How to Build Rapport With Customers Using AI in Financial Services

How to Build Rapport With Customers Using AI in Financial Services

Learn how to build rapport with customers in banking and insurance. Discover proven AI strategies to personalize care and streamline claims for lasting loyalty.

In the world of financial services, building real rapport with customers now comes down to a smart blend of human empathy and AI efficiency. The idea is to use AI to take care of the routine, often complex, background tasks. This frees up your human agents to do what they do best: handle high-stakes, emotionally driven conversations that build genuine trust and lasting loyalty, especially in areas like automating insurance claims with AI.

The New Blueprint for Customer Rapport in Finance

Let's be honest, the old ways of building relationships in finance just don't cut it anymore. Customers today have high expectations; they want service that's proactive, personal, and completely seamless. Trying to deliver that consistently with purely manual processes is a recipe for failure. The modern blueprint demands a fundamental shift in strategy, particularly for customer care with AI for financial services.

Forward-thinking firms are turning to AI-native platforms to manage the intricate, compliance-heavy work. This isn't about replacing people—it's about empowering them. When you automate the repetitive stuff, your team can finally focus on the moments that truly matter. They can be fully present for those critical, empathetic interactions where a real connection is made.

Automating for Empathy in Insurance and Banking

Think about it from a practical standpoint. Picture an AI agent, trained on your company's own standard operating procedures (SOPs), handling the first steps of an insurance claim. It can instantly pull up policy details, gather all the required documents, and field common questions, all while talking directly to core systems like Guidewire or Salesforce. This is the future of how AI insurance companies operate.

This kind of speed and accuracy completely changes the customer's experience. Instead of being stuck on hold or having to repeat their story multiple times, they get a fast, smooth, and correct process. What could have been a stressful interaction becomes an opportunity to build trust right from the start.

The core idea is simple: let technology handle the transactional, and let humans manage the relational. When AI manages the tedious back-end work, your team can dedicate its full attention to providing exceptional AI customer care and resolving sensitive issues with a personal touch.

The financial upside here is massive. In banking and insurance, trust is everything. We know that repeat customers spend 67% more on average than new ones, yet so many businesses still pour resources into acquisition instead of retention—even when it's four times easier to sell to a client you already have.

Firms that get rapport right can slash customer churn by 25% and see their Net Promoter Scores jump by an average of 30 points. That’s not just a nice-to-have; it's a powerful competitive advantage.

The Strategic Role of AI in Customer Interactions

AI's role goes far beyond just checking off tasks. It's about creating a single, intelligent workflow that makes every single customer interaction better. To truly change the game, you have to understand just how profoundly AI transforms brands' connection with customers.

This guide will walk you through how AI agents can turn every touchpoint—from a standard KYC check to a complicated insurance claim—into a positive, loyalty-building moment. This synergy is a cornerstone of any effective financial services digital transformation strategy. By leaning into this partnership between humans and AI, both AI insurance companies and banks can significantly improve customer retention and drive real revenue growth.

Mastering Active Listening with AI-Powered Personalization

Real rapport isn't about following a script. It all starts with something much more fundamental: listening. For large financial institutions, though, "active listening" at scale has always felt like an impossible task. How can you genuinely understand thousands of individual customers when their information is siloed and your agents are jumping from one call to the next?

This is where AI becomes a game-changer. It’s no longer just a buzzword; it's a practical tool for forging better relationships. A modern AI agent can process immense volumes of customer data in real time, picking up on sentiment, intent, and the complete history of every interaction—whether that’s a ticket in ServiceNow or a call logged in a platform like Genesys.

The goal is to shift from reacting to customer issues to anticipating their needs. This proactive stance is what separates a standard interaction from a superior AI customer care experience that feels both personal and incredibly effective.

Turning Raw Data into Actionable Insight

Think about a customer calling your insurance company, clearly frustrated about a delayed claim. In a typical contact center, the agent only hears the frustration in that single call. An AI agent, on the other hand, sees the whole story. It can instantly pull up past call transcripts, email threads, and support tickets to understand why the customer is upset.

This unified view is where the magic happens. By connecting to your core systems, whether it’s Duck Creek or Guidewire, the AI stitches together fragmented data and transforms it into something your team can actually use.

Sentiment Analysis: The AI detects rising frustration or disappointment in a customer's tone or word choice, even across different channels.

Intent Recognition: It figures out the customer’s ultimate goal—not just what they’re saying, but what they need to achieve.

Historical Context: The AI brings up all previous interactions so the customer never has to repeat themselves.

This deep contextual understanding is the bedrock of effective claims AI reviews. The system isn't just processing a transaction; it's understanding the human on the other end of it.

By pulling together information from every touchpoint, AI essentially hands your team a 'cheat sheet' for demonstrating genuine understanding. This is active listening scaled across your entire organization, making every single interaction smarter and more empathetic.

A Real-World Insurance Scenario

Here’s a situation we see all the time with AI insurance companies: a policyholder named Jane submitted a claim for water damage. Her first few interactions were fine, but a processing delay is making her anxious.

AI Detection: An AI agent monitors Jane’s recent emails and a web chat transcript. It flags keywords like "disappointed," "taking too long," and "worried," automatically assigning a negative sentiment score to her case.

Proactive Flagging: Instead of waiting for Jane to call in angry, the system flags her file and escalates it to a specialized human agent.

Empathetic Scripting: The AI gives the human agent a complete summary and a suggested, empathetic opening: "Hi Jane, I see you've been waiting for an update on your claim, and I want to personally apologize for the delay. I've reviewed your file and am here to get you a clear answer right now."

In this example, the AI did more than just automate a task; it orchestrated an empathetic intervention that builds trust. The agent is empowered to solve the problem immediately, turning a potential complaint into a moment of exceptional service. To get a better handle on the technology that makes this possible, check out our guide on what is conversational AI.

The table below breaks down how these AI-assisted techniques directly improve upon traditional methods.

Manual vs AI-Assisted Rapport Building Techniques

Technique | Traditional Manual Approach | AI-Assisted (Nolana) Approach | Key Business Impact |

|---|---|---|---|

Personalization | Agent relies on manual CRM notes and memory during the call. | AI provides a real-time, 360-degree view of the customer's history and sentiment. | Increased Efficiency & Consistency: Every agent has the same deep context, reducing handle time and improving first-call resolution. |

Active Listening | Agent manually takes notes, trying to listen for key details while navigating systems. | AI transcribes the call, analyzes sentiment, and highlights key information for the agent. | Improved Customer Satisfaction: Customers feel heard and understood without having to repeat themselves, boosting CSAT scores. |

Empathy | Relies solely on the agent's soft skills and emotional intelligence at that moment. | AI offers real-time coaching and suggests empathetic phrases based on the customer's sentiment. | Reduced Agent Burnout & Churn: Agents feel more supported and confident, leading to better morale and performance. |

Compliance | Agent must remember all regulatory scripts and disclosures, risking human error. | AI automatically ensures compliance checks are performed and logs adherence for auditing. | Minimized Compliance Risk: Drastically reduces the risk of fines and legal issues by ensuring every interaction is compliant. |

By offloading the cognitive burden of data recall and compliance, AI frees up human agents to focus on what they do best: connecting with customers on a human level.

The Financial Impact of Listening First

In financial services, deep client connections are your currency. This approach directly impacts the bottom line. Research shows that 74% of consumers say trust is the foundation of their loyalty. Furthermore, an analysis of over one million sales calls revealed that top performers establish rapport within the first 40% of a conversation, leading to 22% higher close rates.

For contact center managers, this means using AI agents to prompt rapport-building questions—like "What's your biggest worry with this claim?"—to foster genuine empathy without overwhelming your team. By automating the listening process, you ensure every customer feels heard and valued from the very first interaction.

Weaving Empathy into Your Automated Workflows

Knowing a customer's history is the baseline. Showing you actually care is what builds real rapport. This gets tricky in highly regulated fields like insurance and banking, where every conversation has to be both efficient and auditable. The solution isn't to avoid automation but to design automated workflows that feel human, especially when customers are stressed—like during an insurance claim.

Modern AI customer care has moved far beyond rigid, one-size-fits-all scripts. You can now build AI agents that use conversational language modeled directly on your best human agents. This way, right from the first "hello," the interaction reflects your brand's voice and your commitment to service.

Designing Smart Escalation Paths

The real test of any automated system is how it deals with problems it can't—or shouldn't—solve on its own. A tense, emotionally charged customer conversation is the perfect example. A well-designed AI agent knows its limits. It's programmed to pick up on cues that signal distress, confusion, or flat-out anger.

When the system senses a conversation is getting too sensitive, it shouldn't just create a ticket and call it a day. It needs to trigger a seamless, intelligent handoff to a human specialist.

Context is King: The AI should package up a complete summary of the conversation—transcripts, sentiment analysis, everything—for the human expert.

Don't Make Them Repeat It: This handoff means the customer never has to re-tell their frustrating story, which is a massive friction point and a quick way to lose goodwill.

Ready to Help, Instantly: The human agent jumps in fully briefed and ready to offer a solution, not start from square one.

This kind of smart handoff turns a potential breaking point into a moment where you can actually build trust. The customer feels heard and taken care of, seeing a system that works for them, not against them. For AI insurance companies, this is a must-have for managing complex cases, a topic that comes up frequently in claims AI reviews.

The goal of automation isn't to eliminate human interaction. It's to make human interaction more meaningful. By handling the rote intake and escalating with full context, AI frees up your best people to provide the empathy and expertise where it matters most.

Maintaining Trust with Compliance Guardrails

In financial services, building rapport is a balancing act between empathy and security. Every personalized touchpoint has to be wrapped in strict compliance guardrails to keep customer trust. With regulations like SOC 2 and GDPR in play, this is non-negotiable.

An enterprise-grade AI platform is built for this reality. It ensures that as you're personalizing interactions, you're also creating a complete, auditable trail of every single action the AI agent takes.

This traceability is critical for a few reasons:

Demonstrating Compliance: It gives regulators concrete proof that your automated processes meet all the required standards.

Internal Auditing: It lets your own risk and compliance teams review workflows to make sure they align with internal policies.

Building Customer Confidence: It shows customers you're handling their sensitive data securely and responsibly.

Think about it: when an AI agent processes an initial insurance claim, it logs every piece of data collected and every step taken. If that claim is later flagged for a claims AI review, auditors can see a precise, time-stamped record of the entire automated process. That level of transparency is essential for operating at scale in a regulated industry.

In Practice: An Insurance Claims Scenario

Let’s walk through how this looks for a customer reporting a car accident.

Initial Intake: An AI agent kicks off the claim, asking simple, clear questions to gather the basics: policy number, date of the incident, a description of what happened. The tone is calm and reassuring.

Emotional Detection: As the customer describes the accident, their voice gets shaky. They mention being "really shaken up." The AI's sentiment analysis flags this emotional distress immediately.

Seamless Escalation: Instead of plowing ahead, the AI responds with empathy: "It sounds like that was a very stressful experience. I'm connecting you with one of our specialized claims advocates right now who can offer more personal support."

The Empowered Human Agent: A human agent gets the alert, along with the full transcript and a note on the customer's emotional state. They can then start the call with, "Hi Mark, this is Sarah. I see you've been in an accident, and I'm so sorry to hear that. I have all your initial details here, so you don't need to repeat anything. Let's talk about how we can help."

This flow combines the speed of automation with the irreplaceable value of human empathy. You end up with a supportive, efficient, and trustworthy experience. Mastering these processes is a core part of building effective systems, and you can learn more about the underlying technology in our guide to AI workflow automation tools. By embedding these principles, you create a system that doesn't just process tasks—it strengthens customer relationships.

Putting Your AI Rapport Strategy Into Action

Taking this from a whiteboard concept to a real-world system means carefully weaving AI into your existing enterprise architecture. A successful AI customer care implementation isn’t about flipping a switch overnight. It’s a phased rollout, connecting AI agents with your core platforms—think Salesforce, Genesys, or Guidewire—to create a single, unified workflow. This integration is what unlocks real operational efficiency and lets you build rapport at scale.

The best way to start? Pinpoint high-impact, high-volume use cases where you can get immediate wins. For many AI insurance companies, this often means automating insurance claims with AI at the initial stages or handling routine customer questions. By tackling these first, you prove the system's value quickly and build momentum for a wider rollout.

Training AI Agents on Your Unique Business DNA

An AI agent is only as good as the data it’s trained on. The first critical task is to train your AI on your company’s specific Standard Operating Procedures (SOPs). But more importantly, it needs to learn from the real actions your top-performing teams take every single day. We're not talking about generic industry knowledge here; this is about capturing the nuances of how your business operates.

By analyzing how your best agents navigate complex calls or resolve tricky claims, the AI learns what exceptional service actually looks like inside your organization. This process ensures the AI’s responses aren't just accurate but are perfectly aligned with your brand's voice and commitment to the customer. The result is an AI that feels like a natural extension of your team.

For organizations looking to get this right, partnering with specialists like an Artificial Intelligence Automation Agency can provide crucial expertise and support.

Building a True Human-AI Partnership

A smooth rollout is all about effective change management. It's vital to frame the AI not as a replacement for your people but as a powerful new collaborator. Leaders need to help their teams see AI as a tool that offloads the repetitive, data-heavy work, freeing them up to focus on the high-value, empathetic conversations that only a human can deliver.

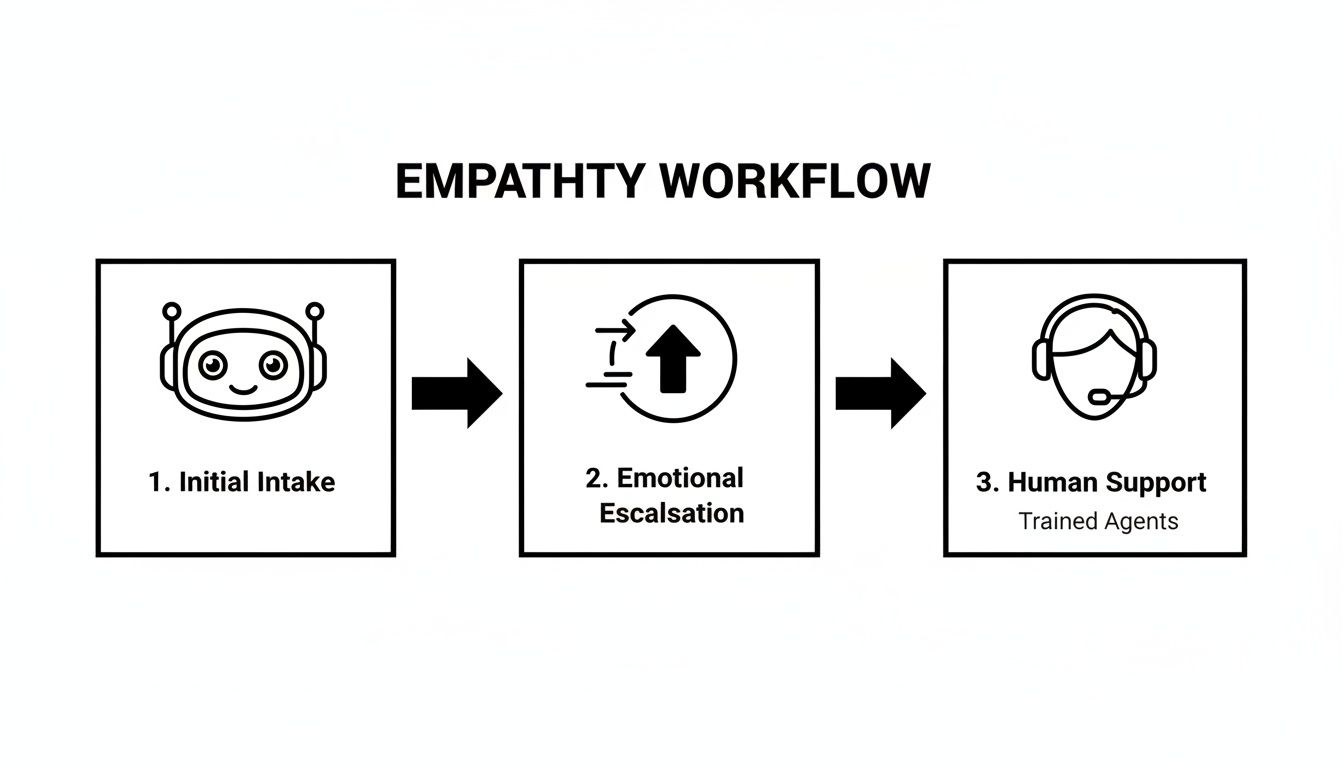

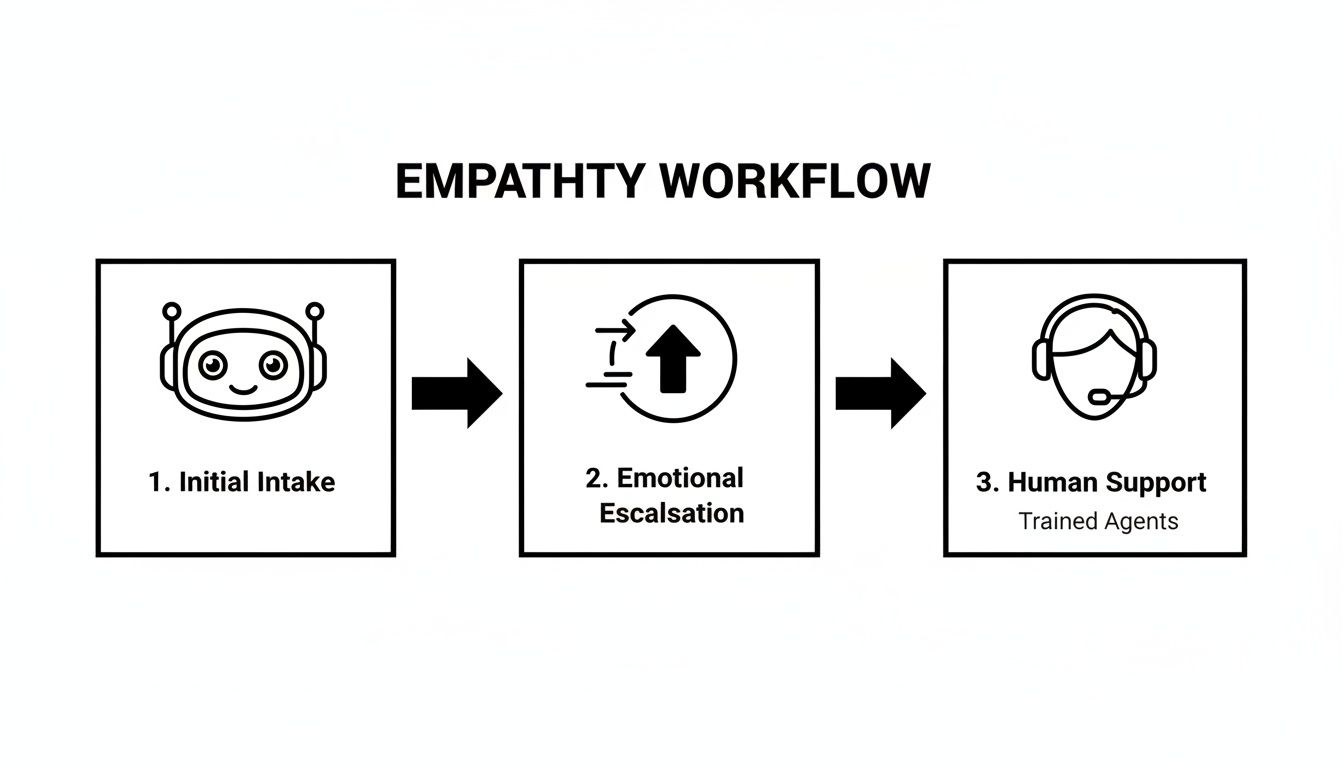

To make this partnership work, you can design specific workflows that highlight the synergy between your human and AI agents. This empathy workflow is a great example of how to handle sensitive customer interactions.

This flow shows how AI can manage the initial contact efficiently but also has the intelligence to escalate emotionally charged situations to a human agent, providing them with the full context.

This kind of structured approach ensures that automation elevates the customer experience instead of diminishing it. By defining clear roles, you create a powerful, unified team where technology and human expertise work in tandem to build lasting customer relationships.

The ultimate goal is a seamless blend of automation and human touch. AI handles the procedural work with speed and accuracy, while your team provides the critical thinking and emotional intelligence that turn a good experience into a great one.

As you map out your implementation, think bigger about where automation can make a difference. Our detailed guide on AI agent use cases offers valuable insights into applying these tools across different functions in financial services. This will help you prioritize the most impactful initiatives and ensure your journey toward building better customer rapport is both successful and sustainable.

Measuring the ROI of AI-Driven Rapport

Rolling out an AI-driven rapport strategy isn’t a one-and-done project. It’s a genuine commitment to better customer relationships. But to get the budget and keep executives bought in, you have to prove it's working—and that means moving past vanity metrics to measure what actually moves the needle.

For leaders in financial services, the only way to justify the investment is to tie your AI customer care initiatives directly to tangible business outcomes. Success isn't about counting how many chats you've automated. It’s found in stronger customer loyalty, faster operations, and real bottom-line growth. The right AI platform gives you this visibility with real-time dashboards and detailed audit trails, showing you exactly how you're tracking against the KPIs that matter in banking and insurance.

Key Metrics for AI-Powered Rapport

To get a true picture of your return on investment, you need to track KPIs that reflect both customer satisfaction and operational efficiency. These metrics give you a complete view of how automating insurance claims with AI really impacts the business.

Customer Lifetime Value (LTV): This is the ultimate yardstick for a strong relationship. When AI helps resolve issues faster and with a personal touch, customers stick around, buy more services, and ultimately generate more revenue over their lifetime.

Net Promoter Score (NPS): Every AI-driven interaction leaves an impression. Tracking your NPS before and after implementation will show you exactly how improvements in speed, accuracy, and empathy—especially in critical moments like claims AI reviews—turn customers into advocates for your brand.

Customer Churn Rate: Seeing your churn rate drop is one of the clearest signs that your rapport-building efforts are paying off. When customers feel like your automated systems actually understand them, they have fewer reasons to shop around for a new provider.

Claims Cycle Times: For any AI insurance company, this is a massive operational lever. Slashing the time from the first notice of loss to settlement doesn't just cut your internal costs; it dramatically improves the policyholder's experience during what is often a very stressful time.

Building rapport with customers through AI isn't just a "nice-to-have" initiative; it's a strategic move with a clear financial return. By tracking metrics like LTV and claims cycle times, you can draw a straight line from a better customer experience to a healthier bottom line.

Creating a Data-Driven Feedback Loop

The data flowing from your AI platform is more than just a report card; think of it as a roadmap for continuous improvement. The best systems provide the visibility you need to create a powerful feedback loop, allowing you to fine-tune your strategy based on what's actually happening on the front lines.

This cycle of constant optimization is where the top financial institutions are gaining a real competitive advantage. It helps transform customer care with AI for financial services from a cost center into a dynamic engine for growth and loyalty.

Using Data to Refine AI and Human Performance

The performance data from your AI gives you incredible insight into both your automated systems and your human agents.

Refining AI Agent Scripts: Start by analyzing customer satisfaction scores tied to specific automated conversations. If you see a particular script or workflow consistently leading to low scores or escalations, you've found a friction point. You can then quickly dive in and adjust the AI's language or logic.

Identifying Training Opportunities: The data might show that handoffs from the AI to a human agent are clunky or inefficient. This is a classic signal that your team might need better training on how to seamlessly pick up the conversation where the AI left off, creating a single, unified experience.

Optimizing Workflow Efficiency: Detailed audit trails can expose hidden bottlenecks you never knew you had. For instance, you might find that a certain compliance check during the claims process is adding unnecessary delays, giving you an opportunity to re-engineer that step for greater speed.

The financial upside of a well-nurtured customer base is huge. We all know retention is more profitable than acquisition; repeat customers can deliver 67% higher spending. Yet, so many firms remain fixated on chasing new leads instead of nurturing their loyal clients. This is a massive missed opportunity, especially when we know customers are looking for proactive support and personalized service.

For compliance-heavy workflows, Nolana's detailed audit trails can reduce costs by 20-30% while simultaneously improving experiences. This leads directly to more effective loyalty programs that can increase LTV by up to 30%. As you think about your own strategies, you can explore more ideas on building rapport with customers on Salesforce.com.

By taking a data-first approach, you can ensure your strategy for how to build rapport with customers is always evolving, adapting, and delivering exceptional value—both for your clients and your business.

Frequently Asked Questions About AI in Customer Care

When you're thinking about bringing AI into your customer interactions, a lot of questions come up. It's only natural. For leaders in financial services, moving from the idea of AI to actually putting it to work involves some real strategic and operational hurdles, especially in a heavily regulated world like banking or insurance. Let's tackle some of the most common questions we hear from people on the ground.

How Can AI Truly Automate Complex Insurance Claims?

It's easy to think of AI as just a simple chatbot, but its real power in insurance goes so much deeper. A well-designed AI agent can handle the entire front end of a claim. It starts the conversation, gathers all the essential details from the policyholder, instantly checks policy information in your core systems—like Guidewire or Duck Creek—and even collects the necessary documents.

But here’s where it gets really valuable. The AI doesn't just collect data; it analyzes it. It can spot missing information, flag potential issues, and even make initial liability suggestions based on the rules and historical patterns you've defined. For the straightforward, clear-cut claims, the AI can see them through from start to finish. This is how automating insurance claims with AI frees up your experienced adjusters to put their skills where they're needed most: on the complex, high-stakes cases that demand a human touch.

The real game-changer with claims AI reviews isn't just speed; it's about letting the technology handle the high-volume, repetitive tasks with flawless accuracy. Your team gets to focus their expertise on the moments that truly define the customer's experience.

Will AI Replace Our Customer Service Team?

This is probably the number one concern we hear, but the goal isn't replacement—it's collaboration. Think of AI as a tool to empower your team, not erase it. AI is perfectly suited to handle the routine, process-heavy tasks that can bog down your best people and lead to burnout.

By letting AI manage the simple inquiries and data gathering, you free up your human agents to do what they do best: build relationships, solve thorny problems, and navigate those sensitive customer conversations where empathy is everything. The AI becomes a co-pilot, feeding your team the right information at the right time and making them far more effective. This human-AI partnership creates a better, more supportive environment for your employees and a much smoother experience for your customers.

How Do We Ensure AI Interactions Remain Secure and Compliant?

For AI insurance companies and banks, security and compliance aren't just a feature; they're the foundation of trust. Any enterprise-grade AI platform worth its salt is built with this in mind from day one.

Every single action the AI agent takes is logged and tracked, creating a permanent, unchangeable audit trail. This is non-negotiable for meeting strict standards like SOC 2 and GDPR. These AI systems operate within carefully defined "guardrails" that you set based on your own internal policies. You have complete control over what the AI can and can't do, ensuring it only touches the data it absolutely needs. This built-in accountability doesn't just keep auditors happy; it shows your customers you're serious about protecting their information.

What Is the Real Impact on Customer Rapport?

The impact can be massive, and you can actually measure it. When you automate the routine parts of the process, you remove the most common sources of customer frustration. No more long hold times, no more repeating the same information to three different people. Customers get their answers faster and more accurately, which is the bedrock of a good experience.

This newfound efficiency also gives your human agents the breathing room to focus on genuine connection. When a customer does need to speak with a person, that agent comes into the conversation fully briefed and ready to offer thoughtful, personalized help. The end result is a customer journey with far less friction and a lot more satisfaction, which is exactly how you build lasting loyalty.

You can dive deeper into this topic in our complete guide to AI customer care, where we break down how intelligent automation can truly strengthen customer relationships.

Ready to see how AI can transform your high-stakes operations? Nolana deploys compliant AI agents that automate complex workflows in claims, case management, and customer service. Learn how our AI-native operating system can cut costs, reduce cycle times, and build lasting customer rapport by visiting https://nolana.com.

In the world of financial services, building real rapport with customers now comes down to a smart blend of human empathy and AI efficiency. The idea is to use AI to take care of the routine, often complex, background tasks. This frees up your human agents to do what they do best: handle high-stakes, emotionally driven conversations that build genuine trust and lasting loyalty, especially in areas like automating insurance claims with AI.

The New Blueprint for Customer Rapport in Finance

Let's be honest, the old ways of building relationships in finance just don't cut it anymore. Customers today have high expectations; they want service that's proactive, personal, and completely seamless. Trying to deliver that consistently with purely manual processes is a recipe for failure. The modern blueprint demands a fundamental shift in strategy, particularly for customer care with AI for financial services.

Forward-thinking firms are turning to AI-native platforms to manage the intricate, compliance-heavy work. This isn't about replacing people—it's about empowering them. When you automate the repetitive stuff, your team can finally focus on the moments that truly matter. They can be fully present for those critical, empathetic interactions where a real connection is made.

Automating for Empathy in Insurance and Banking

Think about it from a practical standpoint. Picture an AI agent, trained on your company's own standard operating procedures (SOPs), handling the first steps of an insurance claim. It can instantly pull up policy details, gather all the required documents, and field common questions, all while talking directly to core systems like Guidewire or Salesforce. This is the future of how AI insurance companies operate.

This kind of speed and accuracy completely changes the customer's experience. Instead of being stuck on hold or having to repeat their story multiple times, they get a fast, smooth, and correct process. What could have been a stressful interaction becomes an opportunity to build trust right from the start.

The core idea is simple: let technology handle the transactional, and let humans manage the relational. When AI manages the tedious back-end work, your team can dedicate its full attention to providing exceptional AI customer care and resolving sensitive issues with a personal touch.

The financial upside here is massive. In banking and insurance, trust is everything. We know that repeat customers spend 67% more on average than new ones, yet so many businesses still pour resources into acquisition instead of retention—even when it's four times easier to sell to a client you already have.

Firms that get rapport right can slash customer churn by 25% and see their Net Promoter Scores jump by an average of 30 points. That’s not just a nice-to-have; it's a powerful competitive advantage.

The Strategic Role of AI in Customer Interactions

AI's role goes far beyond just checking off tasks. It's about creating a single, intelligent workflow that makes every single customer interaction better. To truly change the game, you have to understand just how profoundly AI transforms brands' connection with customers.

This guide will walk you through how AI agents can turn every touchpoint—from a standard KYC check to a complicated insurance claim—into a positive, loyalty-building moment. This synergy is a cornerstone of any effective financial services digital transformation strategy. By leaning into this partnership between humans and AI, both AI insurance companies and banks can significantly improve customer retention and drive real revenue growth.

Mastering Active Listening with AI-Powered Personalization

Real rapport isn't about following a script. It all starts with something much more fundamental: listening. For large financial institutions, though, "active listening" at scale has always felt like an impossible task. How can you genuinely understand thousands of individual customers when their information is siloed and your agents are jumping from one call to the next?

This is where AI becomes a game-changer. It’s no longer just a buzzword; it's a practical tool for forging better relationships. A modern AI agent can process immense volumes of customer data in real time, picking up on sentiment, intent, and the complete history of every interaction—whether that’s a ticket in ServiceNow or a call logged in a platform like Genesys.

The goal is to shift from reacting to customer issues to anticipating their needs. This proactive stance is what separates a standard interaction from a superior AI customer care experience that feels both personal and incredibly effective.

Turning Raw Data into Actionable Insight

Think about a customer calling your insurance company, clearly frustrated about a delayed claim. In a typical contact center, the agent only hears the frustration in that single call. An AI agent, on the other hand, sees the whole story. It can instantly pull up past call transcripts, email threads, and support tickets to understand why the customer is upset.

This unified view is where the magic happens. By connecting to your core systems, whether it’s Duck Creek or Guidewire, the AI stitches together fragmented data and transforms it into something your team can actually use.

Sentiment Analysis: The AI detects rising frustration or disappointment in a customer's tone or word choice, even across different channels.

Intent Recognition: It figures out the customer’s ultimate goal—not just what they’re saying, but what they need to achieve.

Historical Context: The AI brings up all previous interactions so the customer never has to repeat themselves.

This deep contextual understanding is the bedrock of effective claims AI reviews. The system isn't just processing a transaction; it's understanding the human on the other end of it.

By pulling together information from every touchpoint, AI essentially hands your team a 'cheat sheet' for demonstrating genuine understanding. This is active listening scaled across your entire organization, making every single interaction smarter and more empathetic.

A Real-World Insurance Scenario

Here’s a situation we see all the time with AI insurance companies: a policyholder named Jane submitted a claim for water damage. Her first few interactions were fine, but a processing delay is making her anxious.

AI Detection: An AI agent monitors Jane’s recent emails and a web chat transcript. It flags keywords like "disappointed," "taking too long," and "worried," automatically assigning a negative sentiment score to her case.

Proactive Flagging: Instead of waiting for Jane to call in angry, the system flags her file and escalates it to a specialized human agent.

Empathetic Scripting: The AI gives the human agent a complete summary and a suggested, empathetic opening: "Hi Jane, I see you've been waiting for an update on your claim, and I want to personally apologize for the delay. I've reviewed your file and am here to get you a clear answer right now."

In this example, the AI did more than just automate a task; it orchestrated an empathetic intervention that builds trust. The agent is empowered to solve the problem immediately, turning a potential complaint into a moment of exceptional service. To get a better handle on the technology that makes this possible, check out our guide on what is conversational AI.

The table below breaks down how these AI-assisted techniques directly improve upon traditional methods.

Manual vs AI-Assisted Rapport Building Techniques

Technique | Traditional Manual Approach | AI-Assisted (Nolana) Approach | Key Business Impact |

|---|---|---|---|

Personalization | Agent relies on manual CRM notes and memory during the call. | AI provides a real-time, 360-degree view of the customer's history and sentiment. | Increased Efficiency & Consistency: Every agent has the same deep context, reducing handle time and improving first-call resolution. |

Active Listening | Agent manually takes notes, trying to listen for key details while navigating systems. | AI transcribes the call, analyzes sentiment, and highlights key information for the agent. | Improved Customer Satisfaction: Customers feel heard and understood without having to repeat themselves, boosting CSAT scores. |

Empathy | Relies solely on the agent's soft skills and emotional intelligence at that moment. | AI offers real-time coaching and suggests empathetic phrases based on the customer's sentiment. | Reduced Agent Burnout & Churn: Agents feel more supported and confident, leading to better morale and performance. |

Compliance | Agent must remember all regulatory scripts and disclosures, risking human error. | AI automatically ensures compliance checks are performed and logs adherence for auditing. | Minimized Compliance Risk: Drastically reduces the risk of fines and legal issues by ensuring every interaction is compliant. |

By offloading the cognitive burden of data recall and compliance, AI frees up human agents to focus on what they do best: connecting with customers on a human level.

The Financial Impact of Listening First

In financial services, deep client connections are your currency. This approach directly impacts the bottom line. Research shows that 74% of consumers say trust is the foundation of their loyalty. Furthermore, an analysis of over one million sales calls revealed that top performers establish rapport within the first 40% of a conversation, leading to 22% higher close rates.

For contact center managers, this means using AI agents to prompt rapport-building questions—like "What's your biggest worry with this claim?"—to foster genuine empathy without overwhelming your team. By automating the listening process, you ensure every customer feels heard and valued from the very first interaction.

Weaving Empathy into Your Automated Workflows

Knowing a customer's history is the baseline. Showing you actually care is what builds real rapport. This gets tricky in highly regulated fields like insurance and banking, where every conversation has to be both efficient and auditable. The solution isn't to avoid automation but to design automated workflows that feel human, especially when customers are stressed—like during an insurance claim.

Modern AI customer care has moved far beyond rigid, one-size-fits-all scripts. You can now build AI agents that use conversational language modeled directly on your best human agents. This way, right from the first "hello," the interaction reflects your brand's voice and your commitment to service.

Designing Smart Escalation Paths

The real test of any automated system is how it deals with problems it can't—or shouldn't—solve on its own. A tense, emotionally charged customer conversation is the perfect example. A well-designed AI agent knows its limits. It's programmed to pick up on cues that signal distress, confusion, or flat-out anger.

When the system senses a conversation is getting too sensitive, it shouldn't just create a ticket and call it a day. It needs to trigger a seamless, intelligent handoff to a human specialist.

Context is King: The AI should package up a complete summary of the conversation—transcripts, sentiment analysis, everything—for the human expert.

Don't Make Them Repeat It: This handoff means the customer never has to re-tell their frustrating story, which is a massive friction point and a quick way to lose goodwill.

Ready to Help, Instantly: The human agent jumps in fully briefed and ready to offer a solution, not start from square one.

This kind of smart handoff turns a potential breaking point into a moment where you can actually build trust. The customer feels heard and taken care of, seeing a system that works for them, not against them. For AI insurance companies, this is a must-have for managing complex cases, a topic that comes up frequently in claims AI reviews.

The goal of automation isn't to eliminate human interaction. It's to make human interaction more meaningful. By handling the rote intake and escalating with full context, AI frees up your best people to provide the empathy and expertise where it matters most.

Maintaining Trust with Compliance Guardrails

In financial services, building rapport is a balancing act between empathy and security. Every personalized touchpoint has to be wrapped in strict compliance guardrails to keep customer trust. With regulations like SOC 2 and GDPR in play, this is non-negotiable.

An enterprise-grade AI platform is built for this reality. It ensures that as you're personalizing interactions, you're also creating a complete, auditable trail of every single action the AI agent takes.

This traceability is critical for a few reasons:

Demonstrating Compliance: It gives regulators concrete proof that your automated processes meet all the required standards.

Internal Auditing: It lets your own risk and compliance teams review workflows to make sure they align with internal policies.

Building Customer Confidence: It shows customers you're handling their sensitive data securely and responsibly.

Think about it: when an AI agent processes an initial insurance claim, it logs every piece of data collected and every step taken. If that claim is later flagged for a claims AI review, auditors can see a precise, time-stamped record of the entire automated process. That level of transparency is essential for operating at scale in a regulated industry.

In Practice: An Insurance Claims Scenario

Let’s walk through how this looks for a customer reporting a car accident.

Initial Intake: An AI agent kicks off the claim, asking simple, clear questions to gather the basics: policy number, date of the incident, a description of what happened. The tone is calm and reassuring.

Emotional Detection: As the customer describes the accident, their voice gets shaky. They mention being "really shaken up." The AI's sentiment analysis flags this emotional distress immediately.

Seamless Escalation: Instead of plowing ahead, the AI responds with empathy: "It sounds like that was a very stressful experience. I'm connecting you with one of our specialized claims advocates right now who can offer more personal support."

The Empowered Human Agent: A human agent gets the alert, along with the full transcript and a note on the customer's emotional state. They can then start the call with, "Hi Mark, this is Sarah. I see you've been in an accident, and I'm so sorry to hear that. I have all your initial details here, so you don't need to repeat anything. Let's talk about how we can help."

This flow combines the speed of automation with the irreplaceable value of human empathy. You end up with a supportive, efficient, and trustworthy experience. Mastering these processes is a core part of building effective systems, and you can learn more about the underlying technology in our guide to AI workflow automation tools. By embedding these principles, you create a system that doesn't just process tasks—it strengthens customer relationships.

Putting Your AI Rapport Strategy Into Action

Taking this from a whiteboard concept to a real-world system means carefully weaving AI into your existing enterprise architecture. A successful AI customer care implementation isn’t about flipping a switch overnight. It’s a phased rollout, connecting AI agents with your core platforms—think Salesforce, Genesys, or Guidewire—to create a single, unified workflow. This integration is what unlocks real operational efficiency and lets you build rapport at scale.

The best way to start? Pinpoint high-impact, high-volume use cases where you can get immediate wins. For many AI insurance companies, this often means automating insurance claims with AI at the initial stages or handling routine customer questions. By tackling these first, you prove the system's value quickly and build momentum for a wider rollout.

Training AI Agents on Your Unique Business DNA

An AI agent is only as good as the data it’s trained on. The first critical task is to train your AI on your company’s specific Standard Operating Procedures (SOPs). But more importantly, it needs to learn from the real actions your top-performing teams take every single day. We're not talking about generic industry knowledge here; this is about capturing the nuances of how your business operates.

By analyzing how your best agents navigate complex calls or resolve tricky claims, the AI learns what exceptional service actually looks like inside your organization. This process ensures the AI’s responses aren't just accurate but are perfectly aligned with your brand's voice and commitment to the customer. The result is an AI that feels like a natural extension of your team.

For organizations looking to get this right, partnering with specialists like an Artificial Intelligence Automation Agency can provide crucial expertise and support.

Building a True Human-AI Partnership

A smooth rollout is all about effective change management. It's vital to frame the AI not as a replacement for your people but as a powerful new collaborator. Leaders need to help their teams see AI as a tool that offloads the repetitive, data-heavy work, freeing them up to focus on the high-value, empathetic conversations that only a human can deliver.

To make this partnership work, you can design specific workflows that highlight the synergy between your human and AI agents. This empathy workflow is a great example of how to handle sensitive customer interactions.

This flow shows how AI can manage the initial contact efficiently but also has the intelligence to escalate emotionally charged situations to a human agent, providing them with the full context.

This kind of structured approach ensures that automation elevates the customer experience instead of diminishing it. By defining clear roles, you create a powerful, unified team where technology and human expertise work in tandem to build lasting customer relationships.

The ultimate goal is a seamless blend of automation and human touch. AI handles the procedural work with speed and accuracy, while your team provides the critical thinking and emotional intelligence that turn a good experience into a great one.

As you map out your implementation, think bigger about where automation can make a difference. Our detailed guide on AI agent use cases offers valuable insights into applying these tools across different functions in financial services. This will help you prioritize the most impactful initiatives and ensure your journey toward building better customer rapport is both successful and sustainable.

Measuring the ROI of AI-Driven Rapport

Rolling out an AI-driven rapport strategy isn’t a one-and-done project. It’s a genuine commitment to better customer relationships. But to get the budget and keep executives bought in, you have to prove it's working—and that means moving past vanity metrics to measure what actually moves the needle.

For leaders in financial services, the only way to justify the investment is to tie your AI customer care initiatives directly to tangible business outcomes. Success isn't about counting how many chats you've automated. It’s found in stronger customer loyalty, faster operations, and real bottom-line growth. The right AI platform gives you this visibility with real-time dashboards and detailed audit trails, showing you exactly how you're tracking against the KPIs that matter in banking and insurance.

Key Metrics for AI-Powered Rapport

To get a true picture of your return on investment, you need to track KPIs that reflect both customer satisfaction and operational efficiency. These metrics give you a complete view of how automating insurance claims with AI really impacts the business.

Customer Lifetime Value (LTV): This is the ultimate yardstick for a strong relationship. When AI helps resolve issues faster and with a personal touch, customers stick around, buy more services, and ultimately generate more revenue over their lifetime.

Net Promoter Score (NPS): Every AI-driven interaction leaves an impression. Tracking your NPS before and after implementation will show you exactly how improvements in speed, accuracy, and empathy—especially in critical moments like claims AI reviews—turn customers into advocates for your brand.

Customer Churn Rate: Seeing your churn rate drop is one of the clearest signs that your rapport-building efforts are paying off. When customers feel like your automated systems actually understand them, they have fewer reasons to shop around for a new provider.

Claims Cycle Times: For any AI insurance company, this is a massive operational lever. Slashing the time from the first notice of loss to settlement doesn't just cut your internal costs; it dramatically improves the policyholder's experience during what is often a very stressful time.

Building rapport with customers through AI isn't just a "nice-to-have" initiative; it's a strategic move with a clear financial return. By tracking metrics like LTV and claims cycle times, you can draw a straight line from a better customer experience to a healthier bottom line.

Creating a Data-Driven Feedback Loop

The data flowing from your AI platform is more than just a report card; think of it as a roadmap for continuous improvement. The best systems provide the visibility you need to create a powerful feedback loop, allowing you to fine-tune your strategy based on what's actually happening on the front lines.

This cycle of constant optimization is where the top financial institutions are gaining a real competitive advantage. It helps transform customer care with AI for financial services from a cost center into a dynamic engine for growth and loyalty.

Using Data to Refine AI and Human Performance

The performance data from your AI gives you incredible insight into both your automated systems and your human agents.

Refining AI Agent Scripts: Start by analyzing customer satisfaction scores tied to specific automated conversations. If you see a particular script or workflow consistently leading to low scores or escalations, you've found a friction point. You can then quickly dive in and adjust the AI's language or logic.

Identifying Training Opportunities: The data might show that handoffs from the AI to a human agent are clunky or inefficient. This is a classic signal that your team might need better training on how to seamlessly pick up the conversation where the AI left off, creating a single, unified experience.

Optimizing Workflow Efficiency: Detailed audit trails can expose hidden bottlenecks you never knew you had. For instance, you might find that a certain compliance check during the claims process is adding unnecessary delays, giving you an opportunity to re-engineer that step for greater speed.

The financial upside of a well-nurtured customer base is huge. We all know retention is more profitable than acquisition; repeat customers can deliver 67% higher spending. Yet, so many firms remain fixated on chasing new leads instead of nurturing their loyal clients. This is a massive missed opportunity, especially when we know customers are looking for proactive support and personalized service.

For compliance-heavy workflows, Nolana's detailed audit trails can reduce costs by 20-30% while simultaneously improving experiences. This leads directly to more effective loyalty programs that can increase LTV by up to 30%. As you think about your own strategies, you can explore more ideas on building rapport with customers on Salesforce.com.

By taking a data-first approach, you can ensure your strategy for how to build rapport with customers is always evolving, adapting, and delivering exceptional value—both for your clients and your business.

Frequently Asked Questions About AI in Customer Care

When you're thinking about bringing AI into your customer interactions, a lot of questions come up. It's only natural. For leaders in financial services, moving from the idea of AI to actually putting it to work involves some real strategic and operational hurdles, especially in a heavily regulated world like banking or insurance. Let's tackle some of the most common questions we hear from people on the ground.

How Can AI Truly Automate Complex Insurance Claims?

It's easy to think of AI as just a simple chatbot, but its real power in insurance goes so much deeper. A well-designed AI agent can handle the entire front end of a claim. It starts the conversation, gathers all the essential details from the policyholder, instantly checks policy information in your core systems—like Guidewire or Duck Creek—and even collects the necessary documents.

But here’s where it gets really valuable. The AI doesn't just collect data; it analyzes it. It can spot missing information, flag potential issues, and even make initial liability suggestions based on the rules and historical patterns you've defined. For the straightforward, clear-cut claims, the AI can see them through from start to finish. This is how automating insurance claims with AI frees up your experienced adjusters to put their skills where they're needed most: on the complex, high-stakes cases that demand a human touch.

The real game-changer with claims AI reviews isn't just speed; it's about letting the technology handle the high-volume, repetitive tasks with flawless accuracy. Your team gets to focus their expertise on the moments that truly define the customer's experience.

Will AI Replace Our Customer Service Team?

This is probably the number one concern we hear, but the goal isn't replacement—it's collaboration. Think of AI as a tool to empower your team, not erase it. AI is perfectly suited to handle the routine, process-heavy tasks that can bog down your best people and lead to burnout.

By letting AI manage the simple inquiries and data gathering, you free up your human agents to do what they do best: build relationships, solve thorny problems, and navigate those sensitive customer conversations where empathy is everything. The AI becomes a co-pilot, feeding your team the right information at the right time and making them far more effective. This human-AI partnership creates a better, more supportive environment for your employees and a much smoother experience for your customers.

How Do We Ensure AI Interactions Remain Secure and Compliant?

For AI insurance companies and banks, security and compliance aren't just a feature; they're the foundation of trust. Any enterprise-grade AI platform worth its salt is built with this in mind from day one.

Every single action the AI agent takes is logged and tracked, creating a permanent, unchangeable audit trail. This is non-negotiable for meeting strict standards like SOC 2 and GDPR. These AI systems operate within carefully defined "guardrails" that you set based on your own internal policies. You have complete control over what the AI can and can't do, ensuring it only touches the data it absolutely needs. This built-in accountability doesn't just keep auditors happy; it shows your customers you're serious about protecting their information.

What Is the Real Impact on Customer Rapport?

The impact can be massive, and you can actually measure it. When you automate the routine parts of the process, you remove the most common sources of customer frustration. No more long hold times, no more repeating the same information to three different people. Customers get their answers faster and more accurately, which is the bedrock of a good experience.

This newfound efficiency also gives your human agents the breathing room to focus on genuine connection. When a customer does need to speak with a person, that agent comes into the conversation fully briefed and ready to offer thoughtful, personalized help. The end result is a customer journey with far less friction and a lot more satisfaction, which is exactly how you build lasting loyalty.

You can dive deeper into this topic in our complete guide to AI customer care, where we break down how intelligent automation can truly strengthen customer relationships.

Ready to see how AI can transform your high-stakes operations? Nolana deploys compliant AI agents that automate complex workflows in claims, case management, and customer service. Learn how our AI-native operating system can cut costs, reduce cycle times, and build lasting customer rapport by visiting https://nolana.com.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP