Sapiens Insurance AI: How to Transform Claims and Customer Care

Sapiens Insurance AI: How to Transform Claims and Customer Care

Discover how Sapiens Insurance provides the foundation for AI automation, transforming claims processing and customer care for modern insurance companies.

Think of the Sapiens insurance platform as the digital backbone for today's insurance carriers. It’s built to pull insurers out of the world of clunky, outdated legacy systems and into a more modern, efficient operational model. At its heart, it acts as the central nervous system for an insurer, handling everything from the nitty-gritty of policy administration and billing to the complexities of claims and underwriting.

The Foundation of Modern Insurance Operations

Picture an insurance carrier as a sprawling city. You've got policyholders, adjusters, underwriters, and regulators—all interacting and generating a constant flood of information. Without a central plan, that city quickly becomes a chaotic mess. The Sapiens platform is that plan, creating a single, reliable "system of record" where every piece of data has its place.

This is more than just good housekeeping. It means that when a customer calls to file a claim, the adjuster isn't digging through different systems to find the right policy details or payment history. Everything is right there. This approach breaks down the data silos that so often hamstring carriers stuck with fragmented, decades-old software. For any operations leader or CTO, this stability is the non-negotiable first step toward real innovation.

Why a Strong Core System Matters

You can't build a skyscraper on a shaky foundation. The same is true for advanced tech like artificial intelligence in insurance. AI insurance companies can't automate anything if their core data is a mess. A platform like Sapiens provides the clean, structured data that AI tools need to work reliably.

For example, you can't automate a claim without instantly pulling the correct policy terms. You can't deliver personalized AI customer care without a complete, 360-degree view of the policyholder. Sapiens is designed to create that essential operational stability.

An insurer's ability to innovate is directly tied to the strength of its core systems. Without a modern, API-enabled platform, attempts to deploy AI and automation are often hindered by data fragmentation and legacy constraints, leading to disappointing claims AI reviews and poor customer outcomes.

The table below offers a quick snapshot of how Sapiens positions itself as a foundational solution for insurers.

Sapiens Insurance Platform at a Glance

Core Function | Primary Benefit for Insurers | Key Modules |

|---|---|---|

Policy Administration | Centralizes policy lifecycle management from quoting to renewal. | PolicyPro, IDITSuite |

Billing & Collections | Automates premium collection, invoicing, and financial reconciliation. | Sapiens Billing |

Claims Management | Manages the entire claims process for faster, more accurate settlements. | ClaimsPro, Sapiens Claims |

Underwriting | Provides tools for risk assessment, pricing, and decision-making. | UnderwritingPro |

Digital & API Layer | Enables integration with third-party apps, portals, and insurtechs. | Sapiens DigitalSuite |

Ultimately, these components work together to create a single source of truth, which is the launchpad for any meaningful digital initiative.

Building for the Future of Insurance

Sapiens International Corporation has carved out a significant space in the global insurance software market. The company serves as the core system for over 600 insurance carriers worldwide. While that number is impressive, it also highlights the opportunity—many of the roughly 11,000 carriers globally are still running on technology that belongs in a museum.

By getting all operations onto a single platform, Sapiens helps insurers:

Roll out new products much faster.

Keep up with ever-changing regulatory demands.

Deliver a consistent, smooth customer experience.

This foundational layer is where the journey to operational excellence begins. It sets the stage for integrating more sophisticated tools and automation. For a closer look at what it takes to build these kinds of powerful systems, our guide on insurance software development is a great place to start. It helps frame the transition from simply managing data to using it for intelligent, business-driving automation.

A Look Inside Sapiens’ Core Insurance Modules

To really understand what makes the Sapiens insurance platform tick, you have to look under the hood at its core engines. These modules are the workhorses that handle the daily business of insurance, from selling a new policy to settling a complex claim. Think of the platform as a well-organized workshop; each module is a specialized workstation built for a specific, crucial task.

The entire suite is split into two main camps: one for Property & Casualty (P&C) and another for Life, Pensions, and Annuities (L&A). Each side has its own flagship system, built from the ground up to meet the unique demands of that market. This design gives carriers a solid operational base and allows them to pick the tools that fit their business lines perfectly.

Powering Property and Casualty Operations

For P&C carriers, the foundation is the Sapiens IDITSuite. This is a comprehensive system that manages the entire policy lifecycle for personal, commercial, and specialty lines. It's the engine that drives quoting, underwriting, policy issuance, billing, and renewals.

Let's put this into a real-world context. Imagine a large insurer wants to launch an innovative usage-based auto insurance product. With IDITSuite's configuration tools, they can define new rules and rating factors in just a few weeks. On a legacy platform, a project like this could get bogged down in months of complex, expensive custom coding.

The suite's footprint in the enterprise space is hard to ignore. Data shows that 33 companies are actively using Sapiens IDIT. What's telling is that 47% of these are large organizations with over 1,000 employees. Even more striking, 50% of these users pull in more than $1 billion in annual revenue, confirming its adoption by major industry players.

Driving Life and Pension Management

On the other side of the aisle is the Sapiens CoreSuite for Life, Pensions, and Annuities. This module is built for the long-term, relationship-focused nature of the life and retirement business. It’s designed to handle intricate products, from individual life policies to group pensions and complex annuity payouts.

Its real power is in how it consolidates all policyholder information into a single, clean record. For instance, when a customer with multiple products calls, a service agent can see their entire relationship with the company in one view. No more toggling between siloed systems. This unified perspective is the key to providing high-quality, personalized service.

A core system’s true value is measured by its agility. The ability to centralize data and quickly configure new products allows an insurer to respond to market demands, not just react to them. This is the difference between leading the industry and struggling to keep up.

The Impact on Claims and Customer Workflows

Both suites come with specialized claims management modules, which are absolutely critical for operational success. A well-structured claims process within Sapiens ensures all the necessary data—policy details, customer history, and incident reports—is organized right from the start. This clean data foundation is essential for any effective automation that comes next.

This is where AI can make a dramatic difference. By integrating intelligent automation, insurers move beyond basic administration. This is especially vital in claims, where speed and accuracy have a direct line to customer satisfaction and the bottom line. To see how this works in practice, you can explore our guide on applying AI in insurance claims.

The core system acts as the reliable data provider, while AI serves as the intelligent task executor—a combination modern insurers need to compete.

Using AI to Automate Insurance Claims in Sapiens

Automating insurance claims with AI is where the rubber meets the road. The claims process is traditionally slow, manual, and full of friction, which inflates costs and damages customer relationships. This is a story that AI insurance companies are rapidly rewriting. The real magic happens when you pair a solid core system like Sapiens insurance with the power of artificial intelligence. Think of Sapiens as the foundation—it provides the clean data, structured workflows, and the definitive system of record.

With that strong foundation in place, AI can be layered on top to execute tasks with incredible speed and accuracy. This partnership transforms a clunky, linear process into a smart, automated workflow for handling insurance claims.

The Foundational Role of Sapiens in Claims

Before you can even think about automating claims with AI, you have to get your data house in order. The Sapiens claims module is built to do just that. When a First Notice of Loss (FNOL) comes in, the platform captures and organizes all the essential information: policy details, customer history, and the initial incident report.

This step is non-negotiable. If you feed an AI messy, inconsistent data, you'll get messy, inconsistent results. It's that simple. Sapiens establishes a single source of truth that an AI can trust, ensuring every automated decision is grounded in accurate, verified information.

The success of any claims automation initiative hinges on the quality of the underlying data. A robust core system like Sapiens acts as the bedrock, providing the clean, structured information that allows AI to move from simple task execution to intelligent decision-making.

This is what separates modern platforms from legacy systems. Older systems often create data silos that make reliable automation nearly impossible. A platform like Sapiens, however, is designed for integration, setting the stage for more advanced technologies to step in and shine.

Layering AI for Intelligent Automation

Once your Sapiens foundation is solid, you can bring in AI to tackle the repetitive, high-volume tasks that clog up the claims lifecycle. This isn't about replacing your experienced adjusters. It’s about freeing them from the administrative grind so they can focus on higher-value work.

Here’s a practical look at how automating insurance claims with AI plays out:

Instant Triage: The moment a new claim is filed in Sapiens, an AI agent can ingest it.

Data Enrichment: The AI immediately pulls policy details, verifies coverage, and reviews the customer's interaction history.

Initial Analysis: If the claim includes photos or documents, AI-powered computer vision can perform a preliminary damage assessment, flagging potential fraud indicators or gauging the loss severity.

Smart Routing: Based on its findings, the AI intelligently routes the claim. A simple, low-cost claim might get fast-tracked for straight-through processing. A more complex case gets assigned to a specialized human adjuster, who receives a complete, actionable summary.

This whole sequence can unfold in minutes, not days. The impact on claim cycle times is massive, a common thread you’ll see in positive claims AI reviews. For claims leaders, this means lower operating costs and, more importantly, happier customers. We dig deeper into this in our guide to insurance claims processing automation, which breaks down exactly how AI reshapes these workflows.

The Impact on Customer Experience and Operational Costs

When you integrate AI with a core system like Sapiens, you see a direct and powerful impact on the two metrics that matter most: customer satisfaction and operational efficiency. When a claim is handled quickly and transparently, you build immense trust with your policyholder. That positive experience is a huge competitive advantage.

At the same time, automating the routine work lets your skilled adjusters do what they do best—handle tough negotiations, show empathy to customers in crisis, and make crucial judgment calls. Not only does this improve their own job satisfaction, but it also ensures your best people are focused on the most critical work.

By combining the structural integrity of the Sapiens platform with the intelligent execution of AI, insurers can finally move beyond outdated, manual processes and build a claims operation that’s ready for the future.

Elevating Customer Care with AI Integration

In today's market for financial services, exceptional customer experience isn't just a nice-to-have; it's the price of entry. Policyholders expect quick, accurate, and personalized service. A single bad interaction can send them looking for a new carrier. The biggest roadblock for most insurers? Fragmented data. Customer information is often siloed in different systems, leaving service agents without the full story when they're on a live call.

This is exactly why a modern core system like the Sapiens insurance platform is so critical. It creates a single source of truth, pulling every policy detail, interaction history, and claim file into one unified view. Once you have that clean, organized data, you can unlock the next level of service: AI customer care.

From Data Hub to Intelligent Action

Think of your Sapiens platform as the central nervous system for all customer information. It holds every piece of data, perfectly organized and ready to go. But data just sitting there doesn't do much on its own. The real magic happens when you connect that system to an intelligent agent that can act on the information.

That's where AI-powered customer care platforms come in. They plug into Sapiens via APIs and become the "system of action." Instead of a human agent manually digging through files, an AI agent can find, interpret, and act on that information in a split second.

A core system like Sapiens provides the 'what'—the complete history of a customer's relationship with you. AI provides the 'how'—the ability to use that information in real-time to solve problems, answer questions, and get things done instantly.

This fundamentally changes the customer service dynamic. You move from a reactive, often cumbersome process to a proactive and incredibly efficient engagement.

A Practical Use Case: AI Customer Care in Action

Let’s see how AI customer care for financial services plays out in a real-world scenario. Imagine a long-time customer calls with a tricky question about their auto policy. They're planning an international trip and need to know if their coverage extends to a rental car abroad and what their options are.

In a traditional call center, this simple query can become a drawn-out affair. The agent puts the customer on hold, toggles between multiple screens, skims through dense policy documents, and might even have to escalate the call. The customer gets frustrated, and the cost of handling that call goes up.

Now, let's run that same scenario with an AI agent connected to Sapiens:

Instant Recognition: The moment the call connects, the AI identifies the customer from their phone number. It instantly queries Sapiens and pulls up their complete profile—active policies, claim history, and past conversations.

Understanding the Real Question: The customer asks about the rental car. The AI uses natural language understanding to grasp the true intent: this isn't just about a car, it's about the specifics of international coverage.

Split-Second Data Retrieval: The AI agent accesses the customer's exact auto policy terms within Sapiens, checks them against the insurer’s knowledge base for international travel, and comes back with a clear, accurate answer in seconds.

Immediate Resolution: The AI explains that their current policy doesn't cover rentals abroad but immediately presents two approved rider options with pricing. The customer picks one, and the AI processes the policy update on the spot, writing the change back to the Sapiens platform and sending a confirmation email before the call even ends.

The entire issue is resolved in one quick, seamless conversation. That’s the power of connecting a system of record with a system of action. This kind of responsiveness is what sets leading AI insurance companies apart on customer experience. For a deeper look at how this works, check out our guide on the core principles of AI customer care.

This efficiency has a massive impact on how customers see your brand, which you'll see reflected in claims AI reviews and overall service feedback. When both claims and customer care are powered by smart automation, the policyholder gets a consistently great experience at every turn, which is how you build real, lasting loyalty.

How AI Agents Supercharge Your Sapiens Investment

Investing in a core system like the Sapiens insurance platform is a massive commitment, but it's one that builds a solid foundation for your entire operation. It creates your "system of record"—the single source of truth for all your data and processes. But to get the most out of that investment, you need a "system of action" that can intelligently execute tasks on top of that foundation.

This is exactly where AI agents come into the picture.

Think of Sapiens as a car’s high-performance engine and chassis—it’s the powerful, reliable core. AI agents, like those from Nolana, are the advanced driver-assist system. They navigate the tricky twists and turns of complex workflows, make smart decisions on the fly, and execute tasks with precision, all powered by the core engine.

These aren't just generic chatbots. They are trained specifically on your company's unique Standard Operating Procedures (SOPs), so they know how you do business. They integrate directly with Sapiens, operate within strict compliance rules, and are smart enough to know when a problem needs to be handed off to a human expert.

A New Workflow Paradigm: Sapiens And AI Together

The difference between a standard Sapiens workflow and one boosted by AI is night and day. In a typical setup, your employees are the bridge between the data in Sapiens and the actions that need to be taken. They have to manually pull information, make a decision, and then execute the next step. Sapiens makes the data easy to find, but the process is still bound by human speed and availability.

When you add AI agents, they become that bridge. They can instantly access Sapiens data, interpret it based on your business rules, and see a task through from start to finish. It’s an exponential leap in efficiency and consistency. The best AI insurance companies are the ones that have mastered this symbiotic relationship between their core systems and intelligent automation.

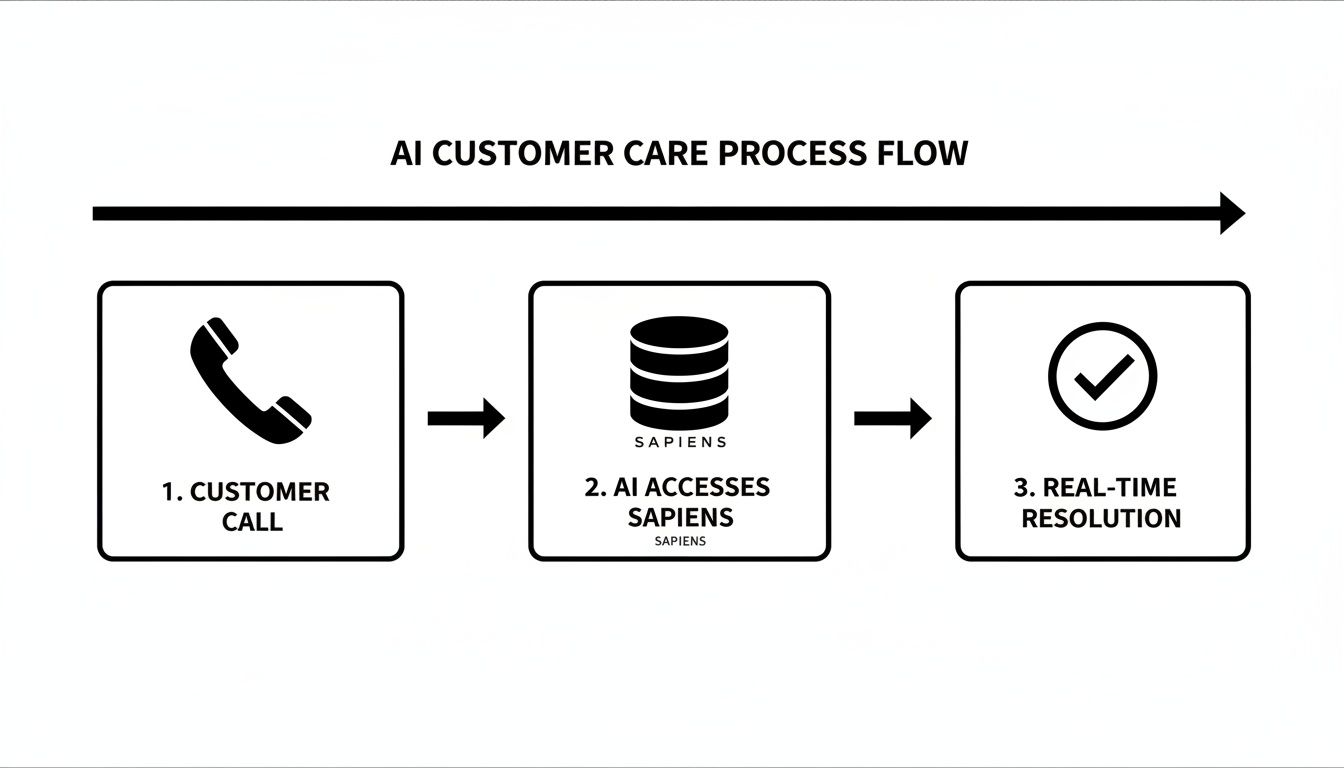

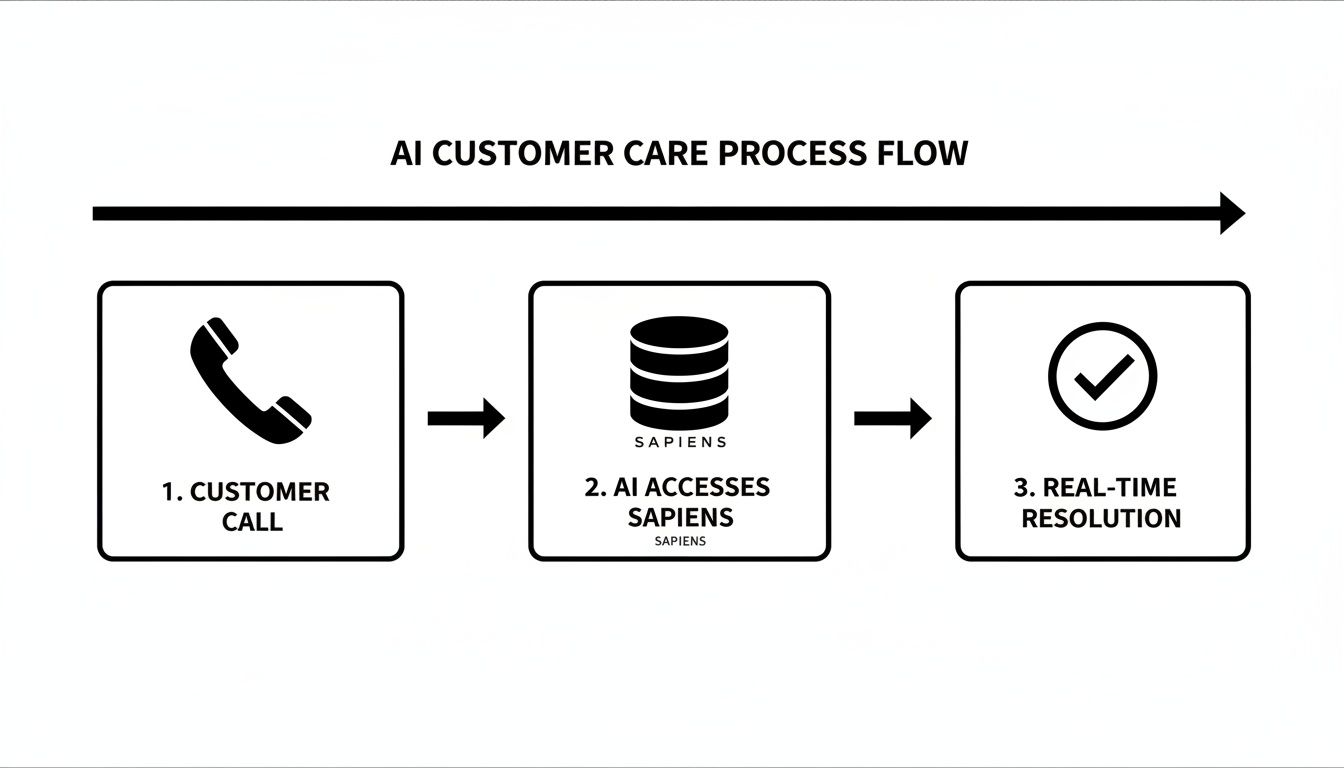

This visual shows just how much simpler customer interactions become when an AI agent connects directly to your Sapiens system.

This simple flow—from a customer's first call to an AI-driven resolution—gets rid of all the manual handoffs and delays that frustrate everyone involved.

Automating High-Stakes Operations

This combination of Sapiens and AI is a game-changer in high-stakes areas like claims processing and AI customer care. In claims, for instance, an AI agent can handle the entire intake process. It can manage initial data entry, validate information against Sapiens records, run preliminary fraud checks, and assign the claim to the right person.

This frees up your human adjusters to focus on what they do best: handling complex negotiations and providing empathetic customer support. It's a shift that frequently comes up in positive claims AI reviews.

The industry is clearly moving in this direction. Recent wins, like Bankers Insurance Group choosing Sapiens for its digital modernization, show the platform’s momentum. For risk and compliance teams, the focus on AI and ecosystem partnerships—which is exactly where Nolana's integrations fit in—delivers a new level of accuracy and control. You can read more about these modernization trends and Sapiens' financial performance and strategic direction on prnewswire.com.

The goal of automation isn't to replace your core system but to activate it. AI agents turn the passive data sitting in Sapiens into active, intelligent work that drives processes forward without needing someone to constantly click the "next" button.

This partnership delivers real, measurable results. It shortens cycle times, slashes operational costs, and gives customers a much better experience with faster, more accurate service. For a closer look at what's possible, you can check out our detailed guide to AI agent use cases in insurance and other financial sectors.

To make this crystal clear, the table below shows a side-by-side comparison for a common claims process.

Workflow Comparison Traditional Sapiens vs Sapiens with Nolana AI

The following table illustrates how integrating Nolana's AI agents transforms a standard claims workflow within the Sapiens platform, highlighting key efficiency gains at each step.

Process Step | Standard Sapiens Workflow | Sapiens + Nolana AI Workflow |

|---|---|---|

FNOL Intake | A customer service representative manually enters claim details into Sapiens. | An AI agent captures details from a call or digital form and instantly creates the claim record in Sapiens. |

Policy Verification | The agent manually searches Sapiens to confirm coverage, limits, and deductibles. | The AI agent automatically verifies policy details against the Sapiens record in milliseconds. |

Initial Assessment | The claim is placed in a queue for a human adjuster to review and triage. | The AI agent performs an initial assessment, flags potential issues, and routes it to the correct adjuster with a full summary. |

Customer Updates | The customer waits for a human to provide a status update via phone or email. | The AI agent sends proactive, real-time status updates as the claim progresses through Sapiens workflows. |

By automating these foundational steps, insurers empower their teams to focus on the high-value moments that truly matter, turning their Sapiens investment into a real competitive advantage.

Common Questions About Sapiens Insurance and AI

As insurance leaders look at modernizing their core systems, a lot of practical questions come up, especially around integrating something as powerful as artificial intelligence. Moving to a platform like Sapiens is a big step, but pairing it with AI automation is a complete operational shift.

This section tackles the most common questions we hear, offering straight answers to guide your thinking as you work to build a smarter, more responsive insurance operation.

How Does AI Actually Automate Insurance Claims?

Automating claims isn't about flipping a switch. It's a series of connected steps that absolutely depend on the clean, organized data you get from a core system like Sapiens.

Think of Sapiens as your meticulously organized library of every policy and customer detail. AI is the expert librarian who doesn't just find the right information in seconds but also reads it, understands it, and recommends what to do next. This partnership is what really sets leading AI insurance companies apart.

When a claim comes in, an AI agent plugged into Sapiens gets to work immediately:

It pulls in and digitizes information from any source—a phone call, an email, or a web form.

It instantly checks the policy against the Sapiens record to confirm coverage and limits.

It analyzes documents and photos for an initial damage assessment and flags potential fraud.

The AI then triages the claim, fast-tracking simple ones for immediate settlement and sending the complex cases to the right adjuster with a full summary already prepared.

This process eliminates the soul-crushing manual data entry and review that bogs down so many claims departments. It’s no surprise that claims AI reviews often highlight this speed. The result? The claims process can kick off within minutes of the first notice of loss, not days.

What Does AI Do for Customer Care?

The same logic applies to AI customer care. Every customer interaction is a moment of truth, and AI's job is to make sure it's a good one by delivering instant, accurate, and personal service. It helps turn the contact center from a cost center into an engine for building loyalty.

With a live connection to the Sapiens customer record, an AI agent can handle a huge range of inquiries without needing a person. This isn't just about basic FAQs; we're talking about answering complex policy questions, processing endorsements, and walking customers through the entire claims process.

For instance, an AI agent can pull up a customer's entire history in real-time to give a precise answer about coverage for a specific event. It can then process the necessary policy change on the spot and send a confirmation email before the customer even hangs up the phone. Delivering that level of service consistently is almost impossible with human agents alone, especially when they're stuck toggling between multiple old systems.

The real power of AI in customer service is how it turns a system of record into a system of action. Sapiens holds the customer's story; AI uses that story to solve their problem instantly.

Can AI Integrate with Our Customized Sapiens Setup?

Yes, and this is a crucial question for most insurance carriers. Modern AI automation platforms are built to be flexible. They connect to core systems like Sapiens using standard APIs, which act as a universal language between the two.

Even if you have a heavily customized Sapiens instance, AI agents can tap into the underlying data and business logic as long as those API connections are open.

The key is that these AI agents aren't generic chatbots. They are trained specifically on your Standard Operating Procedures (SOPs). This training teaches them to work with your custom fields, unique business rules, and the specific processes that make your company what it is. This ensures the automation fits your existing workflows and compliance standards like a glove.

Ready to see how intelligent automation can supercharge your Sapiens investment? Nolana deploys compliant AI agents that automate complex claims and customer service workflows from end to end. Learn how Nolana can transform your operations.

Think of the Sapiens insurance platform as the digital backbone for today's insurance carriers. It’s built to pull insurers out of the world of clunky, outdated legacy systems and into a more modern, efficient operational model. At its heart, it acts as the central nervous system for an insurer, handling everything from the nitty-gritty of policy administration and billing to the complexities of claims and underwriting.

The Foundation of Modern Insurance Operations

Picture an insurance carrier as a sprawling city. You've got policyholders, adjusters, underwriters, and regulators—all interacting and generating a constant flood of information. Without a central plan, that city quickly becomes a chaotic mess. The Sapiens platform is that plan, creating a single, reliable "system of record" where every piece of data has its place.

This is more than just good housekeeping. It means that when a customer calls to file a claim, the adjuster isn't digging through different systems to find the right policy details or payment history. Everything is right there. This approach breaks down the data silos that so often hamstring carriers stuck with fragmented, decades-old software. For any operations leader or CTO, this stability is the non-negotiable first step toward real innovation.

Why a Strong Core System Matters

You can't build a skyscraper on a shaky foundation. The same is true for advanced tech like artificial intelligence in insurance. AI insurance companies can't automate anything if their core data is a mess. A platform like Sapiens provides the clean, structured data that AI tools need to work reliably.

For example, you can't automate a claim without instantly pulling the correct policy terms. You can't deliver personalized AI customer care without a complete, 360-degree view of the policyholder. Sapiens is designed to create that essential operational stability.

An insurer's ability to innovate is directly tied to the strength of its core systems. Without a modern, API-enabled platform, attempts to deploy AI and automation are often hindered by data fragmentation and legacy constraints, leading to disappointing claims AI reviews and poor customer outcomes.

The table below offers a quick snapshot of how Sapiens positions itself as a foundational solution for insurers.

Sapiens Insurance Platform at a Glance

Core Function | Primary Benefit for Insurers | Key Modules |

|---|---|---|

Policy Administration | Centralizes policy lifecycle management from quoting to renewal. | PolicyPro, IDITSuite |

Billing & Collections | Automates premium collection, invoicing, and financial reconciliation. | Sapiens Billing |

Claims Management | Manages the entire claims process for faster, more accurate settlements. | ClaimsPro, Sapiens Claims |

Underwriting | Provides tools for risk assessment, pricing, and decision-making. | UnderwritingPro |

Digital & API Layer | Enables integration with third-party apps, portals, and insurtechs. | Sapiens DigitalSuite |

Ultimately, these components work together to create a single source of truth, which is the launchpad for any meaningful digital initiative.

Building for the Future of Insurance

Sapiens International Corporation has carved out a significant space in the global insurance software market. The company serves as the core system for over 600 insurance carriers worldwide. While that number is impressive, it also highlights the opportunity—many of the roughly 11,000 carriers globally are still running on technology that belongs in a museum.

By getting all operations onto a single platform, Sapiens helps insurers:

Roll out new products much faster.

Keep up with ever-changing regulatory demands.

Deliver a consistent, smooth customer experience.

This foundational layer is where the journey to operational excellence begins. It sets the stage for integrating more sophisticated tools and automation. For a closer look at what it takes to build these kinds of powerful systems, our guide on insurance software development is a great place to start. It helps frame the transition from simply managing data to using it for intelligent, business-driving automation.

A Look Inside Sapiens’ Core Insurance Modules

To really understand what makes the Sapiens insurance platform tick, you have to look under the hood at its core engines. These modules are the workhorses that handle the daily business of insurance, from selling a new policy to settling a complex claim. Think of the platform as a well-organized workshop; each module is a specialized workstation built for a specific, crucial task.

The entire suite is split into two main camps: one for Property & Casualty (P&C) and another for Life, Pensions, and Annuities (L&A). Each side has its own flagship system, built from the ground up to meet the unique demands of that market. This design gives carriers a solid operational base and allows them to pick the tools that fit their business lines perfectly.

Powering Property and Casualty Operations

For P&C carriers, the foundation is the Sapiens IDITSuite. This is a comprehensive system that manages the entire policy lifecycle for personal, commercial, and specialty lines. It's the engine that drives quoting, underwriting, policy issuance, billing, and renewals.

Let's put this into a real-world context. Imagine a large insurer wants to launch an innovative usage-based auto insurance product. With IDITSuite's configuration tools, they can define new rules and rating factors in just a few weeks. On a legacy platform, a project like this could get bogged down in months of complex, expensive custom coding.

The suite's footprint in the enterprise space is hard to ignore. Data shows that 33 companies are actively using Sapiens IDIT. What's telling is that 47% of these are large organizations with over 1,000 employees. Even more striking, 50% of these users pull in more than $1 billion in annual revenue, confirming its adoption by major industry players.

Driving Life and Pension Management

On the other side of the aisle is the Sapiens CoreSuite for Life, Pensions, and Annuities. This module is built for the long-term, relationship-focused nature of the life and retirement business. It’s designed to handle intricate products, from individual life policies to group pensions and complex annuity payouts.

Its real power is in how it consolidates all policyholder information into a single, clean record. For instance, when a customer with multiple products calls, a service agent can see their entire relationship with the company in one view. No more toggling between siloed systems. This unified perspective is the key to providing high-quality, personalized service.

A core system’s true value is measured by its agility. The ability to centralize data and quickly configure new products allows an insurer to respond to market demands, not just react to them. This is the difference between leading the industry and struggling to keep up.

The Impact on Claims and Customer Workflows

Both suites come with specialized claims management modules, which are absolutely critical for operational success. A well-structured claims process within Sapiens ensures all the necessary data—policy details, customer history, and incident reports—is organized right from the start. This clean data foundation is essential for any effective automation that comes next.

This is where AI can make a dramatic difference. By integrating intelligent automation, insurers move beyond basic administration. This is especially vital in claims, where speed and accuracy have a direct line to customer satisfaction and the bottom line. To see how this works in practice, you can explore our guide on applying AI in insurance claims.

The core system acts as the reliable data provider, while AI serves as the intelligent task executor—a combination modern insurers need to compete.

Using AI to Automate Insurance Claims in Sapiens

Automating insurance claims with AI is where the rubber meets the road. The claims process is traditionally slow, manual, and full of friction, which inflates costs and damages customer relationships. This is a story that AI insurance companies are rapidly rewriting. The real magic happens when you pair a solid core system like Sapiens insurance with the power of artificial intelligence. Think of Sapiens as the foundation—it provides the clean data, structured workflows, and the definitive system of record.

With that strong foundation in place, AI can be layered on top to execute tasks with incredible speed and accuracy. This partnership transforms a clunky, linear process into a smart, automated workflow for handling insurance claims.

The Foundational Role of Sapiens in Claims

Before you can even think about automating claims with AI, you have to get your data house in order. The Sapiens claims module is built to do just that. When a First Notice of Loss (FNOL) comes in, the platform captures and organizes all the essential information: policy details, customer history, and the initial incident report.

This step is non-negotiable. If you feed an AI messy, inconsistent data, you'll get messy, inconsistent results. It's that simple. Sapiens establishes a single source of truth that an AI can trust, ensuring every automated decision is grounded in accurate, verified information.

The success of any claims automation initiative hinges on the quality of the underlying data. A robust core system like Sapiens acts as the bedrock, providing the clean, structured information that allows AI to move from simple task execution to intelligent decision-making.

This is what separates modern platforms from legacy systems. Older systems often create data silos that make reliable automation nearly impossible. A platform like Sapiens, however, is designed for integration, setting the stage for more advanced technologies to step in and shine.

Layering AI for Intelligent Automation

Once your Sapiens foundation is solid, you can bring in AI to tackle the repetitive, high-volume tasks that clog up the claims lifecycle. This isn't about replacing your experienced adjusters. It’s about freeing them from the administrative grind so they can focus on higher-value work.

Here’s a practical look at how automating insurance claims with AI plays out:

Instant Triage: The moment a new claim is filed in Sapiens, an AI agent can ingest it.

Data Enrichment: The AI immediately pulls policy details, verifies coverage, and reviews the customer's interaction history.

Initial Analysis: If the claim includes photos or documents, AI-powered computer vision can perform a preliminary damage assessment, flagging potential fraud indicators or gauging the loss severity.

Smart Routing: Based on its findings, the AI intelligently routes the claim. A simple, low-cost claim might get fast-tracked for straight-through processing. A more complex case gets assigned to a specialized human adjuster, who receives a complete, actionable summary.

This whole sequence can unfold in minutes, not days. The impact on claim cycle times is massive, a common thread you’ll see in positive claims AI reviews. For claims leaders, this means lower operating costs and, more importantly, happier customers. We dig deeper into this in our guide to insurance claims processing automation, which breaks down exactly how AI reshapes these workflows.

The Impact on Customer Experience and Operational Costs

When you integrate AI with a core system like Sapiens, you see a direct and powerful impact on the two metrics that matter most: customer satisfaction and operational efficiency. When a claim is handled quickly and transparently, you build immense trust with your policyholder. That positive experience is a huge competitive advantage.

At the same time, automating the routine work lets your skilled adjusters do what they do best—handle tough negotiations, show empathy to customers in crisis, and make crucial judgment calls. Not only does this improve their own job satisfaction, but it also ensures your best people are focused on the most critical work.

By combining the structural integrity of the Sapiens platform with the intelligent execution of AI, insurers can finally move beyond outdated, manual processes and build a claims operation that’s ready for the future.

Elevating Customer Care with AI Integration

In today's market for financial services, exceptional customer experience isn't just a nice-to-have; it's the price of entry. Policyholders expect quick, accurate, and personalized service. A single bad interaction can send them looking for a new carrier. The biggest roadblock for most insurers? Fragmented data. Customer information is often siloed in different systems, leaving service agents without the full story when they're on a live call.

This is exactly why a modern core system like the Sapiens insurance platform is so critical. It creates a single source of truth, pulling every policy detail, interaction history, and claim file into one unified view. Once you have that clean, organized data, you can unlock the next level of service: AI customer care.

From Data Hub to Intelligent Action

Think of your Sapiens platform as the central nervous system for all customer information. It holds every piece of data, perfectly organized and ready to go. But data just sitting there doesn't do much on its own. The real magic happens when you connect that system to an intelligent agent that can act on the information.

That's where AI-powered customer care platforms come in. They plug into Sapiens via APIs and become the "system of action." Instead of a human agent manually digging through files, an AI agent can find, interpret, and act on that information in a split second.

A core system like Sapiens provides the 'what'—the complete history of a customer's relationship with you. AI provides the 'how'—the ability to use that information in real-time to solve problems, answer questions, and get things done instantly.

This fundamentally changes the customer service dynamic. You move from a reactive, often cumbersome process to a proactive and incredibly efficient engagement.

A Practical Use Case: AI Customer Care in Action

Let’s see how AI customer care for financial services plays out in a real-world scenario. Imagine a long-time customer calls with a tricky question about their auto policy. They're planning an international trip and need to know if their coverage extends to a rental car abroad and what their options are.

In a traditional call center, this simple query can become a drawn-out affair. The agent puts the customer on hold, toggles between multiple screens, skims through dense policy documents, and might even have to escalate the call. The customer gets frustrated, and the cost of handling that call goes up.

Now, let's run that same scenario with an AI agent connected to Sapiens:

Instant Recognition: The moment the call connects, the AI identifies the customer from their phone number. It instantly queries Sapiens and pulls up their complete profile—active policies, claim history, and past conversations.

Understanding the Real Question: The customer asks about the rental car. The AI uses natural language understanding to grasp the true intent: this isn't just about a car, it's about the specifics of international coverage.

Split-Second Data Retrieval: The AI agent accesses the customer's exact auto policy terms within Sapiens, checks them against the insurer’s knowledge base for international travel, and comes back with a clear, accurate answer in seconds.

Immediate Resolution: The AI explains that their current policy doesn't cover rentals abroad but immediately presents two approved rider options with pricing. The customer picks one, and the AI processes the policy update on the spot, writing the change back to the Sapiens platform and sending a confirmation email before the call even ends.

The entire issue is resolved in one quick, seamless conversation. That’s the power of connecting a system of record with a system of action. This kind of responsiveness is what sets leading AI insurance companies apart on customer experience. For a deeper look at how this works, check out our guide on the core principles of AI customer care.

This efficiency has a massive impact on how customers see your brand, which you'll see reflected in claims AI reviews and overall service feedback. When both claims and customer care are powered by smart automation, the policyholder gets a consistently great experience at every turn, which is how you build real, lasting loyalty.

How AI Agents Supercharge Your Sapiens Investment

Investing in a core system like the Sapiens insurance platform is a massive commitment, but it's one that builds a solid foundation for your entire operation. It creates your "system of record"—the single source of truth for all your data and processes. But to get the most out of that investment, you need a "system of action" that can intelligently execute tasks on top of that foundation.

This is exactly where AI agents come into the picture.

Think of Sapiens as a car’s high-performance engine and chassis—it’s the powerful, reliable core. AI agents, like those from Nolana, are the advanced driver-assist system. They navigate the tricky twists and turns of complex workflows, make smart decisions on the fly, and execute tasks with precision, all powered by the core engine.

These aren't just generic chatbots. They are trained specifically on your company's unique Standard Operating Procedures (SOPs), so they know how you do business. They integrate directly with Sapiens, operate within strict compliance rules, and are smart enough to know when a problem needs to be handed off to a human expert.

A New Workflow Paradigm: Sapiens And AI Together

The difference between a standard Sapiens workflow and one boosted by AI is night and day. In a typical setup, your employees are the bridge between the data in Sapiens and the actions that need to be taken. They have to manually pull information, make a decision, and then execute the next step. Sapiens makes the data easy to find, but the process is still bound by human speed and availability.

When you add AI agents, they become that bridge. They can instantly access Sapiens data, interpret it based on your business rules, and see a task through from start to finish. It’s an exponential leap in efficiency and consistency. The best AI insurance companies are the ones that have mastered this symbiotic relationship between their core systems and intelligent automation.

This visual shows just how much simpler customer interactions become when an AI agent connects directly to your Sapiens system.

This simple flow—from a customer's first call to an AI-driven resolution—gets rid of all the manual handoffs and delays that frustrate everyone involved.

Automating High-Stakes Operations

This combination of Sapiens and AI is a game-changer in high-stakes areas like claims processing and AI customer care. In claims, for instance, an AI agent can handle the entire intake process. It can manage initial data entry, validate information against Sapiens records, run preliminary fraud checks, and assign the claim to the right person.

This frees up your human adjusters to focus on what they do best: handling complex negotiations and providing empathetic customer support. It's a shift that frequently comes up in positive claims AI reviews.

The industry is clearly moving in this direction. Recent wins, like Bankers Insurance Group choosing Sapiens for its digital modernization, show the platform’s momentum. For risk and compliance teams, the focus on AI and ecosystem partnerships—which is exactly where Nolana's integrations fit in—delivers a new level of accuracy and control. You can read more about these modernization trends and Sapiens' financial performance and strategic direction on prnewswire.com.

The goal of automation isn't to replace your core system but to activate it. AI agents turn the passive data sitting in Sapiens into active, intelligent work that drives processes forward without needing someone to constantly click the "next" button.

This partnership delivers real, measurable results. It shortens cycle times, slashes operational costs, and gives customers a much better experience with faster, more accurate service. For a closer look at what's possible, you can check out our detailed guide to AI agent use cases in insurance and other financial sectors.

To make this crystal clear, the table below shows a side-by-side comparison for a common claims process.

Workflow Comparison Traditional Sapiens vs Sapiens with Nolana AI

The following table illustrates how integrating Nolana's AI agents transforms a standard claims workflow within the Sapiens platform, highlighting key efficiency gains at each step.

Process Step | Standard Sapiens Workflow | Sapiens + Nolana AI Workflow |

|---|---|---|

FNOL Intake | A customer service representative manually enters claim details into Sapiens. | An AI agent captures details from a call or digital form and instantly creates the claim record in Sapiens. |

Policy Verification | The agent manually searches Sapiens to confirm coverage, limits, and deductibles. | The AI agent automatically verifies policy details against the Sapiens record in milliseconds. |

Initial Assessment | The claim is placed in a queue for a human adjuster to review and triage. | The AI agent performs an initial assessment, flags potential issues, and routes it to the correct adjuster with a full summary. |

Customer Updates | The customer waits for a human to provide a status update via phone or email. | The AI agent sends proactive, real-time status updates as the claim progresses through Sapiens workflows. |

By automating these foundational steps, insurers empower their teams to focus on the high-value moments that truly matter, turning their Sapiens investment into a real competitive advantage.

Common Questions About Sapiens Insurance and AI

As insurance leaders look at modernizing their core systems, a lot of practical questions come up, especially around integrating something as powerful as artificial intelligence. Moving to a platform like Sapiens is a big step, but pairing it with AI automation is a complete operational shift.

This section tackles the most common questions we hear, offering straight answers to guide your thinking as you work to build a smarter, more responsive insurance operation.

How Does AI Actually Automate Insurance Claims?

Automating claims isn't about flipping a switch. It's a series of connected steps that absolutely depend on the clean, organized data you get from a core system like Sapiens.

Think of Sapiens as your meticulously organized library of every policy and customer detail. AI is the expert librarian who doesn't just find the right information in seconds but also reads it, understands it, and recommends what to do next. This partnership is what really sets leading AI insurance companies apart.

When a claim comes in, an AI agent plugged into Sapiens gets to work immediately:

It pulls in and digitizes information from any source—a phone call, an email, or a web form.

It instantly checks the policy against the Sapiens record to confirm coverage and limits.

It analyzes documents and photos for an initial damage assessment and flags potential fraud.

The AI then triages the claim, fast-tracking simple ones for immediate settlement and sending the complex cases to the right adjuster with a full summary already prepared.

This process eliminates the soul-crushing manual data entry and review that bogs down so many claims departments. It’s no surprise that claims AI reviews often highlight this speed. The result? The claims process can kick off within minutes of the first notice of loss, not days.

What Does AI Do for Customer Care?

The same logic applies to AI customer care. Every customer interaction is a moment of truth, and AI's job is to make sure it's a good one by delivering instant, accurate, and personal service. It helps turn the contact center from a cost center into an engine for building loyalty.

With a live connection to the Sapiens customer record, an AI agent can handle a huge range of inquiries without needing a person. This isn't just about basic FAQs; we're talking about answering complex policy questions, processing endorsements, and walking customers through the entire claims process.

For instance, an AI agent can pull up a customer's entire history in real-time to give a precise answer about coverage for a specific event. It can then process the necessary policy change on the spot and send a confirmation email before the customer even hangs up the phone. Delivering that level of service consistently is almost impossible with human agents alone, especially when they're stuck toggling between multiple old systems.

The real power of AI in customer service is how it turns a system of record into a system of action. Sapiens holds the customer's story; AI uses that story to solve their problem instantly.

Can AI Integrate with Our Customized Sapiens Setup?

Yes, and this is a crucial question for most insurance carriers. Modern AI automation platforms are built to be flexible. They connect to core systems like Sapiens using standard APIs, which act as a universal language between the two.

Even if you have a heavily customized Sapiens instance, AI agents can tap into the underlying data and business logic as long as those API connections are open.

The key is that these AI agents aren't generic chatbots. They are trained specifically on your Standard Operating Procedures (SOPs). This training teaches them to work with your custom fields, unique business rules, and the specific processes that make your company what it is. This ensures the automation fits your existing workflows and compliance standards like a glove.

Ready to see how intelligent automation can supercharge your Sapiens investment? Nolana deploys compliant AI agents that automate complex claims and customer service workflows from end to end. Learn how Nolana can transform your operations.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP