AI-Powered Guide to Managing Customer Communication in Finance

AI-Powered Guide to Managing Customer Communication in Finance

Transform how you're managing customer communication. Learn to automate claims and service workflows with AI for superior experiences in finance and insurance.

For financial services, effectively managing customer communication is no longer about simply answering the phone. It's about engineering an automated, intelligent system that delivers instant, seamless service—especially for high-stakes interactions like insurance claims and urgent customer care. This isn't just a "nice-to-have" upgrade; it's a fundamental requirement for staying competitive.

The High Cost of Outdated Communication

Let's be blunt: the old ways of interacting with customers are broken. Today’s clients are used to the instant, one-click experiences they get everywhere else. When they hit a wall of friction with their financial institution—like having to repeat information or wait on hold—their patience wears thin, and fast.

This isn’t just a minor annoyance; it’s a direct threat to your business. Customer frustration with clunky data collection is a massive driver of churn. A report from The Financial Brand found that a staggering 66% of customers are prepared to switch institutions if the process of providing information is too difficult. That's a huge, self-inflicted wound caused by failing to get the basics of communication right.

From Manual Drag to AI Efficiency

The operational weight of these outdated systems is crushing. Your human agents are likely bogged down by hours of repetitive, administrative work—manually verifying identities, gathering initial claim details, or answering the same policy questions over and over. This not only inflates your operating costs but also keeps your best people from tackling the complex issues where they can truly make a difference.

This is exactly where AI customer care completely changes the game. By handing over these high-volume, rules-based tasks to intelligent automation, you can immediately:

Slash response times: AI agents work 24/7, providing instant answers and collecting data without a queue.

Lighten the administrative load: This frees up your human experts to focus on complex escalations, build relationships, and solve real problems.

Guarantee process consistency: AI executes tasks according to your SOPs perfectly, every single time, which is a massive win for compliance and accuracy.

The real strategy here isn't about replacing people. It's about augmenting them. Let AI handle the predictable, high-volume grind so your team can apply judgment, empathy, and creative problem-solving where it matters most.

The New Standard for Claims and Care

For AI insurance companies, the results are especially dramatic. Automating the First Notice of Loss (FNOL) process with a dedicated claims AI can shrink a cycle that once took days down to just a few minutes. Imagine a customer reporting an accident through a simple, conversational chat. The AI can capture all the details, validate policy information on the spot, and get the ball rolling immediately. This is a powerful antidote to negative claims AI reviews, which almost always come from slow, confusing, and impersonal experiences.

The table below breaks down these common pain points and shows exactly how AI-powered solutions address them head-on.

Key Challenges in Financial Services Communication vs AI Solutions

Traditional Challenge | AI-Powered Solution | Impact on Business |

|---|---|---|

High call volumes & long wait times for simple queries | 24/7 AI agents handle routine questions, data collection, and status updates instantly. | Reduces operational costs, improves customer satisfaction scores (CSAT), and frees up human agents for high-value tasks. |

Inconsistent information & process adherence across human agents | AI follows pre-defined scripts & SOPs with 100% accuracy for every interaction. | Ensures compliance, minimizes errors in data capture, and delivers a consistent brand experience. |

Slow claims processing (FNOL) and cumbersome data gathering | Automated FNOL intake via conversational AI (chat/voice) that integrates with core systems. | Accelerates claim cycle times, reduces administrative burden, and improves the claimant experience during a critical moment. |

Lack of personalization in mass communications | AI analyzes customer data to provide tailored responses, relevant offers, and proactive support. | Increases customer loyalty, improves cross-sell/upsell opportunities, and makes customers feel understood. |

Difficulty scaling support during peak events (e.g., storms, market volatility) | AI capacity scales instantly to handle unlimited concurrent interactions without hiring or training. | Maintains service levels during crises, prevents system overload, and protects brand reputation when it matters most. |

Ultimately, rethinking your approach to managing customer communication is a critical part of a modern business strategy. You can see how this fits into the bigger picture in our guide on financial services digital transformation. Bringing in AI isn’t just about adopting a new tool; it's about building a more resilient, compliant, and customer-focused operation ready for the future.

Building a Compliant AI Governance Framework

In regulated industries like banking and insurance, deploying AI without a rock-solid governance framework isn't just risky—it's a non-starter. When it comes to managing customer communication, you can't just plug in a new tool and hope for the best. You need a foundation of clear rules, roles, and responsibilities that not only works but also satisfies your internal risk and compliance teams from day one.

This isn't about slowing down innovation; it's about giving it the structure it needs to succeed safely and at scale. A strong governance framework provides the guardrails that make every automated action documented, auditable, and perfectly aligned with your operational standards.

For AI insurance companies, this means you can trace and justify every automated claims decision. For banks using AI customer care, it ensures sensitive financial data is handled with precision and airtight control. This structure is what turns a powerful technology into a trusted, enterprise-ready system.

Drawing the Line: AI vs. Human Agent Roles

The very first thing you have to do is clearly define who does what. It's a critical distinction. AI agents are brilliant at executing structured, repetitive, high-volume tasks with 100% consistency. Think of them as your first line of defense, handling the predictable work like initial data intake, policy verification, or routine status updates.

Your human agents, on the other hand, should be freed up for what they do best: handling situations that require empathy, complex problem-solving, and nuanced judgment. This hybrid model doesn't just make you more efficient; it preserves the critical human touch that builds customer trust, especially when things get complicated.

The AI Agent's Job: Execute predefined Standard Operating Procedures (SOPs). This could be anything from First Notice of Loss (FNOL) intake and KYC data collection to answering common policy questions.

The Human Agent's Job: Take over escalated cases, help distressed customers, investigate tricky fraud scenarios, and make the final call on anything that falls outside the AI's programming.

This division of labor is fundamental for audit and review. To effectively manage risks and ensure robust information handling, a strong Governance, Risk, and Compliance (GRC) approach is essential, as detailed in this guide to Mastering GRC Cyber Security.

The Auditable AI Interaction Playbook

Your entire governance framework should be built around a meticulously detailed interaction playbook. This isn't just a guide; it's a living document that maps out every single workflow the AI will touch, from the first greeting to the final handoff. It needs to be so thorough that an external auditor could pick it up and know exactly how and why the AI made a particular decision.

Let's take the insurance claims process as an example. The playbook would document:

Initial Contact: How the claims AI greets the customer and what specific questions it asks to triage the situation.

Data Collection: Which precise data points the AI is authorized to collect (policy number, incident details, etc.) and where it gets this information (e.g., your core systems like Guidewire).

Validation Logic: The explicit rules the AI uses to validate information in real-time, like checking if a policy is active or confirming if the reported incident is covered.

Escalation Triggers: The specific keywords, sentiment scores, or scenarios (like a potential fraud flag) that automatically and seamlessly transfer the conversation to a human agent.

This level of documentation is completely non-negotiable. It’s how you address the concerns that often pop up in claims AI reviews, which almost always center on a lack of transparency. A detailed, auditable playbook is your proof that the system operates on clear, consistent, and compliant logic.

Setting Up Compliance Guardrails and Controls

With your playbook defined, the next step is to put the technical and procedural guardrails in place. These are the active enforcement mechanisms that bring your governance policy to life. They physically prevent the AI from going off-script and ensure every action it takes is logged for review.

A huge piece of this is making sure the AI platform itself meets rigorous security standards. For example, understanding https://nolana.com/articles/what-is-soc-2-compliance is essential, as a certification like this provides third-party assurance that a vendor handles data with the highest levels of security and confidentiality. Your technology has to be as compliant as your processes.

Key controls you absolutely must implement include:

Immutable Audit Trails: Every single interaction, decision, and data point touched by the AI must be logged in a tamper-proof record. No exceptions.

Strict Access Controls: Lock down who can modify AI workflows. Only authorized personnel should ever be able to make changes to the playbook or the underlying SOPs.

Real-time Monitoring: Use dashboards that give your compliance teams a live view of AI performance, escalation rates, and any operational anomalies as they happen.

By building a comprehensive governance framework before you go live, you give your organization the confidence to unlock the incredible efficiencies of automation while maintaining the strict control and visibility that financial services demand. This deliberate, structured approach is the only sustainable way to succeed in managing customer communication at scale.

Designing a Seamless Omnichannel Customer Journey

Your customers don’t see channels; they just see one company. So why do so many financial firms still force them into siloed, disconnected conversations? A truly effective communication strategy erases the lines between voice, chat, email, and SMS, creating a single, continuous dialogue. The goal is simple: build an experience where context is never lost, no matter how a customer reaches out.

This is about more than just being available everywhere. It’s about intelligent orchestration. Picture a client starting an insurance claim on your app, asking a follow-up question on your website’s chat later that day, and then getting a final confirmation via SMS. A well-designed AI-powered system should carry the full context through that entire journey, finally putting an end to the dreaded, “Can you please repeat that for me?”

Unifying Channels with an AI Hub

The classic problem has always been that your phone system doesn’t talk to your web chat, which in turn knows nothing about your SMS gateway. This is where AI steps in to act as the central nervous system for your entire AI customer care operation. It plugs into each channel, understands the history of every interaction, and makes sure the next step is always the right one.

Omnichannel continuity isn't just a nice-to-have anymore; it's a core expectation in financial services. Customer preferences are shifting hard toward instant answers. Live chat now leads the pack at 41%, well ahead of the 32% who prefer phone calls and the 23% who stick with email. The satisfaction numbers tell the same story: 73% for chat, compared to just 51% for email and 44% for phone.

This kind of fluid experience demands deep integration. To make this a reality, many organizations find immense value in Mastering CRM with VoIP integration. This vital link ensures even traditional phone calls are captured and woven into the customer's digital journey, feeding crucial data back into your central system.

A Smart Strategy for Each Channel

While the end goal is a unified experience, each channel has its own strengths. A smart strategy uses each one for what it does best, with a central AI orchestrating the entire flow.

Web Chat for Instant Triage: Live chat is the perfect front door for a new issue. An AI agent can engage immediately, ask the right diagnostic questions, and gather key info, like a policy number for an insurance claim, before a human even gets involved.

SMS for Proactive Updates: For quick, outbound notifications that don't need a full conversation, nothing beats SMS. The AI can trigger automated texts to confirm a payment was received, let a customer know their application is under review, or share the good news that a claim has been approved.

Email for Detailed Documentation: When you need to send a detailed summary or official documents, email is still king. The AI can automatically generate and send a full chat transcript or a summary of a claim for the customer's records.

Voice for Complex Escalations: For the most sensitive or complex issues, you still can't beat the human touch. Here, the AI's job is to handle the initial query and then execute a perfect, contextual handoff to a human agent, who gets a full summary of the interaction so far.

The magic isn't in just offering these channels. It's in the AI's ability to seamlessly transition a single customer interaction between them without dropping a single piece of information. That's the real difference between a multi-channel mess and a true omnichannel journey.

Breaking Down Data Silos for Good

This seamless experience is just a dream if your core systems can’t talk to each other. The real work is connecting your communication platforms, like Genesys or Salesforce, with your industry-specific back-end systems—think Guidewire or Duck Creek for insurance. This is how you finally tear down the walls that create so much customer frustration.

The AI agent acts as a universal translator, using APIs to pull and push data between these systems in real time. For example, when a customer starts a claim via chat:

The AI first queries the CRM (like Salesforce) to identify the customer and pull their history.

It then connects to the insurance platform (like Guidewire) to validate their policy details.

Finally, it logs the entire interaction back into the CRM, creating a single source of truth.

Mapping these intricate pathways is the critical first step. You can start by outlining the ideal flow for your most important processes with a structured approach, like the one in our customer journey mapping form template. Getting this clarity upfront allows you to program the AI to execute these complex, multi-system workflows flawlessly, turning what used to be a series of disjointed steps into one cohesive and efficient conversation.

Putting AI Agents to Work in Claims and Customer Care

This is where the rubber meets the road. Moving from a well-designed framework to a live, operational AI agent isn't just a technical exercise—it's about building a system your customers and compliance officers can trust. The goal is to create an intelligent assistant that doesn't just follow a script but truly understands and executes the high-stakes workflows of insurance claims and financial customer care.

To get there, you have to nail three things: training the AI on your specific Standard Operating Procedures (SOPs), connecting it deeply with your core systems, and designing foolproof escape hatches for when a human touch is required. This is how you transform customer communication from a reactive cost center into a proactive, intelligent asset.

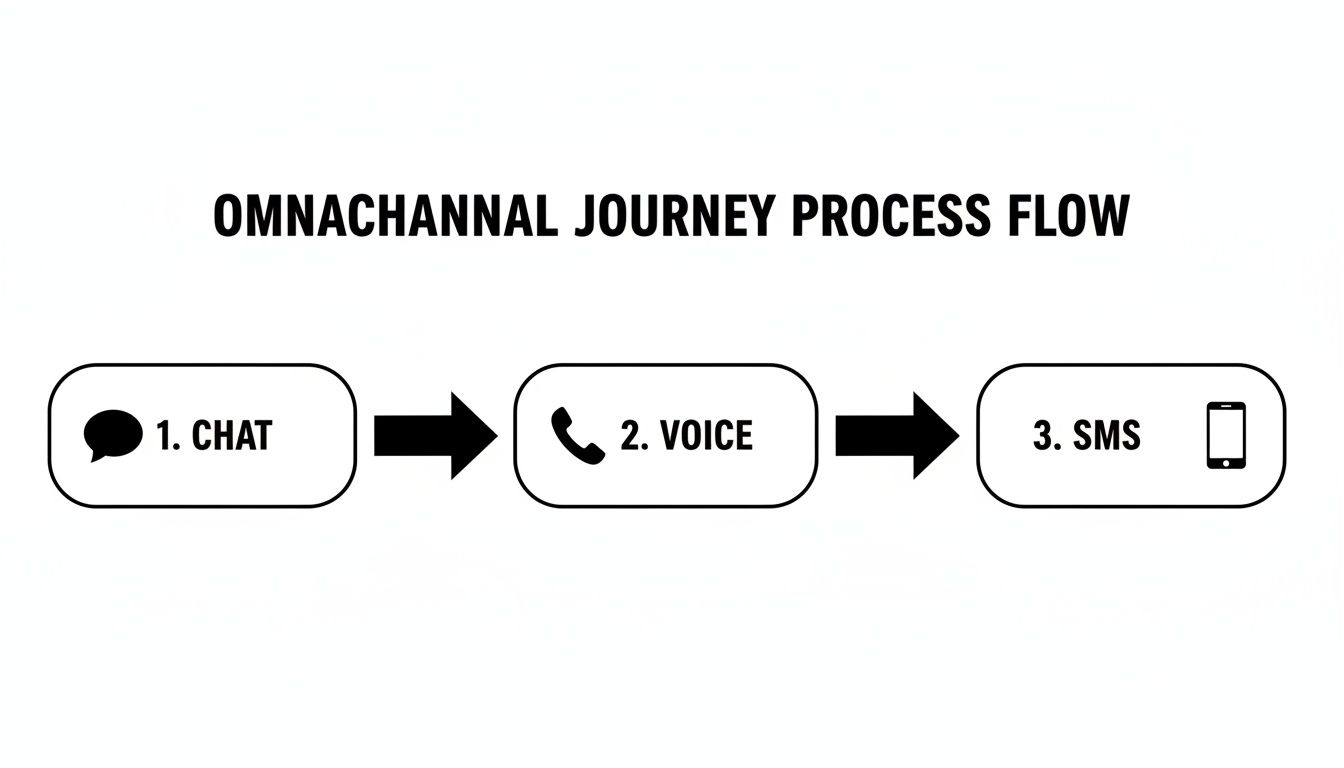

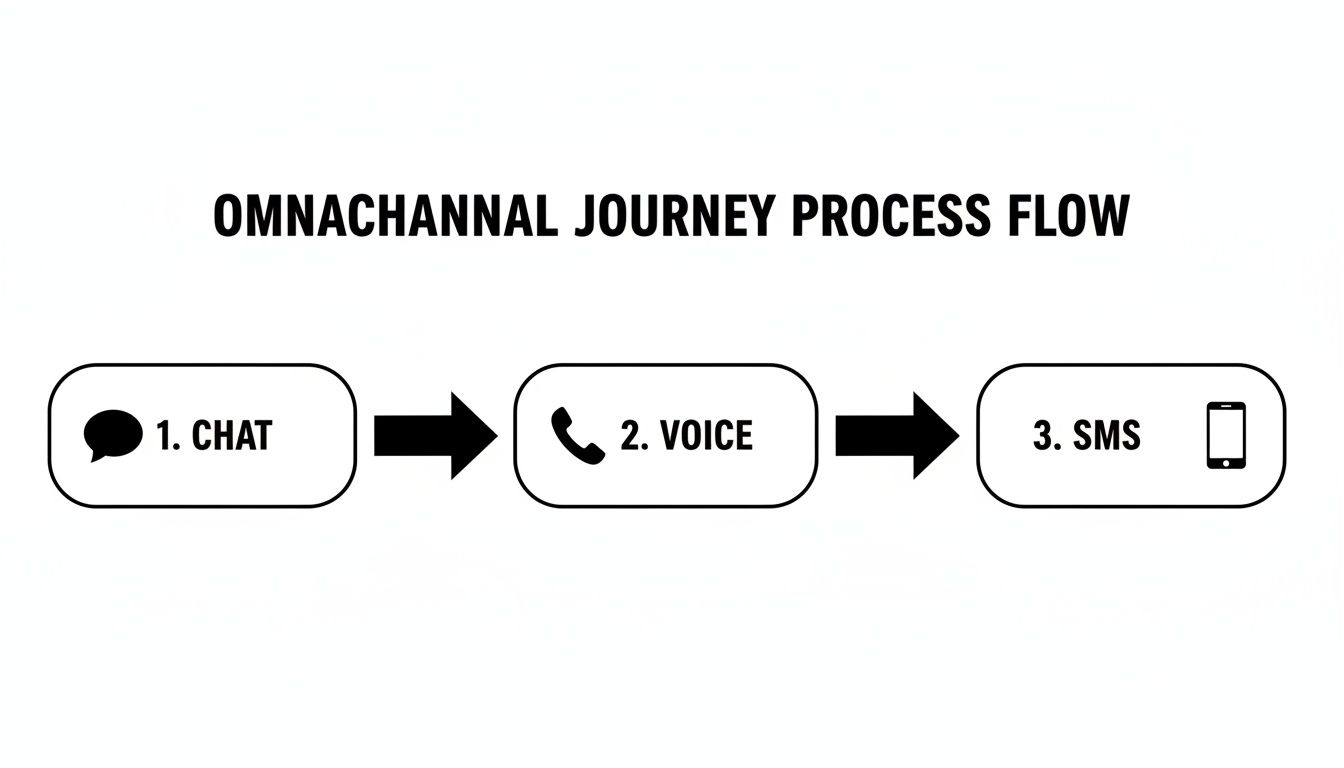

The flow below shows how an AI can orchestrate a conversation as a customer moves between channels, keeping the context intact the entire time.

This kind of seamless transition is what customers now expect, and it's something that AI is uniquely positioned to deliver.

Turning Your SOPs into Automated Workflows

An AI agent is only as smart as the knowledge you give it. The first real step is training it on your existing SOPs. This means you're not just uploading a PDF; you're teaching the AI the exact, step-by-step processes your best human agents use to get things done.

Think about the First Notice of Loss (FNOL) process. Instead of a clunky form, an AI agent can start a natural conversation, asking the right questions just like a seasoned adjuster would. It learns to:

Capture details naturally: It can ask, "Can you tell me where the incident occurred?" and follow up with, "And what was the approximate date and time?" instead of just presenting empty fields.

Verify policy details on the spot: By connecting to your core policy system, the AI can instantly confirm coverage, which stops errors before they start.

Triage the claim’s urgency: Based on what the customer says, the agent can categorize the claim's severity and kick off the right internal workflow automatically.

This conversational approach directly tackles the root cause of many negative claims AI reviews—impersonal, rigid systems that feel cold and inefficient. A well-trained AI creates a more empathetic and effective experience right from that first crucial interaction.

Weaving AI into Your Core Systems

An AI agent working in isolation is a missed opportunity. Its true power comes alive when it’s connected to the systems that run your business, like your CRM or claims management platform. This integration, usually done through APIs, lets the AI become an intelligent hub, reading and writing data in real time.

Here’s a real-world example. Imagine a banking customer needs to complete a Know Your Customer (KYC) verification through an AI customer care chat:

The AI agent pulls the customer’s profile from your CRM (like Salesforce).

It then prompts the customer to securely upload their ID documents.

Next, the agent connects to a third-party verification service to validate the documents instantly.

Finally, it updates the customer's status in the core banking system and logs the entire interaction for the audit trail.

What used to be a multi-step, manual process taking days becomes a smooth, two-minute conversation. You can dive deeper into how these systems are built in our guide on AI agents for customer service.

Build Trust with Transparency and Smart Escalations

In financial services, automation without trust is a non-starter. Customers are wary. A recent Salesforce report found that 73% of consumers are concerned about companies using AI unethically and want transparency when interacting with it. That same report noted only 41% of wealth management clients are satisfied with the speed of service, highlighting a huge gap that AI can fill—but only if it’s done right. You can discover more about these financial services trends.

The golden rule is simple: never trap a customer in an automated loop. A well-built AI always knows its limits and offers a seamless, contextual handoff to a human expert when things get complicated.

This means building clear escalation triggers into every workflow. If the AI’s sentiment analysis detects a customer is getting frustrated, or if a case involves a unique variable it hasn’t been trained on, the system must automatically route the conversation to the right person. And crucially, it has to pass along the entire conversation history, so the customer doesn't have to repeat themselves. It’s this hybrid approach that delivers the best of both worlds: robotic efficiency for the routine and expert human empathy for the moments that matter.

For leaders overseeing these deployments, a structured approach is critical. The checklist below outlines the key phases and checkpoints to ensure your AI agent implementation is both effective and compliant from day one.

AI Agent Implementation Checklist for Regulated Workflows

Phase | Key Action Item | Compliance Checkpoint |

|---|---|---|

1. Discovery & Design | Define a single, high-impact workflow (e.g., FNOL, KYC). | Map the workflow against all relevant regulations (e.g., GDPR, CCPA, industry-specific rules). |

Document existing SOPs and identify escalation points. | Identify all PII handled and confirm data handling protocols. | |

2. Training & Development | Ingest and tag SOPs, call transcripts, and chat logs for training. | Ensure training data is anonymized and free of bias. |

Develop and test API integrations with core systems (CRM, Claims). | Audit API security and data access permissions. | |

3. Testing & Validation | Conduct User Acceptance Testing (UAT) with internal agents. | Run scenarios for data privacy requests (e.g., data deletion). |

Simulate edge cases and escalation failures in a sandbox environment. | Validate that all interactions are logged immutably for audit trails. | |

4. Deployment & Monitoring | Launch with a small pilot group of customers. | Confirm that disclosures ("you are talking to an AI") are active. |

Monitor KPIs (containment rate, CSAT, escalation rate) in real time. | Schedule regular compliance reviews of AI conversations and outcomes. |

Following a structured checklist like this helps demystify the process and ensures that from design to deployment, your AI agent is a trusted, compliant, and valuable part of your customer service operation.

Measuring Success and Proving ROI

Rolling out a sophisticated AI system without a clear way to measure its impact is just an expensive experiment. To justify the investment in managing customer communication with automation, you have to prove its worth. That means moving beyond vanity metrics and zeroing in on the key performance indicators (KPIs) that truly reflect operational health and business value.

This is how you demonstrate that your new system is a profit center, not just a line item in the budget.

For an AI insurance company, this comes down to how a claims AI directly slashes cycle times and improves settlement accuracy. For a bank, it's about how AI customer care boosts resolution rates while navigating a maze of compliance rules. The ultimate goal is to build a data-backed narrative that proves automation is making your organization faster, smarter, and more efficient.

Identifying KPIs That Truly Matter

Forget about generic metrics like the total number of chats handled. You need to focus on outcomes that show a tangible return. The right KPIs don't just highlight your wins; they also expose bottlenecks in your automated workflows, giving you the insights needed for continuous improvement.

These are the core metrics that should live on your dashboard:

First Contact Resolution (FCR): What percentage of issues are completely solved by the AI on the first try, without a human ever getting involved? A high FCR is a direct sign of AI effectiveness and a massive driver of cost savings.

Customer Satisfaction (CSAT): How do people actually feel about interacting with your AI? Sending a quick post-interaction survey is essential to ensure your efficiency gains aren't silently killing customer loyalty.

Claims Cycle Time: This is a non-negotiable metric for AI insurance companies. Track the average time from the First Notice of Loss (FNOL) to final resolution. A dramatic drop here is hard evidence that your AI is accelerating a core business function.

Cost-Per-Interaction: Run the numbers. Calculate the fully loaded cost of a human-led interaction and put it side-by-side with the cost of one handled by your AI agent. This simple comparison makes a powerful, bottom-line argument for your strategy.

Leveraging AI Data for Operational Insights

One of the most valuable, and often overlooked, benefits of an AI-driven system is the mountain of structured data it generates. Every single conversation is a goldmine of information you can use to spot operational risks and execution gaps before they snowball into major headaches.

By digging into conversation transcripts and outcomes, you can pinpoint recurring customer pain points, common reasons for escalation, or specific process steps where the AI stumbles. This feedback loop is invaluable. It lets you refine your AI's training data, update your SOPs, and improve both the automated and human sides of your service. For a real-world look at this in action, you can explore case studies about transforming insurance claims with agentic AI.

The data from your AI conversations is more than just a performance report—it's your early warning system. It gives you the visibility to proactively address systemic issues, whether it's an unclear policy clause or a broken step in your onboarding workflow.

Sample KPI Dashboard for Insurance Claims

Data is only useful if it's easy to understand. A well-designed dashboard gives leaders an at-a-glance view of how the AI is performing against critical business objectives. This is how you shift the conversation from abstract tech talk to concrete results.

Here’s a practical example of what a KPI dashboard for an insurance claims team might look like. It focuses on the metrics that both leadership and compliance teams care about most.

Metric Category | KPI | Target | Current Performance | Trend (MoM) |

|---|---|---|---|---|

Efficiency | AI Containment Rate | 75% | 82% | ▲ 5% |

Average Claims Cycle Time | < 48 Hours | 36 Hours | ▼ 10 Hours | |

Quality | CSAT (AI Interactions) | > 4.5/5 | 4.6/5 | ▲ 0.1 |

Escalation Rate | < 15% | 11% | ▼ 2% | |

Cost | Cost-Per-Claim (AI vs. Human) | < $15 | $8 | - |

This kind of clear, quantifiable reporting builds confidence in your AI strategy across the entire organization. It provides the indisputable proof you need to show that your approach to managing customer communication is not only meeting but exceeding business goals, turning a major investment into a clear competitive advantage.

Answering the Tough Questions About AI in Customer Communication

When you're leading a team in financial services, bringing in new technology like AI naturally comes with some tough, practical questions. The stakes are high—compliance is non-negotiable and customer trust is everything. Let's tackle some of the most common concerns I hear from leaders just like you.

Will AI Replace Our Human Agents?

This is easily the most frequent question, and the answer is a firm no. The goal isn't replacement; it's about making your best people even better.

Think of an AI customer care agent as a force multiplier. They are exceptionally good at handling the high-volume, predictable tasks that burn out even the most dedicated employees. We're talking about the initial data gathering for a new insurance claim or answering the same basic policy questions over and over, 24/7.

By taking that work off their plate, your experienced human agents are freed up to handle what they do best: high-value, high-empathy interactions. They can now dedicate their full attention to calming a distressed client through a complicated claim, untangling a tricky fraud case, or giving nuanced advice that only a human can. This hybrid approach doesn't just make your team more productive; it boosts morale and delivers faster service on the front end while saving your best people for the moments that truly matter.

The real power of AI is in elevating your human team from process-followers to expert problem-solvers. It lets them focus on the critical moments that define your customer relationships.

How Can We Ensure AI Stays Compliant?

Keeping AI in check from a compliance standpoint isn't about one single thing; it's a multi-layered strategy. This is especially true for AI insurance companies that are stewards of incredibly sensitive customer data.

Here's how we've seen it work best:

Start with a Secure Foundation: The AI platform you choose must be built on a secure, auditable framework. Look for essential certifications like SOC 2 Type II, which independently verifies the platform's security and data confidentiality practices. It's a non-negotiable starting point.

Train It on Your Rules: The AI agents can't be generic. They must be trained specifically on your company's Standard Operating Procedures (SOPs). This creates strict operational guardrails, effectively locking the AI into your pre-approved workflows and preventing it from ever going "off-script."

Demand Immutable Audit Trails: Every single action the AI takes—every interaction, every data lookup, every decision—has to be logged in a tamper-proof audit trail. This gives your compliance officers a complete, transparent record to review any case and prove you followed every regulation to the letter.

On top of all that, you need seamless, automatic escalation paths to a human agent for any situation that falls outside the lines. This ensures a person is always in ultimate control.

What Does Integration with Core Systems Actually Look Like?

This is where many people expect a massive, painful project, but modern AI platforms are built to avoid that. They're designed to connect smoothly with the systems you already rely on, using APIs (Application Programming Interfaces) to talk to platforms like Guidewire or Salesforce. There's no "rip and replace" needed.

The process typically starts with mapping out your key operational workflows to pinpoint where data needs to flow. The AI platform then uses your systems' existing APIs to both pull and push information in real-time.

For example, an AI agent could instantly query your policy system to verify a customer's coverage during a first notice of loss call. Once it collects all the initial details, it then writes that information directly into a new file in your claims management system. This API-first approach means the AI acts as an intelligent layer on top of your current technology stack, making your existing systems smarter without a disruptive overhaul. It's also how you get ahead of common negative claims AI reviews, by ensuring data is captured accurately from the very first touchpoint.

Ready to see how intelligent automation can transform your high-stakes operations? Nolana deploys compliant, auditable AI agents trained on your specific workflows to automate claims, case management, and customer care. Discover how Nolana can help you accelerate cycle times and reduce costs today.

For financial services, effectively managing customer communication is no longer about simply answering the phone. It's about engineering an automated, intelligent system that delivers instant, seamless service—especially for high-stakes interactions like insurance claims and urgent customer care. This isn't just a "nice-to-have" upgrade; it's a fundamental requirement for staying competitive.

The High Cost of Outdated Communication

Let's be blunt: the old ways of interacting with customers are broken. Today’s clients are used to the instant, one-click experiences they get everywhere else. When they hit a wall of friction with their financial institution—like having to repeat information or wait on hold—their patience wears thin, and fast.

This isn’t just a minor annoyance; it’s a direct threat to your business. Customer frustration with clunky data collection is a massive driver of churn. A report from The Financial Brand found that a staggering 66% of customers are prepared to switch institutions if the process of providing information is too difficult. That's a huge, self-inflicted wound caused by failing to get the basics of communication right.

From Manual Drag to AI Efficiency

The operational weight of these outdated systems is crushing. Your human agents are likely bogged down by hours of repetitive, administrative work—manually verifying identities, gathering initial claim details, or answering the same policy questions over and over. This not only inflates your operating costs but also keeps your best people from tackling the complex issues where they can truly make a difference.

This is exactly where AI customer care completely changes the game. By handing over these high-volume, rules-based tasks to intelligent automation, you can immediately:

Slash response times: AI agents work 24/7, providing instant answers and collecting data without a queue.

Lighten the administrative load: This frees up your human experts to focus on complex escalations, build relationships, and solve real problems.

Guarantee process consistency: AI executes tasks according to your SOPs perfectly, every single time, which is a massive win for compliance and accuracy.

The real strategy here isn't about replacing people. It's about augmenting them. Let AI handle the predictable, high-volume grind so your team can apply judgment, empathy, and creative problem-solving where it matters most.

The New Standard for Claims and Care

For AI insurance companies, the results are especially dramatic. Automating the First Notice of Loss (FNOL) process with a dedicated claims AI can shrink a cycle that once took days down to just a few minutes. Imagine a customer reporting an accident through a simple, conversational chat. The AI can capture all the details, validate policy information on the spot, and get the ball rolling immediately. This is a powerful antidote to negative claims AI reviews, which almost always come from slow, confusing, and impersonal experiences.

The table below breaks down these common pain points and shows exactly how AI-powered solutions address them head-on.

Key Challenges in Financial Services Communication vs AI Solutions

Traditional Challenge | AI-Powered Solution | Impact on Business |

|---|---|---|

High call volumes & long wait times for simple queries | 24/7 AI agents handle routine questions, data collection, and status updates instantly. | Reduces operational costs, improves customer satisfaction scores (CSAT), and frees up human agents for high-value tasks. |

Inconsistent information & process adherence across human agents | AI follows pre-defined scripts & SOPs with 100% accuracy for every interaction. | Ensures compliance, minimizes errors in data capture, and delivers a consistent brand experience. |

Slow claims processing (FNOL) and cumbersome data gathering | Automated FNOL intake via conversational AI (chat/voice) that integrates with core systems. | Accelerates claim cycle times, reduces administrative burden, and improves the claimant experience during a critical moment. |

Lack of personalization in mass communications | AI analyzes customer data to provide tailored responses, relevant offers, and proactive support. | Increases customer loyalty, improves cross-sell/upsell opportunities, and makes customers feel understood. |

Difficulty scaling support during peak events (e.g., storms, market volatility) | AI capacity scales instantly to handle unlimited concurrent interactions without hiring or training. | Maintains service levels during crises, prevents system overload, and protects brand reputation when it matters most. |

Ultimately, rethinking your approach to managing customer communication is a critical part of a modern business strategy. You can see how this fits into the bigger picture in our guide on financial services digital transformation. Bringing in AI isn’t just about adopting a new tool; it's about building a more resilient, compliant, and customer-focused operation ready for the future.

Building a Compliant AI Governance Framework

In regulated industries like banking and insurance, deploying AI without a rock-solid governance framework isn't just risky—it's a non-starter. When it comes to managing customer communication, you can't just plug in a new tool and hope for the best. You need a foundation of clear rules, roles, and responsibilities that not only works but also satisfies your internal risk and compliance teams from day one.

This isn't about slowing down innovation; it's about giving it the structure it needs to succeed safely and at scale. A strong governance framework provides the guardrails that make every automated action documented, auditable, and perfectly aligned with your operational standards.

For AI insurance companies, this means you can trace and justify every automated claims decision. For banks using AI customer care, it ensures sensitive financial data is handled with precision and airtight control. This structure is what turns a powerful technology into a trusted, enterprise-ready system.

Drawing the Line: AI vs. Human Agent Roles

The very first thing you have to do is clearly define who does what. It's a critical distinction. AI agents are brilliant at executing structured, repetitive, high-volume tasks with 100% consistency. Think of them as your first line of defense, handling the predictable work like initial data intake, policy verification, or routine status updates.

Your human agents, on the other hand, should be freed up for what they do best: handling situations that require empathy, complex problem-solving, and nuanced judgment. This hybrid model doesn't just make you more efficient; it preserves the critical human touch that builds customer trust, especially when things get complicated.

The AI Agent's Job: Execute predefined Standard Operating Procedures (SOPs). This could be anything from First Notice of Loss (FNOL) intake and KYC data collection to answering common policy questions.

The Human Agent's Job: Take over escalated cases, help distressed customers, investigate tricky fraud scenarios, and make the final call on anything that falls outside the AI's programming.

This division of labor is fundamental for audit and review. To effectively manage risks and ensure robust information handling, a strong Governance, Risk, and Compliance (GRC) approach is essential, as detailed in this guide to Mastering GRC Cyber Security.

The Auditable AI Interaction Playbook

Your entire governance framework should be built around a meticulously detailed interaction playbook. This isn't just a guide; it's a living document that maps out every single workflow the AI will touch, from the first greeting to the final handoff. It needs to be so thorough that an external auditor could pick it up and know exactly how and why the AI made a particular decision.

Let's take the insurance claims process as an example. The playbook would document:

Initial Contact: How the claims AI greets the customer and what specific questions it asks to triage the situation.

Data Collection: Which precise data points the AI is authorized to collect (policy number, incident details, etc.) and where it gets this information (e.g., your core systems like Guidewire).

Validation Logic: The explicit rules the AI uses to validate information in real-time, like checking if a policy is active or confirming if the reported incident is covered.

Escalation Triggers: The specific keywords, sentiment scores, or scenarios (like a potential fraud flag) that automatically and seamlessly transfer the conversation to a human agent.

This level of documentation is completely non-negotiable. It’s how you address the concerns that often pop up in claims AI reviews, which almost always center on a lack of transparency. A detailed, auditable playbook is your proof that the system operates on clear, consistent, and compliant logic.

Setting Up Compliance Guardrails and Controls

With your playbook defined, the next step is to put the technical and procedural guardrails in place. These are the active enforcement mechanisms that bring your governance policy to life. They physically prevent the AI from going off-script and ensure every action it takes is logged for review.

A huge piece of this is making sure the AI platform itself meets rigorous security standards. For example, understanding https://nolana.com/articles/what-is-soc-2-compliance is essential, as a certification like this provides third-party assurance that a vendor handles data with the highest levels of security and confidentiality. Your technology has to be as compliant as your processes.

Key controls you absolutely must implement include:

Immutable Audit Trails: Every single interaction, decision, and data point touched by the AI must be logged in a tamper-proof record. No exceptions.

Strict Access Controls: Lock down who can modify AI workflows. Only authorized personnel should ever be able to make changes to the playbook or the underlying SOPs.

Real-time Monitoring: Use dashboards that give your compliance teams a live view of AI performance, escalation rates, and any operational anomalies as they happen.

By building a comprehensive governance framework before you go live, you give your organization the confidence to unlock the incredible efficiencies of automation while maintaining the strict control and visibility that financial services demand. This deliberate, structured approach is the only sustainable way to succeed in managing customer communication at scale.

Designing a Seamless Omnichannel Customer Journey

Your customers don’t see channels; they just see one company. So why do so many financial firms still force them into siloed, disconnected conversations? A truly effective communication strategy erases the lines between voice, chat, email, and SMS, creating a single, continuous dialogue. The goal is simple: build an experience where context is never lost, no matter how a customer reaches out.

This is about more than just being available everywhere. It’s about intelligent orchestration. Picture a client starting an insurance claim on your app, asking a follow-up question on your website’s chat later that day, and then getting a final confirmation via SMS. A well-designed AI-powered system should carry the full context through that entire journey, finally putting an end to the dreaded, “Can you please repeat that for me?”

Unifying Channels with an AI Hub

The classic problem has always been that your phone system doesn’t talk to your web chat, which in turn knows nothing about your SMS gateway. This is where AI steps in to act as the central nervous system for your entire AI customer care operation. It plugs into each channel, understands the history of every interaction, and makes sure the next step is always the right one.

Omnichannel continuity isn't just a nice-to-have anymore; it's a core expectation in financial services. Customer preferences are shifting hard toward instant answers. Live chat now leads the pack at 41%, well ahead of the 32% who prefer phone calls and the 23% who stick with email. The satisfaction numbers tell the same story: 73% for chat, compared to just 51% for email and 44% for phone.

This kind of fluid experience demands deep integration. To make this a reality, many organizations find immense value in Mastering CRM with VoIP integration. This vital link ensures even traditional phone calls are captured and woven into the customer's digital journey, feeding crucial data back into your central system.

A Smart Strategy for Each Channel

While the end goal is a unified experience, each channel has its own strengths. A smart strategy uses each one for what it does best, with a central AI orchestrating the entire flow.

Web Chat for Instant Triage: Live chat is the perfect front door for a new issue. An AI agent can engage immediately, ask the right diagnostic questions, and gather key info, like a policy number for an insurance claim, before a human even gets involved.

SMS for Proactive Updates: For quick, outbound notifications that don't need a full conversation, nothing beats SMS. The AI can trigger automated texts to confirm a payment was received, let a customer know their application is under review, or share the good news that a claim has been approved.

Email for Detailed Documentation: When you need to send a detailed summary or official documents, email is still king. The AI can automatically generate and send a full chat transcript or a summary of a claim for the customer's records.

Voice for Complex Escalations: For the most sensitive or complex issues, you still can't beat the human touch. Here, the AI's job is to handle the initial query and then execute a perfect, contextual handoff to a human agent, who gets a full summary of the interaction so far.

The magic isn't in just offering these channels. It's in the AI's ability to seamlessly transition a single customer interaction between them without dropping a single piece of information. That's the real difference between a multi-channel mess and a true omnichannel journey.

Breaking Down Data Silos for Good

This seamless experience is just a dream if your core systems can’t talk to each other. The real work is connecting your communication platforms, like Genesys or Salesforce, with your industry-specific back-end systems—think Guidewire or Duck Creek for insurance. This is how you finally tear down the walls that create so much customer frustration.

The AI agent acts as a universal translator, using APIs to pull and push data between these systems in real time. For example, when a customer starts a claim via chat:

The AI first queries the CRM (like Salesforce) to identify the customer and pull their history.

It then connects to the insurance platform (like Guidewire) to validate their policy details.

Finally, it logs the entire interaction back into the CRM, creating a single source of truth.

Mapping these intricate pathways is the critical first step. You can start by outlining the ideal flow for your most important processes with a structured approach, like the one in our customer journey mapping form template. Getting this clarity upfront allows you to program the AI to execute these complex, multi-system workflows flawlessly, turning what used to be a series of disjointed steps into one cohesive and efficient conversation.

Putting AI Agents to Work in Claims and Customer Care

This is where the rubber meets the road. Moving from a well-designed framework to a live, operational AI agent isn't just a technical exercise—it's about building a system your customers and compliance officers can trust. The goal is to create an intelligent assistant that doesn't just follow a script but truly understands and executes the high-stakes workflows of insurance claims and financial customer care.

To get there, you have to nail three things: training the AI on your specific Standard Operating Procedures (SOPs), connecting it deeply with your core systems, and designing foolproof escape hatches for when a human touch is required. This is how you transform customer communication from a reactive cost center into a proactive, intelligent asset.

The flow below shows how an AI can orchestrate a conversation as a customer moves between channels, keeping the context intact the entire time.

This kind of seamless transition is what customers now expect, and it's something that AI is uniquely positioned to deliver.

Turning Your SOPs into Automated Workflows

An AI agent is only as smart as the knowledge you give it. The first real step is training it on your existing SOPs. This means you're not just uploading a PDF; you're teaching the AI the exact, step-by-step processes your best human agents use to get things done.

Think about the First Notice of Loss (FNOL) process. Instead of a clunky form, an AI agent can start a natural conversation, asking the right questions just like a seasoned adjuster would. It learns to:

Capture details naturally: It can ask, "Can you tell me where the incident occurred?" and follow up with, "And what was the approximate date and time?" instead of just presenting empty fields.

Verify policy details on the spot: By connecting to your core policy system, the AI can instantly confirm coverage, which stops errors before they start.

Triage the claim’s urgency: Based on what the customer says, the agent can categorize the claim's severity and kick off the right internal workflow automatically.

This conversational approach directly tackles the root cause of many negative claims AI reviews—impersonal, rigid systems that feel cold and inefficient. A well-trained AI creates a more empathetic and effective experience right from that first crucial interaction.

Weaving AI into Your Core Systems

An AI agent working in isolation is a missed opportunity. Its true power comes alive when it’s connected to the systems that run your business, like your CRM or claims management platform. This integration, usually done through APIs, lets the AI become an intelligent hub, reading and writing data in real time.

Here’s a real-world example. Imagine a banking customer needs to complete a Know Your Customer (KYC) verification through an AI customer care chat:

The AI agent pulls the customer’s profile from your CRM (like Salesforce).

It then prompts the customer to securely upload their ID documents.

Next, the agent connects to a third-party verification service to validate the documents instantly.

Finally, it updates the customer's status in the core banking system and logs the entire interaction for the audit trail.

What used to be a multi-step, manual process taking days becomes a smooth, two-minute conversation. You can dive deeper into how these systems are built in our guide on AI agents for customer service.

Build Trust with Transparency and Smart Escalations

In financial services, automation without trust is a non-starter. Customers are wary. A recent Salesforce report found that 73% of consumers are concerned about companies using AI unethically and want transparency when interacting with it. That same report noted only 41% of wealth management clients are satisfied with the speed of service, highlighting a huge gap that AI can fill—but only if it’s done right. You can discover more about these financial services trends.

The golden rule is simple: never trap a customer in an automated loop. A well-built AI always knows its limits and offers a seamless, contextual handoff to a human expert when things get complicated.

This means building clear escalation triggers into every workflow. If the AI’s sentiment analysis detects a customer is getting frustrated, or if a case involves a unique variable it hasn’t been trained on, the system must automatically route the conversation to the right person. And crucially, it has to pass along the entire conversation history, so the customer doesn't have to repeat themselves. It’s this hybrid approach that delivers the best of both worlds: robotic efficiency for the routine and expert human empathy for the moments that matter.

For leaders overseeing these deployments, a structured approach is critical. The checklist below outlines the key phases and checkpoints to ensure your AI agent implementation is both effective and compliant from day one.

AI Agent Implementation Checklist for Regulated Workflows

Phase | Key Action Item | Compliance Checkpoint |

|---|---|---|

1. Discovery & Design | Define a single, high-impact workflow (e.g., FNOL, KYC). | Map the workflow against all relevant regulations (e.g., GDPR, CCPA, industry-specific rules). |

Document existing SOPs and identify escalation points. | Identify all PII handled and confirm data handling protocols. | |

2. Training & Development | Ingest and tag SOPs, call transcripts, and chat logs for training. | Ensure training data is anonymized and free of bias. |

Develop and test API integrations with core systems (CRM, Claims). | Audit API security and data access permissions. | |

3. Testing & Validation | Conduct User Acceptance Testing (UAT) with internal agents. | Run scenarios for data privacy requests (e.g., data deletion). |

Simulate edge cases and escalation failures in a sandbox environment. | Validate that all interactions are logged immutably for audit trails. | |

4. Deployment & Monitoring | Launch with a small pilot group of customers. | Confirm that disclosures ("you are talking to an AI") are active. |

Monitor KPIs (containment rate, CSAT, escalation rate) in real time. | Schedule regular compliance reviews of AI conversations and outcomes. |

Following a structured checklist like this helps demystify the process and ensures that from design to deployment, your AI agent is a trusted, compliant, and valuable part of your customer service operation.

Measuring Success and Proving ROI

Rolling out a sophisticated AI system without a clear way to measure its impact is just an expensive experiment. To justify the investment in managing customer communication with automation, you have to prove its worth. That means moving beyond vanity metrics and zeroing in on the key performance indicators (KPIs) that truly reflect operational health and business value.

This is how you demonstrate that your new system is a profit center, not just a line item in the budget.

For an AI insurance company, this comes down to how a claims AI directly slashes cycle times and improves settlement accuracy. For a bank, it's about how AI customer care boosts resolution rates while navigating a maze of compliance rules. The ultimate goal is to build a data-backed narrative that proves automation is making your organization faster, smarter, and more efficient.

Identifying KPIs That Truly Matter

Forget about generic metrics like the total number of chats handled. You need to focus on outcomes that show a tangible return. The right KPIs don't just highlight your wins; they also expose bottlenecks in your automated workflows, giving you the insights needed for continuous improvement.

These are the core metrics that should live on your dashboard:

First Contact Resolution (FCR): What percentage of issues are completely solved by the AI on the first try, without a human ever getting involved? A high FCR is a direct sign of AI effectiveness and a massive driver of cost savings.

Customer Satisfaction (CSAT): How do people actually feel about interacting with your AI? Sending a quick post-interaction survey is essential to ensure your efficiency gains aren't silently killing customer loyalty.

Claims Cycle Time: This is a non-negotiable metric for AI insurance companies. Track the average time from the First Notice of Loss (FNOL) to final resolution. A dramatic drop here is hard evidence that your AI is accelerating a core business function.

Cost-Per-Interaction: Run the numbers. Calculate the fully loaded cost of a human-led interaction and put it side-by-side with the cost of one handled by your AI agent. This simple comparison makes a powerful, bottom-line argument for your strategy.

Leveraging AI Data for Operational Insights

One of the most valuable, and often overlooked, benefits of an AI-driven system is the mountain of structured data it generates. Every single conversation is a goldmine of information you can use to spot operational risks and execution gaps before they snowball into major headaches.

By digging into conversation transcripts and outcomes, you can pinpoint recurring customer pain points, common reasons for escalation, or specific process steps where the AI stumbles. This feedback loop is invaluable. It lets you refine your AI's training data, update your SOPs, and improve both the automated and human sides of your service. For a real-world look at this in action, you can explore case studies about transforming insurance claims with agentic AI.

The data from your AI conversations is more than just a performance report—it's your early warning system. It gives you the visibility to proactively address systemic issues, whether it's an unclear policy clause or a broken step in your onboarding workflow.

Sample KPI Dashboard for Insurance Claims

Data is only useful if it's easy to understand. A well-designed dashboard gives leaders an at-a-glance view of how the AI is performing against critical business objectives. This is how you shift the conversation from abstract tech talk to concrete results.

Here’s a practical example of what a KPI dashboard for an insurance claims team might look like. It focuses on the metrics that both leadership and compliance teams care about most.

Metric Category | KPI | Target | Current Performance | Trend (MoM) |

|---|---|---|---|---|

Efficiency | AI Containment Rate | 75% | 82% | ▲ 5% |

Average Claims Cycle Time | < 48 Hours | 36 Hours | ▼ 10 Hours | |

Quality | CSAT (AI Interactions) | > 4.5/5 | 4.6/5 | ▲ 0.1 |

Escalation Rate | < 15% | 11% | ▼ 2% | |

Cost | Cost-Per-Claim (AI vs. Human) | < $15 | $8 | - |

This kind of clear, quantifiable reporting builds confidence in your AI strategy across the entire organization. It provides the indisputable proof you need to show that your approach to managing customer communication is not only meeting but exceeding business goals, turning a major investment into a clear competitive advantage.

Answering the Tough Questions About AI in Customer Communication

When you're leading a team in financial services, bringing in new technology like AI naturally comes with some tough, practical questions. The stakes are high—compliance is non-negotiable and customer trust is everything. Let's tackle some of the most common concerns I hear from leaders just like you.

Will AI Replace Our Human Agents?

This is easily the most frequent question, and the answer is a firm no. The goal isn't replacement; it's about making your best people even better.

Think of an AI customer care agent as a force multiplier. They are exceptionally good at handling the high-volume, predictable tasks that burn out even the most dedicated employees. We're talking about the initial data gathering for a new insurance claim or answering the same basic policy questions over and over, 24/7.

By taking that work off their plate, your experienced human agents are freed up to handle what they do best: high-value, high-empathy interactions. They can now dedicate their full attention to calming a distressed client through a complicated claim, untangling a tricky fraud case, or giving nuanced advice that only a human can. This hybrid approach doesn't just make your team more productive; it boosts morale and delivers faster service on the front end while saving your best people for the moments that truly matter.

The real power of AI is in elevating your human team from process-followers to expert problem-solvers. It lets them focus on the critical moments that define your customer relationships.

How Can We Ensure AI Stays Compliant?

Keeping AI in check from a compliance standpoint isn't about one single thing; it's a multi-layered strategy. This is especially true for AI insurance companies that are stewards of incredibly sensitive customer data.

Here's how we've seen it work best:

Start with a Secure Foundation: The AI platform you choose must be built on a secure, auditable framework. Look for essential certifications like SOC 2 Type II, which independently verifies the platform's security and data confidentiality practices. It's a non-negotiable starting point.

Train It on Your Rules: The AI agents can't be generic. They must be trained specifically on your company's Standard Operating Procedures (SOPs). This creates strict operational guardrails, effectively locking the AI into your pre-approved workflows and preventing it from ever going "off-script."

Demand Immutable Audit Trails: Every single action the AI takes—every interaction, every data lookup, every decision—has to be logged in a tamper-proof audit trail. This gives your compliance officers a complete, transparent record to review any case and prove you followed every regulation to the letter.

On top of all that, you need seamless, automatic escalation paths to a human agent for any situation that falls outside the lines. This ensures a person is always in ultimate control.

What Does Integration with Core Systems Actually Look Like?

This is where many people expect a massive, painful project, but modern AI platforms are built to avoid that. They're designed to connect smoothly with the systems you already rely on, using APIs (Application Programming Interfaces) to talk to platforms like Guidewire or Salesforce. There's no "rip and replace" needed.

The process typically starts with mapping out your key operational workflows to pinpoint where data needs to flow. The AI platform then uses your systems' existing APIs to both pull and push information in real-time.

For example, an AI agent could instantly query your policy system to verify a customer's coverage during a first notice of loss call. Once it collects all the initial details, it then writes that information directly into a new file in your claims management system. This API-first approach means the AI acts as an intelligent layer on top of your current technology stack, making your existing systems smarter without a disruptive overhaul. It's also how you get ahead of common negative claims AI reviews, by ensuring data is captured accurately from the very first touchpoint.

Ready to see how intelligent automation can transform your high-stakes operations? Nolana deploys compliant, auditable AI agents trained on your specific workflows to automate claims, case management, and customer care. Discover how Nolana can help you accelerate cycle times and reduce costs today.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP