Genesys AI for Modern Financial Services

Genesys AI for Modern Financial Services

Discover how Genesys transforms financial services with AI-driven customer care and automated claims processing to boost efficiency and ensure compliance.

In the world of customer experience, Genesys stands out as a powerful cloud platform built to bring every customer interaction together. For businesses in demanding sectors like financial services, it offers a sophisticated suite of tools for AI customer care, intelligent omnichannel routing, and workforce engagement, all designed to deliver highly personalized and efficient service.

The New Standard for Customer Experience in Finance

Let's be honest: the days of siloed, reactive contact centers in finance are long gone. Today's customers expect every interaction to be seamless, secure, and incredibly personal, whether they're just checking an account balance, disputing a transaction, or filing a complex insurance claim. This shift in expectations has left many legacy systems in the dust, creating an urgent need for a completely new operational backbone for AI customer care.

This is precisely where a platform like Genesys comes into the picture. Think of it less as a piece of software and more as the central nervous system for modern banking and insurance operations. Its main job is to solve the massive challenge of unifying every customer touchpoint into one single, continuous journey.

The Problem with Disconnected Systems

So many traditional financial institutions are still wrestling with fragmented systems. We’ve all seen it: a customer starts a query on the mobile app, moves to a web chat, and finally has to call an agent. In a disconnected world, each of those steps forces the customer to start over, repeating information and growing more frustrated by the minute. It’s not just a bad experience; it’s a compliance risk waiting to happen.

Take insurance claims, for example. Information has to move perfectly from the first notice of loss all the way through verification and payout. Clunky, older systems create bottlenecks that slow everything down, delaying settlements and driving up operational costs for ai insurance companies.

The real problem is the disconnect between what customers expect and what outdated technology can deliver. People want an experience that’s as smooth as their favorite consumer apps, but too many financial workflows are still stuck in the past.

A New Infrastructure for Financial Operations

Genesys tackles this head-on by creating a single hub where every interaction is managed, from a simple chatbot question to a multi-stage insurance claim. It provides the solid foundation needed to not only meet modern customer expectations but also adhere to the industry's strict regulatory standards. To see just how much AI is changing the game, it's worth comparing the capabilities of AI voice agents versus traditional call centers.

This pivot to integrated platforms is a huge part of the larger financial services digital transformation, which is all about using technology to build more agile and customer-centric businesses. By centralizing interaction data, Genesys creates the perfect environment for intelligent automation. It makes sophisticated AI customer care and automated claims ai reviews not just a nice-to-have, but an essential part of growing the business, staying compliant, and keeping a competitive edge.

Inside the Genesys Cloud Platform

To really get what makes Genesys tick for modern finance, it helps to think of it as a central nervous system for a business. It doesn't just pass messages along; it intelligently connects every touchpoint—from the agent on the front lines to the critical back-office systems—into one cohesive operation.

Under the hood, the platform runs on a microservices-based, API-first architecture. That sounds a bit technical, but the idea is simple. Instead of being one massive, rigid application, Genesys Cloud is made up of many small, independent services that talk to each other through APIs (Application Programming Interfaces).

For financial services, this design is non-negotiable. A bank or insurer simply can’t afford system-wide failures or slow performance. With microservices, if one small component hits a snag, it doesn't bring the whole system down. This gives you the kind of reliability that ai insurance companies and banks absolutely depend on.

Built for Scalability and Seamless Integration

That API-first approach is also the secret to breaking down frustrating data silos. It’s what lets Genesys connect so cleanly with essential industry systems like Guidewire for insurance claims or Salesforce for CRM. This open connectivity unlocks genuine end-to-end process automation.

Let’s look at a practical example. A customer starts a claim using a chat widget on the website. Behind the scenes, Genesys uses its APIs to:

Pull policy details straight from Guidewire.

Confirm the customer's identity using information in Salesforce.

Send the conversation to the right claims specialist, armed with all that context.

This fluid exchange of data means agents aren't fumbling between different windows, and customers don't have to repeat their story. You get a single source of truth for every interaction, which is the bedrock for effective AI customer care.

The true power of an API-first platform lies in its flexibility. It allows a financial institution to adapt quickly, adding new communication channels or integrating new technologies without having to overhaul its entire infrastructure.

Core Capabilities of the Genesys Engine

While the architecture is the foundation, the platform’s real muscle comes from its core capabilities working together. These are the tools that run the day-to-day customer and employee experience, making Genesys far more than just a call center system. You can see how this works in our guide to deploying Cloud Genesys in regulated industries.

Three pillars really hold everything up:

Omnichannel Routing: This is all about consistency. Whether a customer calls, emails, chats, or sends a message on social media, the experience feels connected. Genesys routes every interaction to the best agent based on their skills, availability, and the customer’s past interactions.

Workforce Engagement Management (WEM): This is the agent-focused part of the equation. WEM tools offer performance dashboards, quality management, and smart scheduling. They give managers what they need to coach their teams and keep service levels high.

Advanced Analytics and Reporting: Every conversation, every click, every interaction creates data. Genesys provides powerful tools to track KPIs, spot trends in customer behavior, and perform deep-dive claims ai reviews to find opportunities for improvement.

These three components create a rich, data-driven ecosystem. This unified stream of information then feeds the platform’s more advanced AI tools, helping financial institutions shift from just reacting to customer needs to proactively anticipating them. The architecture isn't just about technology; it's about building a smarter, more connected organization.

Automating Insurance Claims and Customer Care with AI

Once you have a unified platform like Genesys in place, the real work begins: applying AI to solve the most stubborn and expensive problems financial institutions face. This is where you see the shift from simply reacting to customer needs to proactively and intelligently automating entire workflows for insurance claims and financial AI customer care.

These aren't far-off concepts; they are practical tools making a difference today. Predictive routing, voicebots, chatbots, and agent-assist tools are fundamentally changing how ai insurance companies and banks operate. They work together to handle the routine, predictable tasks, which frees up your expert human agents to manage the complex, high-empathy situations where they are needed most.

Transforming the Insurance Claims Journey

If you're looking for a workflow ripe for AI-driven improvement, the insurance claims process is a perfect candidate. It's traditionally a tangled mess of manual steps, endless paperwork, and frustrating delays that drive up costs and drive away customers. Genesys AI cuts through that complexity by injecting efficiency at every critical stage.

Let’s look at how this plays out in the real world:

Automated First Notice of Loss (FNOL): Instead of waiting for business hours, a customer can report a claim 24/7 through a voicebot or chatbot. The AI gathers the essential details, creates the initial claim file, and instantly gives the customer a claim number and a clear sense of what happens next—all without a single human touch.

Instant Status Updates: Forget making a customer call an agent just to ask, "What's the status of my claim?" A policyholder can now ask a bot that question and get an immediate, accurate answer pulled securely from the core claims system.

Intelligent Triage: AI gets smart about assigning work. It analyzes the initial claim details to gauge complexity. Simple, low-value claims can be fast-tracked for automated processing, while the tricky ones are immediately routed to senior adjusters who have the specific expertise to handle them.

This kind of automation makes the whole claims experience faster and far more transparent. For a deeper dive into this, check out our complete guide on insurance claims processing automation.

Elevating Banking Customer Care with AI

In banking, the focus for AI customer care usually boils down to three things: security, speed, and self-service. When it comes to their money, customers expect immediate answers and fast resolutions, and AI provides the tools to deliver that experience at scale.

Common applications include AI-powered fraud alerts, where a bot can proactively text or call a customer to verify a suspicious transaction in real time. For everyday banking, AI enables secure self-service for tasks like checking a balance, transferring funds, or disputing a charge, which takes a huge load off your live agents.

The adoption rate for these tools is staggering. For instance, in its second quarter of fiscal year 2026, the Genesys Cloud Agent Copilot generated over 17 million automated summaries in July 2025 alone. That’s a nearly 6x increase from the previous year. You can learn more about how enterprises are quickly operationalizing AI at scale.

A crucial, but often overlooked, application is what we call claims AI reviews. This is where AI analyzes call transcripts, chat logs, and even agent screen recordings to check for compliance with regulatory scripts, spot coaching opportunities, and identify emerging customer issues before they turn into widespread problems.

This proactive approach to quality assurance ensures consistency and helps you stay on the right side of strict financial regulations.

AI Transformation in Financial Services Workflows

To see the difference AI makes, it helps to compare the old way of doing things with the new. The table below illustrates the stark contrast between traditional manual workflows and those augmented by Genesys AI, especially in claims processing.

Workflow Step | Traditional Manual Process | Genesys AI-Automated Process |

|---|---|---|

Initial Customer Contact (FNOL) | Customer waits for an agent to become available during business hours to manually input claim details. | A 24/7 chatbot or voicebot instantly captures FNOL data and creates a claim file automatically. |

Claim Routing and Triage | A supervisor manually reviews each new claim and assigns it to an adjuster based on a best guess of their workload. | AI analyzes claim complexity and routes it to the best-skilled, available adjuster based on predictive algorithms. |

Status Inquiry | Customer calls the contact center, waits on hold, and an agent manually looks up the claim status in the core system. | Customer gets an instant, on-demand status update via a self-service bot on any channel (web, mobile, voice). |

Quality and Compliance Review | Managers manually listen to a small, random sample of calls each month to check for compliance and quality. | AI analyzes 100% of interactions, flagging specific moments for review and generating automated compliance reports. |

Looking at this comparison, it’s clear that integrating AI isn't just about making small improvements. It’s a fundamental redesign of how financial services get delivered, moving the needle on efficiency, customer satisfaction, and compliance all at the same time.

Unlocking End-to-End Automation with Agentic AI

The native AI inside the Genesys platform is fantastic at what it does—optimizing the interaction itself. Think smart routing, quick call summaries, and real-time guidance for agents. It's a game-changer for the contact center.

But what happens when the conversation ends? For complex workflows, like a multi-stage insurance claim or a mortgage application, the initial customer touchpoint is just the beginning. This is where we need to think beyond AI-assisted tasks and start talking about true end-to-end automation.

This is where integrating an agentic AI platform like Nolana with Genesys really shines. Here's a simple way to look at it: Genesys AI masters the conversation, while agentic AI masters the work that comes after. These autonomous AI agents pick up right where a human or Genesys bot leaves off, diving into the complex backend processes without needing a human to guide them.

From Conversation to Autonomous Execution

Let's walk through a real-world example: an auto insurance claim. It all starts with a First Notice of Loss (FNOL) call, which Genesys handles beautifully. The human agent gathers the initial facts, offers empathy, and reassures the distressed customer.

Once that call is over, the real work begins. Instead of that agent manually logging into five different systems, an AI agent takes the baton.

Here’s what it does, completely on its own:

Validates Policy Coverage: The AI agent instantly accesses the core policy system to confirm the customer's coverage is active and applies to the incident.

Verifies Information: It gets to work cross-referencing details from the call with external data, like pulling a police report or checking a vehicle damage database.

Checks for Compliance: It meticulously ensures every single action aligns with internal SOPs and strict regulatory rules.

Updates Core Systems: Finally, it logs all its findings, updates the claim status in the claims management system, and kicks off the next step, like assigning the case to a field adjuster.

This seamless handoff is the core of end-to-end automation. It gets rid of the soul-crushing "swivel chair" problem, where agents spend their day copying and pasting data. The result? Faster cycle times and far fewer human errors.

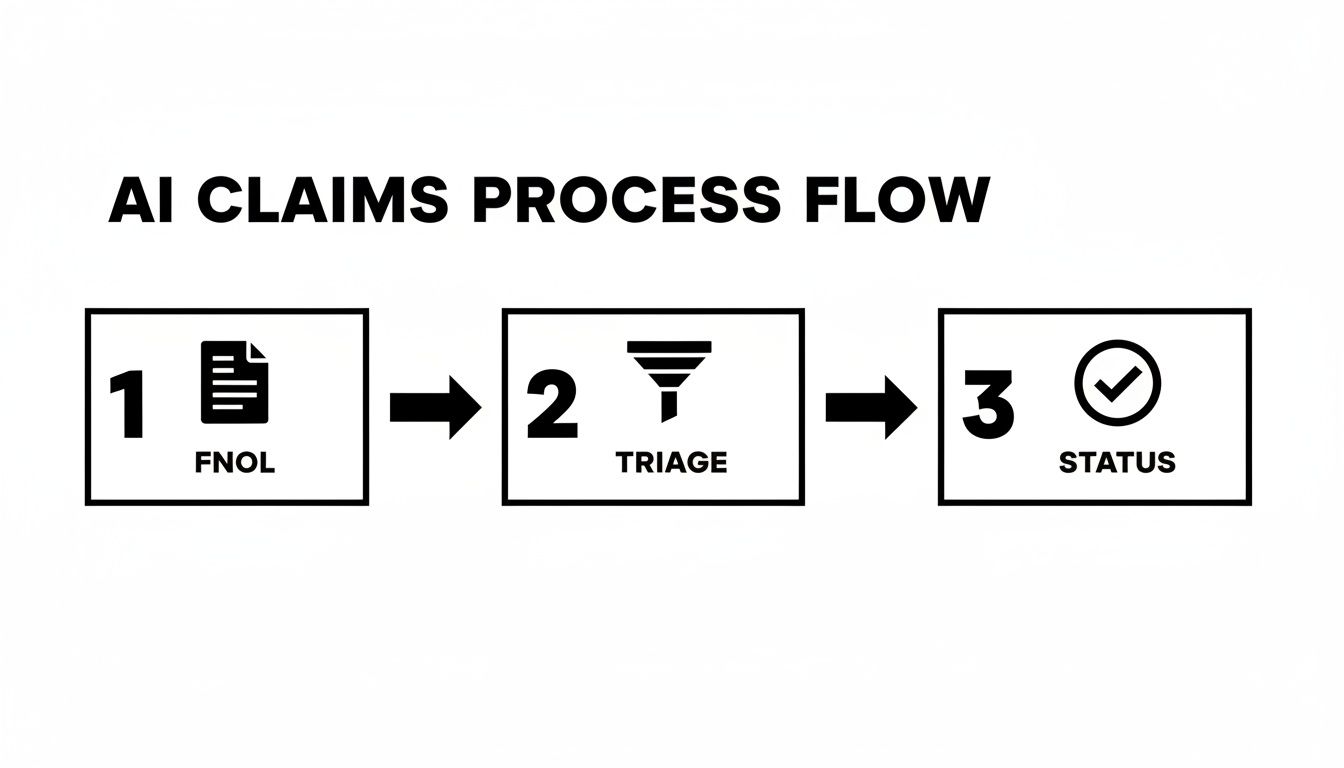

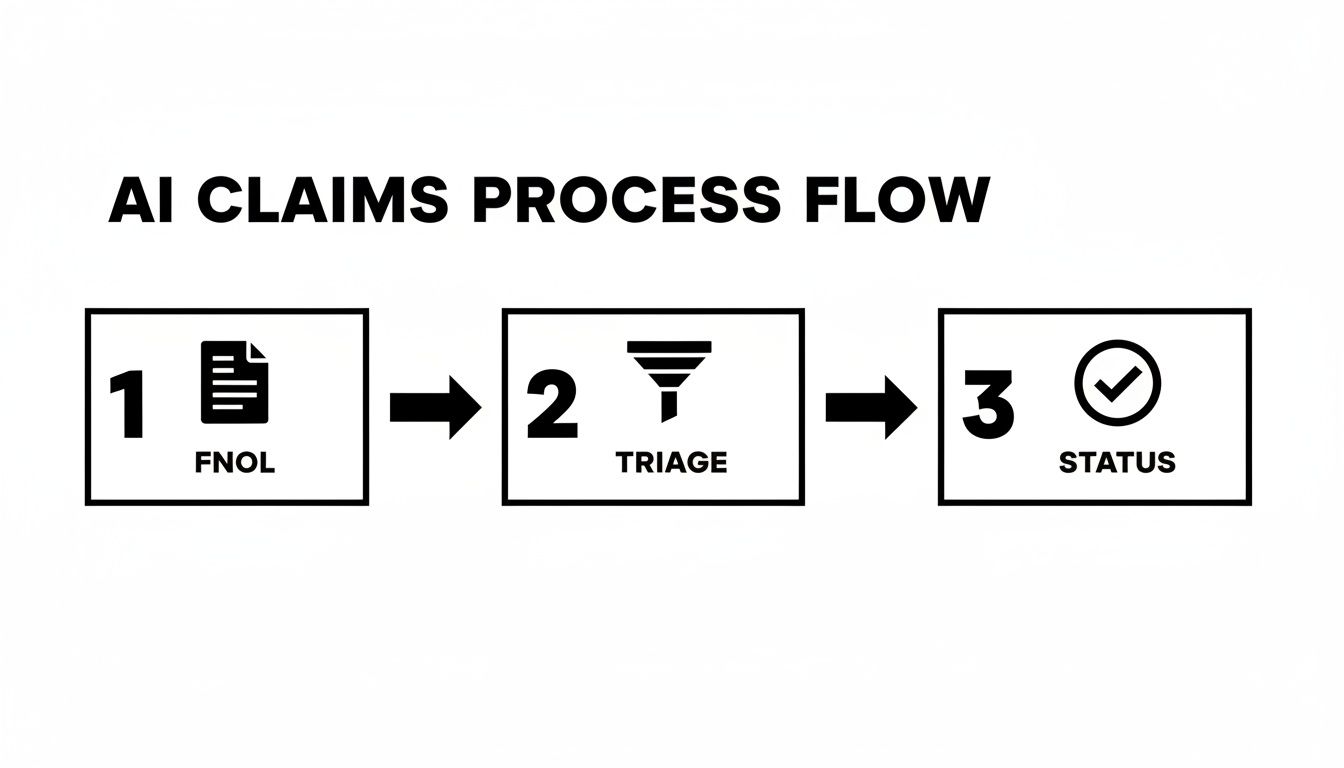

This flow chart gives a high-level view of how AI can manage those crucial first steps in a claims process.

You can see how a structured, automated process handles the key touchpoints, perfectly setting the stage for AI agents to take on the deeper, more complex work behind the scenes.

Designed for Regulated, High-Stakes Environments

This kind of deep automation is more than just a "nice-to-have" for the large, regulated companies that rely on Genesys. In fact, around 39% of Genesys customers are enterprises pulling in over $1 billion a year. For them, tight controls, audit trails, and compliance aren't optional.

For AI-native platforms like Nolana, this huge footprint of sophisticated users is a clear opportunity to augment their existing Genesys investment with compliant, autonomous automation.

The goal was never to replace your best people. It's about augmenting them. By automating all the repetitive, rules-based work, you free up your senior claims adjusters and service pros to focus on what they do best: making high-judgment calls and handling sensitive customer situations.

This approach is how insurance operations are truly being modernized. When you deploy AI agents to manage the complicated backend tasks, you see a dramatic drop in claims processing times and a real reduction in operational costs.

To see what this looks like in practice, check out our case study on transforming insurance claims with agentic AI.

When you combine Genesys for orchestrating customer communication with agentic AI for executing the work, you get a powerful, connected system for financial services. It bridges the gap between the customer-facing front office and the operational back office, creating an experience that's efficient for the business and far less frustrating for the customer.

To dig deeper into this idea, it's worth understanding the broader Agentic AI customer service transformation. This synergy allows institutions to handle much higher volumes with greater accuracy, all while staying on the right side of the demanding compliance standards that govern their industry.

A Strategic Guide to Implementing Genesys

Bringing a platform like Genesys into your organization is far more than a simple tech upgrade. It’s a fundamental shift in how your business operates, especially in the high-stakes world of financial services. A successful rollout demands a clear strategy—one that balances the platform's incredible potential with the non-negotiable realities of security, compliance, and getting your team on board. For leaders in tech and operations, the real job is to build a practical playbook that starts delivering a return on investment from day one.

The first move? Step away from the technology and build a rock-solid business case. This means connecting every single feature to a concrete business outcome. Don't just aim for "better customer service." Define what that actually looks like. Will you slash average handle time by 15%? Or maybe boost first contact resolution for complex insurance claims by 20%? These specific, measurable goals become your North Star, guiding every decision and proving the project's worth to the people holding the purse strings.

Navigating Migration and Change Management

Moving from an old, on-premise system to Genesys Cloud is a major project, no two ways about it. The "big bang" approach, where you flip a switch overnight, is almost always a recipe for chaos and disruption. Instead, a phased rollout has proven to be the smarter path.

You can start small. Pick a single, well-defined team—like a specific claims department or a banking support group—to run a pilot. This gives you a controlled environment to iron out the wrinkles, collect real feedback from the front lines, and build some early wins to create momentum.

A smooth migration really boils down to two things:

A Smart Data Strategy: You need a meticulous plan for moving historical customer data, call recordings, and performance reports. This isn't just about archiving; that data is gold for training your new AI models and maintaining a seamless audit trail for compliance and claims AI reviews.

Agent Training That Actually Works: Your agents are the ones who will make or break this implementation. Training can't just be about which buttons to click. It has to cover the "why." You need to show them how new tools, like AI-powered agent assistance, are there to make their jobs easier, not to replace them.

Adopting a new platform is as much a cultural change as it is a technological one. Strong change management, clear communication, and visible executive sponsorship are non-negotiable for getting buy-in from the frontline teams who will use Genesys every day.

Upholding Security and Compliance

For AI insurance companies and banks, security isn't just a feature on a checklist; it's the bedrock of your entire operation. Any implementation plan has to be built on a foundation of data privacy and regulatory adherence. That means running exhaustive security reviews and configuring the system to meet standards like GDPR, CCPA, and any other rules specific to your industry. Things like granular access controls, end-to-end encryption, and detailed audit logs must be set up from the very beginning to protect sensitive customer information.

The investment in platforms like Genesys, especially with embedded AI, is significant—but the results are speaking for themselves. During the first half of fiscal year 2025, deals worth over $1 million in annual contract value that included AI components grew more than 3x year-over-year. This surge shows that once regulated industries see the initial impact, they're eager to expand their deployments. You can explore the latest on Genesys AI adoption trends to see how quickly this is moving.

By focusing on a strategic, phased approach that puts clear metrics, effective change management, and uncompromising compliance first, financial institutions can avoid the common traps. This discipline is what turns a Genesys implementation from just another technology project into a genuine business transformation.

Measuring the True ROI of AI Automation

Putting a platform like Genesys to work is a major commitment. To really prove its worth, you have to look past the usual contact center metrics like Average Handle Time (AHT) or First Contact Resolution (FCR). Those are important, sure, but the real story for banks and insurance carriers is told through high-impact business outcomes—the kind that get the C-suite's attention.

We're talking about tangible financial results, not just small operational tweaks. This means building a business case that draws a straight line from AI automation to the company's financial health. The conversation needs to shift from "we're handling calls faster" to "we're directly boosting revenue and cutting down on risk."

KPIs That Matter to the C-Suite

To make a compelling case, you need to zero in on the key performance indicators (KPIs) that show a clear, measurable impact on the bottom line. These are the numbers that prove how Genesys, paired with smart AI, contributes to the organization's biggest financial goals.

Here are the metrics that really move the needle:

Reduced Claims Leakage: When AI automates validation and compliance checks, it drastically cuts down on overpayments and fraudulent claims. For a large carrier, even a 1-2% reduction in leakage can mean saving millions of dollars every single year.

Accelerated Policy Issuance: Automating the underwriting and onboarding grind means you can get policies into customers' hands faster. This doesn't just make for a better experience; it means you start collecting revenue sooner, directly fueling top-line growth.

Improved Customer Lifetime Value (CLV): A better customer experience, driven by smart AI customer care, keeps people around longer. By calculating the bump in CLV from these AI-powered interactions, you can show a direct link between customer happiness and long-term profit.

Stronger Compliance Audit Trails: Automated systems don't forget. They create perfect, auditable records for every single interaction and decision. This makes compliance audits far less painful and expensive, and it slashes the risk of costly regulatory fines—a huge win for any financial institution.

The ultimate measure of success isn't how many calls your AI deflects. It's how much you reduce claims leakage, how quickly you can recognize revenue, and how effectively you can prove compliance during an audit.

By focusing on these high-level metrics, you can show exactly how a strategic Genesys implementation delivers a powerful, quantifiable return. This is the kind of evidence that secures executive buy-in and justifies continued investment in automation. To see how this works in the real world, you can explore our insurance case studies and see the tangible results for yourself.

Answering Your Top Questions About Genesys

When financial services leaders look at a platform as critical as Genesys, the same questions always come up. It usually boils down to security, how it will play with their existing core systems, and what the implementation really looks like on the ground. Getting straight answers here is what separates a successful business case from a stalled one.

For any bank or AI insurance company, data protection is non-negotiable. So, how does Genesys Cloud handle it? It’s built on a secure AWS foundation and maintains rigorous compliance with global standards you’d expect, like SOC 2 Type II, GDPR, HIPAA, and PCI DSS. The platform gives you the tools you need to lock things down, from end-to-end data encryption to detailed audit logs that keep everything transparent.

How Does Genesys Connect with Our Core Systems?

This is a big one. You've got legacy systems—everyone does. Genesys was built with an API-first mindset, which is a fancy way of saying it's designed to connect to other software. It comes with ready-made integrations for giants like Salesforce and Guidewire. For your unique or older core systems, its open APIs are the bridge, making sure new AI-powered workflows can pull the data they need. This is the secret sauce for effective AI customer care and thorough claims AI reviews.

I'm always asked about the timeline. My advice is consistent: take it in phases. You can get a pilot program running for a single department in just three to six months. This gives you quick wins and critical insights before you commit to a full enterprise rollout, which typically takes nine to eighteen months.

A clear strategy is your best friend during the transition. Focus on high-impact business units first, and don't skimp on agent training. It's the fastest way to minimize disruption and start seeing a real return on your Genesys investment.

By pairing Genesys's powerful interaction management with the autonomous action of Nolana, financial institutions can automate incredibly complex operational workflows from start to finish. Discover how Nolana’s compliant AI agents can work with your existing systems to slash costs and speed up cycle times at the official Nolana website.

In the world of customer experience, Genesys stands out as a powerful cloud platform built to bring every customer interaction together. For businesses in demanding sectors like financial services, it offers a sophisticated suite of tools for AI customer care, intelligent omnichannel routing, and workforce engagement, all designed to deliver highly personalized and efficient service.

The New Standard for Customer Experience in Finance

Let's be honest: the days of siloed, reactive contact centers in finance are long gone. Today's customers expect every interaction to be seamless, secure, and incredibly personal, whether they're just checking an account balance, disputing a transaction, or filing a complex insurance claim. This shift in expectations has left many legacy systems in the dust, creating an urgent need for a completely new operational backbone for AI customer care.

This is precisely where a platform like Genesys comes into the picture. Think of it less as a piece of software and more as the central nervous system for modern banking and insurance operations. Its main job is to solve the massive challenge of unifying every customer touchpoint into one single, continuous journey.

The Problem with Disconnected Systems

So many traditional financial institutions are still wrestling with fragmented systems. We’ve all seen it: a customer starts a query on the mobile app, moves to a web chat, and finally has to call an agent. In a disconnected world, each of those steps forces the customer to start over, repeating information and growing more frustrated by the minute. It’s not just a bad experience; it’s a compliance risk waiting to happen.

Take insurance claims, for example. Information has to move perfectly from the first notice of loss all the way through verification and payout. Clunky, older systems create bottlenecks that slow everything down, delaying settlements and driving up operational costs for ai insurance companies.

The real problem is the disconnect between what customers expect and what outdated technology can deliver. People want an experience that’s as smooth as their favorite consumer apps, but too many financial workflows are still stuck in the past.

A New Infrastructure for Financial Operations

Genesys tackles this head-on by creating a single hub where every interaction is managed, from a simple chatbot question to a multi-stage insurance claim. It provides the solid foundation needed to not only meet modern customer expectations but also adhere to the industry's strict regulatory standards. To see just how much AI is changing the game, it's worth comparing the capabilities of AI voice agents versus traditional call centers.

This pivot to integrated platforms is a huge part of the larger financial services digital transformation, which is all about using technology to build more agile and customer-centric businesses. By centralizing interaction data, Genesys creates the perfect environment for intelligent automation. It makes sophisticated AI customer care and automated claims ai reviews not just a nice-to-have, but an essential part of growing the business, staying compliant, and keeping a competitive edge.

Inside the Genesys Cloud Platform

To really get what makes Genesys tick for modern finance, it helps to think of it as a central nervous system for a business. It doesn't just pass messages along; it intelligently connects every touchpoint—from the agent on the front lines to the critical back-office systems—into one cohesive operation.

Under the hood, the platform runs on a microservices-based, API-first architecture. That sounds a bit technical, but the idea is simple. Instead of being one massive, rigid application, Genesys Cloud is made up of many small, independent services that talk to each other through APIs (Application Programming Interfaces).

For financial services, this design is non-negotiable. A bank or insurer simply can’t afford system-wide failures or slow performance. With microservices, if one small component hits a snag, it doesn't bring the whole system down. This gives you the kind of reliability that ai insurance companies and banks absolutely depend on.

Built for Scalability and Seamless Integration

That API-first approach is also the secret to breaking down frustrating data silos. It’s what lets Genesys connect so cleanly with essential industry systems like Guidewire for insurance claims or Salesforce for CRM. This open connectivity unlocks genuine end-to-end process automation.

Let’s look at a practical example. A customer starts a claim using a chat widget on the website. Behind the scenes, Genesys uses its APIs to:

Pull policy details straight from Guidewire.

Confirm the customer's identity using information in Salesforce.

Send the conversation to the right claims specialist, armed with all that context.

This fluid exchange of data means agents aren't fumbling between different windows, and customers don't have to repeat their story. You get a single source of truth for every interaction, which is the bedrock for effective AI customer care.

The true power of an API-first platform lies in its flexibility. It allows a financial institution to adapt quickly, adding new communication channels or integrating new technologies without having to overhaul its entire infrastructure.

Core Capabilities of the Genesys Engine

While the architecture is the foundation, the platform’s real muscle comes from its core capabilities working together. These are the tools that run the day-to-day customer and employee experience, making Genesys far more than just a call center system. You can see how this works in our guide to deploying Cloud Genesys in regulated industries.

Three pillars really hold everything up:

Omnichannel Routing: This is all about consistency. Whether a customer calls, emails, chats, or sends a message on social media, the experience feels connected. Genesys routes every interaction to the best agent based on their skills, availability, and the customer’s past interactions.

Workforce Engagement Management (WEM): This is the agent-focused part of the equation. WEM tools offer performance dashboards, quality management, and smart scheduling. They give managers what they need to coach their teams and keep service levels high.

Advanced Analytics and Reporting: Every conversation, every click, every interaction creates data. Genesys provides powerful tools to track KPIs, spot trends in customer behavior, and perform deep-dive claims ai reviews to find opportunities for improvement.

These three components create a rich, data-driven ecosystem. This unified stream of information then feeds the platform’s more advanced AI tools, helping financial institutions shift from just reacting to customer needs to proactively anticipating them. The architecture isn't just about technology; it's about building a smarter, more connected organization.

Automating Insurance Claims and Customer Care with AI

Once you have a unified platform like Genesys in place, the real work begins: applying AI to solve the most stubborn and expensive problems financial institutions face. This is where you see the shift from simply reacting to customer needs to proactively and intelligently automating entire workflows for insurance claims and financial AI customer care.

These aren't far-off concepts; they are practical tools making a difference today. Predictive routing, voicebots, chatbots, and agent-assist tools are fundamentally changing how ai insurance companies and banks operate. They work together to handle the routine, predictable tasks, which frees up your expert human agents to manage the complex, high-empathy situations where they are needed most.

Transforming the Insurance Claims Journey

If you're looking for a workflow ripe for AI-driven improvement, the insurance claims process is a perfect candidate. It's traditionally a tangled mess of manual steps, endless paperwork, and frustrating delays that drive up costs and drive away customers. Genesys AI cuts through that complexity by injecting efficiency at every critical stage.

Let’s look at how this plays out in the real world:

Automated First Notice of Loss (FNOL): Instead of waiting for business hours, a customer can report a claim 24/7 through a voicebot or chatbot. The AI gathers the essential details, creates the initial claim file, and instantly gives the customer a claim number and a clear sense of what happens next—all without a single human touch.

Instant Status Updates: Forget making a customer call an agent just to ask, "What's the status of my claim?" A policyholder can now ask a bot that question and get an immediate, accurate answer pulled securely from the core claims system.

Intelligent Triage: AI gets smart about assigning work. It analyzes the initial claim details to gauge complexity. Simple, low-value claims can be fast-tracked for automated processing, while the tricky ones are immediately routed to senior adjusters who have the specific expertise to handle them.

This kind of automation makes the whole claims experience faster and far more transparent. For a deeper dive into this, check out our complete guide on insurance claims processing automation.

Elevating Banking Customer Care with AI

In banking, the focus for AI customer care usually boils down to three things: security, speed, and self-service. When it comes to their money, customers expect immediate answers and fast resolutions, and AI provides the tools to deliver that experience at scale.

Common applications include AI-powered fraud alerts, where a bot can proactively text or call a customer to verify a suspicious transaction in real time. For everyday banking, AI enables secure self-service for tasks like checking a balance, transferring funds, or disputing a charge, which takes a huge load off your live agents.

The adoption rate for these tools is staggering. For instance, in its second quarter of fiscal year 2026, the Genesys Cloud Agent Copilot generated over 17 million automated summaries in July 2025 alone. That’s a nearly 6x increase from the previous year. You can learn more about how enterprises are quickly operationalizing AI at scale.

A crucial, but often overlooked, application is what we call claims AI reviews. This is where AI analyzes call transcripts, chat logs, and even agent screen recordings to check for compliance with regulatory scripts, spot coaching opportunities, and identify emerging customer issues before they turn into widespread problems.

This proactive approach to quality assurance ensures consistency and helps you stay on the right side of strict financial regulations.

AI Transformation in Financial Services Workflows

To see the difference AI makes, it helps to compare the old way of doing things with the new. The table below illustrates the stark contrast between traditional manual workflows and those augmented by Genesys AI, especially in claims processing.

Workflow Step | Traditional Manual Process | Genesys AI-Automated Process |

|---|---|---|

Initial Customer Contact (FNOL) | Customer waits for an agent to become available during business hours to manually input claim details. | A 24/7 chatbot or voicebot instantly captures FNOL data and creates a claim file automatically. |

Claim Routing and Triage | A supervisor manually reviews each new claim and assigns it to an adjuster based on a best guess of their workload. | AI analyzes claim complexity and routes it to the best-skilled, available adjuster based on predictive algorithms. |

Status Inquiry | Customer calls the contact center, waits on hold, and an agent manually looks up the claim status in the core system. | Customer gets an instant, on-demand status update via a self-service bot on any channel (web, mobile, voice). |

Quality and Compliance Review | Managers manually listen to a small, random sample of calls each month to check for compliance and quality. | AI analyzes 100% of interactions, flagging specific moments for review and generating automated compliance reports. |

Looking at this comparison, it’s clear that integrating AI isn't just about making small improvements. It’s a fundamental redesign of how financial services get delivered, moving the needle on efficiency, customer satisfaction, and compliance all at the same time.

Unlocking End-to-End Automation with Agentic AI

The native AI inside the Genesys platform is fantastic at what it does—optimizing the interaction itself. Think smart routing, quick call summaries, and real-time guidance for agents. It's a game-changer for the contact center.

But what happens when the conversation ends? For complex workflows, like a multi-stage insurance claim or a mortgage application, the initial customer touchpoint is just the beginning. This is where we need to think beyond AI-assisted tasks and start talking about true end-to-end automation.

This is where integrating an agentic AI platform like Nolana with Genesys really shines. Here's a simple way to look at it: Genesys AI masters the conversation, while agentic AI masters the work that comes after. These autonomous AI agents pick up right where a human or Genesys bot leaves off, diving into the complex backend processes without needing a human to guide them.

From Conversation to Autonomous Execution

Let's walk through a real-world example: an auto insurance claim. It all starts with a First Notice of Loss (FNOL) call, which Genesys handles beautifully. The human agent gathers the initial facts, offers empathy, and reassures the distressed customer.

Once that call is over, the real work begins. Instead of that agent manually logging into five different systems, an AI agent takes the baton.

Here’s what it does, completely on its own:

Validates Policy Coverage: The AI agent instantly accesses the core policy system to confirm the customer's coverage is active and applies to the incident.

Verifies Information: It gets to work cross-referencing details from the call with external data, like pulling a police report or checking a vehicle damage database.

Checks for Compliance: It meticulously ensures every single action aligns with internal SOPs and strict regulatory rules.

Updates Core Systems: Finally, it logs all its findings, updates the claim status in the claims management system, and kicks off the next step, like assigning the case to a field adjuster.

This seamless handoff is the core of end-to-end automation. It gets rid of the soul-crushing "swivel chair" problem, where agents spend their day copying and pasting data. The result? Faster cycle times and far fewer human errors.

This flow chart gives a high-level view of how AI can manage those crucial first steps in a claims process.

You can see how a structured, automated process handles the key touchpoints, perfectly setting the stage for AI agents to take on the deeper, more complex work behind the scenes.

Designed for Regulated, High-Stakes Environments

This kind of deep automation is more than just a "nice-to-have" for the large, regulated companies that rely on Genesys. In fact, around 39% of Genesys customers are enterprises pulling in over $1 billion a year. For them, tight controls, audit trails, and compliance aren't optional.

For AI-native platforms like Nolana, this huge footprint of sophisticated users is a clear opportunity to augment their existing Genesys investment with compliant, autonomous automation.

The goal was never to replace your best people. It's about augmenting them. By automating all the repetitive, rules-based work, you free up your senior claims adjusters and service pros to focus on what they do best: making high-judgment calls and handling sensitive customer situations.

This approach is how insurance operations are truly being modernized. When you deploy AI agents to manage the complicated backend tasks, you see a dramatic drop in claims processing times and a real reduction in operational costs.

To see what this looks like in practice, check out our case study on transforming insurance claims with agentic AI.

When you combine Genesys for orchestrating customer communication with agentic AI for executing the work, you get a powerful, connected system for financial services. It bridges the gap between the customer-facing front office and the operational back office, creating an experience that's efficient for the business and far less frustrating for the customer.

To dig deeper into this idea, it's worth understanding the broader Agentic AI customer service transformation. This synergy allows institutions to handle much higher volumes with greater accuracy, all while staying on the right side of the demanding compliance standards that govern their industry.

A Strategic Guide to Implementing Genesys

Bringing a platform like Genesys into your organization is far more than a simple tech upgrade. It’s a fundamental shift in how your business operates, especially in the high-stakes world of financial services. A successful rollout demands a clear strategy—one that balances the platform's incredible potential with the non-negotiable realities of security, compliance, and getting your team on board. For leaders in tech and operations, the real job is to build a practical playbook that starts delivering a return on investment from day one.

The first move? Step away from the technology and build a rock-solid business case. This means connecting every single feature to a concrete business outcome. Don't just aim for "better customer service." Define what that actually looks like. Will you slash average handle time by 15%? Or maybe boost first contact resolution for complex insurance claims by 20%? These specific, measurable goals become your North Star, guiding every decision and proving the project's worth to the people holding the purse strings.

Navigating Migration and Change Management

Moving from an old, on-premise system to Genesys Cloud is a major project, no two ways about it. The "big bang" approach, where you flip a switch overnight, is almost always a recipe for chaos and disruption. Instead, a phased rollout has proven to be the smarter path.

You can start small. Pick a single, well-defined team—like a specific claims department or a banking support group—to run a pilot. This gives you a controlled environment to iron out the wrinkles, collect real feedback from the front lines, and build some early wins to create momentum.

A smooth migration really boils down to two things:

A Smart Data Strategy: You need a meticulous plan for moving historical customer data, call recordings, and performance reports. This isn't just about archiving; that data is gold for training your new AI models and maintaining a seamless audit trail for compliance and claims AI reviews.

Agent Training That Actually Works: Your agents are the ones who will make or break this implementation. Training can't just be about which buttons to click. It has to cover the "why." You need to show them how new tools, like AI-powered agent assistance, are there to make their jobs easier, not to replace them.

Adopting a new platform is as much a cultural change as it is a technological one. Strong change management, clear communication, and visible executive sponsorship are non-negotiable for getting buy-in from the frontline teams who will use Genesys every day.

Upholding Security and Compliance

For AI insurance companies and banks, security isn't just a feature on a checklist; it's the bedrock of your entire operation. Any implementation plan has to be built on a foundation of data privacy and regulatory adherence. That means running exhaustive security reviews and configuring the system to meet standards like GDPR, CCPA, and any other rules specific to your industry. Things like granular access controls, end-to-end encryption, and detailed audit logs must be set up from the very beginning to protect sensitive customer information.

The investment in platforms like Genesys, especially with embedded AI, is significant—but the results are speaking for themselves. During the first half of fiscal year 2025, deals worth over $1 million in annual contract value that included AI components grew more than 3x year-over-year. This surge shows that once regulated industries see the initial impact, they're eager to expand their deployments. You can explore the latest on Genesys AI adoption trends to see how quickly this is moving.

By focusing on a strategic, phased approach that puts clear metrics, effective change management, and uncompromising compliance first, financial institutions can avoid the common traps. This discipline is what turns a Genesys implementation from just another technology project into a genuine business transformation.

Measuring the True ROI of AI Automation

Putting a platform like Genesys to work is a major commitment. To really prove its worth, you have to look past the usual contact center metrics like Average Handle Time (AHT) or First Contact Resolution (FCR). Those are important, sure, but the real story for banks and insurance carriers is told through high-impact business outcomes—the kind that get the C-suite's attention.

We're talking about tangible financial results, not just small operational tweaks. This means building a business case that draws a straight line from AI automation to the company's financial health. The conversation needs to shift from "we're handling calls faster" to "we're directly boosting revenue and cutting down on risk."

KPIs That Matter to the C-Suite

To make a compelling case, you need to zero in on the key performance indicators (KPIs) that show a clear, measurable impact on the bottom line. These are the numbers that prove how Genesys, paired with smart AI, contributes to the organization's biggest financial goals.

Here are the metrics that really move the needle:

Reduced Claims Leakage: When AI automates validation and compliance checks, it drastically cuts down on overpayments and fraudulent claims. For a large carrier, even a 1-2% reduction in leakage can mean saving millions of dollars every single year.

Accelerated Policy Issuance: Automating the underwriting and onboarding grind means you can get policies into customers' hands faster. This doesn't just make for a better experience; it means you start collecting revenue sooner, directly fueling top-line growth.

Improved Customer Lifetime Value (CLV): A better customer experience, driven by smart AI customer care, keeps people around longer. By calculating the bump in CLV from these AI-powered interactions, you can show a direct link between customer happiness and long-term profit.

Stronger Compliance Audit Trails: Automated systems don't forget. They create perfect, auditable records for every single interaction and decision. This makes compliance audits far less painful and expensive, and it slashes the risk of costly regulatory fines—a huge win for any financial institution.

The ultimate measure of success isn't how many calls your AI deflects. It's how much you reduce claims leakage, how quickly you can recognize revenue, and how effectively you can prove compliance during an audit.

By focusing on these high-level metrics, you can show exactly how a strategic Genesys implementation delivers a powerful, quantifiable return. This is the kind of evidence that secures executive buy-in and justifies continued investment in automation. To see how this works in the real world, you can explore our insurance case studies and see the tangible results for yourself.

Answering Your Top Questions About Genesys

When financial services leaders look at a platform as critical as Genesys, the same questions always come up. It usually boils down to security, how it will play with their existing core systems, and what the implementation really looks like on the ground. Getting straight answers here is what separates a successful business case from a stalled one.

For any bank or AI insurance company, data protection is non-negotiable. So, how does Genesys Cloud handle it? It’s built on a secure AWS foundation and maintains rigorous compliance with global standards you’d expect, like SOC 2 Type II, GDPR, HIPAA, and PCI DSS. The platform gives you the tools you need to lock things down, from end-to-end data encryption to detailed audit logs that keep everything transparent.

How Does Genesys Connect with Our Core Systems?

This is a big one. You've got legacy systems—everyone does. Genesys was built with an API-first mindset, which is a fancy way of saying it's designed to connect to other software. It comes with ready-made integrations for giants like Salesforce and Guidewire. For your unique or older core systems, its open APIs are the bridge, making sure new AI-powered workflows can pull the data they need. This is the secret sauce for effective AI customer care and thorough claims AI reviews.

I'm always asked about the timeline. My advice is consistent: take it in phases. You can get a pilot program running for a single department in just three to six months. This gives you quick wins and critical insights before you commit to a full enterprise rollout, which typically takes nine to eighteen months.

A clear strategy is your best friend during the transition. Focus on high-impact business units first, and don't skimp on agent training. It's the fastest way to minimize disruption and start seeing a real return on your Genesys investment.

By pairing Genesys's powerful interaction management with the autonomous action of Nolana, financial institutions can automate incredibly complex operational workflows from start to finish. Discover how Nolana’s compliant AI agents can work with your existing systems to slash costs and speed up cycle times at the official Nolana website.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP