Unlocking Insurance Efficiency with Sapiens Software

Unlocking Insurance Efficiency with Sapiens Software

Discover how Sapiens software transforms insurance operations. Explore its core modules, AI-powered claims automation, and advanced customer care solutions.

Sapiens is a comprehensive, cloud-native software suite that acts as the core operating system for insurance and financial services companies. Think of it as the modern engine that replaces outdated, clunky legacy systems, providing an integrated platform for managing policies, billing, and claims. This shift allows firms to innovate faster and run their operations far more efficiently.

What Sapiens Software Is and Why It Matters

Imagine the central nervous system of an insurance company—a sprawling network of policy data, customer histories, billing schedules, and claims workflows. For years, many insurers have been held back by rigid, aging mainframes that make it nearly impossible to adapt, grow, or keep customers happy. Sapiens is designed to be the modern answer to this long-standing problem, offering a strategic platform built for a digital-first world.

At its heart, Sapiens replaces siloed, outdated infrastructure with a flexible, cloud-based foundation. This isn't just a simple software upgrade; it represents a fundamental change in how insurance carriers manage their entire business, from the ground up.

The image above really captures the essence of what a modern core system like Sapiens enables: a collaborative, data-driven environment where insights are accessible and actionable.

The Foundation for AI-Powered Transformation

The real magic happens when Sapiens' solid data foundation is connected to artificial intelligence. This pairing becomes a powerful catalyst for reinventing high-stakes operations, especially in complex areas like automating insurance claims with AI and enhancing customer care in financial services. By letting AI handle routine tasks and uncover deep insights from the data Sapiens organizes, insurers can achieve a whole new level of efficiency.

This synergy helps AI insurance companies achieve critical goals:

Automate huge chunks of the claims lifecycle, from the first notice of loss all the way to the final payout.

Deliver exceptional AI customer care by giving support agents a complete, real-time view of a policyholder's history and needs.

Analyze market trends and portfolio risks with incredible accuracy, which fuels smarter underwriting and better strategic decisions.

Sapiens International Corporation has cemented its position as a major player in the global insurance software market, reporting $514.8 million in revenue for 2023. This figure is the result of a strong 14.7% compound annual growth rate (CAGR) from 2012 to 2023. This impressive growth highlights the company's success in meeting the demand for digital platforms across key insurance markets.

In the end, Sapiens provides the stable, reliable system of record that AI absolutely needs to work properly. Without a modern core system, AI initiatives often stumble because they can't get the clean, structured data required for intelligent automation. By implementing https://nolana.com/articles/sapiens-insurance solutions, organizations are not just upgrading their software—they're building a resilient foundation for whatever comes next.

2. A Look Under the Hood: The Sapiens Core Engine

To really get a feel for what Sapiens brings to the table, you have to look past the marketing and understand its architecture. It’s less like a single, monolithic program and more like a set of high-performance, specialized tools designed to work together. This modular approach is exactly what gives insurers the flexibility to build a solid, yet adaptable, operational backbone.

At its heart, the platform is organized into distinct suites built for specific lines of business. For property and casualty carriers, the Sapiens IDITSuite is the workhorse, handling everything from complex underwriting and product configuration to day-to-day policy administration. For those in the life and pensions space, the CoreSuite is built to manage the unique, long-term nature of their products, from new business intake to complex annuity payouts.

Think of these core suites as the central nervous system for an insurance company. They manage the entire policy lifecycle, creating a single, reliable source of truth for every customer and policy detail. This alone is a massive step up from the disconnected, legacy systems where data fragmentation is a constant headache.

Powering Claims and Billing Operations

Plugging into these core systems are two of the most critical operational modules: ClaimsPro and Billing. ClaimsPro is engineered to manage the entire claims journey, which is an area absolutely packed with opportunities for intelligent automation. From the moment a first notice of loss comes in, this module kicks in to manage everything from data collection and validation to investigation and final payment.

This is where the connection to AI and automation really starts to click. An AI agent, like one from an automation platform such as Nolana, can ping ClaimsPro through an API to instantly verify policy coverage for a new claim—a job that might take a human adjuster several minutes and multiple screen-switches. Every one of these actions is logged, creating a clean audit trail that keeps regulators happy.

The real magic happens when Sapiens' structured data meets the cognitive power of AI. For example, AI can scan incoming claim documents, pull out the key information, and push it directly into the right fields in ClaimsPro. We've seen this reduce manual data entry by over 80% in certain workflows, which not only speeds up the cycle time but also frees up experienced adjusters to handle the truly complex cases.

The same principle applies to customer service. When a policyholder calls in, an AI-powered system can query the Sapiens CoreSuite in real-time to pull up that customer's complete history. This equips the human agent with a full 360-degree view, ending the all-too-common frustration of a customer having to repeat their story to multiple people.

How the Pieces Fit Together

What truly makes the Sapiens platform effective isn't just the individual modules, but how they talk to each other. It’s not about having one system for policies and another for claims in isolation; it’s about the seamless data flow between them that creates a unified, real-time view of the business.

This table gives a clearer picture of how these primary components work in tandem.

Sapiens Core Platform Modules Overview

Module Name | Primary Function | Key Benefit for Operations |

|---|---|---|

IDITSuite / CoreSuite | Manages the entire policy lifecycle from underwriting and issuance to renewals and endorsements. | Acts as the definitive, structured source for all customer and policy data, which is essential for accurate AI-driven decisions. |

ClaimsPro | Orchestrates the end-to-end claims process, from First Notice of Loss (FNOL) to final settlement. | Provides the necessary workflow and data hooks for AI to automate tasks like initial triage, document indexing, and fraud detection. |

Sapiens Billing | Handles all aspects of premium billing, collections, disbursements, and commission management. | Enables AI agents to autonomously handle routine financial inquiries, verify payment status, or trigger refunds without human input. |

In the end, this tight integration allows an insurer to move beyond simple, one-off task automation. Instead of just having an AI agent perform a basic lookup, you can have it execute a complex, multi-step process that spans different modules. For instance, a claim settlement approved in ClaimsPro can automatically trigger a payment in the Billing module and simultaneously update the policy record in the CoreSuite. This kind of orchestrated, end-to-end automation, with a human in the loop for final sign-off, is the key to scaling your efficiency gains and truly modernizing your operations.

Automating Insurance Claims with Sapiens and AI

For any insurance carrier, the claims department is where the rubber meets the road. It's a high-pressure environment where efficiency, accuracy, and customer experience all hang in the balance. The Sapiens ecosystem is built to manage the entire claims journey with precision, acting as a reliable system of record from the first notice of loss (FNOL) all the way to the final settlement.

But when you layer an AI-native platform on top of that solid foundation, the process changes completely. It goes from a methodical, manual workflow to a smart, automated operation. Sapiens provides the trusted data backbone, and AI executes the surrounding tasks with incredible speed. This combination is exactly how modern carriers are building a real competitive edge.

This process flow shows how Sapiens structures its core functions for different lines of business, with claims being a central operational event.

As you can see, whether it’s a Property & Casualty (P&C) or a Life & Pension (L&P) policy, a claim is what kicks the system into high gear.

From Manual Steps to Intelligent Actions

Think about a standard auto insurance claim. An adjuster might spend hours just on administrative legwork: keying in data from a police report, toggling between screens to cross-reference policy details, and checking another system for potential fraud flags. The whole process is slow, creates opportunities for human error, and leaves the policyholder waiting.

Now, let's replay that scenario with an AI agent connected to Sapiens. The moment a customer uploads a photo of their damaged car, the AI gets to work.

Instant Data Extraction: The AI agent reads the image, identifies the license plate, and pulls text from any attached documents, like a repair estimate.

Policy Validation: It immediately pings the Sapiens core system via API to confirm the policy is active, check coverage limits, and review the policyholder's claims history.

Initial Triage: Based on established business rules, the AI can classify the claim's severity, flag it for potential fraud, and route it to the right human adjuster—all within seconds.

This frees up the adjuster to focus on what humans do best: making complex judgment calls and communicating with empathy. By taking over the high-volume, repetitive work, AI makes the entire claims operation faster and more cost-effective.

Enhancing Quality with Claims AI Reviews

AI's role doesn't stop at the initial intake. It’s also a powerful tool for maintaining quality and compliance long after a claim is filed. The concept of claims AI reviews uses AI to systematically analyze adjuster notes, customer communications, and settlement decisions stored right inside the Sapiens platform.

Think of it as a tireless compliance officer that never sleeps. An AI agent can scan thousands of claim files overnight to ensure adjusters are following company procedures, adhering to regulatory standards, and communicating consistently with customers.

This kind of automated oversight helps spot financial leakage, promotes fair settlements, and gives leadership a real-time view of operational quality without needing to conduct slow, manual audits. And as insurers work to improve these processes, it helps to understand the nuances of what they're handling, like understanding total loss claims from the customer’s point of view.

The Market Push for Modernization

This shift toward automation isn’t just about internal efficiency—it’s part of a massive industry trend. The global insurance software platforms market is set to grow from $4.7 billion in 2025 to $6.5 billion by 2030, a 6.6% compound annual growth rate. That growth is being driven by carriers replacing legacy platforms to cut costs and launch products faster, both of which are critical for claims leaders.

Ultimately, Sapiens provides the stable, reliable core that makes this level of automation possible. By connecting an AI-native operating system like Nolana, insurers can turn their Sapiens platform from a simple system of record into a dynamic engine for intelligent action. To go deeper, check out our guide on insurance claims processing automation. This approach doesn't just fix a single workflow; it builds a more resilient and competitive insurance business from the ground up.

Using AI to Redefine Customer Care in Financial Services

Automating insurance claims is a massive win for back-office efficiency, but the real moment of truth for any financial institution happens on the front lines—during a customer interaction. This is where a system like Sapiens, rich with customer data, should shine. But just having the data isn't enough. The real challenge is turning that mountain of information into genuinely helpful, real-time support.

This means moving past the simplistic chatbots of yesterday and into a new reality. We're talking about intelligent systems that work hand-in-glove with human agents, creating a single, powerful service desk. By integrating AI customer care, financial services and AI insurance companies can finally deliver consistently great support without buckling under the pressure.

A New Reality for Customer Service Teams

Let's walk through a common scenario. A customer calls their insurance provider, confused about a recent premium increase. In a typical call center, the agent is already behind. They’re fumbling through multiple old-school systems, putting the customer on hold, and trying to stitch together a coherent story from different screens. It’s slow, frustrating for everyone, and a recipe for mistakes.

Now, imagine that same call with an AI assistant working alongside the human agent. The second the call connects, the AI is already pulling the customer's complete history from the Sapiens software platform.

On the agent's screen, a neat summary pops up: policy details, recent claims, past conversations, and payment history. All in one place.

The AI has already figured out why they're calling and is suggesting the next best action, maybe even scripting a clear explanation for the rate change.

If the customer needs to update their address, the AI handles the backend request in Sapiens directly. The agent never even has to switch tabs.

This partnership completely changes the agent's job. They're no longer just data miners; they’re true problem-solvers, armed with all the context needed to give a fast, accurate, and empathetic answer. It’s worth exploring different tools for this, like using AI chatbots to boost customer engagement to handle initial queries and gather context.

Tangible Improvements to Service Metrics

For anyone managing a customer service team, this kind of integration delivers results you can actually measure. The game is all about resolving issues on the first call, which has a massive impact on both customer happiness and operational costs.

When you give agents instant, AI-powered insights from a core system like Sapiens, the numbers speak for themselves. We've seen financial institutions achieve a 20-30% reduction in average call handling times. Even better, first-contact resolution rates often jump by over 15% because agents have everything they need to solve the problem right then and there.

This boost in efficiency means your team can handle more interactions without sacrificing an ounce of quality. For the customer, it feels like a seamless, almost effortless experience where their needs are met proactively. And for the business, every action is logged automatically, creating a clean, compliant, and auditable trail for every interaction—a non-negotiable in highly regulated industries.

Getting Ahead with Proactive Support and QA

The benefits don't stop at just reacting to calls. Think about how claims AI reviews analyze adjuster notes for quality. You can apply that exact same logic to customer service. An AI agent can monitor call transcripts and agent notes as they happen, ensuring every interaction meets company policies and regulatory standards.

The system could flag a call where a customer sounds particularly frustrated, letting a manager step in to help before things escalate. It can also spot knowledge gaps across the team, pointing out exactly where a little more training is needed. This combination of Sapiens' data and AI's analytical muscle creates a constant feedback loop that keeps getting better over time. If you're ready to build a plan around this, our detailed guide on how to implement AI customer care is a great place to start. This is how a contact center stops being a cost center and starts becoming a powerful tool for building real customer loyalty.

Integrating Sapiens with Modern AI Platforms

For any CIO or IT leader, the real test of a core system like Sapiens software isn't just what it does on its own, but how well it connects to the rest of your technology stack. Getting this right is absolutely fundamental to any serious automation strategy.

The good news? Sapiens was built for this. Its modern, API-first architecture means you aren't looking at massive, custom-coded integration projects. Instead, the connection is made through well-documented REST APIs that act as secure, standardized bridges between your systems.

Think of these APIs as reliable messengers. An external AI platform can use them to ask Sapiens for a piece of information or tell it to perform a specific action. For instance, an AI agent could make a quick API call to Sapiens to pull up a policyholder's coverage details in the middle of a live customer chat. This kind of fast, secure data exchange is the bedrock of modern financial services automation.

The Mechanics of AI and Sapiens Integration

So, what does this look like in practice? On a technical level, the integration is all about letting AI agents interact with Sapiens data and workflows in a highly controlled way. This is essential for keeping everything secure and compliant, which is non-negotiable in a regulated industry like insurance.

The most common integration patterns we see are:

Real-Time Data Retrieval: An AI agent needs an answer, now. It uses a Sapiens API to instantly look up a policy status or find customer contact information to support AI customer care functions.

Workflow Execution: The AI agent can kick off a process inside Sapiens. A classic example is creating a new claim file after pulling key details from a customer's email.

Large-Scale Data Syncs: For heavier analytical work, like claims AI reviews, structured data can be securely sent from Sapiens to an AI platform for deep processing and trend analysis.

The golden rule here is that Sapiens always remains the system of record. Its data integrity is never compromised. The AI platform acts as the intelligent execution layer, automating tasks around the core system without messing with its fundamental structure. It’s a clean separation of duties that auditors and compliance teams love to see.

This disciplined approach gives IT leaders the confidence to scale automation without introducing unnecessary risk. It also means that every single action taken by an AI agent is logged, creating a rock-solid audit trail across every connected system.

Ensuring Security and Governance Across Systems

Connecting any two powerful systems immediately brings security and governance to the forefront. When an AI platform talks to Sapiens, you need multiple layers of protection to ensure every interaction is controlled, secure, and fully compliant.

This isn't just a single firewall; it's a comprehensive security posture.

Security Layer | Description | Key Benefit |

|---|---|---|

API Authentication | Every API call must present secure credentials (like OAuth 2.0 tokens) to prove the AI agent is authorized to even knock on Sapiens' door. | This stops unauthorized access in its tracks and ensures only trusted systems can talk to your core data. |

Role-Based Access Control | AI agents get specific permissions, limiting them to only the data and actions they need for their assigned job. No more, no less. | It contains the potential impact of any single process and enforces the critical principle of least privilege. |

Immutable Audit Logs | Every single thing an AI agent does—every API call, data lookup, and update—is written into a tamper-proof record. | This gives you a complete, transparent history for compliance audits and makes troubleshooting a whole lot easier. |

By building this framework, organizations can deploy AI agents to handle sensitive customer and financial data with total confidence. This is exactly how forward-thinking AI insurance companies are able to innovate at speed while maintaining their rigorous risk management standards. You can see how this works in the real world by exploring case studies on transforming insurance claims with agentic AI. It proves that your automation strategy can be both powerful and built on an unshakeable foundation of trust.

Why Leading AI Insurance Companies Choose Sapiens

In a crowded market with heavy hitters like Guidewire and Duck Creek, you might wonder why so many forward-looking AI insurance companies are hitching their wagon to Sapiens. It’s not about winning a simple feature-to-feature bake-off. The decision is far more strategic.

Insurers are choosing Sapiens because it offers a uniquely balanced and future-ready foundation. They don't just see a product; they see a robust, open, and scalable core system that was practically engineered to be supercharged by specialized AI. It brings a global presence and a versatile portfolio that can handle anything from P&C to life and pensions.

The Perfect Foundation for Intelligent Automation

The real story here is Sapiens' architectural readiness for the next generation of automation. While its competitors offer powerful systems, Sapiens hits a sweet spot. It delivers the rock-solid stability and deep data management you'd expect from an enterprise platform, but it does so with an API-first mindset. This openness is exactly what's needed to plug in AI-native platforms like Nolana without a massive IT headache.

This makes Sapiens an ideal partner for automating complex, high-stakes workflows. Think about AI customer care. An AI agent can ping Sapiens during a live call and pull a customer’s entire policy history in milliseconds, giving the human representative instant context. That's a world away from the operational friction you get with more closed-off legacy systems.

Adopting Sapiens is more than a modernization project; it’s a strategic commitment to an architecture designed for intelligent automation. It provides the reliable system of record that AI needs to execute tasks accurately and the open framework required to innovate without restriction.

It's a similar story for claims AI reviews. The platform’s structured data environment is a goldmine for AI, allowing it to sift through thousands of files to check for compliance and quality. The system isn't just a data vault; it makes information accessible and actionable for intelligent agents.

A Strategic Decision for Future Growth

For any leader driving transformation, the message is clear: picking a core system is one of the most critical decisions you'll ever make. The real goal isn’t just to fix today’s problems. It’s to build an operational backbone that can handle whatever the future throws at it.

Sapiens provides that adaptability. Its architecture promotes a clean separation between the core system of record and the intelligent layer where the work gets done. This lets AI insurance companies deploy and scale automation for claims and customer service at speed, all without touching the stable, underlying core. To see this in action, you can learn more about leading AI insurance companies and their playbooks.

This isn’t just about improving today's KPIs. It's about building a more resilient, competitive, and future-proof business.

Questions We Hear All the Time About Sapiens

When business and IT leaders are digging into Sapiens software, a few key questions always come up. Let's walk through the most common ones, covering everything from implementation and integration to how the platform really works with advanced automation.

So, How Long Does a Sapiens Implementation Really Take?

This is the big one, and the honest answer is: it depends on your ambition. If you're looking to roll out a single line of business in a focused, phased approach, you're typically looking at a 9-12 month timeline.

But if you're undertaking a full-blown digital transformation—modernizing multiple departments and legacy systems—it’s more realistic to plan for 18-24 months. Sapiens really leans into agile methodologies, which means you're not waiting two years to see results. The goal is to deliver value in stages, keeping the process grounded and well-managed from the initial discovery sessions all the way through to go-live.

How Does Sapiens Fit into an AI-Powered Customer Service Strategy?

Think of Sapiens as the central nervous system for your customer data; it’s the single source of truth that makes effective AI customer care possible. AI agents from platforms like Nolana tap into Sapiens through its APIs to get a complete, real-time view of a policyholder's history.

This connection allows the AI to act as a hyper-efficient assistant. It can instantly feed a human agent the right context, suggest the next best action, or even handle backend tasks like updating a record without anyone lifting a finger. The result is a much smoother customer journey and faster resolutions.

The secret sauce here is Sapiens' API-first design. It's built to let other systems securely pull policy data, push claim status updates, and kick off workflows. This is what unlocks true, end-to-end automation and supports a new, more intelligent tier of customer support.

Can We Use Sapiens to Automate AI-Driven Claims Reviews?

Absolutely. In fact, Sapiens provides the perfect foundation for automating claims AI reviews. Because all the claims data—adjuster notes, settlement figures, policy details—is structured and organized within the platform, an AI agent can systematically analyze thousands of files at once.

For AI insurance companies, this is a game-changer. It replaces slow, manual audits with continuous, automated oversight. The AI can flag compliance issues, spot potential financial leakage, and ensure quality standards are met across the entire claims operation. It’s about constantly refining your processes and cutting down on risk.

Is Sapiens Flexible Enough for Our Unique Business Needs?

Yes, Sapiens is built to be highly configurable. It offers a low-code/no-code environment where your business analysts can tweak rules, design new products, and adjust workflows without needing to write a line of code.

For those truly unique, complex requirements that set your business apart, the platform’s architecture is open enough to support significant customizations and extensions. This gives you the best of both worlds: the flexibility to stay competitive today and a clear, manageable upgrade path for whatever comes next.

Ready to see how intelligent automation can transform your operations? Nolana deploys compliant AI agents that connect directly with Sapiens to automate high-stakes workflows in claims, case management, and customer service. Learn more at https://nolana.com.

Sapiens is a comprehensive, cloud-native software suite that acts as the core operating system for insurance and financial services companies. Think of it as the modern engine that replaces outdated, clunky legacy systems, providing an integrated platform for managing policies, billing, and claims. This shift allows firms to innovate faster and run their operations far more efficiently.

What Sapiens Software Is and Why It Matters

Imagine the central nervous system of an insurance company—a sprawling network of policy data, customer histories, billing schedules, and claims workflows. For years, many insurers have been held back by rigid, aging mainframes that make it nearly impossible to adapt, grow, or keep customers happy. Sapiens is designed to be the modern answer to this long-standing problem, offering a strategic platform built for a digital-first world.

At its heart, Sapiens replaces siloed, outdated infrastructure with a flexible, cloud-based foundation. This isn't just a simple software upgrade; it represents a fundamental change in how insurance carriers manage their entire business, from the ground up.

The image above really captures the essence of what a modern core system like Sapiens enables: a collaborative, data-driven environment where insights are accessible and actionable.

The Foundation for AI-Powered Transformation

The real magic happens when Sapiens' solid data foundation is connected to artificial intelligence. This pairing becomes a powerful catalyst for reinventing high-stakes operations, especially in complex areas like automating insurance claims with AI and enhancing customer care in financial services. By letting AI handle routine tasks and uncover deep insights from the data Sapiens organizes, insurers can achieve a whole new level of efficiency.

This synergy helps AI insurance companies achieve critical goals:

Automate huge chunks of the claims lifecycle, from the first notice of loss all the way to the final payout.

Deliver exceptional AI customer care by giving support agents a complete, real-time view of a policyholder's history and needs.

Analyze market trends and portfolio risks with incredible accuracy, which fuels smarter underwriting and better strategic decisions.

Sapiens International Corporation has cemented its position as a major player in the global insurance software market, reporting $514.8 million in revenue for 2023. This figure is the result of a strong 14.7% compound annual growth rate (CAGR) from 2012 to 2023. This impressive growth highlights the company's success in meeting the demand for digital platforms across key insurance markets.

In the end, Sapiens provides the stable, reliable system of record that AI absolutely needs to work properly. Without a modern core system, AI initiatives often stumble because they can't get the clean, structured data required for intelligent automation. By implementing https://nolana.com/articles/sapiens-insurance solutions, organizations are not just upgrading their software—they're building a resilient foundation for whatever comes next.

2. A Look Under the Hood: The Sapiens Core Engine

To really get a feel for what Sapiens brings to the table, you have to look past the marketing and understand its architecture. It’s less like a single, monolithic program and more like a set of high-performance, specialized tools designed to work together. This modular approach is exactly what gives insurers the flexibility to build a solid, yet adaptable, operational backbone.

At its heart, the platform is organized into distinct suites built for specific lines of business. For property and casualty carriers, the Sapiens IDITSuite is the workhorse, handling everything from complex underwriting and product configuration to day-to-day policy administration. For those in the life and pensions space, the CoreSuite is built to manage the unique, long-term nature of their products, from new business intake to complex annuity payouts.

Think of these core suites as the central nervous system for an insurance company. They manage the entire policy lifecycle, creating a single, reliable source of truth for every customer and policy detail. This alone is a massive step up from the disconnected, legacy systems where data fragmentation is a constant headache.

Powering Claims and Billing Operations

Plugging into these core systems are two of the most critical operational modules: ClaimsPro and Billing. ClaimsPro is engineered to manage the entire claims journey, which is an area absolutely packed with opportunities for intelligent automation. From the moment a first notice of loss comes in, this module kicks in to manage everything from data collection and validation to investigation and final payment.

This is where the connection to AI and automation really starts to click. An AI agent, like one from an automation platform such as Nolana, can ping ClaimsPro through an API to instantly verify policy coverage for a new claim—a job that might take a human adjuster several minutes and multiple screen-switches. Every one of these actions is logged, creating a clean audit trail that keeps regulators happy.

The real magic happens when Sapiens' structured data meets the cognitive power of AI. For example, AI can scan incoming claim documents, pull out the key information, and push it directly into the right fields in ClaimsPro. We've seen this reduce manual data entry by over 80% in certain workflows, which not only speeds up the cycle time but also frees up experienced adjusters to handle the truly complex cases.

The same principle applies to customer service. When a policyholder calls in, an AI-powered system can query the Sapiens CoreSuite in real-time to pull up that customer's complete history. This equips the human agent with a full 360-degree view, ending the all-too-common frustration of a customer having to repeat their story to multiple people.

How the Pieces Fit Together

What truly makes the Sapiens platform effective isn't just the individual modules, but how they talk to each other. It’s not about having one system for policies and another for claims in isolation; it’s about the seamless data flow between them that creates a unified, real-time view of the business.

This table gives a clearer picture of how these primary components work in tandem.

Sapiens Core Platform Modules Overview

Module Name | Primary Function | Key Benefit for Operations |

|---|---|---|

IDITSuite / CoreSuite | Manages the entire policy lifecycle from underwriting and issuance to renewals and endorsements. | Acts as the definitive, structured source for all customer and policy data, which is essential for accurate AI-driven decisions. |

ClaimsPro | Orchestrates the end-to-end claims process, from First Notice of Loss (FNOL) to final settlement. | Provides the necessary workflow and data hooks for AI to automate tasks like initial triage, document indexing, and fraud detection. |

Sapiens Billing | Handles all aspects of premium billing, collections, disbursements, and commission management. | Enables AI agents to autonomously handle routine financial inquiries, verify payment status, or trigger refunds without human input. |

In the end, this tight integration allows an insurer to move beyond simple, one-off task automation. Instead of just having an AI agent perform a basic lookup, you can have it execute a complex, multi-step process that spans different modules. For instance, a claim settlement approved in ClaimsPro can automatically trigger a payment in the Billing module and simultaneously update the policy record in the CoreSuite. This kind of orchestrated, end-to-end automation, with a human in the loop for final sign-off, is the key to scaling your efficiency gains and truly modernizing your operations.

Automating Insurance Claims with Sapiens and AI

For any insurance carrier, the claims department is where the rubber meets the road. It's a high-pressure environment where efficiency, accuracy, and customer experience all hang in the balance. The Sapiens ecosystem is built to manage the entire claims journey with precision, acting as a reliable system of record from the first notice of loss (FNOL) all the way to the final settlement.

But when you layer an AI-native platform on top of that solid foundation, the process changes completely. It goes from a methodical, manual workflow to a smart, automated operation. Sapiens provides the trusted data backbone, and AI executes the surrounding tasks with incredible speed. This combination is exactly how modern carriers are building a real competitive edge.

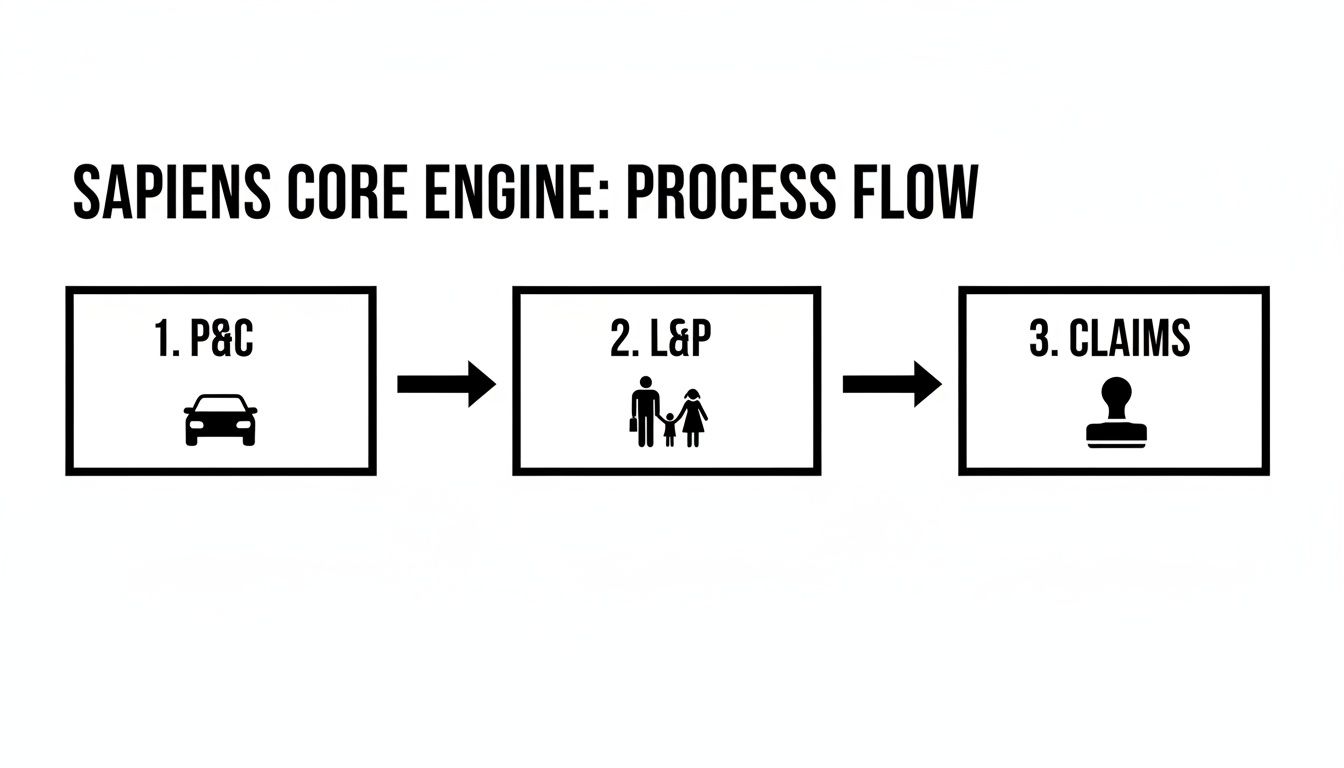

This process flow shows how Sapiens structures its core functions for different lines of business, with claims being a central operational event.

As you can see, whether it’s a Property & Casualty (P&C) or a Life & Pension (L&P) policy, a claim is what kicks the system into high gear.

From Manual Steps to Intelligent Actions

Think about a standard auto insurance claim. An adjuster might spend hours just on administrative legwork: keying in data from a police report, toggling between screens to cross-reference policy details, and checking another system for potential fraud flags. The whole process is slow, creates opportunities for human error, and leaves the policyholder waiting.

Now, let's replay that scenario with an AI agent connected to Sapiens. The moment a customer uploads a photo of their damaged car, the AI gets to work.

Instant Data Extraction: The AI agent reads the image, identifies the license plate, and pulls text from any attached documents, like a repair estimate.

Policy Validation: It immediately pings the Sapiens core system via API to confirm the policy is active, check coverage limits, and review the policyholder's claims history.

Initial Triage: Based on established business rules, the AI can classify the claim's severity, flag it for potential fraud, and route it to the right human adjuster—all within seconds.

This frees up the adjuster to focus on what humans do best: making complex judgment calls and communicating with empathy. By taking over the high-volume, repetitive work, AI makes the entire claims operation faster and more cost-effective.

Enhancing Quality with Claims AI Reviews

AI's role doesn't stop at the initial intake. It’s also a powerful tool for maintaining quality and compliance long after a claim is filed. The concept of claims AI reviews uses AI to systematically analyze adjuster notes, customer communications, and settlement decisions stored right inside the Sapiens platform.

Think of it as a tireless compliance officer that never sleeps. An AI agent can scan thousands of claim files overnight to ensure adjusters are following company procedures, adhering to regulatory standards, and communicating consistently with customers.

This kind of automated oversight helps spot financial leakage, promotes fair settlements, and gives leadership a real-time view of operational quality without needing to conduct slow, manual audits. And as insurers work to improve these processes, it helps to understand the nuances of what they're handling, like understanding total loss claims from the customer’s point of view.

The Market Push for Modernization

This shift toward automation isn’t just about internal efficiency—it’s part of a massive industry trend. The global insurance software platforms market is set to grow from $4.7 billion in 2025 to $6.5 billion by 2030, a 6.6% compound annual growth rate. That growth is being driven by carriers replacing legacy platforms to cut costs and launch products faster, both of which are critical for claims leaders.

Ultimately, Sapiens provides the stable, reliable core that makes this level of automation possible. By connecting an AI-native operating system like Nolana, insurers can turn their Sapiens platform from a simple system of record into a dynamic engine for intelligent action. To go deeper, check out our guide on insurance claims processing automation. This approach doesn't just fix a single workflow; it builds a more resilient and competitive insurance business from the ground up.

Using AI to Redefine Customer Care in Financial Services

Automating insurance claims is a massive win for back-office efficiency, but the real moment of truth for any financial institution happens on the front lines—during a customer interaction. This is where a system like Sapiens, rich with customer data, should shine. But just having the data isn't enough. The real challenge is turning that mountain of information into genuinely helpful, real-time support.

This means moving past the simplistic chatbots of yesterday and into a new reality. We're talking about intelligent systems that work hand-in-glove with human agents, creating a single, powerful service desk. By integrating AI customer care, financial services and AI insurance companies can finally deliver consistently great support without buckling under the pressure.

A New Reality for Customer Service Teams

Let's walk through a common scenario. A customer calls their insurance provider, confused about a recent premium increase. In a typical call center, the agent is already behind. They’re fumbling through multiple old-school systems, putting the customer on hold, and trying to stitch together a coherent story from different screens. It’s slow, frustrating for everyone, and a recipe for mistakes.

Now, imagine that same call with an AI assistant working alongside the human agent. The second the call connects, the AI is already pulling the customer's complete history from the Sapiens software platform.

On the agent's screen, a neat summary pops up: policy details, recent claims, past conversations, and payment history. All in one place.

The AI has already figured out why they're calling and is suggesting the next best action, maybe even scripting a clear explanation for the rate change.

If the customer needs to update their address, the AI handles the backend request in Sapiens directly. The agent never even has to switch tabs.

This partnership completely changes the agent's job. They're no longer just data miners; they’re true problem-solvers, armed with all the context needed to give a fast, accurate, and empathetic answer. It’s worth exploring different tools for this, like using AI chatbots to boost customer engagement to handle initial queries and gather context.

Tangible Improvements to Service Metrics

For anyone managing a customer service team, this kind of integration delivers results you can actually measure. The game is all about resolving issues on the first call, which has a massive impact on both customer happiness and operational costs.

When you give agents instant, AI-powered insights from a core system like Sapiens, the numbers speak for themselves. We've seen financial institutions achieve a 20-30% reduction in average call handling times. Even better, first-contact resolution rates often jump by over 15% because agents have everything they need to solve the problem right then and there.

This boost in efficiency means your team can handle more interactions without sacrificing an ounce of quality. For the customer, it feels like a seamless, almost effortless experience where their needs are met proactively. And for the business, every action is logged automatically, creating a clean, compliant, and auditable trail for every interaction—a non-negotiable in highly regulated industries.

Getting Ahead with Proactive Support and QA

The benefits don't stop at just reacting to calls. Think about how claims AI reviews analyze adjuster notes for quality. You can apply that exact same logic to customer service. An AI agent can monitor call transcripts and agent notes as they happen, ensuring every interaction meets company policies and regulatory standards.

The system could flag a call where a customer sounds particularly frustrated, letting a manager step in to help before things escalate. It can also spot knowledge gaps across the team, pointing out exactly where a little more training is needed. This combination of Sapiens' data and AI's analytical muscle creates a constant feedback loop that keeps getting better over time. If you're ready to build a plan around this, our detailed guide on how to implement AI customer care is a great place to start. This is how a contact center stops being a cost center and starts becoming a powerful tool for building real customer loyalty.

Integrating Sapiens with Modern AI Platforms

For any CIO or IT leader, the real test of a core system like Sapiens software isn't just what it does on its own, but how well it connects to the rest of your technology stack. Getting this right is absolutely fundamental to any serious automation strategy.

The good news? Sapiens was built for this. Its modern, API-first architecture means you aren't looking at massive, custom-coded integration projects. Instead, the connection is made through well-documented REST APIs that act as secure, standardized bridges between your systems.

Think of these APIs as reliable messengers. An external AI platform can use them to ask Sapiens for a piece of information or tell it to perform a specific action. For instance, an AI agent could make a quick API call to Sapiens to pull up a policyholder's coverage details in the middle of a live customer chat. This kind of fast, secure data exchange is the bedrock of modern financial services automation.

The Mechanics of AI and Sapiens Integration

So, what does this look like in practice? On a technical level, the integration is all about letting AI agents interact with Sapiens data and workflows in a highly controlled way. This is essential for keeping everything secure and compliant, which is non-negotiable in a regulated industry like insurance.

The most common integration patterns we see are:

Real-Time Data Retrieval: An AI agent needs an answer, now. It uses a Sapiens API to instantly look up a policy status or find customer contact information to support AI customer care functions.

Workflow Execution: The AI agent can kick off a process inside Sapiens. A classic example is creating a new claim file after pulling key details from a customer's email.

Large-Scale Data Syncs: For heavier analytical work, like claims AI reviews, structured data can be securely sent from Sapiens to an AI platform for deep processing and trend analysis.

The golden rule here is that Sapiens always remains the system of record. Its data integrity is never compromised. The AI platform acts as the intelligent execution layer, automating tasks around the core system without messing with its fundamental structure. It’s a clean separation of duties that auditors and compliance teams love to see.

This disciplined approach gives IT leaders the confidence to scale automation without introducing unnecessary risk. It also means that every single action taken by an AI agent is logged, creating a rock-solid audit trail across every connected system.

Ensuring Security and Governance Across Systems

Connecting any two powerful systems immediately brings security and governance to the forefront. When an AI platform talks to Sapiens, you need multiple layers of protection to ensure every interaction is controlled, secure, and fully compliant.

This isn't just a single firewall; it's a comprehensive security posture.

Security Layer | Description | Key Benefit |

|---|---|---|

API Authentication | Every API call must present secure credentials (like OAuth 2.0 tokens) to prove the AI agent is authorized to even knock on Sapiens' door. | This stops unauthorized access in its tracks and ensures only trusted systems can talk to your core data. |

Role-Based Access Control | AI agents get specific permissions, limiting them to only the data and actions they need for their assigned job. No more, no less. | It contains the potential impact of any single process and enforces the critical principle of least privilege. |

Immutable Audit Logs | Every single thing an AI agent does—every API call, data lookup, and update—is written into a tamper-proof record. | This gives you a complete, transparent history for compliance audits and makes troubleshooting a whole lot easier. |

By building this framework, organizations can deploy AI agents to handle sensitive customer and financial data with total confidence. This is exactly how forward-thinking AI insurance companies are able to innovate at speed while maintaining their rigorous risk management standards. You can see how this works in the real world by exploring case studies on transforming insurance claims with agentic AI. It proves that your automation strategy can be both powerful and built on an unshakeable foundation of trust.

Why Leading AI Insurance Companies Choose Sapiens

In a crowded market with heavy hitters like Guidewire and Duck Creek, you might wonder why so many forward-looking AI insurance companies are hitching their wagon to Sapiens. It’s not about winning a simple feature-to-feature bake-off. The decision is far more strategic.

Insurers are choosing Sapiens because it offers a uniquely balanced and future-ready foundation. They don't just see a product; they see a robust, open, and scalable core system that was practically engineered to be supercharged by specialized AI. It brings a global presence and a versatile portfolio that can handle anything from P&C to life and pensions.

The Perfect Foundation for Intelligent Automation

The real story here is Sapiens' architectural readiness for the next generation of automation. While its competitors offer powerful systems, Sapiens hits a sweet spot. It delivers the rock-solid stability and deep data management you'd expect from an enterprise platform, but it does so with an API-first mindset. This openness is exactly what's needed to plug in AI-native platforms like Nolana without a massive IT headache.

This makes Sapiens an ideal partner for automating complex, high-stakes workflows. Think about AI customer care. An AI agent can ping Sapiens during a live call and pull a customer’s entire policy history in milliseconds, giving the human representative instant context. That's a world away from the operational friction you get with more closed-off legacy systems.

Adopting Sapiens is more than a modernization project; it’s a strategic commitment to an architecture designed for intelligent automation. It provides the reliable system of record that AI needs to execute tasks accurately and the open framework required to innovate without restriction.

It's a similar story for claims AI reviews. The platform’s structured data environment is a goldmine for AI, allowing it to sift through thousands of files to check for compliance and quality. The system isn't just a data vault; it makes information accessible and actionable for intelligent agents.

A Strategic Decision for Future Growth

For any leader driving transformation, the message is clear: picking a core system is one of the most critical decisions you'll ever make. The real goal isn’t just to fix today’s problems. It’s to build an operational backbone that can handle whatever the future throws at it.

Sapiens provides that adaptability. Its architecture promotes a clean separation between the core system of record and the intelligent layer where the work gets done. This lets AI insurance companies deploy and scale automation for claims and customer service at speed, all without touching the stable, underlying core. To see this in action, you can learn more about leading AI insurance companies and their playbooks.

This isn’t just about improving today's KPIs. It's about building a more resilient, competitive, and future-proof business.

Questions We Hear All the Time About Sapiens

When business and IT leaders are digging into Sapiens software, a few key questions always come up. Let's walk through the most common ones, covering everything from implementation and integration to how the platform really works with advanced automation.

So, How Long Does a Sapiens Implementation Really Take?

This is the big one, and the honest answer is: it depends on your ambition. If you're looking to roll out a single line of business in a focused, phased approach, you're typically looking at a 9-12 month timeline.

But if you're undertaking a full-blown digital transformation—modernizing multiple departments and legacy systems—it’s more realistic to plan for 18-24 months. Sapiens really leans into agile methodologies, which means you're not waiting two years to see results. The goal is to deliver value in stages, keeping the process grounded and well-managed from the initial discovery sessions all the way through to go-live.

How Does Sapiens Fit into an AI-Powered Customer Service Strategy?

Think of Sapiens as the central nervous system for your customer data; it’s the single source of truth that makes effective AI customer care possible. AI agents from platforms like Nolana tap into Sapiens through its APIs to get a complete, real-time view of a policyholder's history.

This connection allows the AI to act as a hyper-efficient assistant. It can instantly feed a human agent the right context, suggest the next best action, or even handle backend tasks like updating a record without anyone lifting a finger. The result is a much smoother customer journey and faster resolutions.

The secret sauce here is Sapiens' API-first design. It's built to let other systems securely pull policy data, push claim status updates, and kick off workflows. This is what unlocks true, end-to-end automation and supports a new, more intelligent tier of customer support.

Can We Use Sapiens to Automate AI-Driven Claims Reviews?

Absolutely. In fact, Sapiens provides the perfect foundation for automating claims AI reviews. Because all the claims data—adjuster notes, settlement figures, policy details—is structured and organized within the platform, an AI agent can systematically analyze thousands of files at once.

For AI insurance companies, this is a game-changer. It replaces slow, manual audits with continuous, automated oversight. The AI can flag compliance issues, spot potential financial leakage, and ensure quality standards are met across the entire claims operation. It’s about constantly refining your processes and cutting down on risk.

Is Sapiens Flexible Enough for Our Unique Business Needs?

Yes, Sapiens is built to be highly configurable. It offers a low-code/no-code environment where your business analysts can tweak rules, design new products, and adjust workflows without needing to write a line of code.

For those truly unique, complex requirements that set your business apart, the platform’s architecture is open enough to support significant customizations and extensions. This gives you the best of both worlds: the flexibility to stay competitive today and a clear, manageable upgrade path for whatever comes next.

Ready to see how intelligent automation can transform your operations? Nolana deploys compliant AI agents that connect directly with Sapiens to automate high-stakes workflows in claims, case management, and customer service. Learn more at https://nolana.com.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP