Boost Efficiency: how to reduce operational costs with AI in Banking & Insurance

Boost Efficiency: how to reduce operational costs with AI in Banking & Insurance

Learn how to reduce operational costs with AI-driven automation for banking and insurance, from claims processing to customer care, with practical steps.

To truly get a handle on operational costs, financial and insurance firms are looking past simple belt-tightening. The new game plan involves AI-driven automation to fundamentally reshape core workflows. It’s about targeting the big-ticket items—like claims processing and customer care—and turning cost management from a defensive chore into a real competitive advantage.

The Mandate for Smarter Cost Management in Finance

It’s a familiar story for leaders in finance and insurance: you have to slash operational expenses, but you can't compromise on strict regulations or ever-rising customer expectations. The old playbook of across-the-board budget cuts just doesn't work anymore. It fails to fix the deep-rooted inefficiencies that come from manual, repetitive work.

The pressure is on. In banking and insurance, operational costs can easily balloon, driven by intricate claims processes and the constant demands of customer service. It’s no wonder executives are laser-focused on efficiency. A recent BCG survey really brings this home, revealing that companies globally only hit 48% of their cost-saving targets.

This gap has pushed a third of leaders to name cost management as their number one priority. And while the sector faces unique hurdles, here's the interesting part: 67% of those surveyed plan to reinvest savings directly into AI to finally achieve those deep cost reductions.

Targeting High-Impact Areas with AI

So where do you start? The biggest wins come from automating the complex, repetitive tasks that drain your team's time and energy. In financial services, two areas practically scream for attention: insurance claims processing and customer care.

Before diving into solutions, it helps to see where the money is actually going. Here’s a quick breakdown of the most common cost centers.

Top Operational Cost Drivers in Financial Services

Operational Area | Primary Cost Drivers | Typical Manual Overhead |

|---|---|---|

Customer Support | High call volumes, agent salaries, long handling times, training costs | Repetitive inquiries, password resets, transaction lookups, basic policy questions |

Claims Processing | Manual data entry, document verification, fraud detection, settlement delays | Reviewing forms, cross-referencing policy details, coordinating with adjusters |

Underwriting | Data gathering, risk assessment, manual decisioning, compliance checks | Sourcing and validating applicant data from multiple systems, manual report generation |

Compliance & Reporting | KYC/AML checks, regulatory reporting, audit preparation, monitoring | Manual data aggregation, report creation, endless cross-checking and validation |

This table makes it clear: manual processes are the common thread tying these high costs together. They're not just inefficient; they're expensive.

Insurance Claims: The journey of a claim, from that first call to the final payout, is often a maze of manual data entry, document checks, and policy lookups. Every manual step is a chance for an error or a delay, which directly inflates the cost per claim.

Customer Care: Contact centers are essential, but they're costly. Agents spend far too much of their day on routine stuff—simple inquiries, transaction disputes, and pulling up information. This drives up handling times and, with them, operational overhead.

This is where intelligent automation comes in. Modern AI customer care platforms and specialized solutions for AI insurance companies are built to do more than just answer a basic question; they can handle complex, multi-step processes from start to finish. For a deeper look, it's worth exploring dedicated business process automation solutions.

From Defensive Tactic to Competitive Advantage

Adopting this kind of automation changes the entire conversation about how to reduce operational costs. It’s no longer about just trimming the fat; it’s about building a leaner, more resilient operational engine for the long haul.

By automating routine tasks, organizations empower their teams to focus on high-value activities that require human expertise, judgment, and empathy. This strategic reallocation of resources is the key to turning cost reduction into a genuine competitive advantage.

The money saved can be plowed back into innovation, new products, and, most importantly, a better customer experience. For example, faster claims AI reviews don't just cut your internal costs—they make policyholders happier and more likely to stick around. This forward-thinking approach is what separates the leaders from the laggards. For more on this, check out our guide on the https://nolana.com/articles/financial-services-digital-transformation.

Streamlining Insurance Claims with AI Automation

Insurance claims processing has always been a classic cost center, tangled in manual tasks and disconnected workflows. From the first notice of loss (FNOL) all the way to settlement, every step is a potential bottleneck, inviting delays and errors that inflate the cost per claim. This is precisely where leading AI insurance companies are gaining a serious competitive advantage by completely rethinking the process with AI.

When you automate the administrative grind with AI, you can drastically reduce the overhead tied to every single claim. We're not talking about small, incremental gains here. This is a fundamental shift in how to reduce operational costs within one of the most resource-intensive parts of the business. AI agents can manage routine tasks from start to finish, letting your human adjusters apply their expertise to the complex, high-stakes decisions that truly matter.

Pinpointing AI's Impact Across the Claims Lifecycle

To really see where AI makes a difference, let's walk through a common scenario: a property damage claim after a major storm.

A homeowner uploads photos, repair estimates, and a description of the damage through your customer portal. In a typical setup, this simple action triggers a long, manual chain reaction. An adjuster has to open every file, key data into the core system, and manually check policy details—all before the real assessment even starts.

With an AI agent, the entire game changes. The moment those documents hit the server, the agent is on it.

Automated Data Extraction: The AI reads and pulls key information from photos, PDFs, and text forms instantly. It identifies the policy number, date of loss, damage type, and claimant details without anyone lifting a finger.

Policy Verification: Next, it cross-references that info with the customer's policy to confirm coverage, check deductibles, and flag any potential exclusions. This takes seconds, not hours.

Initial Triage: Based on rules you define, the AI categorizes the claim's severity. Simple, low-value claims might get fast-tracked for immediate approval, while complex cases are routed to a specialized adjuster with a neatly packaged case file.

This initial automation alone can slash cycle times. By giving adjusters a verified, structured, and complete case file right from the start, you get rid of the costly back-and-forth that plagues traditional claims intake.

A Practical Example of an End-to-End AI Workflow

Let's stick with our storm damage claim. After the AI handles the initial intake and verification, its role expands, acting as a co-pilot for the human adjuster.

The AI analyzes the submitted photos, looking for signs of pre-existing damage, and compares the repair estimate against regional cost benchmarks. It then compiles a summary for the human adjuster, highlighting key findings and suggesting a settlement range based on policy limits and historical data.

The adjuster reviews this AI-generated summary, applies their professional judgment to the nuances of the situation, and makes the final call. From there, the AI can execute the approved settlement, generating payment authorizations and sending the necessary communications to the policyholder. This is a perfect example of human-in-the-loop automation, where technology handles the process and people provide critical oversight. For a deeper dive into a real-world application, you can explore this case study on transforming insurance claims with agentic AI.

Seamless Integration with Core Insurance Systems

One of the biggest hesitations I hear about automation is the fear of messing with deeply embedded core systems. But today's AI platforms are built to play nice with industry-standard software like Guidewire and Duck Creek.

This integration is the secret sauce for true end-to-end automation. The AI agent acts as a smart bridge, pulling policy data from your core system and pushing validated claim information back into it, ensuring everything stays perfectly in sync across your entire tech stack.

Most importantly, this whole process maintains strict compliance and auditability. Every single action the AI agent takes is logged, creating a transparent, auditable trail for both internal and regulatory reviews. This improves the consistency of claims AI reviews, ensuring decisions stick to your established procedures every time. The results are undeniable: faster cycle times, better accuracy, a lower cost per claim, and much happier customers.

Reimagining Customer Care in Banking and Insurance

Once you’ve started to get a handle on back-office processes like claims, the next logical place to look for major cost savings is right at the customer interface. Customer care has always been a massive operational expense, but it’s undergoing a radical shift thanks to intelligent AI. This isn't about the simple, first-generation chatbots we've all grown tired of; it’s about a new class of AI customer care that can actually manage and resolve complex issues from beginning to end.

The objective has changed. It's no longer just about deflecting calls away from human agents. The real goal is to resolve customer problems accurately and efficiently on the first try, which directly attacks the high costs of manual case management. Think about it: a single, multi-touch customer issue can easily bounce between different agents, require logging into numerous systems, and chew up hours of investigation time. The savings potential here is enormous.

By letting AI handle the procedural heavy lifting, you free up your human agents to focus on situations that genuinely need empathy and nuanced problem-solving. This creates a win-win: significantly lower operational overhead for the business and a much faster, less frustrating experience for the customer.

Beyond Chatbots to True Case Resolution

The real breakthrough with modern AI in customer service is its ability to do things. It isn't just a conversational layer sitting on top of your website; it's a powerful execution engine that can perform the same tasks a human agent would, only at machine speed and scale.

Let's take a common, yet often messy, banking scenario: a customer calls to dispute a transaction, suspecting it’s fraudulent. The old way of doing things is a time-consuming manual slog.

An agent has to verify the customer's identity.

Next, they need to pull up the transaction history in the core banking platform.

Then, they have to switch over to a separate fraud detection system to look for red flags.

Finally, they probably have to log a case in a CRM like Salesforce to track the entire investigation.

Each one of those steps introduces a chance for delay and human error. An advanced AI agent, however, can run this entire workflow as a single, seamless process.

An AI agent can connect directly with your core systems—pulling customer data from Salesforce and contact center context from a platform like Genesys—to assemble a complete picture in seconds. From there, it can either guide a human agent through the decision-making process or, depending on your business rules, resolve the entire issue on its own.

This approach absolutely crushes Average Handling Time (AHT) and boosts First Contact Resolution (FCR)—two of the biggest cost drivers in any contact center. You can explore the strategic advantages in our detailed article on AI customer care.

A Practical Fraud Investigation Scenario

To see how this works in practice, let's walk through how an AI agent tackles that fraud investigation.

Instant Information Gathering: The moment a customer initiates contact, the AI agent is already at work. It instantly pulls their profile from Salesforce, grabs transaction records from the core banking system, and flags any related alerts from your fraud monitoring tool. This 360-degree view is ready before a human agent even says hello.

Guided Decision Support: The AI doesn't just dump raw data on the agent. It presents a consolidated view, highlighting the important stuff. It might surface a insight like, "This customer's last five transactions were in New York, but this charge is from a new online merchant based in another country. This matches fraud pattern X."

Automated Execution: As soon as the human agent confirms the transaction is fraudulent, the AI takes over the resolution. It can be configured to automatically freeze the card, reverse the charge, log a formal case in your tracking system, and fire off a confirmation email to the customer. A process that once took a skilled agent 15-20 minutes of clicking and typing is now done in under a minute.

This "human-in-the-loop" model perfectly blends AI's speed and consistency with human judgment, delivering huge operational savings while ensuring compliance and accuracy.

The Impact on Cost and Customer Experience

This kind of intelligent automation sends positive ripples throughout the entire organization. The benefits stack up quickly, going far beyond just cutting down the time spent on individual calls.

Reduced Training Costs: When your standard operating procedures are built directly into the AI, new agents can become effective almost immediately. The AI acts as a co-pilot, guiding them through complex, multi-system processes and dramatically reducing their cognitive load.

Improved Compliance: AI agents are sticklers for the rules. They execute tasks the exact same way, every single time. In highly regulated industries like banking and insurance, this consistency is a godsend, ensuring every case is handled according to strict protocols and creating a perfect audit trail.

Enhanced Agent Satisfaction: Freeing your agents from the soul-crushing, repetitive tasks allows them to focus on more engaging and valuable customer conversations. This is a direct path to reducing agent burnout and employee turnover—another significant, though often hidden, operational cost.

Ultimately, this smarter approach to customer care helps AI insurance companies and banks deliver service that is both faster and more accurate. It’s definitive proof that you don't have to choose between cutting costs and improving the customer experience. With the right technology in place, you can absolutely do both.

Your Blueprint for Implementing AI Automation

Moving AI automation from a whiteboard concept to a real-world, value-generating deployment demands a clear and deliberate plan. I’ve seen too many promising AI projects stumble because they treated it as a pure technology play. It's not. This is a strategic initiative that starts with diagnosing the right opportunities, building an undeniable business case, and carefully managing change across your organization.

Your first move? Find the friction. Look for workflows drowning in high-volume, repetitive tasks with multiple system handoffs. These are the processes bleeding your budget and creating operational bottlenecks, making them perfect candidates for automation.

Diagnosing Workflows for Maximum ROI

Not all processes are created equal, and to figure out how to reduce operational costs effectively, you have to find where your resources are really being drained. This diagnostic phase is the bedrock of a business case that will actually get your stakeholders to listen.

Start by mapping the entire journey for a high-cost operation, like new insurance claims intake or a customer transaction dispute. You need to quantify everything: the number of manual steps, the average time spent on each one, and the current error rates. This data gives you a concrete baseline to measure success against and shines a spotlight on the pain points where AI customer care or claims automation can deliver a knockout punch.

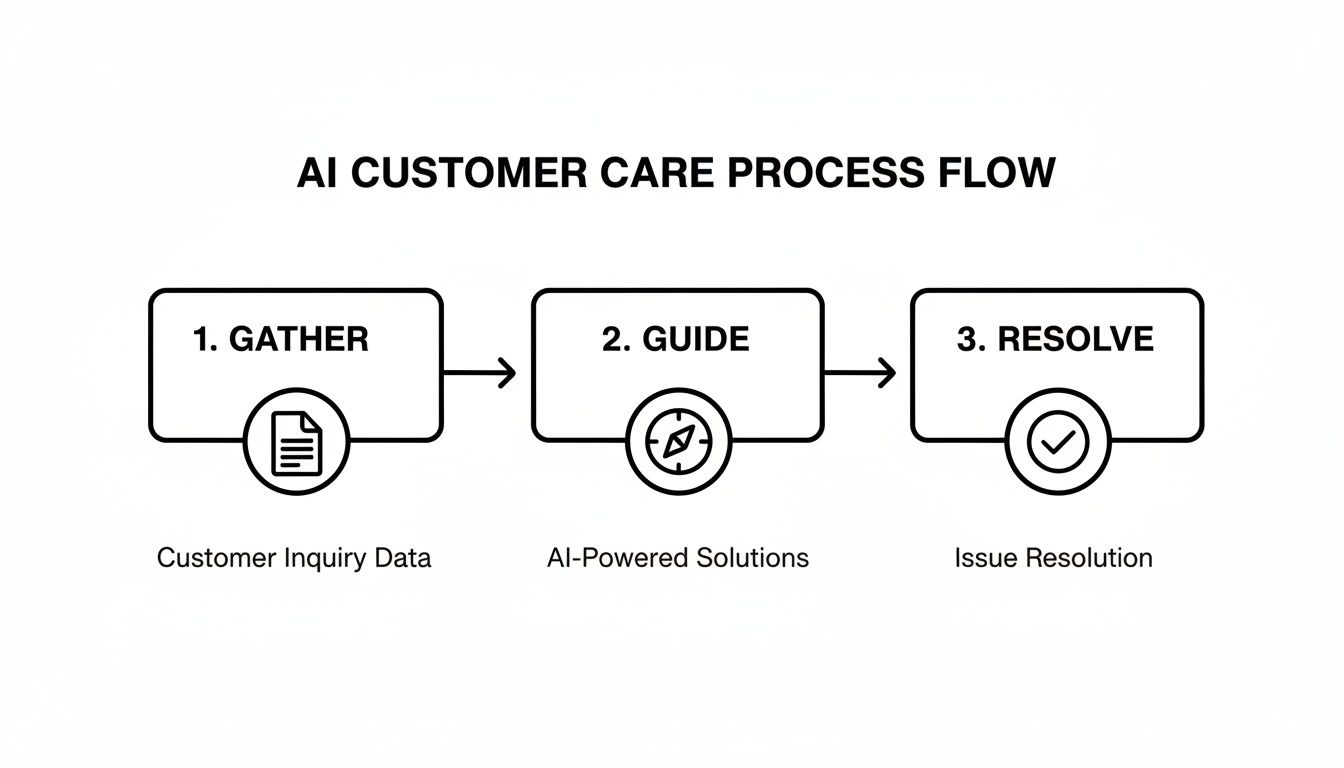

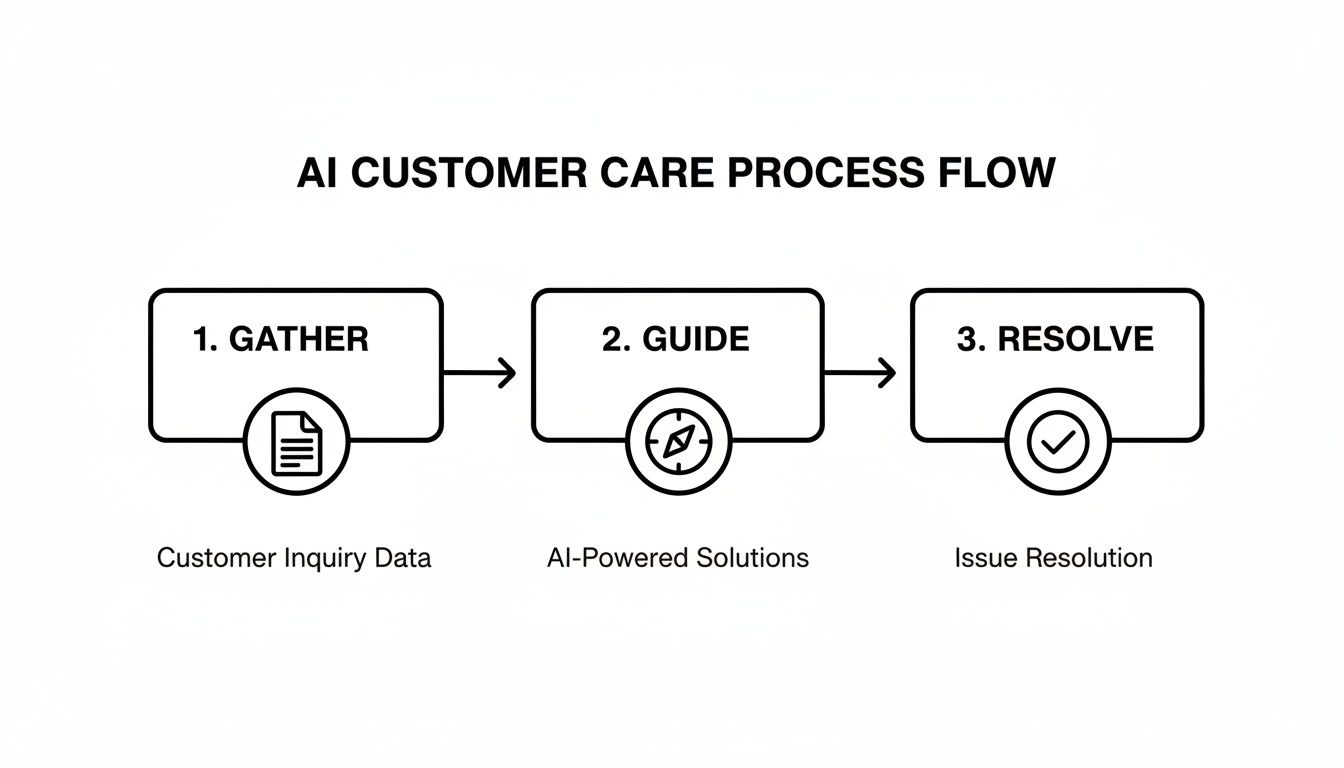

A simplified AI customer care process usually breaks down into three core stages: gathering information, guiding decisions, and resolving the issue.

This flow shows how AI agents can methodically collect data, provide guidance, and execute the resolution, drastically reducing the manual workload on your team.

Building a Compelling Business Case

Once you've pinpointed your target workflows, it's time to build a business case that’s impossible to ignore. This goes far beyond a simple cost-benefit spreadsheet. You need to draw a clear line from the technology to tangible business outcomes, proving gains in both raw efficiency and the customer experience.

Your business case absolutely must include:

Quantified Cost Savings: Project the real dollar savings based on less manual work, lower average handling times, and fewer costly errors.

Customer Experience Metrics: Show how this will move the needle on key indicators like First Contact Resolution (FCR), customer satisfaction (CSAT) scores, and faster claims cycle times.

Risk and Compliance Benefits: Underscore how auditable, consistent AI-driven processes will tighten up regulatory compliance and cut down on operational risk.

Presenting this holistic view ensures stakeholders see the full value, making it much easier to get the green light for your automation initiatives.

Integrating AI with Your Core Systems

A question I hear all the time is, "How will this new AI platform work with our existing, mission-critical systems?" The answer lies in choosing a solution built for integration, one that can seamlessly connect with industry-standard platforms like ServiceNow for customer service or Sapiens for insurance administration.

Modern AI platforms don't rip and replace. They use robust APIs to act as an intelligent orchestration layer sitting on top of your current infrastructure. This approach is minimally disruptive, allowing the AI agent to pull data from and push updates to your core systems without a massive IT overhaul. Proper integration is what creates a truly unified environment where your people and AI can work together effectively.

The global push for operational streamlining is undeniable, especially for banking and insurance firms weighed down by legacy systems. The cost reduction services market is a clear signal, projected to surge to USD 242.4 million by 2032. This growth is fueled by a demand for data-driven efficiency, with specialized providers using AI to identify waste and deliver 20-35% savings in high-cost areas. You can see more on these market trends from Coherent Market Insights.

Governance and Managing Organizational Change

Remember, technology is only half the battle. A successful AI rollout depends on strong governance and a thoughtful change management strategy. You have to prepare your teams for a new reality where their roles are augmented by AI, not replaced by it. For a deeper look, you can learn more about how to automate business processes effectively.

Establish clear human-in-the-loop oversight from day one. This means defining the exact moments in a workflow where a human expert must review and approve an AI's decision. In regulated industries, this isn't optional—it's essential for maintaining control and accountability.

Be transparent. Communicate openly with your teams about how AI will free them from tedious, repetitive tasks, allowing them to focus on complex problem-solving and high-value customer engagement. Providing the right training and support will help them adapt to their new roles as supervisors of an automated workforce, building the trust needed for long-term success.

Measuring the True ROI of Your AI Investment

Bringing AI into your operations isn't just a tech project; it's a serious investment. If you want to get stakeholder buy-in and justify scaling up, you have to prove its worth with hard data. This goes way beyond simple cost savings. You need to show the full picture—improvements in efficiency, a better customer experience, and even a reduction in risk.

It's time to move past vanity metrics and zero in on the Key Performance Indicators (KPIs) that actually reflect the health of your operations. Whether you’re automating insurance claims or customer care, the key is building a transparent measurement framework that ties every AI action to a tangible business outcome. Without it, even a successful deployment can look like just another expense on a spreadsheet instead of the value-driver it truly is.

Key Metrics for AI in Insurance Claims

When you’re looking at the impact of AI on insurance claims, you can't just focus on one part of the process. A lower cost per claim is great, but it's only a piece of a much larger puzzle. A holistic view is what really shows you the efficiency gains and service quality improvements you've made.

Claims Cycle Time: This is the big one—the total time from the First Notice of Loss (FNOL) to settlement. Good automation should slash this by getting rid of manual data entry and other administrative bottlenecks, which means faster resolutions for your policyholders.

Cost Per Claim: Keep a close eye on the direct operational costs tied to processing each claim, from adjuster time to administrative overhead. This is where effective automation should make a direct, measurable dent.

Adjuster Productivity: How many claims can a single adjuster realistically handle? By letting AI take over the routine, repetitive tasks, your adjusters can focus their expertise on the complex cases, boosting their capacity and throughput in a big way.

Critical KPIs for AI Customer Care

In customer service, the success of AI customer care is all about how well it resolves issues while actually making customers happier. It’s a delicate balance, but the right KPIs will show you're hitting both marks. To get the complete picture, you have to track metrics that reflect both speed and quality.

A few key indicators you should be monitoring are:

First Contact Resolution (FCR): What percentage of customer problems are solved in that very first interaction? A rising FCR rate is a fantastic sign that your AI is handling inquiries effectively, without needing to escalate to a human agent.

Average Handling Time (AHT): This classic metric is still incredibly relevant. AHT measures the average length of a customer interaction, and by automating things like information gathering and after-call work, AI should drive this number down significantly.

Customer Satisfaction (CSAT) Scores: Are customers actually happier with the faster, more accurate service? Tying CSAT scores directly to AI-assisted interactions gives you definitive proof that you’re improving the customer experience.

AI has become a major lever for financial services, with 82% of leaders reporting direct cost reductions. Think about it: in banking and insurance, back-office and customer service tasks eat up 25-35% of budgets. AI agents that automate claims and case management are delivering 30-50% cost savings. And it doesn't stop there. As 70% of executives reinvest these savings into better technology, they see faster cycle times and happier customers. You can dig into more insights in the 2025 Financial Services Outlook on slalom.com.

Visualizing Success with Real-Time Dashboards

Collecting all this data is just the first step. Making it visible and actionable is what really drives change. You need to build dashboards that track these KPIs in real time. This kind of transparency allows you to show stakeholders the tangible impact of your AI investment at any given moment.

Your dashboard shouldn’t just be a collection of charts. It should tell a story—how AI is reducing workloads, speeding up processes, and making customers happier. This visual evidence is your most powerful tool for proving ROI.

Beyond the direct financial wins, don't forget to calculate the indirect benefits. We're talking about things like reduced operational risk, thanks to more consistent and auditable processes, and better compliance with regulatory standards. When you can present a holistic ROI that captures these qualitative gains alongside the hard numbers, the value of your AI investment becomes undeniable. For more guidance on this, check out our article on how to measure operational efficiency.

Frequently Asked Questions

When we talk with leaders in banking and insurance, the same practical questions tend to pop up. Everyone wants to understand how AI actually works in their world and what it takes to get it right. Here are a few of the most common topics we discuss.

How Can We Keep AI Automation Compliant?

This is the big one, and for good reason. The key is that AI platforms designed specifically for financial services aren't a black box. They're built from the ground up with compliance in mind.

Every single action an AI agent takes creates a detailed, unchangeable audit trail. This gives you complete transparency for internal reviews and regulatory audits. The system is also hard-coded to follow your exact Standard Operating Procedures (SOPs), so it can't go off-script.

Most importantly, there's always a "human-in-the-loop" option. For sensitive decisions or edge cases, the AI instantly escalates the task to one of your team members. It’s this blend of perfect recall, strict rule-following, and human oversight that makes it work in a regulated industry.

Will AI Make Our Customer Service Feel Robotic?

Quite the opposite, actually. The goal of AI customer care is to free up your best people to be more human, not less.

Think about it: AI is brilliant at handling the high-volume, repetitive queries that clog up your phone lines and inboxes. It can answer "What's my policy number?" or "What's my account balance?" in a split second. This frees your experienced agents to handle the complex, sensitive issues where empathy and creative problem-solving really matter.

For the customer, it means simple problems get solved instantly, and when they have a serious issue, they get a focused expert who isn't bogged down by busywork.

The magic happens when you pair machine efficiency with human judgment. Let the AI handle the grunt work so your team can focus on building relationships and solving the tough problems. That's how you build real customer loyalty.

What's a Realistic Integration Timeline for an AI Platform?

It's almost always faster than people assume. Modern AI platforms are built with powerful APIs designed to connect cleanly with the systems you already use, like Guidewire or Duck Creek. This isn't a "rip and replace" project.

A smart approach is to start with a pilot project targeting one high-value, high-pain process—maybe initial claims intake or a common underwriting check. You can often get something like that up and running in a matter of weeks. This lets you prove the value quickly and build momentum before scaling out to other parts of the business.

How Are AI-Powered Insurance Companies Using This?

Top-tier AI insurance companies are heavily focused on using this technology to speed up claims AI reviews. This is one of the most direct ways to attack operational costs in the claims department.

Instant Data Triage: AI agents can pull data from forms, photos, and reports the moment they arrive, cutting out the manual entry bottleneck and the errors that come with it.

Automated Policy Checks: The system instantly cross-references claim details against the policy's terms and conditions, flagging anything that needs an adjuster's attention.

Intelligent Prioritization: For straightforward, low-value claims, the AI can even package everything up and suggest a settlement for a human to approve, closing the file in a fraction of the time.

The result is that your adjusters spend far less time on administrative tasks and more time applying their expertise to complex cases. This not only cuts costs but also leads to faster, more consistent outcomes for your customers.

Nolana is the AI-native operating system built to automate high-stakes financial services operations. Deploy compliant AI agents to automate case management, claims, and customer service workflows from end to end. Learn more about Nolana and request a demo.

To truly get a handle on operational costs, financial and insurance firms are looking past simple belt-tightening. The new game plan involves AI-driven automation to fundamentally reshape core workflows. It’s about targeting the big-ticket items—like claims processing and customer care—and turning cost management from a defensive chore into a real competitive advantage.

The Mandate for Smarter Cost Management in Finance

It’s a familiar story for leaders in finance and insurance: you have to slash operational expenses, but you can't compromise on strict regulations or ever-rising customer expectations. The old playbook of across-the-board budget cuts just doesn't work anymore. It fails to fix the deep-rooted inefficiencies that come from manual, repetitive work.

The pressure is on. In banking and insurance, operational costs can easily balloon, driven by intricate claims processes and the constant demands of customer service. It’s no wonder executives are laser-focused on efficiency. A recent BCG survey really brings this home, revealing that companies globally only hit 48% of their cost-saving targets.

This gap has pushed a third of leaders to name cost management as their number one priority. And while the sector faces unique hurdles, here's the interesting part: 67% of those surveyed plan to reinvest savings directly into AI to finally achieve those deep cost reductions.

Targeting High-Impact Areas with AI

So where do you start? The biggest wins come from automating the complex, repetitive tasks that drain your team's time and energy. In financial services, two areas practically scream for attention: insurance claims processing and customer care.

Before diving into solutions, it helps to see where the money is actually going. Here’s a quick breakdown of the most common cost centers.

Top Operational Cost Drivers in Financial Services

Operational Area | Primary Cost Drivers | Typical Manual Overhead |

|---|---|---|

Customer Support | High call volumes, agent salaries, long handling times, training costs | Repetitive inquiries, password resets, transaction lookups, basic policy questions |

Claims Processing | Manual data entry, document verification, fraud detection, settlement delays | Reviewing forms, cross-referencing policy details, coordinating with adjusters |

Underwriting | Data gathering, risk assessment, manual decisioning, compliance checks | Sourcing and validating applicant data from multiple systems, manual report generation |

Compliance & Reporting | KYC/AML checks, regulatory reporting, audit preparation, monitoring | Manual data aggregation, report creation, endless cross-checking and validation |

This table makes it clear: manual processes are the common thread tying these high costs together. They're not just inefficient; they're expensive.

Insurance Claims: The journey of a claim, from that first call to the final payout, is often a maze of manual data entry, document checks, and policy lookups. Every manual step is a chance for an error or a delay, which directly inflates the cost per claim.

Customer Care: Contact centers are essential, but they're costly. Agents spend far too much of their day on routine stuff—simple inquiries, transaction disputes, and pulling up information. This drives up handling times and, with them, operational overhead.

This is where intelligent automation comes in. Modern AI customer care platforms and specialized solutions for AI insurance companies are built to do more than just answer a basic question; they can handle complex, multi-step processes from start to finish. For a deeper look, it's worth exploring dedicated business process automation solutions.

From Defensive Tactic to Competitive Advantage

Adopting this kind of automation changes the entire conversation about how to reduce operational costs. It’s no longer about just trimming the fat; it’s about building a leaner, more resilient operational engine for the long haul.

By automating routine tasks, organizations empower their teams to focus on high-value activities that require human expertise, judgment, and empathy. This strategic reallocation of resources is the key to turning cost reduction into a genuine competitive advantage.

The money saved can be plowed back into innovation, new products, and, most importantly, a better customer experience. For example, faster claims AI reviews don't just cut your internal costs—they make policyholders happier and more likely to stick around. This forward-thinking approach is what separates the leaders from the laggards. For more on this, check out our guide on the https://nolana.com/articles/financial-services-digital-transformation.

Streamlining Insurance Claims with AI Automation

Insurance claims processing has always been a classic cost center, tangled in manual tasks and disconnected workflows. From the first notice of loss (FNOL) all the way to settlement, every step is a potential bottleneck, inviting delays and errors that inflate the cost per claim. This is precisely where leading AI insurance companies are gaining a serious competitive advantage by completely rethinking the process with AI.

When you automate the administrative grind with AI, you can drastically reduce the overhead tied to every single claim. We're not talking about small, incremental gains here. This is a fundamental shift in how to reduce operational costs within one of the most resource-intensive parts of the business. AI agents can manage routine tasks from start to finish, letting your human adjusters apply their expertise to the complex, high-stakes decisions that truly matter.

Pinpointing AI's Impact Across the Claims Lifecycle

To really see where AI makes a difference, let's walk through a common scenario: a property damage claim after a major storm.

A homeowner uploads photos, repair estimates, and a description of the damage through your customer portal. In a typical setup, this simple action triggers a long, manual chain reaction. An adjuster has to open every file, key data into the core system, and manually check policy details—all before the real assessment even starts.

With an AI agent, the entire game changes. The moment those documents hit the server, the agent is on it.

Automated Data Extraction: The AI reads and pulls key information from photos, PDFs, and text forms instantly. It identifies the policy number, date of loss, damage type, and claimant details without anyone lifting a finger.

Policy Verification: Next, it cross-references that info with the customer's policy to confirm coverage, check deductibles, and flag any potential exclusions. This takes seconds, not hours.

Initial Triage: Based on rules you define, the AI categorizes the claim's severity. Simple, low-value claims might get fast-tracked for immediate approval, while complex cases are routed to a specialized adjuster with a neatly packaged case file.

This initial automation alone can slash cycle times. By giving adjusters a verified, structured, and complete case file right from the start, you get rid of the costly back-and-forth that plagues traditional claims intake.

A Practical Example of an End-to-End AI Workflow

Let's stick with our storm damage claim. After the AI handles the initial intake and verification, its role expands, acting as a co-pilot for the human adjuster.

The AI analyzes the submitted photos, looking for signs of pre-existing damage, and compares the repair estimate against regional cost benchmarks. It then compiles a summary for the human adjuster, highlighting key findings and suggesting a settlement range based on policy limits and historical data.

The adjuster reviews this AI-generated summary, applies their professional judgment to the nuances of the situation, and makes the final call. From there, the AI can execute the approved settlement, generating payment authorizations and sending the necessary communications to the policyholder. This is a perfect example of human-in-the-loop automation, where technology handles the process and people provide critical oversight. For a deeper dive into a real-world application, you can explore this case study on transforming insurance claims with agentic AI.

Seamless Integration with Core Insurance Systems

One of the biggest hesitations I hear about automation is the fear of messing with deeply embedded core systems. But today's AI platforms are built to play nice with industry-standard software like Guidewire and Duck Creek.

This integration is the secret sauce for true end-to-end automation. The AI agent acts as a smart bridge, pulling policy data from your core system and pushing validated claim information back into it, ensuring everything stays perfectly in sync across your entire tech stack.

Most importantly, this whole process maintains strict compliance and auditability. Every single action the AI agent takes is logged, creating a transparent, auditable trail for both internal and regulatory reviews. This improves the consistency of claims AI reviews, ensuring decisions stick to your established procedures every time. The results are undeniable: faster cycle times, better accuracy, a lower cost per claim, and much happier customers.

Reimagining Customer Care in Banking and Insurance

Once you’ve started to get a handle on back-office processes like claims, the next logical place to look for major cost savings is right at the customer interface. Customer care has always been a massive operational expense, but it’s undergoing a radical shift thanks to intelligent AI. This isn't about the simple, first-generation chatbots we've all grown tired of; it’s about a new class of AI customer care that can actually manage and resolve complex issues from beginning to end.

The objective has changed. It's no longer just about deflecting calls away from human agents. The real goal is to resolve customer problems accurately and efficiently on the first try, which directly attacks the high costs of manual case management. Think about it: a single, multi-touch customer issue can easily bounce between different agents, require logging into numerous systems, and chew up hours of investigation time. The savings potential here is enormous.

By letting AI handle the procedural heavy lifting, you free up your human agents to focus on situations that genuinely need empathy and nuanced problem-solving. This creates a win-win: significantly lower operational overhead for the business and a much faster, less frustrating experience for the customer.

Beyond Chatbots to True Case Resolution

The real breakthrough with modern AI in customer service is its ability to do things. It isn't just a conversational layer sitting on top of your website; it's a powerful execution engine that can perform the same tasks a human agent would, only at machine speed and scale.

Let's take a common, yet often messy, banking scenario: a customer calls to dispute a transaction, suspecting it’s fraudulent. The old way of doing things is a time-consuming manual slog.

An agent has to verify the customer's identity.

Next, they need to pull up the transaction history in the core banking platform.

Then, they have to switch over to a separate fraud detection system to look for red flags.

Finally, they probably have to log a case in a CRM like Salesforce to track the entire investigation.

Each one of those steps introduces a chance for delay and human error. An advanced AI agent, however, can run this entire workflow as a single, seamless process.

An AI agent can connect directly with your core systems—pulling customer data from Salesforce and contact center context from a platform like Genesys—to assemble a complete picture in seconds. From there, it can either guide a human agent through the decision-making process or, depending on your business rules, resolve the entire issue on its own.

This approach absolutely crushes Average Handling Time (AHT) and boosts First Contact Resolution (FCR)—two of the biggest cost drivers in any contact center. You can explore the strategic advantages in our detailed article on AI customer care.

A Practical Fraud Investigation Scenario

To see how this works in practice, let's walk through how an AI agent tackles that fraud investigation.

Instant Information Gathering: The moment a customer initiates contact, the AI agent is already at work. It instantly pulls their profile from Salesforce, grabs transaction records from the core banking system, and flags any related alerts from your fraud monitoring tool. This 360-degree view is ready before a human agent even says hello.

Guided Decision Support: The AI doesn't just dump raw data on the agent. It presents a consolidated view, highlighting the important stuff. It might surface a insight like, "This customer's last five transactions were in New York, but this charge is from a new online merchant based in another country. This matches fraud pattern X."

Automated Execution: As soon as the human agent confirms the transaction is fraudulent, the AI takes over the resolution. It can be configured to automatically freeze the card, reverse the charge, log a formal case in your tracking system, and fire off a confirmation email to the customer. A process that once took a skilled agent 15-20 minutes of clicking and typing is now done in under a minute.

This "human-in-the-loop" model perfectly blends AI's speed and consistency with human judgment, delivering huge operational savings while ensuring compliance and accuracy.

The Impact on Cost and Customer Experience

This kind of intelligent automation sends positive ripples throughout the entire organization. The benefits stack up quickly, going far beyond just cutting down the time spent on individual calls.

Reduced Training Costs: When your standard operating procedures are built directly into the AI, new agents can become effective almost immediately. The AI acts as a co-pilot, guiding them through complex, multi-system processes and dramatically reducing their cognitive load.

Improved Compliance: AI agents are sticklers for the rules. They execute tasks the exact same way, every single time. In highly regulated industries like banking and insurance, this consistency is a godsend, ensuring every case is handled according to strict protocols and creating a perfect audit trail.

Enhanced Agent Satisfaction: Freeing your agents from the soul-crushing, repetitive tasks allows them to focus on more engaging and valuable customer conversations. This is a direct path to reducing agent burnout and employee turnover—another significant, though often hidden, operational cost.

Ultimately, this smarter approach to customer care helps AI insurance companies and banks deliver service that is both faster and more accurate. It’s definitive proof that you don't have to choose between cutting costs and improving the customer experience. With the right technology in place, you can absolutely do both.

Your Blueprint for Implementing AI Automation

Moving AI automation from a whiteboard concept to a real-world, value-generating deployment demands a clear and deliberate plan. I’ve seen too many promising AI projects stumble because they treated it as a pure technology play. It's not. This is a strategic initiative that starts with diagnosing the right opportunities, building an undeniable business case, and carefully managing change across your organization.

Your first move? Find the friction. Look for workflows drowning in high-volume, repetitive tasks with multiple system handoffs. These are the processes bleeding your budget and creating operational bottlenecks, making them perfect candidates for automation.

Diagnosing Workflows for Maximum ROI

Not all processes are created equal, and to figure out how to reduce operational costs effectively, you have to find where your resources are really being drained. This diagnostic phase is the bedrock of a business case that will actually get your stakeholders to listen.

Start by mapping the entire journey for a high-cost operation, like new insurance claims intake or a customer transaction dispute. You need to quantify everything: the number of manual steps, the average time spent on each one, and the current error rates. This data gives you a concrete baseline to measure success against and shines a spotlight on the pain points where AI customer care or claims automation can deliver a knockout punch.

A simplified AI customer care process usually breaks down into three core stages: gathering information, guiding decisions, and resolving the issue.

This flow shows how AI agents can methodically collect data, provide guidance, and execute the resolution, drastically reducing the manual workload on your team.

Building a Compelling Business Case

Once you've pinpointed your target workflows, it's time to build a business case that’s impossible to ignore. This goes far beyond a simple cost-benefit spreadsheet. You need to draw a clear line from the technology to tangible business outcomes, proving gains in both raw efficiency and the customer experience.

Your business case absolutely must include:

Quantified Cost Savings: Project the real dollar savings based on less manual work, lower average handling times, and fewer costly errors.

Customer Experience Metrics: Show how this will move the needle on key indicators like First Contact Resolution (FCR), customer satisfaction (CSAT) scores, and faster claims cycle times.

Risk and Compliance Benefits: Underscore how auditable, consistent AI-driven processes will tighten up regulatory compliance and cut down on operational risk.

Presenting this holistic view ensures stakeholders see the full value, making it much easier to get the green light for your automation initiatives.

Integrating AI with Your Core Systems

A question I hear all the time is, "How will this new AI platform work with our existing, mission-critical systems?" The answer lies in choosing a solution built for integration, one that can seamlessly connect with industry-standard platforms like ServiceNow for customer service or Sapiens for insurance administration.

Modern AI platforms don't rip and replace. They use robust APIs to act as an intelligent orchestration layer sitting on top of your current infrastructure. This approach is minimally disruptive, allowing the AI agent to pull data from and push updates to your core systems without a massive IT overhaul. Proper integration is what creates a truly unified environment where your people and AI can work together effectively.

The global push for operational streamlining is undeniable, especially for banking and insurance firms weighed down by legacy systems. The cost reduction services market is a clear signal, projected to surge to USD 242.4 million by 2032. This growth is fueled by a demand for data-driven efficiency, with specialized providers using AI to identify waste and deliver 20-35% savings in high-cost areas. You can see more on these market trends from Coherent Market Insights.

Governance and Managing Organizational Change

Remember, technology is only half the battle. A successful AI rollout depends on strong governance and a thoughtful change management strategy. You have to prepare your teams for a new reality where their roles are augmented by AI, not replaced by it. For a deeper look, you can learn more about how to automate business processes effectively.

Establish clear human-in-the-loop oversight from day one. This means defining the exact moments in a workflow where a human expert must review and approve an AI's decision. In regulated industries, this isn't optional—it's essential for maintaining control and accountability.

Be transparent. Communicate openly with your teams about how AI will free them from tedious, repetitive tasks, allowing them to focus on complex problem-solving and high-value customer engagement. Providing the right training and support will help them adapt to their new roles as supervisors of an automated workforce, building the trust needed for long-term success.

Measuring the True ROI of Your AI Investment

Bringing AI into your operations isn't just a tech project; it's a serious investment. If you want to get stakeholder buy-in and justify scaling up, you have to prove its worth with hard data. This goes way beyond simple cost savings. You need to show the full picture—improvements in efficiency, a better customer experience, and even a reduction in risk.

It's time to move past vanity metrics and zero in on the Key Performance Indicators (KPIs) that actually reflect the health of your operations. Whether you’re automating insurance claims or customer care, the key is building a transparent measurement framework that ties every AI action to a tangible business outcome. Without it, even a successful deployment can look like just another expense on a spreadsheet instead of the value-driver it truly is.

Key Metrics for AI in Insurance Claims

When you’re looking at the impact of AI on insurance claims, you can't just focus on one part of the process. A lower cost per claim is great, but it's only a piece of a much larger puzzle. A holistic view is what really shows you the efficiency gains and service quality improvements you've made.

Claims Cycle Time: This is the big one—the total time from the First Notice of Loss (FNOL) to settlement. Good automation should slash this by getting rid of manual data entry and other administrative bottlenecks, which means faster resolutions for your policyholders.

Cost Per Claim: Keep a close eye on the direct operational costs tied to processing each claim, from adjuster time to administrative overhead. This is where effective automation should make a direct, measurable dent.

Adjuster Productivity: How many claims can a single adjuster realistically handle? By letting AI take over the routine, repetitive tasks, your adjusters can focus their expertise on the complex cases, boosting their capacity and throughput in a big way.

Critical KPIs for AI Customer Care

In customer service, the success of AI customer care is all about how well it resolves issues while actually making customers happier. It’s a delicate balance, but the right KPIs will show you're hitting both marks. To get the complete picture, you have to track metrics that reflect both speed and quality.

A few key indicators you should be monitoring are:

First Contact Resolution (FCR): What percentage of customer problems are solved in that very first interaction? A rising FCR rate is a fantastic sign that your AI is handling inquiries effectively, without needing to escalate to a human agent.

Average Handling Time (AHT): This classic metric is still incredibly relevant. AHT measures the average length of a customer interaction, and by automating things like information gathering and after-call work, AI should drive this number down significantly.

Customer Satisfaction (CSAT) Scores: Are customers actually happier with the faster, more accurate service? Tying CSAT scores directly to AI-assisted interactions gives you definitive proof that you’re improving the customer experience.

AI has become a major lever for financial services, with 82% of leaders reporting direct cost reductions. Think about it: in banking and insurance, back-office and customer service tasks eat up 25-35% of budgets. AI agents that automate claims and case management are delivering 30-50% cost savings. And it doesn't stop there. As 70% of executives reinvest these savings into better technology, they see faster cycle times and happier customers. You can dig into more insights in the 2025 Financial Services Outlook on slalom.com.

Visualizing Success with Real-Time Dashboards

Collecting all this data is just the first step. Making it visible and actionable is what really drives change. You need to build dashboards that track these KPIs in real time. This kind of transparency allows you to show stakeholders the tangible impact of your AI investment at any given moment.

Your dashboard shouldn’t just be a collection of charts. It should tell a story—how AI is reducing workloads, speeding up processes, and making customers happier. This visual evidence is your most powerful tool for proving ROI.

Beyond the direct financial wins, don't forget to calculate the indirect benefits. We're talking about things like reduced operational risk, thanks to more consistent and auditable processes, and better compliance with regulatory standards. When you can present a holistic ROI that captures these qualitative gains alongside the hard numbers, the value of your AI investment becomes undeniable. For more guidance on this, check out our article on how to measure operational efficiency.

Frequently Asked Questions

When we talk with leaders in banking and insurance, the same practical questions tend to pop up. Everyone wants to understand how AI actually works in their world and what it takes to get it right. Here are a few of the most common topics we discuss.

How Can We Keep AI Automation Compliant?

This is the big one, and for good reason. The key is that AI platforms designed specifically for financial services aren't a black box. They're built from the ground up with compliance in mind.

Every single action an AI agent takes creates a detailed, unchangeable audit trail. This gives you complete transparency for internal reviews and regulatory audits. The system is also hard-coded to follow your exact Standard Operating Procedures (SOPs), so it can't go off-script.

Most importantly, there's always a "human-in-the-loop" option. For sensitive decisions or edge cases, the AI instantly escalates the task to one of your team members. It’s this blend of perfect recall, strict rule-following, and human oversight that makes it work in a regulated industry.

Will AI Make Our Customer Service Feel Robotic?

Quite the opposite, actually. The goal of AI customer care is to free up your best people to be more human, not less.

Think about it: AI is brilliant at handling the high-volume, repetitive queries that clog up your phone lines and inboxes. It can answer "What's my policy number?" or "What's my account balance?" in a split second. This frees your experienced agents to handle the complex, sensitive issues where empathy and creative problem-solving really matter.

For the customer, it means simple problems get solved instantly, and when they have a serious issue, they get a focused expert who isn't bogged down by busywork.

The magic happens when you pair machine efficiency with human judgment. Let the AI handle the grunt work so your team can focus on building relationships and solving the tough problems. That's how you build real customer loyalty.

What's a Realistic Integration Timeline for an AI Platform?

It's almost always faster than people assume. Modern AI platforms are built with powerful APIs designed to connect cleanly with the systems you already use, like Guidewire or Duck Creek. This isn't a "rip and replace" project.

A smart approach is to start with a pilot project targeting one high-value, high-pain process—maybe initial claims intake or a common underwriting check. You can often get something like that up and running in a matter of weeks. This lets you prove the value quickly and build momentum before scaling out to other parts of the business.

How Are AI-Powered Insurance Companies Using This?

Top-tier AI insurance companies are heavily focused on using this technology to speed up claims AI reviews. This is one of the most direct ways to attack operational costs in the claims department.

Instant Data Triage: AI agents can pull data from forms, photos, and reports the moment they arrive, cutting out the manual entry bottleneck and the errors that come with it.

Automated Policy Checks: The system instantly cross-references claim details against the policy's terms and conditions, flagging anything that needs an adjuster's attention.

Intelligent Prioritization: For straightforward, low-value claims, the AI can even package everything up and suggest a settlement for a human to approve, closing the file in a fraction of the time.

The result is that your adjusters spend far less time on administrative tasks and more time applying their expertise to complex cases. This not only cuts costs but also leads to faster, more consistent outcomes for your customers.

Nolana is the AI-native operating system built to automate high-stakes financial services operations. Deploy compliant AI agents to automate case management, claims, and customer service workflows from end to end. Learn more about Nolana and request a demo.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP