How Sapiens Software Company Is Transforming Insurance With AI

How Sapiens Software Company Is Transforming Insurance With AI

Discover how Sapiens Software Company leverages AI to automate insurance claims and revolutionize customer care, setting new standards for insurtech platforms.

As a global provider of cloud-based software, Sapiens has become a central figure for the insurance and financial services industries. Think of them as the architects and engineers behind the core operational systems that let insurers move away from clunky, outdated platforms and embrace a more modern, digital-first approach.

Sapiens provides the technology for companies to manage their entire business, from the intricacies of policy administration to the complexities of claims processing.

Understanding The Sapiens Ecosystem

At its core, the Sapiens platform provides the digital foundation for an insurance carrier's operations. It's the technology that helps them transition from legacy systems and manual workflows to a more automated, data-driven business model.

Imagine an insurer's internal processes as a sprawling, old city grid with inefficient routes and constant traffic jams. Sapiens comes in and installs a modern, centralized traffic control system, making sure data flows smoothly and efficiently between every department—from underwriting and billing to customer service and claims.

This kind of operational overhaul is no longer a "nice-to-have." It's essential for insurers who want to meet the expectations of today's customers. The objective is to build a business that's more responsive, accurate, and efficient from the ground up. By replacing a patchwork of disconnected systems with a single, unified platform, Sapiens gives organizations a much clearer view of their day-to-day business and a serious boost in productivity.

Core Mission and Capabilities

The main goal for Sapiens is to give insurers the tools they need to compete effectively by automating their most critical functions. They do this by offering comprehensive software suites designed to handle the entire insurance lifecycle.

Their financial performance shows just how much the industry is leaning into this shift. Sapiens reported a third-quarter 2024 revenue of $137 million, which is a 4.8% increase year-over-year. According to their Sapiens Q3 2024 financial report, this growth was largely driven by high demand for their cloud-based platforms, signaling a clear industry trend toward greater efficiency in claims and policy management.

So, what does the platform actually do? Here's a quick look at some key capabilities:

Automated Claims Processing: Sapiens uses intelligent automation to manage the entire claims journey, from the moment a claim is filed to its final settlement. This use of claims AI helps reduce manual work, speeds up resolution times, and improves overall accuracy.

Modern Policy Administration: The platform provides a centralized system for managing policies, handling billing, and tracking commissions. This ensures everything stays consistent and compliant across the organization.

Enhanced Customer Experience: Through AI customer care solutions, Sapiens integrates tools like customer self-service portals and intelligent communication systems, allowing insurers to offer more personalized and immediate support.

Sapiens provides a wide range of solutions tailored to different sectors within the insurance and financial services landscape. The table below offers a high-level summary of its main functional areas.

Sapiens Platform Capabilities At A Glance

Core Area | Key Functionality | Primary Business Impact |

|---|---|---|

P&C Insurance | End-to-end policy, billing, and claims management for personal and commercial lines. | Increases operational efficiency, reduces time-to-market for new products, and improves agent and customer experiences. |

Life & Annuities | Comprehensive administration for individual and group life, health, and annuity products. | Modernizes legacy systems, ensures regulatory compliance, and supports complex product configurations. |

Reinsurance | Full lifecycle management for all types of reinsurance contracts (treaty and facultative). | Automates complex calculations and reporting, providing a single source of truth for ceded and assumed business. |

Digital Engagement | Customer and agent portals, digital journey orchestration, and API-driven services. | Enhances customer self-service capabilities, streamlines agent workflows, and enables seamless ecosystem integration. |

Data & Analytics | Pre-built data models, business intelligence tools, and predictive analytics capabilities. | Unlocks actionable insights from core system data, improves decision-making, and identifies new growth opportunities. |

Ultimately, these capabilities work together to create a more agile and competitive insurance operation.

For any financial services firm looking to truly overhaul its technology stack, Sapiens acts as a foundational partner. It provides the essential digital infrastructure needed to not only keep up but get ahead by delivering superior performance and better customer experiences.

Choosing a core systems provider like Sapiens is a major strategic decision for any insurer focused on long-term growth and market relevance. For a more detailed breakdown, you can also explore our full guide on the Sapiens software ecosystem.

Automating Insurance Claims With Sapiens AI

For decades, insurance claims processing has been a serious bottleneck. It’s an area bogged down by manual data entry, stacks of paper forms, and investigations that can drag on for weeks. The Sapiens software company tackles this head-on by building artificial intelligence directly into the claims lifecycle. This approach helps turn a slow, reactive process into a much more efficient, automated workflow.

For ai insurance companies looking to get a handle on operational costs while keeping customers happy, this shift is no longer a "nice-to-have"—it's essential.

The whole process kicks off at the First Notice of Loss (FNOL). Here, AI-powered tools can capture claim information right away from various digital channels. Instead of an agent manually keying in details from a phone call, Sapiens helps systems pull data directly from photos, documents, and online forms. This ensures everything is accurate from the get-go.

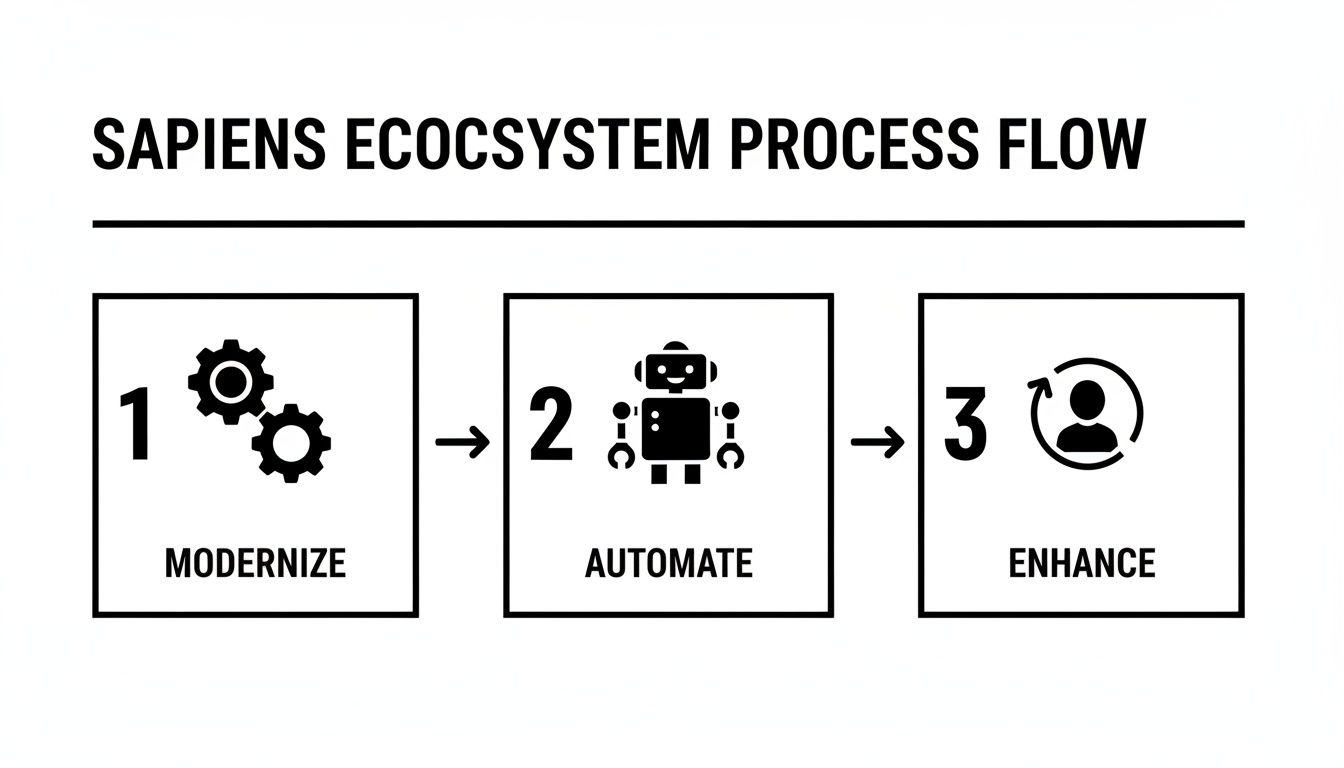

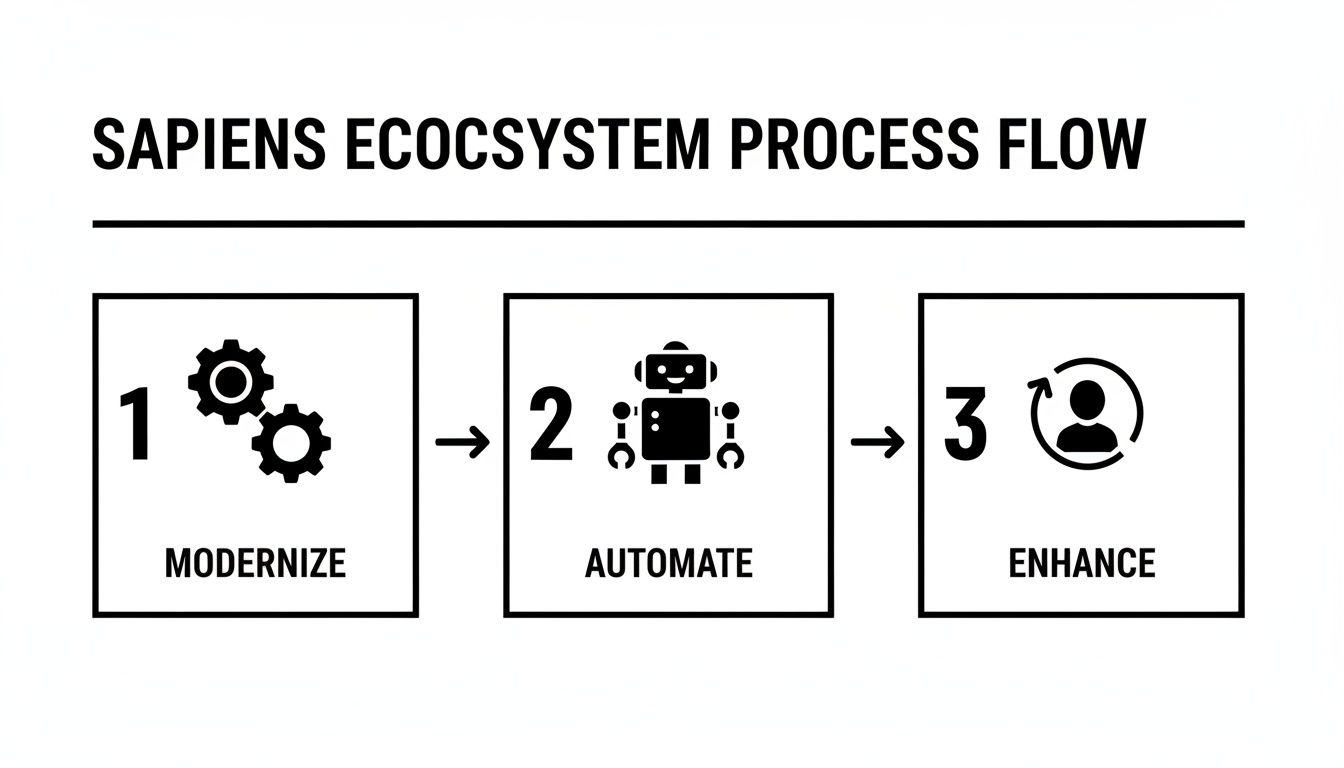

This diagram shows the basic philosophy Sapiens advocates for bringing insurance operations up to speed.

The journey from modernizing core systems to automating key processes and finally enhancing the user experience is a clear roadmap for any carrier wanting to advance digitally.

From Manual Adjudication To AI-Powered Decisions

As soon as a claim is in the system, machine learning algorithms get to work. These models can sift through all the digital evidence, check it against the policyholder's details, and even spot potential fraud patterns that a human adjuster might easily miss. This capability allows for the automated adjudication of simple, straightforward claims—often settling them in minutes, not days.

Let’s look at a common auto insurance claim. In a traditional setup, this could easily take a week or more to resolve:

The policyholder calls their agent to report the accident.

An adjuster is assigned, who then has to schedule an in-person inspection.

Paperwork gets filled out, photos are reviewed by hand, and repair estimates are collected.

Finally, the adjuster approves the claim and initiates the payment.

With Sapiens' AI, that entire timeline is compressed. The policyholder can just upload photos through a mobile app. From there, an AI model assesses the damage, confirms the policy coverage, and calculates the payout almost instantly. This kind of speed and simplicity is what drives positive claims ai reviews from both internal teams and the customers they serve.

The real value of AI in claims isn’t just about moving faster. It's about freeing up your best people. When AI handles all the routine, low-complexity claims, your experienced adjusters can dedicate their time to the complex, high-stakes cases that truly require human judgment and empathy.

The Financial and Customer Impact

The payoff from this level of automation goes far beyond just operational efficiency. When you can settle claims faster and with fewer manual errors, you dramatically improve the customer's experience during what is often a very stressful time. That directly translates to higher retention rates and stronger brand loyalty.

This focus on intelligent platforms is also a major reason for Sapiens' own financial performance. In 2024, Sapiens reported full-year revenue of $487.5 million, marking a 7.8% increase over the prior year, a success largely driven by the industry’s hunger for its AI-first solutions.

Ultimately, Sapiens gives insurers the toolkit to build a claims process that isn't just faster, but also smarter and more focused on the customer. It's an approach that's becoming critical for carriers who want to stay competitive.

If you're curious about how agentic AI can push automation even further, you might find our case study on transforming insurance claims with agentic AI interesting.

Using AI to Elevate the Customer Experience

Automating claims is a huge win for efficiency, but it's only half the battle. Today’s policyholders expect and deserve more than just a slick back-office operation. Real leaders in the financial services space, what you might call true ai insurance companies, understand that customer service is where they can truly stand out. This is where a platform like Sapiens comes in, helping them move from a reactive, wait-for-the-phone-to-ring support model to a proactive engagement strategy that actually anticipates customer needs.

The whole idea is to build a service experience that feels seamless and is always available. It starts by giving customers powerful self-service tools that let them solve their own problems instantly, without ever having to get in a queue for a human agent.

Sapiens helps embed sophisticated AI customer care tools right into a company's digital front door—their website, their app, you name it. This means intelligent chatbots are on duty 24/7, ready to answer common policy questions or walk users through simple processes. We're not talking about those old, frustrating bots that just repeat the same three phrases. These are designed to understand the context of a conversation and give answers that are genuinely helpful.

What a Modern Customer Journey Looks Like

Think about a common scenario. A policyholder, let's call her Sarah, needs to add a new driver to her auto policy, but it's 10 PM on a Tuesday. In the old days, she'd have to wait until morning to call an agent. With a Sapiens-powered portal, her experience is completely different.

Instant Access: Sarah just opens her insurer’s mobile app and starts a chat with an AI assistant.

Guided Interaction: The bot immediately understands her request. It asks for the new driver’s information and pulls up the right digital forms right there in the chat.

Seamless Handover: Let's say the resulting premium change needs an official sign-off. The system is smart enough to route the request to the correct underwriting queue, ready for a quick approval first thing in the morning.

The entire conversation is logged, and Sarah gets an automatic notification the moment her policy is updated. She never had to make a call, sit on hold, or repeat herself. That level of convenience is what builds real customer loyalty. For a closer look at the technology making this possible, you can find out more about how AI is reshaping customer care.

By letting AI handle routine questions and tasks, Sapiens allows financial services companies to dramatically reduce call center volume and improve first-contact resolution rates. This frees up experienced human agents to focus on the more complex, high-empathy situations where their expertise truly makes a difference.

The Business Impact You Can Actually Measure

This proactive approach delivers real, tangible results that go far beyond just getting good claims ai reviews. Companies that adopt these AI customer care capabilities see a measurable improvement in their most important KPIs. By providing a consistent and convenient experience across every channel—whether it’s a laptop, tablet, or smartphone—companies forge much stronger relationships with their policyholders.

At the end of the day, the goal is to create an experience so smooth it feels effortless. This has a direct impact on customer retention and can lead to a significant boost in Net Promoter Scores (NPS), turning happy clients into your best brand advocates.

Integrating Sapiens With Modern AI Platforms

A powerful core system from the Sapiens software company gives you a stable foundation, but its real value shines when you connect it to a modern tech stack. The platform’s open architecture was built for exactly this, allowing it to sync up smoothly with other crucial enterprise systems, like a CRM from Salesforce or contact center software from Genesys.

This connectivity is a huge plus. The real game-changer, however, is layering a next-generation, AI-native platform on top of Sapiens to build out an intelligent automation fabric across the enterprise.

This strategy creates a smart separation between your system of record (Sapiens), which safely houses all your critical data, and an agile system of action that gets the work done. For ai insurance companies, this kind of synergy is the key to unlocking a higher degree of automation while keeping everything fully compliant.

Creating an Intelligent Automation Layer

Think of an AI agent designed to manage complex workflows. You could task this agent with pulling specific policy details directly from Sapiens, checking that information against external data sources, and then carrying out a sequence of actions based on your business rules—all without a person needing to step in.

Let’s walk through a claims example. An AI agent could:

Query Sapiens to retrieve the claimant’s full policy history and coverage limits.

Access external data to verify details, like pulling a police report for a car accident.

Analyze the combined information to confirm the claim is valid and calculate a preliminary settlement offer.

Trigger the next step in the workflow, whether that means flagging the claim for an adjuster’s review or initiating an automated payment.

This level of intelligent automation drastically cuts down processing times and boosts accuracy, which directly improves the quality of claims ai reviews and, ultimately, customer satisfaction. The same goes for AI customer care—an agent could instantly pull a customer's entire interaction history from Sapiens to deliver highly personalized support.

A core system like Sapiens serves as the single source of truth. An AI automation layer, like Nolana, acts as the intelligent workforce that puts that truth into action—executing tasks and making decisions at machine speed within secure, auditable guardrails.

The Synergy of Systems

This integration model lets you keep your reliable, compliant Sapiens core while adding sophisticated automation capabilities. You get the best of both worlds without going through a disruptive "rip and replace" project. The AI platform simply communicates with Sapiens through APIs, treating it as the definitive source for all policy, billing, and claims data.

This setup is perfect for highly regulated financial environments where data integrity and audit trails are absolute must-haves. The AI layer can operate with precision, knowing that every action is logged and traceable right back to the core system. It enables ai insurance companies to finally automate more complex, high-stakes processes that were previously considered too risky to hand over to technology.

For teams evaluating other core systems, our deep dive into Guidewire Software Inc. provides more perspective on another major player in the space. By combining a trusted system of record with an intelligent system of action, insurers can achieve true end-to-end automation—safely and effectively.

How To Evaluate Sapiens For Your Organization

Picking a core systems provider like the Sapiens software company is one of those foundational decisions that will echo for years. For any technology leader, this goes way beyond ticking boxes on a feature list. You need a practical way to weigh its scalability, lock down the security, and get a real handle on the total cost of ownership. It’s all about making sure the platform can solve today’s problems while paving the way for your future strategy.

A solid evaluation digs into the vendor’s actual implementation process and what their support looks like after you go live. How does Sapiens get you from your old system to their new one? What can you expect when you need help six months down the line? Answering these questions paints a clear picture of the partnership you’re signing up for. It's also smart to get a look at their product roadmap to see if their vision for the future, particularly around AI, matches where you're headed.

Key Evaluation Criteria For Decision-Makers

When you’re kicking the tires on Sapiens, zero in on three areas that will make or break your operational success and ROI. Think of these as the pillars for assessing whether the platform is the right fit for your unique world.

Scalability and Performance: Will this system keep up as you grow? You should be asking for performance benchmarks and real-world examples from companies that look a lot like yours in size and complexity. The platform absolutely must be able to handle massive spikes in volume—like during a major weather event—without grinding to a halt. This is a huge concern for modern ai insurance companies.

Security and Compliance: In the world of financial services, security isn't just a feature; it's everything. You need to investigate Sapiens' compliance posture, including certifications like SOC 2 and GDPR. A vendor’s dedication to security is a direct reflection of how seriously they take protecting your clients' sensitive data.

Total Cost of Ownership (TCO): Don't get fixated on the initial sticker price. A true TCO calculation includes implementation services, any new hardware or cloud infrastructure, ongoing maintenance fees, and the costs of any customizations you’ll inevitably need. Getting this number right from the start saves a lot of financial headaches later.

A vendor’s financial stability is also a tell-tale sign of their reliability. Sapiens has shown consistent growth, with its second-quarter 2025 revenue reaching $141.6 million. This isn't just a number; it signals market leadership and the capacity to keep investing in the platform. With 600 customers in 30 countries, their strong financial footing offers peace of mind about their long-term viability. You can get more details on Sapiens' financial performance and global reach.

At the end of the day, the real question is simple: does this core system free you up to innovate, or does it hold you back? Your platform should be a launchpad for new initiatives like advanced AI customer care and automated claims, not a roadblock.

This structured approach gives you the right questions to ask. It helps ensure the platform you choose isn’t just a quick fix, but a strategic asset for the long haul. To explore this further, see our guide on intelligent automation in insurance.

Common Questions About Sapiens

When leaders are looking at the Sapiens software company, the same few questions always seem to come up. It's crucial to understand the details of implementation, how the platform can be customized, and where it fits in the larger insurance tech space before making a decision. Let's tackle those common questions head-on.

One of the first things people ask about is the timeline and headache of moving off an old, legacy system. While no two projects are identical, a typical Sapiens implementation is a phased rollout. This approach is designed to minimize day-to-day disruption and give your teams time to get comfortable with the new system gradually.

Customization is another big topic. Insurers need to know if the platform can be molded to fit their unique products and internal processes. Sapiens was built to be highly flexible, so you can configure it to your specific business rules without destabilizing the core platform.

How Does Sapiens Use AI in Claims and Customer Service?

Sapiens builds artificial intelligence right into its core platform to make things run smoother and get better results. For claims, this means automating the simple stuff, from the first notice of loss all the way to settlement. This use of claims AI helps insurers speed up how quickly they can close a claim and cuts down on manual work for their adjusters.

When it comes to AI customer care, the platform lets insurers provide round-the-clock support with smart chatbots and self-service portals. Policyholders can get quick answers to basic questions or manage their own accounts without ever talking to a person. This frees up your support staff to focus on the more complicated issues that really need a human touch.

Sapiens' strategy is all about making AI a practical tool that produces real, measurable value. By automating routine work in both claims and customer service, the platform helps ai insurance companies reduce their operating costs while making their customers much happier.

This focus on improving both back-office operations and the front-end customer experience is a huge part of what makes their offering compelling.

What Sets Sapiens Apart From Other Insurance Tech Companies?

Lots of vendors have solutions for the insurance industry, but Sapiens stands out by offering a complete, end-to-end platform. Instead of selling you a bunch of one-off tools for specific problems, Sapiens gives you an integrated suite that manages the entire insurance lifecycle—from policy and billing to claims and even reinsurance.

This all-in-one approach keeps your data consistent across the entire organization and gets rid of the integration nightmares that come from trying to stitch together a dozen different systems. Plus, Sapiens has been in this game for a long time. Their deep industry knowledge and global footprint are reflected in the positive claims ai reviews they receive from a massive client base.

They serve over 600 customers in more than 30 countries, which says a lot about their reliability and ability to scale. That kind of proven track record gives large, regulated enterprises the confidence they need when looking for a technology partner to help them navigate their digital shift.

Are you ready to see how AI agents can automate your most complex insurance workflows? Nolana deploys a compliant, AI-native operating system that integrates seamlessly with core systems like Sapiens to execute tasks, assist decisions, and deliver end-to-end automation with clear, auditable guardrails. Discover Nolana today.

As a global provider of cloud-based software, Sapiens has become a central figure for the insurance and financial services industries. Think of them as the architects and engineers behind the core operational systems that let insurers move away from clunky, outdated platforms and embrace a more modern, digital-first approach.

Sapiens provides the technology for companies to manage their entire business, from the intricacies of policy administration to the complexities of claims processing.

Understanding The Sapiens Ecosystem

At its core, the Sapiens platform provides the digital foundation for an insurance carrier's operations. It's the technology that helps them transition from legacy systems and manual workflows to a more automated, data-driven business model.

Imagine an insurer's internal processes as a sprawling, old city grid with inefficient routes and constant traffic jams. Sapiens comes in and installs a modern, centralized traffic control system, making sure data flows smoothly and efficiently between every department—from underwriting and billing to customer service and claims.

This kind of operational overhaul is no longer a "nice-to-have." It's essential for insurers who want to meet the expectations of today's customers. The objective is to build a business that's more responsive, accurate, and efficient from the ground up. By replacing a patchwork of disconnected systems with a single, unified platform, Sapiens gives organizations a much clearer view of their day-to-day business and a serious boost in productivity.

Core Mission and Capabilities

The main goal for Sapiens is to give insurers the tools they need to compete effectively by automating their most critical functions. They do this by offering comprehensive software suites designed to handle the entire insurance lifecycle.

Their financial performance shows just how much the industry is leaning into this shift. Sapiens reported a third-quarter 2024 revenue of $137 million, which is a 4.8% increase year-over-year. According to their Sapiens Q3 2024 financial report, this growth was largely driven by high demand for their cloud-based platforms, signaling a clear industry trend toward greater efficiency in claims and policy management.

So, what does the platform actually do? Here's a quick look at some key capabilities:

Automated Claims Processing: Sapiens uses intelligent automation to manage the entire claims journey, from the moment a claim is filed to its final settlement. This use of claims AI helps reduce manual work, speeds up resolution times, and improves overall accuracy.

Modern Policy Administration: The platform provides a centralized system for managing policies, handling billing, and tracking commissions. This ensures everything stays consistent and compliant across the organization.

Enhanced Customer Experience: Through AI customer care solutions, Sapiens integrates tools like customer self-service portals and intelligent communication systems, allowing insurers to offer more personalized and immediate support.

Sapiens provides a wide range of solutions tailored to different sectors within the insurance and financial services landscape. The table below offers a high-level summary of its main functional areas.

Sapiens Platform Capabilities At A Glance

Core Area | Key Functionality | Primary Business Impact |

|---|---|---|

P&C Insurance | End-to-end policy, billing, and claims management for personal and commercial lines. | Increases operational efficiency, reduces time-to-market for new products, and improves agent and customer experiences. |

Life & Annuities | Comprehensive administration for individual and group life, health, and annuity products. | Modernizes legacy systems, ensures regulatory compliance, and supports complex product configurations. |

Reinsurance | Full lifecycle management for all types of reinsurance contracts (treaty and facultative). | Automates complex calculations and reporting, providing a single source of truth for ceded and assumed business. |

Digital Engagement | Customer and agent portals, digital journey orchestration, and API-driven services. | Enhances customer self-service capabilities, streamlines agent workflows, and enables seamless ecosystem integration. |

Data & Analytics | Pre-built data models, business intelligence tools, and predictive analytics capabilities. | Unlocks actionable insights from core system data, improves decision-making, and identifies new growth opportunities. |

Ultimately, these capabilities work together to create a more agile and competitive insurance operation.

For any financial services firm looking to truly overhaul its technology stack, Sapiens acts as a foundational partner. It provides the essential digital infrastructure needed to not only keep up but get ahead by delivering superior performance and better customer experiences.

Choosing a core systems provider like Sapiens is a major strategic decision for any insurer focused on long-term growth and market relevance. For a more detailed breakdown, you can also explore our full guide on the Sapiens software ecosystem.

Automating Insurance Claims With Sapiens AI

For decades, insurance claims processing has been a serious bottleneck. It’s an area bogged down by manual data entry, stacks of paper forms, and investigations that can drag on for weeks. The Sapiens software company tackles this head-on by building artificial intelligence directly into the claims lifecycle. This approach helps turn a slow, reactive process into a much more efficient, automated workflow.

For ai insurance companies looking to get a handle on operational costs while keeping customers happy, this shift is no longer a "nice-to-have"—it's essential.

The whole process kicks off at the First Notice of Loss (FNOL). Here, AI-powered tools can capture claim information right away from various digital channels. Instead of an agent manually keying in details from a phone call, Sapiens helps systems pull data directly from photos, documents, and online forms. This ensures everything is accurate from the get-go.

This diagram shows the basic philosophy Sapiens advocates for bringing insurance operations up to speed.

The journey from modernizing core systems to automating key processes and finally enhancing the user experience is a clear roadmap for any carrier wanting to advance digitally.

From Manual Adjudication To AI-Powered Decisions

As soon as a claim is in the system, machine learning algorithms get to work. These models can sift through all the digital evidence, check it against the policyholder's details, and even spot potential fraud patterns that a human adjuster might easily miss. This capability allows for the automated adjudication of simple, straightforward claims—often settling them in minutes, not days.

Let’s look at a common auto insurance claim. In a traditional setup, this could easily take a week or more to resolve:

The policyholder calls their agent to report the accident.

An adjuster is assigned, who then has to schedule an in-person inspection.

Paperwork gets filled out, photos are reviewed by hand, and repair estimates are collected.

Finally, the adjuster approves the claim and initiates the payment.

With Sapiens' AI, that entire timeline is compressed. The policyholder can just upload photos through a mobile app. From there, an AI model assesses the damage, confirms the policy coverage, and calculates the payout almost instantly. This kind of speed and simplicity is what drives positive claims ai reviews from both internal teams and the customers they serve.

The real value of AI in claims isn’t just about moving faster. It's about freeing up your best people. When AI handles all the routine, low-complexity claims, your experienced adjusters can dedicate their time to the complex, high-stakes cases that truly require human judgment and empathy.

The Financial and Customer Impact

The payoff from this level of automation goes far beyond just operational efficiency. When you can settle claims faster and with fewer manual errors, you dramatically improve the customer's experience during what is often a very stressful time. That directly translates to higher retention rates and stronger brand loyalty.

This focus on intelligent platforms is also a major reason for Sapiens' own financial performance. In 2024, Sapiens reported full-year revenue of $487.5 million, marking a 7.8% increase over the prior year, a success largely driven by the industry’s hunger for its AI-first solutions.

Ultimately, Sapiens gives insurers the toolkit to build a claims process that isn't just faster, but also smarter and more focused on the customer. It's an approach that's becoming critical for carriers who want to stay competitive.

If you're curious about how agentic AI can push automation even further, you might find our case study on transforming insurance claims with agentic AI interesting.

Using AI to Elevate the Customer Experience

Automating claims is a huge win for efficiency, but it's only half the battle. Today’s policyholders expect and deserve more than just a slick back-office operation. Real leaders in the financial services space, what you might call true ai insurance companies, understand that customer service is where they can truly stand out. This is where a platform like Sapiens comes in, helping them move from a reactive, wait-for-the-phone-to-ring support model to a proactive engagement strategy that actually anticipates customer needs.

The whole idea is to build a service experience that feels seamless and is always available. It starts by giving customers powerful self-service tools that let them solve their own problems instantly, without ever having to get in a queue for a human agent.

Sapiens helps embed sophisticated AI customer care tools right into a company's digital front door—their website, their app, you name it. This means intelligent chatbots are on duty 24/7, ready to answer common policy questions or walk users through simple processes. We're not talking about those old, frustrating bots that just repeat the same three phrases. These are designed to understand the context of a conversation and give answers that are genuinely helpful.

What a Modern Customer Journey Looks Like

Think about a common scenario. A policyholder, let's call her Sarah, needs to add a new driver to her auto policy, but it's 10 PM on a Tuesday. In the old days, she'd have to wait until morning to call an agent. With a Sapiens-powered portal, her experience is completely different.

Instant Access: Sarah just opens her insurer’s mobile app and starts a chat with an AI assistant.

Guided Interaction: The bot immediately understands her request. It asks for the new driver’s information and pulls up the right digital forms right there in the chat.

Seamless Handover: Let's say the resulting premium change needs an official sign-off. The system is smart enough to route the request to the correct underwriting queue, ready for a quick approval first thing in the morning.

The entire conversation is logged, and Sarah gets an automatic notification the moment her policy is updated. She never had to make a call, sit on hold, or repeat herself. That level of convenience is what builds real customer loyalty. For a closer look at the technology making this possible, you can find out more about how AI is reshaping customer care.

By letting AI handle routine questions and tasks, Sapiens allows financial services companies to dramatically reduce call center volume and improve first-contact resolution rates. This frees up experienced human agents to focus on the more complex, high-empathy situations where their expertise truly makes a difference.

The Business Impact You Can Actually Measure

This proactive approach delivers real, tangible results that go far beyond just getting good claims ai reviews. Companies that adopt these AI customer care capabilities see a measurable improvement in their most important KPIs. By providing a consistent and convenient experience across every channel—whether it’s a laptop, tablet, or smartphone—companies forge much stronger relationships with their policyholders.

At the end of the day, the goal is to create an experience so smooth it feels effortless. This has a direct impact on customer retention and can lead to a significant boost in Net Promoter Scores (NPS), turning happy clients into your best brand advocates.

Integrating Sapiens With Modern AI Platforms

A powerful core system from the Sapiens software company gives you a stable foundation, but its real value shines when you connect it to a modern tech stack. The platform’s open architecture was built for exactly this, allowing it to sync up smoothly with other crucial enterprise systems, like a CRM from Salesforce or contact center software from Genesys.

This connectivity is a huge plus. The real game-changer, however, is layering a next-generation, AI-native platform on top of Sapiens to build out an intelligent automation fabric across the enterprise.

This strategy creates a smart separation between your system of record (Sapiens), which safely houses all your critical data, and an agile system of action that gets the work done. For ai insurance companies, this kind of synergy is the key to unlocking a higher degree of automation while keeping everything fully compliant.

Creating an Intelligent Automation Layer

Think of an AI agent designed to manage complex workflows. You could task this agent with pulling specific policy details directly from Sapiens, checking that information against external data sources, and then carrying out a sequence of actions based on your business rules—all without a person needing to step in.

Let’s walk through a claims example. An AI agent could:

Query Sapiens to retrieve the claimant’s full policy history and coverage limits.

Access external data to verify details, like pulling a police report for a car accident.

Analyze the combined information to confirm the claim is valid and calculate a preliminary settlement offer.

Trigger the next step in the workflow, whether that means flagging the claim for an adjuster’s review or initiating an automated payment.

This level of intelligent automation drastically cuts down processing times and boosts accuracy, which directly improves the quality of claims ai reviews and, ultimately, customer satisfaction. The same goes for AI customer care—an agent could instantly pull a customer's entire interaction history from Sapiens to deliver highly personalized support.

A core system like Sapiens serves as the single source of truth. An AI automation layer, like Nolana, acts as the intelligent workforce that puts that truth into action—executing tasks and making decisions at machine speed within secure, auditable guardrails.

The Synergy of Systems

This integration model lets you keep your reliable, compliant Sapiens core while adding sophisticated automation capabilities. You get the best of both worlds without going through a disruptive "rip and replace" project. The AI platform simply communicates with Sapiens through APIs, treating it as the definitive source for all policy, billing, and claims data.

This setup is perfect for highly regulated financial environments where data integrity and audit trails are absolute must-haves. The AI layer can operate with precision, knowing that every action is logged and traceable right back to the core system. It enables ai insurance companies to finally automate more complex, high-stakes processes that were previously considered too risky to hand over to technology.

For teams evaluating other core systems, our deep dive into Guidewire Software Inc. provides more perspective on another major player in the space. By combining a trusted system of record with an intelligent system of action, insurers can achieve true end-to-end automation—safely and effectively.

How To Evaluate Sapiens For Your Organization

Picking a core systems provider like the Sapiens software company is one of those foundational decisions that will echo for years. For any technology leader, this goes way beyond ticking boxes on a feature list. You need a practical way to weigh its scalability, lock down the security, and get a real handle on the total cost of ownership. It’s all about making sure the platform can solve today’s problems while paving the way for your future strategy.

A solid evaluation digs into the vendor’s actual implementation process and what their support looks like after you go live. How does Sapiens get you from your old system to their new one? What can you expect when you need help six months down the line? Answering these questions paints a clear picture of the partnership you’re signing up for. It's also smart to get a look at their product roadmap to see if their vision for the future, particularly around AI, matches where you're headed.

Key Evaluation Criteria For Decision-Makers

When you’re kicking the tires on Sapiens, zero in on three areas that will make or break your operational success and ROI. Think of these as the pillars for assessing whether the platform is the right fit for your unique world.

Scalability and Performance: Will this system keep up as you grow? You should be asking for performance benchmarks and real-world examples from companies that look a lot like yours in size and complexity. The platform absolutely must be able to handle massive spikes in volume—like during a major weather event—without grinding to a halt. This is a huge concern for modern ai insurance companies.

Security and Compliance: In the world of financial services, security isn't just a feature; it's everything. You need to investigate Sapiens' compliance posture, including certifications like SOC 2 and GDPR. A vendor’s dedication to security is a direct reflection of how seriously they take protecting your clients' sensitive data.

Total Cost of Ownership (TCO): Don't get fixated on the initial sticker price. A true TCO calculation includes implementation services, any new hardware or cloud infrastructure, ongoing maintenance fees, and the costs of any customizations you’ll inevitably need. Getting this number right from the start saves a lot of financial headaches later.

A vendor’s financial stability is also a tell-tale sign of their reliability. Sapiens has shown consistent growth, with its second-quarter 2025 revenue reaching $141.6 million. This isn't just a number; it signals market leadership and the capacity to keep investing in the platform. With 600 customers in 30 countries, their strong financial footing offers peace of mind about their long-term viability. You can get more details on Sapiens' financial performance and global reach.

At the end of the day, the real question is simple: does this core system free you up to innovate, or does it hold you back? Your platform should be a launchpad for new initiatives like advanced AI customer care and automated claims, not a roadblock.

This structured approach gives you the right questions to ask. It helps ensure the platform you choose isn’t just a quick fix, but a strategic asset for the long haul. To explore this further, see our guide on intelligent automation in insurance.

Common Questions About Sapiens

When leaders are looking at the Sapiens software company, the same few questions always seem to come up. It's crucial to understand the details of implementation, how the platform can be customized, and where it fits in the larger insurance tech space before making a decision. Let's tackle those common questions head-on.

One of the first things people ask about is the timeline and headache of moving off an old, legacy system. While no two projects are identical, a typical Sapiens implementation is a phased rollout. This approach is designed to minimize day-to-day disruption and give your teams time to get comfortable with the new system gradually.

Customization is another big topic. Insurers need to know if the platform can be molded to fit their unique products and internal processes. Sapiens was built to be highly flexible, so you can configure it to your specific business rules without destabilizing the core platform.

How Does Sapiens Use AI in Claims and Customer Service?

Sapiens builds artificial intelligence right into its core platform to make things run smoother and get better results. For claims, this means automating the simple stuff, from the first notice of loss all the way to settlement. This use of claims AI helps insurers speed up how quickly they can close a claim and cuts down on manual work for their adjusters.

When it comes to AI customer care, the platform lets insurers provide round-the-clock support with smart chatbots and self-service portals. Policyholders can get quick answers to basic questions or manage their own accounts without ever talking to a person. This frees up your support staff to focus on the more complicated issues that really need a human touch.

Sapiens' strategy is all about making AI a practical tool that produces real, measurable value. By automating routine work in both claims and customer service, the platform helps ai insurance companies reduce their operating costs while making their customers much happier.

This focus on improving both back-office operations and the front-end customer experience is a huge part of what makes their offering compelling.

What Sets Sapiens Apart From Other Insurance Tech Companies?

Lots of vendors have solutions for the insurance industry, but Sapiens stands out by offering a complete, end-to-end platform. Instead of selling you a bunch of one-off tools for specific problems, Sapiens gives you an integrated suite that manages the entire insurance lifecycle—from policy and billing to claims and even reinsurance.

This all-in-one approach keeps your data consistent across the entire organization and gets rid of the integration nightmares that come from trying to stitch together a dozen different systems. Plus, Sapiens has been in this game for a long time. Their deep industry knowledge and global footprint are reflected in the positive claims ai reviews they receive from a massive client base.

They serve over 600 customers in more than 30 countries, which says a lot about their reliability and ability to scale. That kind of proven track record gives large, regulated enterprises the confidence they need when looking for a technology partner to help them navigate their digital shift.

Are you ready to see how AI agents can automate your most complex insurance workflows? Nolana deploys a compliant, AI-native operating system that integrates seamlessly with core systems like Sapiens to execute tasks, assist decisions, and deliver end-to-end automation with clear, auditable guardrails. Discover Nolana today.

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP

Want early access?

© 2026 Nolana Limited. All rights reserved.

Leroy House, Unit G01, 436 Essex Rd, London N1 3QP