How Duck Creek Technologies Uses AI to Automate Insurance

How Duck Creek Technologies Uses AI to Automate Insurance

Discover how Duck Creek Technologies is transforming insurance with its AI-powered platform for policy, billing, and claims automation.

For P&C insurers, the name Duck Creek Technologies has become synonymous with moving away from the constraints of old, cumbersome legacy systems. Think of it as a modern, cloud-first operating system designed specifically for the insurance world. It gives carriers the tools to handle the entire policy lifecycle—from quoting and binding to billing and complex claims—with a level of speed and agility that just wasn't possible before.

Why Modern Insurance Needs a Technology Overhaul

The insurance industry is wrestling with a major problem: its foundation is built on aging mainframe technology. These systems, once the workhorses of the industry, are now the source of major operational headaches. They're slow, inflexible, and simply can't keep up with the expectations of today’s customers, who are used to seamless digital experiences in every other part of their lives.

This technological gap isn't just about inconvenience—it directly impacts a carrier's ability to compete. The rigid code of these legacy platforms makes launching a new insurance product a painstaking, months-long project. Integrating a new data source or a third-party tool? It’s often a monumental effort. This leaves insurers struggling to adapt, innovate, or deliver the personalized service policyholders demand.

The Rise of AI-Powered Solutions

This is precisely the gap a modern platform like Duck Creek Technologies was built to fill. It’s not about slapping a digital front-end on a clunky old process. Instead, Duck Creek enables a fundamental rethinking of how insurance operations should work, with intelligent automation at its core. It’s this shift that separates true modernization from simple digitization.

For P&C carriers, the game has changed. It's no longer enough to just manage risk. The new standard is delivering faster, more transparent, and more empathetic service at every turn, and technology is the engine making it all happen.

The company’s story started back in 2000, when its founders recognized that P&C carriers were being held back by their own technology. Their goal was to create a truly modern software suite to replace these rigid systems. By 2005, they had successfully launched their core Policy, Billing, and Claims modules, laying the groundwork for the platform we see today. You can get more details on their founding and growth in this brief history of Duck Creek.

Automating Claims and Elevating Customer Care

So where do you see the most significant impact of this shift? It comes down to two critical areas: automating insurance claims with AI and delivering superior customer care. With the right technology, these functions are no longer just cost centers; they become powerful opportunities to earn trust and build lasting loyalty.

Automated Claims Processing: Imagine AI analyzing a first notice of loss, instantly verifying policy coverage, and even assessing vehicle damage from uploaded photos. This is happening now, and it dramatically cuts down settlement times. We dive deeper into this in our guide on insurance claims processing automation.

Enhanced AI Customer Care: Intelligent virtual assistants can answer common questions around the clock, freeing up human agents for more complex issues. At the same time, analytics can give those agents a complete picture of a customer's history and potential needs before they even pick up the phone.

At the end of the day, platforms like Duck Creek give AI insurance companies the foundation they need to do more than just improve efficiency. They provide the tools to completely redefine the carrier-policyholder relationship for the better. This guide will show you exactly how.

Exploring The Duck Creek OnDemand Platform

At its core, the Duck Creek Technologies platform is an intelligent, unified system built for the realities of modern insurance. It’s a comprehensive, cloud-native Software-as-a-Service (SaaS) solution known as Duck Creek OnDemand, giving P&C carriers a complete toolkit to run their business without being anchored to legacy infrastructure.

Think of it this way: an old-school insurer had to build their factory from the ground up, piece by painful piece. Duck Creek OnDemand is like being handed the keys to a state-of-the-art, fully integrated manufacturing plant. It comes with all the specialized machinery you need, is built to scale at a moment's notice, and gets continuous upgrades without you ever having to shut down production.

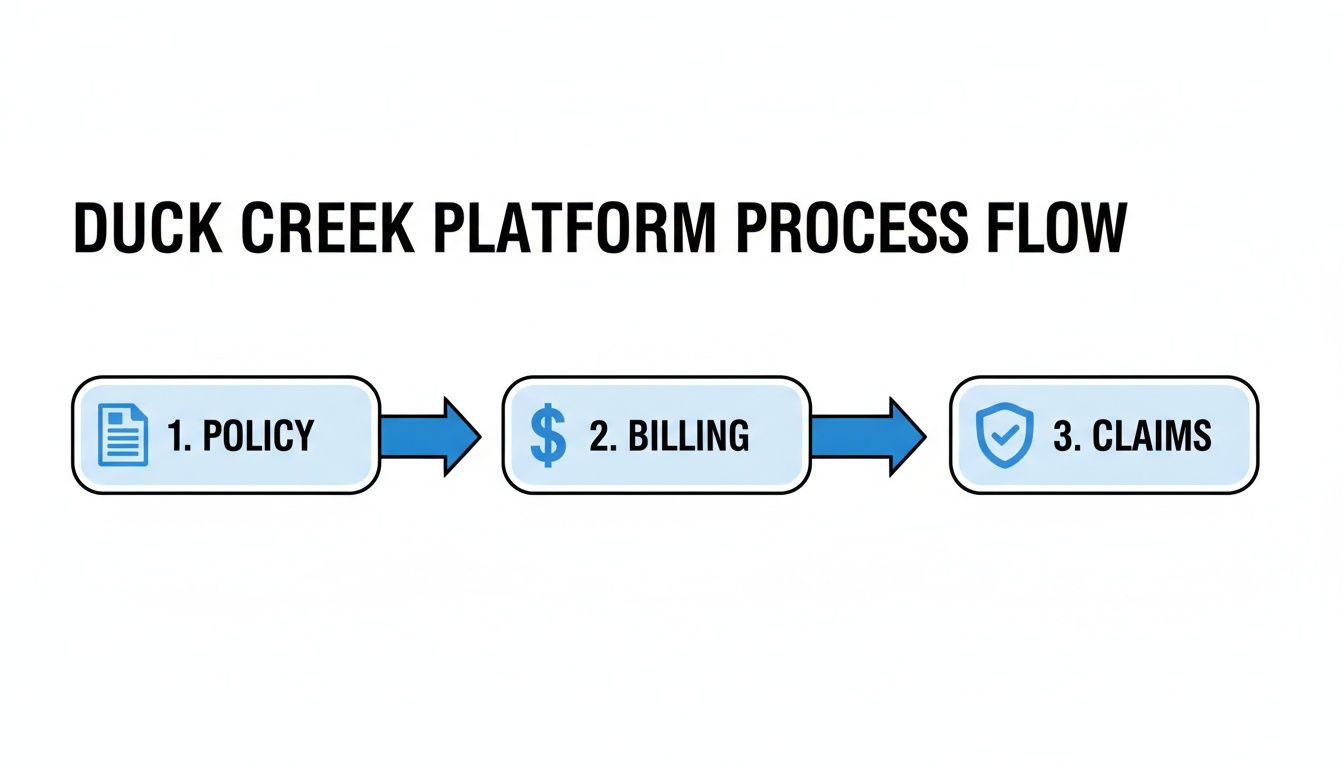

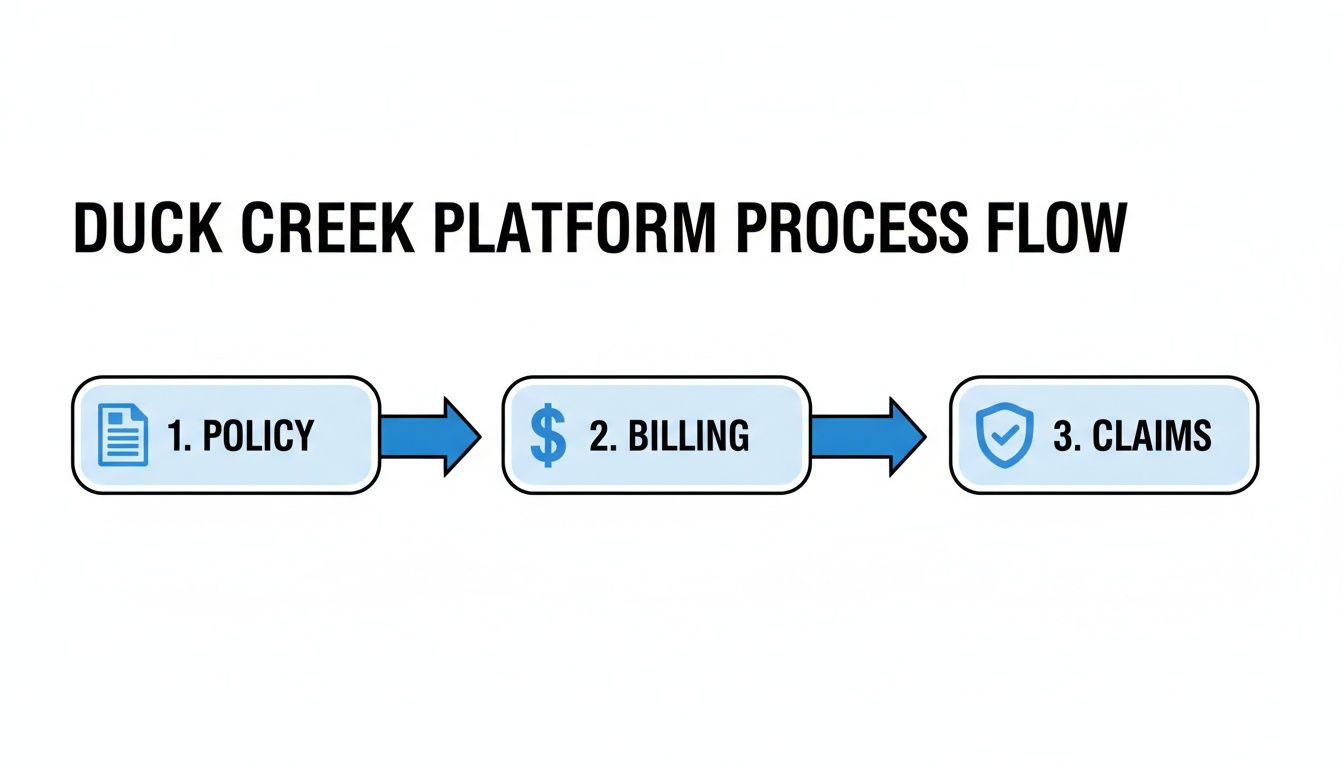

This integrated approach is absolutely critical for today's AI insurance companies focused on delivering superior AI customer care. Instead of wrestling with fragmented systems that create data silos and disjointed workflows, Duck Creek offers a single source of truth. The platform is built on three foundational pillars that are designed to work in perfect harmony: Policy, Billing, and Claims.

Duck Creek Policy: The Product Design Studio

First up is Duck Creek Policy, which is essentially the carrier's product design studio. This is the engine room where insurance products are conceived, defined, and managed. It gives insurers the agility to configure new policies, fine-tune rates, and get innovative products to market in a fraction of the time it would take on older, more rigid systems.

For instance, an insurer might want to launch a usage-based auto insurance product that adjusts premiums based on real-time driving behavior. Policy is where they would build out all the complex rules, underwriting guidelines, and policy documentation, ensuring everything is consistent and compliant from the very first quote. That kind of speed-to-market is a massive competitive advantage.

Duck Creek Billing: The Central Finance Hub

Next, Duck Creek Billing serves as the central finance hub for the entire operation. It handles the complete lifecycle of premiums and payments—from invoicing and collections all the way through to commissions and disbursements. But it’s much more than a simple transaction processor; it's a flexible framework capable of managing incredibly diverse and complex billing scenarios.

Whether it’s a straightforward direct-bill plan for a personal auto policy or a sophisticated payment schedule for a large commercial account with multiple stakeholders, Billing ensures accuracy and efficiency. Its tight integration with the other modules means that when a policy change happens in Policy, the billing information updates instantly. This prevents costly errors and makes for a much better customer experience. A smooth, transparent billing process is a quiet but powerful part of great customer care.

Let's take a quick look at how these core solutions fit together.

Duck Creek Core Suite at a Glance

Core Solution | Primary Function | Key Benefit |

|---|---|---|

Duck Creek Policy | Manages the entire policy lifecycle, from quoting and underwriting to issuance and servicing. | Enables rapid product development and speed-to-market for new insurance offerings. |

Duck Creek Billing | Handles all financial transactions, including invoicing, collections, commissions, and payments. | Provides flexible, accurate billing options that improve cash flow and customer satisfaction. |

Duck Creek Claims | Manages the end-to-end claims process, from first notice of loss (FNOL) to final settlement. | Accelerates claim resolution, reduces operational costs, and enhances the policyholder experience. |

The seamless flow of information between these components is what makes the platform so powerful. Each module is a strong performer on its own, but their true value is unlocked when they operate as one cohesive unit.

A seamless system isn't just about internal efficiency. For the policyholder, it's the difference between a frustrating, fragmented interaction and a smooth, trustworthy experience that builds confidence in their insurer.

Duck Creek Claims: The Rapid Response Unit

Finally, we have Duck Creek Claims, which acts as the carrier’s rapid response unit. It manages the entire claims journey, from the first notice of loss (FNOL) to the final settlement. This is often the moment of truth where an insurer’s promise is tested, and technology plays an indispensable role in making good on that promise.

The Claims module is engineered to automate and accelerate every step of the process. According to various claims AI reviews, this kind of automation can dramatically reduce cycle times and operational costs. For example, AI can analyze photos of vehicle damage, cross-reference them with parts databases, and generate a solid initial repair estimate in just minutes. This lets adjusters focus their expertise on more complex and nuanced cases.

This deep integration creates a truly unified operational backbone. When a claim is filed, the adjuster has immediate, one-click access to the complete policy and billing history without ever needing to jump between systems. This holistic view enables faster, more accurate decisions and is fundamental to providing the kind of responsive AI customer care that modern policyholders don’t just want—they expect.

How AI Is Revolutionizing Insurance Claims

When a claim is filed, that's the moment of truth for any insurer. It’s where their promise to the policyholder is put to the test. For decades, this process has been bogged down by manual paperwork, endless phone calls, and frustrating delays. But now, with platforms like Duck Creek Technologies, AI is completely overhauling this critical interaction, making it faster, more transparent, and impressively efficient.

This isn’t just about making small improvements; it's a fundamental rebuild of the entire claims workflow, driven by intelligent automation. The aim is to shatter the old bottlenecks. For today's AI insurance companies, the mission is to handle claims with more speed and precision than ever before, creating a much better experience for everyone involved.

This process flow shows how Duck Creek's main components—Policy, Billing, and Claims—are designed to work in concert.

The diagram really drives home how seamless integration allows information to flow from policy creation right through to claims settlement. This connectivity is the bedrock of AI-powered automation.

From Days to Minutes With AI-Powered Assessments

One of the most practical applications of AI in claims is image recognition. Think about a typical car accident. The old way involved scheduling an adjuster, waiting for them to inspect the vehicle, and then waiting again for a damage estimate. The whole ordeal could easily drag on for days, leaving the policyholder stuck.

With AI, the policyholder just needs to snap a few photos of the damage with their phone and upload them. An AI model gets to work immediately, analyzing the images to identify dents, scratches, and broken parts with stunning accuracy. In seconds, it can cross-reference that data with parts catalogs and local labor costs to generate a preliminary repair estimate.

Just that one change completely transforms the start of the claims journey, shrinking inspection times from days down to a matter of minutes. It’s not just faster—it gives the customer a sense of control and provides instant, reassuring feedback.

The Rise of Touchless Claims

The next logical step in this evolution is the "touchless claim." This is where AI manages a straightforward, low-risk claim from the initial report all the way to payment, with zero human intervention. For platforms like Duck Creek Technologies, this is the gold standard of claims efficiency.

Here’s a quick look at how a touchless claim might play out for minor property damage:

Automated First Report: The customer reports the claim online, and an AI system instantly logs the details.

Instant Verification: The system immediately confirms the policy is active and checks for any obvious red flags.

Damage Analysis: The customer uploads photos, and an AI model assesses the damage and calculates the repair cost.

Automated Payout: If the claim is within pre-set limits for cost and complexity, the system automatically approves it and sends a digital payment.

Touchless claims do more than just save money. They deliver on the modern customer's expectation for speed and convenience, turning a moment of stress into a surprisingly simple and positive interaction.

This level of automation frees up experienced human adjusters to focus on what they do best: handling complex, high-value, or emotionally charged claims that truly need empathy and expertise. To see how this works in practice, check out our guide on implementing AI in insurance claims.

Uncovering Fraud with Advanced Algorithms

Beyond just processing claims faster, AI adds a powerful layer of security through sophisticated fraud detection. Insurance fraud costs the industry billions, and traditional methods often rely on an adjuster’s gut feeling to spot inconsistencies—a process that's both slow and susceptible to human error.

AI algorithms, on the other hand, can sift through massive amounts of data to find subtle red flags and suspicious patterns that a person would never catch. These systems can highlight odd connections between claimants and repair shops, spot inflated damage estimates, or identify a pattern of similar claims from one person.

By constantly analyzing claims AI reviews and historical data, the system gets smarter over time, improving its ability to separate legitimate claims from fraudulent ones. This proactive approach helps insurers stop losses before they happen, which in turn helps keep premiums more affordable for everyone.

By building in these intelligent features, Duck Creek Technologies provides clear, measurable value. For insurers, it means lower operational costs and a much stronger defense against fraud. For customers, it translates to a faster, less stressful experience right when they need support the most. To learn more about how this technology is driving growth, explore the different Artificial Intelligence business solutions that are making an impact across industries.

Elevating Customer Care with Intelligent Automation

While smooth claims processing is essential, the real test for today's AI insurance companies is the quality of the customer experience. A fast payout doesn’t count for much if getting there was a confusing and frustrating ordeal. This is precisely where Duck Creek Technologies pivots from purely back-office efficiency to building a proactive, intelligent approach to AI customer care.

The objective is simple: create a more responsive, personal, and supportive journey for every single policyholder. The technology is designed to anticipate what a customer needs and deliver answers before they even have to ask, fundamentally changing the carrier-policyholder relationship.

It's like giving every customer their own digital concierge. Instead of getting stuck in complex phone menus or waiting on hold, they receive instant help, personalized updates, and clear guidance, all driven by smart automation.

Creating a Responsive and Personalized Journey

Policyholders today expect immediate, accurate information on their own terms. Duck Creek's platform makes this a reality by embedding AI-powered tools directly into the channels customers already use. Support is no longer restricted to business hours—it’s available 24/7.

A big piece of this is the use of intelligent chatbots and virtual assistants. These tools can handle a huge range of common questions on the spot, from explaining coverage details to providing a claim’s status. Because they pull from the same core system data as a human agent, the information is always correct and up-to-the-minute.

To get a better sense of how this technology can handle support tasks and automate workflows, check out this practical guide on using AI for customer service.

This kind of automation delivers a powerful one-two punch. Customers get the instant answers they crave, and human service teams are freed from answering the same low-level questions over and over. This lets your expert agents focus their time on the more complex or sensitive situations where real empathy and critical thinking make all the difference.

The Power of Proactive Communication

One of the biggest drivers of customer anxiety during a claim is uncertainty. Just waiting for an update can be incredibly stressful. AI helps eliminate this by enabling proactive, automated communication, keeping the policyholder in the loop.

For example, the system can be set up to automatically send notifications at key moments:

When a claim has been successfully received and assigned.

After an adjuster is dispatched or a virtual inspection is scheduled.

As soon as a repair estimate is approved.

The moment a payment is issued and on its way.

By keeping customers informed every step of the way, insurers manage expectations and build a deep sense of trust. This proactive communication turns a potentially negative event into a powerful demonstration of reliability and care.

This becomes especially critical during large-scale events like a hurricane or wildfire. The platform can use location data to proactively identify and reach out to affected customers, offering immediate assistance and instructions on how to start a claim. A simple, automated message can be a massive source of relief for people in a crisis, cementing their loyalty for years to come.

Intelligent Routing for High-Empathy Interactions

Of course, not every problem can be solved by a bot. When a customer has a complex issue or is in a highly emotional state, they need to talk to a skilled human. Intelligent automation also makes this handoff seamless.

Based on the customer's initial query, an intelligent routing system can direct them to the agent with the exact right skillset. A question about a tricky liability claim, for instance, goes straight to a senior claims specialist, skipping the general service queue entirely.

This gets the customer to the right person on the first try, avoiding the all-too-common frustration of being transferred multiple times. The agent who takes the call instantly gets a full transcript of the AI interaction, so the customer never has to repeat their story. This blend of automated efficiency and human expertise is the hallmark of modern AI customer care.

Building a Complete Insurtech Ecosystem

To really get a handle on Duck Creek Technologies, you have to look at how it grew up. The company didn't just stop at building a solid core system. Instead, it methodically built out a complete, end-to-end platform that can run the entire insurance lifecycle. This shift from a core systems player to a full-blown ecosystem wasn't an accident; it was the result of a clear vision and some very smart acquisitions.

This forward-looking approach means modern insurers can now manage everything from their digital agent portals to complex data analytics, all within a single, unified environment. It shows Duck Creek is serious about being a long-term technology partner, offering a platform that can genuinely scale and adapt as an insurer's business evolves.

From Core Systems to a Full Value Chain

The real turning point came in August 2016. A joint venture took Duck Creek private again, which lit a fire under its expansion plans. The company immediately started snapping up specialist firms to bolt new, critical capabilities onto its core platform. Key buys included Agencyport Software for digital engagement, Yodil for insurance data management, and Outline Systems for distribution management. You can get more of the inside story on this pivotal period and their return to independence on their blog.

This wasn't just growth for growth's sake. It created a powerful, interconnected ecosystem where every part talks to the others. Let’s look at how these pieces fit together:

Digital Portals: With Agencyport, Duck Creek added the crucial front-end tools that agents and customers actually interact with. This was a massive step up for the digital experience.

Data Analytics: The Yodil acquisition brought serious data management and analytics muscle, giving insurers the raw power to make smarter underwriting and pricing calls.

Distribution Management: Adding Outline Systems’ tech gave Duck Creek a robust solution for managing complex agent and broker networks, covering everything from onboarding to commissions.

A Unified Platform for Modern Insurers

By weaving these specialized solutions together, Duck Creek created a platform where information just flows. An agent using the digital portal to write a new policy automatically pushes that data into the core policy system. That, in turn, informs the billing and claims modules. It’s the kind of integration that finally breaks down the data silos that have held the industry back for decades.

This isn't just an IT convenience; it's a genuine strategic advantage. Insurers get a single, reliable view of their customers, agents, and overall business health, which is absolutely essential for making good decisions.

This complete picture becomes even more critical when you start bringing AI into the mix. Clean, accessible data is the fuel for any automation project. By ensuring data integrity across the entire value chain, Duck Creek lays the groundwork needed to automate complex workflows and drive better outcomes. For a real-world look at this, our case study on transforming insurance claims with agentic AI shows what's possible.

If you look at various claims AI reviews, you'll see a common theme: a unified data source is one of the biggest success factors for any claims automation rollout. This ecosystem approach is how Duck Creek Technologies makes sure that foundation is there from day one.

The Future-Ready Vision of Duck Creek Technologies

While the current platform delivers immediate benefits, the real story behind Duck Creek Technologies is its vision for where the insurance industry is heading. This isn't just about reacting to today's market—it's about actively building the technology that will define tomorrow. The goal is a platform that gets progressively smarter, faster, and more woven into the fabric of an insurer's daily operations.

At the heart of this vision is the idea of "invisible technology." Think of powerful, intelligent systems working so seamlessly in the background that they empower professionals, not get in their way. The objective is to automate the repetitive, manual work that bogs down underwriters, claims adjusters, and service agents, freeing them to focus on what humans do best: building relationships, thinking strategically, and making nuanced judgment calls.

Empowering Insurers with Agility and Innovation

How does this vision become a reality? It starts with a foundation built on flexibility and openness. Tools like low-code configuration and open APIs are central to this, giving AI insurance companies the ability to pivot and adapt with remarkable speed. Instead of being handcuffed to a rigid, legacy system, carriers can quickly reconfigure workflows, plug in new data sources, and partner with third-party insurtechs.

This kind of adaptability is what it means to be a future-ready insurer. It shifts IT from a simple cost center to a genuine driver of business agility—a transformation often mentioned in positive claims AI reviews. When you can design and launch a new product in a matter of weeks, not months or years, you've secured a powerful competitive advantage.

Partnering with Duck Creek is more than a technology upgrade; it's a strategic investment in becoming an agile, customer-centric organization prepared for whatever comes next.

The platform's global scale reinforces its role as a major force in the market. Duck Creek Technologies has grown into a major global player, with over 1,200 employees working across 12 offices in five countries. This international footprint highlights a deep commitment to building smarter, more invisible technology that supports human ingenuity everywhere. You can learn more about Duck Creek's global story and vision for the future.

This mix of advanced AI customer care, operational efficiency, and a constant push for innovation is what makes Duck Creek compelling. By providing the tools for continuous evolution, the platform helps carriers not just keep up with change, but lead it. For companies looking to build similar capabilities, exploring these intelligent automation solutions is a great next step toward transforming core business processes.

Frequently Asked Questions About Duck Creek

We've covered a lot of ground on Duck Creek Technologies, so let's tackle some of the most practical questions that pop up when insurers are weighing their options. Think of this as the "boots on the ground" perspective on implementation, security, and real-world performance.

How Does Duck Creek Automate Insurance Claims?

At its core, Duck Creek uses AI to orchestrate the entire claims journey, from the first notice of loss all the way to settlement. It's not just about simple task automation; it's about intelligent workflow management.

A great example is in auto claims. The system can analyze photos of vehicle damage and, within minutes, generate a surprisingly accurate repair estimate. This used to take an adjuster days of back-and-forth. This is the magic behind "touchless claims"—simple, clear-cut cases can be processed and paid out without a single person needing to touch them, which is a game-changer for speed and efficiency.

You’ll see this capability highlighted in many claims AI reviews. It lets your experienced adjusters step away from the straightforward, repetitive claims and focus their expertise on the complex, high-stakes cases that truly require a human touch. The AI also acts as a silent partner in fraud detection, spotting unusual patterns in claim data that a person might easily miss.

What Is AI Customer Care in This Context?

AI customer care is all about using smart technology to make the policyholder experience feel more immediate, personal, and supportive. It’s not about replacing people but augmenting them.

Imagine a policyholder needing a claim status update at 2 AM. Instead of waiting for business hours, they can interact with an AI-powered chatbot that provides instant, accurate answers. These bots can also guide users through filing a claim or answer common policy questions, available 24/7.

The real aim of AI customer care is to handle the immediate, factual needs instantly, so human agents can dedicate their time to situations that require empathy and complex problem-solving. It shifts the entire dynamic from purely transactional to genuinely helpful.

The platform can also push out proactive notifications—like "Your vehicle inspection is scheduled" or "Your payment has been issued"—which goes a long way in reducing customer anxiety and building trust. And when a human is needed, the system intelligently routes the policyholder to the best-qualified agent for their specific problem, creating a smooth and frustration-free handoff.

Can Duck Creek Integrate with Existing Systems?

Absolutely. In fact, this is one of its biggest selling points. You can’t just rip and replace decades of IT infrastructure overnight. Duck Creek was designed with this reality in mind.

It’s built on an open architecture with a massive library of APIs. This allows it to plug into just about anything: your tried-and-true legacy mainframes, third-party data services (like weather or fraud watchlists), and other modern insurtech tools. This flexibility is crucial for AI insurance companies that want to modernize in stages, not in one giant, disruptive leap.

Think of Duck Creek as a central nervous system. It can connect to your various data sources and create a single, unified view of both your customer and your operations. This is the connectivity that makes powerful automation and sharp analytics possible.

At Nolana, we build and deploy compliant AI agents designed to work directly inside core systems like Duck Creek. Our platform supercharges your claims processing and case management, creating a unified workspace where your teams and our AI can collaborate seamlessly on your most complex insurance workflows.

For P&C insurers, the name Duck Creek Technologies has become synonymous with moving away from the constraints of old, cumbersome legacy systems. Think of it as a modern, cloud-first operating system designed specifically for the insurance world. It gives carriers the tools to handle the entire policy lifecycle—from quoting and binding to billing and complex claims—with a level of speed and agility that just wasn't possible before.

Why Modern Insurance Needs a Technology Overhaul

The insurance industry is wrestling with a major problem: its foundation is built on aging mainframe technology. These systems, once the workhorses of the industry, are now the source of major operational headaches. They're slow, inflexible, and simply can't keep up with the expectations of today’s customers, who are used to seamless digital experiences in every other part of their lives.

This technological gap isn't just about inconvenience—it directly impacts a carrier's ability to compete. The rigid code of these legacy platforms makes launching a new insurance product a painstaking, months-long project. Integrating a new data source or a third-party tool? It’s often a monumental effort. This leaves insurers struggling to adapt, innovate, or deliver the personalized service policyholders demand.

The Rise of AI-Powered Solutions

This is precisely the gap a modern platform like Duck Creek Technologies was built to fill. It’s not about slapping a digital front-end on a clunky old process. Instead, Duck Creek enables a fundamental rethinking of how insurance operations should work, with intelligent automation at its core. It’s this shift that separates true modernization from simple digitization.

For P&C carriers, the game has changed. It's no longer enough to just manage risk. The new standard is delivering faster, more transparent, and more empathetic service at every turn, and technology is the engine making it all happen.

The company’s story started back in 2000, when its founders recognized that P&C carriers were being held back by their own technology. Their goal was to create a truly modern software suite to replace these rigid systems. By 2005, they had successfully launched their core Policy, Billing, and Claims modules, laying the groundwork for the platform we see today. You can get more details on their founding and growth in this brief history of Duck Creek.

Automating Claims and Elevating Customer Care

So where do you see the most significant impact of this shift? It comes down to two critical areas: automating insurance claims with AI and delivering superior customer care. With the right technology, these functions are no longer just cost centers; they become powerful opportunities to earn trust and build lasting loyalty.

Automated Claims Processing: Imagine AI analyzing a first notice of loss, instantly verifying policy coverage, and even assessing vehicle damage from uploaded photos. This is happening now, and it dramatically cuts down settlement times. We dive deeper into this in our guide on insurance claims processing automation.

Enhanced AI Customer Care: Intelligent virtual assistants can answer common questions around the clock, freeing up human agents for more complex issues. At the same time, analytics can give those agents a complete picture of a customer's history and potential needs before they even pick up the phone.

At the end of the day, platforms like Duck Creek give AI insurance companies the foundation they need to do more than just improve efficiency. They provide the tools to completely redefine the carrier-policyholder relationship for the better. This guide will show you exactly how.

Exploring The Duck Creek OnDemand Platform

At its core, the Duck Creek Technologies platform is an intelligent, unified system built for the realities of modern insurance. It’s a comprehensive, cloud-native Software-as-a-Service (SaaS) solution known as Duck Creek OnDemand, giving P&C carriers a complete toolkit to run their business without being anchored to legacy infrastructure.

Think of it this way: an old-school insurer had to build their factory from the ground up, piece by painful piece. Duck Creek OnDemand is like being handed the keys to a state-of-the-art, fully integrated manufacturing plant. It comes with all the specialized machinery you need, is built to scale at a moment's notice, and gets continuous upgrades without you ever having to shut down production.

This integrated approach is absolutely critical for today's AI insurance companies focused on delivering superior AI customer care. Instead of wrestling with fragmented systems that create data silos and disjointed workflows, Duck Creek offers a single source of truth. The platform is built on three foundational pillars that are designed to work in perfect harmony: Policy, Billing, and Claims.

Duck Creek Policy: The Product Design Studio

First up is Duck Creek Policy, which is essentially the carrier's product design studio. This is the engine room where insurance products are conceived, defined, and managed. It gives insurers the agility to configure new policies, fine-tune rates, and get innovative products to market in a fraction of the time it would take on older, more rigid systems.

For instance, an insurer might want to launch a usage-based auto insurance product that adjusts premiums based on real-time driving behavior. Policy is where they would build out all the complex rules, underwriting guidelines, and policy documentation, ensuring everything is consistent and compliant from the very first quote. That kind of speed-to-market is a massive competitive advantage.

Duck Creek Billing: The Central Finance Hub

Next, Duck Creek Billing serves as the central finance hub for the entire operation. It handles the complete lifecycle of premiums and payments—from invoicing and collections all the way through to commissions and disbursements. But it’s much more than a simple transaction processor; it's a flexible framework capable of managing incredibly diverse and complex billing scenarios.

Whether it’s a straightforward direct-bill plan for a personal auto policy or a sophisticated payment schedule for a large commercial account with multiple stakeholders, Billing ensures accuracy and efficiency. Its tight integration with the other modules means that when a policy change happens in Policy, the billing information updates instantly. This prevents costly errors and makes for a much better customer experience. A smooth, transparent billing process is a quiet but powerful part of great customer care.

Let's take a quick look at how these core solutions fit together.

Duck Creek Core Suite at a Glance

Core Solution | Primary Function | Key Benefit |

|---|---|---|

Duck Creek Policy | Manages the entire policy lifecycle, from quoting and underwriting to issuance and servicing. | Enables rapid product development and speed-to-market for new insurance offerings. |

Duck Creek Billing | Handles all financial transactions, including invoicing, collections, commissions, and payments. | Provides flexible, accurate billing options that improve cash flow and customer satisfaction. |

Duck Creek Claims | Manages the end-to-end claims process, from first notice of loss (FNOL) to final settlement. | Accelerates claim resolution, reduces operational costs, and enhances the policyholder experience. |

The seamless flow of information between these components is what makes the platform so powerful. Each module is a strong performer on its own, but their true value is unlocked when they operate as one cohesive unit.

A seamless system isn't just about internal efficiency. For the policyholder, it's the difference between a frustrating, fragmented interaction and a smooth, trustworthy experience that builds confidence in their insurer.

Duck Creek Claims: The Rapid Response Unit

Finally, we have Duck Creek Claims, which acts as the carrier’s rapid response unit. It manages the entire claims journey, from the first notice of loss (FNOL) to the final settlement. This is often the moment of truth where an insurer’s promise is tested, and technology plays an indispensable role in making good on that promise.

The Claims module is engineered to automate and accelerate every step of the process. According to various claims AI reviews, this kind of automation can dramatically reduce cycle times and operational costs. For example, AI can analyze photos of vehicle damage, cross-reference them with parts databases, and generate a solid initial repair estimate in just minutes. This lets adjusters focus their expertise on more complex and nuanced cases.

This deep integration creates a truly unified operational backbone. When a claim is filed, the adjuster has immediate, one-click access to the complete policy and billing history without ever needing to jump between systems. This holistic view enables faster, more accurate decisions and is fundamental to providing the kind of responsive AI customer care that modern policyholders don’t just want—they expect.

How AI Is Revolutionizing Insurance Claims

When a claim is filed, that's the moment of truth for any insurer. It’s where their promise to the policyholder is put to the test. For decades, this process has been bogged down by manual paperwork, endless phone calls, and frustrating delays. But now, with platforms like Duck Creek Technologies, AI is completely overhauling this critical interaction, making it faster, more transparent, and impressively efficient.

This isn’t just about making small improvements; it's a fundamental rebuild of the entire claims workflow, driven by intelligent automation. The aim is to shatter the old bottlenecks. For today's AI insurance companies, the mission is to handle claims with more speed and precision than ever before, creating a much better experience for everyone involved.

This process flow shows how Duck Creek's main components—Policy, Billing, and Claims—are designed to work in concert.

The diagram really drives home how seamless integration allows information to flow from policy creation right through to claims settlement. This connectivity is the bedrock of AI-powered automation.

From Days to Minutes With AI-Powered Assessments

One of the most practical applications of AI in claims is image recognition. Think about a typical car accident. The old way involved scheduling an adjuster, waiting for them to inspect the vehicle, and then waiting again for a damage estimate. The whole ordeal could easily drag on for days, leaving the policyholder stuck.

With AI, the policyholder just needs to snap a few photos of the damage with their phone and upload them. An AI model gets to work immediately, analyzing the images to identify dents, scratches, and broken parts with stunning accuracy. In seconds, it can cross-reference that data with parts catalogs and local labor costs to generate a preliminary repair estimate.

Just that one change completely transforms the start of the claims journey, shrinking inspection times from days down to a matter of minutes. It’s not just faster—it gives the customer a sense of control and provides instant, reassuring feedback.

The Rise of Touchless Claims

The next logical step in this evolution is the "touchless claim." This is where AI manages a straightforward, low-risk claim from the initial report all the way to payment, with zero human intervention. For platforms like Duck Creek Technologies, this is the gold standard of claims efficiency.

Here’s a quick look at how a touchless claim might play out for minor property damage:

Automated First Report: The customer reports the claim online, and an AI system instantly logs the details.

Instant Verification: The system immediately confirms the policy is active and checks for any obvious red flags.

Damage Analysis: The customer uploads photos, and an AI model assesses the damage and calculates the repair cost.

Automated Payout: If the claim is within pre-set limits for cost and complexity, the system automatically approves it and sends a digital payment.

Touchless claims do more than just save money. They deliver on the modern customer's expectation for speed and convenience, turning a moment of stress into a surprisingly simple and positive interaction.

This level of automation frees up experienced human adjusters to focus on what they do best: handling complex, high-value, or emotionally charged claims that truly need empathy and expertise. To see how this works in practice, check out our guide on implementing AI in insurance claims.

Uncovering Fraud with Advanced Algorithms

Beyond just processing claims faster, AI adds a powerful layer of security through sophisticated fraud detection. Insurance fraud costs the industry billions, and traditional methods often rely on an adjuster’s gut feeling to spot inconsistencies—a process that's both slow and susceptible to human error.

AI algorithms, on the other hand, can sift through massive amounts of data to find subtle red flags and suspicious patterns that a person would never catch. These systems can highlight odd connections between claimants and repair shops, spot inflated damage estimates, or identify a pattern of similar claims from one person.

By constantly analyzing claims AI reviews and historical data, the system gets smarter over time, improving its ability to separate legitimate claims from fraudulent ones. This proactive approach helps insurers stop losses before they happen, which in turn helps keep premiums more affordable for everyone.

By building in these intelligent features, Duck Creek Technologies provides clear, measurable value. For insurers, it means lower operational costs and a much stronger defense against fraud. For customers, it translates to a faster, less stressful experience right when they need support the most. To learn more about how this technology is driving growth, explore the different Artificial Intelligence business solutions that are making an impact across industries.

Elevating Customer Care with Intelligent Automation

While smooth claims processing is essential, the real test for today's AI insurance companies is the quality of the customer experience. A fast payout doesn’t count for much if getting there was a confusing and frustrating ordeal. This is precisely where Duck Creek Technologies pivots from purely back-office efficiency to building a proactive, intelligent approach to AI customer care.

The objective is simple: create a more responsive, personal, and supportive journey for every single policyholder. The technology is designed to anticipate what a customer needs and deliver answers before they even have to ask, fundamentally changing the carrier-policyholder relationship.

It's like giving every customer their own digital concierge. Instead of getting stuck in complex phone menus or waiting on hold, they receive instant help, personalized updates, and clear guidance, all driven by smart automation.

Creating a Responsive and Personalized Journey

Policyholders today expect immediate, accurate information on their own terms. Duck Creek's platform makes this a reality by embedding AI-powered tools directly into the channels customers already use. Support is no longer restricted to business hours—it’s available 24/7.

A big piece of this is the use of intelligent chatbots and virtual assistants. These tools can handle a huge range of common questions on the spot, from explaining coverage details to providing a claim’s status. Because they pull from the same core system data as a human agent, the information is always correct and up-to-the-minute.

To get a better sense of how this technology can handle support tasks and automate workflows, check out this practical guide on using AI for customer service.

This kind of automation delivers a powerful one-two punch. Customers get the instant answers they crave, and human service teams are freed from answering the same low-level questions over and over. This lets your expert agents focus their time on the more complex or sensitive situations where real empathy and critical thinking make all the difference.

The Power of Proactive Communication

One of the biggest drivers of customer anxiety during a claim is uncertainty. Just waiting for an update can be incredibly stressful. AI helps eliminate this by enabling proactive, automated communication, keeping the policyholder in the loop.

For example, the system can be set up to automatically send notifications at key moments:

When a claim has been successfully received and assigned.

After an adjuster is dispatched or a virtual inspection is scheduled.

As soon as a repair estimate is approved.

The moment a payment is issued and on its way.

By keeping customers informed every step of the way, insurers manage expectations and build a deep sense of trust. This proactive communication turns a potentially negative event into a powerful demonstration of reliability and care.

This becomes especially critical during large-scale events like a hurricane or wildfire. The platform can use location data to proactively identify and reach out to affected customers, offering immediate assistance and instructions on how to start a claim. A simple, automated message can be a massive source of relief for people in a crisis, cementing their loyalty for years to come.

Intelligent Routing for High-Empathy Interactions

Of course, not every problem can be solved by a bot. When a customer has a complex issue or is in a highly emotional state, they need to talk to a skilled human. Intelligent automation also makes this handoff seamless.

Based on the customer's initial query, an intelligent routing system can direct them to the agent with the exact right skillset. A question about a tricky liability claim, for instance, goes straight to a senior claims specialist, skipping the general service queue entirely.

This gets the customer to the right person on the first try, avoiding the all-too-common frustration of being transferred multiple times. The agent who takes the call instantly gets a full transcript of the AI interaction, so the customer never has to repeat their story. This blend of automated efficiency and human expertise is the hallmark of modern AI customer care.

Building a Complete Insurtech Ecosystem

To really get a handle on Duck Creek Technologies, you have to look at how it grew up. The company didn't just stop at building a solid core system. Instead, it methodically built out a complete, end-to-end platform that can run the entire insurance lifecycle. This shift from a core systems player to a full-blown ecosystem wasn't an accident; it was the result of a clear vision and some very smart acquisitions.

This forward-looking approach means modern insurers can now manage everything from their digital agent portals to complex data analytics, all within a single, unified environment. It shows Duck Creek is serious about being a long-term technology partner, offering a platform that can genuinely scale and adapt as an insurer's business evolves.

From Core Systems to a Full Value Chain

The real turning point came in August 2016. A joint venture took Duck Creek private again, which lit a fire under its expansion plans. The company immediately started snapping up specialist firms to bolt new, critical capabilities onto its core platform. Key buys included Agencyport Software for digital engagement, Yodil for insurance data management, and Outline Systems for distribution management. You can get more of the inside story on this pivotal period and their return to independence on their blog.

This wasn't just growth for growth's sake. It created a powerful, interconnected ecosystem where every part talks to the others. Let’s look at how these pieces fit together:

Digital Portals: With Agencyport, Duck Creek added the crucial front-end tools that agents and customers actually interact with. This was a massive step up for the digital experience.

Data Analytics: The Yodil acquisition brought serious data management and analytics muscle, giving insurers the raw power to make smarter underwriting and pricing calls.

Distribution Management: Adding Outline Systems’ tech gave Duck Creek a robust solution for managing complex agent and broker networks, covering everything from onboarding to commissions.

A Unified Platform for Modern Insurers

By weaving these specialized solutions together, Duck Creek created a platform where information just flows. An agent using the digital portal to write a new policy automatically pushes that data into the core policy system. That, in turn, informs the billing and claims modules. It’s the kind of integration that finally breaks down the data silos that have held the industry back for decades.

This isn't just an IT convenience; it's a genuine strategic advantage. Insurers get a single, reliable view of their customers, agents, and overall business health, which is absolutely essential for making good decisions.

This complete picture becomes even more critical when you start bringing AI into the mix. Clean, accessible data is the fuel for any automation project. By ensuring data integrity across the entire value chain, Duck Creek lays the groundwork needed to automate complex workflows and drive better outcomes. For a real-world look at this, our case study on transforming insurance claims with agentic AI shows what's possible.

If you look at various claims AI reviews, you'll see a common theme: a unified data source is one of the biggest success factors for any claims automation rollout. This ecosystem approach is how Duck Creek Technologies makes sure that foundation is there from day one.

The Future-Ready Vision of Duck Creek Technologies

While the current platform delivers immediate benefits, the real story behind Duck Creek Technologies is its vision for where the insurance industry is heading. This isn't just about reacting to today's market—it's about actively building the technology that will define tomorrow. The goal is a platform that gets progressively smarter, faster, and more woven into the fabric of an insurer's daily operations.

At the heart of this vision is the idea of "invisible technology." Think of powerful, intelligent systems working so seamlessly in the background that they empower professionals, not get in their way. The objective is to automate the repetitive, manual work that bogs down underwriters, claims adjusters, and service agents, freeing them to focus on what humans do best: building relationships, thinking strategically, and making nuanced judgment calls.

Empowering Insurers with Agility and Innovation

How does this vision become a reality? It starts with a foundation built on flexibility and openness. Tools like low-code configuration and open APIs are central to this, giving AI insurance companies the ability to pivot and adapt with remarkable speed. Instead of being handcuffed to a rigid, legacy system, carriers can quickly reconfigure workflows, plug in new data sources, and partner with third-party insurtechs.

This kind of adaptability is what it means to be a future-ready insurer. It shifts IT from a simple cost center to a genuine driver of business agility—a transformation often mentioned in positive claims AI reviews. When you can design and launch a new product in a matter of weeks, not months or years, you've secured a powerful competitive advantage.

Partnering with Duck Creek is more than a technology upgrade; it's a strategic investment in becoming an agile, customer-centric organization prepared for whatever comes next.

The platform's global scale reinforces its role as a major force in the market. Duck Creek Technologies has grown into a major global player, with over 1,200 employees working across 12 offices in five countries. This international footprint highlights a deep commitment to building smarter, more invisible technology that supports human ingenuity everywhere. You can learn more about Duck Creek's global story and vision for the future.

This mix of advanced AI customer care, operational efficiency, and a constant push for innovation is what makes Duck Creek compelling. By providing the tools for continuous evolution, the platform helps carriers not just keep up with change, but lead it. For companies looking to build similar capabilities, exploring these intelligent automation solutions is a great next step toward transforming core business processes.

Frequently Asked Questions About Duck Creek

We've covered a lot of ground on Duck Creek Technologies, so let's tackle some of the most practical questions that pop up when insurers are weighing their options. Think of this as the "boots on the ground" perspective on implementation, security, and real-world performance.

How Does Duck Creek Automate Insurance Claims?

At its core, Duck Creek uses AI to orchestrate the entire claims journey, from the first notice of loss all the way to settlement. It's not just about simple task automation; it's about intelligent workflow management.

A great example is in auto claims. The system can analyze photos of vehicle damage and, within minutes, generate a surprisingly accurate repair estimate. This used to take an adjuster days of back-and-forth. This is the magic behind "touchless claims"—simple, clear-cut cases can be processed and paid out without a single person needing to touch them, which is a game-changer for speed and efficiency.

You’ll see this capability highlighted in many claims AI reviews. It lets your experienced adjusters step away from the straightforward, repetitive claims and focus their expertise on the complex, high-stakes cases that truly require a human touch. The AI also acts as a silent partner in fraud detection, spotting unusual patterns in claim data that a person might easily miss.

What Is AI Customer Care in This Context?

AI customer care is all about using smart technology to make the policyholder experience feel more immediate, personal, and supportive. It’s not about replacing people but augmenting them.

Imagine a policyholder needing a claim status update at 2 AM. Instead of waiting for business hours, they can interact with an AI-powered chatbot that provides instant, accurate answers. These bots can also guide users through filing a claim or answer common policy questions, available 24/7.

The real aim of AI customer care is to handle the immediate, factual needs instantly, so human agents can dedicate their time to situations that require empathy and complex problem-solving. It shifts the entire dynamic from purely transactional to genuinely helpful.

The platform can also push out proactive notifications—like "Your vehicle inspection is scheduled" or "Your payment has been issued"—which goes a long way in reducing customer anxiety and building trust. And when a human is needed, the system intelligently routes the policyholder to the best-qualified agent for their specific problem, creating a smooth and frustration-free handoff.

Can Duck Creek Integrate with Existing Systems?

Absolutely. In fact, this is one of its biggest selling points. You can’t just rip and replace decades of IT infrastructure overnight. Duck Creek was designed with this reality in mind.

It’s built on an open architecture with a massive library of APIs. This allows it to plug into just about anything: your tried-and-true legacy mainframes, third-party data services (like weather or fraud watchlists), and other modern insurtech tools. This flexibility is crucial for AI insurance companies that want to modernize in stages, not in one giant, disruptive leap.

Think of Duck Creek as a central nervous system. It can connect to your various data sources and create a single, unified view of both your customer and your operations. This is the connectivity that makes powerful automation and sharp analytics possible.

At Nolana, we build and deploy compliant AI agents designed to work directly inside core systems like Duck Creek. Our platform supercharges your claims processing and case management, creating a unified workspace where your teams and our AI can collaborate seamlessly on your most complex insurance workflows.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP