, is instantly available in ClaimCenter when a claim is filed. At the same time, an agent in PolicyCenter can see the customer's payment status from BillingCenter. It’s all connected.

Data And Digital Layers

On top of these core modules, Guidewire layers in two more capabilities that are crucial for any modern AI insurance company: Data and Digital. These layers turn the raw operational data from the core suite into sharp business insights and exceptional customer experiences.

The Data Platform pulls information from across PolicyCenter, BillingCenter, and ClaimCenter. It then applies analytics to help insurers spot trends, manage risk more effectively, and find new market opportunities. A great example is analyzing claims data to detect new fraud patterns before they become a major problem.

The Digital layer provides the slick, user-friendly portals and mobile apps that today's policyholders expect. It powers self-service options and gives agents the tools they need to serve clients better. When a customer logs into an app to check their claim status, they're interacting with Guidewire's Digital layer. This is central to providing great AI customer care and turning routine tasks into positive interactions that build loyalty.

While Guidewire offers a powerful, all-in-one ecosystem, it’s always smart to understand the competition. For a different perspective on platform strategy, you might want to read our guide on a key Guidewire competitor, Duck Creek Technologies Inc.

How Guidewire AI Is Automating Insurance Claims

Let’s be honest: the traditional insurance claims process has always been a major headache for customers. It’s a world of long waits, endless paperwork, and being passed from one person to another. This is precisely where Guidewire Software Inc.'s use of AI is making a real difference, turning a notoriously frustrating experience into one that’s fast, clear, and surprisingly painless.

Through its ClaimCenter module, Guidewire embeds intelligent automation right into the core claims workflow. This focus on automating insurance claims with AI is completely changing the game for how modern AI insurance companies operate.

Think about a common auto claim, like a minor fender-bender. In the old days, you’d call an 800 number and start the waiting game. Now, you can just open your insurer's app, snap a few pictures of the damage, and hit submit. That’s when Guidewire's AI kicks in.

In just a few minutes, the system's computer vision analyzes the photos, identifies every damaged part, and checks it against a massive database of repair costs. It then spits out an accurate estimate. In many low-complexity cases, it can even trigger a digital payment to the policyholder or their preferred body shop. The whole thing can be over before the tow truck even arrives.

From Days Down to Minutes

This massive acceleration is a recurring theme in claims AI reviews. Policyholders aren't left wondering what’s happening, and insurers can burn through a high volume of simple claims with almost no human touch. This lets seasoned adjusters put their expertise where it’s needed most: on complex, sensitive cases.

Guidewire’s AI models are trained on incredible amounts of data, which lets them handle several crucial jobs in an instant:

Automated Damage Triage: The AI looks at photos or videos and immediately gets a sense of the damage severity. It can tell if a car is a total loss or can be repaired, sending the claim down the right path from the very beginning.

Intelligent Resource Assignment: Not every claim is the same. The system automatically assigns each case to the right adjuster based on the claim type, its complexity, and that adjuster’s specific skills and current workload.

Proactive Communication: The platform keeps the policyholder in the loop with automated text or email updates at every key step. This is a huge part of delivering great AI customer care.

By automating the first steps of a claim—the First Notice of Loss (FNOL) and triage—insurers often cut their claim cycle times by 50% or more. This isn't just great for customer satisfaction; it brings down operational costs in a big way.

Catching Fraud and Managing Risk

Speed is one thing, but Guidewire’s AI also adds a powerful layer of security. Insurance fraud costs the industry billions, and trying to catch it manually is like finding a needle in a haystack. The platform’s embedded AI flips the script by analyzing claims as they come in. To better understand the technology powering these capabilities, you can explore the fundamental principles of AI automation.

The system is always looking for red flags and suspicious patterns that might point to fraud. It could be multiple claims coming from the same address in a short time or photos that don't match the written incident report. These flagged claims get sent straight to a specialized fraud unit for a closer look, stopping bogus payments before they ever go out the door.

A Single, Unified Claims Ecosystem

One of the biggest advantages of Guidewire is that its AI isn’t some add-on tool. It’s woven directly into the fabric of the ClaimCenter workflow, which means adjusters aren’t juggling multiple apps to get AI-powered advice.

For example, when the system has a recommendation for a great local repair shop or spots a potential subrogation opportunity, that insight pops up right on the adjuster's main dashboard. This seamless integration ensures the technology actually helps people make better decisions instead of just creating more work.

This unified approach is what makes true insurance claims automation possible. It connects every piece of the puzzle, from the customer’s first photo submission to the final settlement check, into one smooth process. The outcome is a claims experience that’s not only more efficient for the insurer but far less stressful for the person who needs help. This is how today's top AI insurance companies build loyalty and stay ahead of the competition.

Transforming Customer Care With AI Solutions

Getting claims paid quickly is a massive win for policyholder satisfaction, but the best AI insurance companies know the customer journey doesn't start and end with an incident. These days, exceptional service isn't a bonus—it's the bare minimum. This is where Guidewire Software Inc. really shines, moving beyond reactive problem-solving to create proactive, personalized relationships powered by AI customer care for financial services.

The old way was painfully simple: wait for a customer to call with a problem. The new model, driven by Guidewire’s technology, is all about getting ahead of customer needs before they even pick up the phone. It’s a leap beyond generic chatbots and static FAQ pages into a world of genuinely helpful, timely interactions, a concept we explore in our guide to AI customer care.

This intelligent approach completely reframes the support center. It stops being a cost center and starts acting as a powerful engine for keeping customers happy and loyal. It’s about building lasting relationships, not just closing out service tickets.

Anticipating Needs Before They Arise

Guidewire's platform sifts through enormous amounts of policyholder data, looking for signals of major life events that might require a coverage change. This predictive knack lets an insurer act like a helpful partner instead of a faceless corporation.

Think about a policyholder who just bought a new house. The system can flag this event and trigger a perfectly timed, personalized outreach.

Automated Outreach: An email or app notification can pop up, congratulating them on the new home and gently suggesting a review of their homeowners and auto policies.

Intelligent Recommendations: The system can even pre-fill information for a new bundled quote, pointing out potential savings and highlighting relevant add-ons like flood or earthquake insurance.

Seamless Agent Handoff: If the customer wants to chat with a person, the AI routes them to an agent who already has the full picture, making the conversation smooth and productive from the get-go.

This kind of proactive support makes customers feel seen and understood. It turns a routine policy update into a genuinely positive experience that strengthens the insurer-policyholder bond.

Empowering Customers With Self-Service

Modern consumers expect to be in the driver's seat. They don't want to wait on hold to handle simple things like adding a car to their policy or grabbing a digital insurance card. Guidewire’s digital portals give customers exactly that kind of control.

These portals are far more than just static websites. They are dynamic, interactive hubs wired directly into the core InsuranceSuite. When a customer makes a change online, it reflects instantly across PolicyCenter and BillingCenter. This eliminates the frustrating delays and data-entry errors that plague manual processes.

A well-designed digital portal does more than just cut down on call volume for the insurer; it builds customer trust. By offering clear information and easy-to-use tools, insurers can pull back the curtain on the insurance process and empower their policyholders.

Turning Claims Into Positive Interactions

Even with the smartest AI, filing a claim is almost always a stressful experience. Guidewire’s platform makes sure communication stays clear and consistent from start to finish—a detail often mentioned in positive claims AI reviews. The very same digital portal used for managing a policy becomes the single source of truth during a claim.

Policyholders can simply log in to:

Check the real-time status of their claim.

Send a direct message to their assigned adjuster.

Securely upload photos or required documents.

Receive digital payments the moment a claim is approved.

This transparency takes the anxiety out of the unknown and gives customers a welcome sense of control during what is often a difficult time.

This dedication to innovation is backed by the company's solid financial footing. Guidewire Software's consistent growth is marked by an average annual revenue increase of 9.6% over several years. With a gross profit hitting $803.18 million in recent periods and a market cap of $21.18 billion, the company is well-capitalized to keep investing in the advanced cloud and AI solutions that support over 540 insurers in 40 countries. By turning every customer interaction into an opportunity to build trust, Guidewire Software Inc. helps AI insurance companies forge loyalty that lasts.

The Journey To A Modern Insurance Platform

Bringing a core system like Guidewire into your insurance business is far more than a simple technology upgrade. It’s a genuine business transformation. Making the switch to a modern platform requires careful planning, a solid strategy, and a clear-eyed view of the entire process—from initial project kickoff to seeing a real return on your investment.

One of the first big decisions an insurer has to make is how to deploy the system. In the past, this usually meant a massive on-premise installation, which was a long and expensive undertaking. Today, things look very different. Guidewire Cloud offers a much more agile and scalable Software-as-a-Service (SaaS) model that gets you up and running faster and makes long-term maintenance a whole lot simpler.

This move to the cloud isn't just about servers and infrastructure; it’s about business agility. With a SaaS model, insurers always have access to the latest features and security updates without going through disruptive, painful upgrade projects. This frees up your internal teams to focus on innovating for customers instead of just keeping the lights on.

Guidewire Cloud Vs. On-Premise Installation

The choice between cloud and on-premise has huge implications for your digital transformation timeline and the total cost of ownership. The Guidewire Cloud platform is specifically designed for speed and flexibility—two things that are absolutely critical for staying competitive today.

Let's break down the two approaches:

Feature | Guidewire Cloud (SaaS) | Traditional On-Premise |

|---|---|---|

Speed to Market | Much faster deployment, thanks to pre-configured environments and streamlined update cycles. | Slower, requiring extensive hardware setup and manual installation from the ground up. |

Maintenance | Guidewire handles all updates, patches, and infrastructure maintenance for you. | The insurer's IT team is on the hook for all system upkeep, upgrades, and troubleshooting. |

Scalability | Easily scale your resources up or down to match fluctuating business demands. | Scaling requires significant upfront investment in new hardware and infrastructure. |

Cost Model | A predictable subscription-based model (OpEx) that includes support and hosting. | High initial capital expenditure (CapEx) for licenses and hardware. |

Guidewire's strong performance, highlighted by its Q1 fiscal 2026 results where revenue reached $332.6 million, is largely driven by the momentum behind its cloud platform. This shift to a recurring subscription model not only creates financial stability but also fuels continuous investment in new AI-powered tools designed to make insurers more efficient.

Leveraging The Partner Ecosystem And APIs

No insurer goes through this kind of transition alone. Guidewire has built up an impressive ecosystem of system integrators (SIs) and solution providers who bring deep industry expertise to every implementation project. These partners are invaluable for tailoring the platform to an insurer's unique workflows and regulatory environments, helping ensure the rollout is a success.

On top of that, the platform’s API-first architecture is the key to modern integration. This design philosophy allows Guidewire to connect smoothly with all the other essential tools an insurer relies on.

Payment Processors: To enable smooth, automated billing and claims payouts.

Third-Party Data Sources: To enrich underwriting decisions with real-time risk data.

Customer Relationship Management (CRM) Systems: To create a single, unified view of every policyholder.

An API-first approach means Guidewire doesn't operate in a vacuum. It acts as a central hub in a larger technology ecosystem, giving insurers the flexibility to integrate best-of-breed solutions without being locked into a single vendor's tools.

To successfully build and maintain a modern insurance platform, companies like Guidewire rely on robust software engineering best practices to ensure their systems are resilient and scalable. This transition is a major undertaking, and success demands a solid foundation in both technology and organizational alignment. To learn more about this crucial aspect, check out our guide on change management in digital transformation.

Common Questions About Guidewire

As one of the biggest names in P&C insurance technology, Guidewire Software Inc. comes up in a lot of conversations. Here are some of the most common questions we hear from industry leaders trying to get a clearer picture of the platform, what it takes to get it running, and the real-world impact it can have.

What Kind of Insurers Use Guidewire?

Guidewire is built from the ground up for Property and Casualty (P&C) insurers. You'll find it running the show at a huge range of carriers, from the massive, Tier-1 global players all the way down to smaller regional and niche specialty providers.

Its architecture is designed to be highly configurable, which means it can be molded to fit just about any line of business. Think personal auto, homeowners, workers' comp, and even the most complex and specialized commercial lines. With the shift to Guidewire Cloud, the platform has become a real option for mid-sized AI insurance companies that don’t have the massive IT teams needed to manage a sprawling on-premise system. It's really opened the door for more carriers to access top-tier core systems.

How Does Guidewire’s Claims AI Stack Up Against Other Tools?

Guidewire's biggest differentiator is how deeply its AI is woven into the core claims workflow inside ClaimCenter. You can find plenty of standalone AI tools out there, but Guidewire’s embedded approach creates a much smoother, more natural experience for the user—a detail that often comes up in positive claims AI reviews.

For example, when an AI-powered fraud alert pops up, it does so right inside the adjuster's main workspace. It’s not a notification from another program; it’s an integrated part of the claim file, already loaded with context from the policy and claim history. This is worlds apart from standalone tools that make adjusters jump between different screens, which just adds friction and slows everything down.

What really gives Guidewire an edge is that its AI models are trained on the massive, well-structured dataset that lives right inside its own ecosystem. This tends to produce more accurate and context-aware predictions for critical jobs like forecasting claim severity, flagging litigation risk, or spotting a subrogation opportunity.

So, while some competitors offer fantastic point solutions for one specific task, Guidewire delivers a unified platform where AI-driven insights feel like a natural part of the end-to-end claims process.

Is Guidewire Difficult to Implement?

Let’s be honest: implementing any core insurance system is a massive undertaking, no matter who the vendor is. But Guidewire has made some serious progress in making this journey smoother, especially with its cloud platform. Guidewire Cloud takes a lot of the initial heavy lifting off the insurer's plate when it comes to setting up and maintaining the underlying infrastructure.

Beyond the technology, Guidewire Software Inc. has spent years refining its implementation methodology. They've also built up a huge network of certified system integration (SI) partners who specialize in deploying the platform. These firms bring a ton of industry-specific knowledge to the table. While the process is still complex, Guidewire provides clear roadmaps, pre-built accelerators, and a strong support network to keep projects on track. It makes for a much more predictable and manageable transformation than the legacy system overhauls of the past.

What's the Typical ROI for an Insurer Moving to Guidewire?

The Return on Investment (ROI) you'll see from a Guidewire implementation really depends on your starting point—your size, the state of your current systems, and what you’re trying to achieve. That said, the value almost always shows up in a few key areas.

Operational Efficiency: Automation in underwriting and claims is a huge win. Insurers see major efficiency boosts by cutting down on manual tasks and shortening cycle times, which directly lowers their loss adjustment expenses (LAE).

Business Agility: The platform makes it much faster for AI insurance companies to launch new products, expand into new markets, or just update their rates. This is a massive competitive advantage when speed-to-market is critical.

Customer Experience: Let's face it, faster, more transparent claims and modern digital tools make for happier customers. This has a direct impact on satisfaction and retention rates and is a key part of delivering quality AI customer care.

The upfront investment is significant, but the long-term payoff comes from a powerful mix of lower operating costs, greater business agility, and much stronger customer loyalty.

At Nolana, we deploy compliant AI agents to automate high-stakes financial operations, integrating seamlessly with core systems like Guidewire to enhance efficiency and customer experiences. Discover how our agentic operating system can transform your claims, case management, and customer service workflows at https://nolana.com.

For a long time, the Property and Casualty (P&C) insurance industry has run on a patchwork of aging, disconnected systems. Guidewire Software Inc. was built to fix that, offering a core platform that brings an insurer's most critical operations under one roof.

Think of it as the central operating system for an AI insurance company. It handles the entire lifecycle—from the moment a policy is written and billed to the day a claim is filed and settled. This unified approach finally gives carriers a way to move on from their brittle legacy infrastructure and build a modern, cohesive business focused on automating insurance claims with AI.

The Digital Foundation For Modern Insurance

In the P&C world, the winners are decided by speed, accuracy, and the quality of their customer experience. That's a tall order when your core systems are decades old and can't keep up with changing market demands or customer expectations. Guidewire Software Inc. steps in to provide that foundational layer, InsuranceSuite, which essentially acts as the central nervous system for a carrier’s entire operation.

An insurer's business is incredibly complex. You have underwriting, policy issuance, billing, and claims all happening at once. Guidewire is the engine that makes sure all those moving parts work in harmony. Instead of juggling siloed spreadsheets and clunky old software, everyone works from a single source of truth for every policy and every claim.

A Focus on Intelligent Automation

One of the most powerful themes running through the Guidewire platform is its deep integration of artificial intelligence. This isn't just about automating simple, repetitive tasks; it's about embedding real intelligence into the core workflows that define an insurance business. This capability is making a huge impact on two of the most vital areas of the industry.

Automating Claims with AI: Guidewire helps insurers process claims with far greater speed and precision. For example, AI can analyze a photo of vehicle damage and generate a repair estimate on the spot—a process that used to take days of back-and-forth. This kind of efficiency is why you see so many positive claims AI reviews today. We cover this in-depth in our guide to AI in insurance claims.

Elevating Customer Care with AI: The platform is also driving a new standard for AI customer care in financial services. By crunching data, the system can anticipate a policyholder's needs, suggest a timely coverage update, or empower them with self-service tools that make the whole experience feel more intuitive and transparent.

Guidewire’s philosophy isn't just about digitizing old processes. It’s about completely rethinking them with AI at their heart. This helps insurers shift from being reactive—just waiting for a claim to happen—to being proactive, where they can better predict risk and serve their customers ahead of time.

This strategic shift is what separates forward-thinking AI insurance companies from the rest of the pack. By building these intelligent capabilities into their daily operations, carriers get the tools they need to not only manage risk effectively but to find new ways to grow and innovate.

Understanding The Guidewire Insurance Platform

To really get what makes Guidewire Software Inc. tick, you have to look under the hood at its core components. The platform, known as Guidewire InsuranceSuite, isn’t just one monolithic piece of software. It’s a powerful trio of interconnected systems designed to manage the entire insurance lifecycle, from the first quote to the final claim payment.

Each module has its own job to do, but they’re built to talk to each other seamlessly. This creates a single, unified system for the insurer, which is a world away from the disconnected legacy systems many are still wrestling with.

Think about the life of a typical auto insurance policy. That journey perfectly illustrates how Guidewire's main pillars work together. It starts with an agent creating the policy, moves on to managing the monthly payments, and, if an accident happens, ends with handling the claim.

The Three Pillars of InsuranceSuite

The real magic of the Guidewire platform is how its components constantly share data and workflows. This tight integration breaks down the frustrating data silos and clumsy manual handoffs that slow things down in older systems. The result? A single source of truth for every policyholder.

This diagram shows how Guidewire sits at the center, connecting core P&C insurance functions with modern platform technology and AI-driven automation.

As you can see, Guidewire acts as a foundational hub, giving insurers the tools to build a smarter, more connected business.

This integrated design is a huge reason why the platform has seen such widespread adoption. With a sharp focus on AI-powered tools and a clear path to the cloud, Guidewire now serves over 500 insurers worldwide. For the fiscal year ending July 31, 2025, the company's annual revenue hit $1.20 billion—a 22.64% jump from the prior year, proving its vital role in the industry's shift.

Let's unpack the three core modules.

The table below provides a quick summary of the primary modules within Guidewire's InsuranceSuite, their main jobs, and the business value they deliver.

Guidewire InsuranceSuite Core Components

Component | Core Function | Key Business Value |

|---|---|---|

PolicyCenter | Underwriting and policy administration | Speeds up quoting, binding, and issuance. Ensures underwriting consistency and product agility. |

BillingCenter | Billing, receivables, and commissions | Automates invoicing, payment processing, and collections. Provides flexible billing plans and reduces manual errors. |

ClaimCenter | End-to-end claims management | Streamlines the entire claims process from FNOL to settlement. Improves adjuster efficiency and reduces claim leakage. |

These components are more than just loosely connected; they are designed to operate as a single, cohesive system, delivering a true 360-degree view of the customer.

Information from PolicyCenter, like coverage limits, is instantly available in ClaimCenter when a claim is filed. At the same time, an agent in PolicyCenter can see the customer's payment status from BillingCenter. It’s all connected.

Data And Digital Layers

On top of these core modules, Guidewire layers in two more capabilities that are crucial for any modern AI insurance company: Data and Digital. These layers turn the raw operational data from the core suite into sharp business insights and exceptional customer experiences.

The Data Platform pulls information from across PolicyCenter, BillingCenter, and ClaimCenter. It then applies analytics to help insurers spot trends, manage risk more effectively, and find new market opportunities. A great example is analyzing claims data to detect new fraud patterns before they become a major problem.

The Digital layer provides the slick, user-friendly portals and mobile apps that today's policyholders expect. It powers self-service options and gives agents the tools they need to serve clients better. When a customer logs into an app to check their claim status, they're interacting with Guidewire's Digital layer. This is central to providing great AI customer care and turning routine tasks into positive interactions that build loyalty.

While Guidewire offers a powerful, all-in-one ecosystem, it’s always smart to understand the competition. For a different perspective on platform strategy, you might want to read our guide on a key Guidewire competitor, Duck Creek Technologies Inc.

How Guidewire AI Is Automating Insurance Claims

Let’s be honest: the traditional insurance claims process has always been a major headache for customers. It’s a world of long waits, endless paperwork, and being passed from one person to another. This is precisely where Guidewire Software Inc.'s use of AI is making a real difference, turning a notoriously frustrating experience into one that’s fast, clear, and surprisingly painless.

Through its ClaimCenter module, Guidewire embeds intelligent automation right into the core claims workflow. This focus on automating insurance claims with AI is completely changing the game for how modern AI insurance companies operate.

Think about a common auto claim, like a minor fender-bender. In the old days, you’d call an 800 number and start the waiting game. Now, you can just open your insurer's app, snap a few pictures of the damage, and hit submit. That’s when Guidewire's AI kicks in.

In just a few minutes, the system's computer vision analyzes the photos, identifies every damaged part, and checks it against a massive database of repair costs. It then spits out an accurate estimate. In many low-complexity cases, it can even trigger a digital payment to the policyholder or their preferred body shop. The whole thing can be over before the tow truck even arrives.

From Days Down to Minutes

This massive acceleration is a recurring theme in claims AI reviews. Policyholders aren't left wondering what’s happening, and insurers can burn through a high volume of simple claims with almost no human touch. This lets seasoned adjusters put their expertise where it’s needed most: on complex, sensitive cases.

Guidewire’s AI models are trained on incredible amounts of data, which lets them handle several crucial jobs in an instant:

Automated Damage Triage: The AI looks at photos or videos and immediately gets a sense of the damage severity. It can tell if a car is a total loss or can be repaired, sending the claim down the right path from the very beginning.

Intelligent Resource Assignment: Not every claim is the same. The system automatically assigns each case to the right adjuster based on the claim type, its complexity, and that adjuster’s specific skills and current workload.

Proactive Communication: The platform keeps the policyholder in the loop with automated text or email updates at every key step. This is a huge part of delivering great AI customer care.

By automating the first steps of a claim—the First Notice of Loss (FNOL) and triage—insurers often cut their claim cycle times by 50% or more. This isn't just great for customer satisfaction; it brings down operational costs in a big way.

Catching Fraud and Managing Risk

Speed is one thing, but Guidewire’s AI also adds a powerful layer of security. Insurance fraud costs the industry billions, and trying to catch it manually is like finding a needle in a haystack. The platform’s embedded AI flips the script by analyzing claims as they come in. To better understand the technology powering these capabilities, you can explore the fundamental principles of AI automation.

The system is always looking for red flags and suspicious patterns that might point to fraud. It could be multiple claims coming from the same address in a short time or photos that don't match the written incident report. These flagged claims get sent straight to a specialized fraud unit for a closer look, stopping bogus payments before they ever go out the door.

A Single, Unified Claims Ecosystem

One of the biggest advantages of Guidewire is that its AI isn’t some add-on tool. It’s woven directly into the fabric of the ClaimCenter workflow, which means adjusters aren’t juggling multiple apps to get AI-powered advice.

For example, when the system has a recommendation for a great local repair shop or spots a potential subrogation opportunity, that insight pops up right on the adjuster's main dashboard. This seamless integration ensures the technology actually helps people make better decisions instead of just creating more work.

This unified approach is what makes true insurance claims automation possible. It connects every piece of the puzzle, from the customer’s first photo submission to the final settlement check, into one smooth process. The outcome is a claims experience that’s not only more efficient for the insurer but far less stressful for the person who needs help. This is how today's top AI insurance companies build loyalty and stay ahead of the competition.

Transforming Customer Care With AI Solutions

Getting claims paid quickly is a massive win for policyholder satisfaction, but the best AI insurance companies know the customer journey doesn't start and end with an incident. These days, exceptional service isn't a bonus—it's the bare minimum. This is where Guidewire Software Inc. really shines, moving beyond reactive problem-solving to create proactive, personalized relationships powered by AI customer care for financial services.

The old way was painfully simple: wait for a customer to call with a problem. The new model, driven by Guidewire’s technology, is all about getting ahead of customer needs before they even pick up the phone. It’s a leap beyond generic chatbots and static FAQ pages into a world of genuinely helpful, timely interactions, a concept we explore in our guide to AI customer care.

This intelligent approach completely reframes the support center. It stops being a cost center and starts acting as a powerful engine for keeping customers happy and loyal. It’s about building lasting relationships, not just closing out service tickets.

Anticipating Needs Before They Arise

Guidewire's platform sifts through enormous amounts of policyholder data, looking for signals of major life events that might require a coverage change. This predictive knack lets an insurer act like a helpful partner instead of a faceless corporation.

Think about a policyholder who just bought a new house. The system can flag this event and trigger a perfectly timed, personalized outreach.

Automated Outreach: An email or app notification can pop up, congratulating them on the new home and gently suggesting a review of their homeowners and auto policies.

Intelligent Recommendations: The system can even pre-fill information for a new bundled quote, pointing out potential savings and highlighting relevant add-ons like flood or earthquake insurance.

Seamless Agent Handoff: If the customer wants to chat with a person, the AI routes them to an agent who already has the full picture, making the conversation smooth and productive from the get-go.

This kind of proactive support makes customers feel seen and understood. It turns a routine policy update into a genuinely positive experience that strengthens the insurer-policyholder bond.

Empowering Customers With Self-Service

Modern consumers expect to be in the driver's seat. They don't want to wait on hold to handle simple things like adding a car to their policy or grabbing a digital insurance card. Guidewire’s digital portals give customers exactly that kind of control.

These portals are far more than just static websites. They are dynamic, interactive hubs wired directly into the core InsuranceSuite. When a customer makes a change online, it reflects instantly across PolicyCenter and BillingCenter. This eliminates the frustrating delays and data-entry errors that plague manual processes.

A well-designed digital portal does more than just cut down on call volume for the insurer; it builds customer trust. By offering clear information and easy-to-use tools, insurers can pull back the curtain on the insurance process and empower their policyholders.

Turning Claims Into Positive Interactions

Even with the smartest AI, filing a claim is almost always a stressful experience. Guidewire’s platform makes sure communication stays clear and consistent from start to finish—a detail often mentioned in positive claims AI reviews. The very same digital portal used for managing a policy becomes the single source of truth during a claim.

Policyholders can simply log in to:

Check the real-time status of their claim.

Send a direct message to their assigned adjuster.

Securely upload photos or required documents.

Receive digital payments the moment a claim is approved.

This transparency takes the anxiety out of the unknown and gives customers a welcome sense of control during what is often a difficult time.

This dedication to innovation is backed by the company's solid financial footing. Guidewire Software's consistent growth is marked by an average annual revenue increase of 9.6% over several years. With a gross profit hitting $803.18 million in recent periods and a market cap of $21.18 billion, the company is well-capitalized to keep investing in the advanced cloud and AI solutions that support over 540 insurers in 40 countries. By turning every customer interaction into an opportunity to build trust, Guidewire Software Inc. helps AI insurance companies forge loyalty that lasts.

The Journey To A Modern Insurance Platform

Bringing a core system like Guidewire into your insurance business is far more than a simple technology upgrade. It’s a genuine business transformation. Making the switch to a modern platform requires careful planning, a solid strategy, and a clear-eyed view of the entire process—from initial project kickoff to seeing a real return on your investment.

One of the first big decisions an insurer has to make is how to deploy the system. In the past, this usually meant a massive on-premise installation, which was a long and expensive undertaking. Today, things look very different. Guidewire Cloud offers a much more agile and scalable Software-as-a-Service (SaaS) model that gets you up and running faster and makes long-term maintenance a whole lot simpler.

This move to the cloud isn't just about servers and infrastructure; it’s about business agility. With a SaaS model, insurers always have access to the latest features and security updates without going through disruptive, painful upgrade projects. This frees up your internal teams to focus on innovating for customers instead of just keeping the lights on.

Guidewire Cloud Vs. On-Premise Installation

The choice between cloud and on-premise has huge implications for your digital transformation timeline and the total cost of ownership. The Guidewire Cloud platform is specifically designed for speed and flexibility—two things that are absolutely critical for staying competitive today.

Let's break down the two approaches:

Feature | Guidewire Cloud (SaaS) | Traditional On-Premise |

|---|---|---|

Speed to Market | Much faster deployment, thanks to pre-configured environments and streamlined update cycles. | Slower, requiring extensive hardware setup and manual installation from the ground up. |

Maintenance | Guidewire handles all updates, patches, and infrastructure maintenance for you. | The insurer's IT team is on the hook for all system upkeep, upgrades, and troubleshooting. |

Scalability | Easily scale your resources up or down to match fluctuating business demands. | Scaling requires significant upfront investment in new hardware and infrastructure. |

Cost Model | A predictable subscription-based model (OpEx) that includes support and hosting. | High initial capital expenditure (CapEx) for licenses and hardware. |

Guidewire's strong performance, highlighted by its Q1 fiscal 2026 results where revenue reached $332.6 million, is largely driven by the momentum behind its cloud platform. This shift to a recurring subscription model not only creates financial stability but also fuels continuous investment in new AI-powered tools designed to make insurers more efficient.

Leveraging The Partner Ecosystem And APIs

No insurer goes through this kind of transition alone. Guidewire has built up an impressive ecosystem of system integrators (SIs) and solution providers who bring deep industry expertise to every implementation project. These partners are invaluable for tailoring the platform to an insurer's unique workflows and regulatory environments, helping ensure the rollout is a success.

On top of that, the platform’s API-first architecture is the key to modern integration. This design philosophy allows Guidewire to connect smoothly with all the other essential tools an insurer relies on.

Payment Processors: To enable smooth, automated billing and claims payouts.

Third-Party Data Sources: To enrich underwriting decisions with real-time risk data.

Customer Relationship Management (CRM) Systems: To create a single, unified view of every policyholder.

An API-first approach means Guidewire doesn't operate in a vacuum. It acts as a central hub in a larger technology ecosystem, giving insurers the flexibility to integrate best-of-breed solutions without being locked into a single vendor's tools.

To successfully build and maintain a modern insurance platform, companies like Guidewire rely on robust software engineering best practices to ensure their systems are resilient and scalable. This transition is a major undertaking, and success demands a solid foundation in both technology and organizational alignment. To learn more about this crucial aspect, check out our guide on change management in digital transformation.

Common Questions About Guidewire

As one of the biggest names in P&C insurance technology, Guidewire Software Inc. comes up in a lot of conversations. Here are some of the most common questions we hear from industry leaders trying to get a clearer picture of the platform, what it takes to get it running, and the real-world impact it can have.

What Kind of Insurers Use Guidewire?

Guidewire is built from the ground up for Property and Casualty (P&C) insurers. You'll find it running the show at a huge range of carriers, from the massive, Tier-1 global players all the way down to smaller regional and niche specialty providers.

Its architecture is designed to be highly configurable, which means it can be molded to fit just about any line of business. Think personal auto, homeowners, workers' comp, and even the most complex and specialized commercial lines. With the shift to Guidewire Cloud, the platform has become a real option for mid-sized AI insurance companies that don’t have the massive IT teams needed to manage a sprawling on-premise system. It's really opened the door for more carriers to access top-tier core systems.

How Does Guidewire’s Claims AI Stack Up Against Other Tools?

Guidewire's biggest differentiator is how deeply its AI is woven into the core claims workflow inside ClaimCenter. You can find plenty of standalone AI tools out there, but Guidewire’s embedded approach creates a much smoother, more natural experience for the user—a detail that often comes up in positive claims AI reviews.

For example, when an AI-powered fraud alert pops up, it does so right inside the adjuster's main workspace. It’s not a notification from another program; it’s an integrated part of the claim file, already loaded with context from the policy and claim history. This is worlds apart from standalone tools that make adjusters jump between different screens, which just adds friction and slows everything down.

What really gives Guidewire an edge is that its AI models are trained on the massive, well-structured dataset that lives right inside its own ecosystem. This tends to produce more accurate and context-aware predictions for critical jobs like forecasting claim severity, flagging litigation risk, or spotting a subrogation opportunity.

So, while some competitors offer fantastic point solutions for one specific task, Guidewire delivers a unified platform where AI-driven insights feel like a natural part of the end-to-end claims process.

Is Guidewire Difficult to Implement?

Let’s be honest: implementing any core insurance system is a massive undertaking, no matter who the vendor is. But Guidewire has made some serious progress in making this journey smoother, especially with its cloud platform. Guidewire Cloud takes a lot of the initial heavy lifting off the insurer's plate when it comes to setting up and maintaining the underlying infrastructure.

Beyond the technology, Guidewire Software Inc. has spent years refining its implementation methodology. They've also built up a huge network of certified system integration (SI) partners who specialize in deploying the platform. These firms bring a ton of industry-specific knowledge to the table. While the process is still complex, Guidewire provides clear roadmaps, pre-built accelerators, and a strong support network to keep projects on track. It makes for a much more predictable and manageable transformation than the legacy system overhauls of the past.

What's the Typical ROI for an Insurer Moving to Guidewire?

The Return on Investment (ROI) you'll see from a Guidewire implementation really depends on your starting point—your size, the state of your current systems, and what you’re trying to achieve. That said, the value almost always shows up in a few key areas.

Operational Efficiency: Automation in underwriting and claims is a huge win. Insurers see major efficiency boosts by cutting down on manual tasks and shortening cycle times, which directly lowers their loss adjustment expenses (LAE).

Business Agility: The platform makes it much faster for AI insurance companies to launch new products, expand into new markets, or just update their rates. This is a massive competitive advantage when speed-to-market is critical.

Customer Experience: Let's face it, faster, more transparent claims and modern digital tools make for happier customers. This has a direct impact on satisfaction and retention rates and is a key part of delivering quality AI customer care.

The upfront investment is significant, but the long-term payoff comes from a powerful mix of lower operating costs, greater business agility, and much stronger customer loyalty.

At Nolana, we deploy compliant AI agents to automate high-stakes financial operations, integrating seamlessly with core systems like Guidewire to enhance efficiency and customer experiences. Discover how our agentic operating system can transform your claims, case management, and customer service workflows at https://nolana.com.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP