KYC Automation Solutions for Banking and Insurance

KYC Automation Solutions for Banking and Insurance

Discover how modern KYC automation solutions are transforming banking and insurance with AI-driven efficiency for customer care and claims processing.

At its core, a KYC automation solution is a sophisticated software tool that leverages technology like AI and machine learning to handle customer identity verification. It takes the slow, manual, and often error-prone processes of the past and replaces them with a far more efficient, automated workflow.

For banks, insurers, and other financial institutions, these systems are no longer a "nice-to-have." They are essential for speeding up customer onboarding, locking down regulatory compliance, and delivering a customer experience that doesn't involve endless paperwork and waiting periods. This automation lets your team focus on growing the business, not getting buried in administrative tasks.

The New Standard for Compliance and Customer Experience

Anyone in finance or insurance knows the balancing act: you have to meet strict, ever-changing regulations while also providing a smooth, fast experience for customers. For years, the traditional "Know Your Customer" (KYC) process was a major bottleneck—a paper-heavy, manual grind that created friction and made new customers wait.

Today's KYC automation platforms are a world away from those simple data checks of the past. They've become strategic tools for achieving operational excellence, capable of orchestrating entire compliance workflows from beginning to end. Think of an AI-powered system that doesn't just verify an ID document, but manages the entire customer lifecycle, from near-instant onboarding to real-time verification for insurance claims. This is a fundamental shift in how businesses interact with their customers.

From Regulatory Burden to Strategic Advantage

Historically, KYC was viewed as a cost of doing business—a box-checking exercise required by regulators. That perspective led to clunky, frustrating processes for everyone involved, from the back-office team to the customer trying to open an account. Automation completely flips that script.

By embedding compliance checks directly and invisibly into the customer journey, the process becomes both powerful and seamless. For example, leading ai insurance companies are using this technology to completely overhaul their claims process. Instead of customers waiting days for a human to review documents, claims can be verified and approved in minutes. This speed and accuracy are consistently highlighted in claims ai reviews and directly boost customer satisfaction when it matters most.

It's not just about moving faster, either. It's about putting your human experts to better use. When AI handles the routine identity and document verifications, your skilled professionals can dedicate their time to more complex fraud investigations, edge cases, and building genuine customer relationships.

The Rise of AI-Powered Customer Interaction

This shift is having a profound impact on customer service itself. We're seeing financial firms deploy advanced AI customer care systems that go far beyond simple chatbots. These AI agents can manage sensitive interactions, like guiding a user through opening a new investment account or verifying a large, unusual transaction, all while running continuous KYC checks behind the scenes.

By automating routine compliance tasks, institutions can reduce KYC-related costs by up to 70%. This efficiency frees up resources, allowing teams to concentrate on high-value activities that drive business growth and enhance the customer relationship.

This dual capability creates a process that is smooth for the customer, highly secure, and leaves a perfect, auditable trail for regulators. The move toward AI and automation in KYC is setting a new benchmark for how modern companies navigate the complex world of financial regulation.

To see how this can transform your own operations, explore the world of compliance process automation. For a more comprehensive look at the regulatory environment, our guide on regulatory compliance in financial services is a great next step.

Taming the Claims Chaos with AI-Powered KYC

For an insurance customer, the claims process is the moment that truly matters. A quick, empathetic experience can forge a customer for life. A slow, bureaucratic one will send them straight to a competitor. For too long, the entire claims journey has been hamstrung by tedious, manual identity checks right from the start.

This is where KYC automation solutions are changing the game. Think of an AI agent working behind the scenes, plugged directly into core insurance platforms like Guidewire or Duck Creek. From the very second a claim is filed, it gets to work. This isn't just about moving paperwork faster; it’s about redesigning the entire claims workflow from the ground up for ai insurance companies.

The AI’s first job begins at the First Notice of Loss (FNOL)—that critical first report of an incident. It immediately kicks off identity verification for the policyholder and any other people involved in the claim. This happens seamlessly in the background, creating a much smoother experience for a customer who is likely already under a great deal of stress.

Automating Verification Right from the Start

Instead of a customer waiting for a human adjuster to get around to requesting and checking documents, the AI agent handles the entire sequence. It gathers the required information, validates ID documents with sophisticated recognition technology, and cross-references data against existing records—all in real-time. This instant verification sets a completely different pace for the rest of the claims process.

But the system goes much deeper than just confirming a name and an address. A crucial part of KYC automation is running instant checks against global sanctions lists, Politically Exposed Persons (PEP) databases, and adverse media reports. This kind of robust screening is essential for both compliance and catching fraud early, making sure the insurer isn’t unknowingly paying out to a high-risk individual.

By automating these initial checks, ai insurance companies can slash claim cycle times. What used to take days of back-and-forth communication can now be wrapped up in a matter of minutes, which has a massive impact on both operational costs and customer happiness.

This level of automation gives claims teams a solid foundation to work from. The system flags any discrepancies or red flags for a human to review, allowing experienced adjusters to apply their skills where they matter most—on complex and sensitive cases.

From Catching Fraud to Elevating AI Customer Care

Fraud is a massive, multi-billion-dollar headache for the insurance industry. AI-powered KYC acts as a powerful first line of defense. By analyzing data points and spotting strange patterns right at the FNOL stage, the system can identify activity that suggests organized fraud rings or simple misrepresentation. This proactive screening helps stop fraudulent payments before a single dollar goes out the door.

This newfound efficiency also creates a much better customer experience. When a claim is legitimate, the speed of automated verification means policyholders get the financial help they need, faster. This quick response is a cornerstone of modern AI customer care, proving to the customer that their insurer is reliable when it counts. It's no surprise that claims ai reviews frequently point to this speed and simplicity as a major advantage.

You can see how this technology is reshaping insurance firsthand by exploring case studies on transforming insurance claims with agentic AI.

The Real-World Impact on Claims Operations

For leaders managing claims departments, the benefits stack up quickly and go far beyond a single file. Bringing a KYC automation solution into the workflow builds a far more resilient and scalable operation.

Here’s what that looks like in practice:

Dramatically Shorter Cycle Times: Automating identity checks and initial screening cuts down the time from FNOL to settlement in a big way.

Lower Fraud Rates: Real-time data analysis and watchlist screening are powerful tools for catching fraud early, protecting the bottom line.

More Capacity for Adjusters: When adjusters are freed from routine administrative work, they can focus on and manage a higher volume of complex cases.

Ironclad Compliance: Automation guarantees that every single claim goes through the exact same rigorous, auditable verification process, minimizing human error and strengthening regulatory compliance.

At the end of the day, weaving KYC automation into the claims process turns a mandatory compliance chore into a genuine strategic advantage. It helps ai insurance companies manage risk more effectively while delivering a standout customer experience that builds loyalty in a crowded market.

AI Agents Are Redefining Customer Care in Banking

While the insurance industry has made huge strides in efficiency, the banking world is undergoing its own quiet revolution, fueled by the same intelligent automation. The real action is happening in high-stakes, customer-facing interactions that, until recently, were handled exclusively by people. Today, modern KYC automation solutions are becoming the backbone of next-generation AI customer care in finance.

These aren't just back-office compliance engines anymore. They’re being pushed to the front lines as sophisticated AI agents that can manage entire customer journeys. We're talking about everything from opening a new account to investigating a suspicious transaction, all while performing continuous identity verification behind the scenes.

This new approach finally solves an old dilemma for banks: how to balance ironclad security with the customer's desire for a quick, painless experience. AI agents make compliance a seamless, almost invisible, part of great service.

The AI Agent Journey in Digital Banking

Let’s walk through a common scenario. A potential customer wants to open a new high-yield savings account on their phone. The old way meant uploading documents, waiting days for a manual review, and maybe even a follow-up call. It’s a process notorious for high drop-off rates.

Today, an AI agent can orchestrate that entire workflow in minutes.

The agent kicks off a conversation, guiding the user through the application. When it’s time to verify who they are, it connects to identity verification tools without a hitch. The user might be prompted to snap a picture of their driver's license and a quick selfie, and the system uses biometric and document analysis to confirm their identity in real-time.

At the same time, the agent is running the customer’s details against global watchlists, sanctions lists, and adverse media databases. This isn’t just a one-and-done check; it’s the start of an ongoing monitoring process that gives the bank a solid, auditable record from day one.

The dual benefit is clear: the customer enjoys a frictionless, near-instant account opening, while the bank establishes a secure, compliant relationship backed by a detailed digital audit trail. This combination of speed and security is the hallmark of modern AI-powered banking.

But what if something goes wrong? Maybe the license photo is blurry or the applicant's name flags a potential risk. The system doesn't just crash. A well-designed AI agent gathers all the relevant context, packages the case, and routes it to a human specialist. The human expert gets everything they need to make a fast, informed decision without making the customer repeat themselves. That intelligent handoff is a non-negotiable part of effective AI customer care.

Integration into the Core Banking Ecosystem

For this kind of automation to work, it can't live on an island. The true power of these KYC platforms is unlocked when they are deeply woven into a bank's existing technology. This is where connections to major CRM and contact center platforms are absolutely critical.

Salesforce Integration: By plugging into Salesforce, the AI agent gets a 360-degree view of the customer. This allows for more personal interactions and ensures any new information gathered during KYC automatically updates the customer's central record.

Genesys Integration: Connecting with contact center software like Genesys creates a single, unified customer journey. An interaction that starts with a chatbot can be escalated to a human agent on a phone call, with the full context and verification history transferred instantly.

This creates a cohesive environment where human and AI agents work in tandem, each playing to their strengths. The AI handles the high-volume, data-heavy verification work, freeing up human agents to focus on complex problem-solving and building customer relationships. To see more on how this works, you can explore our detailed guide on AI agents for customer service.

By embedding KYC automation solutions directly into their customer workflows, banks are doing more than just checking a compliance box. They are fundamentally redesigning how they deliver services to be faster, more secure, and far more aligned with what modern customers expect.

Embracing Perpetual KYC and Real-Time Monitoring

The old model of compliance is officially broken. For years, financial institutions got by with periodic KYC reviews—those annual or semi-annual check-ins to see if anything had changed with a customer. This approach was manageable when the world moved slower, but today, it’s like trying to navigate a highway by only looking in the rearview mirror once every few miles. A customer's risk profile can shift in an instant, making a year-old review dangerously obsolete.

This outdated cycle also creates a huge operational drag and a clunky customer experience. Just when a relationship feels established, the bank or insurer pops up again with a long list of questions and document requests, creating friction for no good reason. The modern solution is a complete change in thinking: shifting from periodic checks to perpetual KYC (pKYC), a model built on continuous, real-time monitoring.

This isn’t just a minor tweak; it’s a strategic necessity. With pKYC, compliance becomes an always-on, event-driven process. Instead of waiting for a calendar reminder, KYC automation solutions act as a constant watchdog, scanning for specific triggers that might change a customer's risk level.

The Power of Event-Driven Risk Assessment

In a pKYC framework, the system is never idle. It’s actively monitoring a wide array of internal and external data sources for meaningful changes. When a predefined event happens, it automatically kicks off a workflow to assess the new information and decide on the next steps.

This proactive stance makes anti-financial crime defenses vastly stronger. It means institutions can respond to new threats the moment they emerge, rather than discovering them months down the line. As organizations adopt this level of real-time vigilance, it’s also crucial to guard against sophisticated new fraud methods, such as detecting deepfake video call scams.

So, what kinds of triggers does an automated system look for?

Sanctions and Watchlist Updates: The second a customer’s name appears on a new government sanctions list, the system flags the account for immediate review.

Adverse Media Mentions: Smart algorithms scan global news and media sources for negative press involving a customer, which could signal new reputational or criminal risk.

Changes in Corporate Structure: For business accounts, the system can detect shifts in beneficial ownership or company directors, automatically initiating a re-verification process.

Unusual Transaction Patterns: The platform identifies transactional behavior that deviates from a customer's established profile, flagging potential money laundering or fraud.

This constant vigilance turns compliance from a reactive, administrative chore into a proactive defense mechanism. Our guide on real-time data processing dives deeper into the technology that makes this continuous monitoring possible.

A New Era of Efficiency and Defensibility

The move toward pKYC is more than a trend; it's a fundamental evolution of the industry. As we move through 2026, the financial services world is in the middle of a massive shift away from periodic KYC refreshes. Customer risk profiles now change far too quickly for traditional review cycles to keep up. Research shows that AI-driven KYC leads to a 30% reduction in average digital onboarding time, with projections showing a drop from over 11 minutes in 2023 to under 8 minutes by 2028. This is all while incorporating behavioral signals to create composite risk scores that flag fraud earlier. You can explore more 2026 KYC and AML outlooks to see the full picture.

By only flagging material changes that actually require human attention, pKYC eliminates the vast majority of disruptive and inefficient manual reviews. This frees up compliance teams to focus their expertise on genuine, high-level risks rather than getting bogged down in low-risk accounts.

This approach delivers two huge business benefits. First, it dramatically cuts down on operational friction and cost by automating the bulk of the monitoring workload. Second, it creates a much stronger, more defensible compliance posture. When regulators come knocking, institutions can provide a complete, time-stamped audit trail proving that customer risk was monitored continuously, not just glanced at once a year. This is the new standard for smart, robust risk management.

Building the Business Case for Agentic AI in KYC

Getting executive buy-in for any new technology requires more than just a slick presentation. Leadership needs to see a clear, data-driven path to real business results. When it comes to KYC automation solutions, the conversation has to move past "better compliance" and zero in on quantifiable return on investment (ROI). This is especially true when we're talking about agentic AI, which is a whole different beast than the automation tools of the past.

Traditional, rules-based automation is like a factory robot—it follows a strict script, performing the same task over and over. Agentic AI, on the other hand, operates more like a seasoned specialist. It doesn't just follow instructions; it interprets context, makes independent decisions, and manages entire financial workflows. Imagine a system that not only verifies an ID but also autonomously decides to initiate enhanced due diligence (EDD) for a high-risk individual. That’s the kind of intelligence that turns KYC from a pure cost center into a genuine strategic advantage.

Quantifying the Impact on Operations

To build a compelling business case, you have to speak the language of the C-suite: tangible metrics. For both AI insurance companies and banks, the improvements are dramatic and easy to track. The trick is to directly connect the technology to well-known operational headaches like agonizingly slow client onboarding, overwhelming manual workloads, and ever-rising compliance costs.

Platforms built on agentic AI are completely changing the game for Straight-Through Processing (STP), and the numbers don't lie. We've seen advanced KYC automation solutions slash overall operational costs by 32% and reduce the manual slog of client lifecycle management (CLM) compliance by an incredible 90%. Think about what that frees up. Sales teams, for instance, get back 20% of their time to actually sell instead of chasing down paperwork. These are the kinds of figures that make a powerful argument for investment, and they point toward the future trends shaping KYC compliance.

What really makes agentic AI a game-changer is its ability to manage outcomes, not just perform tasks. With a client journey completion rate of 97.1%, these systems prove you don't have to choose between tough compliance and a great customer experience. They deliver both, making processes anywhere from 45% to 96% faster.

From Cost Savings to Revenue Acceleration

While trimming costs always gets attention, the business case for agentic AI is just as much about growing the top line. Slow, clunky onboarding is one of the biggest reasons potential customers give up and walk away, in banking and insurance alike. Every single applicant who gets frustrated and abandons the process is revenue left on the table.

By making the client journey fast and frictionless, institutions can convert far more of those applicants into loyal customers—a metric every business leader cares about. The benefits don't stop there. When AI customer care systems take over the routine checks and simple questions, your human agents are free to handle the complex, high-value interactions that truly build relationships and boost satisfaction. The overwhelmingly positive feedback seen in claims AI reviews often comes down to this simple fact: speed and seamlessness create a better brand experience.

The table below paints a clear picture of just how different the operational reality is before and after bringing in agentic AI.

Impact of Agentic AI on Financial Operations

This comparison highlights the quantifiable business improvements that financial institutions can expect when shifting from traditional, manual processes to an agentic AI-driven approach for KYC and other core operations.

Metric | Traditional Process | With Agentic AI Automation |

|---|---|---|

Client Onboarding Time | Days or even weeks | Minutes |

CLM Workload | High manual effort, extensive paperwork | 90% reduction in compliance tasks |

Operational Costs | Significant overhead from manual labor | 32% overall cost reduction |

Customer Drop-off Rate | High due to friction and delays | Minimal, with 97.1% completion rates |

Human Agent Focus | Repetitive, low-value data entry | Complex case resolution and customer engagement |

Ultimately, the argument for investing in agentic AI is grounded in hard numbers and clear operational wins. It’s not just about buying new software; it's about investing in a smarter, more scalable operating model that creates better outcomes for your customers and a healthier bottom line for the business.

Your Practical Roadmap to KYC Automation

Getting started with KYC automation solutions isn't about flipping a switch; it requires a well-thought-out plan. This roadmap is built for the IT, data, and transformation leaders tasked with making it happen. We're moving past the theory and into the practical steps for a successful rollout that actually supports your business goals.

The first move is always to take a hard look at your current KYC process. Where are the real bottlenecks? Pinpoint the manual steps that slow everything down and the places where human error creates unnecessary risk or delays.

For AI insurance companies, this pain point is often the initial ID check during claims, an issue that pops up frequently in claims AI reviews. In banking, the classic example is the high number of potential customers who abandon the sign-up process when it gets too complicated.

Selecting the Right Technology Partner

Once you know exactly where automation will make the biggest impact, it's time to find the right technology partner. Don't get distracted by a long list of shiny features. You need a platform that truly integrates with the systems you already rely on, otherwise, you're just creating another operational silo.

When evaluating potential partners, here’s what really matters:

Core System Integration: The solution has to play nicely with your foundational platforms, whether that’s ServiceNow, Salesforce, Guidewire, or Duck Creek. This is the only way to ensure data flows smoothly and the automation fits into your team's existing workflows.

Robust Audit Trails: Compliance is non-negotiable. Every single automated decision and action must be logged in detail. A transparent, easily searchable audit trail is your best friend when regulators come knocking.

Clear Human Escalation Paths: Automation isn't meant to replace your experts; it's meant to support them. The system needs to be smart enough to flag tricky cases and send them to a human agent with all the necessary context, empowering your AI customer care teams to handle exceptions efficiently.

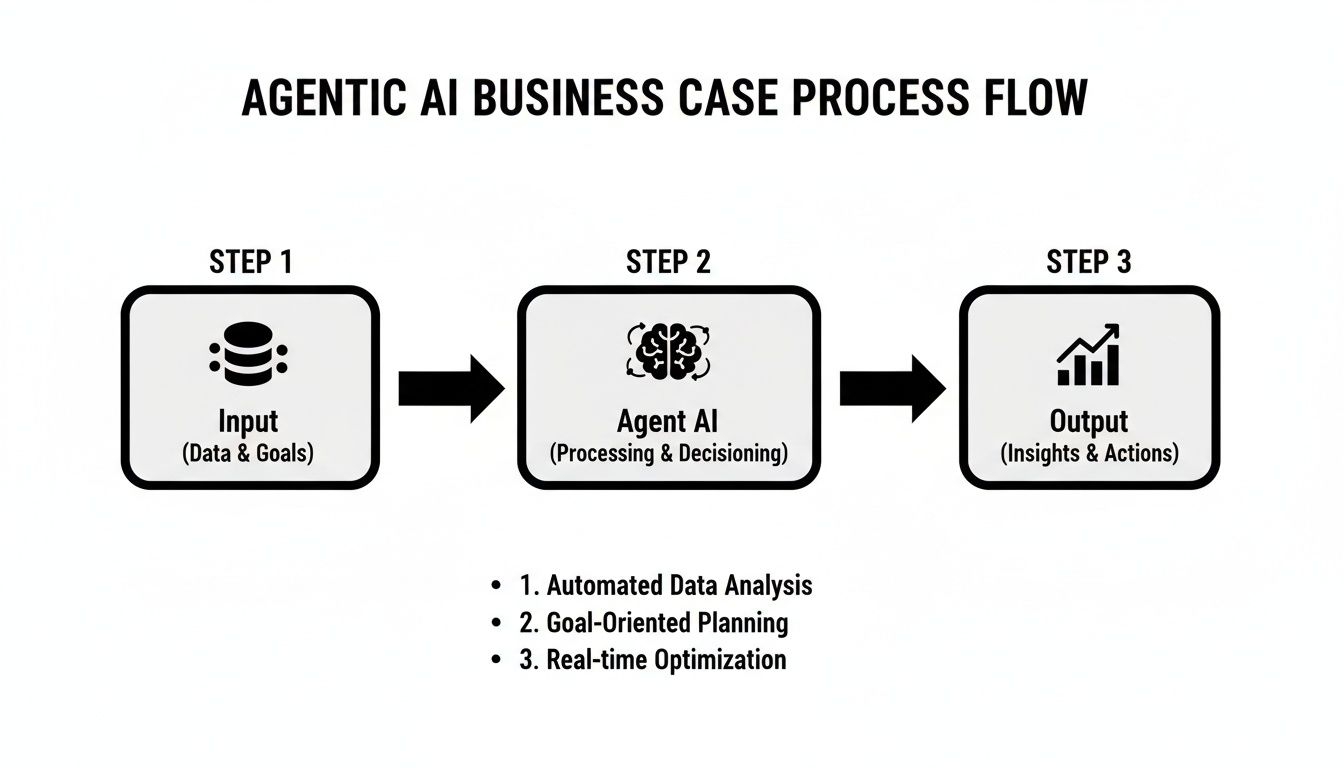

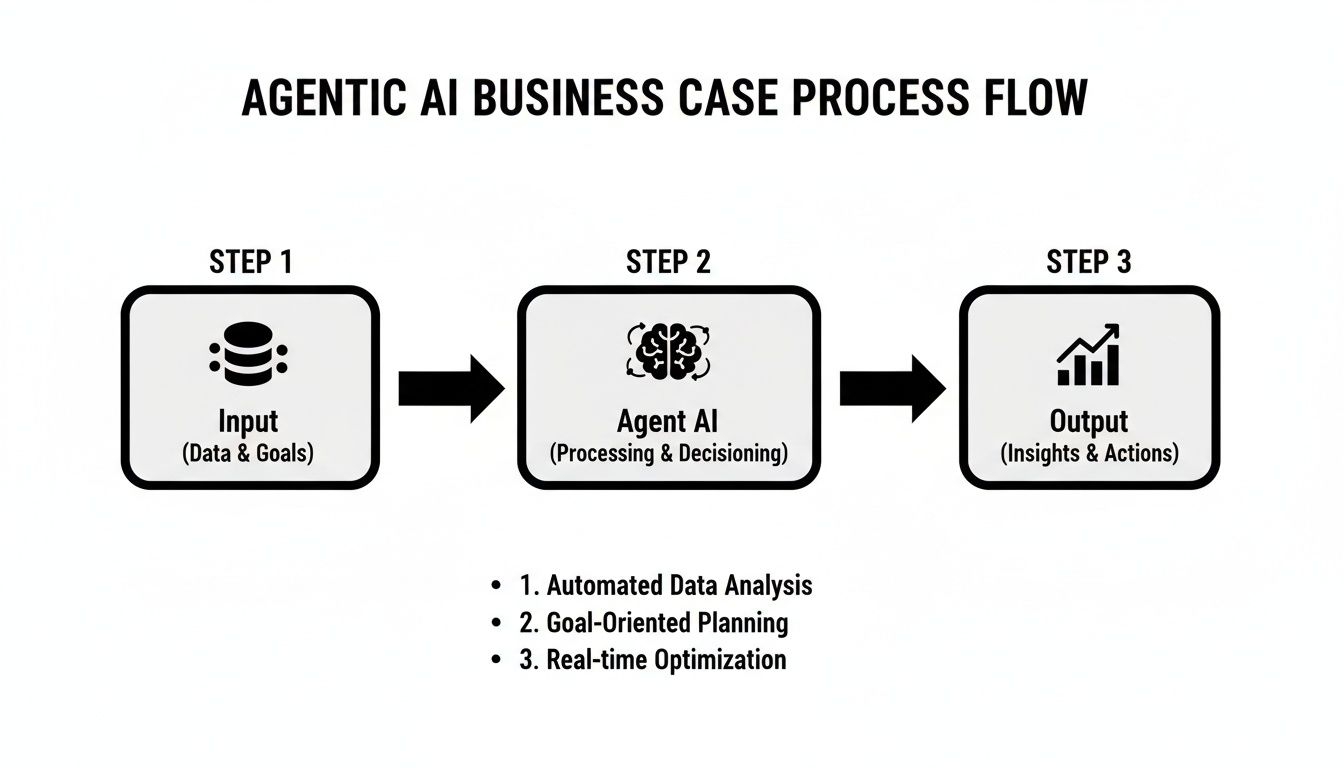

The diagram below gives you a high-level view of how an agentic AI system takes raw data and turns it into concrete business results.

This workflow is the foundation for building a solid business case, showing how you can get from messy inputs to valuable, actionable intelligence.

Managing Change and Driving Adoption

Remember, the technology is just one piece of the puzzle. A successful project depends heavily on your people. You need to get your teams ready for a new way of working by showing them what's in it for them—not just the company.

Frame the automation as a tool that gets them out of the weeds of repetitive data entry and frees them up to solve more complex problems.

Finally, don't try to do everything at once. Kick things off with a pilot project in one specific area. This allows you to prove the value, work out any kinks, and build internal support before you scale the solution across the entire organization. This phased approach minimizes disruption and creates the momentum you need for a wider rollout.

If you want a deeper dive into this part of the process, you can learn more about how to automate business processes in our detailed guide.

Frequently Asked Questions

How Do AI Insurance Companies Use KYC Automation?

For insurance carriers, the real power of KYC automation shines during the claims process. Think about the First Notice of Loss (FNOL) – that initial, critical moment when a customer reports an incident. Instead of a clunky, manual identity check that slows everything down, an AI agent can instantly verify both the policyholder and any claimants involved.

This single step drastically cuts down settlement times, which is a massive driver of customer satisfaction and often mentioned in positive claims AI reviews. It also means your human adjusters can stop chasing paperwork and focus their expertise on the more complex, high-value claims.

Can AI Really Handle Sensitive Customer Care Interactions?

Absolutely. Today's AI customer care agents are built specifically for the kinds of sensitive conversations that happen in finance. They can walk a new customer through opening an account or help someone investigate a tricky transaction, all while running compliant identity checks seamlessly in the background.

And if things get too complicated for the AI? It doesn't just give up. The system is designed to intelligently escalate the entire conversation, along with all the context, to a human agent. This ensures the customer gets the help they need without repeating themselves, and security is never compromised.

A well-designed KYC automation solution doesn't replace your compliance team; it elevates them. When automation handles 90-95% of the routine verifications, your experts are freed up to focus on what they do best: investigating the handful of high-risk exceptions flagged by the system.

Instead of getting bogged down in repetitive manual checks, their oversight becomes a strategic risk management function.

Ready to see how agentic AI can automate your most complex financial operations? Nolana deploys compliant AI agents that orchestrate entire workflows, from claims processing to customer service. Learn more about Nolana's AI agents.

At its core, a KYC automation solution is a sophisticated software tool that leverages technology like AI and machine learning to handle customer identity verification. It takes the slow, manual, and often error-prone processes of the past and replaces them with a far more efficient, automated workflow.

For banks, insurers, and other financial institutions, these systems are no longer a "nice-to-have." They are essential for speeding up customer onboarding, locking down regulatory compliance, and delivering a customer experience that doesn't involve endless paperwork and waiting periods. This automation lets your team focus on growing the business, not getting buried in administrative tasks.

The New Standard for Compliance and Customer Experience

Anyone in finance or insurance knows the balancing act: you have to meet strict, ever-changing regulations while also providing a smooth, fast experience for customers. For years, the traditional "Know Your Customer" (KYC) process was a major bottleneck—a paper-heavy, manual grind that created friction and made new customers wait.

Today's KYC automation platforms are a world away from those simple data checks of the past. They've become strategic tools for achieving operational excellence, capable of orchestrating entire compliance workflows from beginning to end. Think of an AI-powered system that doesn't just verify an ID document, but manages the entire customer lifecycle, from near-instant onboarding to real-time verification for insurance claims. This is a fundamental shift in how businesses interact with their customers.

From Regulatory Burden to Strategic Advantage

Historically, KYC was viewed as a cost of doing business—a box-checking exercise required by regulators. That perspective led to clunky, frustrating processes for everyone involved, from the back-office team to the customer trying to open an account. Automation completely flips that script.

By embedding compliance checks directly and invisibly into the customer journey, the process becomes both powerful and seamless. For example, leading ai insurance companies are using this technology to completely overhaul their claims process. Instead of customers waiting days for a human to review documents, claims can be verified and approved in minutes. This speed and accuracy are consistently highlighted in claims ai reviews and directly boost customer satisfaction when it matters most.

It's not just about moving faster, either. It's about putting your human experts to better use. When AI handles the routine identity and document verifications, your skilled professionals can dedicate their time to more complex fraud investigations, edge cases, and building genuine customer relationships.

The Rise of AI-Powered Customer Interaction

This shift is having a profound impact on customer service itself. We're seeing financial firms deploy advanced AI customer care systems that go far beyond simple chatbots. These AI agents can manage sensitive interactions, like guiding a user through opening a new investment account or verifying a large, unusual transaction, all while running continuous KYC checks behind the scenes.

By automating routine compliance tasks, institutions can reduce KYC-related costs by up to 70%. This efficiency frees up resources, allowing teams to concentrate on high-value activities that drive business growth and enhance the customer relationship.

This dual capability creates a process that is smooth for the customer, highly secure, and leaves a perfect, auditable trail for regulators. The move toward AI and automation in KYC is setting a new benchmark for how modern companies navigate the complex world of financial regulation.

To see how this can transform your own operations, explore the world of compliance process automation. For a more comprehensive look at the regulatory environment, our guide on regulatory compliance in financial services is a great next step.

Taming the Claims Chaos with AI-Powered KYC

For an insurance customer, the claims process is the moment that truly matters. A quick, empathetic experience can forge a customer for life. A slow, bureaucratic one will send them straight to a competitor. For too long, the entire claims journey has been hamstrung by tedious, manual identity checks right from the start.

This is where KYC automation solutions are changing the game. Think of an AI agent working behind the scenes, plugged directly into core insurance platforms like Guidewire or Duck Creek. From the very second a claim is filed, it gets to work. This isn't just about moving paperwork faster; it’s about redesigning the entire claims workflow from the ground up for ai insurance companies.

The AI’s first job begins at the First Notice of Loss (FNOL)—that critical first report of an incident. It immediately kicks off identity verification for the policyholder and any other people involved in the claim. This happens seamlessly in the background, creating a much smoother experience for a customer who is likely already under a great deal of stress.

Automating Verification Right from the Start

Instead of a customer waiting for a human adjuster to get around to requesting and checking documents, the AI agent handles the entire sequence. It gathers the required information, validates ID documents with sophisticated recognition technology, and cross-references data against existing records—all in real-time. This instant verification sets a completely different pace for the rest of the claims process.

But the system goes much deeper than just confirming a name and an address. A crucial part of KYC automation is running instant checks against global sanctions lists, Politically Exposed Persons (PEP) databases, and adverse media reports. This kind of robust screening is essential for both compliance and catching fraud early, making sure the insurer isn’t unknowingly paying out to a high-risk individual.

By automating these initial checks, ai insurance companies can slash claim cycle times. What used to take days of back-and-forth communication can now be wrapped up in a matter of minutes, which has a massive impact on both operational costs and customer happiness.

This level of automation gives claims teams a solid foundation to work from. The system flags any discrepancies or red flags for a human to review, allowing experienced adjusters to apply their skills where they matter most—on complex and sensitive cases.

From Catching Fraud to Elevating AI Customer Care

Fraud is a massive, multi-billion-dollar headache for the insurance industry. AI-powered KYC acts as a powerful first line of defense. By analyzing data points and spotting strange patterns right at the FNOL stage, the system can identify activity that suggests organized fraud rings or simple misrepresentation. This proactive screening helps stop fraudulent payments before a single dollar goes out the door.

This newfound efficiency also creates a much better customer experience. When a claim is legitimate, the speed of automated verification means policyholders get the financial help they need, faster. This quick response is a cornerstone of modern AI customer care, proving to the customer that their insurer is reliable when it counts. It's no surprise that claims ai reviews frequently point to this speed and simplicity as a major advantage.

You can see how this technology is reshaping insurance firsthand by exploring case studies on transforming insurance claims with agentic AI.

The Real-World Impact on Claims Operations

For leaders managing claims departments, the benefits stack up quickly and go far beyond a single file. Bringing a KYC automation solution into the workflow builds a far more resilient and scalable operation.

Here’s what that looks like in practice:

Dramatically Shorter Cycle Times: Automating identity checks and initial screening cuts down the time from FNOL to settlement in a big way.

Lower Fraud Rates: Real-time data analysis and watchlist screening are powerful tools for catching fraud early, protecting the bottom line.

More Capacity for Adjusters: When adjusters are freed from routine administrative work, they can focus on and manage a higher volume of complex cases.

Ironclad Compliance: Automation guarantees that every single claim goes through the exact same rigorous, auditable verification process, minimizing human error and strengthening regulatory compliance.

At the end of the day, weaving KYC automation into the claims process turns a mandatory compliance chore into a genuine strategic advantage. It helps ai insurance companies manage risk more effectively while delivering a standout customer experience that builds loyalty in a crowded market.

AI Agents Are Redefining Customer Care in Banking

While the insurance industry has made huge strides in efficiency, the banking world is undergoing its own quiet revolution, fueled by the same intelligent automation. The real action is happening in high-stakes, customer-facing interactions that, until recently, were handled exclusively by people. Today, modern KYC automation solutions are becoming the backbone of next-generation AI customer care in finance.

These aren't just back-office compliance engines anymore. They’re being pushed to the front lines as sophisticated AI agents that can manage entire customer journeys. We're talking about everything from opening a new account to investigating a suspicious transaction, all while performing continuous identity verification behind the scenes.

This new approach finally solves an old dilemma for banks: how to balance ironclad security with the customer's desire for a quick, painless experience. AI agents make compliance a seamless, almost invisible, part of great service.

The AI Agent Journey in Digital Banking

Let’s walk through a common scenario. A potential customer wants to open a new high-yield savings account on their phone. The old way meant uploading documents, waiting days for a manual review, and maybe even a follow-up call. It’s a process notorious for high drop-off rates.

Today, an AI agent can orchestrate that entire workflow in minutes.

The agent kicks off a conversation, guiding the user through the application. When it’s time to verify who they are, it connects to identity verification tools without a hitch. The user might be prompted to snap a picture of their driver's license and a quick selfie, and the system uses biometric and document analysis to confirm their identity in real-time.

At the same time, the agent is running the customer’s details against global watchlists, sanctions lists, and adverse media databases. This isn’t just a one-and-done check; it’s the start of an ongoing monitoring process that gives the bank a solid, auditable record from day one.

The dual benefit is clear: the customer enjoys a frictionless, near-instant account opening, while the bank establishes a secure, compliant relationship backed by a detailed digital audit trail. This combination of speed and security is the hallmark of modern AI-powered banking.

But what if something goes wrong? Maybe the license photo is blurry or the applicant's name flags a potential risk. The system doesn't just crash. A well-designed AI agent gathers all the relevant context, packages the case, and routes it to a human specialist. The human expert gets everything they need to make a fast, informed decision without making the customer repeat themselves. That intelligent handoff is a non-negotiable part of effective AI customer care.

Integration into the Core Banking Ecosystem

For this kind of automation to work, it can't live on an island. The true power of these KYC platforms is unlocked when they are deeply woven into a bank's existing technology. This is where connections to major CRM and contact center platforms are absolutely critical.

Salesforce Integration: By plugging into Salesforce, the AI agent gets a 360-degree view of the customer. This allows for more personal interactions and ensures any new information gathered during KYC automatically updates the customer's central record.

Genesys Integration: Connecting with contact center software like Genesys creates a single, unified customer journey. An interaction that starts with a chatbot can be escalated to a human agent on a phone call, with the full context and verification history transferred instantly.

This creates a cohesive environment where human and AI agents work in tandem, each playing to their strengths. The AI handles the high-volume, data-heavy verification work, freeing up human agents to focus on complex problem-solving and building customer relationships. To see more on how this works, you can explore our detailed guide on AI agents for customer service.

By embedding KYC automation solutions directly into their customer workflows, banks are doing more than just checking a compliance box. They are fundamentally redesigning how they deliver services to be faster, more secure, and far more aligned with what modern customers expect.

Embracing Perpetual KYC and Real-Time Monitoring

The old model of compliance is officially broken. For years, financial institutions got by with periodic KYC reviews—those annual or semi-annual check-ins to see if anything had changed with a customer. This approach was manageable when the world moved slower, but today, it’s like trying to navigate a highway by only looking in the rearview mirror once every few miles. A customer's risk profile can shift in an instant, making a year-old review dangerously obsolete.

This outdated cycle also creates a huge operational drag and a clunky customer experience. Just when a relationship feels established, the bank or insurer pops up again with a long list of questions and document requests, creating friction for no good reason. The modern solution is a complete change in thinking: shifting from periodic checks to perpetual KYC (pKYC), a model built on continuous, real-time monitoring.

This isn’t just a minor tweak; it’s a strategic necessity. With pKYC, compliance becomes an always-on, event-driven process. Instead of waiting for a calendar reminder, KYC automation solutions act as a constant watchdog, scanning for specific triggers that might change a customer's risk level.

The Power of Event-Driven Risk Assessment

In a pKYC framework, the system is never idle. It’s actively monitoring a wide array of internal and external data sources for meaningful changes. When a predefined event happens, it automatically kicks off a workflow to assess the new information and decide on the next steps.

This proactive stance makes anti-financial crime defenses vastly stronger. It means institutions can respond to new threats the moment they emerge, rather than discovering them months down the line. As organizations adopt this level of real-time vigilance, it’s also crucial to guard against sophisticated new fraud methods, such as detecting deepfake video call scams.

So, what kinds of triggers does an automated system look for?

Sanctions and Watchlist Updates: The second a customer’s name appears on a new government sanctions list, the system flags the account for immediate review.

Adverse Media Mentions: Smart algorithms scan global news and media sources for negative press involving a customer, which could signal new reputational or criminal risk.

Changes in Corporate Structure: For business accounts, the system can detect shifts in beneficial ownership or company directors, automatically initiating a re-verification process.

Unusual Transaction Patterns: The platform identifies transactional behavior that deviates from a customer's established profile, flagging potential money laundering or fraud.

This constant vigilance turns compliance from a reactive, administrative chore into a proactive defense mechanism. Our guide on real-time data processing dives deeper into the technology that makes this continuous monitoring possible.

A New Era of Efficiency and Defensibility

The move toward pKYC is more than a trend; it's a fundamental evolution of the industry. As we move through 2026, the financial services world is in the middle of a massive shift away from periodic KYC refreshes. Customer risk profiles now change far too quickly for traditional review cycles to keep up. Research shows that AI-driven KYC leads to a 30% reduction in average digital onboarding time, with projections showing a drop from over 11 minutes in 2023 to under 8 minutes by 2028. This is all while incorporating behavioral signals to create composite risk scores that flag fraud earlier. You can explore more 2026 KYC and AML outlooks to see the full picture.

By only flagging material changes that actually require human attention, pKYC eliminates the vast majority of disruptive and inefficient manual reviews. This frees up compliance teams to focus their expertise on genuine, high-level risks rather than getting bogged down in low-risk accounts.

This approach delivers two huge business benefits. First, it dramatically cuts down on operational friction and cost by automating the bulk of the monitoring workload. Second, it creates a much stronger, more defensible compliance posture. When regulators come knocking, institutions can provide a complete, time-stamped audit trail proving that customer risk was monitored continuously, not just glanced at once a year. This is the new standard for smart, robust risk management.

Building the Business Case for Agentic AI in KYC

Getting executive buy-in for any new technology requires more than just a slick presentation. Leadership needs to see a clear, data-driven path to real business results. When it comes to KYC automation solutions, the conversation has to move past "better compliance" and zero in on quantifiable return on investment (ROI). This is especially true when we're talking about agentic AI, which is a whole different beast than the automation tools of the past.

Traditional, rules-based automation is like a factory robot—it follows a strict script, performing the same task over and over. Agentic AI, on the other hand, operates more like a seasoned specialist. It doesn't just follow instructions; it interprets context, makes independent decisions, and manages entire financial workflows. Imagine a system that not only verifies an ID but also autonomously decides to initiate enhanced due diligence (EDD) for a high-risk individual. That’s the kind of intelligence that turns KYC from a pure cost center into a genuine strategic advantage.

Quantifying the Impact on Operations

To build a compelling business case, you have to speak the language of the C-suite: tangible metrics. For both AI insurance companies and banks, the improvements are dramatic and easy to track. The trick is to directly connect the technology to well-known operational headaches like agonizingly slow client onboarding, overwhelming manual workloads, and ever-rising compliance costs.

Platforms built on agentic AI are completely changing the game for Straight-Through Processing (STP), and the numbers don't lie. We've seen advanced KYC automation solutions slash overall operational costs by 32% and reduce the manual slog of client lifecycle management (CLM) compliance by an incredible 90%. Think about what that frees up. Sales teams, for instance, get back 20% of their time to actually sell instead of chasing down paperwork. These are the kinds of figures that make a powerful argument for investment, and they point toward the future trends shaping KYC compliance.

What really makes agentic AI a game-changer is its ability to manage outcomes, not just perform tasks. With a client journey completion rate of 97.1%, these systems prove you don't have to choose between tough compliance and a great customer experience. They deliver both, making processes anywhere from 45% to 96% faster.

From Cost Savings to Revenue Acceleration

While trimming costs always gets attention, the business case for agentic AI is just as much about growing the top line. Slow, clunky onboarding is one of the biggest reasons potential customers give up and walk away, in banking and insurance alike. Every single applicant who gets frustrated and abandons the process is revenue left on the table.

By making the client journey fast and frictionless, institutions can convert far more of those applicants into loyal customers—a metric every business leader cares about. The benefits don't stop there. When AI customer care systems take over the routine checks and simple questions, your human agents are free to handle the complex, high-value interactions that truly build relationships and boost satisfaction. The overwhelmingly positive feedback seen in claims AI reviews often comes down to this simple fact: speed and seamlessness create a better brand experience.

The table below paints a clear picture of just how different the operational reality is before and after bringing in agentic AI.

Impact of Agentic AI on Financial Operations

This comparison highlights the quantifiable business improvements that financial institutions can expect when shifting from traditional, manual processes to an agentic AI-driven approach for KYC and other core operations.

Metric | Traditional Process | With Agentic AI Automation |

|---|---|---|

Client Onboarding Time | Days or even weeks | Minutes |

CLM Workload | High manual effort, extensive paperwork | 90% reduction in compliance tasks |

Operational Costs | Significant overhead from manual labor | 32% overall cost reduction |

Customer Drop-off Rate | High due to friction and delays | Minimal, with 97.1% completion rates |

Human Agent Focus | Repetitive, low-value data entry | Complex case resolution and customer engagement |

Ultimately, the argument for investing in agentic AI is grounded in hard numbers and clear operational wins. It’s not just about buying new software; it's about investing in a smarter, more scalable operating model that creates better outcomes for your customers and a healthier bottom line for the business.

Your Practical Roadmap to KYC Automation

Getting started with KYC automation solutions isn't about flipping a switch; it requires a well-thought-out plan. This roadmap is built for the IT, data, and transformation leaders tasked with making it happen. We're moving past the theory and into the practical steps for a successful rollout that actually supports your business goals.

The first move is always to take a hard look at your current KYC process. Where are the real bottlenecks? Pinpoint the manual steps that slow everything down and the places where human error creates unnecessary risk or delays.

For AI insurance companies, this pain point is often the initial ID check during claims, an issue that pops up frequently in claims AI reviews. In banking, the classic example is the high number of potential customers who abandon the sign-up process when it gets too complicated.

Selecting the Right Technology Partner

Once you know exactly where automation will make the biggest impact, it's time to find the right technology partner. Don't get distracted by a long list of shiny features. You need a platform that truly integrates with the systems you already rely on, otherwise, you're just creating another operational silo.

When evaluating potential partners, here’s what really matters:

Core System Integration: The solution has to play nicely with your foundational platforms, whether that’s ServiceNow, Salesforce, Guidewire, or Duck Creek. This is the only way to ensure data flows smoothly and the automation fits into your team's existing workflows.

Robust Audit Trails: Compliance is non-negotiable. Every single automated decision and action must be logged in detail. A transparent, easily searchable audit trail is your best friend when regulators come knocking.

Clear Human Escalation Paths: Automation isn't meant to replace your experts; it's meant to support them. The system needs to be smart enough to flag tricky cases and send them to a human agent with all the necessary context, empowering your AI customer care teams to handle exceptions efficiently.

The diagram below gives you a high-level view of how an agentic AI system takes raw data and turns it into concrete business results.

This workflow is the foundation for building a solid business case, showing how you can get from messy inputs to valuable, actionable intelligence.

Managing Change and Driving Adoption

Remember, the technology is just one piece of the puzzle. A successful project depends heavily on your people. You need to get your teams ready for a new way of working by showing them what's in it for them—not just the company.

Frame the automation as a tool that gets them out of the weeds of repetitive data entry and frees them up to solve more complex problems.

Finally, don't try to do everything at once. Kick things off with a pilot project in one specific area. This allows you to prove the value, work out any kinks, and build internal support before you scale the solution across the entire organization. This phased approach minimizes disruption and creates the momentum you need for a wider rollout.

If you want a deeper dive into this part of the process, you can learn more about how to automate business processes in our detailed guide.

Frequently Asked Questions

How Do AI Insurance Companies Use KYC Automation?

For insurance carriers, the real power of KYC automation shines during the claims process. Think about the First Notice of Loss (FNOL) – that initial, critical moment when a customer reports an incident. Instead of a clunky, manual identity check that slows everything down, an AI agent can instantly verify both the policyholder and any claimants involved.

This single step drastically cuts down settlement times, which is a massive driver of customer satisfaction and often mentioned in positive claims AI reviews. It also means your human adjusters can stop chasing paperwork and focus their expertise on the more complex, high-value claims.

Can AI Really Handle Sensitive Customer Care Interactions?

Absolutely. Today's AI customer care agents are built specifically for the kinds of sensitive conversations that happen in finance. They can walk a new customer through opening an account or help someone investigate a tricky transaction, all while running compliant identity checks seamlessly in the background.

And if things get too complicated for the AI? It doesn't just give up. The system is designed to intelligently escalate the entire conversation, along with all the context, to a human agent. This ensures the customer gets the help they need without repeating themselves, and security is never compromised.

A well-designed KYC automation solution doesn't replace your compliance team; it elevates them. When automation handles 90-95% of the routine verifications, your experts are freed up to focus on what they do best: investigating the handful of high-risk exceptions flagged by the system.

Instead of getting bogged down in repetitive manual checks, their oversight becomes a strategic risk management function.

Ready to see how agentic AI can automate your most complex financial operations? Nolana deploys compliant AI agents that orchestrate entire workflows, from claims processing to customer service. Learn more about Nolana's AI agents.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP